|

市場調查報告書

商品編碼

1911798

印度車床市場:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)India Lathe Machines - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

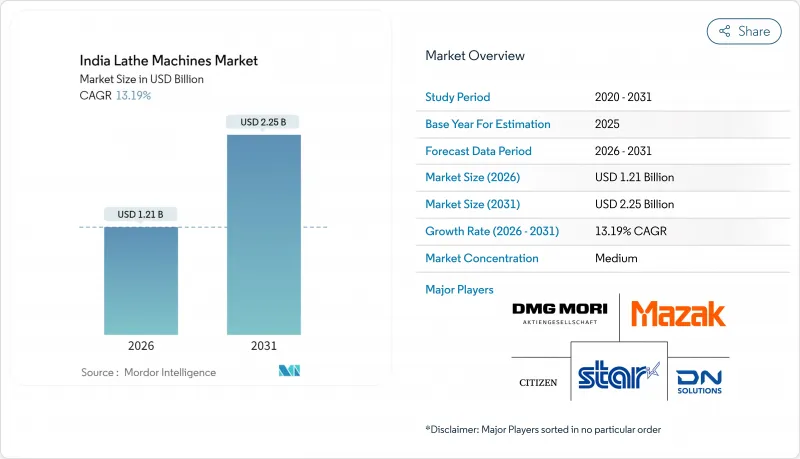

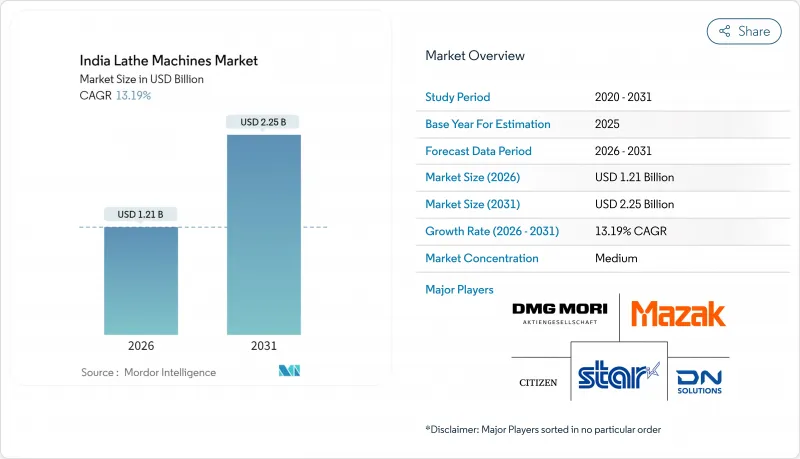

2025 年印度車床市場價值 10.7 億美元,預計從 2026 年的 12.1 億美元成長到 2031 年的 22.5 億美元,預測期(2026-2031 年)複合年成長率為 13.19%。

生產連結獎勵計畫(PLI) 政策、電動車製造業的蓬勃發展以及微型、小型和微企業(MSME) 的廣泛自動化,共同推動了印度車床市場的加速成長。航太、國防和醫療設備叢集需求的不斷成長,擴大了終端用戶群體,並降低了對傳統汽車加工的依賴。工業 4.0 賦能的改造套件降低了升級成本,並為二線製造商提供了先進的加工能力,加劇了市場競爭。同時,主要企業正迅速整合物聯網 (IoT) 連接、預測性維護和多軸精密加工能力,以訂單高利潤訂單。預計這些協同效應將推動印度車床市場在 2030 年前保持持續成長。

印度車床市場趨勢與洞察

政府的生產連結獎勵計畫(PLI)促進了國內資本財生產。

總額達1.97兆印度盧比的生產連結獎勵計畫計畫(PLI)設定了最低投資標準,要求企業在建廠時必須採購精密數控車床。在浦那、德里、班加羅爾以及班加羅爾中央機械技術研究所(CMTI)設立的智慧先進製造地,提供技術指導,並鼓勵永續應用,而非一次性設備採購。 PLI計畫的國產化率要求進一步鼓勵製造商在地採購。

電動動力傳動系統製造推動了對精密加工的需求。

預計到2024年,印度組裝150萬輛電動車,因此,轉子同心度要求低於0.01毫米,這正在加速瑞士型自動車床在泰米爾納德邦快速發展的電動車走廊地區的應用。 2030年實現70%的本地化目標,可望透過確保國內加工能力的穩定供應和限制進口替代,進一步擴大印度車床市場。

設備投資障礙限制了多軸車床的推廣應用。

瑞士製造的工具機售價在500萬至5,000萬印度盧比之間,是傳統工具機價格的三到五倍,這給微企業的預算帶來了沉重負擔。工具、夾具和CAM軟體會使購置成本增加20%至30%,而儘管CGTMSE提供了部分擔保,但銀行貸款仍需大量抵押品,這限制了其廣泛應用。

細分市場分析

到2025年,CNC平台將佔印度車床市場收入的53.05%,這印證了可程式加工技術數十年來持續的流行。預計到2031年,瑞士型自動化車床的複合年成長率將達到14.02%,因為電動車、航太和醫療設備行業的客戶對複雜的多軸加工能力的需求日益成長。到2031年,瑞士型車床在印度市場的規模可能超過4.7億美元,儘管隨著改裝套件縮小價格差距,傳統車床的市佔率正在下降。為了滿足對精密加工的需求,像Nidec Machining Tools這樣的全球性公司正在泰米爾納德邦擴大工具工廠計劃。

由於改裝方案延長了設備的使用壽命,傳統機床和數控機床之間的性能成本差距正在縮小,這使得小規模加工車間能夠贏得以前由大型 OEM 供應商主導的高精度契約,從而加速了印度車床市場質量標準的採用。

2025年,半自動化系統佔總營收的51.20%,而預計到2031年,全自動設備將佔據38.20%的市場佔有率,複合年成長率(CAGR)為14.08%。隨著越來越多的公司面臨技術純熟勞工短缺和嚴格的可追溯性標準,自動化控制系統在印度車床市場的佔有率有望成長。遠端主軸監控和數位日誌有助於醫療和航太產業遵守監管規定,從而支援企業進行全面自動化投資決策。

同時,人工操作平台仍將在培訓中心和小批量工廠中存在,但隨著數位素養的提高,預計到 2031 年,其佔比將降至 9.60% 以下。對於尋求循序漸進變革的中小型企業 (MSME) 而言,先採用半自動化機器,然後再添加工業 4.0 模組的混合策略仍然是一條經濟有效的途徑。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 加速印度微企業製造業自動化普及

- 政府生產關聯激勵措施(PLI)促進國內資本財生產

- 汽車動力系統總成加工需求快速成長

- 醫療設備叢集的快速湧現(泰米爾納德邦、特倫甘納邦)

- 工業4.0改造套件可降低升級成本

- 國防抵銷合約中在地採購義務

- 市場限制

- 多軸數控系統需要較高的初始資本投入。

- 全國範圍內工具機金融產品短缺

- 訓練有素的CNC編程人員和操作員短缺

- 區域城市工業中心持續存在的電力品質問題

- 產業價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 宏觀經濟因素的影響

第5章 市場規模與成長預測

- 依產品類型

- CNC車床

- 傳統車床

- 瑞士型自動車床

- 透過控制方法

- 手動的

- 半自動

- 自動的

- 透過操作

- 轉彎

- 表面磨削

- 無聊的

- 切割/切割加工

- 按最終用戶行業分類

- 車

- 航太與國防

- 一般製造業

- 金屬工業

- 其他終端用戶產業

- 按地區

- 印度北部

- 西印度群島

- 南印度

- 東印度

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Yamazaki Mazak Corporation

- DMG MORI Aktiengesellschaft

- Doosan Machine Tools Co. Ltd.(DN Solutions)

- Citizen Machinery Co. Ltd.

- Star Micronics Co. Ltd.

- Okuma Corporation

- Haas Automation Inc.

- Tsugami Corporation

- Tornos Group SA

- Bharat Fritz Werner Ltd.

- Lakshmi Machine Works Ltd.

- Ace Micromatic Group(Ace Designers Ltd.)

- Jyoti CNC Automation Ltd.

- HMT Machine Tools Ltd.

- Galaxy-Tajmac India Pvt Ltd.

- Laxmi Metal AND Machines

- Arrow Machine Tools Pvt Ltd.

- Micromatic Machine Tools Pvt Ltd.

- Emag India Pvt Ltd.

- Murata Machinery Ltd.

第7章 市場機會與未來展望

The India Lathe Machines market was valued at USD 1.07 billion in 2025 and estimated to grow from USD 1.21 billion in 2026 to reach USD 2.25 billion by 2031, at a CAGR of 13.19% during the forecast period (2026-2031).

The acceleration is fueled by Production Linked Incentive (PLI) allocations, the electric-vehicle manufacturing surge, and widespread automation adoption among micro-, small-, and medium-enterprises (MSMEs). Growing demand from aerospace, defense, and medical-device clusters is broadening the end-user base and reducing historical reliance on automotive machining. Competition is intensifying as Industry 4.0 retrofit kits lower upgrade costs, enabling tier-2 manufacturers to access advanced capabilities. Meanwhile, global and domestic players are racing to embed Internet of Things (IoT) connectivity, predictive maintenance, and multi-axis precision to win high-margin orders. These converging forces promise sustained momentum for the India Lathe Machines market through 2030.

India Lathe Machines Market Trends and Insights

Government PLI Incentives Accelerate Domestic Capital Goods Production

The INR 1.97 lakh-crore PLI program has set minimum investment thresholds that compel beneficiaries to procure precision CNC lathes during plant build-outs. Dedicated Smart Advanced Manufacturing hubs in Pune, Delhi, Bengaluru, and Bengaluru's CMTI offer technical guidance, ensuring sustained rather than one-off equipment purchases. Domestic content conditions under PLI further push manufacturers toward locally sourced India Lathe Machines market solutions that meet stringent value-addition norms.

EV Power-train Manufacturing Drives Precision Demand

India assembled 1.5 million electric vehicles in 2024, and rotor concentricity requirements below 0.01 mm have accelerated the adoption of Swiss-type automatic lathes in Tamil Nadu's rapidly growing EV corridor. Localization targets of 70% by 2030 guarantee steady domestic machining volumes and limit import substitution, further enlarging the India Lathe Machines market.

Capital Expenditure Barriers Limit Multi-Axis Adoption

Swiss-type models priced at Rs 50 lakh-Rs 5 crore cost three to five times more than conventional units, stretching MSME budgets. Tooling, fixtures, and CAM software add 20-30% to acquisition cost, while collateral-heavy bank lending limits uptake despite partial guarantees under CGTMSE.

Other drivers and restraints analyzed in the detailed report include:

- MSME Automation Adoption Accelerates Across Industrial Clusters

- Medical-Device Clusters Create High-Precision Opportunities

- Skills Shortage Constrains Automation Rollout

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

CNC platforms captured 53.05% of 2025 revenue in the India Lathe Machines market, substantiating decades of programmable machining adoption. Swiss-type automatic models are on track for a 14.02% CAGR through 2031 as EV, aerospace, and medical-device customers demand complex multi-axis capability. The India Lathe Machines market size for Swiss-type solutions could surpass USD 0.47 billion by 2031, while conventional units decline as retrofit kits bridge affordability gaps. Global firms such as Nidec Machine Tool are ramping up tool-factory projects in Tamil Nadu to serve this precision demand.

The performance gap between conventional and CNC machines is narrowing in cost terms as retrofit packages extend equipment life cycles. As a result, small job shops can compete for high-tolerance contracts previously reserved for large OEM suppliers, accelerating diffusion of quality standards across the India Lathe Machines market.

Semi-automatic systems held 51.20% of revenue in 2025; however, automatic units are forecast to command 38.20% of value by 2031 on a 14.08% CAGR. The India Lathe Machines market share for automatic control jumps whenever firms face skilled-labor shortages or stringent traceability norms. Remote spindle monitoring and digital logbooks support regulatory compliance in medical and aerospace verticals, tipping investment decisions toward full automation.

Meanwhile, manual platforms still populate training centers and low-volume shops but are expected to fall below 9.60% by 2031 as digital literacy improves. The hybrid strategy of starting with semi-automatic machines then layering Industry 4.0 modules remains a cost-effective path for MSMEs seeking incremental change.

The India Lathe Machines Market Report is Segmented by Product Type (CNC Lathe, Conventional Lathe, and Swiss-Type Automatic Lathe), Control Type (Manual, Semi-Automatic, and Automatic), Operation (Turning, Facing, and More), End-User Industry (Automotive, Aerospace and Defence, and More), and Region. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Yamazaki Mazak Corporation

- DMG MORI Aktiengesellschaft

- Doosan Machine Tools Co. Ltd. (DN Solutions)

- Citizen Machinery Co. Ltd.

- Star Micronics Co. Ltd.

- Okuma Corporation

- Haas Automation Inc.

- Tsugami Corporation

- Tornos Group SA

- Bharat Fritz Werner Ltd.

- Lakshmi Machine Works Ltd.

- Ace Micromatic Group (Ace Designers Ltd.)

- Jyoti CNC Automation Ltd.

- HMT Machine Tools Ltd.

- Galaxy-Tajmac India Pvt Ltd.

- Laxmi Metal AND Machines

- Arrow Machine Tools Pvt Ltd.

- Micromatic Machine Tools Pvt Ltd.

- Emag India Pvt Ltd.

- Murata Machinery Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated automation adoption in Indian MSME manufacturing

- 4.2.2 Government PLI incentives for domestic capital-goods production

- 4.2.3 Surge in EV power-train machining demand

- 4.2.4 Rapid rise of medical-device clusters (Tamil Nadu, Telangana)

- 4.2.5 Industry 4.0 retro-fit kits lowering upgrade costs

- 4.2.6 Local sourcing mandates in defence offset contracts

- 4.3 Market Restraints

- 4.3.1 High upfront capex for multi-axis CNC systems

- 4.3.2 Inadequate nationwide machine-tool financing instruments

- 4.3.3 Shortage of trained CNC programmers and operators

- 4.3.4 Persistent power-quality issues in tier-2 industrial hubs

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Product Type

- 5.1.1 CNC Lathe

- 5.1.2 Conventional Lathe

- 5.1.3 Swiss-type Automatic Lathe

- 5.2 By Control Type

- 5.2.1 Manual

- 5.2.2 Semi-automatic

- 5.2.3 Automatic

- 5.3 By Operation

- 5.3.1 Turning

- 5.3.2 Facing

- 5.3.3 Boring

- 5.3.4 Cutting / Parting

- 5.4 By End-user Industry

- 5.4.1 Automotive

- 5.4.2 Aerospace and Defence

- 5.4.3 General Manufacturing

- 5.4.4 Metal Industry

- 5.4.5 Other End-user Industries

- 5.5 By Region

- 5.5.1 North India

- 5.5.2 West India

- 5.5.3 South India

- 5.5.4 East India

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Yamazaki Mazak Corporation

- 6.4.2 DMG MORI Aktiengesellschaft

- 6.4.3 Doosan Machine Tools Co. Ltd. (DN Solutions)

- 6.4.4 Citizen Machinery Co. Ltd.

- 6.4.5 Star Micronics Co. Ltd.

- 6.4.6 Okuma Corporation

- 6.4.7 Haas Automation Inc.

- 6.4.8 Tsugami Corporation

- 6.4.9 Tornos Group SA

- 6.4.10 Bharat Fritz Werner Ltd.

- 6.4.11 Lakshmi Machine Works Ltd.

- 6.4.12 Ace Micromatic Group (Ace Designers Ltd.)

- 6.4.13 Jyoti CNC Automation Ltd.

- 6.4.14 HMT Machine Tools Ltd.

- 6.4.15 Galaxy-Tajmac India Pvt Ltd.

- 6.4.16 Laxmi Metal AND Machines

- 6.4.17 Arrow Machine Tools Pvt Ltd.

- 6.4.18 Micromatic Machine Tools Pvt Ltd.

- 6.4.19 Emag India Pvt Ltd.

- 6.4.20 Murata Machinery Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need assessment