|

市場調查報告書

商品編碼

1911832

中東數位轉型:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Middle East Digital Transformation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

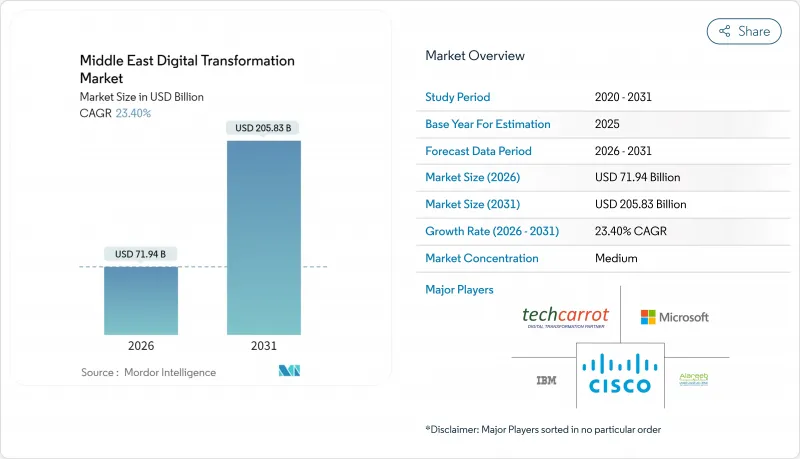

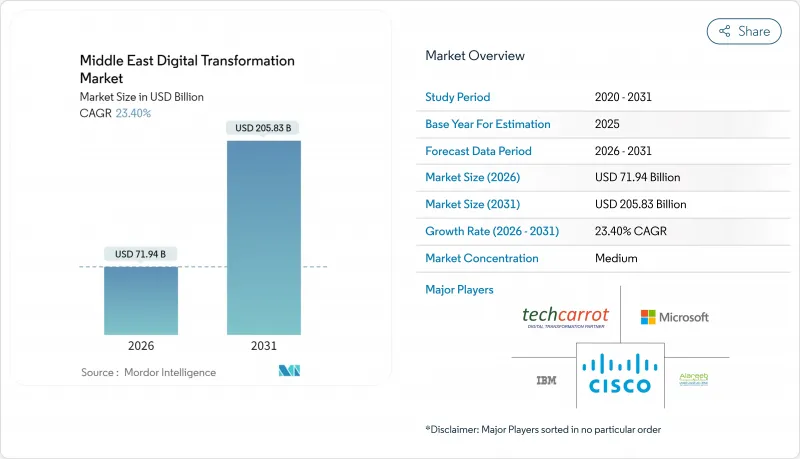

2025年中東數位轉型市場價值為583億美元,預計到2031年將達到2058.3億美元,而2026年為719.4億美元。

預計在預測期(2026-2031 年)內,複合年成長率將達到 23.4%。

這一快速成長反映了該地區在政策主導,從依賴石油轉向以技術為基礎的價值創造。主權財富基金已在人工智慧基礎設施(包括NEOM的淨零排放資料工廠)方面投資超過1,000億美元,超大規模雲端區域如今遍布海灣地區。政府的重大主導將數位轉型定位為經濟保障,要求公共機構和國有企業將其年度技術預算的40%用於人工智慧、5G和雲端運算項目。競爭舉措仍以合作為主,國際超大規模資料中心業者避免正面競爭,而是與當地主要企業建立合資企業。此外,隨著5G技術的進步支持物聯網在智慧城市和工業計劃中的規模化應用,該產業的機會也不斷擴大。

中東數位轉型市場趨勢與洞察

政府主導的大型舉措將加速資訊通訊技術和人工智慧領域的支出。

公共部門計畫正透過將技術預算與國家多元化策略結合,重塑中東的數位轉型市場。沙烏地阿拉伯的「2030願景」、阿拉伯聯合大公國的「2031國家人工智慧戰略」、卡達的「2030國家願景」以及科威特即將推出的「人工智慧藍圖」均撥款數十億美元用於超大規模基礎設施、公共服務數位化和全國技能培訓。這些措施降低了支出受油價波動的影響,並確保了多年計劃儲備,從而鼓勵國際雲端服務供應商和設備原始設備製造商(OEM)將製造、研發和客戶成功團隊在地化。因此,僅公共採購一項就已佔該地區年度支出的約三分之一,為私部門生態系統創造了穩定的需求。

超大規模雲端區域部署可降低轉型成本

微軟、亞馬遜雲端服務 (AWS)、Google雲端、甲骨文和騰訊均已運作本地可用區,與混合本地環境相比,可將企業營運成本降低 25% 至 35%。微軟正與總部位於阿布達比的 G42 公司合作,斥資 15 億美元推出主權 Azure 區域,以支援全球工作負載,同時遵守沿岸地區的隱私法律。這些新可用區將顯著降低行動應用延遲,減少合規成本,並使支援阿拉伯語的 AI 模型能夠大規模運行,從而加速銀行、零售和公共等領域採用雲端優先策略。

資深數位人才和人工智慧專家長期短缺

沿岸地區超過 80% 的雇主表示,雲端架構、資料科學和網路安全營運領域都存在人才短缺。資深 DevSecOps 工程師的薪資成長率持續超過 20%,導致計劃週期延長,整體擁有成本 (TCO) 模式膨脹。各國政府正透過加速 STEM(科學、技術、工程和數學)課程建設、推出面向技術人員的黃金簽證計劃以及廠商主導的認證活動(例如,Oracle 計劃到 2028 年培訓 35 萬名區域專家)來應對這一挑戰。雖然自動化工具、低程式碼平台和生成式人工智慧助理在一定程度上彌補了人才缺口,但複雜的整合任務仍然依賴稀缺的專業人才。

細分市場分析

到2025年,雲端和邊緣平台將佔總營收的22.45%,凸顯其在中東數位轉型市場中作為所有功能基礎的關鍵角色。 GPU密集型執行個體和無伺服器在執行時間將成為主流,而主權雲端將確保公共部門和受監管工作負載的合規性。從大規模語言模型到電腦視覺檢測,人工智慧應用將以26.55%的複合年成長率成長,推動對高效能網路和開放原始碼MLOps堆疊的需求。隨著人工智慧的成熟,石油和氣體純化煉油廠的數位雙胞胎試點計畫、物流樞紐工業機器人的維修安裝以及基於區塊鏈的貿易融資試點項目正在拓展解決方案的範圍。擴增實境(XR)訓練模擬器將在航空和醫療領域日益普及,身臨其境型模組可將認證時間縮短高達40%。由5G和專用LTE網路切片支援的物聯網感測器網路將徹底改變資產追蹤和預測性維護方式,而積層製造技術將在鑽井平台零件的現場列印這一細分領域得到廣泛應用。網路安全平台涵蓋整個技術堆疊,並將繼續推動每年兩位數的持續支出成長。

次級成長動能也遵循類似的模式:電信中心機房聚合的邊緣雲端節點可將工廠車間視覺系統的延遲降低幾毫秒;人工智慧即服務 (AIaaS) API 可協助中小企業部署聊天機器人,而無需建立內部模型。政府支持阿拉伯語人工智慧研究,並培育一個制定資料居住標準的自主模型生態系統。在這個不斷擴展的生態系統中,量子研究實驗室、神經形態晶片原型和光子互連技術等其他技術已獲得種子資金,但仍是長期投資的目標。這些發展共同將中東的數位轉型市場打造成為下一代企業技術堆疊的試驗場。

截至2025年,銀行、金融和保險(BFSI)產業將佔中東數位轉型市場18.55%的佔有率,這主要得益於核心銀行體系現代化、即時付款管道和開放銀行API的早期應用。同時,醫療保健產業正以25.95%的複合年成長率快速成長,這主要得益於遠距遠端醫療、人工智慧診斷和強制性電子健康記錄的廣泛應用。杜拜醫療城管理局的自動化醫療索賠裁決試點計畫表明,人工智慧可以將處理時間縮短35%。製造和能源公司正在將數位雙胞胎與先進的製程控制系統相結合,以將計劃外停機時間減少近10%的百分比。零售商正在部署全通路應用程式、店內分析和人工智慧建議引擎,以提高轉換率。運輸和物流營運商正在實施端到端的貨物可視性和自主堆場管理解決方案的數位化,而公共部門正在加速推動電子政府和智慧城市的建設。

這些努力之間的協同效應正在推動基本客群不斷擴大。跨產業標竿學習正在加速技術遷移,因為先進的應用案例已經證明了投資回報率。醫院正在部署銀行層級的身份驗證系統,而零售業則在利用石油和天然氣行業的預測性維護演算法。這種跨界融合正在深化服務供應商的整合機會,並在中東的數位轉型市場中建立起快速的創新週期。

其他福利

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場演變與採用藍圖

- 市場促進因素

- 大規模政府措施將加速資訊通訊技術和人工智慧領域的支出。

- 透過超大規模雲端區域部署降低轉型成本

- 物聯網規模擴張由 5G 和先進光纖網路驅動

- 主權財富基金和私人資本湧入人工智慧基礎設施

- 主權人工智慧與國家LLM計劃的興起

- 將通訊基礎設施貨幣化以促進數位資本投資

- 市場限制

- 資深數位人才和人工智慧專家長期短缺

- 網路安全和資料主權合規風險日益加劇

- GPU和高效能伺服器供應瓶頸

- 超大規模資料中心冷卻中的能源和水資源限制

- 價值鏈分析

- 監管環境

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 宏觀經濟因素如何影響市場

第5章 市場規模與成長預測

- 依技術類型

- 人工智慧(AI)和機器學習(ML)

- 擴增實境(VR 和 AR)

- 物聯網 (IoT)

- 工業機器人

- 區塊鏈

- 數位雙胞胎

- 積層製造

- 網路安全

- 雲端運算和邊緣運算

- 其他

- 按最終用戶行業分類

- 製造業

- 石油和天然氣公共產業

- 零售與電子商務

- 運輸/物流

- 衛生保健

- BFSI

- 通訊/IT

- 政府/公共部門

- 其他

- 透過部署模式

- 本地部署

- 雲

- 混合

- 按公司規模

- 主要企業

- 中小企業

- 按國家/地區

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 科威特

- 其他中東國家(以色列、巴林、伊朗、阿曼、約旦等)

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Cisco Systems Inc.

- IBM Corporation

- Microsoft Corporation

- SAP SE

- Oracle Corporation

- Accenture PLC

- Siemens AG

- Amazon Web Services Inc.

- Google LLC

- Huawei Technologies Co. Ltd.

- Ericsson AB

- stc Group

- G42 Holding Ltd

- Etisalat by eand

- Ooredoo Group

- Techcarrot FZ LLC

- Alareeb ICT

- Baarez Technology Solutions

- Deloitte Touche Tohmatsu Ltd.

- Ernst and Young(E&Y)Global Limited

- PwC International Limited

- Capgemini SE

- Cognizant Technology Solutions

- Wipro Ltd.

第7章 市場機會與未來展望

The Middle East Digital Transformation Market was valued at USD 58.30 billion in 2025 and estimated to grow from USD 71.94 billion in 2026 to reach USD 205.83 billion by 2031, at a CAGR of 23.4% during the forecast period (2026-2031).

This swift rise mirrors the region's policy-driven pivot from oil dependence toward technology-anchored value creation. Sovereign wealth funds have already committed more than USD 100 billion to artificial-intelligence infrastructure, including NEOM's net-zero data factories, while hyperscale cloud regions now dot every Gulf state . Government mega-initiatives treat digital transformation as economic insurance, compelling public agencies and state-owned enterprises to allocate up to 40% of their annual technology budgets to AI, 5G, and cloud programs. Competitive dynamics remain collaborative as international hyperscalers form joint ventures with local champions instead of entering head-to-head battles, and sector opportunities broaden as 5G densification underpins IoT scale-up across smart-city and industrial projects.

Middle East Digital Transformation Market Trends and Insights

Government mega-initiatives accelerating ICT and AI spend

Public-sector programs redefine the Middle East digital transformation market by anchoring technology budgets to national diversification strategies. Saudi Vision 2030, the UAE National AI Strategy 2031, Qatar National Vision 2030, and Kuwait's forthcoming AI Roadmap earmark multibillion-dollar outlays for hyperscale infrastructure, public-service digitization, and nationwide upskilling. These commitments insulate spending from oil-price cycles and guarantee multi-year project pipelines, prompting international cloud providers and device OEMs to localize manufacturing, R&D, and customer-success teams. As a result, public procurement alone already accounts for nearly one-third of annual regional outlays, funneling steady demand into private-sector ecosystems.

Hyperscale cloud-region rollouts cutting transformation costs

Microsoft, Amazon Web Services, Google Cloud, Oracle, and Tencent have all switched on in-country availability zones, driving enterprise operating-cost reductions of 25-35% compared with hybrid on-premises estates. Microsoft's USD 1.5 billion collaboration with Abu Dhabi-based G42 is rolling out sovereign Azure regions that comply with Gulf privacy laws while supporting global workloads. New zones slash latency for mobile apps, reduce compliance overhead, and enable Arabic-language AI models to run at scale, accelerating cloud-first adoption across banking, retail, and public safety.

Chronic shortage of senior digital talent and AI specialists

Eighty-plus percent of Gulf employers report immediate hiring gaps in cloud architecture, data science, and cyber-operations roles. Wage inflation regularly tops 20% for senior DevSecOps engineers, elongating project timelines and inflating total-cost-of-ownership models. Governments respond with accelerated STEM curricula, golden-visa schemes for tech workers, and vendor-led certification drives, such as Oracle's plan to upskill 350,000 regional professionals by 2028 . Automation tools, low-code platforms, and generative-AI copilots partially offset shortages, yet complex integration work still relies on scarce specialist talent.

Other drivers and restraints analyzed in the detailed report include:

- 5G and fiber network densification enabling IoT scale-up

- Sovereign-wealth and private-capital surge into AI infrastructure

- Heightened cybersecurity and data-sovereignty compliance risks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cloud and edge platforms anchor 22.45% of 2025 revenue, underscoring their role as the indispensable substrate for every other capability in the Middle East digital transformation market. Adoption of GPU-rich instances and serverless runtimes is now mainstream, and sovereign clouds ensure compliance for public-sector and regulated workloads. Artificial-intelligence applications, from large language models to computer-vision inspection, are on track for a 26.55% CAGR, pulling through demand for high-performance networking and open-source MLOps stacks. As AI matures, digital-twin pilots in oil-gas refineries, industrial-robotics retrofits in logistics hubs, and blockchain-based trade-finance pilots widen the solution mix. Extended-reality training simulators gain traction in aviation and healthcare, where immersive modules cut certification time by up to 40%. IoT sensor grids, enabled by 5G and private-LTE slices, transform asset-tracking and predictive-maintenance practices, while additive manufacturing finds niche uptake in on-rig parts printing. Cybersecurity platforms wrap the entire stack, attracting sustained double-digit spend growth every year.

Second-order momentum follows the same pattern. Edge-cloud nodes clustered at telecom central offices trim millisecond latency for factory-floor vision systems, and AI-as-a-Service APIs help SMEs deploy chatbots without building in-house models. Governments back Arabic-language AI research, fostering sovereign-model ecosystems that set data-residency benchmarks. Within this growing mosaic, other technologies, quantum research labs, neuromorphic chip prototypes, and photonic interconnects receive seed funding but remain long-horizon bets. Collectively, these dynamics solidify the Middle East digital transformation market as a laboratory for next-generation enterprise stacks.

BFSI seized 18.55% of the Middle East digital transformation market share in 2025 owing to early adoption of core-bank modernization, instant-payments platforms, and open-banking APIs. Yet healthcare is racing ahead at a 25.95% CAGR as telehealth, AI-enabled diagnostics, and electronic health records mandates proliferate. Dubai Healthcare City Authority's pilot that auto-reviews medical claims demonstrates how AI slashes processing time by 35%. Manufacturing and energy players integrate digital twins with advanced process control systems, reducing unplanned downtime by high single-digit percentages. Retailers roll out omnichannel apps, in-store analytics, and AI recommendation engines that lift conversion rates. Transportation and logistics operators digitize end-to-end freight visibility and deploy autonomous yard-management solutions, while the public sector intensifies e-government and smart-city implementations.

The net effect is a broadening customer base. As frontier use cases prove ROI, cross-industry benchmarking accelerates technology migration. Hospitals adopt banking-style identity verification; retail borrows predictive-maintenance algorithms from oil and gas. That cross-pollination deepens integration opportunities for service providers and cements a fast-cycling innovation loop inside the Middle East digital transformation market.

The Middle East Digital Transformation Market Report is Segmented by Technology Type (AI and ML, Extended Reality, Iot, Industrial Robotics, Blockchain, and More), End-User Industry (Manufacturing, Oil and Gas Utilities, Retail and E-Commerce, and More), Deployment Mode (On-Premise, Cloud, Hybrid), Enterprise Size (Large Enterprises, Smes), and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Cisco Systems Inc.

- IBM Corporation

- Microsoft Corporation

- SAP SE

- Oracle Corporation

- Accenture PLC

- Siemens AG

- Amazon Web Services Inc.

- Google LLC

- Huawei Technologies Co. Ltd.

- Ericsson AB

- stc Group

- G42 Holding Ltd

- Etisalat by eand

- Ooredoo Group

- Techcarrot FZ LLC

- Alareeb ICT

- Baarez Technology Solutions

- Deloitte Touche Tohmatsu Ltd.

- Ernst and Young (E&Y) Global Limited

- PwC International Limited

- Capgemini SE

- Cognizant Technology Solutions

- Wipro Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Evolution and Adoption Roadmap

- 4.3 Market Drivers

- 4.3.1 Government mega-initiatives accelerating ICT and AI spend

- 4.3.2 Hyperscale cloud region rollouts cutting transformation costs

- 4.3.3 5G and fiber network densification enabling IoT scale-up

- 4.3.4 Sovereign wealth and private-capital surge into AI infrastructure

- 4.3.5 Emergence of sovereign AI and national LLM projects

- 4.3.6 Telecom-infrastructure monetization unlocking digital CAPEX

- 4.4 Market Restraints

- 4.4.1 Chronic shortage of senior digital talent and AI specialists

- 4.4.2 Heightened cybersecurity and data-sovereignty compliance risks

- 4.4.3 GPU and advanced-server supply bottlenecks

- 4.4.4 Energy-water constraints for hyperscale data center cooling

- 4.5 Value Chain Analysis

- 4.6 Regulatory Landscape

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Technology Type

- 5.1.1 Artificial Intelligence and Machine Learning

- 5.1.2 Extended Reality (VR and AR)

- 5.1.3 Internet of Things (IoT)

- 5.1.4 Industrial Robotics

- 5.1.5 Blockchain

- 5.1.6 Digital Twin

- 5.1.7 Additive Manufacturing

- 5.1.8 Cybersecurity

- 5.1.9 Cloud and Edge Computing

- 5.1.10 Other Technologies

- 5.2 By End-User Industry

- 5.2.1 Manufacturing

- 5.2.2 Oil and Gas Utilities

- 5.2.3 Retail and E-commerce

- 5.2.4 Transportation and Logistics

- 5.2.5 Healthcare

- 5.2.6 BFSI

- 5.2.7 Telecom and IT

- 5.2.8 Government and Public Sector

- 5.2.9 Other End-user Industries

- 5.3 By Deployment Mode

- 5.3.1 On-Premise

- 5.3.2 Cloud

- 5.3.3 Hybrid

- 5.4 By Enterprise Size

- 5.4.1 Large Enterprises

- 5.4.2 Small and Medium Enterprises (SMEs)

- 5.5 By Country

- 5.5.1 Saudi Arabia

- 5.5.2 United Arab Emirates

- 5.5.3 Qatar

- 5.5.4 Kuwait

- 5.5.5 Other Middle-East Countries (Israel, Bahrain, Iran, Oman, Jordan, etc.)

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Cisco Systems Inc.

- 6.4.2 IBM Corporation

- 6.4.3 Microsoft Corporation

- 6.4.4 SAP SE

- 6.4.5 Oracle Corporation

- 6.4.6 Accenture PLC

- 6.4.7 Siemens AG

- 6.4.8 Amazon Web Services Inc.

- 6.4.9 Google LLC

- 6.4.10 Huawei Technologies Co. Ltd.

- 6.4.11 Ericsson AB

- 6.4.12 stc Group

- 6.4.13 G42 Holding Ltd

- 6.4.14 Etisalat by eand

- 6.4.15 Ooredoo Group

- 6.4.16 Techcarrot FZ LLC

- 6.4.17 Alareeb ICT

- 6.4.18 Baarez Technology Solutions

- 6.4.19 Deloitte Touche Tohmatsu Ltd.

- 6.4.20 Ernst and Young (E&Y) Global Limited

- 6.4.21 PwC International Limited

- 6.4.22 Capgemini SE

- 6.4.23 Cognizant Technology Solutions

- 6.4.24 Wipro Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment