|

市場調查報告書

商品編碼

1910881

歐洲暖通空調設備市場-佔有率分析、產業趨勢、統計數據和成長預測(2026-2031年)Europe HVAC Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

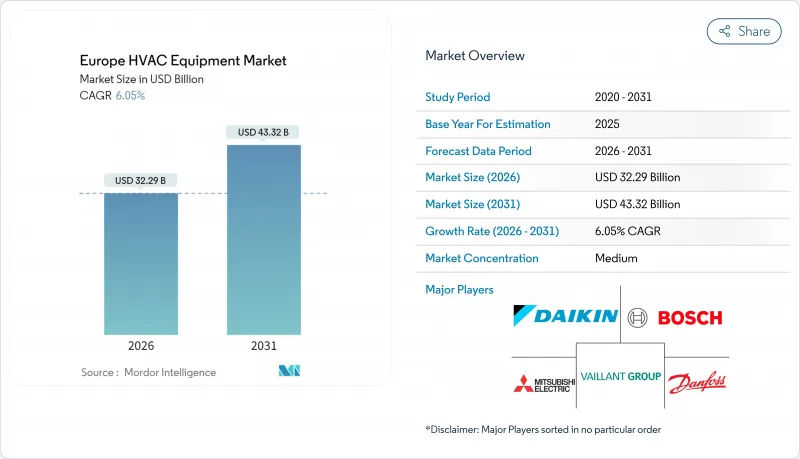

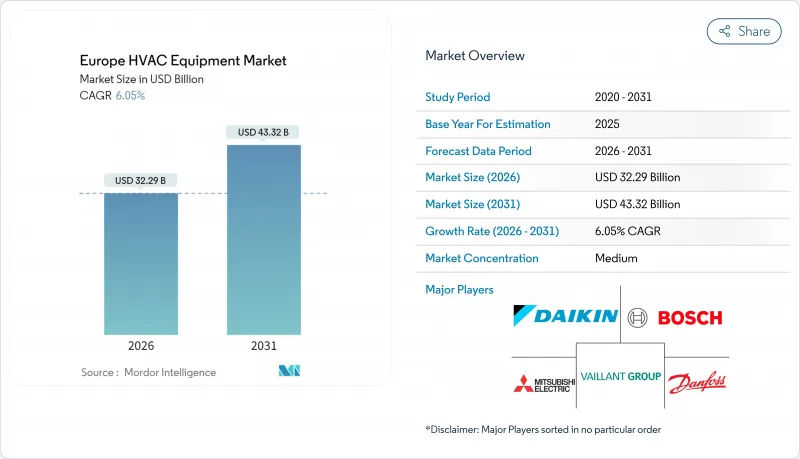

歐洲暖通空調設備市場規模預計在2026年達到322.9億美元,高於2025年的304.5億美元。預計到2031年將達到433.2億美元,2026年至2031年的複合年成長率為6.05%。

這一成長使該地區成為供應商的關鍵市場,這些供應商面臨日益嚴格的脫碳要求和不斷變化的能源政策。綠色交易下加強的熱泵推廣激勵措施、頻繁的夏季熱浪推高了製冷需求,以及老舊鍋爐的加速更換,都在推動電氣化系統的普及。同時,供應鏈通膨和高額的前期投資雖然限制了短期發展勢頭,但並未阻礙電氣化的長期發展軌跡。競爭壓力日益加劇,各大企業集團正斥資數十億美元進行收購,以擴大產能並整合分散的安裝商網路,力求實現歐盟到2030年安裝6000萬台熱泵的目標。

歐洲暖通空調設備市場趨勢與分析

歐盟綠色交易的效率義務推動市場轉型

歐盟於2024年強制實施最低能源效率標準,並推出560億歐元(約655.7億美元)的熱泵扶持計劃,重塑了設備需求。 2025年第一季,德國的熱泵裝機量年增60%,達到4.3萬台。補貼政策主要惠及空氣源熱泵,銷售量從2.2萬台飆升至約3.8萬台,顯示政策制定者高度重視水基熱系統整合。儘管荷蘭的ISDE補貼計畫在2025年有所縮減,但該國仍維持了2030年20%的住宅安裝熱泵的目標,這將推動歐洲暖通空調設備市場實現9.7%的複合年成長率。製造商正積極回應市場需求,推出採用天然冷媒的設計和資金籌措方案,以降低買家的前期成本。

對老舊鍋爐的更換需求正在加速市場擴張。

2024年天然氣價格上漲和更嚴格的碳排放法規意味著歐洲約有1.3億台老舊鍋爐需要更換。為了確保安裝商,原始設備製造商(OEM)加快了併購步伐,其中大金於2024年8月收購瑞典Kirslaget公司就是一個顯著的例子。專為與現有水循環系統相容而設計的維修熱泵縮短了安裝時間,提高了承包商的工作效率。這導致了更換需求的增加,即使在新建房屋較少的市場也是如此。

高額的初始投資限制了市場滲透率。

儘管有補貼,熱泵系統的成本仍然是鍋爐更換的三到五倍,這給東歐和農村地區的家庭造成了不小的負擔。製造商推出的複雜資金籌措方案增加了文書工作,延長了銷售週期。在可支配收入較低的地區,歐洲的暖通空調設備市場正透過公共資助的社會住宅計畫而非私人購買來擴張。

細分市場分析

到2031年,地源熱泵將以9.78%的複合年成長率實現最高成長,而空調和通風系統仍將佔據歐洲暖通空調設備市場57.95%的最大佔有率。機構投資者青睞地源熱泵解決方案,因為其具有高季節能源效率和長使用壽命,足以抵消住宅用戶通常不願承擔的鑽井成本。安裝商報告稱,由於北歐地質條件適宜建造封閉回路型井場,大型園區、兆瓦級計劃數量正在增加。

同時,空氣源熱泵憑藉其利用現有散熱器和簡化石化燃料淘汰流程的優勢,獲得了政策上的優惠支持,並在供暖維修領域繼續保持主流地位。大金公司於2025年3月發布的R-290模組化平台,體現了天然冷媒的演進,在提高部分負載效率的同時,也符合F-gas法規。混合式鍋爐-水泵機組作為過渡方案,在寒冷地區越來越受歡迎。這些技術創新正推動歐洲暖通空調設備市場從燃氣動力系統轉型為電力系統,同時又不影響效能。

2025 年,住宅用戶佔銷售額的 46.80%,而公共和機構建築、學校和醫院預計將增加其在歐洲 HVAC 設備市場規模中的佔有率,到 2031 年將實現最高的複合年成長率 10.05%。政府的脫碳預算推動了大規模維修,將熱泵與按需控制的通風系統結合。

儘管公共設施計劃週期延長,但為了滿足市場需求,原始設備製造商 (OEM) 擴大提供包含安裝、維護和監控的「能源即服務」合約。注重環境、社會和治理 (ESG) 的業主對商業辦公大樓的需求持續穩定,而工業設施則尋求整合製程餘熱回收系統。這些多樣化的用戶需求正促使供應商擴展產品線並開發軟體分析能力,進一步加劇歐洲暖通空調設備市場的競爭差異化。

歐洲 HVAC 設備市場按設備類型(空調和通風、暖氣)、最終用戶產業(住宅、商業、工業和製造業等)、安裝類型(新建、維修和更換)、分銷管道(OEM 安裝商網路、批發商/經銷商等)和國家(德國、英國、法國、義大利、西班牙、俄羅斯等)進行細分。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 宏觀經濟因素的影響

- 市場促進因素

- 歐盟綠色交易效率要求和熱泵補貼

- 加速老舊鍋爐設備的更新換代

- 夏季熱浪頻繁推動了住宅空調的普及。

- 商業暖通空調維修中的快速電氣化

- 在氟碳化合物法規修訂後,引入丙烷(R290)熱泵

- 透過擴大安裝人員培訓計劃來釋放潛在需求

- 市場限制

- 與燃氣鍋爐相比,初始投資金額較高

- 供應鏈和原物料價格上漲

- 由於技術純熟勞工短缺,安裝工程延誤。

- 由於冷媒過渡的不確定性,原始設備製造商面臨設備升級風險。

- 產業價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 透過裝置

- 空調和通風設備

- 單分離式和多分離式空調機組

- 可變冷媒流量(VRF)系統

- 空調機組(AHU)

- 冷卻器

- 風機盤管機組

- 包裝式/屋頂機組

- 其他空調和通風設備

- 加熱設備

- 空氣源熱泵

- 地源熱泵

- 鍋爐/爐子/散熱器

- 混合熱泵系統

- 空調和通風設備

- 按最終用戶行業分類

- 住宅

- 商業設施(辦公室、零售商店、住宿設施)

- 工業/製造業

- 公共設施和建築物

- 按安裝類型

- 新建工程

- 維修/更換

- 透過分銷管道

- OEM安裝商網路

- 批發商/分銷商

- 直接面對消費者與電子商務

- 按國家/地區

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 荷蘭

- 其他歐洲地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Daikin Industries Ltd.

- Carrier Global Corporation

- Mitsubishi Electric Corporation

- Robert Bosch GmbH(Bosch Thermotechnology)

- Vaillant Group

- Danfoss A/S

- Lennox International Inc.

- Panasonic Corporation

- Ariston Holding NV

- BDR Thermea Group BV

- Hitachi Ltd.(Johnson Controls-Hitachi)

- Johnson Controls International plc

- Systemair AB

- NIBE Industrier AB

- Glen Dimplex Group

- Fujitsu General Limited

- LG Electronics Inc.

- Samsung Electronics Co. Ltd.

- Trane Technologies plc

- Viessmann Climate Solutions SE

- STIEBEL ELTRON GmbH & Co. KG

- Gree Electric Appliances Inc. of Zhuhai

- Midea Group Co. Ltd.

- Arcelik AS

- Riello SpA

- Armacell SA

- Thermondo GmbH

- Enertech AB(CTC)

第7章 市場機會與未來展望

European HVAC equipment market size in 2026 is estimated at USD 32.29 billion, growing from 2025 value of USD 30.45 billion with 2031 projections showing USD 43.32 billion, growing at 6.05% CAGR over 2026-2031.

This growth positions the region as a critical arena for vendors contending with stricter decarbonization mandates and evolving energy policies. Mounting heat-pump incentives under the EU Green Deal, intensifying summer heatwaves that lift cooling demand, and accelerated replacement of aging boilers collectively fuel the adoption of electrified systems. Meanwhile, supply-chain inflation and high upfront capital requirements temper near-term momentum but have not derailed the long-term trajectory of electrification. Competitive pressure has risen as conglomerates pursue billion-dollar acquisitions to scale production capacity and consolidate fragmented installer networks, aiming to meet the bloc's 60 million heat-pump target by 2030.

Europe HVAC Equipment Market Trends and Insights

EU Green Deal efficiency mandates drive market transformation

Mandatory minimum-efficiency standards and EUR 56 billion (USD 65.57 billion) in heat-pump incentives rolled out across the bloc in 2024 reshaped equipment demand, pushing heat-pump installations in Germany up 60% year-over-year to 43,000 units in Q1 2025. Subsidies favored air-to-water models whose sales jumped from 22,000 to nearly 38,000 units, underscoring policymakers' bias toward hydronic integration. Although Dutch ISDE rebates were reduced in 2025, the Netherlands still aims to install heat pumps in 20% of homes by 2030, sustaining a 9.7% CAGR for the European HVAC equipment market. Manufacturers have responded with natural-refrigerant designs and financing schemes that shield buyers from upfront costs.

Aging boiler replacement accelerates market expansion

Roughly 130 million legacy boilers across Europe became ripe for swap-out as gas prices climbed in 2024 and carbon penalties tightened. OEMs accelerated M&A to secure installer capacity, highlighted by Daikin's purchase of Sweden-based Kylslaget AB in August 2024. Retrofit-oriented heat-pumps engineered for compatibility with existing hydronic circuits shortened installation times and boosted contractor productivity, lifting replacement demand even in markets with modest new-build volumes.

High upfront capital expenditure constrains market penetration

Heat-pump systems still cost 3-5 times more than a boiler swap, deterring households in Eastern Europe and rural districts despite subsidies. Complex financing packages introduced by OEMs raise administrative hurdles and slow sales cycles. Where disposable income is lower, the European HVAC equipment market expands largely through publicly funded social-housing programs rather than private purchases.

Other drivers and restraints analyzed in the detailed report include:

- Summer heatwave intensity reshapes residential AC demand

- Commercial HVAC electrification gains momentum

- Supply-chain inflation pressures profitability

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Ground-source heat pumps recorded the fastest 9.78% CAGR through 2031, even though air-conditioning and ventilation maintained the largest 57.95% share within the European HVAC equipment market. Institutional buyers favored geothermal solutions that deliver higher seasonal efficiencies and longer lifespans, justifying the drilling expenses that residential customers often avoid. As Nordic geology supports closed-loop borefields, installers are reporting an increase in multi-megawatt campus-scale projects.

In parallel, air-to-water heat pumps remained dominant in heating retrofits, leveraging existing radiators and earning policy preference due to their simplification of the fossil-fuel phase-out. Daikin's R-290 modular platform, unveiled in March 2025, exemplified the natural-refrigerant progression that meets F-Gas regulations while enhancing part-load efficiency. Hybrid boiler-pump kits gained traction as interim solutions in colder interiors. Collectively, these innovations sustain the European HVAC equipment market's technology shift from gas-fired packages to electrified variants without sacrificing performance.

Residential users contributed 46.80% of 2025 sales, while public and institutional estates, schools, and hospitals are projected to post the highest 10.05% CAGR, increasing their share of the European HVAC equipment market size by 2031. Government decarbonization budgets funded large-scale retrofits that pair heat pumps with demand-controlled ventilation.

Institutional project cycles are longer but guarantee volume, encouraging OEMs to offer energy-as-a-service contracts that bundle equipment, maintenance, and monitoring. Commercial offices continue to experience steady demand from ESG-driven landlords, while industrial sites explore process heat recovery integrations. These varied user needs prompt suppliers to expand their portfolios and develop software analytics capabilities, further driving competitive differentiation in the European HVAC equipment market.

Europe HVAC Equipment Market is Segmented by Equipment (Air-Conditioning/Ventilation Equipment, and Heating Equipment), End-User Industry (Residential, Commercial, Industrial and Manufacturing, and More), Installation Type (New Construction, and Retrofit/Replacement), Distribution Channel (OEM-Installer Networks, Wholesale/Distributor, and More), and Country (Germany, United Kingdom, France, Italy, Spain, Russia, and More).

List of Companies Covered in this Report:

- Daikin Industries Ltd.

- Carrier Global Corporation

- Mitsubishi Electric Corporation

- Robert Bosch GmbH (Bosch Thermotechnology)

- Vaillant Group

- Danfoss A/S

- Lennox International Inc.

- Panasonic Corporation

- Ariston Holding N.V.

- BDR Thermea Group B.V.

- Hitachi Ltd. (Johnson Controls-Hitachi)

- Johnson Controls International plc

- Systemair AB

- NIBE Industrier AB

- Glen Dimplex Group

- Fujitsu General Limited

- LG Electronics Inc.

- Samsung Electronics Co. Ltd.

- Trane Technologies plc

- Viessmann Climate Solutions SE

- STIEBEL ELTRON GmbH & Co. KG

- Gree Electric Appliances Inc. of Zhuhai

- Midea Group Co. Ltd.

- Arcelik A.S.

- Riello S.p.A.

- Armacell S.A.

- Thermondo GmbH

- Enertech AB (CTC)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Impact of Macroeconomic Factors

- 4.3 Market Drivers

- 4.3.1 EU Green-Deal efficiency mandates and heat-pump subsidies

- 4.3.2 Accelerating replacement of ageing boiler stock

- 4.3.3 Intensifying summer heatwaves boosting residential AC uptake

- 4.3.4 Rapid electrification of commercial HVAC retrofits

- 4.3.5 Propane (R290) heat-pump launches post-F-Gas revision

- 4.3.6 Scale-up of installer-training programs unlocking latent demand

- 4.4 Market Restraints

- 4.4.1 High upfront capex versus gas boilers

- 4.4.2 Supply-chain and commodity-price inflation

- 4.4.3 Skilled-labour bottlenecks delaying installations

- 4.4.4 OEM re-tooling risk amid refrigerant transition uncertainty

- 4.5 Industry Value Chain Analysis

- 4.6 Regulatory Landscape

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Products

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Equipment

- 5.1.1 Air-Conditioning / Ventilation Equipment

- 5.1.1.1 Single-Split and Multi-Split Units

- 5.1.1.2 Variable Refrigerant Flow (VRF) Systems

- 5.1.1.3 Air-Handling Units (AHU)

- 5.1.1.4 Chillers

- 5.1.1.5 Fan-Coil Units

- 5.1.1.6 Packaged / Rooftop Units

- 5.1.1.7 Other AC / Ventilation Equipment

- 5.1.2 Heating Equipment

- 5.1.2.1 Air-to-Water Heat Pumps

- 5.1.2.2 Ground-Source Heat Pumps

- 5.1.2.3 Boilers / Furnaces / Radiators

- 5.1.2.4 Hybrid Heat-Pump Systems

- 5.1.1 Air-Conditioning / Ventilation Equipment

- 5.2 By End-User Industry

- 5.2.1 Residential

- 5.2.2 Commercial (Offices, Retail, Hospitality)

- 5.2.3 Industrial and Manufacturing

- 5.2.4 Institutional and Public Buildings

- 5.3 By Installation Type

- 5.3.1 New Construction

- 5.3.2 Retrofit / Replacement

- 5.4 By Distribution Channel

- 5.4.1 OEM-Installer Networks

- 5.4.2 Wholesale / Distributor

- 5.4.3 Direct-to-Consumer and E-commerce

- 5.5 By Country

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Russia

- 5.5.7 Netherlands

- 5.5.8 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Daikin Industries Ltd.

- 6.4.2 Carrier Global Corporation

- 6.4.3 Mitsubishi Electric Corporation

- 6.4.4 Robert Bosch GmbH (Bosch Thermotechnology)

- 6.4.5 Vaillant Group

- 6.4.6 Danfoss A/S

- 6.4.7 Lennox International Inc.

- 6.4.8 Panasonic Corporation

- 6.4.9 Ariston Holding N.V.

- 6.4.10 BDR Thermea Group B.V.

- 6.4.11 Hitachi Ltd. (Johnson Controls-Hitachi)

- 6.4.12 Johnson Controls International plc

- 6.4.13 Systemair AB

- 6.4.14 NIBE Industrier AB

- 6.4.15 Glen Dimplex Group

- 6.4.16 Fujitsu General Limited

- 6.4.17 LG Electronics Inc.

- 6.4.18 Samsung Electronics Co. Ltd.

- 6.4.19 Trane Technologies plc

- 6.4.20 Viessmann Climate Solutions SE

- 6.4.21 STIEBEL ELTRON GmbH & Co. KG

- 6.4.22 Gree Electric Appliances Inc. of Zhuhai

- 6.4.23 Midea Group Co. Ltd.

- 6.4.24 Arcelik A.S.

- 6.4.25 Riello S.p.A.

- 6.4.26 Armacell S.A.

- 6.4.27 Thermondo GmbH

- 6.4.28 Enertech AB (CTC)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment