|

市場調查報告書

商品編碼

1910884

礦用自動卸貨卡車:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Mining Dump Truck - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

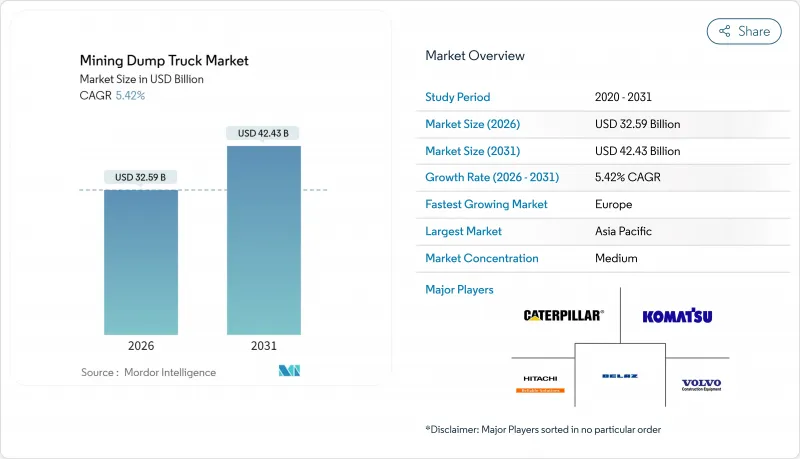

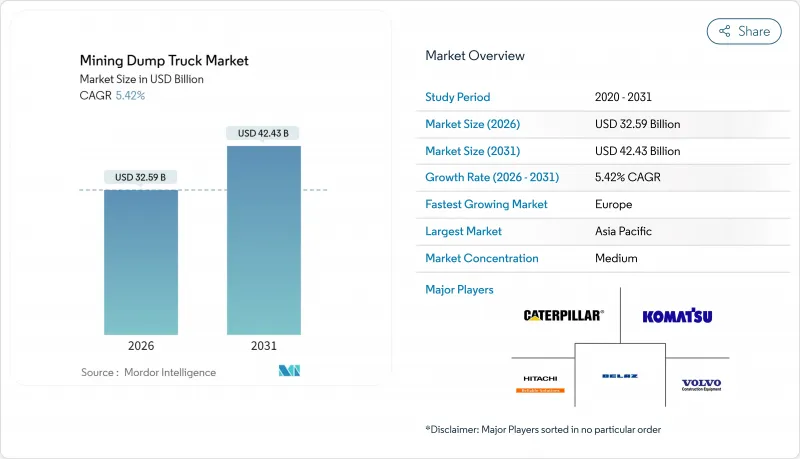

2025 年全球礦用自動卸貨卡車市場價值為 309.1 億美元,預計從 2026 年的 325.9 億美元成長到 2031 年的 424.3 億美元,在預測期(2026-2031 年)內複合年成長率為 5.42%。

自動駕駛技術的投資不斷增加、向電池電動驅動的轉型以及更嚴格的第五階段和第五階段排放標準的實施,是推動需求成長的三大支柱。亞太地區繼續佔據主導地位,這主要得益於中國、印度和印尼露天採礦產量的不斷成長;而歐洲則憑藉排放氣體法規推動的車隊更新換代,實現了最快的成長。設備製造商正致力於開發整合式數位平台,以提高有效載荷公里效率並降低油耗。與每噸成本掛鉤的租賃模式和從採礦到精煉的最佳化工具正在降低資本門檻,使中型生產商也能獲得最新技術。以日本小松公司收購GHH集團為代表的併購活動,標誌著市場正朝著提供全系列地下和地面設備的方向發展,凸顯了市場競爭模式從價格主導轉變為服務型解決方案的方向。

全球礦用自動卸貨卡車市場趨勢及展望

更嚴格的第四階段和第五階段排放氣體標準推動車輛更新換代

歐盟工業排放指令旨在減少非道路引擎的顆粒物排放,而加州的第五階段排放標準則將類似的排放標準擴展到美國礦場。對老舊卡車進行改造成本高昂,因此全面升級更具成本效益。力拓等業者正在加裝雙燃料和混合動力系統,以滿足充電網路成熟前的過渡性規定。隨著處罰措施的臨近,合規期限的縮短正在推動清潔技術卡車的近期訂單成長。旨在減少排放並提高生產效率的車輛更新換代正在直接影響礦用自動卸貨卡車市場。

透過自動駕駛展示提高裝載公里生產率

力拓集團皮爾巴拉地區的23座礦場已投入運作超過700套日本小松公司AHS(自動化運輸系統),該系統顯著提高了單車生產率並降低了維護成本。全天候運作消除了操作員疲勞的限制,並大幅降低了事故率。Caterpillar的「運輸指令」系統可根據即時礦石品位分配自動卸貨卡車執行鏟運任務,從而縮短等待時間並提高冶煉廠的處理能力。高產量礦山可在兩年內收回實施成本,自動化正從試點階段走向主流。安全性、運轉率和單位成本的提升,已使自動化成為新競標文件中的強制性要求。

初始投資額高,投資回收期長

一輛超重型卡車需要300萬至600萬美元的初始投資,包括燃料、輪胎和維護費用,以及未來10年1500萬至2000萬美元的維護費用。光是輪胎一項就需要每年投入大量資金。雖然改用純電動卡車需要額外的充電器和儲能設備成本,但節能帶來的效益可將投資回收期縮短至4至6年。財務狀況較弱的小型礦業公司往往會推遲升級,從而限制了早期採用率。目前,貸款額成本佔礦場總營運成本的15%至20%,因此資金的可用性是決定礦用自動卸貨卡車市場成長軌跡的關鍵因素。

細分市場分析

截至2025年,剛性後自動卸貨卡車將佔據礦用自動卸貨卡車市場48.70%的佔有率,這反映了效用在煤炭、鐵礦石和採石場等廣泛應用領域的實用性。目前規模較小的自動駕駛礦用自卸車細分市場預計將以11.05%的複合年成長率成長,這主要得益於澳洲、智利和加拿大礦場向24小時無人營運模式的轉型。到2030年代初,在車輛運轉率提高和維護成本降低的推動下,自動駕駛礦用自動卸貨卡車市場規模預計將與剛性後卸式自卸車的收入規模相媲美。

生產效率的提升得益於日本小松公司AHS和CaterpillarCommand等系統,這些系統能夠自動執行運輸循環調度、輪胎監測和碰撞規避等操作。為了最大限度地發揮這些優勢,營運商正致力於部署高頻寬的全廠網路和遠端營運中心。剛性側卸式和鉸接式自卸車仍將是窄脈礦床和軟土作業領域的利基市場,在這些領域,機動性比負載容量更為重要。儘管基礎設施成本較高,但自動駕駛的回報非常可觀,因此越來越多的新競標文件中將其列為標準配置,這進一步推動了礦自動卸貨卡車市場向自動化方向發展。

憑藉成熟的供應鏈和高能量密度,內燃柴油引擎在2025年佔據了礦用自動卸貨卡車市場68.73%的佔有率。隨著碳定價的推進,電池電動替代車型正以9.88%的複合年成長率快速成長,預計到2031年將對礦用自動卸貨卡車市場規模做出重大貢獻。

早期電氣化應用將集中在年運作時間超過4000小時的銅礦和金礦,這些礦山的總擁有成本低於柴油車。徐工與Fort Esk簽訂的價值12億美元的240噸電池卡車合約表明,一旦經濟效益得到驗證,大型礦業公司將如何擴大訂單規模。混合動力汽車和氫燃料電池汽車將填補過渡期的空白,在無需深度放電充電網路的情況下逐步降低燃料成本。歐盟和加州的監管期限將起到推動作用,確保電動和混合動力汽車的普及繼續成為礦用自動卸貨卡車市場結構性驅動力。

區域分析

到2025年,亞太地區將佔據礦用自動卸貨卡車市場57.76%的佔有率,這主要得益於中國強大的裝備製造業生態系統、印度煤炭產量的不斷成長以及印尼對電池金屬需求的持續擴大。徐工和三一等本土品牌正利用其規模和地理優勢贏得訂單,而澳洲則主導全球自動駕駛車隊的普及,為其他地區樹立了最佳實踐典範。

到2031年,歐洲將以6.26%的複合年成長率達到最高成長。第五階段排放法規的實施將推動柴油車快速淘汰,而碳權貨幣化將提高電池動力卡車的盈利。瑞典和芬蘭的礦業公司正引領著全面電動化的發展,其中Boliden的目標是到2030年實現碳中和卡車,這充分體現了該地區對電動化的堅定承諾。

北美地區的替換需求穩定成長,尤其是在內華達州的金礦區和亞利桑那州的銅礦基地,這些地區在礦場到冶煉廠軟體的採用率方面處於領先地位。南美洲,以智利和秘魯為首,正在擴大其超重型車輛的車隊規模,以控制成本。同時,中東和非洲地區正在湧現新的管道開發機遇,但電力基礎設施的滯後限制了這些地區礦自動卸貨卡車市場的短期成長。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 更嚴格的第四階段和第五階段排放氣體標準推動車輛更新換代

- 自主運輸技術展現出更高的載貨公里生產力

- 擴大亞太地區露天礦場生產

- 礦山到冶煉廠的最佳化/將負載容量資料與冶煉廠吞吐量關聯起來

- 採用以噸租賃模式降低超大型卡車的資本投資

- 電池電動自動卸貨卡車卡車排碳權貨幣化

- 市場限制

- 初始投資額高,投資回收期長

- 商品價格波動延緩了新礦場的開發

- 偏遠地區電網容量不足延緩了電氣化。

- 容量超過 500 kWh 的鋰離子電池組供應鏈風險

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模及成長預測(價值(美元)及銷售量(單位))

- 按卡車類型

- 剛性後自動卸貨卡車

- 剛性側自動卸貨卡車

- 鉸接式自動卸貨卡車

- 底自動卸貨卡車/腹自動卸貨卡車

- 自動自動卸貨卡車(相容AHS系統)

- 透過燃料/推進方式

- 內燃機(柴油引擎)

- 油電混合(柴油-電力)

- 電池式電動車

- 氫燃料電池

- 按負載容量

- 少於150公噸

- 150-200公噸

- 201至330公噸

- 超過330公噸

- 透過使用

- 露天金屬礦開採

- 煤炭和褐煤開採

- 採石場和骨材

- 重大基礎建設

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 南美洲

- 巴西

- 智利

- 南美洲其他地區

- 歐洲

- 德國

- 英國

- 法國

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 澳洲

- 印尼

- 亞太其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 土耳其

- 埃及

- 南非

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Caterpillar Inc.

- Komatsu Ltd.

- Hitachi Construction Machinery Co., Ltd.

- Liebherr Group

- BelAZ

- Volvo Construction Equipment

- SANY Heavy Industry Co., Ltd.

- Epiroc AB

- Sandvik AB

- HD Hyundai Infracore Co., Ltd.

- Xuzhou Construction Machinery Group Co., Ltd.

- Bell Equipment

- Shaanxi Tonly Heavy Industries Co., Ltd.

- Ashok Leyland Limited

- Guangxi LiuGong Machinery Co., Ltd.

- Daimler Truck AG

第7章 市場機會與未來展望

The global mining dump truck market was valued at USD 30.91 billion in 2025 and estimated to grow from USD 32.59 billion in 2026 to reach USD 42.43 billion by 2031, at a CAGR of 5.42% during the forecast period (2026-2031).

Surging investments in autonomous haulage, the switch to battery-electric propulsion, and stricter Stage V and Tier 5 rules are the three pillars pushing demand higher. Asia-Pacific keeps a commanding lead because surface mines in China, India, and Indonesia scale output, while Europe registers the quickest gains on the back of emission-related fleet renewal. Equipment makers focus on integrated digital platforms that raise payload-kilometer productivity and trim fuel burn. Leasing models tied to cost-per-ton and mine-to-mill optimization tools lower capital hurdles and make the latest technology accessible to mid-tier producers. M&A activity, highlighted by Komatsu's purchase of GHH Group, signals a turn toward full-line underground and surface offerings and underscores the shift from price-led competition toward service-rich solutions.

Global Mining Dump Truck Market Trends and Insights

Tightening Tier-4 and Stage-V Emission Norms Drive Fleet Renewal

The EU Industrial Emissions Directive cuts particulate output from off-road engines, while California's Tier 5 package extends similar thresholds to mines in the United States . Retrofitting older trucks has high costs per unit, tilting the cost-benefit equation toward full replacement. Operators such as Rio Tinto add dual-fuel and hybrid systems to meet interim rules as charging networks mature. With penalties looming ahead, the compliance timetable tightens purchasing cycles and lifts near-term order books for clean-tech trucks. The replacement wave directly feeds the mining dump truck market as fleets look to pair emission cuts with productivity upgrades.

Autonomous Haulage Proven to Raise Payload-km Productivity

Komatsu's AHS has over 700 units running across 23 mines, and Rio Tinto's Pilbara network reports extra productivity and lower maintenance per truck . Around-the-clock operation removes operator fatigue constraints and cuts incident rates significantly. Caterpillar's Command for Hauling allocates trucks to shovel assignments based on real-time ore grade, shrinking idle time, and improving mill throughput. High-volume mines recoup conversion costs within two years, propelling autonomous functionality from pilot stage to mainstream specification. Gains in safety, utilization, and unit cost cement autonomy as a non-negotiable feature in new tender documents.

High Upfront Capex and Long Payback Cycles

An ultra-class truck demands USD 3-6 million in capital and USD 15-20 million over a decade once fuel, tires, and maintenance are folded in. Tires alone can incur high investments annually. Battery-electric conversions tack on significant cost for chargers and storage but promise energy savings, stretching payback to 4-6 years. Smaller miners with thin balance sheets often defer upgrades, limiting early adoption rates. Financing now measures 15-20% of total mine operating cost, making capital availability a decisive factor in the mining dump truck market's growth slope.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Surface-Mine Output in Asia-Pacific

- Mine-to-Mill Optimization Linking Payload Data to Mill Throughput

- Commodity-Price Volatility Delaying Green-Field Mines

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Rigid rear-dump trucks commanded 48.70% of the mining dump truck market share in 2025, reflecting their broad utility across coal, iron ore, and quarry operations. The autonomous sub-segment, while smaller today, is scaling at an 11.05% CAGR as sites in Australia, Chile, and Canada convert fleets to 24-hour driverless operation. The mining dump truck market size for autonomous fleets is projected to match rigid rear-dump revenue by the early 2030s, driven by higher truck utilization and lower maintenance.

Productivity benefits stem from systems such as Komatsu AHS and Caterpillar Command that automate haul cycle dispatch, tire monitoring, and collision avoidance. Operators commit to high-bandwidth sitewide networks and remote-operation centers to unlock these gains. Rigid side-dump and articulated formats remain niche, serving narrow-vein or soft-ground applications where maneuverability overrides payload. Despite infrastructure costs, the payback for autonomy proves compelling enough that new tender documents increasingly specify the feature as standard, further tilting the mining dump truck market toward automated options.

Internal-combustion diesel units held 68.73% of the mining dump truck market share in 2025, supported by mature supply chains and high energy density. Battery-electric alternatives are expanding at a 9.88% CAGR and are forecast to account for a notable contribution to the mining dump truck market size by 2031 as carbon pricing lifts.

Early electric deployments focus on copper and gold pits where high utilization surpasses 4,000 hours annually, pushing total cost of ownership below that of diesel. XCMG's USD 1.2 billion agreement with Fortescue for 240-t battery trucks illustrates how major miners scale orders once economics prove viable. Hybrid and hydrogen pathways fill the transition gap, offering incremental fuel savings without deep-cycle charging networks. Regulatory deadlines in the EU and California act as forcing functions, ensuring electric and hybrid penetration remains a structural, rather than cyclical, driver of the mining dump truck market.

The Global Mining Dump Truck Market Report is Segmented by Truck Type (Rigid Rear-Dump, Rigid Side-Dump, and More), Fuel/Propulsion Type (Internal-Combustion (Diesel), Hybrid (Diesel-Electric), and More), Payload Capacity (Below 150 Metric Tons, 150-200 Metric Tons, and More), Application (Open-Pit Metal Mining, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia-Pacific held 57.76% of the mining dump truck market share in 2025, anchored by China's equipment manufacturing ecosystem, India's rising coal output, and Indonesia's battery-metal growth. Domestic brands such as XCMG and Sany exploit scale and proximity to win contracts, while Australia leads global deployment of autonomous fleets, shaping best practices taken up elsewhere.

Europe records the highest 6.26% CAGR to 2031 as Stage V timelines compel rapid diesel replacement and carbon-credit monetization sweetens returns on battery trucks. Miners in Sweden and Finland pioneer full battery-electric pathways; Boliden targets carbon-neutral trucks by 2030, signaling deep regional commitment.

North America shows steady replacement demand, especially in Nevada gold and Arizona copper hubs, and ranks first in mine-to-mill software adoption. South America, centered on Chile and Peru, scales ultra-class fleets to protect cost curves, while the Middle East and Africa unlock greenfield pipeline potential but lag on grid infrastructure, tempering short-term mining dump truck market growth in those regions.

- Caterpillar Inc.

- Komatsu Ltd.

- Hitachi Construction Machinery Co., Ltd.

- Liebherr Group

- BelAZ

- Volvo Construction Equipment

- SANY Heavy Industry Co., Ltd.

- Epiroc AB

- Sandvik AB

- HD Hyundai Infracore Co., Ltd.

- Xuzhou Construction Machinery Group Co., Ltd.

- Bell Equipment

- Shaanxi Tonly Heavy Industries Co., Ltd.

- Ashok Leyland Limited

- Guangxi LiuGong Machinery Co., Ltd.

- Daimler Truck AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Tightening Tier-4 and Stage-V Emission Norms Drive Fleet Renewal

- 4.2.2 Autonomous Haulage Proven to Raise Payload-km Productivity

- 4.2.3 Expansion of Surface-Mine Output in Asia-Pacific

- 4.2.4 Mine-to-Mill Optimization Linking Payload Data to Mill Throughput

- 4.2.5 Pay-per-Ton Leasing Models for Ultra-Class Trucks Cut Capex

- 4.2.6 Carbon-Credit Monetization for Battery-Electric Dump Trucks

- 4.3 Market Restraints

- 4.3.1 High Upfront Capex and Long Payback Cycles

- 4.3.2 Commodity-Price Volatility Delaying Green-Field Mines

- 4.3.3 Weak Grid Capacity in Remote Sites Slows Electrification

- 4.3.4 Li-ion Supply-Chain Risk for Above 500 kWh Battery Packs

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Truck Type

- 5.1.1 Rigid Rear-Dump Trucks

- 5.1.2 Rigid Side-Dump Trucks

- 5.1.3 Articulated Dump Trucks

- 5.1.4 Bottom/Belly Dump Trucks

- 5.1.5 Autonomous Dump Trucks (AHS-ready)

- 5.2 By Fuel/Propulsion Type

- 5.2.1 Internal-Combustion (Diesel)

- 5.2.2 Hybrid (Diesel-Electric)

- 5.2.3 Battery-Electric

- 5.2.4 Hydrogen Fuel-Cell

- 5.3 By Payload Capacity

- 5.3.1 Below 150 metric tons

- 5.3.2 150-200 metric tons

- 5.3.3 201-330 metric tons

- 5.3.4 Above 330 metric tons

- 5.4 By Application

- 5.4.1 Open-pit Metal Mining

- 5.4.2 Coal and Lignite Mining

- 5.4.3 Quarrying and Aggregates

- 5.4.4 Major Infrastructure Construction

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Chile

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Russia

- 5.5.3.5 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Australia

- 5.5.4.4 Indonesia

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Turkey

- 5.5.5.4 Egypt

- 5.5.5.5 South Africa

- 5.5.5.6 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Caterpillar Inc.

- 6.4.2 Komatsu Ltd.

- 6.4.3 Hitachi Construction Machinery Co., Ltd.

- 6.4.4 Liebherr Group

- 6.4.5 BelAZ

- 6.4.6 Volvo Construction Equipment

- 6.4.7 SANY Heavy Industry Co., Ltd.

- 6.4.8 Epiroc AB

- 6.4.9 Sandvik AB

- 6.4.10 HD Hyundai Infracore Co., Ltd.

- 6.4.11 Xuzhou Construction Machinery Group Co., Ltd.

- 6.4.12 Bell Equipment

- 6.4.13 Shaanxi Tonly Heavy Industries Co., Ltd.

- 6.4.14 Ashok Leyland Limited

- 6.4.15 Guangxi LiuGong Machinery Co., Ltd.

- 6.4.16 Daimler Truck AG

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment