|

市場調查報告書

商品編碼

1911830

歐洲醫藥塑膠包裝:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Europe Pharmaceutical Plastic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

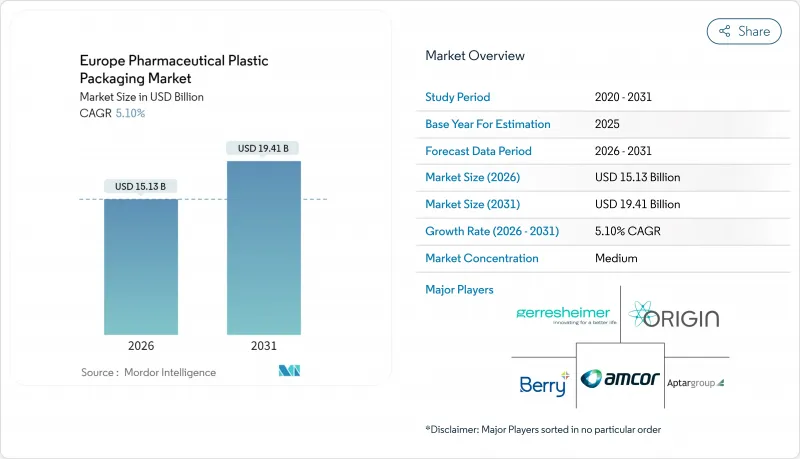

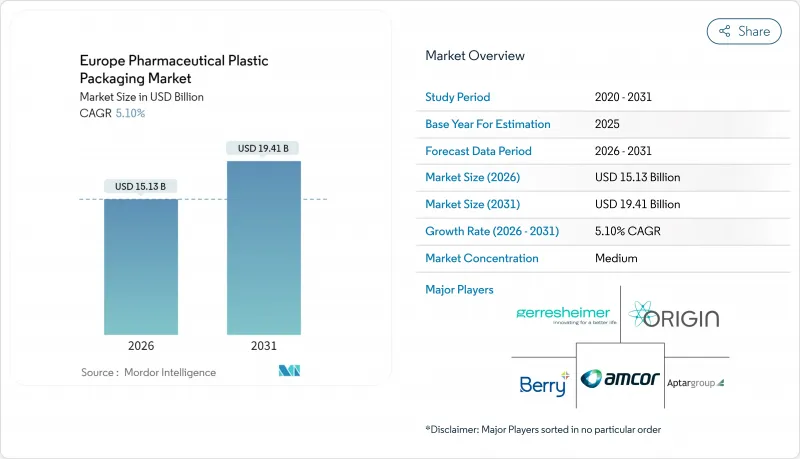

2025年歐洲醫藥塑膠包裝市場價值為144億美元,預計到2031年將達到194.1億美元,高於2026年的151.3億美元。

預計在預測期(2026-2031 年)內,複合年成長率將達到 5.10%。

推動成長的關鍵因素包括永續性的迫切需求、生物製藥的廣泛應用以及家庭護理的擴張,這些因素都對阻隔性能、可回收性和以用戶為中心的設計提出了更為嚴格的要求。領先的供應商正在擴大再生材料產品線和RFID技術產品,以滿足循環經濟目標和醫院自動化專案的需求。同時,樹脂成本的波動和更嚴格的萃取物法規正在擠壓利潤空間,促使企業進行原料避險、供應商多元化以及選擇性併購,以維持規模優勢。由於現有企業擴大垂直整合,而專業公司則在智慧和生物基解決方案的細分市場佔有一席之地,競爭依然保持適度。這正在重塑歐洲醫藥塑膠包裝市場的定價和合作模式。

歐洲醫藥塑膠包裝市場趨勢與洞察

對兒童安全瓶蓋和老年人友善包裝的需求日益成長

受人口老化和日益嚴格的兒童安全法規的推動,包裝投資正轉向兼具觸感操作和經認證的兒童安全鎖的瓶蓋。歐洲加工商為每個符合人體工學的新型瓶蓋平台投資200萬至400萬歐元,這項措施已促使以患者為中心的包裝系統在2024年之前採用率提高18%。 Nemera的低扭力瓶蓋可將開啟力降低30%,同時超越ISO 8317標準,展現了易用性和安全性之間的平衡。歐洲藥品管理局(EMA)2024年發布的指南也為監管提供了支持,該指南建議為慢性病藥物採用方便用戶使用型包裝。早期採用者表示,雖然初始成本增加了15%至20%,特別是對於需要高精度模具來支撐複雜鎖定機制的聚丙烯瓶蓋而言,但更高的定價和品牌忠誠度的提升彌補了這一成本增加。

需要先進腸外塑膠的生物製藥的激增

預計到2024年,歐洲生物製藥產量將增加23%,其中德國和瑞士的工廠將擴大單株抗體的生產規模。這些高價值分子需要超低萃取物和無玻璃抗破損性能,加速了對環烯烴共聚物和聚合物的需求。這些材料具有化學惰性和透明度,但成本是聚丙烯的三到四倍。肖特製藥計畫投資1.5億歐元擴建管瓶,凸顯了供應商對特種聚合物生產能力的重視。生物製藥包裝的成長率幾乎是歐洲整體製藥塑膠包裝市場的兩倍,這正在重塑材料組合、認證時間表和供應商整合格局。

PP和PET樹脂價格波動

石化原料供應中斷和能源價格波動導致2024年聚丙烯和PET價格上漲15%至20%。BASF等生產商已轉向季度定價,將價格波動風險轉移給加工商,而加工商通常與製藥公司簽訂多年供應合約。規模較小、避險能力較弱的公司面臨壓力,引發了一波整合浪潮。同時,大型企業集團正透過多元化供應來源和投資自身回收來減輕價格波動的影響。對於許多中型加工商而言,30%至40%的原料成本受季度調整條款的約束,這削弱了歐洲醫藥塑膠包裝市場的整體可預測性。

細分市場分析

到2025年,聚丙烯(PP)在歐洲醫藥塑膠包裝市場仍將佔據35.20%的佔有率,這主要得益於其成本效益、耐化學腐蝕性和廣泛的監管認可。用於醫藥領域的PP年消費量將超過18萬噸,涵蓋瓶蓋、泡殼包裝、注射器等。然而,歐洲醫藥塑膠包裝市場正逐漸轉向高高密度聚苯乙烯(HDPE),其複合年成長率(CAGR)為5.74%。 HDPE優異的防潮和防氧阻隔性滿足生物製藥的穩定性要求,同時在《塑膠回收再利用條例》(PPWR)下也具有更高的可回收性。

向永續性的轉型正在推動對醫用級再生PET(rPET)的需求,並促進生物基等級產品的試驗。 Gerresheimer已開始商業化生產符合製藥純度標準的再生PET輸液瓶。儘管價格溢價高達300-400%,但特種聚合物(COC、COP和PLA混合物)在注射配方中逐漸被接受,因為超低萃取物是此類配方的關鍵。 Schott Pharma擴大COC生產規模,也印證了市場對這些特殊樹脂日益成長的需求。聚丙烯供應商正透過試驗使用消費後塑膠原料來應對這一需求,但他們必須克服與氣味、顏色和可追溯性相關的技術挑戰,以保持主導地位。

歐洲醫藥塑膠包裝市場按原料(聚丙烯、聚對苯二甲酸乙二醇酯、低密度聚乙烯、高密度聚苯乙烯及其他)、產品類型(固態容器、液體和靜脈注射瓶、滴鼻劑瓶、口腔清潔用品包、小袋/小袋、管瓶/小瓶及其他)和國家/地區進行細分。市場預測以以金額為準。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 對兒童安全包裝和老年人友善包裝的需求日益成長

- 需要先進腸外塑膠的生物製藥的激增

- 歐盟循環經濟規則加速可回收塑膠的開發

- 電子商務藥品分銷的擴張將推動對二級包裝的保護力度加大。

- 家庭注射療法需要使用小型預填充式注射器。

- 用於醫院自動化的機器人輔助RFID泡殼包裝

- 市場限制

- PP和PET樹脂價格波動

- 更嚴格的可萃取物和可浸出物監管標準

- 注射劑中玻璃和鋁的替代品

- 供不應求

- 供應鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 產業價值鏈分析

- 宏觀經濟趨勢的影響

第5章 市場規模與成長預測

- 按原料

- 聚丙烯(PP)

- 聚對苯二甲酸乙二醇酯(PET)

- 低密度聚乙烯(LDPE)

- 高密度聚苯乙烯(HDPE)

- 其他(COP、COC、不含PVC的混合物、生物聚合物)

- 依產品類型

- 固態容器

- 液體/滴管瓶

- 鼻腔噴霧瓶

- 口腔清潔用品套裝

- 小袋/小袋

- 管瓶和安瓿(聚合物)

- 墨水匣

- 預填充式注射器

- 瓶蓋和封口

- 其他(單劑量藥片、吸入器藥罐)

- 按國家/地區

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 比利時

- 瑞典

- 其他歐洲地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Gerresheimer AG

- Amcor PLC

- Berry Global Group Inc.

- AptarGroup Inc.

- Origin Pharma Packaging

- Pretium Packaging

- Klckner Pentaplast

- Comar

- Gil Plastic Products Ltd

- Drug Plastics Group

- West Pharmaceutical Services Inc.

- Nemera

- Bormioli Pharma

- Alpla Group

- Sanner GmbH

- Tekni-Plex

- Weener Plastics

- Jabil Healthcare(Nypro)

- Stevanato Group(EZ-fill polymer vials)

- Raumedic AG

第7章 市場機會與未來展望

The Europe pharmaceutical plastic packaging market was valued at USD 14.40 billion in 2025 and estimated to grow from USD 15.13 billion in 2026 to reach USD 19.41 billion by 2031, at a CAGR of 5.10% during the forecast period (2026-2031).

Growth pivots on sustainability mandates, biologics proliferation, and home-based therapy expansion, each tightening performance requirements for barrier properties, recyclability, and user-centric design. Leading suppliers are scaling recycled-content lines and RFID-ready formats to satisfy circular-economy goals and hospital automation programs. Meanwhile resin cost swings and stricter extractables protocols are compressing margins, prompting raw-material hedging, supplier diversification, and selective mergers to preserve scale advantages. Competitive intensity remains moderate as incumbents extend vertical integration while specialists seize niches in smart and bio-based solutions, reshaping pricing and collaboration models across the Europe pharmaceutical plastic packaging market.

Europe Pharmaceutical Plastic Packaging Market Trends and Insights

Rising Demand for Child-Resistant and Senior-Friendly Packs

An ageing population and tighter pediatric-safety mandates are steering packaging investments toward closures that combine tactile ease with certified child resistance. European converters spend EUR 2-4 million on every new ergonomic closure platform, a commitment that lifted patient-centric system launches by 18% in 2024. Nemera's torque-reducing closure lowers opening force 30% while exceeding ISO 8317, illustrating how usability and safety can coexist.Regulatory endorsement came via the European Medicines Agency's 2024 guidelines stressing user-friendly packaging for chronic therapies. Early adopters report premium pricing and brand-loyalty gains that offset the initial 15-20% cost uplift, especially for polypropylene caps whose mold precision supports intricate locking mechanisms.

Surge in Biologics Needing Advanced Parenteral Plastics

Biologic drug output in Europe jumped 23% in 2024, with German and Swiss plants ramping monoclonal antibody runs. These high-value molecules require ultra-low extractables and glass-free break-resistance, accelerating demand for cyclic olefin copolymers and cyclic olefin polymers that cost 3-4 times polypropylene yet deliver chemical inertness and clarity. SCHOTT Pharma's EUR 150 million vial-expansion plan underscores supplier commitment to specialized polymer capacity. Biologics-ready packaging is growing nearly twice as fast as the overall Europe pharmaceutical plastic packaging market, reshaping material mix, qualification timelines, and supplier consolidation patterns.

Volatile PP and PET Resin Prices

Petrochemical feedstock disruptions and energy-price swings pushed polypropylene and PET up 15-20% during 2024. Producers such as BASF now quote quarterly, shifting volatility risk to converters who often lock in multi-year supply deals with drugmakers. Smaller firms lacking hedging capacity face squeezes that have triggered consolidation waves, while larger groups diversify supply and invest in in-house recycling to temper pricing shocks. Quarterly adjustment clauses already cover 30-40% of raw-material spend for many mid-tier converters, eroding predictability across the Europe pharmaceutical plastic packaging market.

Other drivers and restraints analyzed in the detailed report include:

- EU Circular-Economy Rules Accelerating Recyclable Plastics

- E-Commerce Pharma Boosting Protective Secondary Packaging

- Stricter Extractables / Leachables Limits

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Polypropylene retained 35.20% Europe pharmaceutical plastic packaging market share in 2025, supported by cost-efficiency, chemical resistance, and widespread regulatory familiarity. Annual pharmaceutical PP consumption exceeds 180,000 tons, covering closures, blisters, and syringes. However, the Europe pharmaceutical plastic packaging market size is tilting toward high-density polyethylene, advancing at a 5.74% CAGR as its superior moisture and oxygen barrier meets biologics stability requirements while presenting stronger recyclability credentials under PPWR.

Sustainability shifts also elevate medical-grade rPET and spur trials of bio-based grades. Gerresheimer has begun commercial runs of recycled PET dropper bottles that satisfy pharma purity thresholds. Niche polymers-COC, COP, PLA blends-command premiums of 300-400% but win specifications for parenterals where ultra-low extractables are mandatory. SCHOTT Pharma's COC expansion underscores rising demand for these specialty resins. Polypropylene suppliers are responding by piloting post-consumer content streams, yet must overcome technical hurdles in odor, color, and traceability to retain leadership within the Europe pharmaceutical plastic packaging market.

Europe Pharmaceutical Plastic Packaging Market is Segmented by Raw Material (Polypropylene, Polyethylene Terephthalate, Low-Density Polyethylene, High-Density Polyethylene, Others), Product Type (Solid Containers, Liquid and Dropper Bottles, Nasal Spray Bottles, Oral-Care Packs, Pouches/Sachets, Vials and Ampoules, and More), and by Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Gerresheimer AG

- Amcor PLC

- Berry Global Group Inc.

- AptarGroup Inc.

- Origin Pharma Packaging

- Pretium Packaging

- Klckner Pentaplast

- Comar

- Gil Plastic Products Ltd

- Drug Plastics Group

- West Pharmaceutical Services Inc.

- Nemera

- Bormioli Pharma

- Alpla Group

- Sanner GmbH

- Tekni-Plex

- Weener Plastics

- Jabil Healthcare (Nypro)

- Stevanato Group (EZ-fill polymer vials)

- Raumedic AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for child-resistant and senior-friendly packs

- 4.2.2 Surge in biologics needing advanced parenteral plastics

- 4.2.3 EU circular-economy rules accelerating recyclable plastics

- 4.2.4 E-commerce pharma boosting protective secondary packaging

- 4.2.5 Home-injection therapies driving small PP pre-filled syringes

- 4.2.6 Robotics-ready RFID blister packs for hospital automation

- 4.3 Market Restraints

- 4.3.1 Volatile PP and PET resin prices

- 4.3.2 Stricter extractables / leachables limits

- 4.3.3 Glass and aluminum substitution in injectables

- 4.3.4 Short supply of medical-grade recycled resin

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Degree of Competition

- 4.8 Industry Value-Chain Analysis

- 4.9 Impact of Macroeconomic Trends

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Raw Material

- 5.1.1 Polypropylene (PP)

- 5.1.2 Polyethylene Terephthalate (PET)

- 5.1.3 Low-Density Polyethylene (LDPE)

- 5.1.4 High-Density Polyethylene (HDPE)

- 5.1.5 Others (COP, COC, PVC-free blends, bio-polymers)

- 5.2 By Product Type

- 5.2.1 Solid Containers

- 5.2.2 Liquid and Dropper Bottles

- 5.2.3 Nasal Spray Bottles

- 5.2.4 Oral-care Packs

- 5.2.5 Pouches / Sachets

- 5.2.6 Vials and Ampoules (polymer)

- 5.2.7 Cartridges

- 5.2.8 Prefilled Syringes

- 5.2.9 Caps and Closures

- 5.2.10 Others (unit-dose strips, inhaler canisters)

- 5.3 By Country

- 5.3.1 United Kingdom

- 5.3.2 Germany

- 5.3.3 France

- 5.3.4 Spain

- 5.3.5 Italy

- 5.3.6 Belgium

- 5.3.7 Sweden

- 5.3.8 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Gerresheimer AG

- 6.4.2 Amcor PLC

- 6.4.3 Berry Global Group Inc.

- 6.4.4 AptarGroup Inc.

- 6.4.5 Origin Pharma Packaging

- 6.4.6 Pretium Packaging

- 6.4.7 Klckner Pentaplast

- 6.4.8 Comar

- 6.4.9 Gil Plastic Products Ltd

- 6.4.10 Drug Plastics Group

- 6.4.11 West Pharmaceutical Services Inc.

- 6.4.12 Nemera

- 6.4.13 Bormioli Pharma

- 6.4.14 Alpla Group

- 6.4.15 Sanner GmbH

- 6.4.16 Tekni-Plex

- 6.4.17 Weener Plastics

- 6.4.18 Jabil Healthcare (Nypro)

- 6.4.19 Stevanato Group (EZ-fill polymer vials)

- 6.4.20 Raumedic AG

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment