|

市場調查報告書

商品編碼

1910672

紙杯產業:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Paper Cups Industry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

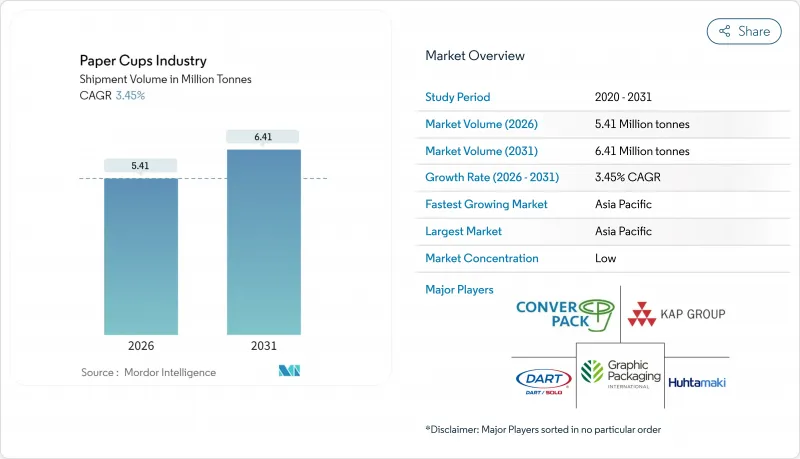

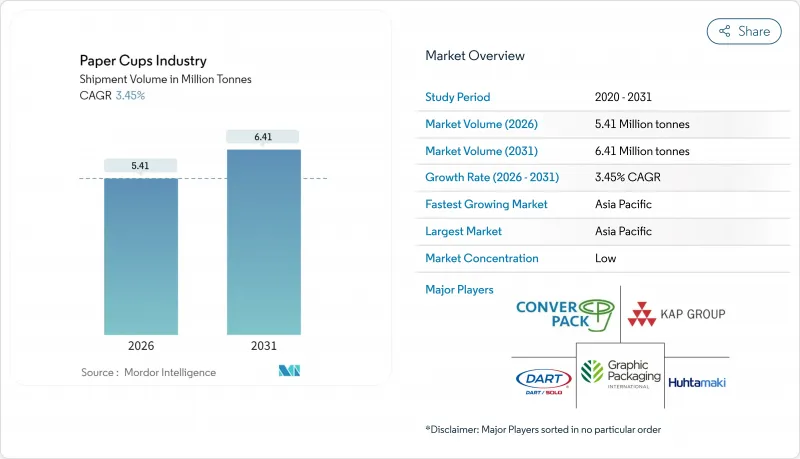

預計到2026年,紙杯產業市場規模將達到541萬噸,較2025年的523萬噸持續成長。預計到2031年,市場規模將達到641萬噸,2026年至2031年的複合年成長率為3.45%。

紙杯市場的穩定擴張反映了纖維基包裝面臨的監管壓力、水性及礦物基塗層技術的快速發展,以及餐飲品牌對易於回收包裝形式的日益青睞。消費者行為的改變、外帶飲料需求的成長、快餐店的擴張以及高速模塑生產線的技術進步,都在推動紙杯銷量的成長;而成熟經濟體的優質化則推動了單價的提升。受都市化和外送市場成長的驅動,亞太地區將在2024年成為全球領先的紙杯生產地區,市佔率將達到39.56%。同時,北美和歐洲市場正轉向使用低PFAS含量的全可回收熱飲杯,這類產品利潤率更高。市場競爭依然溫和,現有企業憑藉著規模經濟、垂直整合和研發投入,在新興的、專注於滿足特定永續性需求的特種加工商領先。

全球紙杯產業趨勢與洞察

外出飲用飲料的需求不斷成長

移動生活方式的興起增加了人們對日常外帶飲品的需求,紙杯也因此成為外帶飲品的標準包裝。都市區通勤者需要防漏紙杯,以符合公共運輸禮儀;而彈性的工作時間也促使人們在午休時間購買咖啡。預計到2024年,美國外送市場規模將達到1.22兆美元,年成長率達8.29%,這表明數位平台如何將應用程式訂餐與紙杯需求的成長聯繫起來。在東南亞和中東地區擴張的特色咖啡館正在推出高階紙杯設計,這些設計能夠更好地保留咖啡油脂,並方便清晰地印刷品牌標誌。會員應用程式鼓勵小額消費,在不增加新客戶流量的情況下增加了包裝消費量。這些趨勢正在推動各地對紙杯持續、高頻的需求,與零售商追求便利服務的概念相輔相成。

政府對一次性塑膠製品的限制

立法者正逐步淘汰一次性塑膠製品,轉而採用高成本更高、用途更有限的替代方案,從而推動向纖維材料的系統性轉變。歐盟《包裝及包裝廢棄物條例》於2024年3月最終定稿,該條例強制要求包裝完全可回收,並設定了到2030年將廢棄物減少5%的目標。南澳將於2024年9月起禁止使用塑膠飲料容器,將立即刺激對纖維杯替代品的需求。蘇格蘭計劃在2025年底前對每個一次性飲料杯附加稅25便士的稅,鼓勵零售商參與循環利用,同時將紙杯定位為成本最低的一次性替代品。這些立法措施形成了一個可預測的替代循環,使加工商能夠合理地調整對新模塑生產線的資本投資。

廢棄物處理和回收基礎設施的問題

許多市政系統仍然缺乏分離紙杯纖維和塗層的設備,這意味著許多技術上可回收的紙杯最終都被掩埋。開發中國家有限的資源回收預算阻礙了紙杯分類系統的實施。歐盟的循環經濟規則加強了對廢棄物處理途徑的審查,企業買家現在要求在簽訂合約前提供當地紙杯回收的證明。在基礎設施完善之前,紙杯行業面臨聲譽風險,這可能會導致需求轉向小眾咖啡館和機構中可重複使用的試點計畫。

細分市場分析

預計到2025年,保溫杯將佔據44.92%的市場佔有率,並在2031年之前以5.24%的複合年成長率成長。紙杯產業受益於全球專門食品咖啡店的興起,這些咖啡店需要高隔熱性能和醒目的杯身圖案來講述品牌故事。優質的阻隔塗層和雙層壁結構使連鎖店能夠合理地提高定價。冷飲杯在冰茶、汽水和冰沙市場保持著一定的市場佔有率,但由於輕質PET杯的持續競爭,其在氣候溫暖地區的成長速度有所放緩。錐形杯和特殊設計的杯子在活動餐飲領域佔據了一個細分市場,在這個領域,差異化比銷量更為重要。星巴克轉向礦物塗層表明,熱飲杯仍然是研發投資和利潤率的基礎。冷飲杯的創新主要集中在無吸管杯蓋和纖維基油墨上,但由於對隔熱性能的需求較低,其單價仍然較低。

熱飲杯的主導地位也體現在區域氣候特徵和飲用習慣。在北歐和北美,較長的涼爽季節維持了人們對熱飲的日常需求。雖然亞太地區的特大城市對冰飲的需求不斷成長,但熱茶的基準消費量仍然足夠高,足以支撐均衡的產品系列。紙杯產業正在透過提供可切換冷熱版本的模組化複合生產線來適應這一變化,從而確保全年產能運轉率。專業烘焙商要求供應商降低最低訂購量,以適應頻繁的設計變更,而只有先進的加工商才能滿足這種服務水準。這種客戶趨勢透過有利於整合設計、成型和物流的大型企業,限制了市場碎片化。

到2025年,雙層杯將佔據47.10%的市場佔有率,其優越的觸感和保溫性能備受青睞。在連鎖咖啡館中,雙層杯也像徵著奢華的觸感。然而,單層杯預計將以5.78%的複合年成長率成長至2031年,成為成長最快的產品。這一成長加速主要得益於價格敏感型市場中降低成本的目標,以及能夠在不影響性能的前提下實現更薄杯壁的塗層技術。含有微氣孔的水性內襯確保了單層杯具有足夠的耐熱性,使快餐店經營者能夠以更少的杯壁滿足顧客的需求。三層杯目前仍屬於小眾市場,主要用於盛裝沸湯的工業食堂。

電子商務包裝政策的改變——強調輕量化以減少運輸排放——也推動了單層層級構造。直接面對消費者的咖啡烘焙商,尤其是那些提供盒裝飲品套裝的商家,更傾向於使用符合嚴格碳排放標準的纖細紙杯。在生產製造方面,加工商正在最佳化層級構造紙杯的成型工藝,並提高生產線速度。然而,雙層紙杯在高利潤市場仍佔有一席之地。擁有強大品牌資產的連鎖店將較厚的紙杯作為感官體驗的一部分。這導致紙杯市場的產品組合呈現兩極化:單層紙杯被廣泛應用於價格親民的大眾市場,而雙層紙杯則被用於盈利更高的核心產品。

本紙杯市場報告按杯型(例如,熱飲紙杯、冷飲紙杯)、壁厚結構(例如,單層、雙層、三層)、容量(例如,4-8盎司、9-12盎司)、終端用戶(例如,快餐店、咖啡連鎖店和自動售貨機運營商)、配銷通路(例如,直接B2B合約)和地區進行分析。市場預測以百萬噸為單位。

區域分析

預計到2025年,亞太地區將佔全球紙杯產量的39.10%,並在2031年之前以6.55%的複合年成長率成長,成為所有地區中成長最快的地區。中國造紙業在2024年將國內產能提高了10%,確保了2025年紙杯加工基材的穩定供應。預計到2025年,印度包裝市場規模將達到2,048.1億美元,複合年成長率高達26.7%,進一步深化了外帶杯的終端市場需求。越南包裝市場正以9.73%的年成長率成長,展現出強大的製造競爭力,並支撐著紙杯在東協地區的出口。可支配收入的成長和品牌咖啡文化的興起正在推動區域需求,使亞太地區成為紙杯行業成長的關鍵驅動力。

北美市場已趨於成熟,但技術仍在不斷進步。美國食品藥物管理局(FDA) 計畫於 2025 年 2 月逐步淘汰全氟合成化合物 (PFAS),這推動了水性及礦物基阻隔塗料的普及。喬治亞-太平洋公司於 2024 年投資 20 億美元,用於其在美國的七家工廠,以保持生產柔軟性並實現永續性目標。現代化的回收系統和企業 ESG 報告推動了高級產品的推出,加工商之間的競爭也從單純的價格戰轉向了產品報廢認證。儘管銷量成長較為溫和,但纖維封口等增值特性正在提升利潤率。

歐洲正走在以監管為先的道路上。到2030年,強制性回收措施將穩步推動塑膠包裝被紙杯取代。 2024年10月,Huhtamäki公司擴大了在北愛爾蘭的纖維杯蓋產能,以滿足當地對無塑膠組件的需求。該地區已採取按杯收費和稅收優惠政策,鼓勵消費者使用可重複使用的產品,但纖維杯仍被視為符合規定的一次性用品。東歐市場的成長機會主要得益於速食店(QSR)的日益普及,彌補了西歐市場規模趨於成熟的不足。

中東、非洲和南美洲是新興的機會地區。基礎設施不足和經濟波動限制了其即時規模擴張,但外送應用和國際咖啡連鎖店已率先站穩腳跟。加工商正與當地造紙廠成立合資企業,以實現供應本地化並降低外匯風險和進口關稅。儘管它們目前對紙杯市場規模的貢獻仍然有限,但長期的人口趨勢預計將推動其產量逐步成長。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 外出飲用飲料的需求不斷成長

- 政府禁止使用一次性塑膠製品

- 拓展快餐店 (QSR) 與食品配送生態系統

- 推出採用水性塗層的全可回收熱飲杯

- 零浪費體育場館和活動採購指示

- 透過人工智慧驅動的高速成型線降低成本

- 市場限制

- 缺乏廢棄物處理和回收基礎設施

- 紙漿價格波動對利潤率帶來壓力

- 咖啡連鎖店試行引進可重複使用杯子循環系統

- PFAS淘汰計劃延期、重新設計和認證

- 供應鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按杯子類型

- 熱紙杯

- 冷紙杯

- 甜筒和專門食品杯

- 依牆體類型

- 單層牆體

- 雙層壁

- 三層壁

- 按體積(盎司)

- 4-8

- 9-12

- 13-20

- >20

- 最終用戶

- 速食店(QSR)

- 咖啡連鎖店和自動販賣機營運商

- 企業餐飲

- 航空公司和鐵路公司

- 其他

- 透過分銷管道

- 直接(B2B合約)

- 分銷商和批發商

- 線上B2B市場

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲和紐西蘭

- 亞太其他地區

- 中東和非洲

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 埃及

- 其他非洲地區

- 中東

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Huhtamaki Oyj

- Dart Container Corp.

- Graphic Packaging International

- Georgia-Pacific LLC

- Seda International Packaging

- Kap Cones Pvt Ltd

- ConverPack Inc.

- Go-Pak UK Ltd(SCGP)

- Benders Paper Cups

- Hotpack Global

- Tekni-Plex Inc.

- CEE Schisler Packaging

- International Paper Foodservice

- Stora Enso Food-Service Boards

- Lollicup USA(Karat)

- Detmold Group

- F-Bender & Co.

- Nissin Paper Products

- Reynolds Consumer Products

- Pactiv Evergreen

第7章 市場機會與未來展望

Paper Cups Industry market size in 2026 is estimated at 5.41 Million tonnes, growing from 2025 value of 5.23 Million tonnes with 2031 projections showing 6.41 Million tonnes, growing at 3.45% CAGR over 2026-2031.

This steady rise in the paper cups market size reflects a regulatory push toward fiber-based packaging, rapid upgrades in aqueous and mineral coatings, and the widening preference of food-service brands for easily recyclable formats. Shifts in consumer behavior toward take-away beverages, the roll-out of new QSR outlets, and technological advances in high-speed forming lines are widening volume demand, while premiumization in mature economies is lifting unit revenues. Asia-Pacific leads global tonnage with 39.56% share in 2024, propelled by urbanization and food-delivery growth, whereas North America and Europe are pivoting toward low-PFAS, fully recyclable hot-cup formats that command higher margins. Competitive intensity remains moderate; incumbents leverage scale, vertical integration, and R&D investment to stay ahead of emerging specialty converters that target niche sustainability needs.

Global Paper Cups Industry Trends and Insights

Rising Demand for On-the-Go Beverages

Mobile lifestyles are lifting daily takeaway beverage volumes, positioning paper cups as the default pack for transit-friendly drinks. Urban commuters seek spill-proof formats that fit public-transport etiquette, and flexible work patterns elevate mid-day coffee runs. The U.S. food-delivery market is on track to generate USD 1.22 trillion in 2024, growing at 8.29% annually, underscoring how digital platforms translate app orders into incremental cup lifts. Specialty cafes expanding in Southeast Asia and the Middle East are introducing premium cup specifications that keep crema intact and print branding crisp. Loyalty apps encourage micro-purchases, which compound packaging volumes without requiring new footfall. Across regions, the result is a consistent, high-frequency pull on the paper cups market that aligns with retailer ambitions for frictionless service.

Government Bans on Single-Use Plastics

Legislators are turning single-use plastics into a costlier, restricted option, forcing a systemic shift toward fiber formats. The EU Packaging and Packaging Waste Regulation finalized in March 2024 mandates full recyclability and sets a 5% waste-cut target by 2030. South Australia banned plastic beverage containers from September 2024, instantly channeling demand to fiber cup alternatives. Scotland intends to levy a 25-pence surcharge on each single-use beverage cup by end-2025, nudging retailers toward reusable loops while positioning paper cups as the least-cost single-use substitute. These legal levers create predictable replacement cycles that let converters rationalize capex in new forming lines.

Disposal and Recycling Infrastructure Gaps

Many municipal systems still lack the equipment to delaminate cup fiber from coatings, so collected cups often end in landfill despite technical recyclability. Developing economies face limited material-recovery budgets, hindering paper cup sorting adoption. EU circular-economy rules tighten scrutiny on end-of-life pathways, and corporate buyers now demand evidence of regional cup recovery before awarding contracts. Until infrastructure catches up, the paper cups industry contends with reputational questions that can shift volumes to reusable pilots in niche cafes and venues.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of QSR and Food-Delivery Ecosystems

- Aqueous-Coated Fully-Recyclable Hot-Cup Launches

- Pulp-Price Volatility Squeezing Margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hot cups represented 44.92% of 2025 volume, and the segment is projected to expand at a 5.24% CAGR through 2031. The paper cups industry benefits from a global surge in specialty coffee houses that require high heat retention and vivid on-cup graphics for brand storytelling. Premium barrier coatings and double-wall builds deliver both, letting chains justify higher ticket prices. Cold cups protect share in iced tea, soda, and smoothie channels, yet growth lags because competition from lightweight PET cups persists in warm climates. Cone and specialty designs occupy event catering niches where differentiation, not mass volume, rules. Starbucks' switch to mineral coatings underscores how hot cups anchor R&D investment and margin capture. Cold-cup innovation focuses on strawless lids and fiber inks, but without the thermal barrier imperative, unit values stay lower.

Hot-cup leadership also reflects regional weather patterns and beverage rituals. Northern Europe and North America experience extended cool seasons that sustain daily hot-drink demand. In APAC mega-cities, iced beverage upticks occur, but hot tea traditions keep baseline consumption high enough to support a balanced portfolio. The paper cups industry adapts by offering modular lamination lines that toggle between hot and cold specs, ensuring asset utilization year-round. Specialty roasters ask suppliers for smaller minimum order quantities with frequent artwork changeovers, a service level only advanced converters can accommodate. This client dynamic moderates fragmentation by favoring scale players that bundle design, forming, and logistics.

Double-wall cups held 47.10% share in 2025, preferred for superior hand comfort and heat insulation. They also serve as a tactile signal of premium positioning in chain cafes. Yet single-wall designs are forecast to grow fastest at 5.78% CAGR through 2031. This acceleration stems from cost-saving goals in price-sensitive markets and from coating technologies that allow thin walls without hurting performance. Aqueous liners with micro-air pockets give single-wall cups sufficient heat resistance, enabling QSR operators to downgrade wall count while meeting customer expectations. Triple-wall cups remain niche, used in industrial canteens where boiling-hot broths are common.

Shifts in e-commerce packaging policies-favoring lower-weight parcels to cut freight emissions-also help single-wall formats. Direct-to-consumer coffee roasters that ship boxed drink kits favor slim cups to fit tight carbon calculators. On factory floors, converters re-engineer forming cycles to align with single-wall geometry, increasing line speed. Still, double-wall cups keep a foothold in high-margin markets. Chains with strong brand equity treat the thicker feel as part of the sensory experience. The paper cups market thus offers a bifurcated product mix: single-wall for broad affordability and double-wall for revenue-rich flagships.

The Paper Cups Market Report is Segmented by Cup Type (Hot Paper Cups, Cold Paper Cups, and More), Wall Type (Single Wall, Double Wall, Triple Wall), Capacity (4-8 Oz, 9-12 Oz, and More), End User (Quick-Service Restaurants, Coffee Chains and Vending Operators, and More), Distribution Channel (Direct B2B Contracts, and More), and Geography. The Market Forecasts are Provided in Terms of Volume (Million Tonnes).

Geography Analysis

Asia-Pacific accounted for 39.10% of global tonnage in 2025 and is projected to grow at 6.55% CAGR to 2031, the highest among all regions. China's paper sector added 10% domestic capacity in 2024, ensuring ample substrate for cup converting in 2025. India's packaging market is expected to reach USD 204.81 billion by 2025, expanding at 26.7% CAGR, a scale that deepens end-market pull for cups in food delivery. Vietnam's packaging growth of 9.73% annually demonstrates manufacturing competitiveness that also feeds cup exports across ASEAN. Rising disposable incomes and a shift toward branded cafe culture underpin regional volume, making APAC the growth anchor of the paper cups industry.

North America remains a mature yet technologically progressive market. The PFAS phase-out finalized by the U.S. FDA in February 2025 is propelling adoption of aqueous and mineral barrier coatings. Georgia-Pacific invested USD 2 billion in seven U.S. facilities in 2024 to sustain production agility and comply with sustainability targets. Modern recycling systems and corporate ESG reporting encourage premium offerings, with converters competing on end-of-life certification rather than pure price. Unit growth is slower, but margins are stronger through value-added specs such as fiber lids.

Europe follows a regulation-first trajectory. Mandatory recyclability by 2030 ensures steady substitution away from plastic packaging to paper-based cups. Huhtamaki expanded fiber-lid capacity in Northern Ireland in October 2024 to meet regional demand for plastic-free components. The region adopts pay-per-cup or tax incentives to nudge consumers toward reusables but still positions fiber cups as the compliant single-use option. Eastern European growth pockets, driven by rising QSR penetration, help offset Western Europe's mature volumes.

The Middle East and Africa and South America constitute emerging opportunity zones. Infrastructure gaps and economic swings temper immediate scale, yet food-delivery apps and international coffee chains are planting early seeds. Converters form joint ventures with local paper mills to localize supply, mitigating currency risk and import tariffs. While their contribution to the paper cups market size is still modest, longer-term demographic trends suggest incremental tonnage upside.

- Huhtamaki Oyj

- Dart Container Corp.

- Graphic Packaging International

- Georgia-Pacific LLC

- Seda International Packaging

- Kap Cones Pvt Ltd

- ConverPack Inc.

- Go-Pak UK Ltd (SCGP)

- Benders Paper Cups

- Hotpack Global

- Tekni-Plex Inc.

- CEE Schisler Packaging

- International Paper Foodservice

- Stora Enso Food-Service Boards

- Lollicup USA (Karat)

- Detmold Group

- F-Bender & Co.

- Nissin Paper Products

- Reynolds Consumer Products

- Pactiv Evergreen

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for on-the-go beverages

- 4.2.2 Government bans on single-use plastics

- 4.2.3 Expansion of QSR and food-delivery ecosystems

- 4.2.4 Aqueous-coated fully-recyclable hot-cup launches

- 4.2.5 Zero-waste stadium and event procurement mandates

- 4.2.6 AI-driven high-speed forming lines lowering cost

- 4.3 Market Restraints

- 4.3.1 Disposal and recycling infrastructure gaps

- 4.3.2 Pulp-price volatility squeezing margins

- 4.3.3 Reusable cup loop pilots in coffee chains

- 4.3.4 PFAS-phase-out redesign and certification delays

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Cup Type

- 5.1.1 Hot Paper Cups

- 5.1.2 Cold Paper Cups

- 5.1.3 Cone and Specialty Cups

- 5.2 By Wall Type

- 5.2.1 Single Wall

- 5.2.2 Double Wall

- 5.2.3 Triple Wall

- 5.3 By Capacity (oz)

- 5.3.1 4-8

- 5.3.2 9-12

- 5.3.3 13-20

- 5.3.4 >20

- 5.4 By End User

- 5.4.1 Quick-Service Restaurants (QSR)

- 5.4.2 Coffee Chains and Vending Operators

- 5.4.3 Institutional Catering

- 5.4.4 Airlines and Railways

- 5.4.5 Others

- 5.5 By Distribution Channel

- 5.5.1 Direct (B2B Contracts)

- 5.5.2 Distributors and Wholesalers

- 5.5.3 Online B2B Marketplaces

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Russia

- 5.6.2.7 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Australia and New Zealand

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 Middle East

- 5.6.4.1.1 United Arab Emirates

- 5.6.4.1.2 Saudi Arabia

- 5.6.4.1.3 Turkey

- 5.6.4.1.4 Rest of Middle East

- 5.6.4.2 Africa

- 5.6.4.2.1 South Africa

- 5.6.4.2.2 Nigeria

- 5.6.4.2.3 Egypt

- 5.6.4.2.4 Rest of Africa

- 5.6.4.1 Middle East

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Huhtamaki Oyj

- 6.4.2 Dart Container Corp.

- 6.4.3 Graphic Packaging International

- 6.4.4 Georgia-Pacific LLC

- 6.4.5 Seda International Packaging

- 6.4.6 Kap Cones Pvt Ltd

- 6.4.7 ConverPack Inc.

- 6.4.8 Go-Pak UK Ltd (SCGP)

- 6.4.9 Benders Paper Cups

- 6.4.10 Hotpack Global

- 6.4.11 Tekni-Plex Inc.

- 6.4.12 CEE Schisler Packaging

- 6.4.13 International Paper Foodservice

- 6.4.14 Stora Enso Food-Service Boards

- 6.4.15 Lollicup USA (Karat)

- 6.4.16 Detmold Group

- 6.4.17 F-Bender & Co.

- 6.4.18 Nissin Paper Products

- 6.4.19 Reynolds Consumer Products

- 6.4.20 Pactiv Evergreen

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment