|

市場調查報告書

商品編碼

1911412

專業音訊:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Professional Audio - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

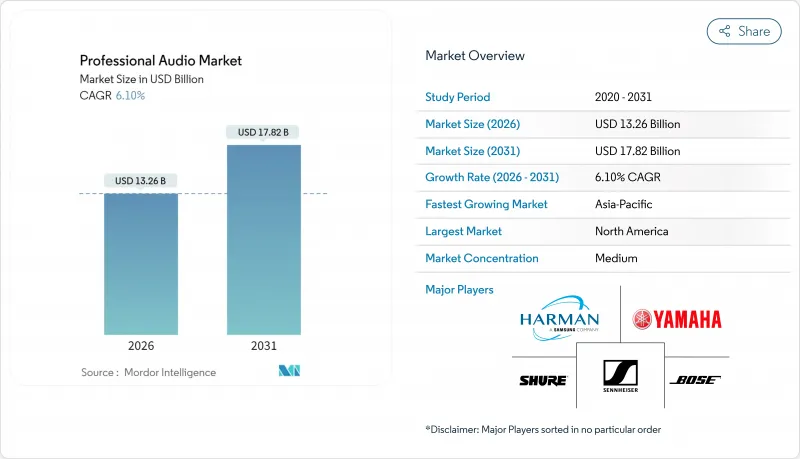

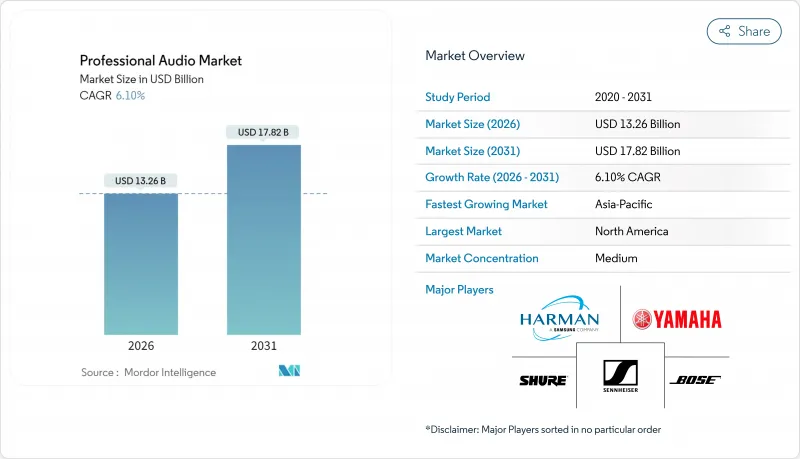

預計到 2025 年,專業音響市場規模將達到 125 億美元,到 2026 年將成長至 132.6 億美元,到 2031 年將成長至 178.2 億美元,預測期(2026-2031 年)的複合年成長率為 6.1%。

隨著實況活動的回歸和企業大力推廣混合辦公環境,市場需求將從設備所有權轉向體驗主導解決方案,而混合辦公環境將成為成長的核心動力。 AES67 和 Dante 等網路通訊協定將降低互通性障礙,助力場館升級其傳統基礎設施。

供應鏈重新設計,以最大限度地減少對半導體的依賴,並轉向軟體定義能力,這將增強經常性收入來源;同時,正如 Acuity Brands 收購 QSC 所證明的那樣,建築系統和音頻的日益融合正在創造一個新的競爭格局,在這個空調格局中,照明、暖通格局和音頻平台相互關聯。

全球專業音訊市場趨勢與洞察

實況活動和體驗式行銷的快速擴張

預計2024年大型演唱會的門票銷售額將年增26%,這將促使租賃公司和場館用心形指向子陣列系統替換老舊的揚聲器陣列,以在滿足嚴格的噪音法規的同時保持震撼的音效。正如2025年Ultra音樂節所展現的那樣,音樂節主辦方正在利用高級音響區域將體驗式行銷與贊助收入相結合,從而實現盈利。混合型企業活動需要現場觀眾和虛擬觀眾之間實現低延遲連接,這推動了可擴展數位主機的銷售。 Sphere Entertainment公司安裝的16.7萬個揚聲器系統展示了身臨其境型架構如何增強品牌互動。因此,專業音訊市場對靈活的揚聲器配置和高密度無線通道的需求日益成長,這些配置和通道能夠簡化快速的演出切換流程。

創意經濟領域對專業錄音室設備的需求激增

預計2024年,中國線上音訊用戶數將達到7.47億,市場規模將達688.6億美元。這凸顯了個人內容創作者對專業採購決策的巨大影響力。同年,全球播客收入超過300億美元,促使麥克風製造商加速推出兼具便利性和擴充性的USB-XLR混合產品。視覺品牌美學至關重要,大型廣播級麥克風能夠提升鏡頭前的真實感,推動了舒爾MV7i等整合即時音訊處理功能的產品的廣泛應用。中端製造商透過將軟體插件與硬體捆綁銷售,將首次購買者轉化為定期訂閱用戶,從而獲益匪淺。這種趨勢透過拓展終端用戶群體,使其不再局限於傳統錄音棚,進一步擴大了專業音訊市場的潛在用戶範圍。

半導體供應鏈持續波動

DSP核心和RF收發器的前置作業時間超過60週,迫使設計團隊尋找替代零件或削減進階功能。預計到2024年,美國半導體進口額將達到1,390億美元,而不斷上漲的關稅推高了到岸成本。小型音響品牌正與大型科技公司爭奪晶圓配額,這往往迫使它們支付溢價或減少產量。元件加速過時導致一些供應商停止生產數位產品,轉而生產晶片使用量較低的類比產品線。預計在晶圓廠產能能夠滿足需求之前,專業音響市場將面臨利潤率壓縮的局面。

細分市場分析

到2025年,揚聲器將佔專業音訊市場38.02%的佔有率,鞏固其在巡迴、固定安裝和混合型場館的核心地位。疫情期間的運作加速了揚聲器的更新換代,許多場館採用心形指向性子陣列來提升低頻定向並符合當地的噪音法規。同時,由於監管機構重新分配頻率,無線麥克風的複合年成長率(CAGR)達到7.45%。這迫使用戶逐步淘汰類比UHF設備,製造商則提供可在日益縮小的頻寬內運作的加密數位平台,以確保即使在擁擠的無線環境中也能保持效能。

在揚聲器領域,市場對增值型放大、吊掛和控制軟體的需求日益成長,這些軟體能夠透過基於FIR的波束控制技術提升系統效能。供應商正在推出軟體訂閱服務,以支援預測模組,從而將一次性硬體銷售轉化為持續的收入來源。麥克風製造商正在探索基於WMAS的生態系統,例如森海塞爾的Spectera,它在單一6MHz頻寬內提供64個通道,很好地展示了先進的調製技術如何解決頻寬短缺問題。 Dante擴充盒和支援PoE供電的舞台介面箱等配件正在填補整合方面的空白,並幫助供應商提升其在專業音訊市場的佔有率。

到2025年,有線解決方案仍將佔據專業音訊市場56.85%的佔有率,這主要得益於政府大樓和廣播工作室等需要避免射頻風險的關鍵任務應用。 Cat6a線纜和冗餘環形拓撲結構可確保近乎零延遲,並支援PoE++供電。然而,隨著Wi-Fi 7開放6 GHz頻寬並改善確定性調度,預計到2031年,無線設備的複合年成長率將達到7.22%。早期基於Wi-Fi的Dante原型機已實現低於5毫秒的延遲,縮小了與乙太網路的效能差距。

電池技術的創新使可攜式擴聲箱在中等聲壓級下的運作延長至 40 小時,從而拓展了戶外應用場景。基於雲端的資料庫協調管理應用程式簡化了部署,降低了志工操作人員的專業門檻。假冒射頻模組增加了複雜性,而行業教育舉措則透過標準化的掃描通訊協定來減少干擾。有線和無線生態系統並存,整合商設計的容錯移轉架構融合了兩者,確保專業音訊市場能夠同時滿足對可靠性和柔軟性的雙重需求。

區域分析

到2025年,北美將佔據專業音訊市場33.12%的佔有率。北美擁有全球密度最高的體育場館、巨型教堂和廣播設施,因此需要持續進行技術升級。美國聯邦通訊委員會(FCC)的頻譜重新分配推動了無線設備的更新換代,而無障礙法規則則鼓勵場館安裝助聽發送器。企業房地產行業優先考慮會議室現代化改造,透過AES67網路整合室內和遠端音訊。加州和伊利諾伊州的區域製造群透過縮短全球供應鏈中斷期間的前置作業時間,增強了該地區的韌性。

亞太地區將以最快的速度成長,到2031年將以7.22%的複合年成長率持續擴張。中國和印度的國家體育場館計畫從設計階段就採用了基於Dante技術的公共廣播系統。中國的「耳部經濟」正在透過強制要求採用高階音訊設備作為消費場所的競爭優勢來影響採購決策。由於政府鼓勵組裝組裝的激勵措施,印度整合商受益於進口組件的較低關稅。該地區蓬勃發展的創新階層刺激了對價格適中的錄音室介面的需求,擴大了零工經濟音樂人和播客主播等專業音頻市場群體。外匯波動仍然是規劃風險,但製造商盡可能以美元計價合約來規避風險。

在歐洲,文化機構和企業園區的需求穩定成長。歷史劇院的維修優先考慮使用可回收的音箱箱體和低功率功放,以滿足歐盟的永續性目標。英國脫歐增加了雙重認證的成本,但也促使歐洲大陸的經銷商維持緩衝庫存,確保供應的連續性。德國Prolight+Sound等展覽會有助於提高產品知名度,英國廣播業也正在加速採用ST 2110相容的主機。因此,歐洲專業音響市場的發展並非依靠大規模的產能擴張,而是透過遵守法規和注重環保的設計來實現的。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 實況活動和體驗式行銷的快速擴張

- 創意經濟領域對專業錄音室設備的需求激增

- 網路化影音設備的成長及AES67/Dante互通性

- 過渡到身臨其境型和空間音訊格式(杜比全景聲、MPEG-H)

- 企業混合辦公模式在高保真音訊領域的投資

- 政府撥款用於智慧城市公共廣播系統升級改造

- 市場限制

- 半導體供應鏈持續不穩定

- 旅遊級系統總擁有成本高

- 仿冒品和灰色市場零件氾濫成災

- 由於電子廢棄物法規日益嚴格,合規成本增加。

- 價值鏈分析

- 監管環境

- 技術展望

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 依產品

- 揚聲器

- 功率放大器

- 混音主機

- 麥克風

- 耳機

- 配件及其他

- 連結性別

- 有線

- 無線的

- 最終用戶

- 對於企業

- 場地和活動

- 零售和酒店

- 媒體與娛樂

- 教育機構及宗教場所

- 透過使用

- 現場擴聲

- 錄音室

- 廣播和串流媒體

- 安裝音響/公共廣播

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 智利

- 阿根廷

- 南美洲其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 新加坡

- 澳洲

- 馬來西亞

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 埃及

- 其他非洲地區

- 中東

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Shure Incorporated

- Sennheiser electronic GmbH & Co. KG

- Harman International Industries Inc.(JBL Professional)

- Yamaha Corporation

- Bose Corporation

- QSC LLC

- Audio-Technica Corporation

- LEWITT GmbH

- RCF Group SpA

- Music Tribe(Global Brands Ltd.)

- PreSonus Audio Electronics Inc.

- Mackie(LOUD Audio LLC)

- Allen and Heath Limited

- DiGiCo UK Ltd.

- Focusrite plc

- Avid Technology Inc.

- Powersoft SpA

- d&b audiotechnik GmbH

- L-Acoustics Group

- Meyer Sound Laboratories Inc.

- Electro-Voice(Bosch Security Systems Inc.)

- Crown International(Harman)

- TASCAM(TEAC Corporation)

- Rode Microphones(Free-fly Pty Ltd)

- Zoom Corporation

第7章 市場機會與未來展望

The professional audio market was valued at USD 12.50 billion in 2025 and estimated to grow from USD 13.26 billion in 2026 to reach USD 17.82 billion by 2031, at a CAGR of 6.1% during the forecast period (2026-2031).

Demand shifts from equipment ownership to experience-driven solutions, live-event resurgence, and enterprise hybrid-work upgrades form the core growth pillars. Networked protocols such as AES67 and Dante reduce interoperability barriers, encouraging facilities to refresh legacy infrastructure.

Supply chain redesigns that minimize semiconductor exposure and a pivot toward software-defined features strengthen recurring revenue streams. Meanwhile, convergence of building systems with audio, evidenced by Acuity Brands' acquisition of QSC, signals new competitive dynamics where lighting, HVAC, and sound platforms interconnect.

Global Professional Audio Market Trends and Insights

Rapid Expansion of Live-Events and Experiential Marketing

Ticket volumes at major concerts increased 26% year over year in 2024, spurring rental firms and venues to replace aging arrays with cardioid sub-array systems that meet stricter noise ordinances while preserving punch. Festival operators monetize premium sound zones that tie experiential marketing to sponsorship revenue, as seen at Ultra Music Festival 2025. Hybrid corporate shows need low-latency bridging between onsite and virtual audiences, driving sales of scalable digital consoles. Sphere Entertainment's 167,000-speaker install illustrates how immersive architecture elevates brand engagement. The professional audio market therefore sees elevated demand for flexible loudspeaker configurations and high-density wireless channels that streamline quick show turnovers.

Surging Creator-Economy Demand for Studio-Grade Gear

China logged 747 million online audio users in 2024, generating a sector worth USD 68.86 billion, underlining how individual content creators influence professional purchasing decisions. Global podcast revenue surpassed USD 30 billion the same year, pushing microphone makers to launch USB-XLR hybrids that combine convenience with expandability. Visual brand aesthetics matter; larger broadcast-style microphones improve on-camera credibility, boosting uptake of units such as Shure's MV7i that integrate real-time voice processing. Mid-tier manufacturers capitalize by bundling software plug-ins alongside hardware, converting first-time buyers into subscription clients. This driver enlarges the addressable professional audio market by expanding the end-user base beyond traditional studios.

Persistent Semiconductor Supply-Chain Volatility

Lead times for DSP cores and RF transceivers extend past 60 weeks, forcing design teams to qualify substitute parts or strip advanced features. U.S. semiconductor imports reached USD 139 billion in 2024 amid tariff hikes that raised landed costs. Smaller audio brands compete against large tech firms for wafer allocation, often paying premiums or shrinking production runs. Component obsolescence accelerates, leading some vendors to sunset digital SKUs in favor of analog lines requiring fewer chips. The professional audio market thus faces margin compression until fab capacity aligns with demand.

Other drivers and restraints analyzed in the detailed report include:

- Growth of Networked-AV and AES67/Dante Interoperability

- Shift to Immersive and Spatial-Audio Formats

- High Total Cost of Ownership for Tour-Grade Systems

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Loudspeakers contributed 38.02% of the professional audio market size in 2025, confirming their centrality across touring, fixed install, and hybrid venues. Replacement cycles accelerated after pandemic-era downtime, with many arenas adopting cardioid sub-arrays that improve low-frequency directionality while complying with municipal noise codes. Meanwhile, wireless microphones advance at an 7.45% CAGR on the back of regulatory spectrum reallocations that compel users to retire analog UHF units. Manufacturers answer with encrypted digital platforms that fit within shrinking frequency bands, safeguarding performance in congested RF environments.

The loudspeaker segment drives value-added demand for amplification, rigging, and control software that elevate system performance through FIR-based beam steering. Vendors unlock software subscriptions that activate prediction modules, converting one-time hardware sales into recurring revenue. Microphone makers explore WMAS-based ecosystems, such as Sennheiser's Spectera, which delivers 64 channels inside a single 6 MHz block and illustrates how advanced modulation counters spectrum scarcity. Accessories like Dante breakout boxes and PoE-powered stage boxes fill integration gaps, rounding out wallet share captured by vendors inside the professional audio market.

Wired solutions retained 56.85% share of the professional audio market size in 2025 thanks to mission-critical applications that resist RF risk, including government chambers and broadcast studios. Cat6a cable and redundant ring topologies guarantee near-zero latency and facilitate power distribution through PoE++. Yet wireless units are forecast to post a 7.22% CAGR to 2031 as Wi-Fi 7 unlocks 6 GHz channels and improves deterministic scheduling. Early Dante-over-Wi-Fi prototypes demonstrate sub-5 ms latency, narrowing the performance gap against Ethernet.

Battery innovation extends runtime to 40 hours at moderate SPL for portable PA boxes, widening addressable outdoor use cases. Managed-frequency coordination apps powered by cloud databases simplify deployment, lowering expertise barriers for volunteer operators. Despite counterfeit RF modules adding complexity, educational initiatives by industry bodies help mitigate interference through standardized scanning protocols. Wired and wireless ecosystems coexist as integrators design fail-over architectures that blend both, ensuring the professional audio market satisfies reliability and flexibility expectations simultaneously.

The Professional Audio Market Report is Segmented by Product (Loudspeakers, Power Amplifiers, Mixing Consoles, Microphones, Headphones, and More), Connectivity (Wired, Wireless), End-User (Corporate, Venues and Events, Retail and Hospitality, Media and Entertainment, and More), Application (Live Sound Reinforcement, Recording Studios, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America accounted for 33.12% of the professional audio market in 2025, backed by the world's densest concentration of arenas, megachurches, and broadcast facilities requiring rolling technology refreshes. FCC spectrum reallocation compels wireless replacements, while accessibility laws push venues to adopt assistive-listening transmitters. Corporate real-estate teams prioritize conference-room modernization that unifies in-room and remote voices via AES67 networks. Regional resilience is reinforced by local manufacturing clusters in California and Illinois that shorten lead times during global supply disruptions.

Asia-Pacific records the fastest pace, advancing at a 7.22% CAGR through 2031 as national stadium programs in China and India embed Dante-native public-address systems from blueprint stages. China's "ear economy" shapes procurement by requiring consumer-facing venues to adopt premium audio as a competitive differentiator. Indian integrators benefit from government incentives that localize assembly, lowering tariffs on imported components. The region's creative-class boom fuels demand for affordable studio interfaces, expanding the professional audio market base among gig-economy musicians and podcasters. Currency fluctuations remain a planning risk, yet manufacturers hedge by denominating contracts in USD where possible.

Europe demonstrates stable demand across cultural institutions and corporate campuses. Renovation of heritage theaters prioritizes recyclable loudspeaker cabinets and low-power amplifiers to align with EU sustainability targets. Brexit spurs dual-certification costs but also motivates continental distributors to hold buffer stock, maintaining supply continuity. German trade fairs like Prolight + Sound drive product visibility, while the United Kingdom broadcast sector accelerates adoption of ST 2110-compatible consoles. The professional audio market in Europe thus evolves through regulatory compliance and green design, rather than large-scale capacity increases.

- Shure Incorporated

- Sennheiser electronic GmbH & Co. KG

- Harman International Industries Inc. (JBL Professional)

- Yamaha Corporation

- Bose Corporation

- QSC LLC

- Audio-Technica Corporation

- LEWITT GmbH

- RCF Group S.p.A

- Music Tribe (Global Brands Ltd.)

- PreSonus Audio Electronics Inc.

- Mackie (LOUD Audio LLC)

- Allen and Heath Limited

- DiGiCo UK Ltd.

- Focusrite plc

- Avid Technology Inc.

- Powersoft S.p.A

- d&b audiotechnik GmbH

- L-Acoustics Group

- Meyer Sound Laboratories Inc.

- Electro-Voice (Bosch Security Systems Inc.)

- Crown International (Harman)

- TASCAM (TEAC Corporation)

- Rode Microphones (Free-fly Pty Ltd)

- Zoom Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid expansion of live-events and experiential marketing

- 4.2.2 Surging creator-economy demand for studio-grade gear

- 4.2.3 Growth of networked-AV and AES67/Dante interoperability

- 4.2.4 Shift to immersive and spatial-audio formats (Dolby Atmos, MPEG-H)

- 4.2.5 Corporate hybrid-work investments in high-fidelity audio

- 4.2.6 Government funding for smart-city public-address upgrades

- 4.3 Market Restraints

- 4.3.1 Persistent semiconductor supply-chain volatility

- 4.3.2 High total-cost-of-ownership for tour-grade systems

- 4.3.3 Proliferation of counterfeit/grey-market components

- 4.3.4 Rising e-waste regulations increasing compliance costs

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product

- 5.1.1 Loudspeakers

- 5.1.2 Power Amplifiers

- 5.1.3 Mixing Consoles

- 5.1.4 Microphones

- 5.1.5 Headphones

- 5.1.6 Accessories and Others

- 5.2 By Connectivity

- 5.2.1 Wired

- 5.2.2 Wireless

- 5.3 By End-User

- 5.3.1 Corporate

- 5.3.2 Venues and Events

- 5.3.3 Retail and Hospitality

- 5.3.4 Media and Entertainment

- 5.3.5 Education and Houses-of-Worship

- 5.4 By Application

- 5.4.1 Live Sound Reinforcement

- 5.4.2 Recording Studios

- 5.4.3 Broadcast and Streaming

- 5.4.4 Installed Sound / Public-Address

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Chile

- 5.5.2.3 Argentina

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 Singapore

- 5.5.4.5 Australia

- 5.5.4.6 Malaysia

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Shure Incorporated

- 6.4.2 Sennheiser electronic GmbH & Co. KG

- 6.4.3 Harman International Industries Inc. (JBL Professional)

- 6.4.4 Yamaha Corporation

- 6.4.5 Bose Corporation

- 6.4.6 QSC LLC

- 6.4.7 Audio-Technica Corporation

- 6.4.8 LEWITT GmbH

- 6.4.9 RCF Group S.p.A

- 6.4.10 Music Tribe (Global Brands Ltd.)

- 6.4.11 PreSonus Audio Electronics Inc.

- 6.4.12 Mackie (LOUD Audio LLC)

- 6.4.13 Allen and Heath Limited

- 6.4.14 DiGiCo UK Ltd.

- 6.4.15 Focusrite plc

- 6.4.16 Avid Technology Inc.

- 6.4.17 Powersoft S.p.A

- 6.4.18 d&b audiotechnik GmbH

- 6.4.19 L-Acoustics Group

- 6.4.20 Meyer Sound Laboratories Inc.

- 6.4.21 Electro-Voice (Bosch Security Systems Inc.)

- 6.4.22 Crown International (Harman)

- 6.4.23 TASCAM (TEAC Corporation)

- 6.4.24 Rode Microphones (Free-fly Pty Ltd)

- 6.4.25 Zoom Corporation

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment