|

市場調查報告書

商品編碼

1911301

數位紡織印花:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Digital Textile Printing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

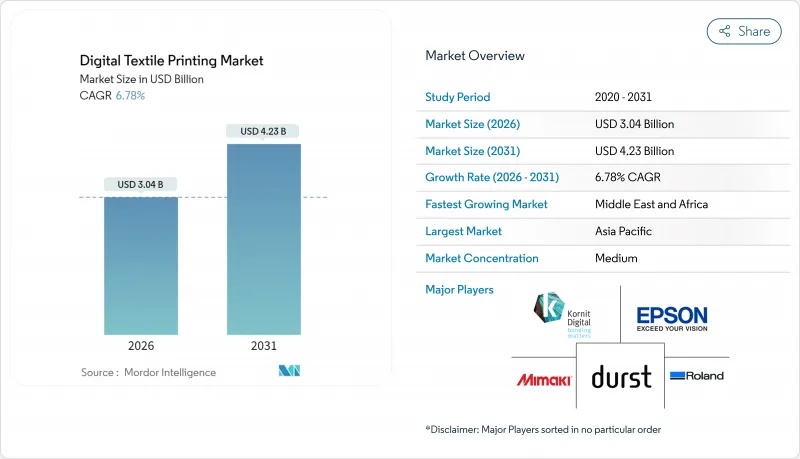

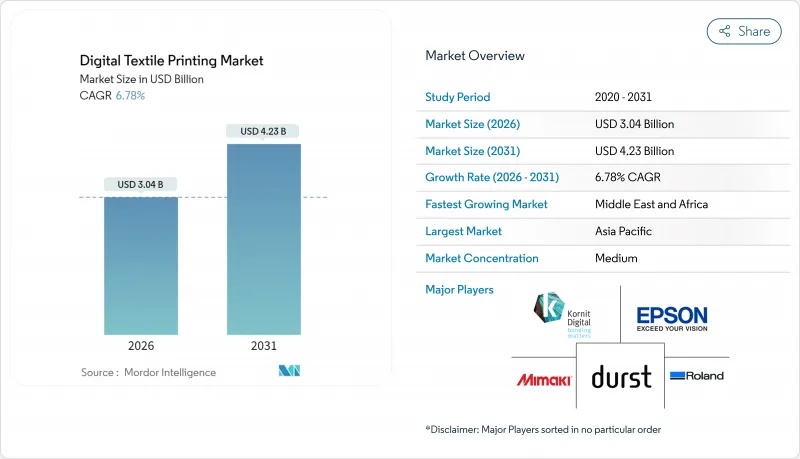

預計到 2026 年,數位紡織品印花市場規模將達到 30.4 億美元,高於 2025 年的 28.5 億美元。

預計到 2031 年將達到 42.3 億美元,2026 年至 2031 年的複合年成長率為 6.78%。

電子商務通路的拓展、監管部門要求減少表面處理工程用水的壓力,以及單一途徑噴墨技術的快速發展,共同推動了持續成長的需求曲線,其增速超過了傳統的模擬印刷。品牌商正將微量庫存與按需生產相結合,以降低庫存風險。同時,歐盟和加州的合規要求正在加速向低水顏料解決方案的轉型。亞太地區憑藉著成熟的供應鏈和具競爭力的投入成本主導生產,而中東和非洲地區則正經歷最快的普及速度,因為各國政府正在逐步擺脫對碳氫化合物的依賴,並投資於出口導向製造業。在競爭方面,硬體專家正將專有墨水、工作流程軟體和服務協議相結合,以確保持續的收入並提高客戶留存率。

全球數位紡織印花市場趨勢與洞察

個性化主導的微型收藏正在蓬勃發展

目前,各大品牌正在試行每週發布新品的膠囊系列,取消最低訂購量限制,並在訂製服裝領域實現高利潤率。 Kornit Digital 的 Apollo 平台使 T-Formation 等公司能夠提供當日設計發布服務,以滿足不斷變化的消費者偏好。按需印刷服務商正在整合資源,以應對客製化服飾市場的激增,例如 Printful 和 Printify 於 2024 年合併。庫存風險降低、高階價格分佈以及設計到上市週期大幅縮短,共同提升了數位紡織印刷市場的生產力。這一趨勢也有助於實現循環經濟目標,減少庫存積壓和相關廢棄物。因此,設計到上市工作流程的需求仍然是下一階段市場擴張的核心驅動力。

單一途徑列印生產力飛躍

單一途徑印表機一次即可完成整個影像的列印,速度比傳統的多程系統快 10 到 20 倍。Delta集團第三台 EFI Nozomi 14000 SD 的安裝案例表明,各大品牌正在用單程印表機取代類比生產線,並縮短顯示圖形的前置作業時間。 Mimaki 的 Tiger 600-1800TS(將於 2025 年 2 月在中東和非洲地區上市)在熱昇華轉印方面也實現了類似的吞吐量提升。機器學習校準確保了工業規模下的色彩穩定性。單一途徑技術的廣泛應用,在降低平方公尺成本和縮短列印週期的同時,擴大了數位紡織印花市場的潛在基本客群,尤其是在那些每週或每日更新產品是常態的行業。

工業系統的高資本投入

入門級單一途徑線價格昂貴,售價在50萬至200萬美元之間,價格分佈許多中小企業望而卻步。在資本市場低度開發的地區,資金籌措障礙更為嚴峻,導致投資回收期更長,設備更新週期更慢。 OEM租賃方案和印刷即服務協議有助於分攤成本,但耗材仍是一筆不小的負擔(可能佔營運成本的40%至60%)。因此,在訂單成本降低和訂單到收款週期縮短能夠抵消資金壁壘之前,數位紡織印刷市場的發展仍將不均衡。

細分市場分析

到2025年,卷對卷印刷將佔據數位紡織品印刷市場64.92%的佔有率,這主要得益於其在服裝、軟指示牌和家用紡織品領域的適用性。列印頭和在線連續夾具技術的不斷改進,使其每平方公尺成本保持競爭力,從而確保了其在大批量訂單中的永續優勢。同時,單一途徑線平台正以10.22%的複合年成長率快速成長,即使是小批量生產也能提供工業級的生產效率,使品牌能夠在一條生產線上完成樣品製作和批量生產。結合模擬底塗和數位面塗的混合配置,使加工商能夠最大限度地延長運作,並根據圖案的複雜程度靈活選擇網版印刷或噴墨印刷。

透過採用直噴服裝印刷技術(即加工商共用單次走紙頭),數位紡織印花市場受益於設備冗餘和庫存的減少。 EFI、Mimaki 和 Kornit Digital 等公司正在將色彩管理、維護分析和工作流程自動化整合到各自的生態系統中,從而降低轉換成本。對於那些正在淘汰舊式網版的企業而言,模組化改裝提供了一條遷移路徑,既能降低資本投資風險,又不會延緩數位轉型。

到2025年,分散型油墨將佔據數位紡織品印花市場41.88%的佔有率,其在聚酯基材上的主導地位將鞏固其市場地位。同時,熱昇華油墨預計將以9.12%的複合年成長率成為成長最快的油墨,這得益於其能夠以最少的後處理流程附著在織物上,尤其適用於那些對色彩鮮豔持久性有較高要求的應用,例如運動服、宣傳旗幟和背光顯示螢幕。隨著無水工藝和一步式後整理技術滿足日益嚴格的環保法規,顏料型油墨套裝也越來越受歡迎。 OEM廠商採用杜邦Artistri® PN1000系列等油墨,標誌著業界正從活性染料轉向更環保、適用於多種基材的油墨。

在棉織物占主導地位的地區,活性油墨佔據主導地位,因為深層色彩滲透和耐洗牢度至關重要;而酸性油墨則非常適合絲綢和羊毛,從而支撐起高階市場。油墨創新主要集中在降低固化溫度和延長噴嘴開放時間上,這些因素直接影響數位紡織印花市場的運作效益。

區域分析

到2025年,亞太地區將佔全球出貨量的42.10%,這主要得益於中國779億美元的紗線和布料出口額,以及印度積極的政策支持,包括七個總理紡織工業園區(PM MITRA parks),並提供22億美元的激勵措施。儘管能源和環境法規日益嚴格,但低廉的工資水平、密集的供應商叢集和完善的港口網路,使得該地區的泊位成本保持競爭力。區域OEM夥伴關係正在將單一途徑列印設備引入垂直整合的工廠,降低了小眾品牌進入數位紡織印花市場的門檻。

預計到2031年,中東和非洲地區將以10.75%的複合年成長率實現最高成長,這主要得益於各國政府的多元化措施。阿拉伯聯合大公國和沙烏地阿拉伯正充分利用自由貿易區的優惠政策,而埃及(最低月薪為103美元)則與土耳其生產商合作,擴大對美國的供應。摩洛哥和衣索比亞的工業園區等基礎設施計劃正在吸引外國直接投資,使該地區成為亞洲採購之外一個靈活且免稅的選擇。

在歐洲,基於環境、社會和管治標準(ESPR)的環境相容性備受重視,工廠擴大採用節水顏料製程並添加再生纖維。品牌商正採取策略,將微膠囊生產集中在附近地區,以縮短交貨時間,這符合成熟消費者群體對透明度和永續性的需求。自2020年以來,北美地區的製造業回流復甦以每年2.8%的速度成長,例如Chaumot Infinite等公司投資800萬美元,用於改造從針織到後整理的一體化生產線。南美地區的成長保持穩定,但受到物流挑戰和宏觀經濟波動的限制,儘管擁有原料採購優勢,但在數位紡織印花市場佔有率的擴張能力仍然有限。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 個性化主導的微型收藏蓬勃發展

- 單一途徑列印,生產力突飛猛進

- 電子商務中的按需印刷履約

- 遵守節水法規的義務

- 近岸外包協助打造更具韌性的供應鏈

- 服裝用永續顏料的進展

- 市場限制

- 工業系統的高資本投入

- 油墨與織物相容性挑戰

- 顏色牢度品質保證方面的瓶頸

- PFAS相關顏料的監管風險

- 供應鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 宏觀經濟影響分析

第5章 市場規模與成長預測

- 透過印刷方法

- 卷對卷印刷

- 直接成衣印花(DTG)

- 單一途徑線

- 混合式(類比+數位)

- 其他印刷方法

- 按墨水類型

- 昇華

- 顏料

- 反應性

- 酸

- 分散式

- 透過使用

- 服飾和服飾

- 家用紡織品

- 技術紡織品

- 展示品和標誌

- 按平台

- 棉布

- 聚酯纖維

- 絲綢

- 尼龍

- 混合

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 義大利

- 英國

- 法國

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲和紐西蘭

- 亞太其他地區

- 中東和非洲

- 中東

- 土耳其

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 其他中東地區

- 非洲

- 南非

- 埃及

- 其他非洲地區

- 中東

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Kornit Digital

- Seiko Epson Corporation

- Mimaki Engineering

- Durst Group

- Electronics For Imaging

- D.Gen Inc.

- Aeoon Technologies

- Roland DG

- Ricoh Company

- ColorJet

- ATP Color

- SPGPrints

- HP Inc.

- Brother International

- Mutoh Industries

- MS Printing Solutions

- Kyocera Corp.

- FujiFilm Dimatix

- ROQ International

- Shenzhen Homer

第7章 市場機會與未來展望

Digital textile printing market size in 2026 is estimated at USD 3.04 billion, growing from 2025 value of USD 2.85 billion with 2031 projections showing USD 4.23 billion, growing at 6.78% CAGR over 2026-2031.

Expanding e-commerce channels, regulatory pressure to reduce water use in finishing operations, and rapid progress in single-pass inkjet technology together create a durable demand curve that outperforms legacy analog printing. Brands now blend micro-collections with on-demand manufacturing to cut inventory risk, while compliance mandates in the European Union and California accelerate the shift toward low-water pigment solutions. Asia-Pacific dominates production because of established supply chains and competitive input costs, yet Middle East and Africa records the fastest adoption as governments diversify away from hydrocarbons and invest in export-oriented manufacturing. On the competitive front, hardware specialists combine proprietary inks, workflow software, and service contracts to lock in recurring revenue and deepen client stickiness.

Global Digital Textile Printing Market Trends and Insights

Personalisation-led micro-collections boom

Labels now pilot capsule lines in weekly drops, eliminating minimum order quantities and monetising higher margins on customised apparel. Kornit Digital's Apollo platform enables companies such as T-Formation to release same-day designs that meet shifting consumer tastes. Print-on-demand players consolidate capacity-as seen in the 2024 Printful/Printify merger-to serve this surge in bespoke garments. Lower inventory risk, premium price points, and dramatically shorter design-to-shelf cycles collectively lift throughput across the digital textile printing market. The trend also supports circular economy objectives by reducing surplus stock and related waste. Demand for design-to-garment workflows therefore remains a central accelerator for the next phase of market expansion.

Single-pass inkjet productivity leap

Single-pass printers lay down an entire image in one motion, reaching speeds 10-20 times faster than classic multi-pass systems. Delta Group's third EFI Nozomi 14000 SD installation underscores how brands replace analog lines to cut lead times for display graphics. Mimaki's Tiger600-1800TS, launched in February 2025 for MEA users, offers similar gains in dye-sublimation throughput. Machine-learning-driven calibration ensures colour consistency at industrial scale. As cost per square metre falls in parallel with cycle times, single-pass adoption widens the addressable base for the digital textile printing market, especially where weekly or daily product refreshes are the norm.

High capex for industrial systems

Entry-level single-pass lines cost USD 500,000-USD 2 million, placing them beyond the reach of many SMEs. Financing barriers are more acute in regions with under-developed capital markets, extending payback horizons and slowing equipment refresh cycles. Leasing programmes and print-as-a-service contracts from OEMs help amortise costs, yet the burden of consumables-which can equal 40-60% of operating expenditure-remains. The digital textile printing market therefore advances unevenly until capital hurdles are offset by lower per-unit costs and quicker order-to-cash timelines.

Other drivers and restraints analyzed in the detailed report include:

- E-commerce print-on-demand fulfilment

- Water-saving compliance mandates

- PFAS-linked pigment regulatory risk

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Roll-to-Roll systems delivered 64.92% of the digital textile printing market size in 2025, supported by their compatibility with high-volume apparel, soft-signage, and home-textile runs. Continued improvements in printheads and inline fixation keep cost per square metre attractive, ensuring enduring relevance for bulk orders. Concurrently, Single-Pass Line platforms are scaling fastest at a 10.22% CAGR, bringing industrial throughput to low-run jobs and enabling brands to merge sampling and mass production on one line. Hybrid configurations that marry analog under-bases with digital overprints now help converters maximise uptime while flexibly deploying screens or inkjets to match artwork complexity.

The digital textile printing market benefits when converters adopt direct-to-garment options that share single-pass heads, reducing equipment redundancy and inventory. EFI, Mimaki, and Kornit Digital each package colour management, maintenance analytics, and workflow automation in their ecosystems, raising switching costs. For enterprises still amortising legacy screens, modular retrofits offer a transitional path, mitigating capex risk without stalling digital transition.

Disperse inks captured 41.88% of the digital textile printing market share in 2025, cemented by polyester's reigning material dominance. Sublimation chemistries, however, notch the quickest 9.12% CAGR because sportswear, promotional flags, and backlit displays prize vivid, durable colour that sublimates into fibre with minimal post-treatment. Pigment sets gain favour as waterless workflows and one-step finishing address tightening environmental codes; OEM introductions such as DuPont's Artistri(R) PN1000 series illustrate the pivot from reactive dyes toward greener, cross-substrate options.

Reactive inks hold sway in cotton-heavy regions where deep shade penetration and wash resistance are mission-critical, while acid inks cater to silk and wool, sustaining premium segments. Ink innovation continues to revolve around lowering curing temperatures and improving nozzle open time, factors that directly influence uptime economics in the digital textile printing market.

The Digital Textile Printing Market Report is Segmented by Printing Method (Roll-To-Roll Printing, Direct-To-Garment (DTG), and More), Ink Type (Sublimation, Pigment, Reactive, Acid, Disperse), Application (Garment and Apparel, Home Textiles, Technical Textiles, Display and Signage), Substrate (Cotton, Polyester, Silk, Nylon, Blends), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific controlled 42.10% of global shipments in 2025, anchored by China's USD 77.9 billion yarn and fabric exports and India's aggressive policy packages, including seven PM MITRA parks backed by USD 2.2 billion in incentives. Lower labour rates, dense supplier clusters, and deep port networks keep landed costs competitive even as energy and environmental rules tighten. Regional OEM partnerships funnel single-pass equipment into vertically integrated mills, lowering the adoption barrier for niche brands entering the digital textile printing market.

Middle East & Africa registers the sharpest 10.75% CAGR to 2031 as governments pursue diversification. The UAE and Saudi Arabia leverage free-zone incentives while Egypt teams with Turkish producers to supply US buyers, taking advantage of USD 103 monthly minimum wages. Infrastructure projects such as industrial parks in Morocco and Ethiopia attract foreign direct investment that positions the region as an agile, tariff-hedged alternative to Asian sourcing.

Europe emphasises ecological compliance under the ESPR, prompting mills to adopt water-saving pigment workstreams and recycled fibre blends. Brands near-shore micro-capsule runs to shorten delivery windows, a strategy aligned with the continent's mature consumer base demanding transparency and sustainable credentials. North America's reshoring renaissance advances at 2.8% annual growth since 2020, with players like Shawmut Infinite investing USD 8 million to modernise integrated knit-to-finish lines. South American growth is steady yet hampered by logistics gaps and macro volatility, limiting its share of the digital textile printing market despite favourable raw-material availability.

- Kornit Digital

- Seiko Epson Corporation

- Mimaki Engineering

- Durst Group

- Electronics For Imaging

- D.Gen Inc.

- Aeoon Technologies

- Roland DG

- Ricoh Company

- ColorJet

- ATP Color

- SPGPrints

- HP Inc.

- Brother International

- Mutoh Industries

- MS Printing Solutions

- Kyocera Corp.

- FujiFilm Dimatix

- ROQ International

- Shenzhen Homer

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Personalisation-led micro-collections boom

- 4.2.2 Single-pass inkjet productivity leap

- 4.2.3 E-commerce print-on-demand fulfilment

- 4.2.4 Water-saving compliance mandates

- 4.2.5 Near-shoring for resilient supply chains

- 4.2.6 On-garment sustainable pigment advances

- 4.3 Market Restraints

- 4.3.1 High capex for industrial systems

- 4.3.2 Ink-fabric compatibility hurdles

- 4.3.3 Colour-fastness QA bottlenecks

- 4.3.4 PFAS-linked pigment regulatory risk

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Macroeconomic Impact Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Printing Method

- 5.1.1 Roll-to-Roll Printing

- 5.1.2 Direct-to-Garment (DTG)

- 5.1.3 Single-Pass Line

- 5.1.4 Hybrid (Analog + Digital)

- 5.1.5 Other Printing Method

- 5.2 By Ink Type

- 5.2.1 Sublimation

- 5.2.2 Pigment

- 5.2.3 Reactive

- 5.2.4 Acid

- 5.2.5 Disperse

- 5.3 By Application

- 5.3.1 Garment and Apparel

- 5.3.2 Home Textiles

- 5.3.3 Technical Textiles

- 5.3.4 Display and Signage

- 5.4 By Substrate

- 5.4.1 Cotton

- 5.4.2 Polyester

- 5.4.3 Silk

- 5.4.4 Nylon

- 5.4.5 Blends

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 Italy

- 5.5.2.3 United Kingdom

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia and New Zealand

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 Middle East

- 5.5.4.1.1 Turkey

- 5.5.4.1.2 Saudi Arabia

- 5.5.4.1.3 United Arab Emirates

- 5.5.4.1.4 Rest of Middle East

- 5.5.4.2 Africa

- 5.5.4.2.1 South Africa

- 5.5.4.2.2 Egypt

- 5.5.4.2.3 Rest of Africa

- 5.5.4.1 Middle East

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Kornit Digital

- 6.4.2 Seiko Epson Corporation

- 6.4.3 Mimaki Engineering

- 6.4.4 Durst Group

- 6.4.5 Electronics For Imaging

- 6.4.6 D.Gen Inc.

- 6.4.7 Aeoon Technologies

- 6.4.8 Roland DG

- 6.4.9 Ricoh Company

- 6.4.10 ColorJet

- 6.4.11 ATP Color

- 6.4.12 SPGPrints

- 6.4.13 HP Inc.

- 6.4.14 Brother International

- 6.4.15 Mutoh Industries

- 6.4.16 MS Printing Solutions

- 6.4.17 Kyocera Corp.

- 6.4.18 FujiFilm Dimatix

- 6.4.19 ROQ International

- 6.4.20 Shenzhen Homer

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment