|

市場調查報告書

商品編碼

1910938

歐洲收縮彈力套筒標籤市場:市場佔有率分析、行業趨勢、統計數據和成長預測(2026-2031 年)Europe Shrink And Stretch Sleeve Label - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

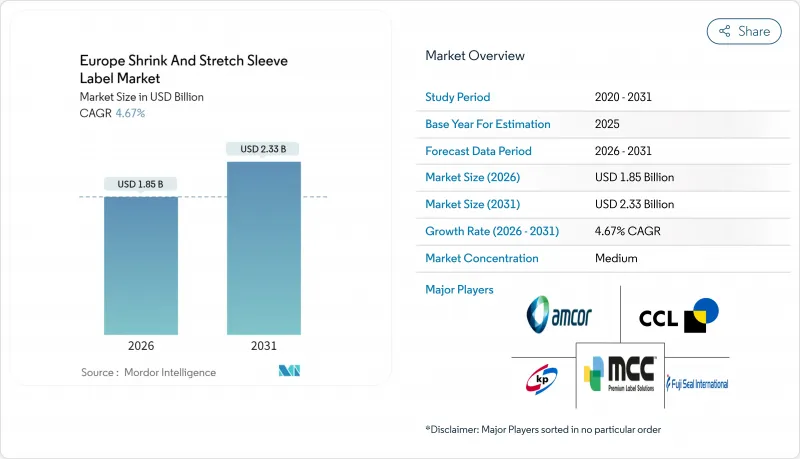

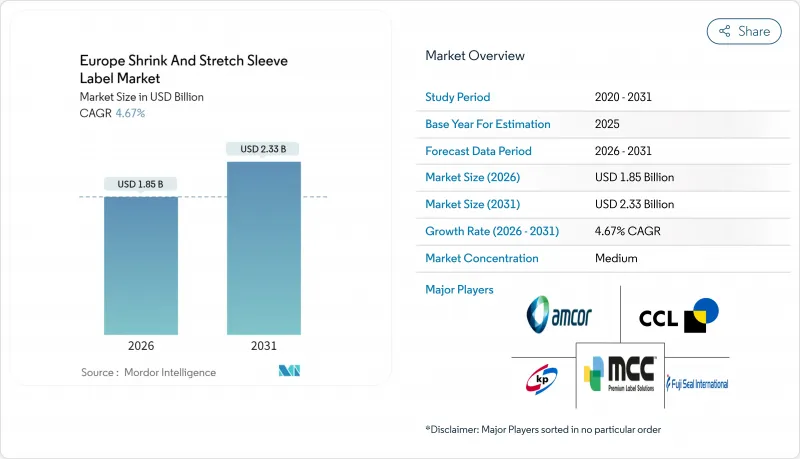

2025年歐洲收縮和彈力套筒標籤市值為17.7億美元,預計到2031年將達到23.3億美元,高於2026年的18.5億美元。

預計在預測期(2026-2031 年)內,複合年成長率將達到 4.67%。

高階消費品的持續需求、日益嚴格的回收法規以及對聚烯加工生產線的快速投資,共同支撐著這一穩步成長的趨勢。飲料品牌正在重新設計包裝套,以符合押金退款規定,同時又不影響視覺效果;個人護理公司則在拓展360度全景影像技術,以證明其高價位產品的合理性。加工商對符合歐盟分類測試標準的基材的需求,加速了聚乙烯材料的替代品。日益激烈的競爭,加上石化產業的整合以及樹脂成本的上漲,迫使中型加工商要麼擴大生產規模,要麼退出市場。在線連續數位印刷技術的應用,實現了經濟高效的小批量生產,使品牌所有者能夠進行本地化宣傳活動,並降低庫存風險。

歐洲收縮彈力套筒標籤市場趨勢與洞察

對提升商店吸引力的需求日益成長

隨著零售貨架空間日益精簡,視覺競爭也愈發激烈。品牌商紛紛採用全包覆式包裝,將標準容器轉變為360度全方位廣告載具。精釀飲料品牌利用限量圖案來提升單品利潤率,而大眾市場汽水品牌則在不影響灌裝線速度的前提下,輪換使用季節性圖案。西歐消費者持續青睞高階美學設計,並會重複購買,這使得全包覆式包裝在價格上優於感壓標籤。隨著零售商不斷拓展自有品牌產品線,全國性品牌正致力於打造差異化裝飾,以避免產品同質化。預計歐洲整體包裝產業規模將從2024年的1,530億歐元成長至2029年的1,860億歐元,這顯示高階包裝形式仍有成長空間。

需要防篡改保護

歐盟藥品安全監管法規強制要求使用可見的安全功能,而收縮膜因其撕開後會留下可見的破損而備受青睞。營養保健品生產商正在採用微縮文字和變色油墨,以便在銷售點進行包裝認證。預計從2024年起,假冒仿冒品產品問題將急劇上升,促使超級市場越來越重視防竄改功能,即使是高階果汁也不例外。政府檢查人員也傾向於使用能夠在低溫運輸審核期間立即發現篡改痕跡的收縮膜。電子商務的蓬勃發展進一步推動了對此類產品的需求,因為它創造了更多可能被篡改包裝的接觸點。

歐盟塑膠包裝廢棄物指令收緊

塑膠包裝廢棄物指令 (PPWR) 引入了可回收設計清單,使得許多傳統的套筒結構一夜之間失效。加工企業必須在 2027 年前承擔生產線檢查、實驗室測試和第三方認證的費用,並逐年承擔不斷上漲的生產者延伸責任 (EPR) 費用。品牌所有者正利用這項法規作為籌碼重新談判價格,在投資高峰期向供應商施加壓力。西歐執法機構已在 2024 年對與包裝相關的企業處以 700 萬歐元的罰款,凸顯了短期合規風險。融資緊張的中小企業正在推遲升級改造,並面臨被市場淘汰的風險。

細分市場分析

由於熱縮套管能夠適應複雜的瓶型,並整合防篡改功能於飲料生產線中,預計到2025年,其在歐洲收縮和彈力套筒標籤市場規模中將佔據68.02%的佔有率。對於每小時在蒸氣隧道中處理5萬瓶的高產量碳酸飲料和水品牌而言,熱縮套管仍然是首選。然而,日益嚴格的監管和不斷上漲的成本正促使品牌所有者採用拉伸套檢測,尤其是在容器設計允許無需加熱即可摩擦貼合的情況下。預計到2031年,拉伸套管在歐洲收縮和彈力套筒標籤市場將以5.61%的複合年成長率成長,因為易剝離性將成為合規性的關鍵差異化因素。

為了分散風險,加工商現在使用雙功能熱縮機,可以根據客戶的特定要求在樹脂收縮和拉伸捲材之間切換。這種新的平衡也使低密度聚乙烯(LDPE)基材受益,只需對烘箱進行少量調整,即可同時使用這兩種技術。個人護理領域率先採用拉伸的企業與收縮型熱縮材料相比,實現了4%的材料節約,有助於抵消樹脂價格上漲的影響。對穿孔技術的投資進一步增強了熱縮生產線的未來適應性,簡化了消費後的剝離流程。

其他福利

- Excel格式的市場預測(ME)表

- 分析師支持(3個月)

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 對提升商店吸引力的需求日益成長

- 需要採取防篡改措施

- 過渡到 360° 品牌表面

- 採用可再生聚烯收縮膜

- 在線連續數位印刷整合

- 添加鋰金屬的油墨可以製造超薄袖套

- 市場限制

- 歐盟塑膠包裝廢棄物指令收緊

- 原生PET-G和PVC樹脂價格上漲

- 多層薄膜回收通路的限制

- 歐盟押金退款計畫中的袖標移除瓶頸

- 產業價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 供應商的議價能力

- 買方和消費者的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 主要機械製造商

第5章 市場規模與成長預測

- 按類型

- 熱縮套管

- 拉伸套

- 其他類型

- 材料

- 聚氯乙烯(PVC)

- 乙二醇改質聚對苯二甲酸乙二醇酯(PET-G)

- 聚乙烯(PE)

- 聚丙烯(PP)

- 其他

- 透過使用

- 飲料

- 食物

- 個人護理

- 其他

- 按國家/地區

- 德國

- 法國

- 英國

- 義大利

- 俄羅斯

- 波蘭

- 荷蘭

- 西班牙

- 其他歐洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Amcor PLC

- CCL Industries Inc.

- Klockner Pentaplast GmbH and Co. KG

- Fuji Seal International Inc.

- Huhtamaki Oyj

- Smurfit WestRock PLC

- Mondi PLC

- Multi-Color Corporation

- Sleevezone Ltd.

- Folienprint Risse Etiketten GmbH

- Oerlemans Plastics BV

- Decomatic SA

- Polifilm Extrusion GmbH

- Maca Srl

- Sleever International Company

- Derprosa Films SLU

- DOW Chemical Company

- UPM Raflatac Oy

- Constantia Flexibles Group GmbH

- Avery Dennison Corporation

- Label-Aire Inc.

第7章 市場機會與未來展望

The Europe shrink and stretch sleeve label market was valued at USD 1.77 billion in 2025 and estimated to grow from USD 1.85 billion in 2026 to reach USD 2.33 billion by 2031, at a CAGR of 4.67% during the forecast period (2026-2031).

Sustained demand from premium consumer goods, tightening recyclability rules, and rapid investments in polyolefin converting lines underpin this steady trajectory. Beverage brands are re-engineering sleeves to survive deposit-return schemes without sacrificing visual impact, while personal care players scale 360-degree graphics to justify premium shelf pricing. Material substitution toward polyethylene accelerates as converters seek substrates that pass EU sorting trials. Competitive intensity rises as petrochemical consolidation inflates resin costs, forcing mid-tier converters to choose between capacity upgrades and exit. Inline digital printing unlocks cost-effective short runs that help brand owners localize campaigns and reduce inventory risk.

Europe Shrink And Stretch Sleeve Label Market Trends and Insights

Demand to Increase On-Shelf Appeal

Retail shelf space rationalization intensifies visual competition, prompting brand owners to adopt full-body sleeves that convert an ordinary container into a 360-degree billboard. Craft beverage lines exploit limited-edition graphics to boost unit margins, while mass-market soda brands rotate seasonal artwork without disrupting fill-line speeds. Western European consumers continue to reward premium aesthetics with repeat purchases, helping sleeves defend pricing versus pressure-sensitive labels. As retailers expand private-label ranges, national brands double down on differentiated decoration to avoid commoditization. The broader European packaging sector's value climb from EUR 153 billion in 2024 to EUR 186 billion by 2029 signals headroom for upscale formats.

Need for Tamper-Evident Protection

EU pharmacovigilance rules mandate overt security features, making shrink sleeves attractive because removal leaves visible damage. Nutraceutical producers embed micro-text and color-shift inks to authenticate packages at point of sale. Counterfeit concern has risen sharply since 2024, pushing supermarkets to favor tamper-proof formats even for premium juices. Government inspectors also prefer sleeves that signal breach instantly during cold-chain audits. Growing e-commerce adds another touch-point where packages can be compromised, further raising demand.

Stricter EU Plastics-Packaging Waste Directives

PPWR introduces design-for-recycling checklists that invalidate many legacy sleeve constructions overnight. Converters must finance line trials, laboratory tests, and third-party certifications before 2027 while absorbing EPR fees that escalate annually. Brand owners use the legislation to renegotiate pricing, squeezing suppliers during investment peaks. Western European enforcement agencies already issued EUR 7 million in packaging fines during 2024, underscoring near-term compliance risk.Cash-strapped SMEs defer upgrades, risking market exit.

Other drivers and restraints analyzed in the detailed report include:

- Shift Toward 360° Branding Surfaces

- Adoption of Recyclable Polyolefin Shrink Films

- Limited Recycling Streams for Multilayer Films

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Heat shrink sleeves represented 68.02% of the Europe shrink and stretch sleeve label market size in 2025 thanks to proven conformity around intricate bottle contours and integrated tamper-evidence on beverage lines. They remain the go-to choice for high-volume soda and water brands that run containers through steam tunnels at 50,000 bottles per hour. Yet regulatory and cost headwinds encourage brand owners to trial stretch sleeves, especially where container designs allow friction application without heat. The Europe shrink and stretch sleeve label market expects stretch formats to post a 5.61% CAGR through 2031 as removal ease becomes a compliance differentiator.

Converters hedging risk now operate dual-capability applicators, shifting between resin shrink ratios and stretch roll stocks to match customer specifications. The new equilibrium also benefits low-density polyethylene substrates that accommodate both technologies with minor oven adjustments. Early stretch adopters in personal care report 4% material savings versus shrink alternatives, helping offset resin inflation. Investment in perforation technology further future-proofs heat shrink lines by simplifying post-consumer detachment.

The Europe Shrink and Stretch Sleeve Label Market Report is Segmented by Type (Heat Shrink Sleeve, Stretch Sleeve, and More), Material (PVC, PET-G, PE, PP, and More), Application (Beverage, Food, Personal Care, and More), and Geography (Germany, France, United Kingdom, Italy, Russia, Poland, Netherlands, Spain, and Rest of Europe). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Amcor PLC

- CCL Industries Inc.

- Klockner Pentaplast GmbH and Co. KG

- Fuji Seal International Inc.

- Huhtamaki Oyj

- Smurfit WestRock PLC

- Mondi PLC

- Multi-Color Corporation

- Sleevezone Ltd.

- Folienprint Risse Etiketten GmbH

- Oerlemans Plastics B.V.

- Decomatic S.A.

- Polifilm Extrusion GmbH

- Maca S.r.l.

- Sleever International Company

- Derprosa Films S.L.U.

- DOW Chemical Company

- UPM Raflatac Oy

- Constantia Flexibles Group GmbH

- Avery Dennison Corporation

- Label-Aire Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Demand to increase on-shelf appeal

- 4.2.2 Need for tamper-evident protection

- 4.2.3 Shift toward 360° branding surfaces

- 4.2.4 Adoption of recyclable polyolefin shrink films

- 4.2.5 Inline digital printing integration

- 4.2.6 Lithium-metal additive inks enabling ultra-thin sleeves

- 4.3 Market Restraints

- 4.3.1 Stricter EU plastics-packaging waste directives

- 4.3.2 Rising prices of virgin PET-G and PVC resins

- 4.3.3 Limited recycling streams for multi-layer films

- 4.3.4 Sleeve removal bottlenecks in EU deposit-return schemes

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers/Consumers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Major Machine Suppliers

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Heat Shrink Sleeve

- 5.1.2 Stretch Sleeve

- 5.1.3 Other Types

- 5.2 By Material

- 5.2.1 Polyvinyl Chloride (PVC)

- 5.2.2 Polyethylene Terephthalate Glycol-modified (PET-G)

- 5.2.3 Polyethylene (PE)

- 5.2.4 Polypropylene (PP)

- 5.2.5 Other Materials

- 5.3 By Application

- 5.3.1 Beverage

- 5.3.2 Food

- 5.3.3 Personal Care

- 5.3.4 Other Applications

- 5.4 By Country

- 5.4.1 Germany

- 5.4.2 France

- 5.4.3 United Kingdom

- 5.4.4 Italy

- 5.4.5 Russia

- 5.4.6 Poland

- 5.4.7 Netherlands

- 5.4.8 Spain

- 5.4.9 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amcor PLC

- 6.4.2 CCL Industries Inc.

- 6.4.3 Klockner Pentaplast GmbH and Co. KG

- 6.4.4 Fuji Seal International Inc.

- 6.4.5 Huhtamaki Oyj

- 6.4.6 Smurfit WestRock PLC

- 6.4.7 Mondi PLC

- 6.4.8 Multi-Color Corporation

- 6.4.9 Sleevezone Ltd.

- 6.4.10 Folienprint Risse Etiketten GmbH

- 6.4.11 Oerlemans Plastics B.V.

- 6.4.12 Decomatic S.A.

- 6.4.13 Polifilm Extrusion GmbH

- 6.4.14 Maca S.r.l.

- 6.4.15 Sleever International Company

- 6.4.16 Derprosa Films S.L.U.

- 6.4.17 DOW Chemical Company

- 6.4.18 UPM Raflatac Oy

- 6.4.19 Constantia Flexibles Group GmbH

- 6.4.20 Avery Dennison Corporation

- 6.4.21 Label-Aire Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment