|

市場調查報告書

商品編碼

1910670

專業視聽系統:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Professional Audio Visual Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

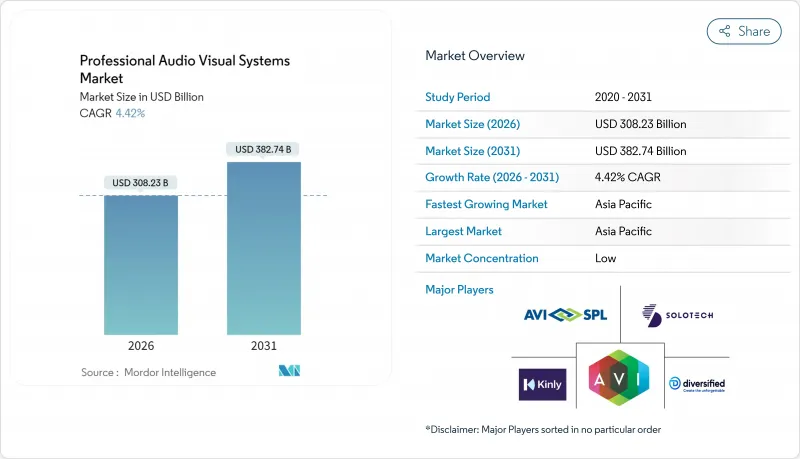

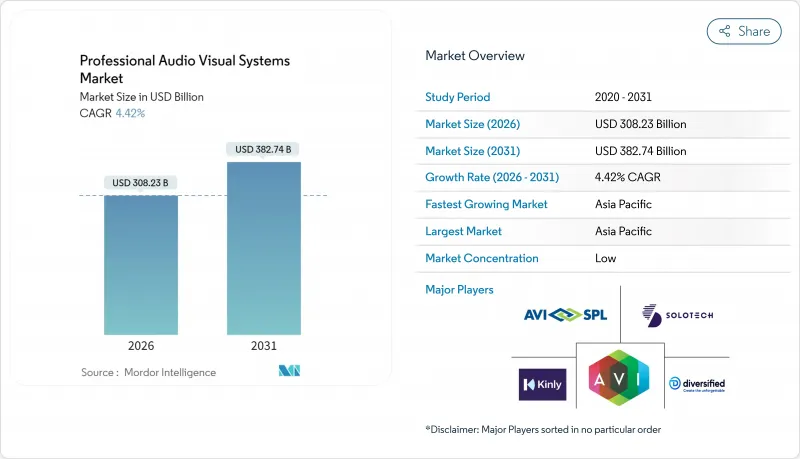

預計到 2025 年,專業視聽系統市場規模將達到 2,951.8 億美元,到 2031 年將達到 3,827.4 億美元,高於 2026 年的 3,082.3 億美元。

預計在預測期(2026-2031 年)內,複合年成長率將達到 4.42%。

對混合辦公的需求、對數位電子看板的投資以及影音處理向雲端和IP網路的遷移,都在支撐著市場需求的韌性。企業協作套件、大型LED顯示器和支援包容性會議的AI音訊設備正迎來消費成長動能。隨著以軟體為中心的新興參與企業憑藉訂閱模式和遠端設備管理挑戰傳統整合商,供應商之間的競爭日益激烈。半導體供應鏈的壓力仍構成阻力,但對無障礙性和能源效率的監管要求,正為符合合規要求的平台創造新的商機。

全球專業影音系統市場趨勢與洞察

混合式工作和學習模式迅速成長

企業支出已從升級孤立的會議室設備轉向建造企業級生態系統,旨在為現場和遠端員工提供公平的體驗。投資範圍涵蓋空間音訊陣列、多攝影機追蹤和自動內容取景等,這些技術均可與主流協作平台整合。教育產業對混合式教室支援解決方案的需求也在不斷成長,包括講座錄製、校園直播和設備管理。專業視聽系統市場受益於企業對可整合到現有IT策略中的認證、全託管解決方案的偏好。員工體驗基準測試正在推動快速的更新周期和多年採購藍圖的發展。因此,跨平台互通性和雲端儀表板正成為供應商之間關鍵的差異化因素。

在體驗式零售和公共設施中引入LED技術

零售連鎖店正將門市改造為身臨其境型媒體空間,利用高清LED顯示器即時傳遞品牌故事、指引方向並推廣產品。 Scheels公司斥資1,100萬美元在全美部署LED顯示螢幕,充分展現了其雄厚的資金實力和規模。公共場所和交通樞紐也部署了類似的顯示螢幕,用於客流管理和安全資訊發布。集中式內容管理系統使營運商能夠跨區域同步推廣宣傳活動,同時客製化本地語言和優惠資訊。如今,顯示硬體標配了可與零售商CRM工具整合的分析功能,從而推動了專業視聽系統市場的發展。儘管零售支出存在週期性波動,但客流量成長的預期仍支撐著LED顯示器的持續需求。

高成本結構和合遵循成本

無障礙存取、網路安全和能源法規的出現改變了採購決策。美國聯邦通訊委員會 (FCC) 的規定將於 2027 年 1 月生效,要求視訊會議平台必須具備隱藏式字幕、手語支援和無障礙使用者介面。同時,能源標準也迫使製造商重新設計機殼和電源,採用更有效率的組件。合規性要求增加了測試、認證和頻繁的軟體更新,使得複雜部署的生命週期成本翻倍。企業往往低估了持續培訓、監控和審核文件所需的工作量,導致預算超支,並限制了專業影音系統市場的短期訂單。

細分市場分析

在專業視聽系統市場,採集和製作設備將在2025年佔據30.25%的領先佔有率,凸顯了對高品質來源內容的重視。隨著企業和教育機構的工作室複製廣播工作流程,攝影系統、雲台控制器和製作切換台等產品正向價格更低的細分市場轉型。捆綁硬體、軟體和遠端支援的訂閱模式正在提升供應商的年度經常性收入。串流媒體儲存和分發領域預計將以5.33%的複合年成長率成長,這反映了市場對可擴展雲端編碼器和隨選節目庫的需求。邊緣快取技術降低了全球分散式用戶的觀看延遲,使媒體伺服器成為討論專業視聽系統市場規模的關鍵節點。

傳統視訊投影在禮堂和教堂等場所仍然十分重要,但在高亮度環境下,其市場佔有率正被直視式LED投影機蠶食。隨著客戶將生命週期管理外包,包括設計、監控和維修合約在內的服務需求日益成長。全像顯示器和空間運算等新興技術雖然仍處於小眾市場,但正吸引高階場所的創新預算。每個細分領域都代表著價值創造模式的轉變,即從孤立的硬體轉向能夠實現分析和內容工作流程貨幣化的整合生態系統。

區域分析

亞太地區以29.55%的市場佔有率和5.78%的複合年成長率保持最大佔有率,這主要得益於交通運輸、酒店和智慧城市領域的大型企劃。中國、印度和印尼的國家數位化政策正在推動校園網路和身臨其境型教室的建設。本地製造群正在縮短前置作業時間並降低成本,加速下一代LED和人工智慧處理技術的應用。日本和韓國透過在microLEDLED構裝和語音人工智慧領域的研發突破來提升產能,增強了出口競爭力。成熟的系統整合商正在組建合資企業,以克服區域採購和語言差異的挑戰,這項策略正在擴大專業視聽系統市場的版圖。

在無障礙法規和混合辦公模式興起的推動下,北美正在穩步升級其系統。美國聯邦通訊委員會(FCC)的字幕規則正在推動對人工智慧轉錄引擎和自適應用戶介面元素的需求。各公司正在重新評估其三到五年的更新周期,以彌合辦公室和遠距辦公環境之間的差距。加拿大幅員遼闊,透過對廣播工作室和遠端教育基礎設施的投資,正在為市場注入活力。墨西哥的加工出口區正在實施基於IP的音影片傳輸技術,以協調跨境供應鏈,這有助於該地區保持其在專業影音系統市場的關鍵地位。

在歐洲,要求降低能耗和循環經濟設計的永續性法規正在推動市場成長。德國和法國優先採用被動式冷卻機殼和可自動切換至低功耗模式的韌體。英國正加速在交通樞紐應用人工智慧分析技術,以管理客流密度。東歐國家正利用重建資金升級社區劇院和當地大學。泛歐資料隱私法規正在影響專業視聽系統市場的採購政策,並將安全的雲端控制視為供應商之間的競爭優勢。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 宏觀經濟因素的影響

- 市場促進因素

- 混合辦公和學習模式激增

- 體驗式零售與公共設施的LED裝置

- 疫情後現場及混合活動的復甦

- 向基於IP的音影片架構過渡

- 人工智慧驅動的即時無障礙解決方案

- 節能型影音設備的脫碳義務

- 市場限制

- 高昂的總擁有成本 (TCO) 和合規成本

- 半導體和顯示器供應鏈波動

- 連網音影音設備的網路保險保費

- 技術純熟勞工短缺和工資上漲

- 產業供應鏈分析

- 監管環境

- 技術展望

- 影響市場的宏觀經濟因素

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

第5章 市場規模與成長預測

- 按類型

- 拍攝和製作設備

- 視訊投影

- 串流媒體、儲存和傳輸

- 服務

- 其他類型

- 按組件

- 音訊設備(麥克風、混音器、擴大器)

- 顯示和投影系統

- 控制與處理

- 儲存和分發硬體

- 按最終用戶行業分類

- 對於企業

- 場地和活動

- 零售

- 媒體與娛樂

- 教育

- 政府

- 衛生保健

- 其他終端用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 歐洲

- 德國

- 英國

- 法國

- 其他歐洲

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 東南亞

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 其他中東地區

- 非洲

- 南非

- 埃及

- 其他非洲地區

- 中東

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- AVI-SPL Inc.

- Diversified

- AVI Systems Inc.

- Ford Audio-Video LLC

- CCS Presentation Systems Inc.

- Solutionz Inc.

- Electrosonic Group

- Solotech Inc.

- Conference Technologies Inc.

- Vistacom Inc.

- Kinly BV

- Vega Global

- IDNS Ltd.

- Ricoh USA Inc.

- Midwich Group plc

- Wesco Anixter Inc.

- Audinate Group Ltd.

- NMK Electronics Enterprises

- Qvest Group

- ACTLD SA

- Almo Professional A/V(Exertis Almo)

- ClearOne Inc.

- Kramer Electronics Ltd.

第7章 市場機會與未來展望

The professional audio visual system market was valued at USD 295.18 billion in 2025 and estimated to grow from USD 308.23 billion in 2026 to reach USD 382.74 billion by 2031, at a CAGR of 4.42% during the forecast period (2026-2031).

Hybrid work requirements, investment in digital signage, and the migration of AV processing to cloud and IP networks drive demand resilience. Spending momentum is visible in enterprise collaboration suites, large-format LED displays, and AI-enabled audio that supports inclusive meetings. Vendor competition is intensifying as software-centric newcomers challenge traditional integrators with subscription models and remote device management. Supply-chain pressures related to semiconductors remain a headwind, yet regulatory mandates on accessibility and energy efficiency are opening new revenue avenues for compliance-ready platforms.

Global Professional Audio Visual Systems Market Trends and Insights

Hybrid Work and Learning Surge

Corporate spending shifted from isolated conference-room upgrades to enterprise-wide ecosystems that deliver equitable experiences for on-site and remote staff. Investments span spatial audio arrays, multi-camera tracking, and automated content framing that integrate with leading collaboration platforms. Education is mirroring this demand with lecture capture, campus streaming, and device management that support blended classrooms. The professional audio visual system market benefits because enterprises prefer certified, fully managed solutions that plug into existing IT policies. Rapid refresh cycles are fueled by employee experience benchmarks, leading to multiyear procurement roadmaps. As a result, platform interoperability and cloud dashboards have emerged as critical vendor differentiators.

Experiential Retail and Public-Venue LED Rollouts

Retail chains are turning stores into immersive media venues where fine-pitch LEDs deliver branded storytelling, wayfinding, and real-time promotions. Scheels' USD 11 million national signage rollout underscores capital intensity and scale. Public buildings and transport hubs are installing similar displays to manage passenger flow and safety messaging. Central content management lets operators synchronize campaigns across regions while tailoring local language and offers. The professional audio visual system market is bolstered because display hardware now ships with embedded analytics that feed retailers' CRM tools. Rising foot-traffic expectations keep LED demand elevated despite cyclical retail spending.

High TCO and Compliance Costs

Accessibility, cybersecurity, and energy mandates have transformed procurement math. The FCC rules, effective January 2027, require captioning, sign-language support, and accessible user interfaces within video-conferencing platforms. Parallel energy standards push manufacturers to redesign enclosures and power supplies with higher-efficiency components. Compliance adds testing, certification, and frequent software updates, doubling lifecycle spending for complex deployments. Organizations underestimate ongoing training, monitoring, and audit documentation, leading to budget overruns that temper near-term orders in the professional audio visual system market.

Other drivers and restraints analyzed in the detailed report include:

- Live and Hybrid Events Rebound Post-Pandemic

- Migration to AV-over-IP Architectures

- Skilled-Labor Shortages and Wage Inflation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The professional audio visual system market recorded Capture and Production Equipment at a leading 30.25% share in 2025, underscoring the premium placed on high-quality source content. Camera systems, PTZ controllers, and production switchers move down-market as corporate and educational studios replicate broadcast workflows. Bundled subscription models that wrap hardware, software, and remote support increase annual recurring revenue for vendors. Streaming Media, Storage, and Distribution, the fastest-growing slice at a 5.33% CAGR, reflects demand for scalable cloud encoders and on-demand content libraries. Edge caching reduces latency for globally dispersed viewers, turning media servers into strategic nodes in the professional audio visual system market size discussions.

Traditional Video Projection retains relevance for auditoriums and houses of worship but yields share to direct-view LED in high-brightness settings. Services, including design, monitoring, and break-fix contracts, climb as customers outsource lifecycle management. Emerging types such as holographic displays and spatial computing remain niche yet capture innovation budgets for premium venues. Every sub-segment illustrates a shift where value creation migrates from isolated hardware to integrated ecosystems that monetize analytics and content workflows.

The Professional Audio Visual System Market Report is Segmented by Type (Capture and Production Equipment, Video Projection, and More), Component (Audio Equipment, Display and Projection Systems, Control and Processing, and More), End-User Vertical (Corporate, Venues and Events, Retail, and More), and Geography (North America, South America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific holds the largest 29.55% share and a leading 5.78% CAGR, propelled by mega-projects in transportation, hospitality, and smart cities. National digitization policies funnel funds into campus networks and immersive classrooms in China, India, and Indonesia. Local manufacturing clusters compress lead times and cost structures, allowing rapid adoption of next-generation LED and AI processing. Japan and South Korea supplement volume with research and development breakthroughs in micro-LED packaging and voice AI, enhancing export competitiveness. Mature integrators forge joint ventures to navigate regional procurement and language diversity, a tactic that expands the professional audio visual system market footprint.

North America posts steady upgrades anchored by accessibility mandates and hybrid work normalization. The FCC captioning rule multiplies demand for AI transcription engines and adaptive UI elements. Enterprises revisit refresh cycles every three to five years to maintain parity between in-office and remote experiences. Canada boosts market momentum through investments in broadcast studios and distance-learning infrastructure across dispersed territories. Mexico's maquiladora centers adopt AV-over-IP to coordinate cross-border supply chains, keeping the region integral to the professional audio visual system market.

Europe advances on the back of sustainability legislation requiring lower energy consumption and circular-economy design. Germany and France prioritize passive cooling enclosures and firmware that schedules low-power modes. The United Kingdom accelerates the adoption of AI analytics in transport hubs to manage passenger density. Eastern European countries allocate recovery funds to upgrade civic theatres and regional universities. Pan-European data-privacy laws elevate secure cloud control as a competitive edge among vendors, shaping procurement policies across the professional audio visual system market.

- AVI-SPL Inc.

- Diversified

- AVI Systems Inc.

- Ford Audio-Video LLC

- CCS Presentation Systems Inc.

- Solutionz Inc.

- Electrosonic Group

- Solotech Inc.

- Conference Technologies Inc.

- Vistacom Inc.

- Kinly BV

- Vega Global

- IDNS Ltd.

- Ricoh USA Inc.

- Midwich Group plc

- Wesco Anixter Inc.

- Audinate Group Ltd.

- NMK Electronics Enterprises

- Qvest Group

- ACTLD SA

- Almo Professional A/V (Exertis Almo)

- ClearOne Inc.

- Kramer Electronics Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Impact of Macroeconomic Factors

- 4.3 Market Drivers

- 4.3.1 Hybrid work and learning surge

- 4.3.2 Experiential retail and public-venue LED roll-outs

- 4.3.3 Live and hybrid events rebound post-pandemic

- 4.3.4 Migration to AV-over-IP architectures

- 4.3.5 AI-driven real-time accessibility solutions

- 4.3.6 Decarbonization mandates for energy-efficient AV

- 4.4 Market Restraints

- 4.4.1 High TCO and compliance costs

- 4.4.2 Semiconductor and display supply-chain volatility

- 4.4.3 Cyber-insurance premiums on networked AV

- 4.4.4 Skilled-labor shortages and wage inflation

- 4.5 Industry Supply Chain Analysis

- 4.6 Regulatory Landscape

- 4.7 Technological Outlook

- 4.8 Impact of Macroeconomic Factors on the Market

- 4.9 Porter's Five Forces Analysis

- 4.9.1 Bargaining Power of Suppliers

- 4.9.2 Bargaining Power of Consumers

- 4.9.3 Threat of New Entrants

- 4.9.4 Intensity of Competitive Rivalry

- 4.9.5 Threat of Substitute Products

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Capture and Production Equipment

- 5.1.2 Video Projection

- 5.1.3 Streaming Media, Storage and Distribution

- 5.1.4 Services

- 5.1.5 Other Types

- 5.2 By Component

- 5.2.1 Audio Equipment (mics, mixers, amps)

- 5.2.2 Display and Projection Systems

- 5.2.3 Control and Processing

- 5.2.4 Storage and Distribution Hardware

- 5.3 By End-user Vertical

- 5.3.1 Corporate

- 5.3.2 Venues and Events

- 5.3.3 Retail

- 5.3.4 Media and Entertainment

- 5.3.5 Education

- 5.3.6 Government

- 5.3.7 Healthcare

- 5.3.8 Other End-user Verticals

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 Japan

- 5.4.4.3 India

- 5.4.4.4 South Korea

- 5.4.4.5 South-East Asia

- 5.4.4.6 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 Middle East

- 5.4.5.1.1 Saudi Arabia

- 5.4.5.1.2 United Arab Emirates

- 5.4.5.1.3 Rest of Middle East

- 5.4.5.2 Africa

- 5.4.5.2.1 South Africa

- 5.4.5.2.2 Egypt

- 5.4.5.2.3 Rest of Africa

- 5.4.5.1 Middle East

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 AVI-SPL Inc.

- 6.4.2 Diversified

- 6.4.3 AVI Systems Inc.

- 6.4.4 Ford Audio-Video LLC

- 6.4.5 CCS Presentation Systems Inc.

- 6.4.6 Solutionz Inc.

- 6.4.7 Electrosonic Group

- 6.4.8 Solotech Inc.

- 6.4.9 Conference Technologies Inc.

- 6.4.10 Vistacom Inc.

- 6.4.11 Kinly BV

- 6.4.12 Vega Global

- 6.4.13 IDNS Ltd.

- 6.4.14 Ricoh USA Inc.

- 6.4.15 Midwich Group plc

- 6.4.16 Wesco Anixter Inc.

- 6.4.17 Audinate Group Ltd.

- 6.4.18 NMK Electronics Enterprises

- 6.4.19 Qvest Group

- 6.4.20 ACTLD SA

- 6.4.21 Almo Professional A/V (Exertis Almo)

- 6.4.22 ClearOne Inc.

- 6.4.23 Kramer Electronics Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment