|

市場調查報告書

商品編碼

1934733

裝飾層壓板:市場佔有率分析、行業趨勢和統計數據、成長預測(2026-2031)Decorative Laminates - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

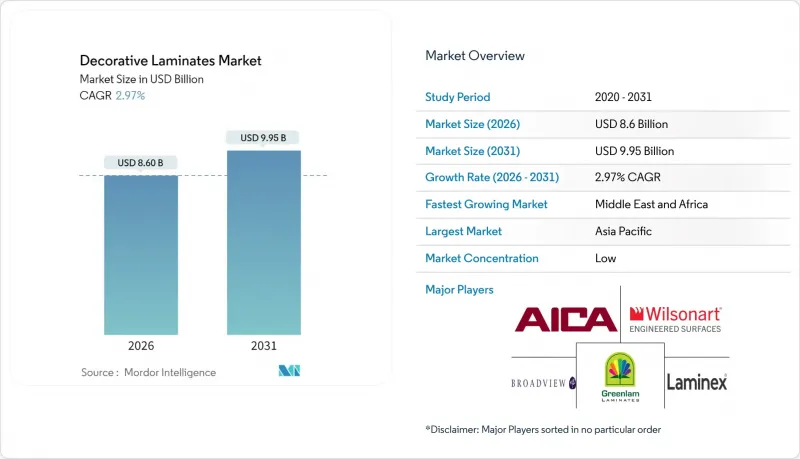

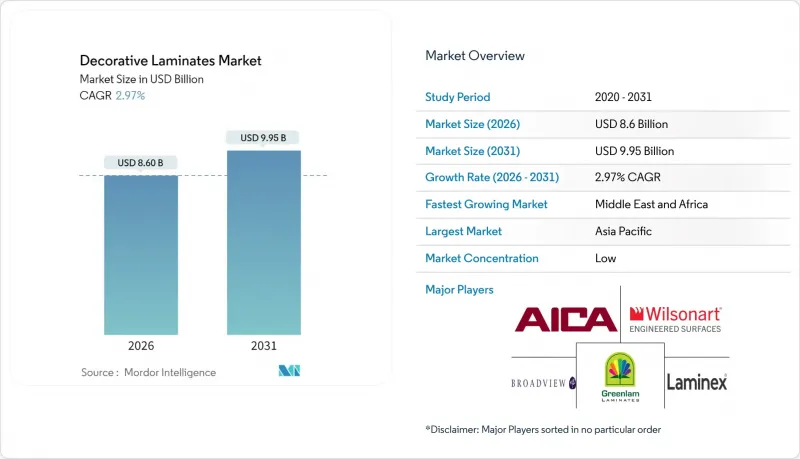

裝飾層壓板市場預計將從 2025 年的 83.5 億美元成長到 2026 年的 86 億美元,預計到 2031 年將達到 99.5 億美元,2026 年至 2031 年的複合年成長率為 2.97%。

這一成長反映出,即使已開發地區的建築週期放緩,住宅和商業室內裝修計劃對經濟實惠的飾面材料的需求仍然穩定。亞太地區的快速都市化、印度的大規模公共住宅計劃以及中國穩步推進的基礎設施建設,都支撐著全球高壓層壓板和密實層壓板的消費。中東和非洲建設活動的同步擴張以及模組化家具的普及,也保持了這一成長勢頭。同時,技術主導的表面創新使生產商能夠獲得溢價,並抵禦替代材料的競爭,捍衛市場佔有率。隨著遵守低甲醛化學品和木材可追溯性法規的成本不斷增加,擁有強大研發能力的垂直整合型企業更具優勢,產業整合的壓力也日益增大。

全球裝飾層壓板市場趨勢與洞察

快速的都市化和模組化家具的蓬勃發展

新興市場城市每年迎來數百萬新居民,推動了對採用輕質板材和裝飾貼面製成的模組化家具的需求,以滿足緊湊型生活空間的需求。預計到2050年,印度的城市人口將增加4.16億,將帶動對平板包裝家具的需求,與實木家具相比,平板包裝家具的運輸重量可減輕40%。數位印刷技術使製造商能夠小批量開發數百種新設計,Egger的2024+系列(超過300種設計和紋理組合)正是這項策略的體現。同時,貼面材料的需求也在成長,因為優質壓花薄膜可以模仿石材和橡木的紋理,同時也具有防刮和防指紋的特性。都市區高密度化和模組化設計的雙重驅動力持續推動裝飾貼面市場的擴張,而不受新建築經濟週期的影響。

亞太地區住宅建設激增

印度、越南和泰國的政府主導住宅計畫正在推動中等價位公寓的持續成長,強化複合地板比天然石材和實木地板更受青睞。光是印度就計畫在2030年投入1兆美元用於建築業,以彌補1億套房的缺口。越南的建築業預計到2024年將達到958億美元,年增率達7%。像CFL Flooring在越南投資1.5億美元的工廠這樣的本地強化複合地板生產企業,縮短了前置作業時間,並有助於穩定價格敏感型市場的價格。該地區對經濟適用住宅政策的重視,有助於鎖定長期需求,抵銷歐洲和美國新建住宅放緩的影響。

酚醛樹脂和三聚氰胺樹脂的價格波動

酚醛樹脂和三聚氰胺樹脂約佔層壓板材料成本的五分之一。 2024年,當其價格飆升18%至25%時,製造商無法即時將成本轉嫁給家具OEM客戶,導致利潤率承壓。特種樹脂市場由五家跨國供應商主導,使得本地加工商議價能力薄弱,一旦供應中斷,便會面臨缺貨風險,造成交貨延遲,並削弱客戶信心。

細分市場分析

到2025年,塑膠樹脂將保持其在裝飾層壓板市場40.92%的佔有率,這凸顯了其在將裝飾紙黏合到基材上的關鍵作用。然而,覆膜預計將以3.39%的複合年成長率快速成長,因為數位印刷需要透明、有紋理且在紫外線照射下不會泛黃的薄膜。覆膜用裝飾層壓板的市場規模預計將穩步擴大,因為防指紋和觸感柔軟的表面處理流程能夠帶來更高的價格差異。木材可追溯性法規以及《化學品註冊、評估、授權和限制》(REACH)法規中規定的0.062 mg/m³的甲醛含量上限,正在推動對生物基樹脂和無醛體系的投資。雖然這些措施會增加投入成本,但也有助於終端用戶獲得LEED(能源與環境設計先鋒獎)認證積分。此外,低VOC(揮發性有機化合物)化學技術的日益普及也使黏合劑產業受益。

裝飾箔和保護膜等輔助原料正變得日益重要,因為它們無需對生產線進行重大維修即可實現產品差異化。掌握抗菌層和刮痕修復微膠囊在線連續塗層技術的製造商,既能滿足醫療計劃規格要求,又能獲得更高的價格。因此,原料創新預計將使供應商的議價能力向那些提供一體化化學包裝和技術支援的供應商傾斜。

區域分析

預計到2025年,亞太地區將佔全球收入的38.20%,並在2031年之前保持主導地位。這主要得益於印度高達1兆美元的住宅建設熱潮以及中國的基礎設施投資將支撐市場需求。越南和泰國新增產能將有助於縮短前置作業時間,並降低該地區的匯率風險。同時,日本和韓國預計將出現對老舊公寓翻新改造的穩定需求。因此,亞太地區裝飾層壓板市場規模的成長將受到高成長的待開發區計劃和穩定的維修週期的共同推動。

中東和非洲地區正以3.45%的複合年成長率快速成長,這主要得益於阿拉伯聯合大公國建築需求7.4%的成長以及沙烏地阿拉伯「2030願景」大型企劃的推進。利雅德和杜拜的大規模飯店建築指定使用高檔層壓板作為牆板和家具材料,推動了對防火防潮等級層壓板的需求。沙烏地阿拉伯工業區的在地化生產計畫預計將促進對層壓板生產線的投資,以避免進口關稅。

在北美,勞動力短缺和房屋抵押貸款成本抑制了新建房屋的需求,但專業翻新的持續需求支撐了檯面和木地板材料的需求。預製單戶住宅模組採用貼合加工牆板,緩解了勞動力短缺,並為板材創造了穩定的需求。在歐洲,成本上升和更嚴格的排放法規迫使鋸木廠重新設計樹脂系統。然而,與節能維修相關的維修補貼維持了室內升級的支出,低甲醛層壓板在公共競標中也獲得了規格優勢。

預計南美洲將實現個位數溫和成長,這主要得益於巴西住宅支出復甦以及南方共同市場關稅調整緩解了跨境供應摩擦。此外,當地單板短缺也促使加工商轉向進口裝飾紙和樹脂,從而更加重視價值而非數量。

其他福利:

- Excel格式的市場預測(ME)表

- 分析師支持(3個月)

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 快速的都市化和模組化家具的蓬勃發展

- 亞太地區住宅建設激增

- 經濟實惠的美學設計推動了維修需求。

- 數位印刷和套暫存器壓花技術的進步

- 採用層壓整合板材的預製單戶住宅

- 市場限制

- 酚醛樹脂和三聚氰胺樹脂的價格波動

- 其他選擇:人造石材、LVT地板和熱壓膜

- 木質基材供應鏈可追溯性成本

- 價值鏈分析

- 波特五力模型

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 按原料

- 塑膠樹脂

- 覆蓋

- 黏合劑

- 木質基材

- 其他成分

- 透過使用

- 家具

- 內閣

- 地板材料

- 牆板

- 其他用途

- 按最終用戶行業分類

- 住宅

- 非住宅

- 運輸

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- Abet Laminati

- Aica Kogyo Co., Ltd.

- Airolam Decorative Laminates

- Archidply

- Bell Laminates

- Broadview Holding

- Durianlam

- Egger

- Greenlam Industries Limited

- Kronoplus Limited

- Laminex

- Merino Industries Limited

- Rushil Decor Limited

- Sonae Arauco

- Stylam

- The Diller Corporation

- Wilsonart LLC

第7章 市場機會與未來展望

The Decorative Laminates market is expected to grow from USD 8.35 billion in 2025 to USD 8.6 billion in 2026 and is forecast to reach USD 9.95 billion by 2031 at 2.97% CAGR over 2026-2031.

This growth reflects stable demand for cost-effective finishes in residential and commercial interior projects, even as construction cycles in developed regions cool. Rapid Asia-Pacific urbanization, sizable public housing targets in India, and China's steady infrastructure pipeline underpin global consumption of high-pressure and compact laminates. Parallel expansion in Middle East and Africa construction activity and the shift toward modular furniture formats sustain momentum, while technology-driven surface innovations allow producers to secure price premiums and defend share against substitute materials. Consolidation pressure is mounting as compliance costs for low-formaldehyde chemistry and wood-traceability rules reward vertically integrated firms with robust research and development (R&D) capabilities.

Global Decorative Laminates Market Trends and Insights

Rapid Urbanization and Modular-furniture Boom

Emerging-market cities absorb millions of new residents each year, and compact living spaces require modular furnishings that rely on lightweight panels finished with decorative laminates. India expects its urban population to swell by 416 million people by 2050, spurring demand for flat-pack furniture that cuts shipping weight by 40% compared with solid wood. Digital printing lets producers roll out hundreds of new decors in small batches, a strategy showcased by EGGER's 2024+ lineup featuring more than 300 design-texture pairings. Overlay consumption rises in tandem because premium embossed films replicate stone and oak grains while resisting scratches and fingerprints. This dual push from urban density and modular design keeps the decorative laminates market expanding independently of cyclical new-build activity.

Residential Construction Surge in Asia-Pacific

Government-led housing programs across India, Vietnam, and Thailand inject sustained spending into mid-price apartments that favor laminates over natural stone or hardwood. India alone targets USD 1 trillion in construction outlays by 2030 to close a 100 million-unit deficit. Vietnam's construction sector reached USD 95.8 billion in 2024 and continues to grow at 7% annually. Localized laminate manufacturing, such as CFL Flooring's USD 150 million Vietnam plant, shortens lead times and holds prices in price-sensitive markets. The region's policy emphasis on affordable housing locks in long-cycle demand that offsets softer Western new-build volumes.

Volatile Prices of Phenolic and Melamine Resins

Phenolic and melamine account for roughly one-fifth of laminate bill-of-materials, and 18-25% price spikes in 2024 squeezed margins as producers could not immediately pass costs to OEM furniture accounts. Because five multinational suppliers dominate specialty resins, regional fabricators lack bargaining leverage and face stock-outs during outages, delaying deliveries and eroding customer trust.

Other drivers and restraints analyzed in the detailed report include:

- Cost-effective Aesthetics Driving Renovation Demand

- Advances in Digital Printing and Emboss-in-register Tech

- Substitution by Engineered Stone, LVT and Thermofoils

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plastic resin retained a 40.92% share of the decorative laminates market in 2025, reflecting its indispensability for bonding decorative papers to core materials. Yet overlays are set to grow fastest at a 3.39% CAGR as digital printing requires clear, textured films that do not yellow under UV exposure. The decorative laminates market size for overlays is projected to climb steadily as anti-fingerprint and soft-touch finishes command premium spreads. Wood-traceability rules and a 0.062 mg/m3 formaldehyde ceiling under Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH) are steering investment into bio-based resins and aldehyde-free systems that raise input costs but unlock Leadership in Energy and Environmental Design (LEED) points for end-users. Adhesives also benefit as low-VOC (Volatile Organic Compound) chemistries gain traction.

Second-tier inputs such as decorative foils and protective films gain strategic value because they enable differentiation without major line overhauls. Producers who master in-line coating of antimicrobial layers or scratch-repair microcapsules can charge more while meeting healthcare project specifications. Consequently, raw-material innovation is expected to tilt bargaining power toward suppliers that offer integrated chemistry packages and technical support.

The Decorative Laminates Market Report is Segmented by Raw Material (Plastic Resin, Adhesives, Wood Substrate, and Other Raw Materials), Application (Furniture, Cabinets, Flooring, and Other Applications), End-User Industry (Residential, Non-Residential, and Transportation), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific accounted for 38.20% of global revenue in 2025 and will stay dominant through 2031 as India's USD 1 trillion housing drive and China's infrastructure commitments underpin volume. New Vietnamese and Thai capacity shortens regional lead times and buffers currency risk, while Japan and South Korea provide steady replacement demand in aging condominiums. Therefore, the decorative laminates market size in Asia-Pacific combines high-growth greenfield projects with stable refurbishment cycles.

The Middle East and Africa are the fastest-growing regions at a 3.45% CAGR, reflecting 7.4% expansion in the United Arab Emirates (UAE) construction and Saudi Arabia's Vision 2030 megaprojects. Large hospitality builds in Riyadh and Dubai specify premium laminates for wall panelling and case goods, boosting demand for fire-rated and moisture-resistant grades. Localization initiatives in Saudi industrial zones will likely draw investments in lamination lines to skirt import duties.

North America faces constrained new-build activity due to labor shortages and mortgage costs, yet ongoing professional remodeling supports countertop and plank-floor demand. Prefab single-family modules with pre-installed laminated walls mitigate labor deficits and spur steady panel offtake. Europe is navigating cost inflation and stringent emission rules that force mills to re-engineer resin systems. Nevertheless, renovation subsidies tied to energy-efficient retrofits keep spending on interior upgrades afloat, and low-formaldehyde laminate earns specification points in public tenders.

South America delivers mid-single-digit growth as Brazilian residential spending recovers and Mercosur tariff alignment lowers cross-border supply friction. Local veneer shortages also push converters toward imported decor papers and resin, driving value rather than volume.

- Abet Laminati

- Aica Kogyo Co., Ltd.

- Airolam Decorative Laminates

- Archidply

- Bell Laminates

- Broadview Holding

- Durianlam

- Egger

- Greenlam Industries Limited

- Kronoplus Limited

- Laminex

- Merino Industries Limited

- Rushil Decor Limited

- Sonae Arauco

- Stylam

- The Diller Corporation

- Wilsonart LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Urbanisation and Modular-furniture Boom

- 4.2.2 Residential Construction Surge in Asia-Pacific

- 4.2.3 Cost-effective Aesthetics Driving Renovation Demand

- 4.2.4 Advances in Digital Printing and Emboss-in-register Tech

- 4.2.5 Prefab Single-family Housing with Laminate-integrated Panels

- 4.3 Market Restraints

- 4.3.1 Volatile Prices of Phenolic and Melamine Resins

- 4.3.2 Substitution by Engineered Stone, LVT and Thermofoils

- 4.3.3 Supply-chain Traceability Costs for Wood Substrates

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Raw Material

- 5.1.1 Plastic Resin

- 5.1.2 Overlays

- 5.1.3 Adhesives

- 5.1.4 Wood Substrate

- 5.1.5 Other Raw Materials

- 5.2 By Application

- 5.2.1 Furniture

- 5.2.2 Cabinets

- 5.2.3 Flooring

- 5.2.4 Wall Panels

- 5.2.5 Other Applications

- 5.3 By End-user Industry

- 5.3.1 Residential

- 5.3.2 Non-residential

- 5.3.3 Transportation

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Abet Laminati

- 6.4.2 Aica Kogyo Co., Ltd.

- 6.4.3 Airolam Decorative Laminates

- 6.4.4 Archidply

- 6.4.5 Bell Laminates

- 6.4.6 Broadview Holding

- 6.4.7 Durianlam

- 6.4.8 Egger

- 6.4.9 Greenlam Industries Limited

- 6.4.10 Kronoplus Limited

- 6.4.11 Laminex

- 6.4.12 Merino Industries Limited

- 6.4.13 Rushil Decor Limited

- 6.4.14 Sonae Arauco

- 6.4.15 Stylam

- 6.4.16 The Diller Corporation

- 6.4.17 Wilsonart LLC

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment