|

市場調查報告書

商品編碼

1911467

北美工業緊固件市場:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)North America Industrial Fasteners - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

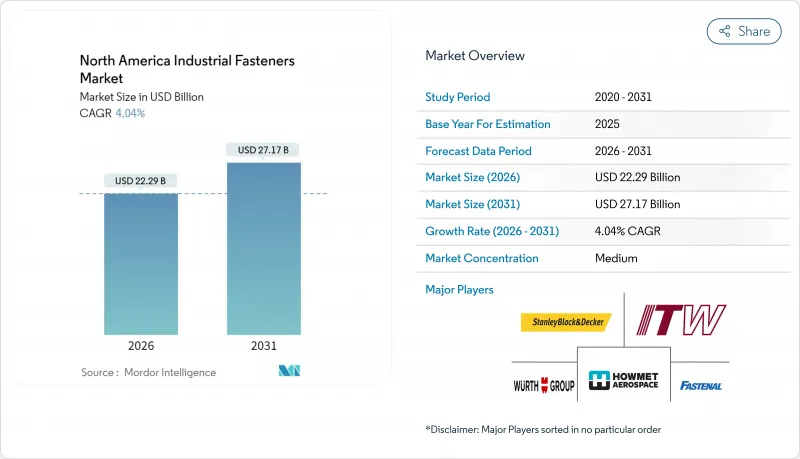

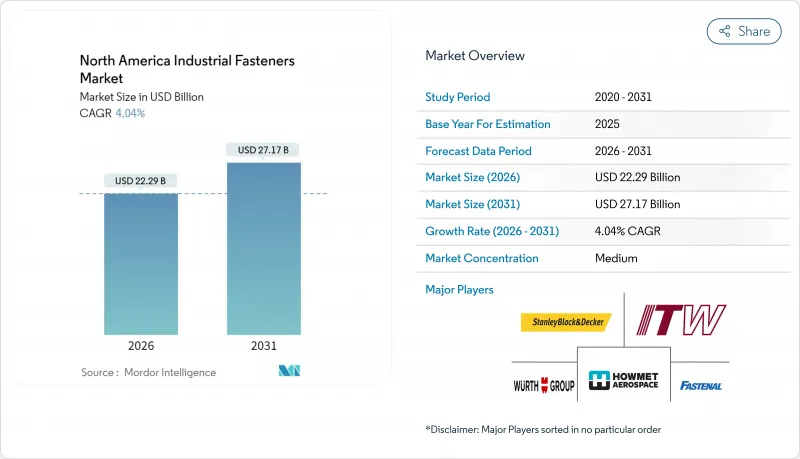

預計到 2026 年,北美工業緊固件市場規模將達到 222.9 億美元,從 2025 年的 214.2 億美元成長到 2031 年的 271.7 億美元,2026 年至 2031 年的複合年成長率為 4.04%。

儘管投入成本有所波動,但穩健的基礎設施投資、不斷成長的電動車產量以及優先考慮國內製造業的回流計劃,共同維持了成長動能。住宅、商業和民用工程計劃的建設活動支撐了基本需求,而汽車和航太項目則帶來了高價值的銷售成長。供應商透過整合數位化可追溯性、耐腐蝕塗層和針對特定應用的設計,增強了自身的定價能力。終端使用者繼續優先考慮能夠縮短組裝時間、延長使用壽命並簡化合規流程的工程解決方案。市場競爭強度仍適中。主要現有企業正利用規模經濟、深厚的經銷網路和策略收購來鞏固其市場地位。

北美工業緊固件市場趨勢與洞察

建築業的成長勢頭支撐了緊固件需求。

根據1.2兆美元的《基礎設施投資和就業創造法案》,建築支出確保了橋樑、交通樞紐和公共產業計劃所需的高強度螺栓、錨栓和螺紋桿的穩定供應。德克薩斯州和佛羅裡達州的住宅維修和多用戶住宅開工建設推動建材經銷商持續大量訂購螺絲和釘子。預製和模組化建築技術傾向於使用精密設計的緊固件,這些緊固件可以快速調整,並在起重機安裝過程中保持公差。供應鏈管理人員擴大指定使用能夠承受腐蝕性沿海和寒冷氣候條件的塗層,從而降低終身維護成本。庫存具有完整可追溯性的認證批次經銷商商正在贏得要求遵守「購買美國」政策並即時交貨的合約。

汽車電氣化正在改變緊固件的要求

電池式電動車平台採用專用螺柱、套筒螺帽和鉚釘來應對熱循環,並在電池組內提供電氣絕緣。汽車製造商在擴建其美國組裝時,需要使用與鋁相容的緊固件來限制輕量化底盤中的電流腐蝕。高速機器人組裝提高了對扭矩和張力性能一致性的需求,並對供應商提出了更嚴格的尺寸公差要求。電動皮卡和SUV產量的成長增加了每輛車平均使用的緊固件數量,從而推高了符合APQP和PPAP標準的工程零件的價格。與電池製造商的合作正在加速下一代固態電池緊固方法的共同開發。

結構性黏著劑面臨的挑戰是挑戰傳統緊固件。

在電動車、飛機內裝和家用電子電器領域,輕量化策略正逐漸取代機械硬體,尤其是在維護性要求不高的情況下,採用黏合劑連接。黏合劑能夠均勻分散負荷,減少應力集中和鑽孔。結合黏合劑的混合連接技術可以減少螺栓數量,從而縮短安裝時間,降低零件數量,最終降低對緊固件的整體需求。緊固件供應商正積極響應這一趨勢,推廣可拆卸設計以提高維護性,並專注於扭矩管理至關重要的安全關鍵領域。易於拆卸塗層技術的研發旨在與黏合劑形成互補,而非直接競爭。

細分市場分析

2025年,金屬緊固件佔北美工業緊固件市場76.80%的佔有率,反映了其在建築、機械和運輸業的性價比優勢。碳鋼螺栓用於固定公路和橋樑結構,而不銹鋼則用於食品加工和製藥廠。鋁製緊固件用於支撐航太面板和電動汽車電池機殼,其重量優勢抵消了較高的單位成本。儘管金屬緊固件佔據主導地位,但鋼材價格的周期性波動正在擠壓利潤空間,迫使製造商實現二次加工自動化並加強廢料管理。標準化規範簡化了各州和各省的採購流程,使這一領域持續受益。

複合材料和特殊材料將成為成長最快的細分市場,到2031年將以5.14%的複合年成長率成長。玻璃纖維增強聚合物、陶瓷和高溫合金彌補了金屬易受腐蝕、導電性和磁力干擾等性能缺陷的不足。在離岸風力發電渦輪機機艙中,碳纖維螺柱無需犧牲塗層即可承受海水侵蝕。半導體製造廠指定使用PEEK螺絲,以避免無塵室中顆粒擴散。成長取決於材料科學的持續創新以及終端市場附近成型能力的擴展,從而縮短前置作業時間。雖然目前價格溢價限制了其應用,但隨著生命週期成本分析顯示在惡劣環境下非金屬材料更具優勢,其應用正在穩步成長。這些趨勢增強了北美工業緊固件市場的長期前景。

截至2025年,供應給木材經銷商、維修店和批發商的標準級五金件佔北美工業緊固件市場62.10%的佔有率。大直徑六角螺栓、粗牙螺絲和釘子以散裝桶裝形式運輸,用於日常維修和組裝工作。自動化冷鍛生產線實現了規模經濟,從而能夠以具有競爭力的價格抵禦進口壓力。然而,商品化降低了利潤率,並使生產商面臨原物料價格波動的風險。

受航太、國防和能源產業對耐熱合金、精密螺紋和特殊塗層的需求所推動,高性能緊固件預計將以每年 4.98% 的速度成長。超合金螺柱用於固定噴射引擎機殼,而雙相不銹鋼螺栓則用於固定海底管線以承受循環壓力。 AS9100 和 NADCAP 等認證會延長前置作業時間,但一旦核准,就能鎖定供應商並帶來可觀的收入來源。許多公司正在試驗積層製造技術,以生產無需昂貴模具的複雜原型。這些專用零件應用範圍的擴大提高了價值密度,即使在產量放緩的情況下也能支撐收入,並推動北美工業緊固件市場的高階細分市場發展。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 建築業成長

- 汽車和航太製造業的擴張

- 耐腐蝕塗層技術的進步

- 北美電動車供應鏈的快速成長

- 透過《美國採購法案》促進在地採購

- 數位追溯和智慧緊固件概念

- 市場限制

- 結構性黏著劑的廣泛應用

- 鋼鐵和非鐵金屬價格波動

- 電鍍業有嚴格的環境法規。

- 特種產品產能短缺是由回流主導的產能不足

- 產業價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 宏觀經濟趨勢如何影響市場

第5章 市場規模與成長預測

- 材料

- 金屬

- 塑膠

- 複合材料和特殊材料

- 按年級

- 標準

- 高效能

- 依產品類型

- 外螺紋

- 內螺紋

- 非螺紋式

- 專用/特殊用途

- 透過最終用戶使用

- OEM

- 汽車/汽車產業

- 內燃機輕型車輛

- 中大型卡車和巴士採用內燃機(ICE)

- 電動車

- 航太

- 機械/資本財

- 電氣和電子設備

- 金屬加工

- 醫療設備

- 其他OEM應用

- 汽車/汽車產業

- 維護、修理和營運 (MRO)

- 建造

- OEM

- 透過塗層/表面處理

- 未上漆(未塗層)

- 鍍鋅

- 熱鍍鋅

- 聚四氟乙烯和特殊塗層

- 按國家/地區

- 美國

- 加拿大

- 墨西哥

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Illinois Tool Works Inc.

- Howmet Aerospace Inc.

- Stanley Black and Decker, Inc.

- Wurth Group

- Fastenal Company

- Fontana Gruppo(Acument Global Technologies, Inc.)

- LISI Group

- Nifco Inc.

- Bulten AB

- ARaymond Group

- Marmon Holdings, Inc.(Berkshire Hathaway)

- Hilti Corporation

- KAMAX Holding GmbH and Co. KG

- Bossard Holding AG

- PennEngineering and Manufacturing Corp.

- Simpson Manufacturing Co., Inc.

- Precision Castparts Corp.(SPS Technologies)

- TriMas Corporation

- Agrati Group

- SFS Group AG

- Optimas Solutions

第7章 市場機會與未來展望

North America industrial fasteners market size in 2026 is estimated at USD 22.29 billion, growing from 2025 value of USD 21.42 billion with 2031 projections showing USD 27.17 billion, growing at 4.04% CAGR over 2026-2031.

Healthy infrastructure outlays, rising electric-vehicle production, and reshoring programs that prioritize domestic manufacturing sustain momentum despite input-cost volatility. Construction activity across residential, commercial, and civil projects underpins baseline demand, while automotive and aerospace programs add high-value volume. Suppliers that integrate digital traceability, corrosion-resistant coatings, and application-specific designs strengthen pricing power. End-users continue to favor engineered solutions that cut assembly time, extend service life, and ease compliance. Competitive intensity remains moderate as leading incumbents leverage scale, distribution depth, and targeted acquisitions to solidify positions.

North America Industrial Fasteners Market Trends and Insights

Construction sector momentum sustains fastener demand

Construction outlays stemming from the USD 1.2 trillion Infrastructure Investment and Jobs Act maintain a steady pipeline of bridges, transit hubs, and utility projects that rely on high-strength bolts, anchors, and threaded rods. Residential remodeling and multifamily starts in Texas and Florida keep builders' merchants ordering large volumes of bulk screws and nails. Prefabricated and modular building techniques favor precision-engineered fasteners that align quickly and hold tolerances during crane placement. Supply-chain managers increasingly specify coatings that withstand corrosive coastal or cold-climate conditions to cut lifetime maintenance. Distributors stocking certified lots with full traceability win contracts that require Buy-American compliance and immediate delivery.

Automotive electrification reshapes fastener requirements

Battery-electric vehicle platforms include specialized studs, sleeve nuts, and rivets that manage thermal cycles and electrical isolation within battery packs. Automakers expanding U.S. assembly lines mandate aluminum-compatible fasteners that curb galvanic corrosion in lightweight chassis. High-speed robotic assembly drives demand for consistent torque-tension performance, pushing suppliers toward tighter dimensional tolerances. As production of electric pickups and SUVs scales, average fastener content per unit rises, supporting premium pricing for engineered parts certified to APQP and PPAP standards. Collaborations with cell manufacturers accelerate the co-development of fastening methods for next-generation solid-state batteries.

Structural adhesives challenge traditional fasteners

Lightweighting strategies in electric cars, aircraft interiors, and consumer electronics substitute bonded joints for mechanical hardware where serviceability is non-critical. Adhesives distribute loads evenly, lowering stress concentrations and reducing drill-hole preparation. Hybrid joining techniques that pair bonding with fewer bolts cut installation time and part counts, trimming overall fastener demand. Fastener suppliers counteract by promoting removable designs for maintenance and by targeting safety-critical zones where torque-auditable joints remain mandatory. R&D into disassembly-friendly coatings seeks to complement adhesive use rather than compete directly.

Other drivers and restraints analyzed in the detailed report include:

- Advances in corrosion-resistant coatings

- Rapid growth of the North American EV supply chain

- Steel price volatility creates margin pressure

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Metal fasteners accounted for 76.80% of the North America industrial fasteners market in 2025, reflecting their strength-to-cost advantage in construction, machinery, and transportation. Carbon-steel bolts anchor highway bridges, while stainless grades service food-processing and pharmaceutical plants. Aluminum fasteners support aerospace panels and EV battery enclosures where weight savings offset higher unit prices. Despite dominance, cyclical shifts in steel prices can compress margins, prompting producers to automate secondary operations and tighten scrap control. The segment continues to benefit from standardized specifications that simplify procurement across state and provincial lines.

Composite and specialty materials represent the fastest-growing slice at a 5.14% CAGR through 2031. Glass-fiber reinforced polymers, ceramics, and high-temperature alloys fill performance gaps where metals suffer corrosion, electrical conductivity, or magnetic interference. In offshore wind nacelles, carbon-fiber studs resist seawater attack without sacrificial coatings. Semiconductor fabs specify PEEK screws to avoid particle shedding inside cleanrooms. Growth hinges on continued material-science breakthroughs and expanded molding capacity near end-markets to shorten lead times. Price premiums limit volume penetration today, yet adoption rises steadily as life-cycle cost analyses favor non-metallic options in harsh environments. These dynamics fortify the long-term outlook for the North America industrial fasteners market.

Standard-grade hardware supplied to lumber yards, maintenance shops, and bulk distributors captured 62.10% of the North America industrial fasteners market size in 2025. Large-diameter hex bolts, coarse-thread screws, and nails ship in high-volume keg packs to support routine repair and erection work. Automated cold-heading lines deliver economies of scale, allowing competitive pricing that resists import pressure. Nevertheless, commoditization breeds thin margins and exposes producers to raw-material swings.

High-performance fasteners are projected to grow 4.98% annually as aerospace, defense, and energy sectors specify heat-resistant alloys, close-tolerance threads, and proprietary coatings. Super-alloy studs secure jet-engine casings, while duplex-stainless bolts fasten subsea pipelines subjected to cyclic pressure. Qualification regimes such as AS9100 and NADCAP extend lead times but lock in suppliers once approved, enabling attractive returns. Many firms adopt additive-manufacturing pilots to prototype complex geometries without costly tooling. Expanded use of such specials lifts value density, bolstering revenue even if tonnage lags, and supports the premium tier of the North America industrial fasteners market.

The North America Industrial Fasteners Market is Segmented by Material (Metal, Plastic, and Composite and Specialty), Grade (Standard and High-Performance), Product Type (Externally Threaded, Internally Threaded, and More), End-User Application (OEM, MRO, and Construction), Coating/Finish (Plain, Zinc-Plated, and More), and Country (United States, Canada, and Mexico). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Illinois Tool Works Inc.

- Howmet Aerospace Inc.

- Stanley Black and Decker, Inc.

- Wurth Group

- Fastenal Company

- Fontana Gruppo (Acument Global Technologies, Inc.)

- LISI Group

- Nifco Inc.

- Bulten AB

- ARaymond Group

- Marmon Holdings, Inc. (Berkshire Hathaway)

- Hilti Corporation

- KAMAX Holding GmbH and Co. KG

- Bossard Holding AG

- PennEngineering and Manufacturing Corp.

- Simpson Manufacturing Co., Inc.

- Precision Castparts Corp. (SPS Technologies)

- TriMas Corporation

- Agrati Group

- SFS Group AG

- Optimas Solutions

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth of the Construction Sector

- 4.2.2 Expansion of Automotive and Aerospace Manufacturing

- 4.2.3 Advances in Corrosion-Resistant Coatings

- 4.2.4 Rapid Growth of North American EV Supply Chain

- 4.2.5 Buy-American Acts Driving Local Sourcing

- 4.2.6 Digital Traceability and Smart-Fastener Initiatives

- 4.3 Market Restraints

- 4.3.1 Rising Adoption of Structural Adhesives

- 4.3.2 Volatility in Steel and Non-Ferrous Metal Prices

- 4.3.3 Stringent Environmental Regulations on Plating

- 4.3.4 Reshoring-led Capacity Bottlenecks for Specials

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Material

- 5.1.1 Metal

- 5.1.2 Plastic

- 5.1.3 Composite and Specialty

- 5.2 By Grade

- 5.2.1 Standard

- 5.2.2 High-Performance

- 5.3 By Product Type

- 5.3.1 Externally Threaded

- 5.3.2 Internally Threaded

- 5.3.3 Non-Threaded

- 5.3.4 Application-Specific/Specialty

- 5.4 By End-User Application

- 5.4.1 OEM

- 5.4.1.1 Motor Vehicles/Automotive

- 5.4.1.1.1 ICE Light Vehicles

- 5.4.1.1.2 ICE Medium and Heavy Trucks/Buses

- 5.4.1.1.3 Electric Vehicles

- 5.4.1.2 Aerospace

- 5.4.1.3 Machinery and Capital Goods

- 5.4.1.4 Electrical and Electronics

- 5.4.1.5 Fabricated Metals

- 5.4.1.6 Medical Equipment

- 5.4.1.7 Other OEM Applications

- 5.4.1.1 Motor Vehicles/Automotive

- 5.4.2 Maintenance, Repair and Operations (MRO)

- 5.4.3 Construction

- 5.4.1 OEM

- 5.5 By Coating/Finish

- 5.5.1 Plain (Uncoated)

- 5.5.2 Zinc-Plated

- 5.5.3 Hot-Dip Galvanized

- 5.5.4 PTFE and Specialty Coatings

- 5.6 By Country

- 5.6.1 United States

- 5.6.2 Canada

- 5.6.3 Mexico

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Illinois Tool Works Inc.

- 6.4.2 Howmet Aerospace Inc.

- 6.4.3 Stanley Black and Decker, Inc.

- 6.4.4 Wurth Group

- 6.4.5 Fastenal Company

- 6.4.6 Fontana Gruppo (Acument Global Technologies, Inc.)

- 6.4.7 LISI Group

- 6.4.8 Nifco Inc.

- 6.4.9 Bulten AB

- 6.4.10 ARaymond Group

- 6.4.11 Marmon Holdings, Inc. (Berkshire Hathaway)

- 6.4.12 Hilti Corporation

- 6.4.13 KAMAX Holding GmbH and Co. KG

- 6.4.14 Bossard Holding AG

- 6.4.15 PennEngineering and Manufacturing Corp.

- 6.4.16 Simpson Manufacturing Co., Inc.

- 6.4.17 Precision Castparts Corp. (SPS Technologies)

- 6.4.18 TriMas Corporation

- 6.4.19 Agrati Group

- 6.4.20 SFS Group AG

- 6.4.21 Optimas Solutions

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet Need Assessment