|

市場調查報告書

商品編碼

1911818

防水解決方案:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Waterproofing Solutions - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

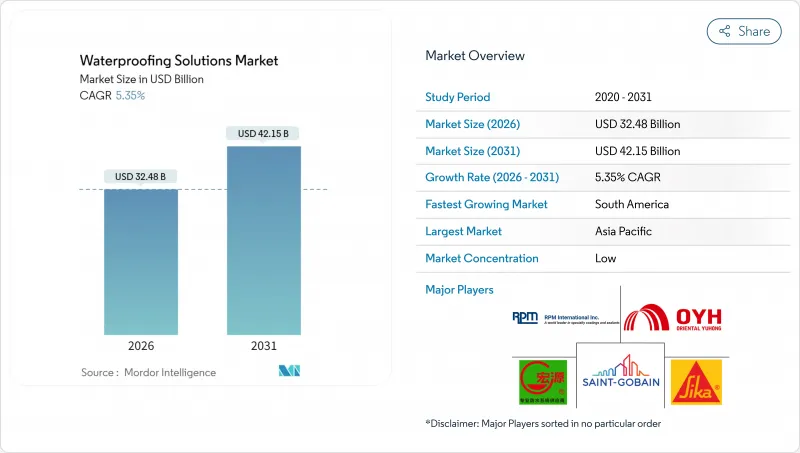

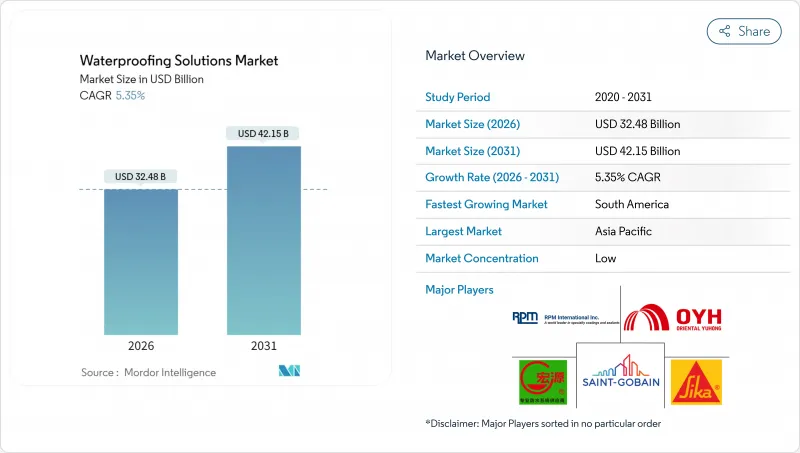

預計防水解決方案市場將從 2025 年的 308.3 億美元成長到 2026 年的 324.8 億美元,到 2031 年將達到 421.5 億美元,2026 年至 2031 年的複合年成長率為 5.35%。

目前的擴張反映了建築圍護結構保護方式從被動維修向預防性保護的重大轉變,這主要得益於綠色建築規範、基礎設施韌性目標以及節省勞動力的施工方法等因素的共同推動。液態防水捲材固化無縫,所需施工人員也更少,因此在新建和維修專案中,液態防水捲材正在取代許多片材防水系統。更嚴格的揮發性有機化合物(VOC)法規正在加速化學塗料向水性及生物基化學品的改良。公共部門的採購也更重視整體生命週期性能而非初始成本。此外,資料中心冷卻系統、隧道修復和氣候適應計劃的應用範圍不斷擴大,使其在原料價格波動的情況下仍能保持相對穩定的定價能力。

全球防水解決方案市場趨勢與洞察

綠建築中低揮發性有機化合物法規的普及

監管機構目前已將許多防水材料的揮發性有機化合物 (VOC) 含量限制在 50 克/公升或以下,這使得溶劑型塗料越來越不符合公共住宅和商業計劃的規範。擁有先進乳化聚合物技術的製造商透過提供耐久性可與溶劑型塗料媲美甚至更優的水性防水卷材,正在贏得市場領先地位。承包商也開始採用這些產品,因為它們可以減少施工現場的異味,縮短房屋重新入住時間,並降低工人接觸有害物質的風險。 LEED 和歐盟生態標章認證正成為建築師重要的採購考量。同時,新興的生物基樹脂使企業能夠證明其碳排放的降低,從而在滿足 VOC 標準之外脫穎而出。

快速的都市化和基礎建設

在亞洲和南美洲,特大城市不斷擴張,每年新增數百萬平方英尺的屋頂、平台和地下空間。大型水壩、地鐵和防洪隧道需要特殊的防水膜,以承受持續的靜水壓力。由於高層建築一旦防水失效,後果更為嚴重,設計團隊通常會選用長期保固的多層液態防水系統。模組化預製公寓大樓也越來越傾向於使用工廠預塗的防水塗料,這種塗料運抵現場後即可完全固化,從而減少工時。隨著各國政府將氣候適應性條款納入競標,那些擁有標誌性基礎設施項目經驗的供應商在競標候選名單中的排名也迅速上升。

石油樹脂原料價格波動

環氧樹脂、聚氨酯樹脂和聚氯乙烯樹脂的原料價格與原油價格波動密切相關,進而影響產品價格的季度性變化。供不應求導致原物料成本在2024年至2025年間上漲15%至20%,迫使廠商進行庫存避險並迅速發布價格調整通知。採購能力有限的小型混煉企業難以取得供應,市佔率逐漸被規模較大的綜合性企業蠶食。一些承包商已開始盡可能地用水泥基塗料取代其他材料,但性能上的差距使得全面轉型難以實現。持續的價格波動促使人們加強對生物基或再生聚合物的研發力度,以降低價格風險,但工業規模的生產仍處於起步階段。

細分市場分析

到2025年,卷材將佔總收入的73.42%,這反映了卷材和液體防水系統在防水解決方案市場的主導地位,這些產品具有厚度均勻、施工快速的優點。以細分市場來看,預計到2031年,卷材將以5.69%的最高複合年成長率成長,穩步擴大其在防水解決方案市場的佔有率。模組化建築的成長推動了對冷浸聚氨酯的需求,用於在模組化模組周圍形成無縫捲材。高溫噴塗聚脲因其即時固化的特性,仍然是土木工程結構的首選,即使在潮濕氣候下,也能在數小時內恢復交通。在低坡屋頂領域,全黏合捲材憑藉其在ASTM測試中驗證的優異性能,繼續保持主導地位。同時,松鋪式組件在需要防根穿刺和可逆防水層的綠色屋頂和廣場平台設計中找到了生態學定位。

製造商正在開發跨基材黏合底漆,以簡化從混凝土到金屬或熱塑性塑膠的過渡。採用RFID標籤卷材的整合品質保證平台可記錄批號、施工量和環境條件數據,從而確保設計人員獲得一致的性能。同時,業界在ISO 22114測試方面的合作正在協調各國標準的結果,並促進跨國計劃核准。總而言之,膜材料的進步和現場施工效率的提高,使其成為注重性價比、尋求更低生命週期成本的防水解決方案業主的首選。

區域分析

亞太地區將繼續佔據主導地位,預計到2025年將佔總收入的36.70%,這主要得益於中國、印度和東南亞地區住宅、公路和發電工程的持續成長。大規模的公私合營(PPP)將為採購量提供保障,有利於那些能夠在計劃現場附近建立區域倉庫和技術團隊的供應商。日本和韓國嚴格的建築規範促使高規格液體防水卷材的早期應用,為新興鄰國樹立了標竿。隨著各國政府將防水建築支出納入氣候調適計劃,並推出防洪和高架鐵路結構等獎勵策略,市場成長速度將進一步加速。

預計到2031年,南美洲將以6.22%的複合年成長率實現最高水準的成長,這主要得益於巴西恢復城市交通建設資金投入以及哥倫比亞跨安第斯隧道的竣工。外匯波動促進了聚合物樹脂的本地化生產,並為跨國公司創造了合資機會。阿根廷經濟復甦緩慢,導致住宅需求積壓,經銷商增加快速固化丙烯酸防水卷材的庫存,這種卷材非常適合勞動力短缺的地區。該地區氣候特徵是降雨量大、紫外線強烈,因此需要保持柔軟性的彈性體系統。政府競標擴大將ASTM C836或EN 14891作為強制性標準。

北美和歐洲是成熟市場,成長率僅為個位數,但它們正引領全球技術趨勢。美國的《基礎設施投資與就業法案》已向橋面鋪裝和雨水隧道注入數十億美元資金,為優質供應商提供了堅實的基礎。歐洲綠色交易正在推動向完全可回收或生物基塗層的轉變,給以石化產品為主的配方帶來了壓力。在中東和非洲市場,需求集中在沿岸地區的大型企劃上,極端高溫促使人們採用抗紫外線聚脲。同時,開發銀行貸款正在為南非城市更新中的低收入住宅防水工程提供資金。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 綠建築中低揮發性有機化合物法規的普及

- 快速的都市化和不斷擴大的基礎設施建設

- 超大規模資料中心的擴張

- 公共基礎設施計劃快速擴張

- 模組化建築中液態防水膜的強勢應用

- 市場限制

- 石油樹脂原料價格波動

- 專業建築工人人手不足

- 遵守微塑膠法規的負擔

- 價值鏈分析

- 監管環境

- 波特五力模型

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 產業間競爭

第5章 市場規模與成長預測

- 依產品

- 化學品

- 環氧樹脂基

- 聚氨酯基

- 水溶液

- 其他技術

- 電影

- 低溫液體應用

- 高溫液體應用

- 全黏性片材

- 鬆散的床上用品

- 化學品

- 按最終用途

- 商業的

- 工業和公共設施

- 基礎設施

- 住宅

- 按地區

- 亞太地區

- 澳洲

- 中國

- 印度

- 印尼

- 日本

- 馬來西亞

- 韓國

- 泰國

- 越南

- 亞太其他地區

- 北美洲

- 加拿大

- 墨西哥

- 美國

- 歐洲

- 法國

- 德國

- 義大利

- 俄羅斯

- 西班牙

- 英國

- 其他歐洲地區

- 南美洲

- 阿根廷

- 巴西

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- Ardex Group

- Arkema(Bostik)

- Asian Paints Ltd.

- Beijing Oriental Yuhong Waterproof Technology Co., Ltd.

- Hongyuan Waterproof Technology Group Co., Ltd.

- Keshun Waterproof Technology Co., Ltd.

- Kingspan Group

- Minerals Technologies Inc.

- Nippon Paint Holdings Co., Ltd.

- Pidilite Industries Ltd.

- RPM International Inc.

- Saint-Gobain

- Sika AG

- Soprema

- Thermax Limited

第7章 市場機會與未來展望

第8章:執行長面臨的關鍵策略問題

The Waterproofing Solutions market is expected to grow from USD 30.83 billion in 2025 to USD 32.48 billion in 2026 and is forecast to reach USD 42.15 billion by 2031 at 5.35% CAGR over 2026-2031.

The current expansion reflects a decisive pivot from reactive repairs to proactive building-envelope protection, as green-building mandates, infrastructure resilience goals, and labor-saving construction methods converge. Liquid-applied membranes, which cure seamlessly and require fewer skilled installers, are replacing many sheet-based systems in both new-build and retrofit settings. Tighter VOC regulations have accelerated the reformulation of chemical coatings toward water-borne and bio-based chemistries, while public-sector procurement now values total life-cycle performance over initial cost. Finally, data-center cooling intensity, tunnel rehabilitation, and climate-adaptation projects are broadening the application base, keeping pricing power relatively stable despite volatility in raw materials.

Global Waterproofing Solutions Market Trends and Insights

Surge in Green-Building Low-VOC Mandates

Regulators now limit VOC content to 50 g/L or lower for many waterproofing categories, pushing solvent-based coatings off specifications in public housing and commercial projects. Manufacturers with advanced emulsion-polymer chemistry are capturing premium positions by delivering water-based membranes that match or surpass the durability of solvent-borne membranes. Contractors embrace these products because reduced on-site odors shorten re-occupancy cycles and cut worker-exposure risks. Labels indicating LEED-compatible or EU Ecolabel compliance have become critical purchasing cues for architects. In parallel, emerging bio-based resins enable firms to advertise carbon footprint reductions, offering differentiation beyond simple VOC compliance.

Rapid Urbanization and Infrastructure Build-Out

Megacity expansion is adding millions of square feet of roof, podium, and below-grade surfaces each year across Asia and South America. Large dams, subways, and flood-control tunnels require specialized membranes that perform under sustained hydrostatic pressure. High-rise construction heightens the consequence of failure, so design teams specify multi-layer liquid-applied systems backed by long warranties. Modular-prefab apartment blocks further favor factory-applied waterproof coatings that arrive onsite fully cured, shrinking labor hours. As governments bundle climate-resilience clauses into tenders, suppliers with track records on landmark infrastructure quickly climb bid shortlists.

Volatile Petro-Resin Input Prices

Epoxy, polyurethane, and PVC feedstocks track crude oil fluctuations, which in turn affect finished goods prices every quarter. Natural-rubber shortfalls lifted raw-material costs by 15-20% between 2024 and 2025, forcing manufacturers to hedge inventory and issue rapid surcharge notices. Smaller formulators with limited purchasing power struggled to secure supplies, conceding market share to integrated majors. Some contractors substituted cementitious coatings where feasible, but performance gaps limit wholesale migration. Continuous volatility encourages research and development into bio-sourced or recycled polymers to buffer price risk, although industrial-scale volumes remain nascent.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Hyperscale Data Centers

- Rapid Growth in Public Infrastructure Projects

- Specialist-Installer Labor Shortage

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Membranes accounted for 73.42% of the revenue in 2025, reflecting the waterproofing solutions market share dominance of sheet and liquid systems, which deliver uniform thickness and rapid installation. At the segment level, membranes are projected to command the highest 5.69% CAGR to 2031, meaning their share of the waterproofing solutions market size is forecasted to widen steadily. Demand aligns with the growth of modular buildings, where cold-liquid-applied polyurethanes form seamless skins around volumetric modules. Hot-spray polyureas remain favored on civil structures because instant curing allows traffic reopening within hours, even in humid climates. Fully adhered sheets continue to lead the way in low-slope roofing, thanks to their well-documented ASTM test pedigree, while loose-laid assemblies find ecological niches in green-roof and plaza-deck designs that require root-resistant yet reversible layers.

Manufacturers are engineering primers that bond across dissimilar substrates to simplify transitions from concrete to metal or thermoplastic. Integrated QA platforms using RFID-tagged rolls now log batch, spread-rate, and ambient-condition data, assuring specifiers of performance consistency. Meanwhile, industry collaboration on ISO 22114 testing harmonizes outcomes across domestic codes, easing cross-border project approvals. Overall, membranes' materials evolution and job-site efficiencies keep them the go-to solution for value-driven owners seeking low life-cycle costs within the waterproofing solutions market.

The Global Waterproofing Solutions Market Report is Segmented by Product (Chemicals Including Epoxy-Based, Polyurethane-Based, Water-Based, and Other Technologies; Membranes Including Cold Liquid Applied, Hot Liquid Applied, Fully Adhered Sheet, and Loose-Laid Sheet), End-Use Sector (Commercial, Residential, and More), and Geography (Asia-Pacific, North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

The Asia-Pacific region retained a commanding 36.70% of 2025 revenue as China, India, and Southeast Asia continued to drive housing, expressway, and hydropower projects. Large public-private partnerships underpin volume commitments that reward suppliers who can establish regional warehouses and technical crews near project hubs. Japan and South Korea, with stringent building codes, adopted high-spec liquid membranes early, setting benchmarks that were later emulated in emerging neighbors. Growth accelerates when governments integrate waterproofing line items into broader climate-adaptation programs, channeling stimulus toward flood protection and elevated rail structures.

South America is projected to deliver the strongest 6.22% CAGR through 2031, as Brazil reinstates urban-mobility funding and Colombia completes cross-Andean tunnels. Exchange-rate swings encourage local manufacturing of polymer resins, creating joint-venture openings for multinationals. Argentina's gradual recovery drives pent-up residential demand, prompting distributors to stock fast-curing acrylic membranes suitable for labor-constrained sites. Regional climate, with heavy rainfall and high UV, favors elastomeric systems that stay flexible, and government tenders increasingly list ASTM C836 or EN 14891 as mandatory standards.

North America and Europe exhibit mature, low-single-digit growth, yet set the global technology pace. The U.S. Infrastructure Investment and Jobs Act steers billions into bridge-deck overlays and stormwater tunnels, maintaining a resilient base for premium suppliers. Europe's Green Deal shifts specifications toward fully recyclable or bio-based layers, pressuring petrochemical-heavy formulations. The Middle East and Africa markets concentrate demand in Gulf megaprojects, where extreme heat drives the uptake of UV-stable polyureas. Meanwhile, South Africa's urban renewal allocates funds to low-income housing waterproofing, financed by development banks.

- Ardex Group

- Arkema (Bostik)

- Asian Paints Ltd.

- Beijing Oriental Yuhong Waterproof Technology Co., Ltd.

- Hongyuan Waterproof Technology Group Co., Ltd.

- Keshun Waterproof Technology Co., Ltd.

- Kingspan Group

- Minerals Technologies Inc.

- Nippon Paint Holdings Co., Ltd.

- Pidilite Industries Ltd.

- RPM International Inc.

- Saint-Gobain

- Sika AG

- Soprema

- Thermax Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in green-building low-VOC mandates

- 4.2.2 Rapid urbanisation and infrastructure build-out

- 4.2.3 Expansion of hyperscale data centres

- 4.2.4 Rapid growth in public infrastructure projects

- 4.2.5 Robust shift towards liquid-applied membranes in modular construction

- 4.3 Market Restraints

- 4.3.1 Volatile petro-resin input prices

- 4.3.2 Specialist-installer labour shortage

- 4.3.3 Microplastic compliance burden

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Industry Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 Chemicals

- 5.1.1.1 Epoxy-based

- 5.1.1.2 Polyurethane-based

- 5.1.1.3 Water-based

- 5.1.1.4 Other Technologies

- 5.1.2 Membranes

- 5.1.2.1 Cold Liquid Applied

- 5.1.2.2 Hot Liquid Applied

- 5.1.2.3 Fully Adhered Sheet

- 5.1.2.4 Loose-Laid Sheet

- 5.1.1 Chemicals

- 5.2 By End-Use Sector

- 5.2.1 Commercial

- 5.2.2 Industrial and Institutional

- 5.2.3 Infrastructure

- 5.2.4 Residential

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 Australia

- 5.3.1.2 China

- 5.3.1.3 India

- 5.3.1.4 Indonesia

- 5.3.1.5 Japan

- 5.3.1.6 Malaysia

- 5.3.1.7 South Korea

- 5.3.1.8 Thailand

- 5.3.1.9 Vietnam

- 5.3.1.10 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 Canada

- 5.3.2.2 Mexico

- 5.3.2.3 United States

- 5.3.3 Europe

- 5.3.3.1 France

- 5.3.3.2 Germany

- 5.3.3.3 Italy

- 5.3.3.4 Russia

- 5.3.3.5 Spain

- 5.3.3.6 United Kingdom

- 5.3.3.7 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Argentina

- 5.3.4.2 Brazil

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Ardex Group

- 6.4.2 Arkema (Bostik)

- 6.4.3 Asian Paints Ltd.

- 6.4.4 Beijing Oriental Yuhong Waterproof Technology Co., Ltd.

- 6.4.5 Hongyuan Waterproof Technology Group Co., Ltd.

- 6.4.6 Keshun Waterproof Technology Co., Ltd.

- 6.4.7 Kingspan Group

- 6.4.8 Minerals Technologies Inc.

- 6.4.9 Nippon Paint Holdings Co., Ltd.

- 6.4.10 Pidilite Industries Ltd.

- 6.4.11 RPM International Inc.

- 6.4.12 Saint-Gobain

- 6.4.13 Sika AG

- 6.4.14 Soprema

- 6.4.15 Thermax Limited

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment