|

市場調查報告書

商品編碼

1910905

醫藥塑膠包裝:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Pharmaceutical Plastic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

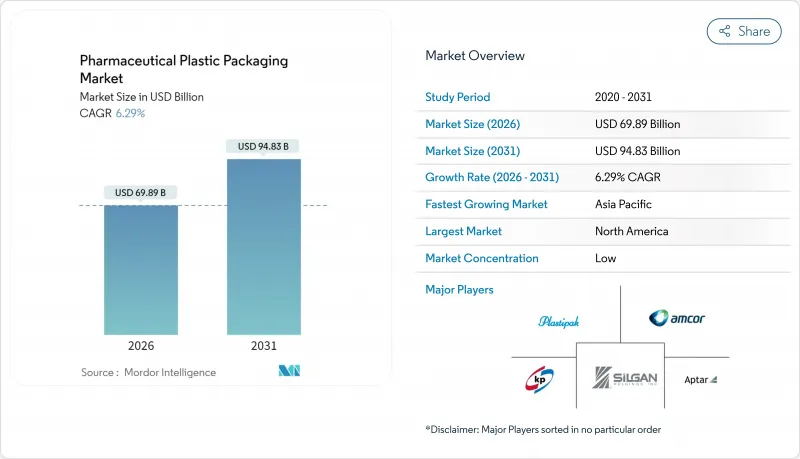

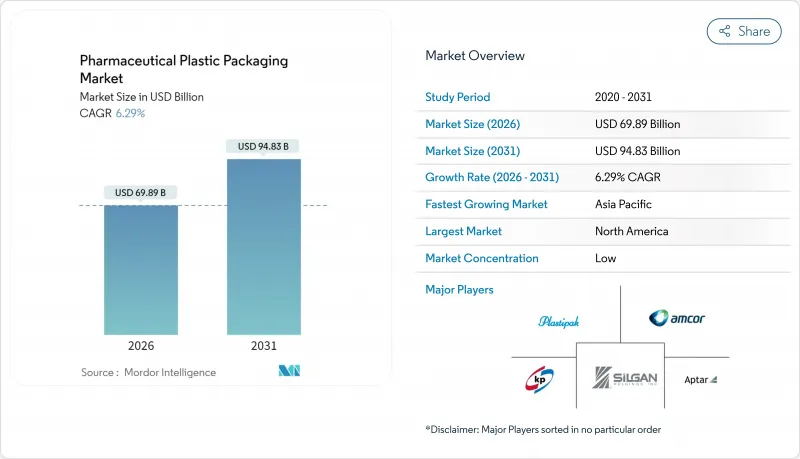

預計醫藥塑膠包裝市場將從 2025 年的 657.5 億美元成長到 2026 年的 698.9 億美元,預計在 2031 年達到 948.3 億美元,2026 年至 2031 年的複合年成長率為 6.29%。

生物製藥和注射劑市場佔有率的不斷成長、更嚴格的可追溯性法規以及日益成熟的永續性要求(有利於可回收和生物基聚合物)是推動成長的主要因素。歐盟的《包裝和包裝廢棄物法規》(PPWR)於2025年2月生效,強制要求到2030年實現包裝的完全可回收性,並加速材料替代計畫的實施。北美市場的需求受惠於《藥品供應鏈安全法案》(DSCSA)將於2025年11月到期,該法案將推動智慧化、可序列化包裝形式的發展。亞太地區的製造商正利用監管協調和學名藥產量激增的優勢,提升該地區的成長前景。中型加工商之間的整合(例如,安姆科以135億美元收購貝瑞世界)為解決無PFAS配方和循環經濟投資問題提供了規模優勢。

全球醫藥塑膠包裝市場趨勢及展望

生物製藥和注射對塑膠包裝的需求日益成長

隨著生物製藥在新核准藥物中所佔比例不斷上升,其易受鹼性物質浸出、分層和破損的影響,使得先進聚合物成為首選的初級包裝容器。 Gerresheimer 的環烯烴聚合物注射器兼具玻璃般的透明度和優異的抗破損性能,最大限度地減少了昂貴生物製藥的損失。預計到 2030 年,全球生物製藥市場規模將達到 8,561 億美元,這將推動對可靠注射劑包裝的需求。經過驗證的吹灌封容器在九個月內對單株抗體的效力和 pH 值均無漂移,從而擴大了聚合物在無菌應用中的使用範圍。疫情期間,管瓶的短缺凸顯了供應鏈風險,並促使企業採取雙重採購策略,優先選擇具有同等監管核准的塑膠容器。

擴大新興市場的學名藥生產

中國的監管改革,特別是上市核准持有人制度的引入,縮短了核准週期,促進了契約製造合作,並增加了包裝需求。北京發布的《2025年指南》包含24項措施,旨在2027年實現中國藥物警戒體系的現代化,並為合規包裝生產線設定了明確的目標。印度與東協之間的核准計畫進一步協調了標準,使加工商能夠在多個市場部署單一設計。對價格敏感的學名藥也優先考慮成本效益高且在長途出口運輸中保持堅固耐用的塑膠。

擴大塑膠廢棄物法規(歐盟SUP、EPR等)

《塑膠廢棄物法規》(PPWR) 規定,到 2030 年,歐盟銷售的所有包裝都必須強制回收利用,引入了生產者延伸責任制 (EPR) 費用和再生材料含量標準(PET 食品包裝的最低含量為 30%),這將增加企業的資金投入和合規負擔。雖然藥品包裝容器可享有醫療保健豁免,但品牌所有者仍需為回收計畫提供資金,重新設計多層複合材料,並在 2026 年前逐步淘汰接觸材料中的 PFAS。將於 2028 年推出的統一標誌將需要更改包裝設計,而 5% 的材料減量目標將進一步加大對本已較薄的壁厚規格的壓力。

細分市場分析

聚丙烯以其優異的耐滅菌性和合規性而聞名,預計到2025年將以30.12%的市場佔有率繼續保持主導地位。然而,生物基和再生塑膠預計將以9.05%的複合年成長率超越現有產品,並在2031年重塑醫藥塑膠包裝市場格局。 Avient公司的MevoPure產品線展現了循環經濟與合規性的完美結合,在維持ISO 10993和USP VI認證的同時,也實現了高達120%的碳足跡減少。歐盟的再生材料含量強制要求和美國FDA的染料禁令正在加速對再生原料的需求。 UPM公司推出的木質瓶也證實了富含木質素的化學技術的商業性可行性。

第二代生物聚烯和化學回收PET已達到醫藥級純度,無需改造設備即可直接取代。然而,醫藥級再生材料的供應有限,阻礙了其即時擴大生產規模,並導致價格溢價。大型樹脂公司正在其歐洲和北美基地附近擴建產能,以縮短物流運輸;而亞洲公司則在尋求出口級再生樹脂認證,以滿足快速成長的訂單。這導致醫藥塑膠包裝市場呈現出平衡:傳統聚丙烯(PP)仍佔據主導地位,而可再生聚合物則在符合PPWR(塑膠包裝回收)和企業淨零排放承諾的前提下,謹慎但加速地滲透。

截至2025年,受口服固體製劑的普及推動,瓶裝和固態容器將佔醫藥塑膠包裝市場26.05%的佔有率。然而,預填充式注射器和藥筒將成為主要的成長動力,由於生物製藥、GLP-1注射和居家給藥藥物的普及,其複合年成長率將達到8.29%。 BD的RFID技術iDFill注射器將注射器和包裝整合在一起,可根據《藥品安全追蹤法案》(DSCSA)的要求提供即時可追溯性。

數位連接、高黏度耐受性和與內建注射器的兼容性,正推動這些容器從普通商品轉向高附加價值工程系統。同時,儘管管瓶和安瓿瓶在醫院藥房仍然必不可少,但劑量範圍生物製藥正擴大轉向使用格雷斯海默公司的聚合物EZ-fill智慧管瓶,這種小瓶簡化了灌裝和表面處理工程。條狀包裝、小袋和軟包裝正逐漸成為偏遠地區藥房的郵寄包裝選擇,因為在這些地區,郵資和緩衝成本使得硬質容器無利可圖。

區域分析

到2025年,北美將佔據全球醫藥塑膠包裝市場36.05%的佔有率,這得益於先進的GMP工廠、DSCSA序列化截止日期以及回流激勵措施。 FDA的指導意見鼓勵採用連續生產和智慧感測器,本地加工商正在將RFID技術嵌入包裝壁,並對不含PFAS的薄膜合格。進口樹脂關稅的徵收提高了國內產能運轉率,鼓勵了對生物基原料的投資,並穩定了易受地緣政治衝擊的供應鏈。

在歐洲,嚴格的法規與永續性相結合,建構了一個強大且不斷發展的市場基礎。 《塑膠包裝法規》(PPWR) 強制要求可回收性、生產者延伸責任制 (EPR) 收費以及禁用全氟烷基和多氟烷基物質 (PFAS),從而鼓勵重新設計,刺激區域加工商增加研發預算。 《一次性塑膠指令》推廣單一材料泡殼薄膜,而國家生態調節計畫則鼓勵低碳包裝形式。北歐和德語區國家正在主導試行回收使用過的吸入器和注射器,為聚丙烯提供了閉合迴路途徑。

到2031年,亞太地區醫藥塑膠包裝市場將達到9.76%的最高複合年成長率。中國正根據其2025年行動計畫加快推進包裝品質審核與ICH Q9標準的對接,同時增加對綠色工廠的投入。印度正在加強藥典偵測和數位化溯源,為智慧標籤供應商創造機會。東協核准協議簡化了數月的文書流程,使出口商能夠在成員國之間運輸符合標準的包裝。日本的生產者責任延伸制度已擴展至醫療包裝領域,促進了PCR級聚丙烯的採購。這些利多因素共同推動了亞太地區開發中國家和成熟市場醫藥塑膠包裝市場的發展。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 生物製藥和注射對塑膠包裝材料的需求不斷成長

- 擴大新興國家的學名藥生產

- 輕且不易碎,這是一項物流優勢。

- 居家醫療和電子商務中單劑量包裝的應用

- 現場BFS和3D列印模具用於個人化醫療

- 抗菌/智慧聚合物相容包裝材料

- 市場限制

- 不斷擴大的塑膠廢棄物法規(歐盟SUP、EPR等)

- 波動性聚合物原料價格

- 政策轉變:從生物玻璃瓶轉向COP管瓶

- 醫藥級再生樹脂供不應求

- 供應鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭強度

- 評估地緣政治情勢

第5章 市場規模與成長預測

- 按原料

- 聚丙烯(PP)

- 聚對苯二甲酸乙二醇酯(PET)

- 高密度聚苯乙烯(HDPE)

- 低密度聚乙烯(LDPE)

- 環烯烴聚合物/共聚物(COP/COC)

- 生物基和再生塑膠

- 依產品類型

- 瓶子和固態容器

- 管瓶和安瓿

- 預填充式注射器和藥筒

- 泡殼和條狀包裝

- 小袋/條狀包裝/小袋

- 瓶蓋、瓶塞和封口

- 點滴袋和軟袋

- 按包裝類型

- 難的

- 柔軟的

- 透過藥物輸送途徑

- 口服

- 注射劑/可注射劑

- 眼科/鼻科

- 局部/經皮

- 最終用戶

- 製藥公司

- 合約研發生產組織(CDMO)

- 醫院和診所

- 居家醫療環境

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲和紐西蘭

- 亞太其他地區

- 中東和非洲

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 埃及

- 其他非洲地區

- 中東

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Amcor PLC

- Gerresheimer AG

- AptarGroup Inc.

- West Pharmaceutical Services Inc.

- Klockner Pentaplast Group

- Comar LLC

- O.Berk Company LLC

- Pretium Packaging LLC

- Drug Plastics and Glass Co. Inc.

- Gil-Pack Ltd.

- Alpla Group

- Silgan Holdings Inc.

- Placon Corporation

- Sealed Air Corporation

- Plastipak Holdings

第7章 市場機會與未來展望

The pharmaceutical plastic packaging market is expected to grow from USD 65.75 billion in 2025 to USD 69.89 billion in 2026 and is forecast to reach USD 94.83 billion by 2031 at 6.29% CAGR over 2026-2031.

Growth rests on the rising share of biologics and injectables, stricter traceability rules, and fast-maturing sustainability mandates that reward recyclable and bio-based polymers. In February 2025 the EU's Packaging and Packaging Waste Regulation (PPWR) entered into force, requiring full recyclability by 2030 and accelerating material substitution programs.North American demand benefits from the Drug Supply Chain Security Act (DSCSA) deadline in November 2025, which pushes smart, serialization-ready formats. Asia-Pacific manufacturers leverage regulatory harmonization and surging generic output, lifting the region's growth prospects. Consolidation among mid-tier converters, exemplified by Amcor's USD 13.5 billion merger with Berry Global, brings scale to tackle PFAS-free formulations and circular-economy investments.

Global Pharmaceutical Plastic Packaging Market Trends and Insights

Growing Demand for Plastic Packs for Biologics and Injectables

Biologics now account for a rising share of new drug approvals, and their sensitivity to alkali leaching, delamination, and breakage positions advanced polymers as preferred primary containers. Cyclic olefin polymer syringes from Gerresheimer combine glass-like transparency with superior break resistance, helping minimize costly biologic losses. The global biopharmaceutical sector is expected to reach USD 856.1 billion by 2030, reinforcing demand for high-integrity parenteral packaging. Validated blow-fill-seal containers show no potency or pH drift for monoclonal antibodies over nine months, broadening polymer uptake in sterile applications. During the pandemic, shortages of glass vials highlighted supply-chain risks, prompting dual-sourcing policies that now favor plastic options with equivalent regulatory acceptance.

Expansion of Generic Drug Production in Emerging Markets

Regulatory reforms in China, notably the Marketing Authorization Holder system, shorten approval cycles and attract contract manufacturing alliances that boost packaging volumes. Beijing's 2025 guidance contains 24 measures to modernize drug oversight by 2027, creating clear targets for compliant packaging lines. India and ASEAN mutual recognition programs further harmonize specifications, letting converters scale a single design across multiple markets. Price-sensitive generics also prioritize cost-efficient plastics that remain robust during long-distance export shipments.

Extended Plastics-Waste Regulation (EU SUP, EPR etc.)

The PPWR obliges all packs sold in the EU to be recyclable by 2030 and introduces EPR fees plus recycled-content thresholds-30% for PET food packs-adding capital and compliance burdens. Healthcare exemptions exist for immediate drug containers, yet brand owners must still fund collection schemes, redesign multilayer laminates, and phase out PFAS in contact materials by 2026. Harmonized symbols due in 2028 compel artwork changes, while the 5% material-reduction target squeezes already lean wall-thickness specs.

Other drivers and restraints analyzed in the detailed report include:

- Lightweight, Shatter-Proof Logistics Advantage

- Home-Health and E-Commerce Unit-Dose Adoption

- Volatile Polymer Feedstock Pricing

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Polypropylene retained leadership with 30.12% of pharmaceutical plastic packaging market share in 2025 thanks to its sterilization tolerance and regulatory familiarity. Yet bio-based and recycled grades are set to outpace all incumbents at 9.05% CAGR, reshaping the pharmaceutical plastic packaging market through 2031. Avient's Mevopur range delivers up to 120% carbon-footprint reduction while keeping ISO 10993 and USP VI credentials, illustrating how circularity and compliance now co-exist. EU recycled-content quotas and the FDA's looming dye phase-out intensify demand for renewable feedstocks. UPM's wood-based bottle launch underscores commercial feasibility of lignin-rich chemistries.

Second-generation bio-polyolefins and chemically recycled PET now reach pharmaceutical purity, unlocking drop-in substitution without retooling. However, limited pharma-grade recyclate supplies restrain immediate scale, creating price premiums. Resin majors ramp capacity near European and North American hubs to shorten logistics, while Asian players eye export-grade r-resin certification to capture surging orders. The pharmaceutical plastic packaging market therefore balances legacy PP dominance with measured yet accelerating penetration of renewable polymers that align with PPWR and corporate net-zero pledges.

Bottles and solid containers captured 26.05% of the pharmaceutical plastic packaging market in 2025 owing to oral solid dosage prevalence. Yet pre-fillable syringes and cartridges headline the growth story, advancing at 8.29% CAGR as biologics, GLP-1 injectables, and home-administered drugs proliferate. BD's RFID-enabled iDFill syringe merges device and pack, supplying real-time traceability that dovetails with DSCSA needs.

Digital connectivity, higher viscosity tolerances, and on-body injector compatibility move these containers from commodity to high-value engineered systems. Conversely, vials and ampoules remain essential for hospital compounding, though dose-banded biologics see a shift to polymer-based EZ-fill Smart vials from Gerresheimer that streamline fill-finish operations. Stick packs, sachets, and pouches gain foothold in tele-pharmacy mailers where postage and cushioning costs punish rigid lines.

The Pharmaceutical Plastic Packaging Market Report is Segmented by Raw Material (Polypropylene, Polyethylene Terephthalate, and More), Product Type (Bottles and Solid Containers, Vials and Ampoules, and More), Packaging Format (Rigid, Flexible), Route of Drug Delivery (Oral, Parenteral/Injectable, and More), End-User (Pharma Manufacturers, Cdmos, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 36.05% of the pharmaceutical plastic packaging market in 2025, supported by advanced GMP plants, DSCSA serialization deadlines, and reshoring incentives. FDA guidance endorses continuous manufacturing and smart sensors, pushing local converters to embed RFID in pack walls and qualify PFAS-free films.Tariffs on imported resins raise domestic capacity utilization and spur investment in bio-based feedstocks, stabilizing supply chains vulnerable to geopolitical shocks.

Europe combines regulatory stringency with sustainability leadership, forging a robust yet evolving market base. The PPWR enforces recyclability, EPR fees, and PFAS bans, forcing redesigns that stimulate R&D budgets among regional converters. Single-Use Plastics Directive restrictions encourage mono-material blister films, while national eco-modulation schemes reward low-carbon formats. Nordic and DACH states lead pilot take-back schemes for used inhalers and injectors, offering closed-loop polypropylene pathways.

Asia-Pacific delivers the highest 9.76% CAGR for the pharmaceutical plastic packaging market through 2031. China accelerates under its 2025 action plan, aligning packaging quality audits with ICH Q9 while funding green factories. India tightens pharmacopoeial tests and digital traceability, creating opportunities for smart-label suppliers. ASEAN mutual recognition saves months of dossier work, letting exporters ship compliant packs across member borders. Japanese EPR schemes extend to medical packs, catalyzing PCR-grade PP sourcing. Together, these tailwinds strengthen the pharmaceutical plastic packaging market across developing and mature APAC nations.

- Amcor PLC

- Gerresheimer AG

- AptarGroup Inc.

- West Pharmaceutical Services Inc.

- Klockner Pentaplast Group

- Comar LLC

- O.Berk Company LLC

- Pretium Packaging LLC

- Drug Plastics and Glass Co. Inc.

- Gil-Pack Ltd.

- Alpla Group

- Silgan Holdings Inc.

- Placon Corporation

- Sealed Air Corporation

- Plastipak Holdings

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing demand for plastic packs for biologics and injectables

- 4.2.2 Expansion of generic drug production in EMs

- 4.2.3 Lightweight, shatter-proof logistics advantage

- 4.2.4 Home-health and e-commerce unit-dose adoption

- 4.2.5 On-site BFS and 3-D printed molds for personalized meds

- 4.2.6 Antimicrobial / smart-polymer enabled packs

- 4.3 Market Restraints

- 4.3.1 Extended plastics-waste regulation (EU SUP, EPR etc.)

- 4.3.2 Volatile polymer feedstock pricing

- 4.3.3 Biologic-glass policy shift toward COP vials

- 4.3.4 Scarcity of pharma-grade r-resin supply

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

- 4.8 Assessment of Geopolitical Scenario

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Raw Material

- 5.1.1 Polypropylene (PP)

- 5.1.2 Polyethylene Terephthalate (PET)

- 5.1.3 High-Density Polyethylene (HDPE)

- 5.1.4 Low-Density Polyethylene (LDPE)

- 5.1.5 Cyclic Olefin Polymer / Copolymer (COP/COC)

- 5.1.6 Bio-based and Recycled Plastics

- 5.2 By Product Type

- 5.2.1 Bottles and Solid Containers

- 5.2.2 Vials and Ampoules

- 5.2.3 Pre-fillable Syringes and Cartridges

- 5.2.4 Blister Packs and Strip Packs

- 5.2.5 Pouches / Stick Packs / Sachets

- 5.2.6 Closures, Caps and Lids

- 5.2.7 IV Bags and Flexible Bags

- 5.3 By Packaging Format

- 5.3.1 Rigid

- 5.3.2 Flexible

- 5.4 By Route of Drug Delivery

- 5.4.1 Oral

- 5.4.2 Parenteral / Injectable

- 5.4.3 Ophthalmic / Nasal

- 5.4.4 Topical / Transdermal

- 5.5 By End-User

- 5.5.1 Pharma Manufacturers

- 5.5.2 Contract Development and Manufacturing Orgs (CDMOs)

- 5.5.3 Hospitals and Clinics

- 5.5.4 Home-care Settings

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 United Kingdom

- 5.6.2.3 France

- 5.6.2.4 Italy

- 5.6.2.5 Spain

- 5.6.2.6 Russia

- 5.6.2.7 Rest of Europe

- 5.6.3 Asia-Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 Australia and New Zealand

- 5.6.3.6 Rest of Asia-Pacific

- 5.6.4 Middle East and Africa

- 5.6.4.1 Middle East

- 5.6.4.1.1 United Arab Emirates

- 5.6.4.1.2 Saudi Arabia

- 5.6.4.1.3 Turkey

- 5.6.4.1.4 Rest of Middle East

- 5.6.4.2 Africa

- 5.6.4.2.1 South Africa

- 5.6.4.2.2 Nigeria

- 5.6.4.2.3 Egypt

- 5.6.4.2.4 Rest of Africa

- 5.6.4.1 Middle East

- 5.6.5 South America

- 5.6.5.1 Brazil

- 5.6.5.2 Argentina

- 5.6.5.3 Rest of South America

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes global overview, market level overview, core segments, financials as available, strategic info, market rank/share, products and services, recent developments)

- 6.4.1 Amcor PLC

- 6.4.2 Gerresheimer AG

- 6.4.3 AptarGroup Inc.

- 6.4.4 West Pharmaceutical Services Inc.

- 6.4.5 Klockner Pentaplast Group

- 6.4.6 Comar LLC

- 6.4.7 O.Berk Company LLC

- 6.4.8 Pretium Packaging LLC

- 6.4.9 Drug Plastics and Glass Co. Inc.

- 6.4.10 Gil-Pack Ltd.

- 6.4.11 Alpla Group

- 6.4.12 Silgan Holdings Inc.

- 6.4.13 Placon Corporation

- 6.4.14 Sealed Air Corporation

- 6.4.15 Plastipak Holdings

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment