|

市場調查報告書

商品編碼

1911447

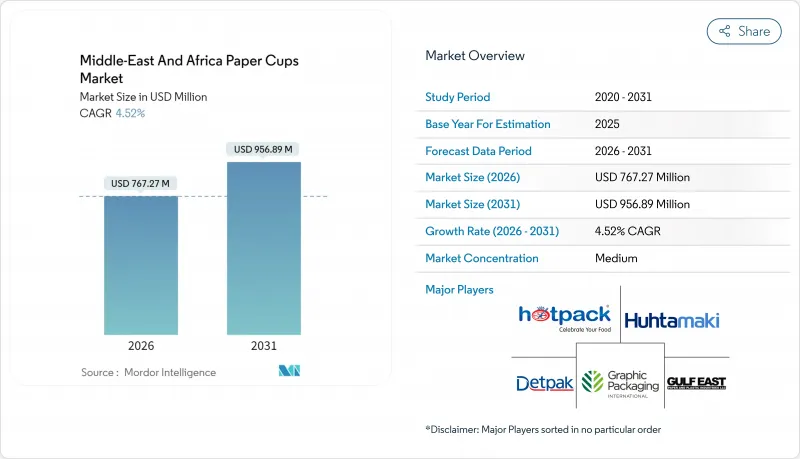

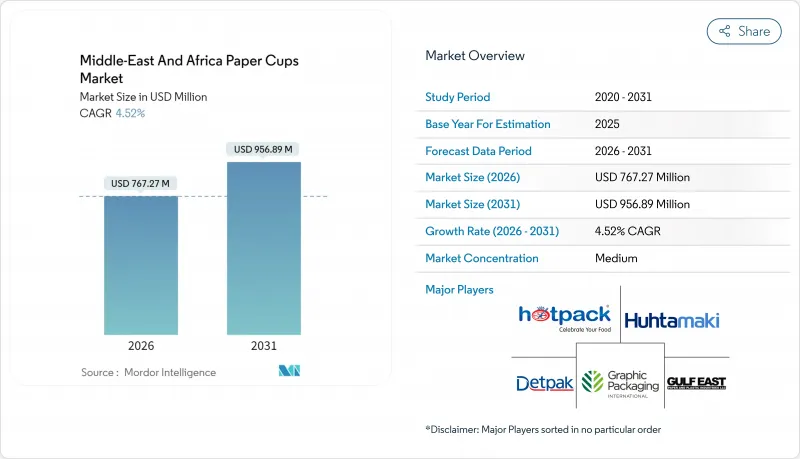

中東和非洲紙杯市場-佔有率分析、產業趨勢、統計和成長預測(2026-2031)Middle-East And Africa Paper Cups - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

2025年中東和非洲紙杯市場價值為7.3409億美元,預計到2031年將達到9.5689億美元,高於2026年的7.6727億美元。

預計在預測期(2026-2031 年)內,複合年成長率將達到 4.52%。

旅遊業的強勁復甦、外帶平台的蓬勃發展以及區域加工商對阻隔塗層創新技術的持續投資,共同推動了紙杯市場的成長。波灣合作理事會(GCC)國家的監管期限正在加速材料替代。同時,工廠效率的提升和企業淨零排放藍圖的製定,也增強了對經認證的可堆肥塗層的需求。市場競爭較為溫和。跨國公司正在整合其區域佈局以降低成本,而主要企業則在投資太陽能發電廠和生物分解技術,以鞏固其在酒店和快餐店管道的品牌客戶。儘管在一些依賴進口的撒哈拉以南非洲市場,原料價格波動和電力短缺問題依然存在,但包括特色咖啡館、機構餐飲和便利店在內的多元化終端用戶群體,仍然有利於紙杯市場的收入成長。

中東和非洲紙杯市場趨勢與分析

外帶熱飲文化蓬勃發展

在海灣合作理事會(GCC)城市,專門食品咖啡連鎖店、職場餐飲和交通樞紐的外帶消費正在蓬勃發展,推動了紙杯市場對優質熱咖啡需求的結構性成長。預計到2028年,海灣合作理事會地區的飯店餐飲業收入將達到481億美元,2022年至2028年的複合年成長率(CAGR)為7.5%。國際觀光人數預計將以每年8.1%的速度成長,達到1.162億人次。飯店和咖啡館正利用差異化的咖啡杯設計來強化品牌形象,尤其是在杜拜計劃舉辦400場國際活動以及卡達每年舉辦80多場展覽的情況下。預計到2030年,咖啡連鎖店的數量將以5.25%的複合年成長率成長,這反映了年輕一代偏好的變化,他們將西方的咖啡文化與傳統的阿拉伯咖啡儀式相結合。營運商在每家新店分店都會統一採用永續的熱咖啡杯規格,這進一步促進了紙杯市場的滲透。

政府禁止使用一次性塑膠製品(海灣合作理事會、南部非洲發展共同體)

自COP28以來,管理體制加速發展,促使企業即時從塑膠轉向紙包裝。阿拉伯聯合大公國於2006年禁止使用硬質聚苯乙烯杯,並在阿布達比環境署的主導下,於2022年分階段將限制範圍擴大至杯蓋、湯匙和刀叉餐具。杜拜機場於2020年全面禁用一次性塑膠製品,而沙烏地阿拉伯則在2017年至2019年間分三個階段逐步淘汰塑膠製品。這些政策框架迫使速食連鎖店、飯店和零售商優先選擇可回收且符合未來生產者延伸責任制(EPR)要求的纖維基包裝,凸顯了監管對紙杯市場的巨大推動力。

分散式轉換器基礎設施給利潤率帶來壓力

數百家小規模加工商主要專注於單價競爭,這限制了規模經濟,並抑制了對高性能塗層的投資。隨著Huhtamaki整合其在阿拉伯聯合大公國的生產,以及Hot Pack World在杜拜運作一家多生產線工廠,市場格局正在分化:大型公司贏得酒店和跨國快餐連鎖店的契約,而小規模企業則繼續留在普通商品領域。利潤率的壓力限制了小規模工廠的研發預算,減緩了紙杯市場技術的廣泛應用。

細分市場分析

到2025年,熱飲杯將佔紙杯市場62.40%的佔有率,而冷飲杯則是成長最快的細分市場,預計複合年成長率將達到4.74%。諸如沿岸地區 Planet的EarthCoating-Bio(可減少高達51%的塑膠含量)等技術創新,正在解決冷飲包裝中的冷凝和阻隔性問題。快餐連鎖店和便利商店正在拓展飲品菜單,增加冰沙和蛋白奶昔等產品,從而推動了對耐用冷飲杯的需求,這類冷飲杯即使在海灣地區常見的40°C高溫下也能保持飲品品質。雖然熱飲杯在機構餐飲和辦公室咖啡服務領域仍佔據主導地位,但雙層壁結構的創新使餐飲業者能夠減少杯套庫存,提升顧客舒適度,從而確保紙杯市場的持續需求。

夏季氣溫升高時,冰飲需求激增,零售商會訂購印有定製圖案的季節性冷飲杯,用於品牌推廣。這種季節性需求與入境旅遊旺季重合,進一步加劇了夏季季度的收入集中。同時,小型烘焙咖啡館和精品茶飲店則偏好紋理豐富的熱飲杯,以實現觸感上的差異化。對這兩個細分市場的持續投資將確保紙杯市場的整體均衡成長。

預計到2025年,聚乙烯內襯紙杯將佔據紙杯市場70.80%的佔有率,這主要得益於其穩定的性能和成本競爭力。然而,隨著企業採購商採用零塑膠採購指南,聚乳酸(PLA)和其他可堆肥塗層預計將以4.83%的複合年成長率擴大其市場佔有率。水性分散技術在保持油和水阻隔性能的同時,也能透過標準的紙張回收流程實現可再生,從而促進城市垃圾分類。海灣合作理事會(GCC)地區的連鎖飯店已在其採購文件中納入可堆肥認證,這標誌著市場結構正在向環保塗層轉變。

由於其熱封強度高,聚乙烯內襯紙杯在熱灌裝應用中仍佔據主導地位,但塑膠含量降低三分之一的混合基材正迅速獲得監管部門的核准。早期投資於水性或礦物基阻隔技術的加工商正憑藉與跨國食品服務品牌的合作獲得先發優勢,並鞏固其在高階紙杯市場的地位。

其他福利

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 市場促進因素

- 外帶熱飲市場快速成長

- 政府禁止使用一次性塑膠製品(海灣合作理事會、南部非洲發展共同體)

- 不斷擴展的食品配送平台

- 旅遊業復甦帶動了餐飲服務業(旅館、餐廳、咖啡館)門市的成長。

- 區域造紙廠的數據驅動型工廠效率提升計劃

- 無塑膠水性阻隔杯的興起

- 市場限制

- 分散式轉換器基礎設施給利潤率帶來壓力

- 貨幣波動導致紙漿價格長期波動

- 回收杯的分銷管道尚不完善。

- 撒哈拉以南非洲電力短缺

- 進出口分析(重點關注中東和非洲)

- 產業價值鏈與供應鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 供應商的議價能力

第5章 市場規模與成長預測

- 按杯子類型

- 熱紙杯

- 冷紙杯

- 透過襯裡材料

- 聚乙烯(PE)塗層

- 聚乳酸(PLA)/可堆肥

- 水性阻隔層/不含塑膠

- 透過使用

- 速食店(QSR)

- 商用餐飲

- 咖啡連鎖店和咖啡館

- 零售和便利商店

- 按體積(盎司)

- 7盎司或更少

- 8至12盎司

- 13至16盎司

- 16盎司或以上

- 按國家/地區

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 埃及

- 南非

- 奈及利亞

- 土耳其

- 肯亞

- 其他中東和非洲地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Hotpack Packaging Industries LLC

- Huhtamaki Oyj

- Graphic Packaging International LLC

- Detpak South Africa(Pty)Ltd

- Gulf East Paper & Plastic Industries LLC

- Golden Paper Cup Manufacturing LLC

- Maimoon Papers Industry LLC

- Falcon Pack Industries LLC

- Al Bahri Packaging Materials Industry LLC

- Jass Pack Industries SAE

- Multipack International FZC

- Droup Al-Jubail Undertaking Est.

- Alexander Foods(Portion Cups)Pty Ltd

- Eco-Products South Africa(Pty)Ltd

- Vegware Ltd.(Regional Hub)

- Dart Container Corporation

- Go-Pak UK Ltd

- Seda International Packaging Group SpA

- Kap Cones Pvt Ltd

第7章 市場機會與未來展望

The Middle-East and Africa paper cups market was valued at USD 734.09 million in 2025 and estimated to grow from USD 767.27 million in 2026 to reach USD 956.89 million by 2031, at a CAGR of 4.52% during the forecast period (2026-2031).

A robust tourism rebound reinforces growth, the proliferation of food-delivery platforms, and sustained investments by regional converters in barrier-coating innovation. Regulatory deadlines in the Gulf Cooperation Council (GCC) nations are accelerating material substitution, while improving mill efficiency and corporate net-zero roadmaps strengthen demand for certified compostable coatings. Competitive intensity is moderate: multinational incumbents consolidate regional footprints to reduce costs, and local champions deploy capital toward solar-powered plants and biodegradable technologies to secure brand accounts across hospitality and quick-service restaurant (QSR) channels. Although raw-material volatility and electricity shortages persist in several import-dependent and Sub-Saharan markets, a diversified end-user base-spanning specialty cafes, institutional catering, and convenience retail-maintains a favorable baseline for revenue expansion in the paper cups market.

Middle-East And Africa Paper Cups Market Trends and Insights

Surging on-the-Go Hot-Drink Culture

Specialty coffee chains, workplace catering, and transit hubs are normalizing grab-and-go consumption across GCC cities, causing a structural uplift in premium hot-cup demand in the paper cups market. GCC hospitality revenue is projected to reach USD 48.1 billion by 2028, marking a 7.5% CAGR from 2022, and international arrivals are on an 8.1% annual trajectory to 116.2 million visitors. Hotels and cafes leverage differentiated cup graphics to reinforce brand identity, particularly during Dubai's targeted 400 global events and Qatar's 80-plus annual exhibitions. A 5.25% CAGR in coffee-chain volume through 2030 mirrors shifting consumer preferences among younger demographics who balance Western cafe culture with traditional Arabic coffee rituals. With every incremental store opening, operators standardize sustainable hot-cup specifications, thereby deepening penetration of the paper cups market.

Government Single-Use Plastic Bans (GCC, SADC)

Regulatory regimes gained momentum after COP28, prompting immediate procurement switches from plastic to paper. The UAE banned rigid polystyrene cups as early as 2006 and, through staged policies led by the Environment Agency - Abu Dhabi, extended restrictions to lids, stirrers, and cutlery in 2022. Dubai airports eliminated single-use plastics in 2020, while Saudi Arabia executed a three-stage plastic phase-out between 2017 and 2019. These frameworks force QSR chains, hotels, and retailers to favor fiber-based formats compliant with recyclability and future extended producer responsibility (EPR) mandates, underscoring the regulatory pull on the paper cups market.

Fragmented Converter Base Squeezing Margins

Hundreds of small converters compete primarily on unit price, limiting scale economies and dampening investments in high-performance coatings. As Huhtamaki consolidates UAE production and Hotpack Global ramps a multi-line Dubai plant, a two-tier structure emerges where large players secure hotel and multinational QSR contracts, while small firms remain trapped in commodity niches. Margin pressures restrict R and D budgets among smaller facilities, slowing broad-based technology diffusion in the paper cups market.

Other drivers and restraints analyzed in the detailed report include:

- Food-Delivery Platform Expansion

- Tourism Rebound Powering HORECA Outlets

- Chronic Pulp Price Volatility Tied to Currency Swings

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cold variants represented the fastest-moving segment with a 4.74% CAGR projection, even as hot cups accounted for a dominant 62.40% share of the paper cups market size in 2025. Technical advances such as Smart Planet's EarthCoating-Bio, which trims plastic content by up to 51%, address condensation and barrier limitations in chilled-drink formats. QSR chains and convenience retailers extend beverage menus to smoothies and protein shakes, elevating demand for durable cold cups that uphold product quality in 40 °C ambient conditions common across the Gulf. Hot cups retain primacy in institutional catering and office coffee service, but double-wall innovations help hospitality operators reduce sleeve inventory and elevate guest comfort, ensuring sustained volume within the paper cups market.

In warmer months, iced beverage volumes surge, prompting retailers to order seasonal cold-cup SKUs with custom prints for brand promotion. This seasonal swing aligns with inbound tourism peaks, reinforcing revenue concentration in the summer quarters. Meanwhile, micro-roaster cafes and boutique tea houses favor textured hot-cup finishes for tactile differentiation. Continuous investments in both segments assure balanced growth across the paper cups market.

Polyethylene linings captured 70.80% of the overall paper cups market share in 2025, thanks to predictable performance and cost competitiveness. Yet polylactic acid and other compostable coatings are gaining a 4.83% CAGR edge as corporate buyers adopt zero-plastic procurement guidelines. Water-based dispersion technology demonstrates recyclability in standard paper streams while matching grease and moisture barriers, easing municipal waste-sorting processes. GCC hotel chains already stipulate compostable credentials in tender documents, signaling a structural pivot toward eco-coatings.

PE-lined cups remain entrenched for high-temperature fill operations because of thermal-sealing robustness, but hybrid substrates that cut plastic content by one-third enjoy faster regulatory clearances. Converters investing early in aqueous or mineral-blend barriers gain first-mover advantages among multinational foodservice brands, consolidating premium tiers of the paper cups market.

The Middle-East and Africa Paper Cups Market is Segmented by Cup Type (Hot Paper Cups, Cold Paper Cups), Material Lining (Polyethylene Coated, Polylactic-Acid Compostable, and More), Application (Quick-Service Restaurants, Institutional Catering, Coffee Chains and Cafes, Retail and Convenience Stores), Capacity (Up To 7 Oz, 8-12 Oz, 13-16 Oz, Above 16 Oz), and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Hotpack Packaging Industries LLC

- Huhtamaki Oyj

- Graphic Packaging International LLC

- Detpak South Africa (Pty) Ltd

- Gulf East Paper & Plastic Industries LLC

- Golden Paper Cup Manufacturing LLC

- Maimoon Papers Industry LLC

- Falcon Pack Industries LLC

- Al Bahri Packaging Materials Industry LLC

- Jass Pack Industries SAE

- Multipack International FZC

- Droup Al-Jubail Undertaking Est.

- Alexander Foods (Portion Cups) Pty Ltd

- Eco-Products South Africa (Pty) Ltd

- Vegware Ltd. (Regional Hub)

- Dart Container Corporation

- Go-Pak UK Ltd

- Seda International Packaging Group SpA

- Kap Cones Pvt Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions andMarket Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Value / Supply-Chain Analysis

- 4.3 Regulatory Landscape

- 4.4 Technological Outlook

- 4.5 Market Drivers

- 4.5.1 Surging On-the-Go Hot-Drink Culture

- 4.5.2 Government Single-Use Plastic Bans (GCC, SADC)

- 4.5.3 Food-Delivery Platform Expansion

- 4.5.4 Tourism Rebound Powering HORECA Outlets

- 4.5.5 Data-Centric Plant Efficiency Programs in Regional Mills

- 4.5.6 Rise of Plastic-Free Water-Based Barrier Cups

- 4.6 Market Restraints

- 4.6.1 Fragmented Converter Base Squeezing Margins

- 4.6.2 Chronic Pulp Price Volatility Tied to Currency Swings

- 4.6.3 Under-Developed Cup-Recycling Streams

- 4.6.4 Electrical-Energy Shortages in Sub-Saharan Africa

- 4.7 Import andExport Analysis (MEA Focus)

- 4.8 Industry Value Chain and Supply Chain Analysis

- 4.9 Regulatory Landscape

- 4.10 Technological Outlook

- 4.11 Porter's Five Forces Analysis

- 4.11.1 Bargaining Power of Suppliers

- 4.11.1.1 Bargaining Power of Buyers

- 4.11.1.2 Threat of New Entrants

- 4.11.1.3 Threat of Substitute Products

- 4.11.1.4 Intensity of Competitive Rivalry

- 4.11.1 Bargaining Power of Suppliers

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Cup Type

- 5.1.1 Hot Paper Cups

- 5.1.2 Cold Paper Cups

- 5.2 By Material Lining

- 5.2.1 Polyethylene (PE) Coated

- 5.2.2 Polylactic-Acid (PLA) / Compostable

- 5.2.3 Water-Based Barrier / Plastic-Free

- 5.3 By Application

- 5.3.1 Quick-Service Restaurants (QSR)

- 5.3.2 Institutional Catering

- 5.3.3 Coffee Chains andCafes

- 5.3.4 Retail andConvenience Stores

- 5.4 By Capacity (oz)

- 5.4.1 Up to 7 oz

- 5.4.2 8 -12 oz

- 5.4.3 13 -16 oz

- 5.4.4 Above 16 oz

- 5.5 By Country

- 5.5.1 Saudi Arabia

- 5.5.2 United Arab Emirates

- 5.5.3 Egypt

- 5.5.4 South Africa

- 5.5.5 Nigeria

- 5.5.6 Turkey

- 5.5.7 Kenya

- 5.5.8 Rest of Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products andServices, Recent Developments)

- 6.4.1 Hotpack Packaging Industries LLC

- 6.4.2 Huhtamaki Oyj

- 6.4.3 Graphic Packaging International LLC

- 6.4.4 Detpak South Africa (Pty) Ltd

- 6.4.5 Gulf East Paper & Plastic Industries LLC

- 6.4.6 Golden Paper Cup Manufacturing LLC

- 6.4.7 Maimoon Papers Industry LLC

- 6.4.8 Falcon Pack Industries LLC

- 6.4.9 Al Bahri Packaging Materials Industry LLC

- 6.4.10 Jass Pack Industries SAE

- 6.4.11 Multipack International FZC

- 6.4.12 Droup Al-Jubail Undertaking Est.

- 6.4.13 Alexander Foods (Portion Cups) Pty Ltd

- 6.4.14 Eco-Products South Africa (Pty) Ltd

- 6.4.15 Vegware Ltd. (Regional Hub)

- 6.4.16 Dart Container Corporation

- 6.4.17 Go-Pak UK Ltd

- 6.4.18 Seda International Packaging Group SpA

- 6.4.19 Kap Cones Pvt Ltd

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-needs Assessment