|

市場調查報告書

商品編碼

1910848

北美自行車市場:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)North America Bicycle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

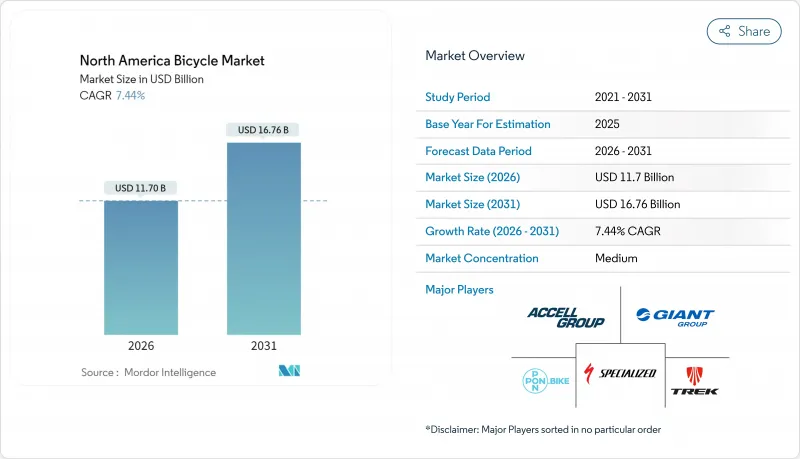

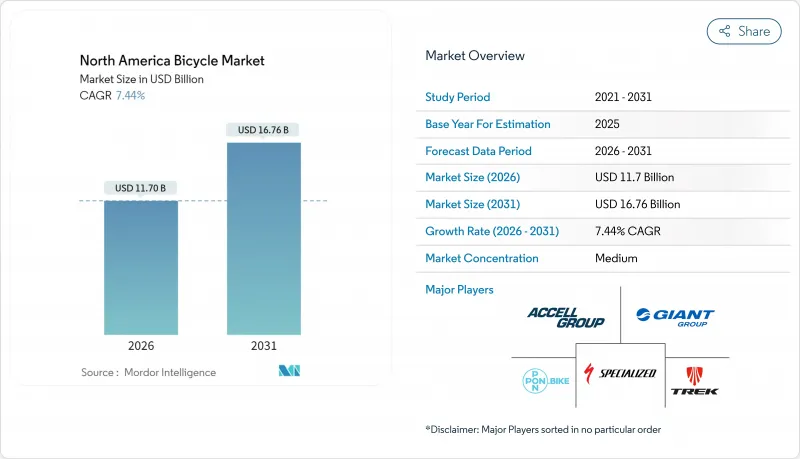

預計到2026年,北美自行車市場規模將達到117億美元,高於2025年的108.9億美元。預計到2031年,該市場規模將達到167.6億美元,2026年至2031年的複合年成長率為7.44%。

這種樂觀前景主要得益於公共部門投資、企業ESG採購以及供應鏈近岸外包。在美國,高達4,450萬美元的預算撥款用於積極交通途徑,凸顯了市場需求,支持基礎建設,並推廣自行車作為一種永續的交通途徑。遵循科學碳目標的企業正在擴大自行車車隊,以減少範圍3排放(與供應鏈和產品使用相關的間接排放)。這一趨勢正在創造機構需求,並顯著推動北美自行車市場的成長。同時,電池即服務(BaaS)模式的興起,透過提供靈活的訂閱式電池解決方案和降低擁有成本,推動了消費者對電動自行車的接受度。即使在疫情初期自行車熱潮消退之後,這項創新也幫助北美自行車市場保持了強勁勢頭。此外,墨西哥的組裝工廠透過縮短前置作業時間和降低關稅風險,為製造商提供了新的成本優勢。這些工廠不僅提高了營運效率,還鞏固了該地區作為具有競爭力的製造地的地位,從而支持其在市場上的長期競爭優勢。

北美自行車市場趨勢與洞察

城市交通資金計畫推動基礎設施主導的需求

北美自行車市場的成長主要得益於消費者的熱情以及強力的基礎設施津貼。美國《基礎設施投資與就業法案》撥款4,450萬美元,用於2025年前的積極交通計劃,專注於建造自行車專用道、綠道和共用出行樞紐。這些計劃旨在改善都市區交通、緩解交通堵塞並促進環境永續交通途徑。加拿大也透過設立4億美元的積極交通基金來支持這項工作,其中1,900萬美元專門用於不列顛哥倫比亞省。該基金支持建造自行車友善基礎設施,例如專用自行車道和步行區,以促進積極通勤。各州政府也扮演重要角色。例如,加州將在四年內投資9.3億美元用於建造專用自行車道和人行道。這項投資預計將顯著改善騎乘者和行人的交通便利性和安全性。這些全面的投資使自行車成為一種準基礎設施資產,市政和企業車隊也開始普遍採用自行車。隨著這些交通網路的發展,預計北美自行車市場將迎來穩定的需求,這得益於更新計劃、車隊擴張以及與公共預算計劃相符的維護合約。

微行程訂閱平台改變城市交通

訂閱服務讓高品質硬體更容易取得,並創造了穩定的收入來源。這些服務降低了消費者的經濟門檻,使他們無需支付高額前期費用即可獲得高品質產品。在美國主要城市,微出行業者每年的出行量超過1.5億次,凸顯了共用出行解決方案的普及和日益成長的依賴性。都市區正擴大將電動自行車共享納入其緩解交通堵塞和減少排放的策略,鼓勵人們減少單人駕駛車輛,並促進永續的城市交通。這種轉變使自行車製造商能夠從不可預測的一次性銷售轉向穩定的多年租賃模式,從而增強現金流並建立可預測的收入模式。由此產生的翻新產品源源不絕地流入管理完善的二手產品通路,不僅延長了產品的使用壽命,也強化了對ESG投資者而言永續性理念。這些通路確保了翻新產品的有效利用,減少了廢棄物,並實現了環境目標。

都市區缺乏自行車失竊保險阻礙了自行車的普及。

自行車騎行者的年失竊率約為4.2%,造成的損失高達14億美元。然而,這些損失的保險覆蓋不足,許多產物保險將價格超過1000美元的自行車排除在承保範圍之外,而且通常不包括其他昂貴的騎行者。這種保險覆蓋不足的情況對低收入社區的影響尤其嚴重,因為高盜竊風險阻礙了他們擁有和使用自行車。這些障礙使得公共機構難以有效地服務關鍵人群,並限制了市場公平成長的潛力。電動自行車領域的挑戰尤其嚴峻,其零售價格起價為2,000美元,使得弱勢族群更加難以負擔。除非擴大保險產品的覆蓋範圍,並且城市投資建設安全的自行車停放基礎設施,否則對盜竊的擔憂將繼續削弱消費者的信心,並阻礙北美自行車市場的成長。

細分市場分析

到2025年,山地自行車和全地形車將佔北美自行車市場35.02%的佔有率,這主要得益於消費者對戶外活動和越野騎行的熱情日益高漲。步道維護津貼和投資擴大了該細分市場的騎行區域,從而提升了山地自行車對更廣泛人群的吸引力。愛好者們被這些自行車堅固耐用、用途廣泛的特點所吸引,尤其重視它們在崎嶇地形上的表現。隨著騎乘者越來越追求優質車架、先進的懸吊系統和專業的越野配件,山地自行車的選擇性消費仍然強勁。製造商們正在不斷最佳化產品線,推廣兼顧強度和重量的設計,以滿足騎乘者不斷變化的需求。儘管其他類型的自行車也在崛起,但山地自行車仍擁有一批忠實的擁躉,並鞏固了其作為各大自行車品牌重要收入來源的地位。

預計混合動力自行車將超越其他所有自行車類別,以7.62%的複合年成長率成長,成為北美成長最快的細分市場。這一快速成長的驅動力在於越來越多的通勤者和休閒騎行者尋求能夠在鋪裝路面和非鋪裝路面上都表現優異的多功能自行車。基礎設施的進步,例如專用車道和碎石連接道的建設,使得混合動力自行車騎乘者無需頻繁更換自行車即可輕鬆應對各種地形。混合動力自行車兼具舒適性、耐用性和適應性,是注重實用性的都市區騎乘者的理想之選。為此,領先的製造商正在拓展產品線,並將研發資源集中在開發兼具耐用性和輕量化設計的車架。隨著混合動力自行車逐漸成為市場的核心實用交通工具,其崛起凸顯了消費者對多功能出行方式和積極生活方式的偏好正在發生更廣泛的轉變。

截至2025年,標準車架自行車仍佔自行車總出貨量的絕大部分,佔所有出貨量的92.05%。其經典的菱形車架確保了騎乘的穩定性,且易於維護。這種傳統設計因其結構簡單而廣受歡迎,適用於從休閒到競技騎行的各種活動。這種簡單性也帶來了價格實惠,使其成為初學者、家庭和休閒騎乘者的理想選擇。製造商致力於在耐用性、重量和成本之間取得平衡,以確保這些自行車的廣泛供應。易於取得的備件和熟悉的維修流程進一步鞏固了它們在不同市場的受歡迎程度。總而言之,標準車架自行車是北美自行車市場的基石,因其在休閒和運動中的多功能性而備受青睞。

折疊式自行車已成為市場中成長最快的細分領域,預計將以9.86%的強勁複合年成長率成長。這一快速成長主要由空間有限的都市區推動。折疊自行車緊湊便攜的設計使其成為公寓居住者和在繁忙城市中使用多種交通途徑通勤者的理想選擇。紐約、多倫多和溫哥華等主要城市的交通管理部門已放寬了尖峰時段對折疊自行車的限制,進一步提升了折疊式自行車在公共交通中的便利性。儘管目前折疊式自行車在北美的市場佔有率不大,但隨著城市居民尋求更便捷的出行方式,其需求正在顯著成長。一個值得關注的趨勢是「雙車」生活方式的興起,人們在工作日休閒時選擇折疊式自行車,週末休閒騎行時則換用普通自行車或電動自行車。這種適應性凸顯了折疊式自行車在解決都市區交通難題方面的重要作用,以及其與現代偏好的契合度。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 城市交通資金計畫推動基礎設施主導的需求

- 微行程訂閱平台改變城市交通

- 在墨西哥的OEM製造投資創造了供應鏈替代方案

- 以ESG為重點的企業車隊採購將使需求制度化。

- 利用電池即服務(BaaS)模式降低電動自行車的總擁有成本(TCO)

- 健身潮流正讓騎乘越來越受歡迎。

- 市場限制

- 自行車失竊保險的缺乏阻礙了自行車在都市區的廣泛使用。

- 零件供應鏈中的漏洞造成生產瓶頸

- 提高對中國進口商品的反傾銷稅

- 拓展二手市場,為我們自己的產品贏得市場佔有率

- 價值/價值鏈分析

- 監管環境

- 技術展望

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 依產品類型

- 道路/城市

- 山地/全地形

- 混合

- 電動自行車

- 其他類型

- 有意為之

- 通常

- 折疊式

- 最終用戶

- 男性

- 女士

- 孩子們

- 透過分銷管道

- 線上零售商

- 線下零售店

- 按地區

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市場排名分析

- 公司簡介

- Trek Bicycle Corporation

- Specialized Bicycle Components

- Giant Manufacturing Co.

- Accell Group(Raleigh, Haibike)

- Cannondale(Cycling Sports Group)

- Pon Bike(Santa Cruz, Gazelle)

- Schwinn(Pacific Cycle)

- Rad Power Bikes

- Lectric eBikes

- Aventon

- Mongoose

- Diamondback

- Marin Bikes

- Salsa Cycles

- QuietKat

- Serial 1(Harley-Davidson)

- Propella

- Ride1Up

- Juiced Bikes

- Brompton Bicycle

第7章 市場機會與未來展望

North American bicycle market size in 2026 is estimated at USD 11.7 billion, growing from 2025 value of USD 10.89 billion with 2031 projections showing USD 16.76 billion, growing at 7.44% CAGR over 2026-2031.

Public-sector investments, corporate ESG procurement, and supply-chain near-shoring are driving this optimistic outlook. In the U.S., a notable USD 44.5 million allocation for active transportation underscores the visibility of demand, supporting infrastructure development and encouraging the adoption of bicycles as a sustainable mode of transport. Companies adhering to science-based climate targets are increasingly adopting bicycle fleets to reduce Scope 3 emissions, which include indirect emissions from their supply chains and product use. This trend is significantly contributing to the growth of the North American bicycle market by adding institutional demand. Meanwhile, the rise of battery-as-a-service models is alleviating ownership costs by offering flexible subscription-based solutions for battery usage, making electric bicycles more accessible to consumers. This innovation is helping the North American bicycles market stay robust as the initial pandemic-driven enthusiasm for cycling normalizes. Additionally, assembly hubs in Mexico are shortening lead times and reducing tariff exposure, providing manufacturers with new cost advantages. These hubs not only enhance operational efficiency but also strengthen the region's position as a competitive manufacturing base, reinforcing long-term competitiveness in the market.

North America Bicycle Market Trends and Insights

Urban-mobility funding programs drive infrastructure-led demand

In North America, the bicycle market thrives not just on consumer enthusiasm but significantly on robust infrastructure grants. Under the U.S. Infrastructure Investment and Jobs Act, a notable USD 44.5 million is allocated for active-transportation projects in 2025, focusing on protected lanes, greenways, and shared-mobility hubs. These projects aim to enhance urban mobility, reduce traffic congestion, and promote environmentally sustainable transportation options. Canada bolsters this initiative with its USD 400 million Active Transportation Fund, designating USD 19 million specifically for British Columbia. This fund supports the development of bike-friendly infrastructure, including dedicated cycling paths and pedestrian-friendly zones, to encourage active commuting. States, too, play a pivotal role; for instance, California is channeling a substantial USD 930 million over four years into bike and pedestrian corridors. This investment is expected to significantly improve connectivity and safety for cyclists and pedestrians alike. Such comprehensive investments elevate bicycles to the status of quasi-infrastructure assets, with municipal agencies and corporate fleets acquiring them on a predictable basis. As these transportation networks evolve, the North American bicycle market sees consistent demand, driven by replacement programs, fleet expansions, and maintenance contracts, all synchronized with public budgeting timelines.

Micro-mobility subscription platforms reshape urban transportation

Subscription services are making premium hardware more accessible and generating steady revenue streams. These services lower the financial barrier for consumers, enabling them to access high-quality products without significant upfront costs. In major U.S. cities, micromobility operators are now logging over 150 million annual rides, a clear sign of mainstream acceptance and growing reliance on shared mobility solutions. Cities are increasingly incorporating e-bike sharing into their strategies to combat congestion and reduce emissions, steering commuters away from single-occupancy vehicles and promoting sustainable urban transportation. This shift allows bicycle manufacturers to transition from unpredictable one-time sales to stable multi-year leasing contracts, bolstering their cash flow and creating predictable revenue models. As a result, there's a consistent influx of refurbished units into well-managed second-life channels, not only extending product life but also bolstering sustainability narratives that appeal to ESG investors. These second-life channels ensure that refurbished products are efficiently utilized, reducing waste and aligning with environmental goals.

Bike-theft insurance gaps undermine urban adoption

Active riders face annual theft rates of about 4.2%, leading to losses of USD 1.4 billion. Coverage for these losses is inconsistent; many property insurers exclude bicycles valued over USD 1,000, unless policyholders opt for expensive riders. This lack of coverage disproportionately impacts lower-income neighborhoods, where higher theft risks create significant barriers to bicycle ownership and use. These barriers prevent public agencies from effectively serving key demographics, limiting the potential for equitable market growth. The challenge is particularly severe in the electric bicycle segment, where retail prices start at USD 2,000, making them even less accessible to vulnerable groups. Without broader insurance offerings or city investments in secure parking infrastructure, theft concerns will continue to undermine consumer confidence and hinder the growth of North America's bicycle market.

Other drivers and restraints analyzed in the detailed report include:

- OEM manufacturing investments in Mexico create supply-chain alternatives

- ESG-driven corporate fleet procurement institutionalizes demand

- Component supply-chain fragility creates production bottlenecks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, mountain and all-terrain bikes command a 35.02% share of the North American bicycle market, fueled by a surge in consumer enthusiasm for outdoor escapades and off-road cycling. Bolstered by trail-building grants and investments, this segment has broadened accessible riding zones, amplifying mountain biking's allure across diverse demographics. Enthusiasts, drawn to the rugged versatility and durability of these bikes, prioritize performance on challenging terrains. As riders increasingly seek premium frames, advanced suspension systems, and specialized trail accessories, discretionary spending on mountain bikes remains strong. Manufacturers are fine-tuning product lines, emphasizing a balance between strength and weight to align with shifting rider demands. While other categories gain traction, mountain bikes retain a devoted following, solidifying their status as a primary revenue source for leading bicycle brands.

Hybrid bicycles are set to outstrip all other categories, boasting a projected CAGR of 7.62%, positioning them as North America's fastest-growing segment. This surge is driven by a rising tide of commuters and leisure riders gravitating towards versatile bikes adept on both paved and unpaved surfaces. Infrastructure advancements, like the melding of protected lanes with gravel connectors, empower hybrid riders to navigate diverse terrains without the hassle of switching bikes. With their blend of comfort, durability, and adaptability, hybrids cater perfectly to urban riders prioritizing practicality. In response, top manufacturers are refining product ranges and channeling research and development into crafting frames that strike a balance between sturdiness and lightweight design. As hybrids cement their status as the market's utility cornerstone, their ascent underscores a broader consumer shift towards versatile mobility and active living.

In 2025, regular bike frames command a dominant 92.05% share of total shipments. Their established diamond geometries ensure consistent ride comfort and easy maintenance. These traditional designs, favored in both leisure and sports cycling, boast straightforward constructions. This simplicity translates to affordability, making regular frames particularly attractive to first-time buyers, families, and casual riders. Manufacturers are honing in on the delicate balance of durability, weight, and cost, ensuring these bikes remain widely accessible. The ready availability of spare parts and familiar repair processes further bolsters their popularity across diverse markets. In essence, regular frame bikes stand as the cornerstone of the North American bicycle market, celebrated for their versatility in both recreational and sporting arenas.

Folding bikes are emerging as the market's fastest-growing segment, boasting a robust projected CAGR of 9.86%. This surge is largely fueled by urban centers grappling with space constraints. Their compact, portable design caters perfectly to apartment dwellers and those navigating multi-modal commutes in bustling cities. Major metropolitan transit authorities, including those in New York, Toronto, and Vancouver, have relaxed restrictions on carrying folding bikes during peak hours, further bolstering their appeal in public transport. While they currently hold a modest slice of the North American market, folding bikes are witnessing a notable uptick as urban residents hunt for convenient mobility solutions. A notable trend sees weekday commuters opting for folding bikes for practical travel, then transitioning to regular or electric bikes for leisurely weekend rides, highlighting a growing trend of dual ownership. This adaptability accentuates folding bikes' pivotal role in navigating urban mobility challenges and aligning with modern lifestyle preferences.

The North America Bicycle Market Report Segments the Industry Into Type (Road Bicycles, Hybrid Bicycles, All-Terrain/Mountain Bicycles, E-Bicycles, Other Types), Distribution Channel (Offline Retail Stores, Online Retail Stores), and Geography (United States, Canada, Mexico, Rest of North America). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Trek Bicycle Corporation

- Specialized Bicycle Components

- Giant Manufacturing Co.

- Accell Group (Raleigh, Haibike)

- Cannondale (Cycling Sports Group)

- Pon Bike (Santa Cruz, Gazelle)

- Schwinn (Pacific Cycle)

- Rad Power Bikes

- Lectric eBikes

- Aventon

- Mongoose

- Diamondback

- Marin Bikes

- Salsa Cycles

- QuietKat

- Serial 1 (Harley-Davidson)

- Propella

- Ride1Up

- Juiced Bikes

- Brompton Bicycle

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Urban-mobility funding programs drive infrastructure-led demand

- 4.2.2 Micro-mobility subscription platforms reshape urban transportation

- 4.2.3 OEM manufacturing investments in Mexico create supply-chain alternatives

- 4.2.4 ESG-driven corporate fleet procurement institutionalizes demand

- 4.2.5 Battery-as-a-service models lowering e-bike TCO

- 4.2.6 Fitness trends increase the popularity of cycling activities

- 4.3 Market Restraints

- 4.3.1 Bike-theft insurance gaps undermine urban adoption

- 4.3.2 Component supply-chain fragility creates production bottlenecks

- 4.3.3 Rising anti-dumping duties on Chinese imports

- 4.3.4 Growing second-hand marketplace cannibalisation

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Road/City

- 5.1.2 Mountain/All-Terrain

- 5.1.3 Hybrid

- 5.1.4 E-Bicycle

- 5.1.5 Other Types

- 5.2 By Design

- 5.2.1 Regular

- 5.2.2 Folding

- 5.3 By End User

- 5.3.1 Men

- 5.3.2 Women

- 5.3.3 Kids

- 5.4 By Distribution Channel

- 5.4.1 Online Retail Stores

- 5.4.2 Offline Retail Stores

- 5.5 By Geography

- 5.5.1 United States

- 5.5.2 Canada

- 5.5.3 Mexico

- 5.5.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Trek Bicycle Corporation

- 6.4.2 Specialized Bicycle Components

- 6.4.3 Giant Manufacturing Co.

- 6.4.4 Accell Group (Raleigh, Haibike)

- 6.4.5 Cannondale (Cycling Sports Group)

- 6.4.6 Pon Bike (Santa Cruz, Gazelle)

- 6.4.7 Schwinn (Pacific Cycle)

- 6.4.8 Rad Power Bikes

- 6.4.9 Lectric eBikes

- 6.4.10 Aventon

- 6.4.11 Mongoose

- 6.4.12 Diamondback

- 6.4.13 Marin Bikes

- 6.4.14 Salsa Cycles

- 6.4.15 QuietKat

- 6.4.16 Serial 1 (Harley-Davidson)

- 6.4.17 Propella

- 6.4.18 Ride1Up

- 6.4.19 Juiced Bikes

- 6.4.20 Brompton Bicycle