|

市場調查報告書

商品編碼

1910889

歐洲汽車塗料市場:市場佔有率分析、行業趨勢、統計數據和成長預測(2026-2031 年)Europe Automotive Paints And Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

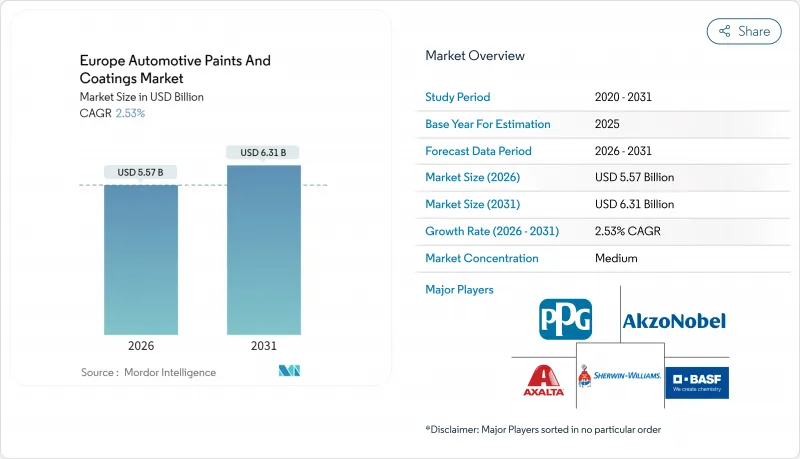

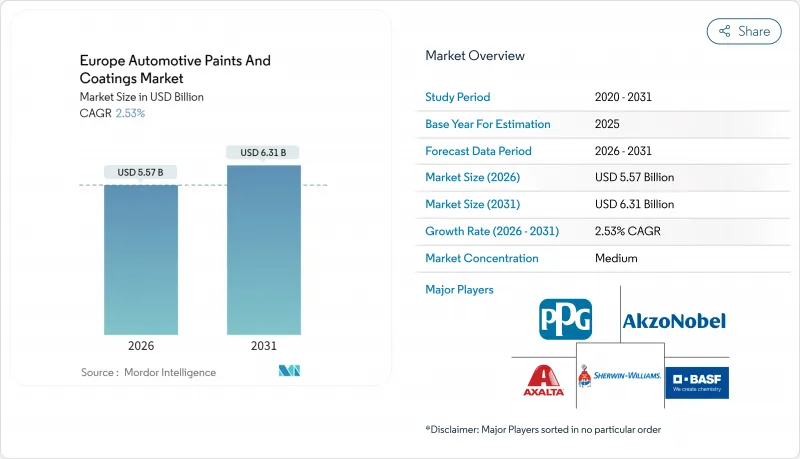

歐洲汽車油漆和塗料市場預計將從 2025 年的 54.3 億美元成長到 2026 年的 55.7 億美元,預計到 2031 年將達到 63.1 億美元,2026 年至 2031 年的複合年成長率為 2.53%。

需求成長主要受組裝電氣化、限制揮發性有機化合物 (VOC)排放的監管要求以及對預測性配色軟體投資增加的推動。電動車 (EV) 產量的擴張正在加速原始設備製造商 (OEM) 對噴漆車間的維修,進一步推動了塗料系統從溶劑型轉變為水性型的轉變。歐盟委員會擬議的全氟烷基物質 (PFAS) 法規(將於 2025 年生效)將要求對添加劑進行全面重新配方,而碳邊境調節機制 (CBAM) 將推高原料成本,使擁有本地顏料和樹脂生產能力的供應商更具優勢。人工智慧 (AI) 平台與噴塗機器人的整合可減少過噴並縮短週期時間,使汽車製造商能夠在天然氣價格波動的情況下降低能源消耗。

歐洲汽車塗料市場趨勢與洞察

電動車主導的噴漆車間升級

電動車平台依賴大量使用鋁材的車身和電池機殼,這些材料無法承受傳統的高溫循環。因此,汽車製造商正轉向低溫烘烤聚氨酯和改性丙烯酸樹脂等可在 80-100°C 下固化的材料。 BMW在其慕尼黑組裝廠實施人工智慧最佳化圖案控制後,噴漆室的能耗降低了 25%,充分展現了數位化優先噴漆生產線的資本效率優勢。隨著汽車製造商計劃對整個噴漆車間維修以配合電動車平台的推出,那些整合了化學、機器人和分析技術的供應商憑藉先發優勢贏得了合約。

向低VOC水基系統過渡

新的工業排放指令將揮發性有機化合物(VOC)的排放閾值設定為35克/平方米,這迫使汽車製造商轉向水性底塗層。賓士計畫在2024年實現德國所有工廠VOC排放量降至20克/平方米,溶劑用量減少85%,同時實現零色差匹配。全氟烷基和多氟烷基物質(PFAS)法規正在逐步淘汰含氟界面活性劑,迫使配方師轉向使用新一代無矽潤濕劑。能夠穩定無PFAS配方中的成膜性、流動性和耐候性的公司正在獲得先發優勢,並根據原始設備製造商(OEM)的「綠色化學」評估標準獲得長期供應合約。

原物料價格波動

2024年,受能源價格上漲和中國供應增加的影響,二氧化鈦價格上漲了18%,丙烯酸單體價格較上季波動達25%。缺乏期貨避險工具的獨立本地製造商面臨利潤率下降的困境,導致併購活動加劇,大型公司紛紛收購專業細分領域的企業以擴大採購規模。

細分市場分析

到2025年,丙烯酸類塗料將佔歐洲汽車塗料市場的41.82%。其多功能性使其可用於底漆、底塗層和透明塗層層。雖然聚氨酯化學品目前市場佔有率較小,但隨著電動車車身結構對柔軟性、耐刮擦且可在低溫烘烤下固化的塗料的需求日益成長,預計其將以2.74%的複合年成長率在樹脂基體系中實現最快成長。環氧樹脂憑藉其優異的防腐蝕腐蝕性能,將繼續作為電塗裝塗料和底漆發揮重要作用。醇酸樹脂和聚酯樹脂則應用於巴士和卡車等細分市場,在這些市場中,成本往往比外觀更為重要。BASF計畫於2024年推出生物基聚氨酯分散體,體現了其在重組樹脂產品組合時,將永續性和性能結合的概念。

丙烯酸樹脂的優勢在於其成本效益高、供應量大,並且與多級水性塗料生產線相容。然而,12年防腐蝕保固的壓力迫使原始設備製造商(OEM)在電池托盤相鄰面板上指定使用聚氨酯面漆。 CBAM樹脂生產的回流進一步強化了歐盟對聚氨酯原料採購的承諾。因此,聚氨酯技術的進步正在逐步蠶食丙烯酸樹脂的市場佔有率,配方師正在將兩種樹脂混合使用,以在整個塗層中實現成本和性能的平衡。如果電動車的預期銷售量得以實現,光是聚氨酯塗料在2031年的歐洲汽車塗料市場規模就可能超過12.6億美元。

溶劑型塗料系統仍佔據歐洲汽車塗料市場47.62%的佔有率,這主要得益於數十年來噴塗室設備的傳承以及高速生產線上可預測的流變性能。然而,水性底塗層正以2.99%的強勁複合年成長率成長,這主要受歐盟VOC排放上限和消費者對永續性品牌的關注所驅動。混合平台將溶劑型閃塗底漆與水性底漆相結合,在實現最佳光澤度的同時,平衡了VOC總排放量。粉末塗料技術曾一度主要應用於卡車車架和小零件生產線,如今隨著低溫聚酯化學技術的成熟,其應用前景再次受到關注。

原始設備製造商 (OEM) 的資本投資正轉向封閉回路型水回收系統、精確的濕度控制以及能夠加速水分蒸發的先進霧化器,從而縮小與溶劑型塗料的週期時間差距。阿克蘇諾貝爾 2024 年的德國擴張計畫將使歐洲大陸水性塗料的產能提高 35%,凸顯了這項化學技術的強勁發展勢頭。雖然溶劑型塗料仍可用於一些特定的金屬效果,但供應商的藍圖表明,由於監管確定性和碳審核透明度會影響採購決策,水性塗料要到 2030 年代初才能接近與溶劑型塗料持平。

其他福利

- Excel格式的市場預測(ME)表

- 分析師支持(3個月)

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 電動車主導的噴漆車間升級

- 向低VOC水基系統過渡

- 歐洲汽車產量正在復甦。

- 碳邊境調節機制(CBAM)影響供應合約

- 在OEM生產線中應用AI引導的按需混色

- 市場限制

- 原物料價格波動

- 加強 REACH 和 PFAS 法規

- 能源價格上漲導致淬火爐運作成本飆升。

- 價值鏈分析

- 監管環境

- 技術展望

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 依樹脂類型

- 聚氨酯

- 環氧樹脂

- 丙烯酸纖維

- 其他

- 透過技術

- 溶劑型

- 水溶液

- 粉末塗裝

- 分層

- 電塗裝塗層

- 底漆

- 底塗層

- 透明塗層

- 透過使用

- 汽車OEM廠商

- 汽車修補漆

- 按地區

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐國家

- 其他歐洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率/排名分析

- 公司簡介

- Akzo Nobel NV

- Axalta Coating Systems

- BASF SE(Carlyle Group)

- Beckers Group

- Brila Coatings

- Jotun

- Kansai Paints Co., Ltd.

- Nippon Paint Holdings

- PPG Industries Inc.

- RPM International Inc.

- Sika AG

- Teknos Group

- The Sherwin-Williams Company

- TIGER Coatings GmbH & Co. KG

第7章 市場機會與未來展望

The Europe automotive paints and coatings market is expected to grow from USD 5.43 billion in 2025 to USD 5.57 billion in 2026 and is forecast to reach USD 6.31 billion by 2031 at 2.53% CAGR over 2026-2031.

Demand stems from the electrification of assembly lines, regulatory mandates that limit VOC emissions, and rising investment in predictive color-matching software. Electric vehicle (EV) production is accelerating OEM retrofits of paint shops, intensifying the shift from solvent-borne to water-borne chemistry. The European Commission's per- and polyfluoroalkyl substances (PFAS) proposal, effective 2025, compels wholesale reformulation of additives, while the Carbon Border Adjustment Mechanism (CBAM) raises raw-material costs, favoring suppliers with regional pigment and resin capacity. The integration of artificial-intelligence (AI) platforms with spray robots reduces overspray and shortens cycle times, enabling automakers to reduce energy consumption even amid volatile natural-gas prices.

Europe Automotive Paints And Coatings Market Trends and Insights

EV-Led Paint-Shop Upgrades

Electric platforms rely on aluminum-intensive bodies and battery enclosures that cannot tolerate legacy high-temperature cycles. Carmakers therefore adopt low-bake polyurethane and modified acrylic chemistries that cure at 80-100 °C. BMW reduced spray-booth energy consumption by 25% after commissioning AI-optimized pattern controls at its Munich assembly facility, confirming the capital efficiency benefits of digital-first coating lines. Suppliers that bundle chemistry, robotics, and analytics are capturing early-mover contracts as OEMs schedule whole-shop refurbishments to coincide with the launch of their EV platforms.

Shift to Low-VOC Waterborne Systems

New Industrial Emissions Directive thresholds of 35 g/m2 VOC pressure automakers to adopt water-borne basecoats. Mercedes-Benz achieved 20 g/m2 in 2024 across its German plants, representing an 85% reduction in solvent use, without any color-match deviations. PFAS curbs now eliminate fluorinated surfactants, prompting formulators to adopt next-generation silicon-free wetting aids. Companies able to stabilize film build, flow, and weathering with PFAS-free packages enjoy first-mover credentials while securing long-term supply agreements under OEM "green-chemistry" scorecards.

Feedstock Price Volatility

Titanium dioxide rose 18% in 2024 on energy-inflated Chinese output, while acrylic monomers swung 25% quarter-to-quarter. Regional independents lacking futures-hedging instruments face margin erosion, prompting merger activity as major companies acquire niche specialists to scale their procurement.

Other drivers and restraints analyzed in the detailed report include:

- Recovery of European Vehicle Output

- Carbon Border Adjustment Mechanism Shaping Supply Contracts

- Tightening REACH and PFAS Restrictions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Acrylic systems held 41.82 of % European automotive paints and coatings market share in 2025, their versatility enabling deployment in primer, basecoat, and clearcoat film builds. Polyurethane chemistries, though smaller today, are on track for a 2.74% CAGR, the fastest among resins, as EV body structures mandate flexible, chip-resistant coatings that cure at lower bake temperatures. Epoxies retain critical e-coat and primer roles by anchoring corrosion-protection performance. Alkyd and polyester variants serve the bus and truck niches, where cost considerations often trump appearance. Bio-based polyurethane dispersions launched by BASF in 2024 reflect how sustainability converges with performance to rewrite resin portfolios.

Acrylic's entrenched position rests on cost-efficient bulk supply and compatibility with multistage water-borne lines. Yet warranty pressure for 12-year anti-perforation coverage compels OEMs to specify polyurethane topcoats on panels adjacent to battery trays. Reshoring resin manufacturing to meet CBAM constraints reinforces poly-purchase commitments inside the EU trading bloc. Consequently, polyurethane's advance erodes acrylic share gradually, with formulators blending both chemistries to achieve balanced cost-to-performance ratios across the coating stack. The European automotive paints and coatings market size for polyurethane grades alone could surpass USD 1.26 billion by 2031 if projected EV volumes materialize.

Solvent-borne systems still command 47.62% of the European automotive paints and coatings market size, a legacy of decades-old booth infrastructure and predictable rheology in high-line-speed operations. Water-borne basecoats, however, achieve a superior 2.99% CAGR, underpinned by EU VOC ceilings and consumer branding that emphasizes sustainability. Hybrid platforms combine solvent-borne flash primers with water-borne base layers to balance VOC totals and achieve optimal gloss depth. Powder technology, limited chiefly to truck frames and small-part lines, earns renewed interest as low-temperature polyester chemistries mature.

OEM capital spending shifts toward closed-loop water reclaim, fine-tuned humidity control, and advanced atomizers that accelerate water evaporation, narrowing the cycle-time gap with solvent finishes. Akzo Nobel's 2024 German expansion increases continental water-borne capacity by 35%, validating the momentum behind this chemistry. Although solvent systems remain for niche metallic effects, supplier roadmaps indicate that water-borne coatings' climb to near-parity will occur by the early 2030s, with regulatory certainty and carbon-audit transparency influencing procurement preferences.

The Europe Automotive Paints and Coatings Market Report is Segmented by Resin Type (Polyurethane, Epoxy, Acrylic, Other Resin Type), Technology (Solvent-Borne, Water-Borne, Powder), Layer (E-Coat, Primer, Basecoat, Clearcoat), Application (Automotive OEM, Automotive Refinish), and Geography (Germany, United Kingdom, France, Italy, Spain, NORDIC Countries, Rest of Europe). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Akzo Nobel N.V.

- Axalta Coating Systems

- BASF SE (Carlyle Group)

- Beckers Group

- Brila Coatings

- Jotun

- Kansai Paints Co., Ltd.

- Nippon Paint Holdings

- PPG Industries Inc.

- RPM International Inc.

- Sika AG

- Teknos Group

- The Sherwin-Williams Company

- TIGER Coatings GmbH & Co. KG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EV-led paint-shop upgrades

- 4.2.2 Shift to low-VOC waterborne systems

- 4.2.3 Recovery of European vehicle output

- 4.2.4 Carbon Border Adjustment Mechanism (CBAM) shaping supply contracts

- 4.2.5 AI-guided colour-on-demand mixing at OEM lines

- 4.3 Market Restraints

- 4.3.1 Feed-stock price volatility

- 4.3.2 Tightening REACH and PFAS restrictions

- 4.3.3 Energy-price driven curing-oven OPEX spikes

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Resin Type

- 5.1.1 Polyurethane

- 5.1.2 Epoxy

- 5.1.3 Acrylic

- 5.1.4 Other Resin Type

- 5.2 By Technology

- 5.2.1 Solvent-borne

- 5.2.2 Water-borne

- 5.2.3 Powder

- 5.3 By Layer

- 5.3.1 E-coat

- 5.3.2 Primer

- 5.3.3 Basecoat

- 5.3.4 Clearcoat

- 5.4 By Application

- 5.4.1 Automotive OEM

- 5.4.2 Automotive Refinish

- 5.5 By Geography

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 NORDIC Countries

- 5.5.7 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Akzo Nobel N.V.

- 6.4.2 Axalta Coating Systems

- 6.4.3 BASF SE (Carlyle Group)

- 6.4.4 Beckers Group

- 6.4.5 Brila Coatings

- 6.4.6 Jotun

- 6.4.7 Kansai Paints Co., Ltd.

- 6.4.8 Nippon Paint Holdings

- 6.4.9 PPG Industries Inc.

- 6.4.10 RPM International Inc.

- 6.4.11 Sika AG

- 6.4.12 Teknos Group

- 6.4.13 The Sherwin-Williams Company

- 6.4.14 TIGER Coatings GmbH & Co. KG

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment