|

市場調查報告書

商品編碼

1892694

自動駕駛車隊營運市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Autonomous Vehicle Fleet Operations Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

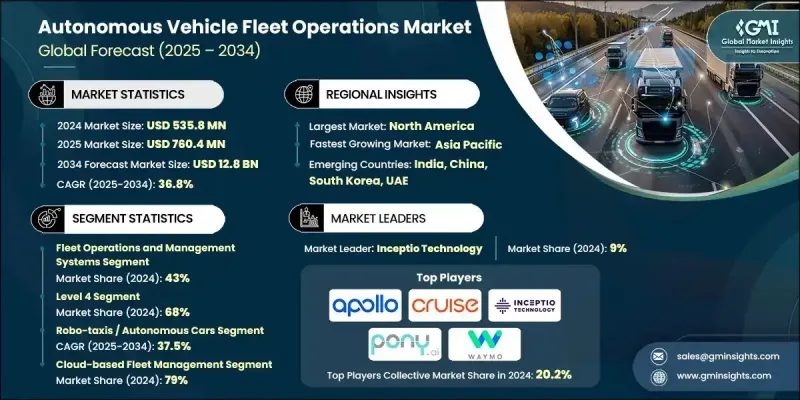

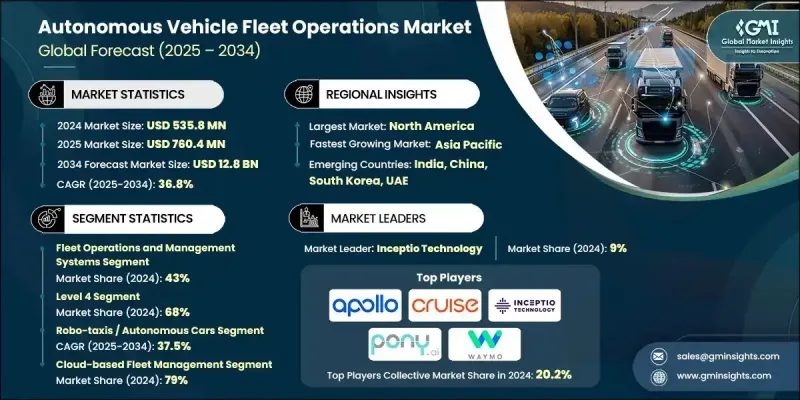

2024 年全球自動駕駛汽車車隊營運市場價值為 5.358 億美元,預計到 2034 年將以 36.8% 的複合年成長率成長至 128 億美元。

隨著企業在客運、配送和無人駕駛計程車營運等領域採用並擴大自動駕駛車輛的應用規模,市場正在迅速擴張。 L4 和 L5 級自動駕駛系統的進步,加上人工智慧驅動的雲端車隊管理平台和高速 5G 連接,正在變革車隊營運模式。美國的監管支援為商業部署提供了一個清晰的框架,使車隊營運商有信心在確保安全的前提下擴展服務規模。這一轉變正推動該行業從試點項目走向廣泛的商業營運,創造了可觀的收入,並每天為成千上萬的用戶提供服務。經濟效益、營運效率和技術創新正在推動自動駕駛技術的普及,而城市交通、貨運物流和消費者期望也不斷重塑市場格局,使自動駕駛車隊營運成為現代交通運輸的基石。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 5.358億美元 |

| 預測值 | 128億美元 |

| 複合年成長率 | 36.8% |

2024年,車隊營運和管理系統市佔率達到43%,預計2034年將以37.1%的複合年成長率成長。這些系統整合了集中監控、預測性維護、路線最佳化和即時分析等軟體。人工智慧演算法和網路安全協議提高了效率並保護了車隊資料。物流、貨運和客運產業的應用推動了這一成長,各公司透過自動化調度、遠端資訊處理整合和分析來改善平台,從而降低營運成本並提高車隊生產力。

2024年,L4級自動駕駛系統佔據了68%的市場佔有率,預計到2034年將以37.2%的複合年成長率成長。 L4級系統可在預設的操作設計範圍內實現完全自主運行,使車輛能夠在特定區域、路況或環境條件下無需人工干預即可行駛。 L4級技術的廣泛商業應用反映了其已獲得監管部門的批准、經濟可行性和營運效率,因為車隊可以在各種地理和氣候條件下降低人工成本,同時確保安全。

預計到2024年,北美自動駕駛車隊營運市場將佔據47%的佔有率。該地區憑藉著雄厚的創投、企業投資和研發投入,引領全球市場。對主要自動駕駛汽車公司的投資加速了車隊擴張和商業化進程。政府機構、州交通部門和產業聯盟之間的合作正在增強區域能力,建立安全協議、遠端操作標準並進行基礎設施升級,從而進一步推動市場成長。

目錄

第1章:方法論

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 4級自動駕駛出行和配送車隊的部署日益增多

- 對經濟高效且無人駕駛的運輸營運的需求日益成長

- 人工智慧、邊緣運算、遠端資訊處理和 5G 連接方面的進步

- 擴大無人駕駛計程車、自動駕駛接駁車和最後一公里配送服務

- 對即時車隊監控、安全和預測性維護的需求日益成長

- 產業陷阱與挑戰

- 高昂的基礎設施、硬體和後端技術成本

- 互聯和遠端管理車隊的網路安全風險

- 市場機遇

- 在城市交通中大規模部署無人駕駛計程車和自動駕駛接駁車

- 最後一公里配送和物流營運的自動化

- 礦業、港口、機場和倉庫的工業車隊自動化

- 建立用於全球監管的遠端艦隊營運中心

- 成長促進因素

- 成長潛力分析

- 監管環境

- 全球監管環境概述

- 聯合國歐洲經濟委員會規章與國際協調

- 美國聯邦管轄權與州管轄權

- 歐盟型式認證框架及實施

- 亞太地區監管碎片化分析

- 各區域的測試和試點計畫要求

- 安全認證和驗證標準

- 資料隱私和網路安全法規

- 責任與保險框架的演變

- 波特的分析

- PESTEL 分析

- 技術與創新格局

- 當前技術趨勢

- 感測器技術發展(LiDAR、雷達、攝影機系統)

- 人工智慧和機器學習在自動駕駛的應用

- 高清地圖和定位技術

- V2X通訊標準及部署

- 新興技術

- 遠端操作和遙操作技術

- 邊緣運算和車載處理

- 用於車隊保護的網路安全技術

- OTA軟體更新功能

- 當前技術趨勢

- 定價分析與成本結構

- 按類型分類的車輛購置成本

- 改裝車輛與專用車輛的經濟性比較

- 車隊管理技術成本

- 遠端營運中心人員配備和基礎設施成本

- 維護和營運費用分析

- 保險和責任成本趨勢

- 總擁有成本 (TCO) 比較

- 車隊服務定價模型

- 專利分析

- 按技術領域分類的專利申請趨勢

- 主要專利持有者和創新領導者

- 車隊管理技術專利

- 遠端操作和調度系統專利

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

- 客戶採納與使用者體驗分析

- 商業機器人計程車普及率指標

- 公共交通機構的採納意向

- 使用者體驗品質與滿意度因素

- 運作可靠度及服務中斷分析

- 無障礙與包容性設計使用者體驗

- 商業貨運及物流用戶採納

- 採礦業的採納與營運接受度

- 經濟影響與產業轉型

- 降低勞動成本的潛力

- 資本投資和基礎設施需求

- 車隊利用率和營運效率經濟學

- 產業整合與市場重組

- 公共部門投資與經濟發展

- 保險及責任市場轉型

- 風險評估與市場逆風

- 安全事故和監管執法行動

- 監管碎片化和合規複雜性

- 技術限制和運行設計領域約束

- 網路安全威脅與資料隱私風險

- 資本密集度和獲利路徑的不確定性

- 公眾接受度與信任度障礙

- 勞動力流失和勞工反對

- 對各業者的關鍵績效指標 (KPI) 進行比較分析

- 艦隊規模和部署指標

- 營運效率和利用率指標

- 可靠性和服務中斷指標

- 安全績效指標

- 經濟績效指標

- 技術成熟度指標

- 監理合規與核准指標

- 客戶採納率與市場滲透率指標

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

- 創投與私募股權投資趨勢

- 政府撥款項目和公共資金

- OEM對 AV 車隊技術的投資

- 併購活動分析

- 資金挑戰和資本需求

第5章:市場估計與預測:依技術分類,2021-2034年

- 車隊營運和管理系統

- 安全、合規和監控系統

- 連接和通訊系統

- 導航和車輛軟體系統

第6章:市場估價與預測:依車輛類型分類,2021-2034年

- 無人駕駛計程車/自動駕駛汽車

- 無人駕駛接駁車

- 自動駕駛卡車

- 無人駕駛送貨車

- 送貨機器人/人行道機器人

- 自主工業車輛

第7章:市場估計與預測:依自主程度分類,2021-2034年

- 3級

- 4級

- 5級

第8章:市場估算與預測:依部署模式分類,2021-2034年

- 基於雲端的車隊管理

- 本地部署解決方案

第9章:市場估算與預測:依最終用途分類,2021-2034年

- 乘客出行業者

- 貨運和物流營運商

- 工業和非公路營運商

- 商業和機構部門

- 其他

第10章:市場估計與預測:依地區分類,2021-2034年

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐

- 葡萄牙

- 克羅埃西亞

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 新加坡

- 泰國

- 印尼

- 越南

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

第11章:公司簡介

- 全球參與者

- Aurora Innovation

- AutoX

- Baidu Apollo

- Cruise

- General Motors

- Inceptio Technology

- Mobileye

- Plus.ai

- Pony.ai

- Scania

- Torc Robotics

- Waymo

- Zoox

- 區域玩家

- ComfortDelGro

- Pinellas Suncoast Transit Authority

- Valley Metro (Phoenix)

- WeRide

- Emerging Technology Innovators

- Forterra

- Kodiak Robotics

- LILEE Systems

- Motional

- Perrone Robotics

The Global Autonomous Vehicle Fleet Operations Market was valued at USD 535.8 million in 2024 and is estimated to grow at a CAGR of 36.8% to reach USD 12.8 billion by 2034.

The market is rapidly expanding as companies adopt and scale self-driving vehicles across passenger mobility, delivery services, and robo-taxi operations. Advances in Level 4 and Level 5 autonomous systems, coupled with AI-driven, cloud-based fleet management platforms and high-speed 5G connectivity, are transforming fleet operations. Regulatory support in the U.S. provides clear frameworks for commercial deployments, giving fleet operators confidence to scale services while ensuring safety. This shift is moving the industry from pilot programs to widespread commercial operations, creating substantial revenue and serving thousands daily. Economic benefits, operational efficiency, and technological innovation are driving adoption, while urban mobility, freight logistics, and consumer expectations continue to reshape the market landscape, positioning autonomous fleet operations as a cornerstone of modern transportation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $535.8 Million |

| Forecast Value | $12.8 Billion |

| CAGR | 36.8% |

The fleet operations and management systems segment held a 43% share in 2024 and is expected to grow at a CAGR of 37.1% through 2034. These systems integrate software for centralized monitoring, predictive maintenance, route optimization, and real-time analytics. AI algorithms and cybersecurity protocols enhance efficiency and protect fleet data. Growth is driven by adoption in logistics, freight, and passenger transport, with companies refining platforms through automated scheduling, telematics integration, and analytics to reduce operational costs and increase fleet productivity.

The Level 4 segment held a 68% share in 2024 and is projected to grow at a CAGR of 37.2% through 2034. Level 4 systems deliver full autonomy within defined operational design domains, allowing vehicles to operate without human intervention in specified areas, road types, or environmental conditions. Widespread commercial adoption of Level 4 technology reflects regulatory approvals, economic viability, and operational efficiency, as fleets can reduce labor costs while maintaining safety across varied geographic and weather conditions.

North America Autonomous Vehicle Fleet Operations Market accounted for a 47% share in 2024. The region leads the global market due to significant venture capital, corporate investment, and R&D expenditure. Investments in major AV companies have accelerated fleet expansion and commercialization. Collaboration between government agencies, state transportation departments, and industry consortia is strengthening regional capabilities, establishing safety protocols, teleoperation standards, and infrastructure upgrades, further boosting market growth.

Key players in the Global Autonomous Vehicle Fleet Operations Market include Aurora Innovation, AutoX, Baidu Apollo, Cruise, Inceptio Technology, Mobileye, Plus.ai, Pony.ai, Torc Robotics, and Waymo. Companies in the Autonomous Vehicle Fleet Operations Market are strengthening their presence through heavy investment in R&D to improve autonomy, AI algorithms, and fleet safety systems. Strategic partnerships with governments, regulators, and infrastructure providers help secure regulatory approvals and facilitate large-scale deployment. Firms are expanding pilot programs into commercial operations while integrating cloud-based fleet management platforms for real-time monitoring, predictive maintenance, and route optimization. Investment in high-speed connectivity, including 5G and edge computing, enhances vehicle communication and operational efficiency.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Technology

- 2.2.3 Vehicle

- 2.2.4 Autonomy Level

- 2.2.5 Deployment Mode

- 2.2.6 End Use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising deployment of Level 4 autonomous mobility and delivery fleets

- 3.2.1.2 Growing demand for cost-efficient and driverless transportation operations

- 3.2.1.3 Advancements in AI, edge computing, telematics, and 5G connectivity

- 3.2.1.4 Expansion of robo-taxi, autonomous shuttle, and last-mile delivery services

- 3.2.1.5 Increasing need for real-time fleet monitoring, safety, and predictive maintenance

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High infrastructure, hardware, and backend technology costs

- 3.2.2.2 Cybersecurity risks in connected and remotely managed fleets

- 3.2.3 Market opportunities

- 3.2.3.1 Large-scale deployment of robo-taxis and autonomous shuttles in urban mobility

- 3.2.3.2 Automation of last-mile delivery and logistics operations

- 3.2.3.3 Industrial fleet automation in mining, ports, airports, and warehouses

- 3.2.3.4 Development of remote fleet operations centers for global supervision

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 Global regulatory landscape overview

- 3.4.2 UNECE regulations & international harmonization

- 3.4.3 Federal vs state jurisdiction in the United States

- 3.4.4 EU type-approval framework & implementation

- 3.4.5 Asia-Pacific regulatory fragmentation analysis

- 3.4.6 Testing & pilot program requirements by region

- 3.4.7 Safety certification & validation standards

- 3.4.8 Data privacy & cybersecurity regulations

- 3.4.9 Liability & insurance framework evolution

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.1.1 Sensor technology evolution (LiDAR, radar, camera systems)

- 3.7.1.2 AI & machine learning for autonomous driving

- 3.7.1.3 HD mapping & localization technologies

- 3.7.1.4 V2X communication standards & deployment

- 3.7.2 Emerging technologies

- 3.7.2.1 Remote operations & teleoperation technologies

- 3.7.2.2 Edge computing & onboard processing

- 3.7.2.3 Cybersecurity technologies for fleet protection

- 3.7.2.4 OTA software update capabilities

- 3.7.1 Current technological trends

- 3.8 Pricing analysis & cost structure

- 3.8.1 Vehicle acquisition costs by type

- 3.8.2 Retrofitting vs purpose-built vehicle economics

- 3.8.3 Fleet management technology costs

- 3.8.4 Remote operations center staffing & infrastructure costs

- 3.8.5 Maintenance & operating expense analysis

- 3.8.6 Insurance & liability cost trends

- 3.8.7 Total cost of ownership (TCO) comparison

- 3.8.8 Pricing models for fleet services

- 3.9 Patent analysis

- 3.9.1 Patent filing trends by technology area

- 3.9.2 Key patent holders & innovation leaders

- 3.9.3 Fleet management technology patents

- 3.9.4 Remote operations & dispatch system patents

- 3.10 Sustainability and environmental aspects

- 3.10.1 Sustainable practices

- 3.10.2 Waste reduction strategies

- 3.10.3 Energy efficiency in production

- 3.10.4 Eco-friendly Initiatives

- 3.11 Carbon footprint considerations

- 3.12 Customer adoption & user experience analysis

- 3.12.1 Commercial robotaxi adoption metrics

- 3.12.2 Public transit agency adoption intentions

- 3.12.3 User experience quality & satisfaction factors

- 3.12.4 Operational reliability & service disruption analysis

- 3.12.5 Accessibility & inclusive design user experience

- 3.12.6 Commercial freight & logistics user adoption

- 3.12.7 Mining industry adoption & operational acceptance

- 3.13 Economic impact & industry transformation

- 3.13.1 Labor cost reduction potential

- 3.13.2 Capital investment & infrastructure requirements

- 3.13.3 Fleet utilization & operational efficiency economics

- 3.13.4 Industry consolidation & market restructuring

- 3.13.5 Public sector investment & economic development

- 3.13.6 Insurance & liability market transformation

- 3.14 Risk assessment & market headwinds

- 3.14.1 Safety incidents & regulatory enforcement actions

- 3.14.2 Regulatory fragmentation & compliance complexity

- 3.14.3 Technology limitations & operational design domain constraints

- 3.14.4 Cybersecurity threats & data privacy risks

- 3.14.5 Capital intensity & path to profitability uncertainty

- 3.14.6 Public acceptance & trust barriers

- 3.14.7 Workforce displacement & labor opposition

- 3.15 Comparative analysis of key performance indicators (KPIs) across operators

- 3.15.1 Fleet scale & deployment metrics

- 3.15.2 Operational efficiency & utilization metrics

- 3.15.3 Reliability & service disruption metrics

- 3.15.4 Safety performance metrics

- 3.15.5 Economic performance metrics

- 3.15.6 Technology maturity metrics

- 3.15.7 Regulatory compliance & approval metrics

- 3.15.8 Customer adoption & market penetration metrics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

- 4.6.4.1 Venture capital & private equity investment trends

- 4.6.4.2 Government grant programs & public funding

- 4.6.4.3 OEM investment in AV fleet technologies

- 4.6.4.4 Merger & acquisition activity analysis

- 4.6.4.5 Funding challenges & capital requirements

Chapter 5 Market Estimates & Forecast, By Technology, 2021 - 2034 (USD Mn, Units)

- 5.1 Key trends

- 5.2 Fleet operations and management systems

- 5.3 Safety, compliance and monitoring systems

- 5.4 Connectivity and communication systems

- 5.5 Navigation and vehicle software systems

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 (USD Mn, Units)

- 6.1 Key trends

- 6.2 Robo-taxis / autonomous cars

- 6.3 Autonomous shuttles

- 6.4 Autonomous trucks

- 6.5 Autonomous delivery vans

- 6.6 Delivery robots / sidewalk robots

- 6.7 Autonomous industrial vehicles

Chapter 7 Market Estimates & Forecast, By Autonomy Level, 2021 - 2034 (USD Mn, Units)

- 7.1 Key trends

- 7.2 Level 3

- 7.3 Level 4

- 7.4 Level 5

Chapter 8 Market Estimates & Forecast, By Deployment Mode, 2021 - 2034 (USD Mn, Units)

- 8.1 Key trends

- 8.2 Cloud-based fleet management

- 8.3 On-premises solutions

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Mn, Units)

- 9.1 Key trends

- 9.2 Passenger mobility operators

- 9.3 Freight and logistics operators

- 9.4 Industrial and off-highway operators

- 9.5 Commercial and institutional sectors

- 9.6 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 US

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.3.8 Portugal

- 10.3.9 Croatia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Singapore

- 10.4.7 Thailand

- 10.4.8 Indonesia

- 10.4.9 Vietnam

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

- 10.6.4 Turkey

Chapter 11 Company Profiles

- 11.1 Global Players

- 11.1.1 Aurora Innovation

- 11.1.2 AutoX

- 11.1.3 Baidu Apollo

- 11.1.4 Cruise

- 11.1.5 General Motors

- 11.1.6 Inceptio Technology

- 11.1.7 Mobileye

- 11.1.8 Plus.ai

- 11.1.9 Pony.ai

- 11.1.10 Scania

- 11.1.11 Torc Robotics

- 11.1.12 Waymo

- 11.1.13 Zoox

- 11.2 Regional Players

- 11.2.1 ComfortDelGro

- 11.2.2 Pinellas Suncoast Transit Authority

- 11.2.3 Valley Metro (Phoenix)

- 11.2.4 WeRide

- 11.3 Emerging Technology Innovators

- 11.3.1 Forterra

- 11.3.2 Kodiak Robotics

- 11.3.3 LILEE Systems

- 11.3.4 Motional

- 11.3.5 Perrone Robotics