|

市場調查報告書

商品編碼

1851840

收縮標籤和彈力套筒標籤:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Shrink And Stretch Sleeve Labels - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

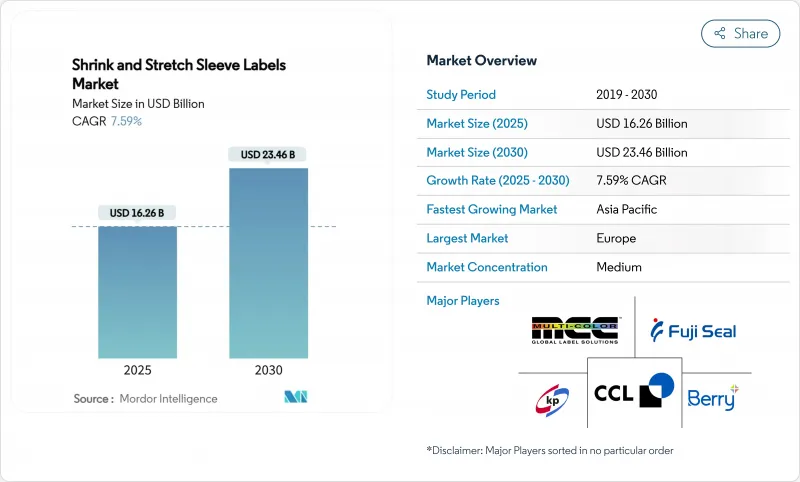

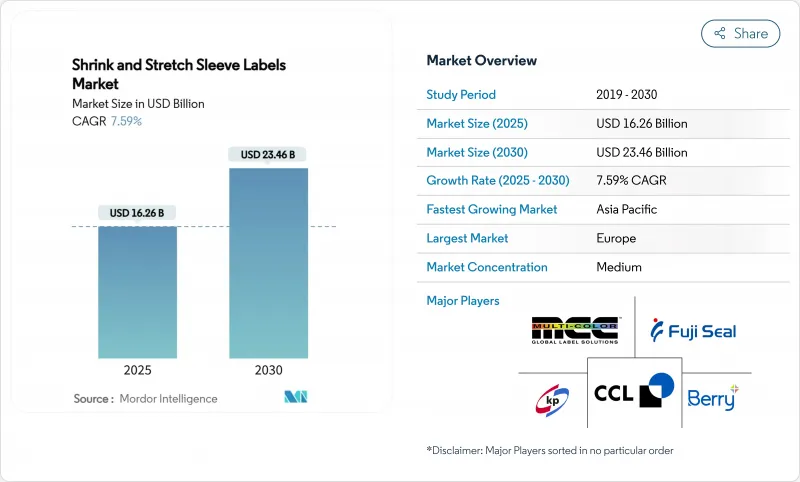

預計到 2025 年,收縮彈力套筒標籤市場規模將達到 162.6 億美元,到 2030 年將達到 234.6 億美元,複合年成長率將達到 7.59%。

品牌擁有者正在尋求能夠提升貨架視覺衝擊力、滿足防篡改要求並符合嚴格回收目標的360度全方位圖形設計。數位噴墨生產能力的快速提升使得加工商能夠印製1000個或更少的套標,從而降低了精釀啤酒商和利基飲料製造商的准入門檻。藥品法規要求包裝上必須有可見的完整性指示器,這刺激了市場需求;而機能飲料則更傾向於使用能夠保持成分效力的避光套標。儘管歐洲因較早採用高階包裝而佔據市場主導地位,但亞太地區正展現出最快的成長速度,因為可支配收入的成長推動了包裝飲料消費量的成長。

全球收縮標籤和彈力套筒標籤市場趨勢及洞察

包裝飲料和機能飲料的成長

機能飲料採用縮膜技術來保護光敏營養成分,並擴展營養成分錶。三分之一的消費者將增強免疫力列為首要購買標準,因此,富含維生素C、接骨木莓和益生菌的飲料需求正在上升。與感壓標籤相比,全包覆式印刷技術可為品牌提供150%的印刷空間,因此可添加產品聲明、QR碼和防偽封條。 Premier Protein公司透過改用帶有防光收縮膜的寶特瓶,減少了35%的塑膠用量,而收縮膜上還帶有便於回收的穿孔。一家精釀啤酒廠以前需要訂購10萬個裝飾罐,現在只需訂購7000個收縮膜罐即可,從而擴大了季節性產品的供應範圍。

利用數位噴墨技術進行小批量印刷,降低小眾 SKU 的最小起訂量

水性噴墨印刷機的生產速度比傳統系統快2.3倍,同時消除了食品包裝中溶劑殘留的問題。加工商現在可以獲利地完成1000件的訂單,而柔版印刷的標準起印量為10萬件,這使得針對區域促銷和電商組合銷售的SKU能夠更加精準。設計迭代只需幾天即可完成,而非幾週,為負責人提供即時回饋。預計到2029年,數位生產將佔標籤總產量的9.7%,以平方公尺計算的複合年成長率將達到4.4%。將收縮標籤和彈力套筒標籤聯線後最後加工與噴墨印表機頭整合在一起的市場參與企業,將獲得傳統凹版印刷生產線無法實現的靈活性。

立式袋與直接印刷袋競爭。

像Velox這樣的數位罐體印刷機每分鐘可以印刷500罐,無需使用套膜,因此深受注重永續性的精釀品牌的青睞。直接裝飾流程省去了收縮線中常見的加熱通道、邊角料和黏合劑等問題。對於大量碳酸飲料而言,成本差異會進一步擴大,套膜的單價是膠印的2-2.5倍。然而,收縮標籤和彈力套筒標籤市場仍然存在,因為它們可以滿足袋裝和罐裝飲料無法複製的異形容器的需求。

細分市場分析

收縮套標在2024年將佔據收縮標籤和彈力套筒標籤市場73.2%的佔有率,其對複雜瓶型和防篡改安全封條的適用性已得到證實。高速自動化施用器每分鐘可處理超過800瓶,誤差率低於0.5%。拉伸套無需熱風隧道,可降低高達40%的能源消耗,並方便消費者在丟棄前輕鬆移除,從而支持回收利用。到2030年,該細分市場將以8.3%的複合年成長率成長,超過整體市場成長速度,因為歐洲飲料品牌正在採用低碳包裝以滿足範圍3目標。

儘管收縮標籤技術仍將保持其主導地位,但未來的生產模式可能會演變為雙效解決方案的生態系統。收縮標籤將用於保護藥品管瓶、機能飲料和需要貼合式封蓋的異形家用清潔劑。拉伸套標將在價格敏感度和永續性定位相交的領域擴展,例如水、乳製品和經濟型可樂。生產線擴大將伺服驅動的捲軸施用器與視覺系統相結合,以即時檢測套標位置並最大限度地減少返工。供應商正在確保兩種套標類型都能使用相同的水性噴墨墨水,從而簡化圖形切換,並增強收縮標籤和彈力套筒標籤市場的靈活生產策略。

收縮套標和彈力套筒標籤市場按類型(收縮套標、拉伸套)、材料(PVC、PET/PET-G、PE、OPP 和 OPS、其他材料)、最終用戶(食品、軟性飲料、酒精飲料、化妝品和家居用品、藥品、其他最終用戶)以及地區(北美、南美、歐洲、亞太、中東和非洲)進行細分。市場預測以美元計價。

區域分析

由於強而有力的環保政策和高階包裝文化,歐洲預計2024年將維持29.8%的銷售成長。德國、法國和英國正將相當一部分資本支出用於配備節能紅外線隧道的套標薄膜生產線。歐盟包裝廢棄物法規要求包裝材料在2030年之前必須可回收利用,這推動了對易於在清洗廠輕鬆剝離的PET材質套標的需求。受精品酒類對精美圖案和低起訂量要求的阻礙,該地區每千個套標的平均售價比全球平均高出12%。

亞太地區成長速度最快,年複合成長率達8.1%,主要得益於可支配所得激增、都市化進程加快以及機能飲料的興起。中國的快遞包裝標準GB 43352-2023限制油墨中的重金屬含量,迫使本地加工商採用符合標準的化學製程。泰國正在試行無標定寶特瓶,將產品資料儲存在瓶蓋上印刷的QR碼中,這給傳統的瓶套帶來了壓力,同時也為智慧互動薄膜鋪平了道路。日本是軟性薄膜水性噴墨印刷技術的早期採用者,目前正積極響應《塑膠資源回收法》,並致力於推動本土創新,以期在區域市場引起共鳴。

北美受惠於蓬勃發展的精釀啤酒生態系統和完善的醫療保健系統。藥品和非處方營養補充劑對防篡改的需求確保了穩定的需求。南美擁有豐富的PET樹脂供應,但易受外匯波動的影響,限制了對高階印刷機的資本投資。中東和非洲的產能相對滯後,但它們是高階進口烈酒和個人護理用品的高價值市場,這些產品依賴套標來提升品牌形象。總而言之,地理多樣性支撐了收縮標籤和彈力套筒標籤市場的長期韌性。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 對360度高清影像的需求提升了貨架吸引力。

- 對防篡改和防偽包裝的需求日益成長

- 包裝飲料和機能飲料的成長

- 轉向使用可回收的PETG和可漂浮的套管薄膜

- 數位噴墨小批量印刷降低了小眾產品SKU的最小起訂量

- 用於行銷的智慧互動功能(感溫變色、2D碼)

- 市場限制

- 多材質套管污染PET回收流程的難題

- 與立式袋和DTP的競爭

- 地緣政治供應衝擊導致樹脂價格波動

- 歐盟/北美PVC套管法規推高了合規成本

- 供應鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭的激烈程度

- 評估市場的宏觀經濟因素

第5章 市場規模與成長預測

- 按類型

- 收縮套

- 拉伸套

- 材料

- PVC

- PET/PET-G

- PE

- OPP 和 OPS

- 其他材料(PO、PLA 等)

- 最終用戶

- 食物

- 軟性飲料

- 酒精飲料

- 化妝品和家居用品

- 製藥

- 其他最終用戶

- 按地區

- 北美洲

- 美國

- 加拿大

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲國家

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲和紐西蘭

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 埃及

- 奈及利亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- CCL Industries

- Fuji Seal International

- Berry Global Group

- Multi-Color Corporation

- KP Klockner Pentaplast

- Amcor PLC

- Huhtamaki Oyj

- Fort Dearborn Company

- Taghleef Industries

- Siegwerk Druckfarben

- Macfarlane Labels

- Avery Dennison Corp.

- Clondalkin Group

- Cenveo Worldwide

- Schur Flexibles

- Hammer Packaging

- Sleeve Seal Inc.

- PDC-Europe

- Fortalab Labels

- Akar Shrink Packs

第7章 市場機會與未來展望

The shrink and stretch sleeve labels market size stands at USD 16.26 billion in 2025 and is forecast to climb to USD 23.46 billion by 2030, reflecting a steady 7.59% CAGR.

Expansion rests on brand owners seeking 360-degree graphics that lift shelf impact, fulfill tamper-evident mandates, and align with strict recycling targets. Rapid gains in digital inkjet capacity let converters print short runs of 1,000 sleeves or fewer, slashing entry costs for craft brewers and niche beverage producers. Pharmaceutical regulations that require visible integrity indicators reinforce demand, while functional drinks favor light-blocking sleeves that maintain ingredient potency. Europe leads by value thanks to early adoption of premium packaging, yet Asia-Pacific registers the quickest growth as rising disposable incomes boost packaged beverage consumption.

Global Shrink And Stretch Sleeve Labels Market Trends and Insights

Growth in Packaged Beverages and Functional Drinks

Functional drinks use sleeve technology to protect light-sensitive nutrients and display expanded nutritional panels. One in three shoppers now ranks immune support as a top purchase criterion, strengthening demand for drinks formulated with vitamin C, elderberry, and probiotics. Full-body graphics give brands 150% more printable area than pressure-sensitive labels, allowing claims, QR codes, and authenticity seals. Premier Protein trimmed plastic by 35% by migrating to PET bottles wrapped in light-blocking shrink sleeves that feature perforations for easy removal during recycling. Craft brewers that previously needed orders of 100,000 decorated cans now source as few as 7,000 cans fitted with shrink sleeves, widening access for seasonal releases.

Digital Inkjet Short-Run Printing Lowering MOQ for Niche SKUs

Water-based inkjet presses achieve production speeds 2.3 times higher than earlier systems while eliminating solvent residue concerns in food packaging. Converters now profitably accept 1,000-unit jobs versus the 100,000-unit threshold required for flexography, enabling hyper-targeted SKUs for regional promotions and e-commerce bundles. Design iterations finalize in days, not weeks, giving marketers real-time feedback loops. Digital volume is projected to reach 9.7% of total label output by 2029, expanding at a 4.4% CAGR in square-meter terms. Shrink and stretch sleeve labels market participants that integrate inline finishing with inkjet heads gain agility that legacy gravure lines cannot match.

Competition from Stand-Up Pouches and Direct-to-Container Printing

Lightweight pouches use 60% less plastic than rigid bottles and cost only USD 0.20 per unit compared with USD 0.50 for comparable PET containers.Digital can printers such as Velox now run 500 cans per minute, eliminating sleeve film altogether and appealing to sustainability-focused craft brands. Direct decoration removes the heat tunnel, trim scrap, and adhesive usage inherent to shrink lines. Cost differentials widen in high-volume carbonated beverages where sleeve application adds 2-2.5 times unit cost relative to offset printing. The shrink and stretch sleeve labels market nonetheless preserves relevance by serving irregular containers that pouches or cans cannot mimic.

Other drivers and restraints analyzed in the detailed report include:

- Demand for 360° High-Definition Graphics to Boost Shelf Appeal

- Shift Toward Recyclable PETG and Floatable Sleeve Films

- Resin-Price Volatility from Geopolitical Supply Shocks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Shrink sleeves controlled 73.2% of the shrink and stretch sleeve labels market in 2024, reflecting their proven fit for complex bottle geometries and tamper-evident safety seals. High-speed automatic applicators run beyond 800 bottles per minute with error rates under 0.5%, a performance metric difficult for alternate formats. Stretch sleeves need no heat tunnel, trimming energy use by up to 40%, and support recycling because consumers can easily remove them before disposal. The segment's 8.3% CAGR through 2030 surpasses overall market pace as European beverage brands adopt low-carbon packaging to achieve Scope 3 commitments.

Although shrink technology retains primacy, future production likely evolves toward a dual-solution ecosystem. Shrink formats will secure pharmaceutical vials, functional drinks, and contoured household cleaners that demand form-fitting coverage. Stretch sleeves will expand in water, dairy, and economy cola where price sensitivity intersects with sustainability positioning. Production lines increasingly pair servo-driven mandrel applicators with vision systems that inspect sleeve placement in real time, minimizing rework. Suppliers confirm that both sleeve types now accept the same water-based inkjet inks, simplifying graphic changeovers and reinforcing flexible manufacturing strategies in the shrink and stretch sleeve labels market.

Shrink and Stretch Sleeve Labels Market is Segmented by Type (Shrink Sleeve, Stretch Sleeve), Material (PVC, PET/PET-G, PE, OPP and OPS, Other Materials), End User (Food, Soft Drinks, Alcoholic Drinks, Cosmetics and Household, Pharmaceutical, Other End Users), and Geography (North America, South America, Europe, Asia-Pacific, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe retained 29.8% revenue in 2024 due to robust environmental policies and a culture of premium packaging. Germany, France, and the United Kingdom direct a sizable share of capital expenditure toward sleeve film lines fitted with energy-efficient infrared tunnels. EU Packaging and Packaging Waste Regulation stipulates recyclability by 2030, driving demand for PET-based sleeves that detach cleanly in wash plants. The region's average selling price per thousand sleeves exceeds the global mean by 12% because of sophisticated graphic requirements and low minimum runs requested by boutique spirits.

Asia-Pacific records the fastest trajectory at an 8.1% CAGR thanks to surging disposable income, urbanization, and the rise of functional beverages. China's express packaging standard GB 43352-2023 restricts heavy metals in inks, compelling local converters to adopt compliant chemistries. Thailand pilots label-free PET bottles that store product data in QR codes printed on caps, pressuring traditional sleeve volumes yet opening new avenues for smart interactive films. Japan's early adoption of water-based inkjet for flexible film aligns with its plastics resource circulation act, fostering home-grown innovations that resonate across regional markets.

North America benefits from a vibrant craft beer ecosystem and a well-established healthcare framework. Tamper-evident needs in pharmaceuticals and over-the-counter nutritional supplements ensure a baseline of steady demand. South America leverages abundant PET resin supply yet remains exposed to currency swings that limit capital spending on high-end presses. The Middle East and Africa trail in installed capacity but exhibit pockets of high value in premium imported spirits and personal care, which rely on sleeves for brand elevation. Taken together, geographic diversity underpins the long-term resilience of the shrink and stretch sleeve labels market.

- CCL Industries

- Fuji Seal International

- Berry Global Group

- Multi-Color Corporation

- KP Klockner Pentaplast

- Amcor PLC

- Huhtamaki Oyj

- Fort Dearborn Company

- Taghleef Industries

- Siegwerk Druckfarben

- Macfarlane Labels

- Avery Dennison Corp.

- Clondalkin Group

- Cenveo Worldwide

- Schur Flexibles

- Hammer Packaging

- Sleeve Seal Inc.

- PDC-Europe

- Fortalab Labels

- Akar Shrink Packs

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Demand for 360 degrees high-definition graphics to boost shelf appeal

- 4.2.2 Rising demand for tamper-evident and anti-counterfeit packaging

- 4.2.3 Growth in packaged beverages and functional drinks

- 4.2.4 Shift toward recyclable PETG and floatable sleeve films

- 4.2.5 Digital inkjet short-run printing lowering MOQ for niche SKUs

- 4.2.6 Smart interactive features (thermochromic, QR) enabling marketing

- 4.3 Market Restraints

- 4.3.1 Recycling hurdles of multimaterial sleeves contaminating PET streams

- 4.3.2 Competition from stand-up pouches and direct-to-container printing

- 4.3.3 Resin-price volatility from geopolitical supply shocks

- 4.3.4 EU/NA curbs on PVC sleeves inflating compliance costs

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

- 4.8 Assesment of macroeconomic Factors on the market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Shrink Sleeve

- 5.1.2 Stretch Sleeve

- 5.2 By Material

- 5.2.1 PVC

- 5.2.2 PET / PET-G

- 5.2.3 PE

- 5.2.4 OPP and OPS

- 5.2.5 Other Materials (PO, PLA, etc.)

- 5.3 By End User

- 5.3.1 Food

- 5.3.2 Soft Drinks

- 5.3.3 Alcoholic Drinks

- 5.3.4 Cosmetics and Household

- 5.3.5 Pharmaceutical

- 5.3.6 Other End Users

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 United Kingdom

- 5.4.3.2 Germany

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 India

- 5.4.4.3 Japan

- 5.4.4.4 South Korea

- 5.4.4.5 Australia and New Zealand

- 5.4.4.6 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 Middle East

- 5.4.5.1.1 Saudi Arabia

- 5.4.5.1.2 UAE

- 5.4.5.1.3 Turkey

- 5.4.5.1.4 Rest of Middle East

- 5.4.5.2 Africa

- 5.4.5.2.1 South Africa

- 5.4.5.2.2 Egypt

- 5.4.5.2.3 Nigeria

- 5.4.5.2.4 Rest of Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 CCL Industries

- 6.4.2 Fuji Seal International

- 6.4.3 Berry Global Group

- 6.4.4 Multi-Color Corporation

- 6.4.5 KP Klockner Pentaplast

- 6.4.6 Amcor PLC

- 6.4.7 Huhtamaki Oyj

- 6.4.8 Fort Dearborn Company

- 6.4.9 Taghleef Industries

- 6.4.10 Siegwerk Druckfarben

- 6.4.11 Macfarlane Labels

- 6.4.12 Avery Dennison Corp.

- 6.4.13 Clondalkin Group

- 6.4.14 Cenveo Worldwide

- 6.4.15 Schur Flexibles

- 6.4.16 Hammer Packaging

- 6.4.17 Sleeve Seal Inc.

- 6.4.18 PDC-Europe

- 6.4.19 Fortalab Labels

- 6.4.20 Akar Shrink Packs

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment