|

市場調查報告書

商品編碼

1910914

歐洲車隊管理:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031 年)Europe Fleet Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

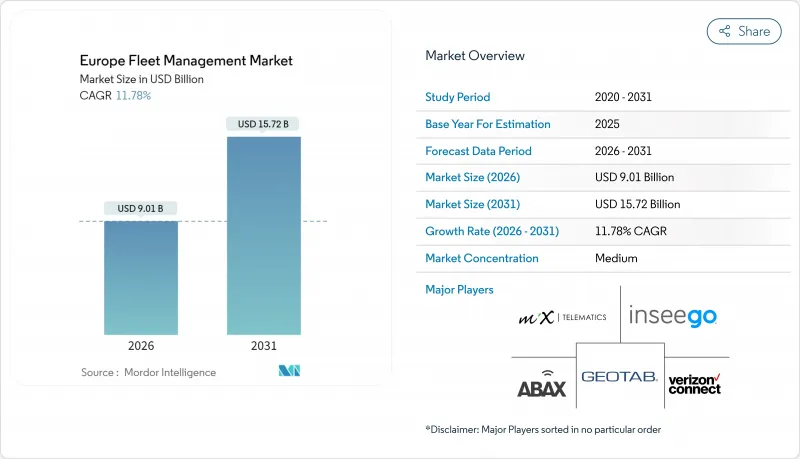

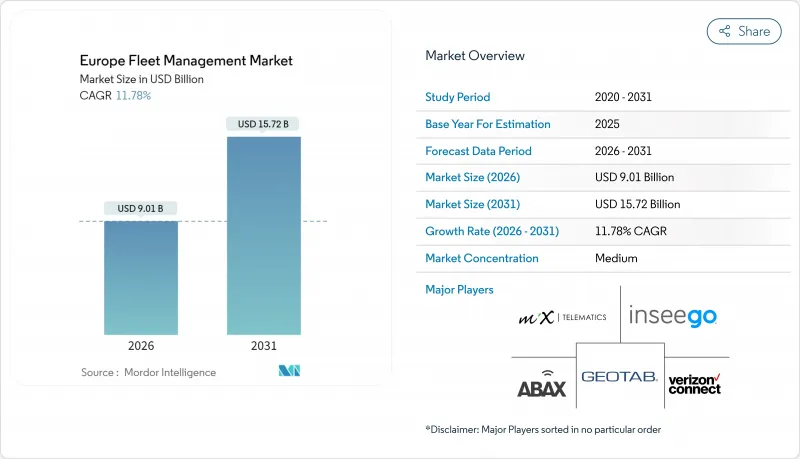

2025年歐洲車隊管理市場價值為80.6億美元,預計到2031年將達到157.2億美元,高於2026年的90.1億美元。

預測期(2026-2031 年)的複合年成長率預計為 11.78%。

監管壓力不斷加大、聯網汽車架構的普及以及「最後一公里」物流的日益密集,共同推動了潛在需求的成長。歐盟智慧行車記錄器第二階段法規將於2025年生效,該法規將強制要求即時資料傳輸,使遠端資訊處理技術從可選的效率提升工具轉變為一項合規要求。電子商務交易量的成長增加了都市區配送里程,促使營運商進行更精細的路線最佳化和駕駛員行為分析。同時,蜂巢式物聯網資費的下降和eSIM的廣泛應用降低了連接成本,而5G網路覆蓋範圍的擴大將支援人工智慧影像安全監控等高頻寬應用。汽車製造商正在開放應用程式介面(API)以實現車輛資料流的商業化,使車隊營運商能夠直接存取嵌入式遠端資訊處理系統。最後,各國碳減量目標和低排放區的實施正在加速電氣化進程,這需要更嚴格的能源和資產協調。

歐洲車隊管理市場趨勢與洞察

遵守歐盟智慧行車記錄器強制令第二階段的必要性

這項將於2025年6月生效的強制規定,將要求3.5噸以上的商用車輛持續傳輸位置和行駛時間數據,從定期數據下載轉變為即時監控。違者將面臨1500歐元至15,000歐元的自動罰款,以強制業者實施整合式遠端資訊處理系統。德國大型物流公司已完成系統部署,以避免服務中斷。供應商表示,小規模車隊也擴大要求採用多車訂閱模式,而非單一行車記錄器。隨著營運商傾向於使用統一的管理介面管理所有類型的車輛,這種需求也蔓延至小型貨車和公司共乘領域,從而推動了整個平台的普及率。

電子商務的成長加速了最後一公里配送的最佳化

到2024年,線上銷售額將佔歐洲零售總額的13.4%,而小包裹遞送業者的物流支出中,最後一公里成本將佔41%。隨著消費者期望隔日送達,輕型貨車的行駛里程將比2024年增加23%。像Seur這樣的營運商在實施基於人工智慧的調度系統後,將路線相關成本降低了15%,這充分體現了遠端資訊處理技術的實際投資回報。巴塞隆納、馬德里和巴黎的低排放區透過限制時限的通行,進一步增加了複雜性,使得即時監管數據至關重要。因此,歐洲車隊管理市場正受益於電子商務和環境壓力的整合,這需要持續提供位置、交通和合規資訊。

GDPR合規性增加了實施的複雜性

根據GDPR,員工必須明確同意且可撤銷地使用GPS追蹤功能。 2024年德國的幾起法院案例也證實,全面監控侵犯了員工的權利。對於中型車隊而言,每年用於法律審查、資料保護官和軟體重新設計的成本可能高達約12.5萬歐元。跨國營運商在跨境時,如果遇到監管更為嚴格的國家,可能不得不禁用諸如駕駛員攝影機即時傳輸等功能,這會抵消遠端資訊處理帶來的效率提升,並延長實施週期。

細分市場分析

預計到2025年,雲端服務將佔據歐洲車隊管理市場63.55%的佔有率,並在2031年之前以14.56%的複合年成長率成長,這主要得益於付費使用制和自動軟體更新。德國電信指出,與本地部署解決方案相比,多租戶架構透過避免伺服器採購和維護義務,可將整體擁有成本降低34%。對於車隊管理人員而言,彈性資料儲存無需手動擴展,並可協助他們應對資料量的季節性波動。儘管資料主權問題限制了一些關鍵基礎設施車隊使用私人伺服器,但雲端服務供應商正在透過提供符合GDPR認證的歐盟資料中心來彌補合規性差距。

邊緣運算如今已成為雲端模式的延伸而非替代:對時間需求較高的駕駛輔助運算在車輛處理器上執行,而匯總的分析、報告和空中下載更新則透過中央樞紐進行路由。這種混合方法既滿足了延遲要求,又滿足了管治要求,鞏固了雲端作為歐洲車隊管理市場新部署預設架構的地位。

到2025年,資產管理領域將佔歐洲車隊管理市場規模的26.72%,主要得益於所有營運商對位置和運轉率數據的日益重視。同時,隨著監管機構和保險公司將經濟獎勵與預防事故掛鉤,安全合規工具將以14.34%的複合年成長率成長。安聯為車隊提供高達15%的保費折扣,前提是車隊能夠證明其積極開展駕駛員監控,這加速了高里程宅配服務採用此類工具。歐盟「零願景」(Vision Zero)計畫旨在在2050年實現道路零死亡,該計畫已將基於人工智慧的疲勞檢測和盲點警告作為多個成員國頒發營運許可證的先決條件。供應商現在將安全儀錶板與行車記錄器檔案捆綁在一起,以確保無縫且檢驗的合規性提交。

其他福利

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 歐盟智慧行車記錄器第二階段強制實施(2025年)

- 電子商務推動輕型商用車行駛里程快速成長

- 蜂巢式物聯網費率下降和 eSIM 的普及

- OEM開放API車載資訊服務貨幣化

- 歐盟排放交易體系(EU ETS)低二氧化碳排放車輛的碳權額度

- 5G C-V2X 微型編隊示範測試

- 市場限制

- GDPR 和 ePrivacy 合規的負擔

- 人工智慧視訊遠端資訊處理技術的高額資本投入

- 低排放城市區域的拼湊

- 車載資訊服務晶片供應中斷

- 產業價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 依部署類型

- 按需(雲端)

- 本地部署

- 透過使用

- 資產管理

- 資訊管理

- 駕駛員管理

- 安全合規管理

- 風險管理

- 營運管理

- 按最終用戶行業分類

- 運輸/物流

- 能源公共產業

- 建造

- 製造業

- 其他終端用戶產業

- 按車隊規模

- 小規模(1至50個單位)

- 中等規模(51-250 單位)

- 大型(251 套或以上)

- 按車輛類型

- 輕型商用車

- 大型商用車輛

- 巴士和長途汽車

- 按地區(國家)

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 其他歐洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- TomTom NV(WEBFLEET)

- Verizon Communications Inc.(Verizon Connect)

- Bridgestone Mobility Solutions BV(WEBFLEET)

- Masternaut Ltd.(MICHELIN Connected Fleet)

- Geotab Inc.

- MiX Telematics Ltd.

- Trimble Inc.

- Samsara Inc.

- Powerfleet Inc.(包括 Fleet Complete)

- ABAX Group AS

- Teletrac Navman(Vontier Corp.)

- AT&T Inc.

- Chevin Fleet Solutions Ltd.

- Gurtam(Wialon)

- Avrios International AG

- Mapon SIA

- Fleetster GmbH

- Shiftmove GmbH

- Transpoco Telematics Ltd.

- Fleetio(RareStep Inc.)

- Teltonika Telematics UAB

- Ruptela UAB

- Motive Technologies Inc.

第7章 市場機會與未來展望

The Europe fleet management market was valued at USD 8.06 billion in 2025 and estimated to grow from USD 9.01 billion in 2026 to reach USD 15.72 billion by 2031, at a CAGR of 11.78% during the forecast period (2026-2031).

Rising regulatory pressure, the spread of connected-vehicle architectures, and intensifying last-mile logistics are together expanding addressable demand. The EU smart-tachograph Phase II rule that starts in 2025 compels real-time data transmission, turning telematics from an optional efficiency tool into a compliance requirement. E-commerce volume growth elevates urban delivery mileage, pushing operators toward granular route optimization and driver behaviour analytics. At the same time, falling cellular-IoT tariffs and eSIM adoption lower connectivity costs while 5G coverage enables high-bandwidth applications such as AI video safety monitoring. OEMs are opening application programming interfaces to monetize in-vehicle data streams, giving fleets a direct path to embedded telematics. Finally, national carbon-reduction targets and low-emission zones speed up electrification, which requires tighter energy and asset coordination.

Europe Fleet Management Market Trends and Insights

EU Smart-Tachograph Phase II Mandate Creates Compliance Imperative

The mandate enforced from June 2025 forces every commercial vehicle above 3.5 t to transmit location and driver-hours data continuously, replacing periodic data downloads with real-time oversight. Automatic fines structured between EUR 1,500 and EUR 15,000 leave operators' little choice but to install integrated telematics suites. Large German logistics firms have already completed rollouts to avoid service disruption, and suppliers report that small fleets now request multi-vehicle subscriptions rather than standalone tachographs. Because operators prefer a single pane of glass across all classes of vehicles, demand is spilling into light vans and company-car pools, lifting total platform adoption.

E-Commerce Growth Intensifies Last-Mile Delivery Optimization

Online retail penetration climbed to 13.4% of European sales in 2024, and last-mile costs swallow 41% of logistics spend for parcel operators. Light vans now cover 23% more mileage than in 2024 as consumers expect next-day delivery. Operators such as Seur cut route-related costs by 15% after introducing AI-based scheduling, demonstrating tangible return on telematics. Low-emission zones in Barcelona, Madrid, and Paris add further complexity by restricting time-window access, making real-time regulatory data essential. The Europe fleet management market, therefore benefits from converging e-commerce and environmental pressures that require constant location, traffic, and compliance feeds.

GDPR Compliance Creates Implementation Complexity

Under GDPR, employee consent for GPS tracking must be explicit and revocable, and several German court cases in 2024 confirmed that blanket monitoring infringes worker rights. For medium fleets, annual spending on legal review, data-protection officers, and software redesign totals about EUR 125,000. Multinational operators must sometimes deactivate features such as driver-cam streaming when crossing borders with stricter rules, diluting the efficiency promise of telematics and extending deployment timelines.

Other drivers and restraints analyzed in the detailed report include:

- Cellular-IoT Cost Reductions Enable Mass-Market Adoption

- OEM Telematics Platforms Monetize Connected Vehicle Data

- AI Video Telematics Capital Requirements Limit SME Adoption

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cloud services captured 63.55% of Europe fleet management market share in 2025 and are climbing at a 14.56% CAGR through 2031, propelled by pay-as-you-go pricing and automatic software updates. Deutsche Telekom observes that a multi-tenant architecture trims total cost of ownership by 34% relative to on-premises hosting because operators avoid server procurement and maintenance obligations. For fleet managers, elastic data storage accommodates seasonal volume swings without manual scaling. Data-sovereignty concerns confined some critical infrastructure fleets to private servers, yet cloud providers have responded with EU-based data centers that carry GDPR certification, closing the compliance gap.

Edge computing now operates as an extension of the cloud model rather than a replacement. Time-sensitive driver-assistance calculations run on in-vehicle processors, while aggregate analysis, reporting, and over-the-air updates flow through centralized hubs. This hybrid approach satisfies both latency and governance requirements, cementing cloud as the default architecture for new deployments within the Europe fleet management market.

Asset management held 26.72% of Europe fleet management market size in 2025 because every operator values location and utilization data. Safety and compliance tools, however, are advancing at a 14.34% CAGR because regulators and insurers tie monetary incentives to incident prevention. Allianz provides up to 15% premium discounts when fleets demonstrate proactive driver monitoring, accelerating adoption among high-mileage courier services. The EU Vision Zero program, which aims for zero road fatalities by 2050, positions AI-enabled fatigue detection and blind-spot alerts as pre-requisites for operating licenses in several member states. Vendors now bundle safety dashboards with tachograph files, ensuring compliance submissions are seamless and verifiable.

The Europe Fleet Management Market Report is Segmented by Deployment Type (On-Demand Cloud, On-Premises), Application (Asset Management, Information Management, and More), End-User Vertical (Transportation and Logistics, Energy and Utilities, and More), Fleet Size, Vehicle Type (Light Commercial Vehicles, Heavy Commercial Vehicles, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- TomTom N.V. (WEBFLEET)

- Verizon Communications Inc. (Verizon Connect)

- Bridgestone Mobility Solutions B.V. (WEBFLEET)

- Masternaut Ltd. (MICHELIN Connected Fleet)

- Geotab Inc.

- MiX Telematics Ltd.

- Trimble Inc.

- Samsara Inc.

- Powerfleet Inc. (incl. Fleet Complete)

- ABAX Group AS

- Teletrac Navman (Vontier Corp.)

- AT&T Inc.

- Chevin Fleet Solutions Ltd.

- Gurtam ( Wialon )

- Avrios International AG

- Mapon SIA

- Fleetster GmbH

- Shiftmove GmbH

- Transpoco Telematics Ltd.

- Fleetio ( RareStep Inc. )

- Teltonika Telematics UAB

- Ruptela UAB

- Motive Technologies Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EU smart-tachograph Phase II mandate (2025)

- 4.2.2 E-commerce-driven LCV mileage surge

- 4.2.3 Falling cellular-IoT tariffs and eSIM adoption

- 4.2.4 OEM open-API telematics monetisation

- 4.2.5 EU ETS-2 credits for low-CO? fleets

- 4.2.6 5G C-V2X micro-platooning pilots

- 4.3 Market Restraints

- 4.3.1 GDPR and ePrivacy compliance burden

- 4.3.2 High cap-ex for AI video telematics

- 4.3.3 Patchwork low-emission city zones

- 4.3.4 Telematics-chip supply disruptions

- 4.4 Industry Value-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment Type

- 5.1.1 On-Demand (Cloud)

- 5.1.2 On-Premises

- 5.2 By Application

- 5.2.1 Asset Management

- 5.2.2 Information Management

- 5.2.3 Driver Management

- 5.2.4 Safety and Compliance Management

- 5.2.5 Risk Management

- 5.2.6 Operations Management

- 5.3 By End-user Vertical

- 5.3.1 Transportation and Logistics

- 5.3.2 Energy and Utilities

- 5.3.3 Construction

- 5.3.4 Manufacturing

- 5.3.5 Other End-Users Verticals

- 5.4 By Fleet Size

- 5.4.1 Small (1-50 vehicles)

- 5.4.2 Medium (51-250)

- 5.4.3 Large (251 +)

- 5.5 By Vehicle Type

- 5.5.1 Light Commercial Vehicles

- 5.5.2 Heavy Commercial Vehicles

- 5.5.3 Bus and Coach

- 5.6 By Geography (Country)

- 5.6.1 Germany

- 5.6.2 United Kingdom

- 5.6.3 France

- 5.6.4 Spain

- 5.6.5 Italy

- 5.6.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level overview, market-level overview, core segments, financials, strategic information, market rank/share, products and services, recent developments)

- 6.4.1 TomTom N.V. (WEBFLEET)

- 6.4.2 Verizon Communications Inc. (Verizon Connect)

- 6.4.3 Bridgestone Mobility Solutions B.V. (WEBFLEET)

- 6.4.4 Masternaut Ltd. (MICHELIN Connected Fleet)

- 6.4.5 Geotab Inc.

- 6.4.6 MiX Telematics Ltd.

- 6.4.7 Trimble Inc.

- 6.4.8 Samsara Inc.

- 6.4.9 Powerfleet Inc. (incl. Fleet Complete)

- 6.4.10 ABAX Group AS

- 6.4.11 Teletrac Navman (Vontier Corp.)

- 6.4.12 AT&T Inc.

- 6.4.13 Chevin Fleet Solutions Ltd.

- 6.4.14 Gurtam ( Wialon )

- 6.4.15 Avrios International AG

- 6.4.16 Mapon SIA

- 6.4.17 Fleetster GmbH

- 6.4.18 Shiftmove GmbH

- 6.4.19 Transpoco Telematics Ltd.

- 6.4.20 Fleetio ( RareStep Inc. )

- 6.4.21 Teltonika Telematics UAB

- 6.4.22 Ruptela UAB

- 6.4.23 Motive Technologies Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment