|

市場調查報告書

商品編碼

1911700

黏合劑:市場佔有率分析、產業趨勢和統計數據、成長預測(2026-2031)Adhesives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

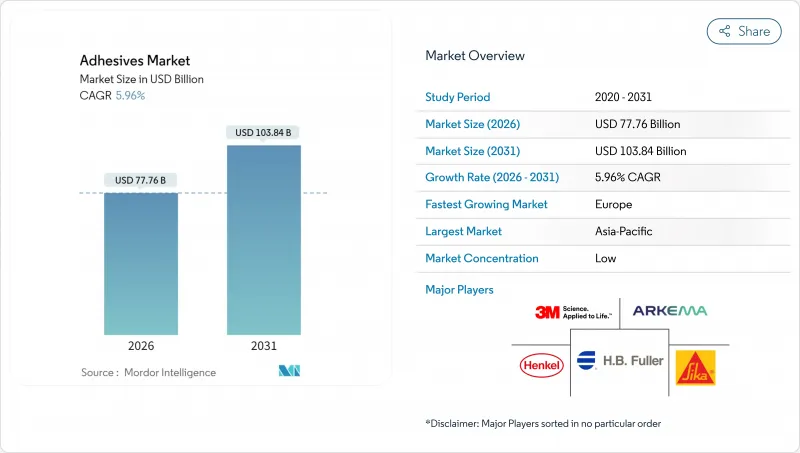

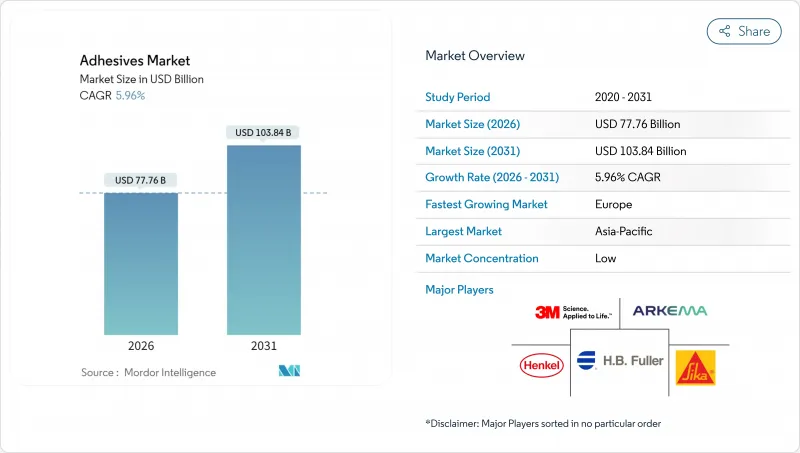

預計黏合劑市場將從 2025 年的 733.9 億美元成長到 2026 年的 777.6 億美元,到 2031 年將達到 1,038.4 億美元,2026 年至 2031 年的複合年成長率為 5.96%。

受電子商務推動的包裝自動化擴張、基礎設施營運中結構黏合日益受到重視以及汽車製造商為支持輕量化複合材料設計而增加黏合劑用量等因素的影響,市場需求正在加速成長。水性黏合劑佔據主導地位,因為品牌需要滿足揮發性有機化合物(VOC)法規的要求;而熱熔膠平台則因其無溶劑加工和高速生產線相容性而不斷擴大市場佔有率。在樹脂領域,丙烯酸樹脂在高性能應用方面持續保持主導,而VAE/EVA系統則因其柔軟性和成本效益而在建築領域得到更廣泛的應用。區域趨勢正在分化,亞太地區引領銷售成長,而歐洲則在符合法規要求的高附加價值等級產品方面取得了進展。

全球黏合劑市場趨勢與洞察

電子商務的快速成長推動了對安全、快速包裝黏合劑的需求。

線上零售倉庫正在使用可在毫秒內固化的熱熔膠和壓敏黏著劑能夠承受輸送機衝擊和多式聯運,從而保持包裝箱的完整性。履約中心報告訂單量實現了兩位數成長,主要電商走廊對包裝黏合劑的需求增加了15-20%。僅印度的線上零售業預計到2024年將推動包裝黏合劑需求增加18%,這主要得益於品牌所有者要求使用適用於熱帶氣候的防篡改密封條。永續性目標進一步推動了水性膠粘劑和生物基膠粘劑的發展,這些膠粘劑與紙張回收過程相容。包裝商現在指定使用易剝離的膠粘劑,這種膠粘劑能夠保持基材清潔,並便於二次纖維回收。

全球建築材料升級再造增加結構膠合劑和地板黏合劑的消耗量

亞太地區大型企劃規劃的加速推進,推動了對高強度、快速固化混凝土-鋼材-複合材料材料連接膠合劑的需求,因為機械緊固效率低或失效風險較高。大型瓷磚和預製板需要使用抗剪切黏合劑來縮短施工週期並增強結構完整性。 2024年,瓦克化學擴大了其位於南京和卡爾弗特市的VAE膠粘劑產能,以滿足瓷磚和隔熱系統建築黏合劑日益成長的需求。歐洲和北美的節能維修獎勵也支撐了對氣流阻隔密封膠和保溫黏合劑的需求。同時,修訂後的建築規範鼓勵使用膠粘連接來提高抗震性能並減少熱橋效應。

石油原料價格波動對製造商的利潤率帶來壓力。

乙烯和丙烯等原油單體佔黏合劑原料成本的60%之多。 2024年丙烯酸價格波動幅度達25%至30%,導致季度附加費擠壓利潤空間,尤其對於缺乏避險能力的中小型加工商而言更是如此。外匯波動加重了那些全球採購但本地開票企業的負擔。為了降低波動風險,製造商正在採用雙重採購和庫存風險策略,但這增加了物流複雜性和營運資金需求。

細分市場分析

預計到2025年,丙烯酸類黏合劑將佔全球黏合劑市場22.60%的佔有率,這主要得益於其在建築建築幕牆、汽車內部裝潢建材和感壓標籤等領域優異的耐候性能。 VAE/EVA產品線預計到2031年將以6.28%的複合年成長率成長,主要受柔軟性地板材料、磁磚鋪貼和包裝薄膜層壓等應用領域需求成長的推動。聚氨酯類黏合劑在交通運輸和航太領域保持著強勁的地位,這些領域對黏合劑的高黏合強度、耐化學性和彈性要求極高。環氧樹脂類黏合劑由於固化週期長,成長速度較為緩慢,但其主要應用領域是電子產品和風力渦輪機葉片連接,這些領域需要承受極端高溫和疲勞。如今,混合化學技術將丙烯酸類黏合劑的抗紫外線性能與聚氨酯的柔軟性相結合,或將VAE的柔韌性與環氧樹脂的剛性相結合,從而拓展了配方師的工具箱。

隨著加工商不斷最佳化樹脂性能以適應特定基材和應用環境,樹脂技術的持續創新正推動全球黏合劑市場擴張。丙烯酸酯生產商正投資研發自交聯乳化以增強其耐水性和抗泛白性,而VAE供應商則透過提高極性單體含量來改善其與低表面能薄膜的黏合力。生物基原料的需求日益成長,但成本和供應限制了其快速普及。策略性樹脂選擇越來越注重在法規遵循、使用溫度和總應用成本之間取得平衡,這使得製造商能夠在同質化終端應用領域中脫穎而出。

此黏合劑報告按樹脂類型(聚氨酯、環氧樹脂、丙烯酸酯、氰基丙烯酸酯、VAE/EVA 等)、技術類型(水性、溶劑型、反應型等)、終端用戶行業類型(建築、包裝、汽車、航太、木工等)和地區類型(亞太、北美、歐洲等)進行結構分類。市場預測以美元計價。

區域分析

亞太地區佔全球黏合劑市場的36.30%,主要得益於中國、印度和東南亞地區集中的製造群和公共基礎設施投資。中國的城市軌道交通和住宅計劃推動了對結構丙烯酸樹脂的需求,而印度的瓷磚黏合劑市場則因城市住宅建設的快速發展而以每年超過15%的速度成長。包括漢高和德莎等新工廠在內的區域供應商正在加強本地供應能力並縮短前置作業時間。產能過剩問題依然存在,尤其是EVA和丙烯酸乳液,因為計畫中的產能提升可能會因下游需求放緩而導致庫存過剩。

預計到2031年,歐洲將保持最高的成長率,年均成長率將達到6.25%,這主要得益於更嚴格的監管推動加工商轉向可再生和低排放系統。將於2026年生效的歐盟包裝和包裝廢棄物法規將要求黏合劑在機械回收過程中完全可分離,且不含PFAS。德國向電動車的轉型正在推動對導熱和阻燃黏合劑的需求,而法國的建築維修補貼計畫則刺激了對隔熱材料黏合劑的需求。

在北美,關稅驅動的單體投資增強了供應安全,並維持了穩定成長。計劃從2025年起運作的丙烯酸產能(美國墨西哥灣沿岸地區)將降低進口依賴性,並透過縮短運輸時間支持區域內的其他化合物生產商。墨西哥作為汽車出口中心,推動了對結構和捲邊膠粘劑系統的需求,而加拿大寒冷地區的建築規範則傾向於使用耐凍黏合劑建造板式住宅。這一趨勢取決於基礎設施立法的進展和汽車生產週期,但由於製造業的復甦和永續性舉措的推進,預計將保持強勁勢頭。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 電子商務的快速成長正在推動對安全快速包裝黏合劑的需求。

- 由於全球建築經濟的復甦,結構和地板黏合劑的消費量正在增加。

- 輕量化和電動車平台將加速汽車黏合劑的普及應用。

- 人工智慧驅動的配方最佳化可顯著縮短研發時間並降低客製化黏合劑成本。

- 自2025年美國加徵關稅以來,丙烯酸單體供應的近岸外包將重塑區域生產能力。

- 市場限制

- 石油原料價格波動對黏合劑生產商的利潤率帶來壓力。

- 更嚴格的揮發性有機化合物(VOC)和化學品法規抑制了溶劑黏合劑的銷售

- 全球資深黏合劑配方師短缺,延緩商業化週期

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 樹脂

- 聚氨酯

- 環氧樹脂

- 丙烯酸纖維

- 氰基丙烯酸酯

- VAE/EVA

- 矽酮

- 其他樹脂

- 透過技術

- 水系統

- 溶劑型

- 反應性

- 熱熔膠

- UV固化黏合劑

- 按最終用戶行業分類

- 建築/施工

- 包裝

- 車

- 航太工業

- 木工和細木工

- 鞋類和皮革製品

- 衛生保健

- 其他終端用戶產業

- 按地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲

- 印尼

- 馬來西亞

- 新加坡

- 泰國

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- 3M

- Aica Kogyo Co..Ltd.

- Arkema

- AVERY DENNISON CORPORATION

- Dow

- HB Fuller Company

- Henkel AG & Co. KGaA

- Huntsman International LLC

- Illinois Tool Works Inc.

- Jowat SE

- MAPEI SpA

- NANPAO RESINS CHEMICAL GROUP

- Pidilite Industries Ltd.

- Sika AG

- Soudal Holding NV

- Wacker Chemie AG

第7章 市場機會與未來展望

The Adhesives market is expected to grow from USD 73.39 billion in 2025 to USD 77.76 billion in 2026 and is forecast to reach USD 103.84 billion by 2031 at 5.96% CAGR over 2026-2031.

Demand accelerates as packaging automation scales with e-commerce, infrastructure programs prioritize structural bonding, and automakers increase adhesive volumes to support lightweight multi-material designs. Water-borne chemistries dominate because brands must meet VOC limits, yet hot-melt platforms gain share through solvent-free processing and rapid line speeds. Within resins, acrylics continue to rule high-performance applications, while VAE/EVA lines capture construction volumes thanks to flexibility and cost efficiency. Regional dynamics diverge, with Asia-Pacific supplying volume growth and Europe advancing premium, regulation-ready grades.

Global Adhesives Market Trends and Insights

E-commerce Boom Enlarging Demand for Secure, High-Speed Packaging Adhesives

Online retail warehouses rely on hot-melt and pressure-sensitive grades that cure in milliseconds yet sustain box integrity through conveyor impacts and multi-modal shipping. Fulfilment centers report double-digit order growth, driving 15-20% volume increases for packaging adhesives in key e-commerce corridors. India's online retail sector alone lifted packaging-adhesive offtake by 18% in 2024 as brand owners mandated tamper-evident bonds suitable for tropical climates. Sustainability goals add momentum for water-borne and bio-sourced options compatible with paper recycling streams. Packagers now specify easily removable grades that leave substrates clean, easing secondary fiber recovery.

Global Construction Upcycle Raising Consumption of Structural and Flooring Adhesives

Megaproject pipelines in Asia-Pacific accelerate uptake of high-strength, fast-set formulations for concrete, steel, and composite bonding where mechanical fasteners are slow or prone to failure. Large-format tiles and pre-fabricated panels need shear-resistant adhesives that shorten installation cycles and enhance structural integrity. Wacker Chemie expanded VAE capacity in Nanjing and Calvert City during 2024 to serve rising construction-adhesive demand in tile and insulation systems. Energy-retrofit incentives in Europe and North America sustain airflow-sealant and insulation-adhesive volumes, while updated building codes champion bonded joints for seismic resilience and thermal-bridge reduction.

Petro-Feedstock Price Volatility Squeezing Manufacturer Margins

Crude-linked monomers such as ethylene and propylene account for up to 60% of adhesive raw-material cost. Acrylic-acid prices swung 25-30% during 2024, forcing quarterly surcharges that erode margins, especially for smaller converters without hedging power. Currency shakiness multiplies the burden for firms that source globally but invoice locally. To blunt volatility, producers adopt dual-sourcing and inventory-risk strategies, yet these raise logistics complexity and working-capital needs.

Other drivers and restraints analyzed in the detailed report include:

- Lightweighting and EV Platforms Accelerating Automotive Adhesive Penetration

- Near-Shoring of Acrylic Monomer Supply in the United States

- Escalating VOC and Chemicals Regulation Curbing Solvent-Borne Sales

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Acrylic systems held a 22.60% share of the global adhesives market in 2025, supported by weather-resistant performance across construction facades, automotive trim, and pressure-sensitive labels. VAE/EVA lines are growing at a 6.28% CAGR through 2031, propelled by flexible flooring, tile-setting, and packaging-film lamination. Polyurethane grades stay entrenched in transportation and aerospace where high bond strength, chemical resistance, and elasticity are critical. Epoxies serve electronics and wind-blade joints that face extreme heat and fatigue, though their growth lags due to longer cure cycles. Hybrid chemistries now combine acrylic UV resistance with polyurethane toughness or VAE flexibility with epoxy rigidity, widening formulator toolkits.

Continuous resin innovation keeps the global adhesives market expanding as converters fine-tune performance for specific substrates and service environments. Acrylic players invest in self-crosslinking emulsions that boost water whitening resistance, while VAE suppliers ramp polar-monomer content to enhance adhesion to low-surface-energy films. Demand for bio-based feedstocks rises, yet cost and supply scalability limit rapid penetration. Strategic resin selection increasingly balances regulatory compliance, service temperature, and total applied cost, enabling manufacturers to differentiate within commoditized end uses.

The Adhesives Report is Segmented by Resin (Polyurethane, Epoxy, Acrylic, Cyanoacrylate, VAE/EVA, and More), Technology (Water-Borne, Solvent-Borne, Reactive, and More), End-User Industry (Building and Construction, Packaging, Automotive, Aerospace, Woodworking and Joinery, and More), and Geography (Asia-Pacific, North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD)

Geography Analysis

Asia-Pacific holds 36.30% of the global adhesives market thanks to concentrated manufacturing clusters and public infrastructure spending across China, India, and Southeast Asia. China's urban rail and residential projects spur demand for structural acrylics, while India's tile-adhesive segment grows more than 15% annually on rapid urban housing. Regional suppliers, including new Henkel and tesa plants, enhance local availability and cut lead times. Overcapacity concerns persist, particularly in EVA and acrylic emulsions, where planned expansions risk surplus inventory if downstream uptake slows.

Europe is forecast to post the fastest 6.25% CAGR through 2031 as regulations push converters toward recyclable, low-emission systems. The EU Packaging and Packaging Waste Regulation, effective in 2026, will require adhesives that separate cleanly in mechanical recycling streams and eliminate PFAS content. Germany's EV transition drives demand for thermally conductive and flame-retardant adhesives, while France's building-retrofit subsidies stimulate insulation-bond volumes.

North America records steady momentum as tariff-induced monomer investments bolster supply security. Gulf Coast acrylic-acid capacity coming online from 2025 lessens reliance on imports and supports regional formulators with shorter transit times. Mexico's role as an automotive export hub lifts demand for structural and hem-flange bonding systems, whereas Canada's cold-weather construction codes favor freeze-resistant adhesives for panelized housing. The trajectory hinges on infrastructure-bill progress and automotive production cycles but remains positive amid reshoring and sustainability commitments.

- 3M

- Aica Kogyo Co..Ltd.

- Arkema

- AVERY DENNISON CORPORATION

- Dow

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Huntsman International LLC

- Illinois Tool Works Inc.

- Jowat SE

- MAPEI S.p.A.

- NANPAO RESINS CHEMICAL GROUP

- Pidilite Industries Ltd.

- Sika AG

- Soudal Holding N.V.

- Wacker Chemie AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 E-commerce boom enlarging demand for secure, high-speed packaging adhesives

- 4.2.2 Global construction upcycle raising consumption of structural and flooring adhesives

- 4.2.3 Lightweighting and EV platforms accelerating automotive adhesive penetration

- 4.2.4 AI-driven formulation optimisation slashing research and development timelines and custom-bonding costs

- 4.2.5 Near-shoring of acrylic monomer supply in US post-2025 tariffs reshapes regional capacity

- 4.3 Market Restraints

- 4.3.1 Petro-feedstock price volatility squeezing adhesive manufacturer margins

- 4.3.2 Escalating VOC and chemicals regulation curbing solvent-borne adhesive sales

- 4.3.3 Global shortage of senior adhesive formulators slowing commercialisation cycles

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Resin

- 5.1.1 Polyurethane

- 5.1.2 Epoxy

- 5.1.3 Acrylic

- 5.1.4 Cyanoacrylate

- 5.1.5 VAE/EVA

- 5.1.6 Silicone

- 5.1.7 Other Resins

- 5.2 By Technology

- 5.2.1 Water-borne

- 5.2.2 Solvent-borne

- 5.2.3 Reactive

- 5.2.4 Hot Melt

- 5.2.5 UV Cured Adhesives

- 5.3 By End-user Industry

- 5.3.1 Building and Construction

- 5.3.2 Packaging

- 5.3.3 Automotive

- 5.3.4 Aerospace

- 5.3.5 Woodworking and Joinery

- 5.3.6 Footwear and Leather

- 5.3.7 Healthcare

- 5.3.8 Other End-user Industries

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 Japan

- 5.4.1.3 India

- 5.4.1.4 South Korea

- 5.4.1.5 Australia

- 5.4.1.6 Indonesia

- 5.4.1.7 Malaysia

- 5.4.1.8 Singapore

- 5.4.1.9 Thailand

- 5.4.1.10 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 3M

- 6.4.2 Aica Kogyo Co..Ltd.

- 6.4.3 Arkema

- 6.4.4 AVERY DENNISON CORPORATION

- 6.4.5 Dow

- 6.4.6 H.B. Fuller Company

- 6.4.7 Henkel AG & Co. KGaA

- 6.4.8 Huntsman International LLC

- 6.4.9 Illinois Tool Works Inc.

- 6.4.10 Jowat SE

- 6.4.11 MAPEI S.p.A.

- 6.4.12 NANPAO RESINS CHEMICAL GROUP

- 6.4.13 Pidilite Industries Ltd.

- 6.4.14 Sika AG

- 6.4.15 Soudal Holding N.V.

- 6.4.16 Wacker Chemie AG

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment