|

市場調查報告書

商品編碼

1892857

數位紡織印花機市場機會、成長促進因素、產業趨勢分析及預測(2026-2035年)Digital Textile Printer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

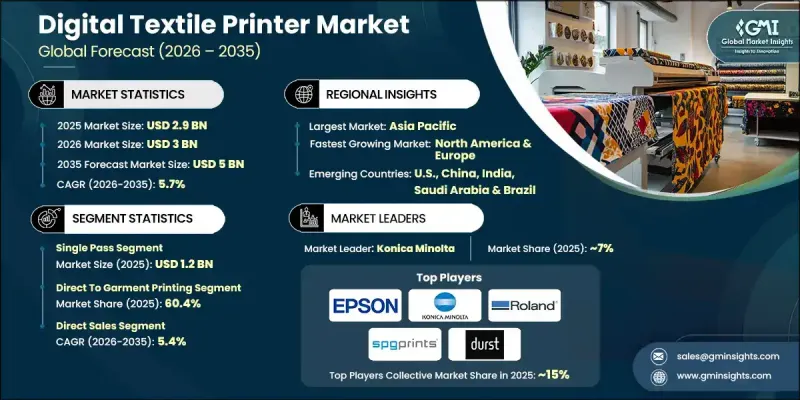

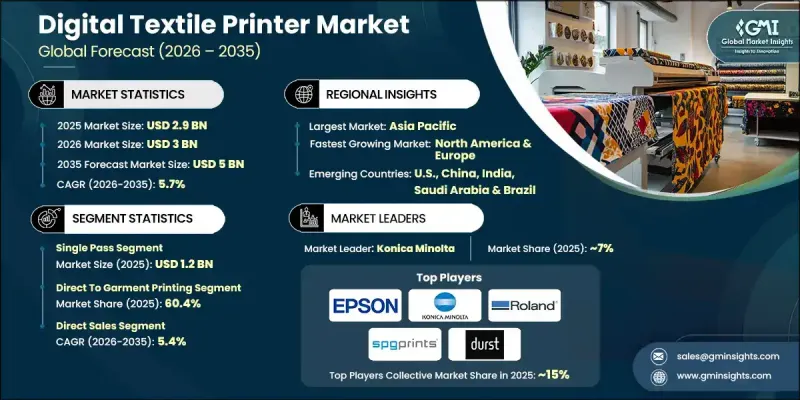

2025年全球數位紡織印表機市場價值為29億美元,預計2035年將以5.7%的複合年成長率成長至50億美元。

這一成長是由幾個關鍵趨勢推動的,這些趨勢正在改變紡織業。消費者對按需客製化和個人化紡織品的需求日益成長,促使製造商採用更快、更靈活的生產方式。快時尚、線上購物平台和社群媒體驅動的趨勢的興起,正推動紡織企業生產更小批量、高度客製化的產品。與傳統印刷方式相比,數位紡織印花技術使品牌能夠以更短的設定時間、更快的周轉速度和更低的庫存成本交付這些產品。單程列印頭、人工智慧驅動的色彩管理系統和自動化工作流程等技術的進步,進一步提高了效率、精確度和生產力。高解析度印刷技術能夠覆蓋各種紡織品類型,同時最大限度地減少停機時間和生產成本,這使得數位紡織印表機對於現代服裝和家居裝飾行業日益重要。

| 市場範圍 | |

|---|---|

| 起始年份 | 2025 |

| 預測年份 | 2026-2035 |

| 起始值 | 29億美元 |

| 預測值 | 50億美元 |

| 複合年成長率 | 5.7% |

2025年,單程印表機市場規模達到12億美元,預計2026年至2035年將以5.7%的複合年成長率成長。這些印表機一次即可完成整個設計,大幅縮短生產時間,使製造商能夠滿足快速週轉的時尚產品和大量訂單的需求,因此非常適合電子商務和個人化服裝生產。

至2025年,直噴印花(DTG)市佔率達到60.4%,預計2026年至2035年將以6%的複合年成長率成長。 DTG技術無需複雜的設定即可將高品質、全彩圖案直接印製到成衣上,從而支援按需生產和電子商務驅動的商業模式。其適應性強,吸引了眾多中小企業、訂製服裝企業以及提供個人化服裝的線上平台。

2025年美國數位紡織印花市場規模為3.7億美元,預計2026年至2035年將以4.6%的複合年成長率成長。時尚、家居裝飾和產業用紡織品行業的強勁需求推動了對先進印花技術的需求,這些技術能夠支援大規模客製化和快速設計迭代。按需生產模式、微型工廠建設以及包括無水印花和低影響油墨在內的永續發展舉措,進一步促進了市場成長。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 產業影響因素

- 成長促進因素

- 消費者對個人化和按需生產的需求

- 省水環保油墨

- 技術進步

- 產業陷阱與挑戰

- 高昂的初始投資和營運成本

- 油墨品質、耐久性和永續性方面的挑戰

- 成長促進因素

- 成長潛力分析

- 未來市場趨勢

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按機器類型

- 監管環境

- 標準和合規要求

- 區域監理框架

- 認證標準

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依機器類型分類,2022-2035年

- 繪圖儀

- 掃描器

- 單次通過

第6章:市場估算與預測:依油墨類型分類,2022-2035年

- 活性油墨

- 酸性墨水

- 分散油墨

- 顏料墨水

- 其他

第7章:市場估計與預測:依材料分類,2022-2035年

- 棉布

- 聚酯纖維

- 絲綢

- 混紡織物

第8章:市場估算與預測:依技術分類,2022-2035年

- 熱噴墨

- 壓電噴墨

- 連續噴墨

- 熱傳遞

- 靜電

- 靜電照相術

- 其他

第9章:市場估價與預測:依印刷流程分類,2022-2035年

- 直接服裝印花

- 直接印製於織物上

第10章:市場估計與預測:依應用領域分類,2022-2035年

- 時尚和服裝業

- 家居用品

- 汽車和運輸

- 醫療保健

- 運動健身產業

- 廣告與行銷

- 其他(航太、教育、建築)

第11章:市場估價與預測:依配銷通路分類,2022-2035年

- 直銷

- 間接銷售

第12章:市場估算與預測:依地區分類,2022-2035年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 印尼

- 馬來西亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第13章:公司簡介

- Aleph Srl

- Durst Group

- EFI (Electronics For Imaging)

- Epson

- Hollanders Printing Systems

- JK Group

- Konica Minolta

- Kornit Digital

- Mimaki Engineering

- MS Printing Solutions

- Mutoh

- Reggiani Machine

- Roland DG

- Seiko Epson Corporation

- SPGPrints

The Global Digital Textile Printer Market was valued at USD 2.9 billion in 2025 and is estimated to grow at a CAGR of 5.7% to reach USD 5 billion by 2035.

This growth is driven by several key trends transforming the textile industry. Consumers increasingly demand on-demand and personalized textiles, prompting manufacturers to adopt faster, more flexible production methods. The rise of fast fashion, online shopping platforms, and social media-driven trends is pushing textile companies to produce smaller, highly customized batches. Digital textile printing enables brands to deliver these products with reduced setup times, faster turnaround, and lower inventory costs compared to traditional printing methods. Advancements in technology, including single-pass print heads, AI-driven color management systems, and automated workflows, further boost efficiency, precision, and productivity. High-resolution printing across diverse textile types while minimizing downtime and production costs makes digital textile printers increasingly essential for the modern apparel and home decor sectors.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $2.9 Billion |

| Forecast Value | $5 Billion |

| CAGR | 5.7% |

The single-pass printers segment generated USD 1.2 billion in 2025 and is expected to grow at a CAGR of 5.7% from 2026 to 2035. These printers complete entire designs in a single pass, dramatically reducing production time and allowing manufacturers to meet demand for rapid-turnaround fashion and bulk orders, making them ideal for e-commerce and personalized apparel production.

The direct-to-garment (DTG) printing segment held a 60.4% share in 2025 and is projected to grow at a CAGR of 6% from 2026 to 2035. DTG technology allows high-quality, full-color designs to be printed directly onto finished garments without complex setups, supporting on-demand production and e-commerce-driven business models. Its adaptability attracts small and medium enterprises, custom apparel businesses, and online platforms offering personalized clothing.

U.S. Digital Textile Printer Market was valued at USD 370 million in 2025 and is expected to grow at a CAGR of 4.6% from 2026 to 2035. Strong fashion, home decor, and technical textile industries drive demand for advanced printing technologies that support mass customization and rapid design turnaround. On-demand production models, micro-factory setups, and sustainability initiatives, including waterless printing and low-impact inks, further fuel market growth.

Key players in the Global Digital Textile Printer Market include Aleph S.r.l., Durst Group, EFI (Electronics For Imaging), Epson, Hollanders Printing Systems, JK Group, Konica Minolta, Kornit Digital, Mimaki Engineering, MS Printing Solutions, Mutoh, Reggiani Machine, Roland DG, Seiko Epson Corporation, and SPGPrints. Companies in the Global Digital Textile Printer Market are expanding their footprint by investing in advanced printing technologies, such as AI-assisted color management, single-pass printing, and automated workflow systems, to increase efficiency and precision. Strategic partnerships with textile manufacturers, fashion brands, and e-commerce platforms enable wider adoption of digital printing solutions. Firms are also focusing on sustainable and eco-friendly printing methods to meet environmental regulations and consumer demand. Expanding global distribution networks, enhancing after-sales support, and offering training programs help strengthen market presence.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Machine type

- 2.2.3 Ink type

- 2.2.4 Material

- 2.2.5 Technology

- 2.2.6 Printing process

- 2.2.7 Application

- 2.2.8 Distribution channel

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Consumer demand for personalization & on-demand production

- 3.2.1.2 Water-saving and eco-friendly inks

- 3.2.1.3 Technological advancements

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial investments & operating costs

- 3.2.2.2 Ink quality, durability & sustainability hurdles

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By machine type

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By Region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By Region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Machine Type, 2022 - 2035, (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Plotter

- 5.3 Scanner

- 5.4 Single pass

Chapter 6 Market Estimates & Forecast, By Ink Type, 2022 - 2035, (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Reactive ink

- 6.3 Acid ink

- 6.4 Disperse ink

- 6.5 Pigment ink

- 6.6 Other

Chapter 7 Market Estimates & Forecast, By Material, 2022 - 2035, (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Cotton

- 7.3 Polyester

- 7.4 Silk

- 7.5 Blended fabrics

Chapter 8 Market Estimates & Forecast, By Technology, 2022 - 2035, (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Thermal inkjet

- 8.3 Piezoelectric inkjet

- 8.4 Continuous inkjet

- 8.5 Thermal transfer

- 8.6 Electrostatic

- 8.7 Electrophotography

- 8.8 Others

Chapter 9 Market Estimates & Forecast, By Printing Process, 2022 - 2035, (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct to garment printing

- 9.3 Direct to fabrics

Chapter 10 Market Estimates & Forecast, By Application, 2022 - 2035, (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Fashion and clothing industry

- 10.3 Home furnishing

- 10.4 Automotive and transportation

- 10.5 Healthcare and medical

- 10.6 Sports and fitness industry

- 10.7 Advertising and marketing

- 10.8 Others (aerospace, education, construction)

Chapter 11 Market Estimates & Forecast, By Distribution Channel, 2022 - 2035, (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 Direct sales

- 11.3 Indirect sales

Chapter 12 Market Estimates & Forecast, By Region, 2022 - 2035, (USD Billion) (Thousand Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 South Korea

- 12.4.5 Australia

- 12.4.6 Indonesia

- 12.4.7 Malaysia

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 MEA

- 12.6.1 Saudi Arabia

- 12.6.2 UAE

- 12.6.3 South Africa

Chapter 13 Company Profiles

- 13.1 Aleph S.r.l.

- 13.2 Durst Group

- 13.3 EFI (Electronics For Imaging)

- 13.4 Epson

- 13.5 Hollanders Printing Systems

- 13.6 JK Group

- 13.7 Konica Minolta

- 13.8 Kornit Digital

- 13.9 Mimaki Engineering

- 13.10 MS Printing Solutions

- 13.11 Mutoh

- 13.12 Reggiani Machine

- 13.13 Roland DG

- 13.14 Seiko Epson Corporation

- 13.15 SPGPrints