|

市場調查報告書

商品編碼

1755263

高壓層壓板和塑膠樹脂市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測High Pressure Laminates and Plastic Resins Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

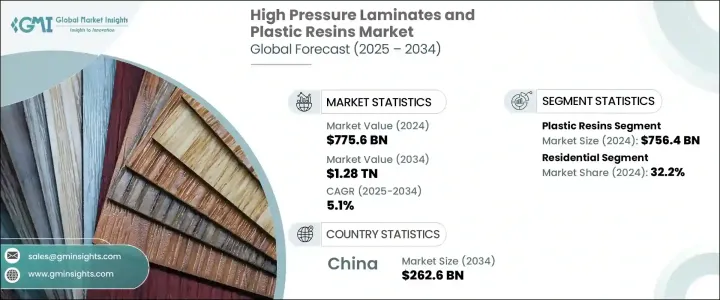

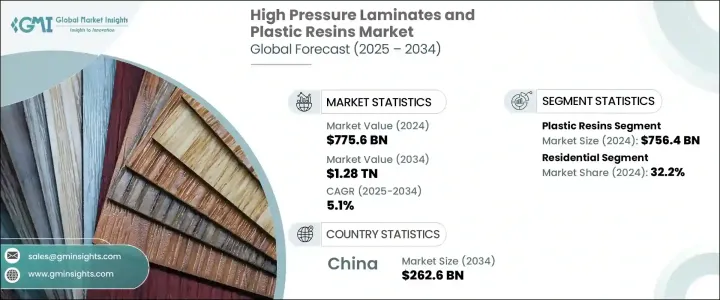

2024年,全球高壓層壓板和塑膠樹脂市場價值為7,756億美元,預計到2034年將以5.1%的複合年成長率成長,達到1.28兆美元。市場發展勢頭強勁,得益於其在多個領域的廣泛應用,尤其是在建築配件、消費品包裝、工業品和行動解決方案領域。市場對輕質、經濟高效和高強度材料的需求不斷成長,持續推動高壓層壓板 (HPL) 和塑膠樹脂的成長,其中樹脂在市場佔有率方面佔據領先地位。由於塑膠樹脂具有良好的加工性、耐用性和多功能性,因此仍然是各種商品的重要原料,預計在可預見的未來,它們仍將在全球市場上佔據主導地位。

耐火板 (HPL) 雖然市場佔有率較小,但由於其在室內設計和建築應用中的日益普及,其發展勢頭正日益強勁。 HPL 材料以其優異的韌性和設計靈活性而聞名,經常被住宅和商業建築所青睞。設計趨勢正轉向不僅注重視覺吸引力,而且維護成本低廉的表面,這提升了人們對層壓板的興趣。隨著對兼具功能性和美觀性材料的需求不斷成長,HPL 正成為一個強勁的細分市場。同時,塑膠樹脂因其成本效益高且易於大量生產,仍在市場中佔據主導地位。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 7756億美元 |

| 預測值 | 1.28兆美元 |

| 複合年成長率 | 5.1% |

新興經濟體和已開發經濟體的城市發展和基礎設施現代化進程加速了市場成長。各行各業都在尋求不僅能提供結構價值,還能兼具永續性的先進材料。設計偏好正穩定地轉向維護成本低、耐候性和輕量化性能的工程產品——而這些特性正是層壓板和塑膠樹脂所具備的。這種對滿足不斷變化的設計和實用性要求的材料的持續需求,確保了這兩個領域儘管規模不同,但仍將持續保持相關性。

按產品類型分類,市場分為高壓層壓板 (HPL)、連續壓層壓板 (CPL) 和塑膠樹脂。其中,塑膠樹脂佔了相當大的市場佔有率,2024 年的收入達到 7,564 億美元。預計該細分市場在整個預測期內將以 5.1% 的複合年成長率擴張。塑膠樹脂的主要優勢在於其能夠作為多個行業的基礎組件,提供經濟的生產價值、易於製造以及廣泛的材料多樣性。它們在從包裝到電子產品等結構和非結構應用領域的出色表現鞏固了其領先地位。

材料創新正在塑造這個市場的未來。透過先進的樹脂化學和可回收聚合物來提升環保性能的努力正在重塑製造商的運作方式。生產高性能、環保材料以支持長期永續發展目標的趨勢日益明顯。可回收和生物基塑膠的採用率正在逐步上升,這與各行業的環保合規和綠色計劃一致。

依最終用途產業分析,市場可分為住宅、商業、醫療保健、交通運輸、工業及其他。目前,商業領域佔據最高市場佔有率,這主要歸功於公共基礎設施、企業辦公室、零售連鎖店和其他高人流量商業環境中塑膠樹脂和耐火板的持續使用。至2024年,住宅領域約佔整體市場的32.2%。現代家居設計意識的不斷增強以及對耐用、易清潔表面的需求,持續刺激耐火板在住宅應用中的使用。另一方面,塑膠樹脂在住宅和商業房地產的室內裝飾、裝飾和安全應用領域佔據著廣泛的主導地位。

中國在塑造該市場全球發展軌跡方面發揮關鍵作用。 2024年,中國市場收入達1,564億美元,預計2034年將達2,626億美元,複合年成長率達5.3%。中國龐大的製造業基礎,加上國內終端消費產業的不斷成長,使其在全球生產和需求領域中佔有領先地位。城市發展、基礎設施擴張和消費升級的快速發展,推動了中國層壓板和樹脂的使用量成長。

高壓層壓板和塑膠樹脂市場的競爭格局略有鞏固,前五大公司佔全球超過30%的佔有率。塑膠樹脂領域深受注重產量可擴展性、全球物流能力和多用途產品線的生產商的影響。這些企業透過永續材料的創新、積極的研發項目和響應迅速的生產模式來保持競爭優勢。在層壓板領域,擁有強大品牌形象、豐富產品種類和廣泛分銷管道的公司繼續表現出色。永續性、創新和高效的定價仍然是企業的核心策略,因為企業正在努力建立消費者信任並滿足不同地區不斷變化的監管要求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 市場機會

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 價格趨勢

- 按地區

- 依產品類型

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 專利態勢

- 貿易統計(註:僅提供重點國家的貿易統計)

3.11.1 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 高壓層壓板(HPL)

- 水平坡度

- 垂直坡度

- 後成型級

- 特殊用途等級

- 緊湊級

- 連續壓力層壓板(CPL)

- 塑膠樹脂

- 酚醛樹脂

- 三聚氰胺樹脂

- 環氧樹脂

- 聚酯樹脂

- 其他

第6章:市場估計與預測:按原料,2021 - 2034 年

- 主要趨勢

- 牛皮紙

- 裝飾紙

- 覆蓋紙

- 熱固性樹脂

- 酚醛樹脂

- 三聚氰胺樹脂

- 熱塑性樹脂

- 聚乙烯(PE)

- 聚丙烯(PP)

- 聚氯乙烯(PVC)

- 聚苯乙烯(PS)

- 其他

第7章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 家具和櫥櫃

- 住宅家具

- 商業家具

- 廚房櫥櫃

- 辦公家具

- 地板

- 住宅地板

- 商業地板

- 牆板和隔板

- 檯面和工作檯面

- 廚房檯面

- 實驗室檯面

- 商業檯面

- 門

- 其他

第8章:市場估計與預測:按最終用途產業,2021 - 2034 年

- 主要趨勢

- 住宅

- 商業的

- 辦公室

- 零售

- 飯店業

- 教育

- 衛生保健

- 醫院

- 實驗室

- 診所

- 運輸

- 汽車

- 海洋

- 航空

- 工業的

- 其他

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第10章:公司簡介

- Abet Laminati SpA

- Arkema Group

- Arpa Industriale SpA

- BASF SE

- Century Plyboards (India) Ltd.

- Changzhou Zhenghang Decorative Materials Co., Ltd.

- Changzhou Zhongtian Fireproof Decorative Sheets Co., Ltd.

- Covestro AG

- Dow Chemical Company

- DuPont de Nemours, Inc.

- Fletcher Building Limited

- Formica Group (Fletcher Building)

- Greenlam Industries Ltd.

- Jiangsu TRSK New Material Co., Ltd.

- Kingboard Laminates Holdings Ltd.

- LyondellBasell Industries NV

- Merino Industries Ltd.

- SABIC

- Solera International

- Wilsonart International Inc.

The Global High Pressure Laminates and Plastic Resins Market was valued at USD 775.6 billion in 2024 and is estimated to grow at a CAGR of 5.1% to reach USD 1.28 trillion by 2034. Market momentum is being driven by widespread application across multiple sectors, especially in construction accessories, consumer packaging, industrial goods, and mobility solutions. The growing demand for lightweight, cost-efficient, and high-strength materials continues to fuel growth in both high-pressure laminates (HPL) and plastic resins, with resins leading the way in terms of market share. As plastic resins remain essential raw materials for a wide spectrum of goods due to their processability, durability, and versatility, they are expected to maintain their dominance in the global marketplace for the foreseeable future.

HPL, although smaller in market share, is gaining traction due to its increasing adoption in interior design and architectural applications. Known for their resilience and design flexibility, HPL materials are frequently preferred in residential and commercial installations. Trends in design are shifting towards surfaces that offer not only visual appeal but also require minimal upkeep, boosting interest in laminates. As demand grows for materials that combine function with aesthetics, HPL is becoming a stronger segment. Meanwhile, plastic resins remain in high-volume circulation due to their cost-efficient nature and adaptability in mass manufacturing.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $775.6 Billion |

| Forecast Value | $1.28 Trillion |

| CAGR | 5.1% |

Increased urban development and modernization of infrastructure across emerging and developed economies alike are further accelerating market growth. Industries seek advanced materials that deliver not just structural value but also sustainability. Design preferences are steadily moving toward engineered products that offer low maintenance, weather resistance, and lightweight performance-all attributes that both laminates and plastic resins bring to the table. This consistent demand for materials that fulfill evolving design and utility requirements ensures continued relevance for both segments, although at different scales.

By product type, the market is segmented into high pressure laminates (HPL), continuous-pressure laminates (CPL), and plastic resins. Among these, plastic resins accounted for a significant market share, with a recorded revenue of USD 756.4 billion in 2024. This segment is expected to expand at a CAGR of 5.1% throughout the forecast period. The key advantage of plastic resins lies in their ability to serve as foundational components across multiple industries, offering economic production value, ease of fabrication, and broad material diversity. Their performance in structural and non-structural applications-ranging from packaging to electronics-reinforces their leadership position.

Material innovation is shaping the future of this market. Efforts to improve environmental performance through advanced resin chemistry and recyclable polymers are reshaping how manufacturers operate. There is a noticeable shift toward producing high-performance, eco-conscious materials that support long-term sustainability goals. The adoption of recyclable and bio-based plastics is gradually rising, aligning with environmental compliance and green initiatives across sectors.

When analyzed by end-use industry, the market is classified into residential, commercial, healthcare, transportation, industrial, and others. The commercial segment currently commands the highest market share, largely due to the consistent use of both plastic resins and HPLs in public infrastructure, corporate offices, retail chains, and other high-traffic commercial environments. In 2024, the residential sector accounted for approximately 32.2% of the overall market. Increasing design consciousness and the need for durable, easy-to-clean surfaces in modern homes continue to stimulate HPL usage in residential applications. Plastic resins, on the other hand, dominate a wide array of uses across interiors, decor, and safety applications in both residential and commercial properties.

China plays a pivotal role in shaping the global trajectory of this market. In 2024, the Chinese market generated revenue of USD 156.4 billion and is on track to reach USD 262.6 billion by 2034, growing at a CAGR of 5.3%. China's extensive manufacturing base, combined with rising domestic consumption in end-user industries, places it at the forefront of global production and demand. The surge in urban development, infrastructure expansion, and consumer upgrades contributes to increased usage of both laminates and resins within the country.

The competitive landscape of the high-pressure laminates and plastic resins market is moderately consolidated, with the top five companies controlling over 30% of the global share. The plastic resins space is highly influenced by producers focused on volume scalability, global logistics capabilities, and multipurpose product lines. These players maintain their competitive edge through innovations in sustainable materials, aggressive R&D programs, and responsive production models. On the laminates side, companies with a strong brand identity, wide product variety, and expansive distribution continue to outperform. Sustainability, innovation, and efficient pricing remain core strategies as companies work to build consumer trust and meet evolving regulatory demands across regions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product type

- 2.2.3 Raw material

- 2.2.4 Application

- 2.2.5 End use industry

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product type

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (Note: the trade statistics will be provided for key countries only)

3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.13 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.7 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Tons)

- 5.1 Key trends

- 5.1.1 High pressure laminates (HPL)

- 5.1.2 Horizontal grade

- 5.1.3 Vertical grade

- 5.1.4 Postforming grade

- 5.1.5 Special purpose grade

- 5.1.6 Compact grade

- 5.2 Continuous pressure laminates (CPL)

- 5.3 Plastic resins

- 5.3.1 Phenolic resins

- 5.3.2 Melamine resins

- 5.3.3 Epoxy resins

- 5.3.4 Polyester resins

- 5.3.5 Others

Chapter 6 Market Estimates and Forecast, By Raw Material, 2021 - 2034 (USD Billion) (Tons)

- 6.1 Key trends

- 6.2 Kraft paper

- 6.3 Decorative paper

- 6.4 Overlay papers

- 6.5 Thermosetting resins

- 6.5.1 Phenolic resins

- 6.5.2 Melamine resins

- 6.6 Thermoplastic resins

- 6.6.1 Polyethylene (PE)

- 6.6.2 Polypropylene (PP)

- 6.6.3 Polyvinyl chloride (PVC)

- 6.6.4 Polystyrene (PS)

- 6.6.5 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Tons)

- 7.1 Key trends

- 7.2 Furniture & cabinetry

- 7.2.1 Residential furniture

- 7.2.2 Commercial furniture

- 7.2.3 Kitchen cabinets

- 7.2.4 Office furniture

- 7.3 Flooring

- 7.3.1 Residential flooring

- 7.3.2 Commercial flooring

- 7.4 Wall panels & partitions

- 7.5 Countertops & worktops

- 7.5.1 Kitchen countertops

- 7.5.2 Laboratory countertops

- 7.5.3 Commercial worktops

- 7.6 Doors

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Billion) (Tons)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

- 8.3.1 Offices

- 8.3.2 Retail

- 8.3.3 Hospitality

- 8.3.4 Education

- 8.4 Healthcare

- 8.4.1 Hospitals

- 8.4.2 Laboratories

- 8.4.3 Clinics

- 8.5 Transportation

- 8.5.1 Automotive

- 8.5.2 Marine

- 8.5.3 Aviation

- 8.6 Industrial

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Abet Laminati S.p.A.

- 10.2 Arkema Group

- 10.3 Arpa Industriale S.p.A.

- 10.4 BASF SE

- 10.5 Century Plyboards (India) Ltd.

- 10.6 Changzhou Zhenghang Decorative Materials Co., Ltd.

- 10.7 Changzhou Zhongtian Fireproof Decorative Sheets Co., Ltd.

- 10.8 Covestro AG

- 10.9 Dow Chemical Company

- 10.10 DuPont de Nemours, Inc.

- 10.11 Fletcher Building Limited

- 10.12 Formica Group (Fletcher Building)

- 10.13 Greenlam Industries Ltd.

- 10.14 Jiangsu TRSK New Material Co., Ltd.

- 10.15 Kingboard Laminates Holdings Ltd.

- 10.16 LyondellBasell Industries N.V.

- 10.17 Merino Industries Ltd.

- 10.18 SABIC

- 10.19 Solera International

- 10.20 Wilsonart International Inc.