|

市場調查報告書

商品編碼

1842436

印刷感測器:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030)Printed Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

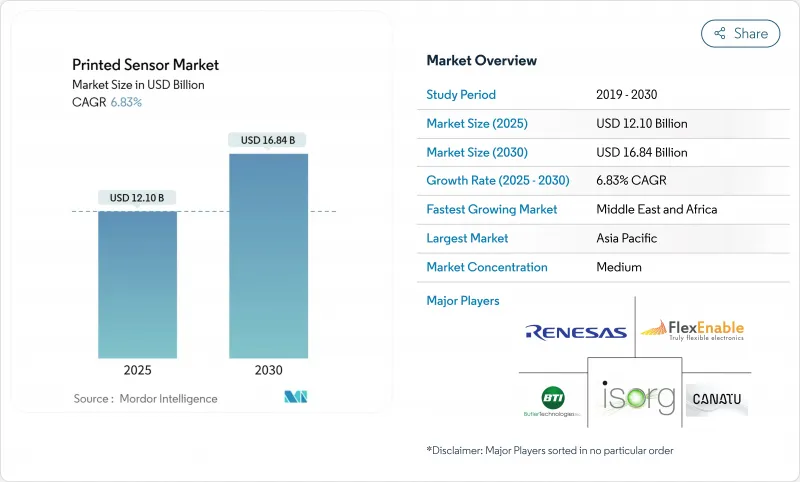

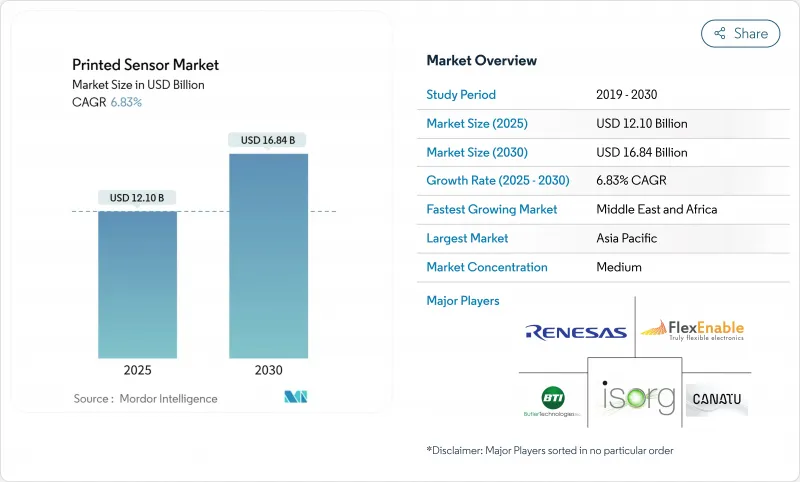

預計印刷感測器市場規模到 2025 年將達到 121 億美元,到 2030 年將達到 168.4 億美元,複合年成長率為 6.83%。

從剛性電子機械感測器轉向軟性輕量化設計的是核心成長引擎,其驅動力來自卷對卷製造技術,該技術可減少高達 90% 的材料浪費並降低單位成本。量產的消費級物聯網曲面汽車儀錶板和穿戴式健康設備都依賴這些成本節約。北美和歐洲的政府獎勵策略正在降低新試點生產線的資本門檻,而亞太地區的供應商則利用長週期生產來維持平均售價的競爭力。導電油墨、網狀電極和混合基板的進步正在擴大與傳統 MEMS 的性能差距,使得印刷陣列成為纖薄、貼合感測器增值的預設選擇。

全球印刷感測器市場趨勢與洞察

軟性和穿戴式醫療設備的快速普及

亞太地區的醫療保健系統正在擴展遠端監控項目,這推動了對可舒適佩戴在皮膚或織物上的生物感測器的需求。目前,基於汗液的平台無需刺穿身體即可分析發炎標記、水分和血糖水平。軟性混合電子裝置整合了印刷陣列和矽邏輯,形成貼片,可透過藍牙將即時生命徵象數據傳輸到醫院儀表板——預計到 2030 年,這項功能將推動全體檢市場規模超過 670 億美元。醫院網路利用這些連續的資料流來縮短住院時間並及早發現併發症。不到 3 美元的單位成本使得即使是中等收入的醫療保健提供者也能在患者出院時為其配備設備,從而加速了該地區的普及。日本、韓國和中國的監管機構正在正式批准穿戴式診斷設備的快速核准,這將進一步推動單位銷售額的成長。

汽車轉向曲面 HMI 儀表板

全球汽車製造商正在用與車輛內飾輪廓相符的觸控面板取代機械旋鈕。庫爾茲的PolyTC®金屬網格電容層採用卷軸式工藝沉積在PET薄膜上,可透過2.5毫米厚的裝飾塑膠識別觸摸,有助於滿足原始設備製造商的造型目標。這些感測器可承受85°C和40°C的高溫循環,確保車輛在整個使用壽命期間保持響應速度。一級製造商還在方向盤和扶手中嵌入印刷陣列,以檢測駕駛員的參與度並相應地調整安全氣囊和警告。軟體定義駕駛座平台利用統一的感測器網格,支援無線升級,無需更換硬體即可更新控制佈局。儘管歐洲和北美目前在部署方面處於領先地位,但中國電動車品牌仍處於落後地位,其全模壓電容面板計劃於2026年推出。

缺乏標準化測試通訊協定

伸縮性生物感測器需要彎曲、扭轉和壓縮以貼合人體,因此不受傳統 IEC 60601 衝擊和振動測試的約束。這需要內部開發伸長率、耐洗性和皮膚接觸生物相容性測試,從而減慢設計週期。 UL 解決方案總結了目前錯綜複雜的 CE、FDA 和 IEC 要求,這些要求因產品類別和地區而異。產業組織正在開發通用的負載工況矩陣,但由於動態監視器、新生兒貼片和智慧運動衫的獨特應變模式,尚未達成共識。認證延遲需要營運資金,這會阻礙小型參與企業的積極性,並限制其短期市場滲透。

報告中分析的其他促進因素和限制因素

- 向固體氣體檢測器的過渡

- 卷軸式在物聯網應用的成本優勢

- 熱循環下的穩定極限

細分分析

到2024年,觸控/電容式感測器將以31.5%的市場佔有率引領印刷感測器市場。隨著醫院轉向臨床外的持續評估,目前體型較小的生物感測器正以11.8%的複合年成長率成長。奈米酶化學技術推動了這一浪潮,它能夠實現乳酸、葡萄糖和感染標誌物的非侵入性檢測。加拿大和德國遠端患者監護報銷的監管批准正在擴大可覆蓋範圍。氣體/化學物質、溫度、壓力/力和壓電/應變類別填補了安全、電池組和結構完整性等細分領域,而122 ppb氨氣檢測等突破性技術則為新的合規解決方案提供了可能。整合式多模態堆疊將觸控、壓力和生物辨識技術整合在一個層壓板中,無需擴大佔地面積,從而贏得了智慧戒指和耳塞等空間受限設計的青睞。

第二段:售價低於 10 美元的生物感測器貼片鼓勵大規模篩檢項目,並改善東南亞診所的慢性病追蹤。印在 TPU 薄膜上的壓力陣列將力數據輸入 AI 步態引擎,以預警老年護理機構的跌倒風險。嵌入鋰離子模組的氣體感測器可提供排氣預警,幫助電池組製造商遵守 UN38.3 安全法規。工廠皮帶中編織的壓電紗線可解讀應變,使預測性維護軟體能夠在重大故障發生前安排停機時間。這種功能多樣性使供應商保持敏捷。定製油墨化學成分、基材選擇和電極幾何形狀因計劃而異,因此需要模組化生產套件包。

絲網印刷憑藉其成熟的產能、厚膜沉積能力以及數十年陶瓷和印刷電路板(PCB)的攤銷設備,將在2024年佔據42%的收益。典型的線寬約為100µm,可滿足大多數電容式和電阻式的需求,但最近的網格升級已將解析度提升至接近50µm。噴墨印刷非常適合設計每週更新的短期生產。氣溶膠噴射、電流體噴射和MEMS微噴嘴陣列可在3D輪廓上沉積小於10µm的軌跡,其複合年成長率最快,達到13.6%,非常適合用於外殼周圍的蜿蜒天線和電池內部的精細溫度網格。

當長度達到數百公尺且色彩套準公差至關重要時,二級柔印機表現出色。凹印擅長均勻塗覆奈米厚度,尤其適用於光學清晰度至關重要的應用,例如HUD擋風玻璃中的透明加熱器。混合生產線融合了多種方法,例如噴墨列印種子層、雷射燒結熔化銅層以及絲網塗佈保護性介電面漆。這種選擇決定了成本、特徵密度和可靠性,促使一級供應商擴大並行部署多台機器。新的AI視覺系統可即時調整刮刀角度和噴射停留時間,以維持公差,從而將產量比率提高到98%以上。

區域分析

受中國大規模生產能力、日本深厚的材料科學以及韓國顯示器巨頭的推動,到2024年,亞太地區將佔據印刷感測器市場的39.2%。當地研發聯盟正在迅速將實驗室突破轉化為中試生產線,縮短從概念到出口的週期。政府補貼抵銷了用於印刷OLED觸摸矩陣的新型凹版印刷機的折舊免稅額成本,大學也正在衍生出瞄準醫院穿戴式裝置的新興企業。該地區的研發產品線包括織物整合呼吸感測器和用於電子紙閱讀器的可折疊觸控膜,從而實現了手機以外的收益多元化。

北美正在利用《晶片與科學法案》撥款建造印刷電子測試平台,以幫助晶圓廠克服高昂的資本支出。與材料供應商和航太製造商的夥伴關係正在生產厚度僅為25微米的壓力陣列,用於測量機翼偏轉,且不會對動態造成不利影響。醫療保健生態系統正在診所進行由醫療保險報銷的家庭監測試點,以檢驗生物感測器貼片的商業可行性。波士頓和矽谷的研究中心正在迭代改進可在70°C下燒結的油墨配方,使其與熱敏性熱塑性塑膠相容。

隨著海灣國家將石油收入轉向智慧城市藍圖,到2030年,中東地區的複合年成長率將達到9.3%,位居全球最快。杜拜2020號地鐵將在軌道上部署印刷應變計,以實現預測性維護;利雅德的計劃將在整個施工現場嵌入空氣品質陣列,以滿足新的環保標準。一家外國合資企業正在傑貝阿里附近建立一條卷對卷生產線,並利用免稅區為歐洲和非洲提供服務。歐洲市場保持著強勁的立足點,尤其是在德國,一級公司正在改進曲面人機的介面面板。歐盟的「歐洲晶片」舉措將為包括軟性混合晶片在內的半導體產能增加79億歐元,從而支持長期競爭力。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場促進因素

- 軟性和穿戴式醫療設備在亞太地區迅速普及

- 汽車轉向曲面 HMI 儀表板需要大面積電容式印刷感測器

- 智慧工廠中從機械檢測到固體氣體檢測的轉變(歐洲主導)

- 在大批量消費性物聯網節點中,卷軸式比 MEMS 技術更具成本優勢

- 市場限制

- 汽車熱循環下導電油墨的長期穩定性有限

- 缺乏伸縮性生物感測器的標準化測試通訊協定,導致 OEM 認證延遲

- 將現有 PCB 生產線轉換為卷對卷混合生產線的資本密集度

- PEDOT:PSS 配方的智慧財產權分散導致專利費成本上升

- 價值/供應鏈分析

- 監理展望

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭的激烈程度

- 技術簡介

- 噴墨列印

- 網版印刷

- 柔版印刷

- 凹版印刷

- 氣溶膠噴射和其他新方法

- 投資分析

- 資金籌措趨勢

- 曼達拉局勢

第5章市場規模及成長預測(金額)

- 依感測器類型

- 觸控/電容式

- 壓力/力

- 生物感測器

- 氣體/化學品

- 壓電/應變

- 溫度感測器

- 透過印刷技術

- 螢幕

- 噴墨

- 柔版印刷

- 凹版印刷

- 氣溶膠噴射等

- 按基材

- 塑膠薄膜(PET、PEN)

- 紙和紙板

- 玻璃

- 紡織品和彈性體

- 按最終用戶

- 消費性電子產品

- 醫療保健和醫療設備

- 工業和製造業

- 汽車和運輸設備

- 航太/國防

- 其他(智慧包裝、農業)

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 法國

- 英國

- 義大利

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 其他亞太地區

- 南美洲

- 巴西

- 其他南美

- 中東

- GCC

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 其他非洲國家

- 北美洲

第6章 競爭態勢

- 策略趨勢

- Partnerships and Licensing

- Capacity Expansions

- 市佔率分析

- 公司簡介

- FlexEnable Ltd.

- ISORG SA

- Plastic Logic HK Ltd.

- Renesas Electronics Corp.

- Butler Technologies Inc.

- Canatu Oy

- SPEC Sensors LLC

- Peratech Holdco Ltd.

- Pressure Profile Systems Inc.

- Tekscan Inc.

- Thin Film Electronics ASA

- Molex LLC

- Interlink Electronics Inc.

- Fujifilm Dimatix Inc.

- Heraeus Noblelight GmbH

- Nissha Co. Ltd.

- T+Ink Inc.

- GSI Technologies LLC

- Brewer Science Inc.

- Henkel AG and Co. KGaA

第7章 市場機會與未來展望

The printed sensor market size stands at USD 12.1 billion in 2025 and is on track to reach USD 16.84 billion by 2030, advancing at a 6.83% CAGR.

The shift from rigid micro-electromechanical sensors toward flexible, lightweight designs is the core growth engine, helped by roll-to-roll manufacturing that cuts material waste by up to 90% and slashes unit costs. High-volume consumer IoT curved automotive dashboards, and wearable health devices all depend on these cost reductions. Government stimulus programs in North America and Europe are lowering the capital barrier for new pilot lines, while Asia-Pacific suppliers leverage long production runs to keep average selling prices competitive. Progress in conductive inks, mesh electrodes, and hybrid substrates is widening the performance gap versus conventional MEMS, positioning printed arrays as the default choice wherever low-profile, conformable sensors add value.

Global Printed Sensor Market Trends and Insights

Rapid Adoption of Flexible & Wearable Medical Devices

Asia-Pacific healthcare systems are scaling remote monitoring programs, elevating demand for biosensors that wrap comfortably around skin and textiles. Sweat-based platforms now profile inflammation markers, hydration, and glucose without puncturing the body. Flexible hybrid electronics integrate printed arrays with silicon logic, forming patches that relay real-time vitals over Bluetooth to hospital dashboards, a capability forecast to lift the FHE market past USD 67 billion by 2030. Hospital networks use these continuous data streams to shorten inpatient stays and flag complications early. With unit prices falling under USD 3, even mid-income providers can equip postoperative patients at discharge, accelerating regional adoption. Regulatory bodies in Japan, Korea, and China are formalizing fast-track approvals for wearable diagnostics, further supporting volume growth.

Automotive Shift to Curved HMI Dashboards

Global automakers are replacing mechanical knobs with sweeping touch surfaces that follow interior contours. PolyTC(R) metal-mesh capacitive layers from KURZ are deposited on PET using roll-to-roll lines and still register touch through 2.5 mm of decorative plastic, satisfying OEM styling goals. These sensors survive the 85 °C heat and 40 °C cold of qualification cycles, preserving responsiveness over vehicle life. Tier-1s are also embedding printed arrays into steering wheels and armrests to detect driver engagement and adjust airbags or alerts accordingly. Software-defined cockpit platforms capitalize on the uniform sensor grid, allowing over-the-air upgrades that refresh control layouts without hardware swaps. Europe and North America lead deployments today, but Chinese EV brands are close behind with fully moulded capacitive panels slated for 2026 launches.

Lack of Standardized Test Protocols

Stretchable biosensors bend, twist, and compress with the body, behaviours not covered by legacy IEC 60601 shock or vibration tests. Brands must invent in-house regimes for elongation, wash durability, and skin-contact biocompatibility, slowing design cycles. UL Solutions summarises the maze of CE, FDA, and IEC requirements that differ by product class and geography. Industry groups are drafting common load-case matrices, yet consensus remains elusive because gait monitors, neonatal patches, and smart jerseys all experience unique strain patterns. Qualification delays raise working capital needs and dissuade smaller entrants, capping near-term market penetration.

Other drivers and restraints analyzed in the detailed report include:

- Transition to Solid-State Gas Detection

- Roll-to-Roll Cost Advantage in IoT Applications

- Limited Stability Under Thermal Cycling

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Touch/Capacitive units led the printed sensor market with 31.5% share in 2024, a dominance tied to their ubiquity across phones, laptops, and infotainment displays. Biosensors, though smaller today, are growing at an 11.8% CAGR as hospitals shift to continuous assessment outside clinical walls. This wave is anchored by nanozyme chemistry that enables non-invasive detection of lactate, glucose, and infection markers. Regulatory green lights for remote patient monitoring refund schemes in Canada and Germany widen the addressable base. Gas/Chemical, Temperature, Pressure/Force, and Piezo/Strain categories fill niche roles in safety, battery packs, and structural health, with breakthroughs such as 122 ppb ammonia detection enabling new compliance solutions. Integrated multi-modal stacks combine touch, pressure, and biometrics in a single laminate without enlarging the footprint, winning space-constrained designs in smart rings and earbuds.

Second paragraph: Biosensor patches priced under USD 10 encourage mass screening programs across Southeast-Asian clinics, improving chronic disease tracking. Pressure arrays printed on TPU film feed force data to AI gait engines that flag fall risk in elder-care homes. Gas sensors embedded inside lithium-ion modules offer early venting alerts, helping pack makers comply with UN 38.3 safety rules. Piezo threads woven into factory belts decode strain, letting predictive maintenance software schedule downtimes before catastrophic tears. This functional diversity keeps suppliers agile; custom ink chemistries, substrate picks, and electrode geometries shift from project to project, forcing a modular production toolkit.

Screen printing captured 42% of revenue in 2024, thanks to proven throughput, thick-film build-up, and equipment amortized over decades in ceramics and PCBs. Typical line widths around 100 µm satisfy most capacitive and resistive formats, while recent mesh upgrades push resolution nearer 50 µm. Inkjet retains relevance for short runs where designs evolve weekly; brands can pivot without fabricating new screens. Aerosol-Jet, electrohydrodynamic jets, and MEMS micro-nozzle arrays post the fastest 13.6% CAGR by depositing sub-10 µm tracks on 3D contours, perfect for antennas snaking around housings or fine-pitch temperature grids inside batteries.

Second paragraph: Flexographic presses win when length hits hundreds of meters and colour registration is forgiving. Gravure excels at uniform nano-thick coatings where optical clarity matters, such as transparent heaters on HUD windshields. Hybrid lines mix methods: inkjet prints seed layers, laser sintering fuses copper, and screen coating applies protective dielectric topcoats. The choice shapes cost, feature density, and reliability, so tier-1s increasingly co-locate multiple machines. Emerging AI vision systems adjust squeegee angle and jet dwell time in real time to hold tolerance, lifting yield beyond 98%.

Printed Sensors Market Segmented by Sensor Type (Touch / Capacitive, Temperature, and More), Printing Technology (Screen, Inkjet and More), Substrate (Plastic Films (PET, PEN), Paper and Paperboard and More), End-User (Consumer Electronics, Healthcare and Medical Devices and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific commanded 39.2% of the printed sensor market in 2024, backed by China's large-scale production capacity, Japan's material science depth, and South Korea's display majors. Local R&D consortia turn lab breakthroughs into pilot lines fast, shortening the cycle from concept to export. Government grants offset depreciation on new gravure presses that print OLED touch matrices, while universities spin off start-ups targeting hospital wearables. The regional pipeline includes textile-integrated respiration sensors and foldable touch foils for e-paper readers, diversifying revenue beyond phones.

North America leverages the CHIPS & Science Act, which earmarked funds for printed electronics testbeds, helping fabs overcome high capex. Partnerships between material suppliers and aerospace primes produce pressure arrays as thin as 25 µm to measure wing flex without aerodynamic penalty. The healthcare ecosystem anchors adoption: clinics run at-home monitoring pilots reimbursed by Medicare, validating business cases for biosensor patches. Research centers in Boston and Silicon Valley iterate ink formulations that sinter at 70 °C, compatible with heat-sensitive thermoplastics.

The Middle East posts the swiftest 9.3% CAGR through 2030 as Gulf states channel oil revenue into smart city blueprints. Dubai's Route 2020 Metro deploys printed strain gauges on tracks for predictive maintenance, while Riyadh's giga projects embed air-quality arrays across construction sites to meet new environmental codes. Foreign joint ventures set up roll-to-roll lines near Jebel Ali, exploiting duty-free zones to serve Europe and Africa. Europe retains a strong foothold, notably Germany where Tier-1s refine curved HMI panels. The EU's Chips for Europe Initiative adds EUR 7.9 billion to semiconductor capacity including flexible hybrids, anchoring long-term competitiveness.

- FlexEnable Ltd.

- ISORG SA

- Plastic Logic HK Ltd.

- Renesas Electronics Corp.

- Butler Technologies Inc.

- Canatu Oy

- SPEC Sensors LLC

- Peratech Holdco Ltd.

- Pressure Profile Systems Inc.

- Tekscan Inc.

- Thin Film Electronics ASA

- Molex LLC

- Interlink Electronics Inc.

- Fujifilm Dimatix Inc.

- Heraeus Noblelight GmbH

- Nissha Co. Ltd.

- T+Ink Inc.

- GSI Technologies LLC

- Brewer Science Inc.

- Henkel AG and Co. KGaA

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Drivers

- 4.1.1 Rapid adoption of flexible and wearable medical devices across Asia-Pacific

- 4.1.2 Automotive shift to curved HMI dashboards requiring large-area capacitive printed sensors

- 4.1.3 Transition from mechanical to solid-state gas detection in smart factories (Europe-led)

- 4.1.4 Roll-to-roll cost advantage versus MEMS in high-volume consumer IoT nodes

- 4.2 Market Restraints

- 4.2.1 Limited long-term stability of conductive inks under automotive thermal cycling

- 4.2.2 Lack of standardized test protocols for stretchable biosensors slows OEM qualification

- 4.2.3 Capital intensity of converting existing PCB lines to roll-to-roll hybrid lines

- 4.2.4 Intellectual-property fragmentation around PEDOT:PSS formulations driving royalty costs

- 4.3 Value / Supply-Chain Analysis

- 4.4 Regulatory Outlook

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Rivalry

- 4.7 Technology Snapshot

- 4.7.1 Inkjet Printing

- 4.7.2 Screen Printing

- 4.7.3 Flexographic Printing

- 4.7.4 Gravure Printing

- 4.7.5 Aerosol-Jet and Other Emerging Methods

- 4.8 Investment Analysis

- 4.8.1 VC Funding Trends

- 4.8.2 MandA Landscape

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Sensor Type

- 5.1.1 Touch/Capacitive

- 5.1.2 Pressure / Force

- 5.1.3 Biosensors

- 5.1.4 Gas/Chemical

- 5.1.5 Piezo/Strain

- 5.1.6 Temperature

- 5.2 By Printing Technology

- 5.2.1 Screen

- 5.2.2 Inkjet

- 5.2.3 Flexographic

- 5.2.4 Gravure

- 5.2.5 Aerosol-Jet and Others

- 5.3 By Substrate

- 5.3.1 Plastic Films (PET, PEN)

- 5.3.2 Paper and Paperboard

- 5.3.3 Glass

- 5.3.4 Textiles and Elastomers

- 5.4 By End-User

- 5.4.1 Consumer Electronics

- 5.4.2 Healthcare and Medical Devices

- 5.4.3 Industrial and Manufacturing

- 5.4.4 Automotive and Transportation

- 5.4.5 Aerospace and Defense

- 5.4.6 Others (Smart Packaging, Agriculture)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 France

- 5.5.2.3 United Kingdom

- 5.5.2.4 Italy

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 South Korea

- 5.5.3.4 India

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Rest of South America

- 5.5.5 Middle East

- 5.5.5.1 GCC

- 5.5.5.2 Turkey

- 5.5.5.3 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Strategic Moves

- 6.1.1 Partnerships and Licensing

- 6.1.2 Capacity Expansions

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.3.1 FlexEnable Ltd.

- 6.3.2 ISORG SA

- 6.3.3 Plastic Logic HK Ltd.

- 6.3.4 Renesas Electronics Corp.

- 6.3.5 Butler Technologies Inc.

- 6.3.6 Canatu Oy

- 6.3.7 SPEC Sensors LLC

- 6.3.8 Peratech Holdco Ltd.

- 6.3.9 Pressure Profile Systems Inc.

- 6.3.10 Tekscan Inc.

- 6.3.11 Thin Film Electronics ASA

- 6.3.12 Molex LLC

- 6.3.13 Interlink Electronics Inc.

- 6.3.14 Fujifilm Dimatix Inc.

- 6.3.15 Heraeus Noblelight GmbH

- 6.3.16 Nissha Co. Ltd.

- 6.3.17 T+Ink Inc.

- 6.3.18 GSI Technologies LLC

- 6.3.19 Brewer Science Inc.

- 6.3.20 Henkel AG and Co. KGaA

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet Need Analysis