|

市場調查報告書

商品編碼

1911377

視訊車載資訊服務:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Video Telematics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

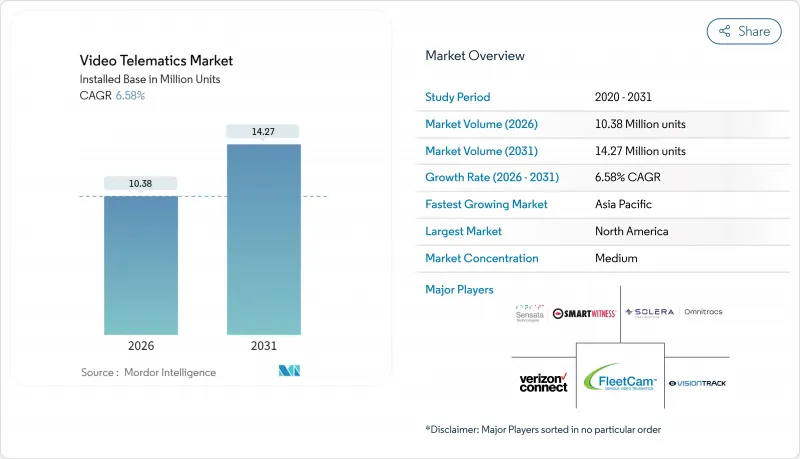

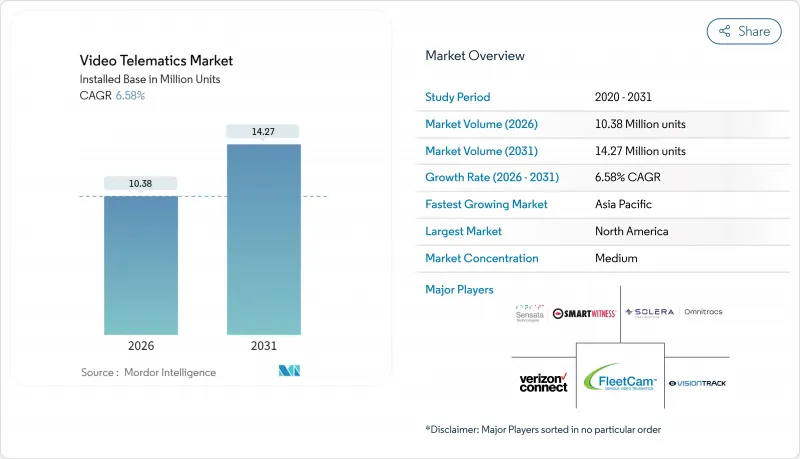

視訊遠端資訊處理市場預計將從 2025 年的 974 萬美元成長到 2026 年的 1,038 萬美元,預計到 2031 年將達到 1,427 萬美元,2026 年至 2031 年的複合年成長率為 6.58%。

歐洲對高級駕駛輔助系統 (ADAS) 和駕駛員監控系統的強制法規、人工智慧硬體成本的下降以及保險公司不斷增加的獎勵,正在加速商用車隊採用這些系統。北美市場的成長仍然主要由保險業主導,保險公司將保費折扣與影片檢驗的駕駛行為掛鉤;而亞洲市場的需求則得益於快速的電氣化和智慧城市建設。整合 GPS、診斷和人工智慧影像的平台正在取代分散的系統,成為主流。這種整合趨勢正在推動從一次性硬體銷售轉變為與雲端分析相關的訂閱收入模式。 Powerfleet 收購 Fleet Complete 等策略性收購表明,將影像、數據和車隊管理整合到單一平台上的競爭日益激烈。

全球視訊遠端資訊處理市場趨勢與洞察

駕駛員監控和ADAS數據記錄的監管要求

歐盟於2024年7月實施了GSR2法規,強制要求在新車認證中納入智慧速度輔助系統、自動緊急煞車系統和駕駛疲勞偵測功能。聯合國歐洲經濟委員會(UNECE)發布的類似框架正在推動亞洲和美洲的監管協調。保險公司現在要求提供影像檢驗的ADAS資料以進行責任認定,這使得行車記錄器從可選工具轉變為強制性合規設備。持續發出駕駛分心警報的需求正促使車隊採用與遠端資訊處理儀錶板整合的多攝影機系統。隨著區域部署的擴展,提供現成合規軟體套件的供應商正在獲得先發優勢。這種連鎖反應也延伸到售後改裝領域,因為混合車齡的車隊必須對老舊車輛進行改裝,以滿足與托運人和物流仲介的合約條款。

擴大整合影像解決方案在車隊遠端資訊處理的應用

過去,車隊管理人員需要透過單獨的合約來協調位置追蹤、維護計劃和影像安全管理。如今,整合式影像遠端資訊處理平台只需一份訂閱即可提供這些功能,將速度、位置和影像證據關聯起來,從而簡化工作流程並減少誤報。 GPS 資料檢驗緊急制動,攝影機可以識別駕駛員分心的情況,從而提高駕駛員的接受度並提供即時安全指導。預測性維護也從中受益,因為 AI影像可以偵測加速車輛磨損的駕駛行為,並結合感測器診斷。 OEM 嵌入式遠端資訊處理系統(預計 2023 年售出的新車中有 75% 將成為標配)將進一步推動系統整合,因為支援攝影機的線束簡化了安裝。雲端部署正逐漸成為主流,無需本地伺服器即可為混合車隊提供可擴展的分析。

隱私和資料保護合規障礙

GDPR法規要求獲得明確同意、建立刪除權工作流程以及對生物識別資料進行安全匿名化,這迫使車隊營運商實施複雜的資料管治結構。跨境營運進一步增加了儲存的複雜性,並提高了基礎設施成本,因為某些司法管轄區限制了承包位置。隱私義務可能與建議持續記錄的安全法規相衝突,而地理圍欄遮蔽和即時人臉模糊處理會增加處理開銷。能夠提供一站式合規工具包的供應商價格較高,而小規模的供應商則難以獲得必要的開發資金。跨多個地區的持續監管審查導致合規目標不斷變化,需要持續的軟體更新和法律諮詢。

細分市場分析

2025年,整合系統將佔據視訊遠端資訊處理市場57.10%的佔有率,年複合成長率達7.89%,這主要得益於安全、維護和路線管理平台整合度的持續提高。將遠端資訊處理資料與影像證據結合,能夠提高偵測精度,增強導航效果,並減少警報疲勞。 OEM夥伴關係透過工廠預載帶攝影機的線束,加速了整合系統的普及,減少了後期改裝工作。同時,對於成本受限、需要基本錄影功能但缺乏全面整合遠端資訊處理系統的營運商而言,獨立攝影機仍然是可行的選擇。

普及勢頭推動了訂閱經濟模式的轉變,這種模式與軟體附加功能而非硬體利潤率掛鉤。嵌入式連線支援空中下載 (OTA) 更新,無需更換裝置即可解鎖新的分析功能。因此,整合用戶的終身價值超過了單次攝影機銷售的價值,這促使供應商將服務捆綁銷售。併購活動也促使遠端資訊處理公司收購專注影像的公司,以彌補自身能力缺口並確保持續收入。

根據訴訟辯護和保險折扣帶來的既定投資回報率 (ROI),到 2025 年,重型卡車將佔據視訊遠端資訊處理市場 35.92% 的佔有率。監管機構強制要求為駕駛員遵守駕駛時間規定 (HOS) 而安裝整合式電子記錄設備 (ELD) 的鏡頭,這正在鞏固其在長途運輸車隊中的應用。隨著城市推行以乘客安全為優先的「零願景」目標,公車產業也穩步採用該技術。輕型商用車行業預計將實現溫和成長,因為電子商務配送公司正在採用影像引導來減少擁擠城市道路上的輕微碰撞事故。

乘用車市場將以7.29%的複合年成長率實現最快成長,這主要得益於租賃公司將車輛損壞免賠額與即時駕駛員行為監控掛鉤。基於使用量的保險試點計畫正在引入攝影機進行遙測檢驗和詐欺防範,以提高消費者接受度。儘管價格敏感,但智慧型手機連接的攝影機適配器降低了准入門檻,使個人保險投保人無需永久安裝即可體驗視訊功能。隨著整合硬體優勢的顯現,這將為未來進一步提升銷售整合硬體鋪平道路。

區域分析

北美在2025年仍維持38.30%的市場佔有率,這主要得益於成熟的遠距資訊處理環境和保險公司的積極參與。保險公司鼓勵小規模貨運公司採用攝影機,並將安全駕駛表現與保費降低掛鉤。更清晰的數據使用法規正在簡化攝影機的普及過程,而5G網路在高流量路段的部署則實現了即時影片傳輸和近乎瞬時的理賠處理。競爭壓力正從車隊規模轉向進階分析,機器學習能夠辨識事故發生前的預測性風險模式。

自GSR2實施以來,歐洲的普及速度加快,因為合規期限迫使車隊管理公司安裝駕駛員監控設備。同時,嚴格的GDPR法規強化了健全隱私保護的重要性,從而催生了對提供平台內匿名化和安全資料管道的營運商的需求。整合解決方案的成功源自於營運商對既滿足安全法規要求又能最佳化營運的單一控制面板的渴望。對清潔運輸走廊投資的不斷成長,也使得人們更加關注用於檢驗綠色貨運認證中環保駕駛性能的技術。

亞太地區將以7.38%的複合年成長率(CAGR)實現最快成長,直至2031年,這主要得益於大規模的電氣化獎勵和雄心勃勃的智慧城市計劃。中國的電動物流車隊需要對電池狀態、充電模式和駕駛行為進行全面監控,從而推動了對電動車特性量身打造的影像分析技術的需求。印度強制要求校車和公共交通車輛進行位置追蹤,也同樣擴大了潛在市場。區域供應鏈生產的低成本硬體進一步降低了進入門檻,使中小企業能夠擺脫傳統設施的限制,直接邁向雲端分析時代。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 車隊遠端資訊處理整合影像解決方案的普及應用日益廣泛

- 駕駛員監控和ADAS數據記錄的監管要求

- 降低攝影機/邊緣人工智慧成本

- 商用車輛安全合規性日益受到重視

- 從按使用量計費的保險過渡到影像檢驗理賠

- 道路圖像資料貨幣化與智慧城市合作

- 市場限制

- 隱私和資料保護合規障礙

- 中小企業車隊面臨高昂的硬體和安裝成本

- 高清和 4K 串流媒體的頻寬和儲存負載

- 視訊分析互通性缺乏開放標準

- 產業價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 投資分析

第5章 市場規模及成長預測(單位)

- 按類型

- 整合系統

- 獨立系統

- 按車輛類型

- 大型卡車

- 公車和長途客車

- 輕型商用車(LCV)

- 搭乘用車

- 按部署模式

- 基於雲端的

- 本地部署/混合部署

- 按組件

- 硬體(相機、DVR/NVR、感測器)

- 軟體和分析

- 服務(安裝、訂閱、支援)

- 按地區

- 北美洲

- 南美洲

- 歐洲

- 亞太地區

- 中東和非洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 供應商市場佔有率和定位

- Global Vendor Share

- North America Vendor Ranking

- Europe Vendor Ranking

- 公司簡介

- SmartWitness(Sensata Technologies)

- Verizon Connect(Verizon Communications Inc.)

- Omnitracs(Solera Holdings Inc.)

- FleetCam(Pty)Ltd

- VisionTrack Ltd

- Lytx Inc.

- Nauto Inc.

- SureCam(Europe)Limited

- LightMetrics Inc.

- NetraDyne Inc.

- Geotab Inc.

- ATandT Inc.

- Fleet Complete Inc.

- Samsara Inc.

- Octo Group SpA

- Motive Technologies Inc.

- One Step GPS LLC

- MiX Telematics Ltd

- Trimble Transportation(Trimble Inc.)

- Streamax Technology Co. Ltd

- Howen Technologies Co. Ltd

- Micronet Ltd

- PFK Electronics(Pty)Ltd

- Blackvue(Pittasoft Co. Ltd)

- Garmin Ltd

- Zonar Systems Inc.

- Azuga Holdings Inc.

第7章 市場機會與未來展望

The video telematics market is expected to grow from USD 9.74 million in 2025 to USD 10.38 million in 2026 and is forecast to reach USD 14.27 million by 2031 at 6.58% CAGR over 2026-2031.

Mandated ADAS and driver-monitoring regulations in Europe, falling edge-AI hardware costs, and rising insurance incentives are accelerating adoption across commercial fleets. North American growth remains insurance-driven as carriers link premium discounts to video-verified driving behavior, while Asian demand rides on rapid electrification and smart-city programs. Integrated platforms that merge GPS, diagnostics, and AI video move to the forefront as fleets replace disparate systems, and the same convergence fuels a shift from one-time hardware sales toward subscription revenues tied to cloud analytics. Strategic acquisitions such as Powerfleet's purchase of Fleet Complete underscore the competitive race to bundle video, data, and fleet management within a single stack.

Global Video Telematics Market Trends and Insights

Regulatory mandates for driver-monitoring and ADAS data logging

The European Union enforced GSR2 in July 2024, requiring intelligent speed assist, autonomous emergency braking, and driver drowsiness detection in new vehicle approvals. Similar frameworks issued by the UN Economic Commission for Europe are prompting alignment in Asia and the Americas. Insurers now demand video-verified ADAS data to confirm liability, converting dashcams from discretionary tools into compliance necessities. The requirement for continuous driver-distraction warnings pushes fleets toward multi-camera installations that integrate with telematics dashboards. As regional rollouts widen, vendors that deliver off-the-shelf compliance packages gain a first-mover advantage. The cascading effect extends to aftermarket retrofits because mixed-age fleets must retrofit older vehicles to meet contract terms with shippers and logistics brokers.

Increasing adoption of fleet telematics-integrated video solutions

Fleet managers once balanced separate contracts for location tracking, maintenance scheduling, and video safety. Integrated video telematics platforms now bundle these functions under a single subscription, streamlining workflows and reducing false alerts by correlating speed, location, and video evidence. When GPS data validates harsh-brake events and cameras confirm distraction, driver acceptance rates improve and safety coaching becomes real time. Predictive maintenance also benefits, as AI video detects driver behavior that accelerates vehicle wear and combines it with sensor diagnostics. OEM-embedded telematics, standard on 75% of new cars sold in 2023, further propels system integration because camera-ready wiring harnesses simplify installation. Cloud deployment dominates, letting mixed fleets scale analytics without on-premise servers.

Privacy and data-protection compliance hurdles

GDPR rules require explicit consent for biometric data, right-to-erasure workflows, and secure anonymization, forcing fleets to deploy complex data-governance architectures. Cross-border operations further complicate storage because certain jurisdictions restrict cloud locations, raising infrastructure costs. Privacy obligations can clash with safety mandates that favor always-on recording, leading to geofenced masking and real-time face blurring that add processing overhead. Vendors able to deliver turnkey compliance toolkits gain a pricing premium, while smaller providers struggle to fund the necessary development. Ongoing legislative reviews in multiple regions keep compliance targets moving, prompting continuous software updates and legal consultations.

Other drivers and restraints analyzed in the detailed report include:

- Falling camera and edge-AI costs

- Growing safety-compliance focus among commercial fleets

- High hardware and installation costs for SMB fleets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Integrated systems controlled 57.10% of the video telematics market in 2025 and are expanding at an 7.89% CAGR as fleets consolidate platforms for safety, maintenance, and routing. The coupling of telematics data with video evidence increases detection accuracy, improving coaching while reducing alert fatigue. OEM partnerships accelerate uptake by factory-installing camera-ready harnesses that cut retrofitting labor. In contrast, standalone cameras persist among cost-constrained operators that need basic recording but lack resources for full telematics integration.

Deployment momentum favors subscription economics tied to software add-ons rather than hardware margins. Embedded connectivity supports over-the-air updates that unlock new analytics without swapping devices. As a result, the lifetime value of an integrated subscriber outpaces a one-off camera sale, motivating vendors to bundle services. M&A activity shows telematics firms buying vision specialists to close capability gaps and secure recurring revenues.

Heavy trucks captured 35.92% of the video telematics market share in 2025, anchored by well-established ROI through litigation defense and premium discounts. Regulatory bodies mandate ELD-integrated cameras for hours-of-service compliance, cementing penetration in long-haul fleets. Buses maintain steady uptake as municipalities adopt Vision Zero targets that prioritize passenger safety. Light commercial vehicles experience moderate growth as e-commerce couriers adopt video coaching to reduce fender-benders in dense urban routes.

Passenger cars post the steepest rise at a 7.29% CAGR, propelled by rental and leasing companies that tie damage-waiver fees to real-time driver behavior monitoring. Usage-based insurance pilots embed cameras to validate telemetry and curb fraud, broadening consumer exposure. Despite price sensitivity, smartphone-linked camera dongles lower barriers, allowing personal-line policyholders to trial video without permanent installations, priming a future upsell path to integrated hardware as benefits become evident.

The Video Telematics Market Report is Segmented by Type (Integrated Systems, and Stand-Alone Systems), Vehicle Type (Heavy Trucks, Buses and Coaches, Light Commercial Vehicles, and Passenger Cars), Deployment Model (Cloud-Based, and On-premises/Hybrid), Component (Hardware [Cameras, and More}, Software and Analytics, and Services [Installation, and More]), and Geography. The Market Forecasts are Provided in Terms of Value (Units).

Geography Analysis

North America retained 38.30% share in 2025 on the back of mature telematics ecosystems and strong insurer engagement. Carriers link premium savings to documented safe driving, encouraging even small haulers to add cameras. Regulatory clarity on data usage streamlines rollouts, and 5G coverage in high-traffic corridors allows real-time video transfer for near-instant claims processing. Competitive pressure now pivots away from installation counts toward advanced analytics, where machine learning identifies predictive risk patterns before incidents occur.

Europe shows brisk uptake following GSR2, as compliance deadlines leave fleets little choice but to install driver-monitoring hardware. The strict GDPR regime simultaneously elevates the importance of robust privacy safeguards, rewarding providers with in-platform anonymization and secure data pipelines. Integrated solutions prosper because operators prefer single dashboards that satisfy both safety mandates and business optimization imperatives. Increasing investment in clean transport corridors places further emphasis on technology that validates eco-driving credentials for green freight certification.

Asia Pacific posts the fastest growth at 7.38% CAGR to 2031, fueled by large-scale electrification incentives and ambitious smart-city programs. China's electric logistics fleets require combined monitoring of battery health, charging patterns, and driver behavior, generating incremental demand for video analytics tailored to EV dynamics. India's mandate for vehicle location tracking on school buses and public transport similarly broadens addressable volumes. Cost-efficient hardware produced in regional supply chains further lowers barriers, enabling smaller operators to leapfrog to cloud analytics without legacy equipment constraints.

- SmartWitness (Sensata Technologies)

- Verizon Connect (Verizon Communications Inc.)

- Omnitracs (Solera Holdings Inc.)

- FleetCam (Pty) Ltd

- VisionTrack Ltd

- Lytx Inc.

- Nauto Inc.

- SureCam (Europe) Limited

- LightMetrics Inc.

- NetraDyne Inc.

- Geotab Inc.

- ATandT Inc.

- Fleet Complete Inc.

- Samsara Inc.

- Octo Group SpA

- Motive Technologies Inc.

- One Step GPS LLC

- MiX Telematics Ltd

- Trimble Transportation (Trimble Inc.)

- Streamax Technology Co. Ltd

- Howen Technologies Co. Ltd

- Micronet Ltd

- PFK Electronics (Pty) Ltd

- Blackvue (Pittasoft Co. Ltd)

- Garmin Ltd

- Zonar Systems Inc.

- Azuga Holdings Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing adoption of fleet telematics-integrated video solutions

- 4.2.2 Regulatory mandates for driver-monitoring and ADAS data logging

- 4.2.3 Falling camera/edge-AI costs

- 4.2.4 Growing safety-compliance focus among commercial fleets

- 4.2.5 Usage-based-insurance shift to video-verified claims

- 4.2.6 Road-image data monetisation and smart-city partnerships

- 4.3 Market Restraints

- 4.3.1 Privacy and data-protection compliance hurdles

- 4.3.2 High hardware and installation costs for SMB fleets

- 4.3.3 Bandwidth / storage burdens for HD and 4K streaming

- 4.3.4 Lack of open standards for video-analytics interoperability

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Degree of Competition

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (UNITS)

- 5.1 By Type

- 5.1.1 Integrated Systems

- 5.1.2 Stand-alone Systems

- 5.2 By Vehicle Type

- 5.2.1 Heavy Trucks

- 5.2.2 Buses and Coaches

- 5.2.3 Light Commercial Vehicles (LCV)

- 5.2.4 Passenger Cars

- 5.3 By Deployment Model

- 5.3.1 Cloud-based

- 5.3.2 On-premises / Hybrid

- 5.4 By Component

- 5.4.1 Hardware (Cameras, DVR/NVR, Sensors)

- 5.4.2 Software and Analytics

- 5.4.3 Services (Installation, Subscription, Support)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.2 South America

- 5.5.3 Europe

- 5.5.4 Asia Pacific

- 5.5.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Vendor Market Share and Positioning

- 6.4.1 Global Vendor Share

- 6.4.2 North America Vendor Ranking

- 6.4.3 Europe Vendor Ranking

- 6.5 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.5.1 SmartWitness (Sensata Technologies)

- 6.5.2 Verizon Connect (Verizon Communications Inc.)

- 6.5.3 Omnitracs (Solera Holdings Inc.)

- 6.5.4 FleetCam (Pty) Ltd

- 6.5.5 VisionTrack Ltd

- 6.5.6 Lytx Inc.

- 6.5.7 Nauto Inc.

- 6.5.8 SureCam (Europe) Limited

- 6.5.9 LightMetrics Inc.

- 6.5.10 NetraDyne Inc.

- 6.5.11 Geotab Inc.

- 6.5.12 ATandT Inc.

- 6.5.13 Fleet Complete Inc.

- 6.5.14 Samsara Inc.

- 6.5.15 Octo Group SpA

- 6.5.16 Motive Technologies Inc.

- 6.5.17 One Step GPS LLC

- 6.5.18 MiX Telematics Ltd

- 6.5.19 Trimble Transportation (Trimble Inc.)

- 6.5.20 Streamax Technology Co. Ltd

- 6.5.21 Howen Technologies Co. Ltd

- 6.5.22 Micronet Ltd

- 6.5.23 PFK Electronics (Pty) Ltd

- 6.5.24 Blackvue (Pittasoft Co. Ltd)

- 6.5.25 Garmin Ltd

- 6.5.26 Zonar Systems Inc.

- 6.5.27 Azuga Holdings Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment