|

市場調查報告書

商品編碼

1911809

歐洲 SOCaaS(安全營運中心即服務)-市場佔有率分析、產業趨勢與統計、成長預測(2026-2031 年)Europe SOC As A Service (SOCaaS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

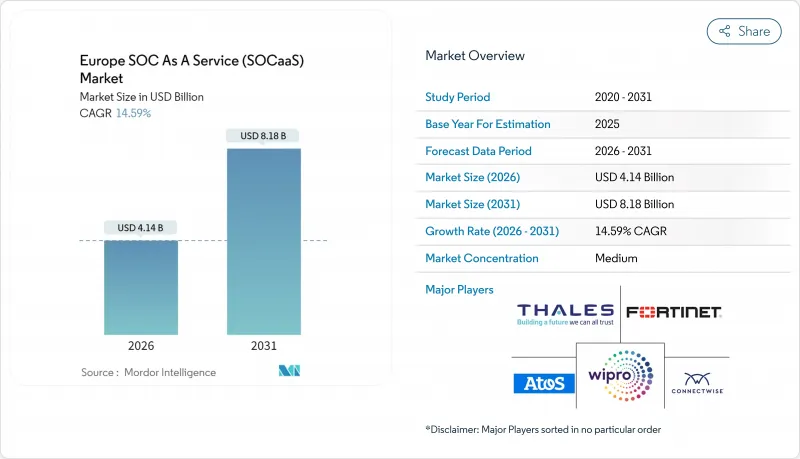

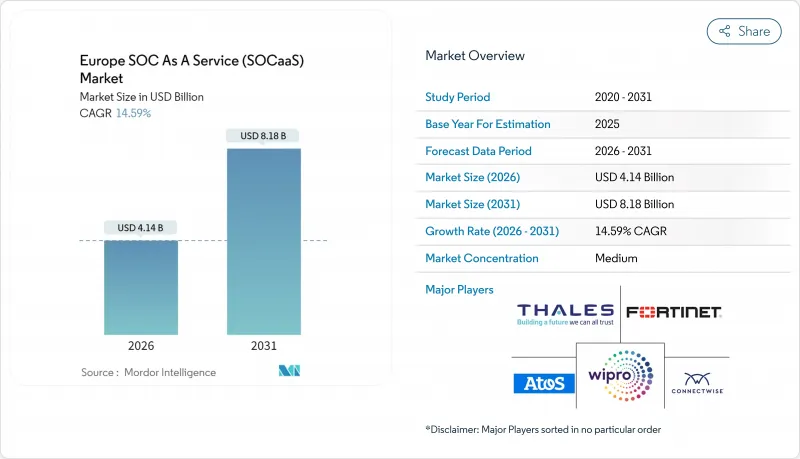

預計到 2026 年,歐洲 SOC 即服務 (SOCaaS) 市場規模將達到 41.4 億美元。

這意味著從 2025 年的 36.1 億美元成長到 2031 年的 81.8 億美元,預計 2026 年至 2031 年的年複合成長率(CAGR)為 14.59%。

這一強勁的成長軌跡反映了關鍵領域的快速數位化、歐盟NIS2指令下日益嚴格的監管,以及對靈活的按需計量收費模式日益成長的需求,這些都促使企業將支出從資本支出轉向營運支出。生成式人工智慧分析帶來的更快偵測速度、雲端優先架構帶來的簡化跨境部署,以及電信安全合作帶來的整合連接和全天候監控,都在加速這一趨勢的普及。同時,區域人才短缺和資料主權規則的碎片化限制了服務供應商的規模經濟效益,從而維持了全球巨頭和歐洲專業公司之間的競爭平衡。日益嚴格的網路保險要求、不斷增加的操作技術(OT)風險以及持續不斷的勒索軟體攻擊,使得企業高層持續專注於外包保全行動,從而推動了跨產業的需求成長。

歐洲SOCaaS(安全營運中心即服務)市場趨勢與洞察

計量收費營運成本模式的採用率不斷提高

歐洲企業正將安全支出從資本預算轉向彈性營運模式,按監控事件或資產數量收費,從而能夠即時調整成本以適應業務需求。這種模式加速了外包營運的普及,降低了中小企業的初始門檻,並使大型企業擺脫了頻繁的硬體更新週期。付費使用制還允許跨國公司根據司法管轄區調整服務範圍,這在歐洲安全營運中心即服務 (SOCaaS) 市場尤其重要,因為各國的監管義務各不相同。服務供應商也積極回應,提供分級套餐,將威脅情報、回應編配和合規性儀表板整合到單一帳單中。從中長期來看,這種定價結構的變化將重塑供應商選擇標準,使透明度和使用分析與檢測準確性同等重要。

中小企業的快速雲端遷移

到2024年,78%的歐洲中小企業將把關鍵工作負載遷移到公共雲端,這將帶來傳統單點工具無法保護的新型威脅面。這些企業目前正在尋找能夠直接連接到超大規模資料中心業者服務商API並提供即時遙測資料的雲端原生安全營運中心(SOC)平台,而無需昂貴的設備。北歐中小企業引領著這一採用趨勢,受益於成熟的寬頻基礎設施和國家數位化措施。隨著「數位十年」設定到2030年雲端採用率達到75%的目標,歐洲安全營運中心即服務(SOCaaS)市場有望實現長期成長。服務供應商透過提供針對Microsoft 365、Google Workspace和多重雲端場景的客製化方案來脫穎而出,從而減輕小規模IT團隊的技能負擔。

資料居住和主權問題的複雜性

各國不同的監管規定要求分別配置獨立的儲存、處理和日誌保留設施,這為多租戶營運帶來了結構性成本。法國的SecNumCloud和德國的C5認證提出了不同的框架,安全營運中心(SOC)供應商必須同時滿足這些框架的要求,這往往迫使他們維護重複的基礎設施。諸如歐盟數據法案等待決立法增加了未來跨境數據流動的不確定性,並延長了投資回報期。小規模的供應商面臨不成比例的負擔,這可能會延緩市場整合,並導致持續的價格戰。

細分市場分析

到2025年,大型企業將佔總收入的62.70%,為高複雜性、跨司法管轄區的監控奠定基礎,從而推動歐洲安全營運中心即服務 (SOCaaS) 市場規模的成長。這些企業需要操作技術、供應鏈遙測和專用事件回應服務,因此需要簽訂包含客製化服務等級協定的高階合約。然而,中小企業 (SME) 的複合年成長率 (CAGR) 為16.75%,憑藉整合在易於理解、簡化的雲端入口網站中的高級分析功能,它們擁有最大的收入成長潛力。付費使用制和與 Microsoft 365 的原生整合正在加速中小企業採用該服務,部署時間也成為服務提供者的關鍵績效指標。

這種兩極化的成長軌跡將迫使供應商在規模和專業化之間取得平衡。為大型企業複雜需求而最佳化的平台也需要為中小企業提供便利的入門管道,進而推動模組化架構的發展趨勢。培訓、客戶成功資源和多語言介面將成為競爭優勢,尤其是在英語程度差異較大的中歐和東歐地區。隨著NIS2等法規降低合規閾值,歐洲安全營運中心即服務(SOCaaS)市場中小企業的比例將會增加,從而將收入重新分配給以規模為導向的服務層級。

到2025年,銀行業、金融服務業和保險業將保持26.73%的市場佔有率,這反映了多年來在保全行動的投入以及嚴格的審核要求。與《數位營運彈性法案》的監管協調將進一步鞏固對高級安全策略和即時報告的需求。醫療保健產業將以15.30%的複合年成長率成長,由於互聯醫療設備、遠端醫療和電子病歷的普及導致攻擊面擴大,該行業備受關注。歐洲藥品管理局(EMA)發布的《2024年設備網路安全指南》強制要求持續監控,這將加速醫院將全天候監控職能外包的趨勢。

製造業正在部署安全營運中心 (SOC) 對工業控制系統進行監控,而零售業則專注於支付安全和客戶資料完整性。歐盟網路包裝等政府計畫正在為公共部門的 SOC 提供資金,這些 SOC 通常與國家通訊業者合作運作。總體而言,行業特定的法規和獨特的資產概況正在塑造客製化的檢測技術和事件回應手冊,從而提高了「一刀切」服務模式的進入門檻。

其他福利

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 宏觀經濟因素的影響

- 產業價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 市場促進因素

- 計量收費營運成本模式的採用率不斷提高

- 加速中小企業雲端遷移

- 提高網路保險對全天候監控的必要性

- 歐盟NIS2指令帶來的合規要求日益提高

- 基於生成式人工智慧的威脅狩獵能力

- 通訊業者和MSP對託管式XDR商品搭售銷售的需求激增

- 市場限制

- 資料居住和主權問題的複雜性

- 歐洲安全營運中心(SOC)層級網路安全人才短缺

- 多租戶 SIEM 的隱性長期總擁有成本

- 與傳統OT環境的整合存在摩擦

第5章 市場規模與成長預測

- 按組織規模

- 小型企業

- 主要企業

- 最終用戶

- 資訊科技和電信

- BFSI

- 零售和消費品

- 衛生保健

- 製造業

- 政府機構

- 其他

- 按服務類型

- 託管偵測與回應

- 安全監控

- 脆弱性評估

- 事件回應

- 威脅情報

- 託管式安全資訊與事件管理 (SIEM)

- 其他服務類型

- 透過部署模式

- 雲

- 本地部署

- 混合

- 按安全類型

- 網路安全

- 端點安全

- 應用程式安全

- 雲端安全

- 其他安全類型

- 按國家/地區

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 奧地利

- 比利時

- 瑞典

- 丹麥

- 波蘭

- 捷克共和國

- 斯洛維尼亞

- 克羅埃西亞

- 保加利亞

- 白俄羅斯

- 其他歐洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- IBM Corporation

- SecureWorks Inc.

- Fortinet Inc.

- Atos SE

- Thales Group

- Wipro Limited

- Cloudflare Inc.

- ConnectWise LLC

- Sophos Limited

- Ontinue Inc.

- PlusServer GmbH

- Teceze Limited

- Arctic Wolf Networks Inc.

- Rapid7 Inc.

- Orange Cyberdefense SA

- NTT Security Holdings Corporation

- Accenture PLC

- Telefonica Tech SLU

- Deloitte Touche Tohmatsu Limited

- KPMG International Limited

第7章 市場機會與未來展望

Europe Security Operations Center as a Service (SOCaaS) market size in 2026 is estimated at USD 4.14 billion, growing from 2025 value of USD 3.61 billion with 2031 projections showing USD 8.18 billion, growing at 14.59% CAGR over 2026-2031.

This strong trajectory reflects rapid digitization across critical sectors, the tightening grip of the EU NIS2 Directive, and the growing appeal of flexible pay-per-use models that shift spending from capital budgets to operating expenses. Adoption accelerates as generative-AI analytics shorten detection times, cloud-first architectures simplify cross-border deployment, and telecom-security partnerships bundle connectivity with 24X7 monitoring. At the same time, regional talent shortages and fragmented data-sovereignty rules temper scale advantages for service providers, keeping competition balanced between global giants and European specialists. Heightened cyber-insurance prerequisites, rising operational technology exposure, and persistent ransomware incidents keep board-level attention firmly on outsourced security operations, amplifying demand across industries.

Europe SOC As A Service (SOCaaS) Market Trends and Insights

Rise in Adoption of Pay-per-Use Opex Model

European organizations are shifting security spending from capital budgets to elastic operating models that bill by events or assets monitored, allowing real-time alignment of cost with business demand. The approach lowers upfront barriers for SMEs and frees large enterprises from periodic hardware refresh cycles, accelerating migration toward outsourced operations. Pay-per-use also helps multinational firms tune coverage per jurisdiction, a feature that resonates in the Europe SOC as a Service market where regulatory obligations diverge by country. Service providers respond by offering tiered packages that bundle threat intelligence, response orchestration, and compliance dashboards under a single invoice. Over the medium term, the pricing shift reshapes vendor selection criteria, making transparency and consumption analytics as important as detection accuracy.

Rapid Cloud Migration Among SMEs

Seventy-eight percent of European SMEs moved critical workloads to public clouds during 2024, exposing fresh threat surfaces that legacy point tools cannot secure. These companies now look to cloud-native SOC platforms that plug directly into hyperscaler APIs and deliver instant telemetry without costly appliance rollouts. Nordic SMEs lead adoption, benefiting from mature broadband infrastructure and national digital agendas. As the Digital Decade sets a 75% cloud-adoption target by 2030, the Europe SOC as a Service market gains a long runway for expansion. Providers differentiate through curated playbooks for Microsoft 365, Google Workspace, and multi-cloud scenarios, easing the skills burden for smaller IT teams.

Data Residency and Sovereignty Complexities

Fragmented national rules require separate storage, processing, and log-retention footprints, driving structural cost into multi-tenant operations. France's SecNumCloud and Germany's C5 certifications illustrate divergent frameworks that SOC vendors must satisfy in parallel, often maintaining duplicate infrastructure. Pending legislation such as the EU Data Act adds uncertainty on future cross-border flows, prolonging investment payback periods. Smaller providers face disproportionate burdens, potentially slowing market consolidation and sustaining price competition.

Other drivers and restraints analyzed in the detailed report include:

- EU NIS2 Directive Amplifying Compliance Demand

- Generative-AI Powered Threat Hunting Capabilities

- Scarcity of European SOC-Grade Cyber Talent

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Large enterprises commanded 62.70% of revenue in 2025, underpinning the Europe SOC as a Service market size for high-complexity, multi-jurisdiction monitoring. Their needs span operational technology, supply-chain telemetry, and dedicated incident response, fostering premium contracts with custom service-level agreements. Yet SMEs, growing at a 16.75% CAGR, inject the greatest volume upside as simplified cloud portals package advanced analytics into digestible bundles. Consumption pricing and native integration with Microsoft 365 accelerate SME onboarding, making onboarding time a key performance metric for providers.

The bifurcated trajectory places pressure on vendors to balance scale with specialization. Platforms tuned for large-enterprise complexity must also present easy paths for smaller customers, leading to modular architectures. Training, customer-success resources, and multilinguistic interfaces become competitive levers, especially in Central and Eastern Europe where English fluency varies. As compliance thresholds creep downward through regulations such as NIS2, SMEs will account for a rising portion of the Europe SOC as a Service market, redistributing revenue toward volume-oriented service tiers.

Banking, financial services, and insurance retained a 26.73% share in 2025, reflecting decades-long investment in security operations and stringent audit obligations. Regulatory alignment with the Digital Operational Resilience Act further cements demand for advanced playbooks and real-time reporting. Healthcare, advancing at a 15.30% CAGR, shifts the spotlight as connected medical devices, telehealth, and electronic records expand attack surfaces. The European Medicines Agency's 2024 guidance on device cybersecurity mandates ongoing monitoring, prompting hospitals to outsource round-the-clock oversight.

Manufacturing embraces SOC-enabled monitoring of industrial control systems, while retail focuses on payment security and customer-data integrity. Government programs such as the EU Cyber Package allocate funding to public-sector SOCs, often delivered in partnership with national telecoms. Overall, sector-specific regulation and unique asset profiles shape tailored detection-engineering and incident-response runbooks, strengthening barriers to entry for generic service models.

The Europe SOC As A Service Market Report is Segmented by Organization Size (Small and Medium-Sized Enterprises, and Large Enterprises), End User (IT and Telecom, BFSI, Healthcare, Manufacturing, Government, and More), Service Type (Managed Detection and Response, and More), Deployment Mode (Cloud, and More), Security Type (Network, Endpoint, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- IBM Corporation

- SecureWorks Inc.

- Fortinet Inc.

- Atos SE

- Thales Group

- Wipro Limited

- Cloudflare Inc.

- ConnectWise LLC

- Sophos Limited

- Ontinue Inc.

- PlusServer GmbH

- Teceze Limited

- Arctic Wolf Networks Inc.

- Rapid7 Inc.

- Orange Cyberdefense SA

- NTT Security Holdings Corporation

- Accenture PLC

- Telefonica Tech S.L.U.

- Deloitte Touche Tohmatsu Limited

- KPMG International Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Impact of Macroeconomic Factors

- 4.3 Industry Value-Chain Analysis

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

- 4.7 Market Drivers

- 4.7.1 Rise in Adoption of Pay-per-Use Opex Model

- 4.7.2 Rapid Cloud Migration Among SMEs

- 4.7.3 Mounting Cyber-Insurance Prerequisites for 24x7 Monitoring

- 4.7.4 EU NIS2 Directive Amplifying Compliance Demand

- 4.7.5 Generative AI-Powered Threat Hunting Capabilities

- 4.7.6 Surge in Managed XDR Bundling by Telcos and MSPs

- 4.8 Market Restraints

- 4.8.1 Data Residency and Sovereignty Complexities

- 4.8.2 Scarcity of European SOC-Grade Cyber Talent

- 4.8.3 Hidden Long-Term TCO in Multi-Tenant SIEM

- 4.8.4 Integration Friction with Legacy OT Environments

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Organization Size

- 5.1.1 Small and Medium-sized Enterprises

- 5.1.2 Large Enterprises

- 5.2 By End User

- 5.2.1 IT and Telecom

- 5.2.2 BFSI

- 5.2.3 Retail and Consumer Goods

- 5.2.4 Healthcare

- 5.2.5 Manufacturing

- 5.2.6 Government

- 5.2.7 Other End Users

- 5.3 By Service Type

- 5.3.1 Managed Detection and Response

- 5.3.2 Security Monitoring

- 5.3.3 Vulnerability Assessment

- 5.3.4 Incident Response

- 5.3.5 Threat Intelligence

- 5.3.6 Managed SIEM

- 5.3.7 Other Service Types

- 5.4 By Deployment Mode

- 5.4.1 Cloud

- 5.4.2 On-Premise

- 5.4.3 Hybrid

- 5.5 By Security Type

- 5.5.1 Network Security

- 5.5.2 Endpoint Security

- 5.5.3 Application Security

- 5.5.4 Cloud Security

- 5.5.5 Other Security Types

- 5.6 By Country

- 5.6.1 Germany

- 5.6.2 United Kingdom

- 5.6.3 France

- 5.6.4 Italy

- 5.6.5 Spain

- 5.6.6 Netherlands

- 5.6.7 Austria

- 5.6.8 Belgium

- 5.6.9 Sweden

- 5.6.10 Denmark

- 5.6.11 Poland

- 5.6.12 Czechia

- 5.6.13 Slovenia

- 5.6.14 Croatia

- 5.6.15 Bulgaria

- 5.6.16 Belarus

- 5.6.17 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 IBM Corporation

- 6.4.2 SecureWorks Inc.

- 6.4.3 Fortinet Inc.

- 6.4.4 Atos SE

- 6.4.5 Thales Group

- 6.4.6 Wipro Limited

- 6.4.7 Cloudflare Inc.

- 6.4.8 ConnectWise LLC

- 6.4.9 Sophos Limited

- 6.4.10 Ontinue Inc.

- 6.4.11 PlusServer GmbH

- 6.4.12 Teceze Limited

- 6.4.13 Arctic Wolf Networks Inc.

- 6.4.14 Rapid7 Inc.

- 6.4.15 Orange Cyberdefense SA

- 6.4.16 NTT Security Holdings Corporation

- 6.4.17 Accenture PLC

- 6.4.18 Telefonica Tech S.L.U.

- 6.4.19 Deloitte Touche Tohmatsu Limited

- 6.4.20 KPMG International Limited

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment