|

市場調查報告書

商品編碼

1910815

印刷軟性感測器:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Printed Flexible Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

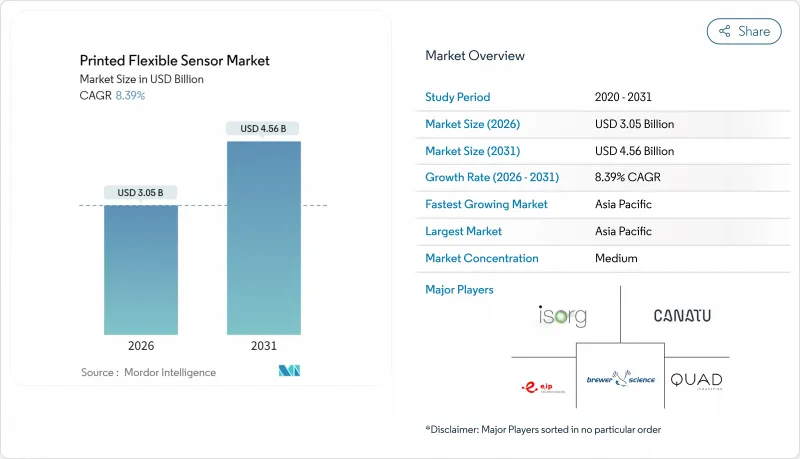

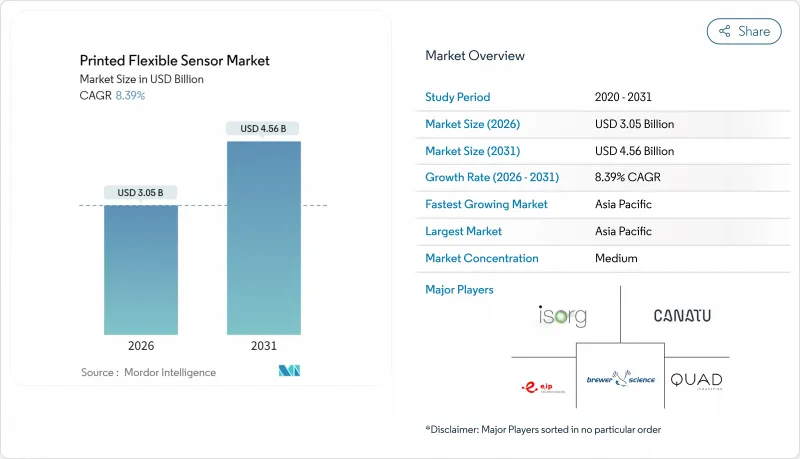

預計印刷軟性感測器市場將從 2025 年的 28.1 億美元成長到 2026 年的 30.5 億美元,到 2031 年將達到 45.6 億美元,2026 年至 2031 年的複合年成長率為 8.39%。

這項穩步擴張得益於卷對卷積層製造技術的進步、支持國內半導體產能的政策獎勵,以及家用電子電器、醫療穿戴式設備、汽車系統和國防平台等領域對可適應性感測解決方案日益成長的需求。新的印刷製程可將資本支出降低40%以上,進而降低成熟企業和新興企業的進入門檻,而成本最佳化仍是成長的關鍵驅動力。政府項目,例如拜登-哈里斯政府撥款16億美元用於先進封裝,凸顯了軟性電子產品基礎設施的戰略重要性。憑藉規模優勢,尤其是在擴大軟性OLED產能方面,亞太地區預計在2030年前供應近一半的印刷感測器。同時,歐洲的監管發展正在推動對可回收感測器結構的需求。

全球印刷軟性感測器市場趨勢及展望

節能超薄家用電子電器的需求不斷成長

智慧型手機和穿戴式裝置廠商正在採用印刷軟性感測器,以實現傳統剛性組件無法實現的折疊式顯示器和壓力感測外殼。超低功耗架構延長了設備電池續航時間,並實現了纖薄外形規格,同時滿足了消費者對節能的需求。賓州州立大學的研究開發了一種自組裝導電網路,無需二次活化步驟,從而降低了製造過程中的能耗。壓力映射表面正擴大應用於遊戲周邊設備,將印刷軟性感測器的市場拓展到行動裝置之外。類似的超薄可彎曲薄膜也正在應用於工業監測領域,在這些領域中,感測器必須能夠貼合曲面設備,同時又不增加厚度。

在醫療穿戴式裝置和生物感測領域不斷擴大應用

醫療機構正在部署印刷生物感測器進行即時生命徵象監測,加速向預防性和遠端醫療轉型。科思創和埃森哲合作,利用Baymedix黏合劑和Platilon TPU薄膜,開發出透氣舒適的貼片式感測器。韓國材料科學研究院展示了一種靈敏度為1 ppm的氨氣偵測器,開創了非侵入性診斷在腎臟病監測領域應用的先河。隨著軟性設備臨床證據的累積和監管流程的簡化,生物感測器有望在印刷軟性感測器市場中佔據最快的成長軌道。

與矽感測器相比,精度和穩定性方面存在差異

印刷式壓力感測器在長期穩定性方面仍遜於微加工矽材料,尤其是在溫度波動和機械疲勞條件下。微晶矽元件的靈敏度係數可達31,漂移極小,而印刷薄膜在精確度要求高的應用上可能出現不可接受的偏差。臨床評估報告顯示,軟性壓力感測器的精度在88%至94%之間,足以滿足指標監測的要求,但無法達到侵入性偵測的基準值。目前正在進行封裝和奈米複合油墨方面的研究,以縮小性能差距。

細分市場分析

至2025年,印刷式壓力感測器將佔軟性感測器市場總量的27.95%,為智慧型手機、遊戲控制器和汽車觸控面板提供觸覺介面。生物感測器領域也呈現同步成長勢頭,年複合成長率達9.03%,反映醫療保健領域對非侵入性、運作病患監測的需求日益成長。隨著診斷技術從醫療機構向消費領域轉移,生物感測器的快速成長正在推動印刷式軟性感測器市場的擴張。強勁的需求與人工智慧賦能的分析技術相輔相成,高解析度應變計可用於繪煞車態,從而建立復健回饋迴路。此外,能夠檢測1ppm氨氣的氣體感測器在農業和環境健康領域開闢了新的應用前景,預示著印刷式軟性感測器產業產品系列的多元化發展。

鄰近市場將推動差異化發展:用於智慧包裝的光學檢測器可實現新鮮度認證,而編織到電子紡織品中的應變感測器則可採集人體工學指標,用於工業安全專案。生物感測器的印刷軟性感測器市場規模預計將超過傳統領域,因為聚合物基板和奈米工程油墨的結合可在不影響佩戴舒適度的前提下提供臨床實用的靈敏度。酵素功能化電極和自修復導體的研發投入不斷增加,預計將鞏固該領域相對於傳統壓力和溫度感測器的優勢。

網版印刷憑藉其厚膜印刷能力和低單位成本,預計2025年將維持35.55%的市佔率。而噴墨印刷預計8.78%的複合年成長率則預示著產業正朝著更高解析度圖案和多材料相容性方向發展。隨著線寬接近20微米以下的極限,噴墨平台能夠在有限面積內實現高密度互連,進而推動印刷軟性感測器市場的微型化藍圖。新興的氣溶膠噴射印刷和3D列印技術能夠將導電漿料應用於非平面形狀,滿足航空電子設備和醫療植入所需的貼合性,進一步拓展了設計自由度。

儘管凹版和柔版印刷生產線仍然是生產數百萬台消費性電子設備的主要方式,但噴墨技術的數位化特性縮短了換線時間,並實現了感測器佈局的大規模客製化。學術團隊展示了亞微米碳奈米管電晶體的毛細流動印刷技術,實現了與光刻技術相媲美的微型化,標誌著競爭格局的關鍵轉折點。隨著油墨供應商將光閃燒結無氧化物銅奈米流體商業化,其導電性可與塊狀銀媲美,且不受貴金屬價格的影響,與噴墨系統相關的軟性印刷感測器的市場規模預計將加速成長。

區域分析

預計到2025年,亞太地區將佔據軟性印刷感測器市場46.35%的佔有率,並在2031年之前以8.71%的複合年成長率成長。中國主導產能擴張,京東方預計2028年超越三星顯示,成為軟性OLED產能最大的企業。這項進展將保障上游材料的需求,並實現印刷感測器供應鏈的本地化。日本的精密製造傳統和韓國在材料科學領域的深厚實力將增強該地區的韌性,而東南亞國家將為大規模生產的消費性電子產品提供具成本效益的組裝基地。

北美地區在收入方面排名第二。聯邦政府的支持,例如16億美元的先進封裝計畫和1.79億美元的能源部微電子中心,正在幫助提升國內印刷軟性感測器產業的能力。國防開支推動了共形航空電子感測器的早期應用,而強大的醫療設備生態系統則加速了生物感測器的商業化進程。

歐洲正利用其在汽車產業的主導和嚴格的生態設計法規,推動可回收感測器的全球規範制定。 「轉型計劃」旨在建構區域性功能電子產品供應鏈,這將減少對亞洲進口的依賴,並將研發資金用於永續基板技術。儘管拉丁美洲和中東/非洲目前市場佔有率較小,但工業現代化和通訊基礎設施的進步表明,這些地區存在潛在需求,尤其是在智慧電網和建築自動化感測領域。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 節能超薄家用電子電器的需求不斷成長

- 穿戴式醫療設備和生物感測技術的應用日益廣泛

- 汽車車載人機互動系統與電池監控系統的整合

- 國防研發:用於保形航空電子設備和結構健康監測

- 卷對卷積層製造技術可減少超過40%的資本投資

- 歐盟生態設計政策傾向於使用可回收的印刷感測器

- 市場限制

- 與矽感測器相比,精度和穩定性方面存在差異

- 製造流程缺乏標準化

- 銀奈米顆粒墨水的供應不穩定

- 高溫應用案例缺乏可靠性數據

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力模型

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 依感測器類型

- 生物感測器

- 觸摸感應器

- 檢測器

- 溫度感測器

- 壓力感測器

- 氣體感測器

- 應變和力感測器

- 透過印刷技術

- 網版印刷

- 噴墨列印

- 凹版印刷

- 柔版印刷

- 3D/氣溶膠噴射列印

- 按基礎材料

- 聚醯亞胺(PI)

- PET

- PEN

- 紙張和纖維素

- 其他(玻璃、金屬箔)

- 按最終用戶行業分類

- 家用電子電器

- 醫療保健

- 車

- 工業和製造業

- 航太/國防

- 其他(智慧包裝、建築自動化)

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 歐洲

- 德國

- 法國

- 英國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 澳洲和紐西蘭

- 東南亞

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 中東

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Canatu Oy

- Brewer Science

- ISORG

- E2IP Technologies

- Quad Industries

- Pressure Profile Systems Inc.

- Butler Technologies Inc.

- Tekscan Inc.

- PST Sensors

- PolyIC GmbH and Co. KG

- Memtronik

- Linepro Controls Pvt. Ltd.

- Forciot

- Nissha Co. Ltd.

- TactoTek

- Interlink Electronics

- FlexEnable

- Heraeus Nexensos

- Molex

- 3M

第7章 市場機會與未來展望

The printed flexible sensor market is expected to grow from USD 2.81 billion in 2025 to USD 3.05 billion in 2026 and is forecast to reach USD 4.56 billion by 2031 at 8.39% CAGR over 2026-2031.

This steady expansion results from converging advances in roll-to-roll additive manufacturing, policy incentives supporting domestic semiconductor capacity, and rising demand for conformable sensing solutions across consumer electronics, medical wearables, automotive systems, and defense platforms. Cost optimization remains a pivotal growth lever as new printing processes shave more than 40% from capital expenditure outlays, thereby lowering entry barriers for both incumbents and start-ups. Government programs such as the Biden-Harris Administration's USD 1.6 billion allocation for advanced packaging underscore the strategic relevance of flexible electronics infrastructure.Asia-Pacific's scale advantage, particularly in flexible OLED capacity build-out, positions the region to supply nearly half of all printed sensors by 2030, while regulatory moves in Europe foster demand for recyclable sensor architectures.

Global Printed Flexible Sensor Market Trends and Insights

Rising Demand for Energy-Efficient, Ultra-Thin Consumer Electronics

Smartphone and wearable OEMs embed printed flexible sensors to deliver foldable displays and pressure-sensitive housings that conventional rigid components cannot support. Ultra-low-power architectures extend device battery life, meeting user expectations for energy efficiency while enabling slim form factors. Research at Penn State produced self-assembling conductive networks that remove secondary activation steps, trimming manufacturing energy budgets. Gaming peripherals increasingly rely on pressure-mapped surfaces, widening the printed flexible sensor market beyond mobile hardware. The same thin, bendable films are migrating into industrial monitoring where sensors must conform to curved equipment without adding bulk.

Increasing Adoption in Medical Wearables and Biosensing

Healthcare providers deploy printed biosensors for real-time vital-sign tracking, accelerating the shift toward preventive, remote care. Covestro's partnership with accensors yielded breathable, skin-friendly patch sensors that leverage Baymedix adhesives and Platilon TPU films. The Korea Institute of Materials Science demonstrated ammonia-gas detectors with 1 ppm sensitivity, opening non-invasive diagnostics for renal disease monitoring. Regulatory pathways are streamlining as flexible devices build clinical evidence, positioning biosensors to capture the fastest growth trajectory within the printed flexible sensor market.

Accuracy and Stability Gap vs. Silicon Sensors

Printed gauges still trail micro-machined silicon alternatives on long-term stability, especially when exposed to temperature swings or mechanical fatigue. Microcrystalline silicon devices achieve gauge factors of 31 with minimal drift, whereas printed films can deviate beyond acceptable thresholds in precision-critical deployments. Clinical evaluations report accuracy spreads of 88-94% for flexible pressure sensors, sufficient for indicative monitoring yet below invasive-grade benchmarks. Ongoing research into encapsulation layers and nanocomposite inks seeks to narrow the performance delta.

Other drivers and restraints analyzed in the detailed report include:

- Automotive In-Cabin HMI and Battery Monitoring Integration

- Defense R&D for Conformal Avionics and Structural Health Monitoring

- Lack of Fabrication Standardization

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Printed pressure sensors controlled 27.95% of the overall printed flexible sensor market share in 2025, supplying haptic interfaces to smartphones, gaming controllers, and automotive touch-surfaces. Parallel momentum in biosensors, expanding at a 9.03% CAGR, reflects healthcare's drive toward non-invasive, always-on patient monitoring. The biosensor surge widens the printed flexible sensor market as diagnostics migrate from clinic to consumer spheres. Robust demand intersects with AI-enabled analytics, where high-resolution strain gauges map biomechanics for rehabilitation feedback loops. Furthermore, gas sensors detecting 1 ppm ammonia open agricultural and environmental-health use-cases, illustrating portfolio diversification within the printed flexible sensor industry.

Market adjacencies amplify differentiation: photodetectors for smart packaging authenticate freshness, while strain sensors woven into e-textiles capture ergonomic metrics for industrial safety programs. The printed flexible sensor market size for biosensors is forecast to outgrow legacy segments as polymer substrates coupled with nano-engineered inks deliver clinically relevant sensitivity without sacrificing wearer comfort. Intensifying R&D in enzyme-functionalized electrodes and self-healing conductors will likely sustain the segment's outperformance against conventional pressure and temperature counterparts.

Screen printing retained 35.55% revenue in 2025 thanks to its thick-film capability and low-unit cost, but inkjet printing's anticipated 8.78% CAGR underscores industry migration toward higher pattern resolution and multi-material flexibility. As line widths approach the sub-20 µm threshold, inkjet platforms enable dense routing on limited real-estate, thereby advancing miniaturization roadmaps within the printed flexible sensor market. Emergent aerosol-jet and 3D printing modalities further extend the design envelope by depositing conductive pastes on non-planar geometries, a requirement for conformal avionics and medical implants.

Gravure and flexographic lines remain staples for million-unit consumer-electronics volumes, yet inkjet's digital nature curtails changeover time, permitting mass-customization of sensor layouts. Capillary-flow printing of submicron CNT transistors demonstrated by academic groups showcases feature parity with photolithography, marking a decisive competitive inflection. The printed flexible sensor market size tied to inkjet systems is projected to accelerate as ink suppliers commercialize oxide-free copper nanofluids that sinter via photonic flashes, achieving bulk-silver conductivities without the precious-metal price drag.

The Printed Flexible Sensor Market Report is Segmented by Sensor Type (Biosensors, Touch Sensors, Photodetectors, and More), Printing Technology (Screen Printing, Inkjet Printing, Gravure Printing, Fand More), Substrate Material (Polyimide, PET, PEN, Paper and More), End-User Industry (Consumer Electronics, Medical and Healthcare, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific held 46.35% printed flexible sensor market share in 2025 and is anticipated to grow at 8.71% CAGR to 2031. China leads capacity additions, with BOE projected to surpass Samsung Display in flexible OLED throughput by 2028, a development that secures upstream material demand and localizes printed sensor supply chains. Japan's precision-manufacturing heritage and South Korea's material-science depth add regional resilience, while Southeast Asian economies provide cost-efficient assembly for high-volume consumer electronics.

North America ranks second by revenue. Federal incentives such as the USD 1.6 billion advanced packaging program and the USD 179 million DOE microelectronics centers stimulate domestic printed flexible sensor industry capability. Defense budgets catalyze early adoption of conformal avionics sensors, and the robust medical-device ecosystem accelerates biosensor commercialization.

Europe leverages automotive leadership and stringent eco-design mandates to shape global specifications for recyclable sensors. The Reform Project's initiative to forge a regional functional electronics supply chain reduces reliance on Asian imports and channels R&D funding toward sustainable substrate technologies. Latin America and the Middle East & Africa currently command small shares, yet industrial modernization and telecom infrastructure upgrades signal latent demand, particularly in smart-grid and building-automation sensing.

- Canatu Oy

- Brewer Science

- ISORG

- E2IP Technologies

- Quad Industries

- Pressure Profile Systems Inc.

- Butler Technologies Inc.

- Tekscan Inc.

- PST Sensors

- PolyIC GmbH and Co. KG

- Memtronik

- Linepro Controls Pvt. Ltd.

- Forciot

- Nissha Co. Ltd.

- TactoTek

- Interlink Electronics

- FlexEnable

- Heraeus Nexensos

- Molex

- 3M

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for energy-efficient, ultra-thin consumer electronics

- 4.2.2 Increasing adoption in medical wearables and biosensing

- 4.2.3 Automotive in-cabin HMI and battery monitoring integration

- 4.2.4 Defense R&D for conformal avionics and structural health monitoring

- 4.2.5 Roll-to-roll additive manufacturing cutting CapEx >40 %

- 4.2.6 EU eco-design policies favouring recyclable printed sensors

- 4.3 Market Restraints

- 4.3.1 Accuracy and stability gap vs. silicon sensors

- 4.3.2 Lack of fabrication standardisation

- 4.3.3 Volatile supply of silver nanoparticle inks

- 4.3.4 Limited reliability data for high-temperature use-cases

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS

- 5.1 By Sensor Type

- 5.1.1 Biosensors

- 5.1.2 Touch Sensors

- 5.1.3 Photodetectors

- 5.1.4 Temperature Sensors

- 5.1.5 Pressure Sensors

- 5.1.6 Gas Sensors

- 5.1.7 Strain and Force Sensors

- 5.2 By Printing Technology

- 5.2.1 Screen Printing

- 5.2.2 Inkjet Printing

- 5.2.3 Gravure Printing

- 5.2.4 Flexographic Printing

- 5.2.5 3D / Aerosol-Jet Printing

- 5.3 By Substrate Material

- 5.3.1 Polyimide (PI)

- 5.3.2 PET

- 5.3.3 PEN

- 5.3.4 Paper and Cellulose

- 5.3.5 Others (Glass, Metal Foils)

- 5.4 By End-user Industry

- 5.4.1 Consumer Electronics

- 5.4.2 Medical and Healthcare

- 5.4.3 Automotive

- 5.4.4 Industrial and Manufacturing

- 5.4.5 Aerospace and Defense

- 5.4.6 Others (Smart Packaging, Building Automation)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 France

- 5.5.3.3 United Kingdom

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Australia and New Zealand

- 5.5.4.6 Southeast Asia

- 5.5.4.7 Rest of Asia Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 UAE

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Canatu Oy

- 6.4.2 Brewer Science

- 6.4.3 ISORG

- 6.4.4 E2IP Technologies

- 6.4.5 Quad Industries

- 6.4.6 Pressure Profile Systems Inc.

- 6.4.7 Butler Technologies Inc.

- 6.4.8 Tekscan Inc.

- 6.4.9 PST Sensors

- 6.4.10 PolyIC GmbH and Co. KG

- 6.4.11 Memtronik

- 6.4.12 Linepro Controls Pvt. Ltd.

- 6.4.13 Forciot

- 6.4.14 Nissha Co. Ltd.

- 6.4.15 TactoTek

- 6.4.16 Interlink Electronics

- 6.4.17 FlexEnable

- 6.4.18 Heraeus Nexensos

- 6.4.19 Molex

- 6.4.20 3M

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment