|

市場調查報告書

商品編碼

1911466

標籤:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Label - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

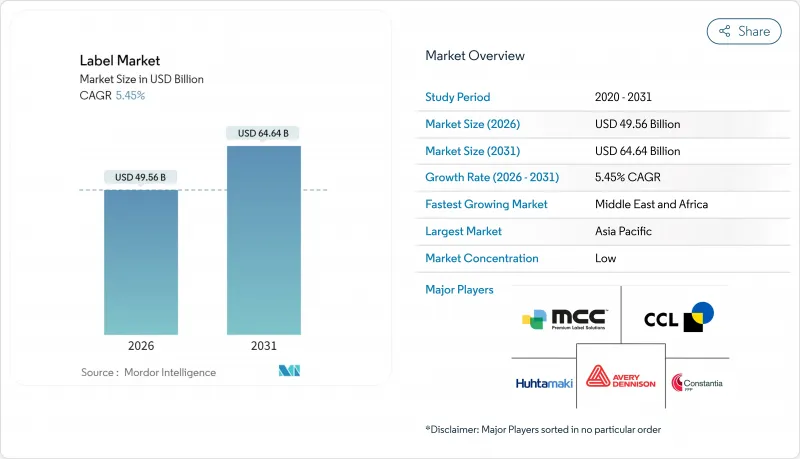

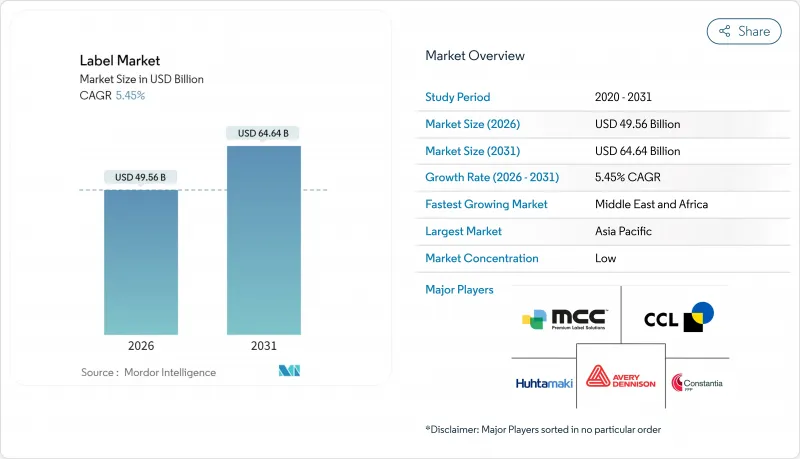

全球標籤市場預計到 2025 年將達到 470 億美元,到 2026 年將達到 495.6 億美元,到 2031 年將達到 646.4 億美元,預測期(2026-2031 年)的複合年成長率為 5.45%。

這種穩定成長的趨勢反映了標籤產業適應變化的能力,例如電子商務的擴張、永續性法規的實施以及智慧包裝的普及。監管對可再生材料的壓力持續促使加工商轉向無襯裡結構和生物基薄膜,而零售商對即時產品認證的需求正在加速向智慧包裝的轉型。數位印刷的經濟效益有利於小批量生產和客製化,儘管其在總產量中所佔比例不高,但利潤率卻有所提高。能夠大規模整合RFID、NFC和QR碼解決方案的公司將獲得競爭優勢,這些解決方案可以將標籤轉變為資料觸點,從而增強供應鏈的透明度和消費者參與度。儘管某些飲料品類面臨直接貼標的威脅,但這些因素共同為標籤市場的持續成長奠定了基礎。

全球標籤市場趨勢與洞察

電子商務的快速成長推動了可變數據運輸標籤的發展

預計2023年全球小包裹量將達到217億件,2029年將達到290億件,這將給標籤加工商帶來壓力,他們需要提供能夠處理即時訂單資料的標籤。體積重量收費和全通路支援要求標籤上的圖形能夠經得起自動化分類流程的考驗。亞馬遜2023年15.7%的包裹量成長凸顯了市場對耐用型熱敏和壓敏黏著劑的龐大需求。物流業者傾向於選擇黏合劑,而品牌所有者則需要能夠進行臨時客製化的標籤佈局。因此,投資高速數位印刷機的標籤加工商能夠獲得更高的溢價,以實現快速的印刷作業切換,這也鞏固了電子商務作為標籤市場結構性成長引擎的地位。

永續性法規加速無底紙和可回收紙張形式的推廣

歐盟包裝及包裝廢棄物法規要求到2030年,包裝材料的可回收率(按重量計)達到70%,這鼓勵對標籤面、底紙和黏合劑進行重新設計。 CELAB-Europe的目標是到2025年回收75%的廢舊底紙,並正在推進收集方案的實施,使其超越自願試點階段。美國各州的延伸生產者責任制(EPR)計畫使得合規包裝和不合規包裝之間的費用差異高達300%,使永續性成為利潤促進因素。採用無底紙標籤的加工商可減少高達40%的廢棄物,並提高物流效率。材料科學的進步,例如含有85%可再生原料的生物基黏合劑,正在促進這一轉型,同時又不影響應用速度,從而進一步增強了這一促進因素對標籤市場成長的長期影響。

原料成本波動

美國墨西哥灣沿岸的颶風擾亂了石化產品的供應,導致丙烯酸樹脂和聚烯的採購趨緊,進而推高了黏合劑價格並延長了前置作業時間。預計到2026年,歐洲黏合劑市場規模將達到222億歐元,該市場也在爭奪同樣的原料,這給購買力較弱的小型加工商帶來了壓力。為了因應市場波動,加工商增加了安全庫存,增加了營運資金需求,短期內利潤受到擠壓,限制了標籤市場的擴張。

細分市場分析

到2025年,壓敏黏著劑將佔據32.75%的市場佔有率,這得益於其在食品、個人護理和物流等廣泛應用領域的多功能性。套標產品雖然目前絕對銷售量較小,但隨著品牌商追求360度全景影像和防永續性功能,預計將以8.71%的複合年成長率成長。套標的日益普及正在推動高階飲料和營養補充劑領域標籤市場規模的成長,而環繞式標籤則面臨著被瓶蓋印刷和壓紋等製程替代的風險。在壓敏黏著劑領域,可回收黏合劑的持續創新(可減少35%的碳足跡)有助於在日益嚴格的永續發展審查下維持市場佔有率。因此,市場兩極化的趨勢日益明顯。大眾飲料正轉向直接印刷,而高階產品則採用先進的套標,這兩種路徑都在強化全球標籤市場中差異化的價值平台。

柔版印刷憑藉其速度和成本優勢,尤其適用於5萬米以上的連續印刷,預計到2025年將佔據標籤市場57.55%的佔有率。然而,數位噴墨和靜電照相技術將以8.87%的複合年成長率成長,儘管產量僅佔4.10%,但其收入將佔16.20%。它們的優勢在於依靠軟體驅動的作業切換來減少停機時間並實現產品種類多樣化。近期複合黑墨專利的出現,加速了其在多孔基材上的乾燥速度,提高了印刷機的生產效率並降低了單位成本。雖然凹版印刷、膠印和網版印刷等傳統印刷方式在燙金酒標和高速罐頭標籤等細分市場仍佔有一席之地,但投資趨勢顯然更傾向於數位技術。未來幾年,掌握混合印刷工作流程的加工商將進一步拓展其在不斷成長的標籤市場的滲透,同時贏得大批量通用標籤和高階客製化標籤的市場佔有率。

區域分析

亞太地區將繼續保持其領先地位,到2025年將佔據44.60%的標籤市場佔有率,推動要素中國龐大的市場規模和印度包裝食品市場的成長。政府對先進製造業的支持以及印刷設備製造商的集中,將降低資本投資成本,並促進產能擴張。泰國和韓國推行無標籤瓶的做法,反映了亞太地區一些監管機構願意突破傳統做法,進而影響全球關於永續標籤的討論。

預計中東和非洲地區2025年的營收成長率僅為6.10%,但到2031年,其複合年成長率將達到5.24%,這主要得益於食品加工投資和零售業現代化。沙烏地阿拉伯的NEOM等大型企劃以及埃及的工業園區將推動瓦楞紙箱和標籤的需求,而非洲的電子商務平台將促進運輸標籤的成長。然而,由於缺乏襯紙回收基礎設施,無襯紙解決方案仍處於發展階段,這為向該地區出口承包技術的供應商創造了成長機會。

北美是技術標竿地區,擁有超過2000家加工商和龐大的數位印刷機裝機量。沃爾瑪的RFID強制令以及履約倉庫的興起正在推動智慧標籤的需求。歐洲市場雖然已趨於成熟,但在可回收性法規方面仍保持領先地位,推動了可水洗黏合劑和單一材料解決方案的普及。隨著宏觀環境的趨於穩定,南美市場正在復甦,一家領先的巴西飲料公司通過在其風味水SKU中採用套筒標籤來擴展其產品線。這些跨區域的趨勢共同構成了全球標籤市場平衡且充滿機會的模式。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 電子商務的快速成長推動了可變數據運輸標籤的發展

- 永續性法規推動了無襯紙和可回收紙張形式的發展。

- 食品飲料產業對優質、符合監管要求的包裝的需求日益成長。

- 透過智慧/互聯包裝(QR碼、RFID)開發新的收入來源

- 日益嚴格的電動車電池安全法規正在推動對高性能感壓標籤的需求。

- 東協無標定瓶試點計畫推廣直接在容器上印刷

- 市場限制

- 原料成本波動(薄膜、黏合劑)

- 轉向立式袋和直接印刷技術

- 全球缺乏襯墊廢棄物回收基礎設施

- 由於無標定瓶裝法規的訂定,環繞式包裝的需求正在萎縮。

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力模型

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 供應鏈分析

- 評估新冠肺炎疫情及其地緣政治影響

第5章 市場規模及成長預測(以金額為準,2021-2030 年)

- 按標籤類型

- 感壓標籤

- 拉伸套

- 套模標籤

- 濕膠標籤

- 熱感標籤

- 環繞式標籤

- 透過印刷技術

- 柔版印刷

- 凹版印刷

- 抵銷

- 數位(噴墨和靜電照相)

- 螢幕和其他類比設備

- 材料

- 紙和紙板

- PVC

- PET

- 聚乙烯和聚丙烯

- 生物基可堆肥薄膜

- 按最終用戶行業分類

- 食品/飲料

- 製藥和醫療保健

- 個人護理和化妝品

- 零售和物流

- 工業與汽車

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲和紐西蘭

- 亞太其他地區

- 中東和非洲

- 中東

- 阿拉伯聯合大公國

- 土耳其

- 沙烏地阿拉伯

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 中東

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- CCL Industries Inc.

- Avery Dennison Corporation

- Multi-Color Corporation

- Huhtamaki Oyj

- Constantia Flexibles GmbH

- UPM Raflatac(UPM Group)

- Mondi plc

- Fuji Seal International Inc.

- Fort Dearborn Company

- Lintec Corporation

- 3M Company

- Smurfit WestRock

- Amcor plc

- Taghleef Industries

- Stora Enso Oyj

- Xeikon BV

- KRIS Flexipacks Pvt Ltd

- Royal Sens Group

- Leading Edge Labels & Packaging

第7章 市場機會與未來展望

The Global label market was valued at USD 47 billion in 2025 and estimated to grow from USD 49.56 billion in 2026 to reach USD 64.64 billion by 2031, at a CAGR of 5.45% during the forecast period (2026-2031).

This steady trajectory reflects the sector's capacity to adjust to e-commerce expansion, sustainability regulations, and smart packaging adoption. Regulatory pressure for recyclable materials continues to push converters toward liner-less constructions and bio-based films, while retailers' demand for real-time product authentication accelerates the shift toward connected packaging. Digital printing's economics favor short runs and customization, raising margins despite its modest share of total output. Competitive momentum favors firms that can integrate RFID, NFC, and QR solutions at scale, turning labels into data touchpoints that enhance supply-chain visibility and consumer engagement. The convergence of these forces positions the label market for durable growth even as direct-to-container printing presents a substitution threat in specific beverage categories.

Global Label Market Trends and Insights

E-commerce Boom Driving Variable-Data Shipping Labels

Worldwide parcel volume reached 21.7 billion in 2023 and is tracking toward 29 billion by 2029, pushing converters to supply labels capable of real-time, order-specific data. Dimensional-weight billing and omnichannel fulfillment require scannable graphics that survive automated sortation. Amazon's 15.7% volume surge in 2023 underscores the scale of demand for durable thermal and pressure-sensitive constructions. Logistics providers prefer adhesives that remain tacky across diverse corrugated substrates, while brand owners seek layouts that accommodate late-stage customization. As a result, converters investing in high-speed digital presses capture the premium associated with quick-change print jobs, reinforcing e-commerce as a structural growth engine for the label market.

Sustainability Regulations Accelerating Liner-Less and Recyclable Formats

The EU Packaging and Packaging Waste Regulation mandates 70% recyclability by weight by 2030, compelling redesign of face stocks, liners, and adhesives. CELAB-Europe targets recycling of 75% of spent liners by 2025, pushing collection schemes beyond voluntary pilots. Extended Producer Responsibility in U.S. states imposes fee differentials as high as 300% between compliant and non-compliant packaging, making sustainability a profit determinant. Converters responding with liner-less labels reduce waste by up to 40% and unlock logistics efficiencies. Material science advances, including bio-adhesives with 85% renewable content, ease the transition without sacrificing application speed, reinforcing the driver's long-term impact on label market growth.

Raw-Material Cost Volatility

Petrochemical supply disruptions from hurricanes in the U.S. Gulf Coast have tightened feedstock availability for acrylics and polyolefins, lifting adhesive prices and extending lead times. Europe's adhesives market, expected to reach EUR 22.2 billion by 2026, competes for the same inputs, squeezing smaller converters that lack purchasing leverage. To manage volatility, converters hold larger safety stocks, raising working-capital needs and pressuring earnings in the short term, thereby restraining label market expansion.

Other drivers and restraints analyzed in the detailed report include:

- Food and Beverage Demand for Premium Compliance-Driven Packaging

- Smart/Connected Packaging Opening New Revenue Streams

- Shift Toward Stand-Up Pouches and Direct-to-Object Printing

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Pressure-sensitive formats held 32.75% of the label market share in 2025, thanks to their versatility across food, personal care, and logistics applications. Sleeve products, although smaller in absolute terms, are projected to expand at an 8.71% CAGR as brand owners pursue 360-degree graphics and tamper evidence. This sleeve uptake lifts the label market size in premium beverages and nutraceuticals, while wrap-around formats encounter substitution risk from cap-print and embossing. Pressure-sensitive innovation continues with recyclable adhesives 35% lower carbon footprints help sustain share even as sustainability scrutiny intensifies. Consequently, a two-track pattern sets in: commodity beverages pivot to direct print, while premium SKUs adopt sophisticated sleeves, each path reinforcing differentiated value pools inside the global label market.

Flexography controlled 57.55% of the label market size in 2025 due to speed and cost advantages on runs above 50,000 linear meters. Digital inkjet and electrophotography, however, are pacing at 8.87% CAGR, securing 16.20% of revenue from just 4.10% of output. The economics hinge on software-driven job changeovers that slash downtime and enable SKU proliferation. Recent patents on composite black inks accelerate drying on porous substrates, boosting press throughput and lowering per-unit cost. .Analog stalwarts gravure, offset, and screen retain niches such as foil-on-foil spirits labels and high-speed canning, yet investment trends unambiguously favor digital. Over the outlook period, converters that master hybrid press workflows capture both commodity scale and premium customization, deepening their penetration of the expanding label market.

The Global Label Market Report is Segmented by Label Type (Pressure-Sensitive, Shrink and Stretch Sleeves, and More), Printing Technology (Flexography, Gravure, Offset, Digital, Screen and Other Analog), Material (Paper and Paperboard, PVC, and More), End-User Industry (Food and Beverages, Pharmaceutical and Healthcare, and More), and Geography (North America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific led with 44.60% of label market share in 2025, fueled by China's scale and India's growth in packaged foods. Government incentives for advanced manufacturing and the clustering of press-builders lower capital costs, encouraging capacity additions. Thailand's and South Korea's shifts toward labelless bottles illustrate how some APAC regulators leapfrog legacy practices, thereby shaping the global conversation on sustainable labeling.

Middle East and Africa, though only 6.10% of 2025 revenue, will post a 5.24% CAGR through 2031, propelled by food-processing investments and retail modernization. Mega-projects in Saudi Arabia's NEOM and Egypt's industrial zones spur corrugated and label demand, while African e-commerce platforms fuel shipping-label growth. Limited liner recycling infrastructure, however, keeps liner-less solutions nascent, offering upside for suppliers exporting turnkey technologies into the region.

North America remains the technological bellwether, home to over 2,000 converters and a deep installed base of digital presses. RFID mandates at Walmart and the proliferation of direct-fulfillment warehouses intensify demand for smart labels. Europe, while mature, continues to set the regulatory pace on recyclability, driving adoption of wash-off adhesives and mono-material solutions. South America rebounds as macro conditions stabilize; Brazil's beverage giants adopt sleeves for flavored-water SKUs, widening product breadth. Collectively, cross-regional dynamics reinforce a balanced yet opportunity-rich landscape for the global label market.

- CCL Industries Inc.

- Avery Dennison Corporation

- Multi-Color Corporation

- Huhtamaki Oyj

- Constantia Flexibles GmbH

- UPM Raflatac (UPM Group)

- Mondi plc

- Fuji Seal International Inc.

- Fort Dearborn Company

- Lintec Corporation

- 3M Company

- Smurfit WestRock

- Amcor plc

- Taghleef Industries

- Stora Enso Oyj

- Xeikon BV

- KRIS Flexipacks Pvt Ltd

- Royal Sens Group

- Leading Edge Labels & Packaging

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 E-commerce boom driving variable-data shipping labels

- 4.2.2 Sustainability regulations accelerating liner-less and recyclable formats

- 4.2.3 Food-and-beverage demand for premium compliance-driven packaging

- 4.2.4 Smart/connected packaging (QR, RFID) opening new revenue streams

- 4.2.5 EV battery-safety mandates spurring high-spec pressure-sensitive labels

- 4.2.6 ASEAN label-free bottle pilots catalyzing direct-to-container printing

- 4.3 Market Restraints

- 4.3.1 Raw-material cost volatility (films, adhesives)

- 4.3.2 Shift toward stand-up pouches and direct-to-object printing

- 4.3.3 Limited global liner-waste recycling infrastructure

- 4.3.4 Emerging label-free bottle regulations shrinking wrap-around demand

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Supply-Chain Analysis

- 4.9 Assessment of COVID-19 and Geopolitical Impacts

5 MARKET SIZE & GROWTH FORECASTS (VALUE, 2021-2030)

- 5.1 By Label Type

- 5.1.1 Pressure-Sensitive Labels

- 5.1.2 Shrink and Stretch Sleeves

- 5.1.3 In-Mold Labels

- 5.1.4 Wet-Glue Labels

- 5.1.5 Thermal-Transfer Labels

- 5.1.6 Wrap-Around Labels

- 5.2 By Printing Technology

- 5.2.1 Flexography

- 5.2.2 Gravure

- 5.2.3 Offset

- 5.2.4 Digital (Inkjet and Electrophotographic)

- 5.2.5 Screen and Other Analog

- 5.3 By Material

- 5.3.1 Paper and Paperboard

- 5.3.2 PVC

- 5.3.3 PET

- 5.3.4 PE and PP

- 5.3.5 Bio-based and Compostable Films

- 5.4 By End-User Industry

- 5.4.1 Food and Beverages

- 5.4.2 Pharmaceutical and Healthcare

- 5.4.3 Personal Care and Cosmetics

- 5.4.4 Retail and Logistics

- 5.4.5 Industrial and Automotive

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia and New Zealand

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 UAE

- 5.5.5.1.2 Turkey

- 5.5.5.1.3 Saudi Arabia

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 CCL Industries Inc.

- 6.4.2 Avery Dennison Corporation

- 6.4.3 Multi-Color Corporation

- 6.4.4 Huhtamaki Oyj

- 6.4.5 Constantia Flexibles GmbH

- 6.4.6 UPM Raflatac (UPM Group)

- 6.4.7 Mondi plc

- 6.4.8 Fuji Seal International Inc.

- 6.4.9 Fort Dearborn Company

- 6.4.10 Lintec Corporation

- 6.4.11 3M Company

- 6.4.12 Smurfit WestRock

- 6.4.13 Amcor plc

- 6.4.14 Taghleef Industries

- 6.4.15 Stora Enso Oyj

- 6.4.16 Xeikon BV

- 6.4.17 KRIS Flexipacks Pvt Ltd

- 6.4.18 Royal Sens Group

- 6.4.19 Leading Edge Labels & Packaging

7 MARKET OPPORTUNITIES & FUTURE OUTLOOK

- 7.1 White-Space & Unmet-Need Assessment