|

市場調查報告書

商品編碼

1910806

葉蠟石:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Pyrophyllite - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

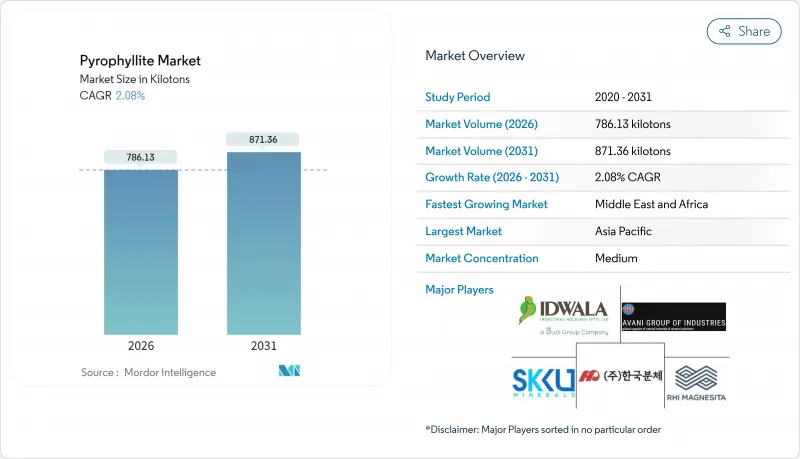

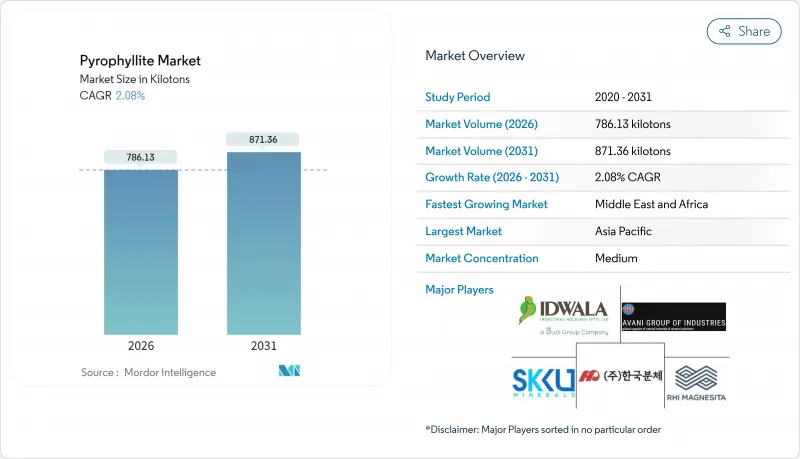

2025 年葉蠟石市場價值為 770.11 千噸,預計從 2026 年的 786.13 千噸成長到 2031 年的 871.36 千噸,在預測期(2026-2031 年)內複合年成長率為 2.08%。

這種穩定成長得益於該礦物可靠的物理特性,例如熱穩定性、化學惰性和低收縮率,這些特性有助於工業用戶維持產品品質的穩定性。亞太地區的需求成長是主要驅動力,該地區不斷擴大的陶瓷產能和電弧煉鋼製程維持了高產量水準。固態電池陶瓷和厚保護塗層是新的需求促進因素,抵消了傳統填料應用成長放緩的影響。對可吸入結晶質二氧化矽的監管力度加大推高了採礦成本,但也提高了品管標準,有利於資金雄厚且擁有先進抑塵技術的供應商。競爭整合,例如RHI Magnesita在2024年收購Resco Products,正在增強大型耐火材料買家的供應安全,並凸顯葉蠟石市場作為戰略材料平台的地位。

全球葉蠟石市場趨勢與洞察

擴大亞太地區的陶瓷生產能力

中國和印度瓷磚及衛浴設備線的強勁擴張,透過大量吸收三軸瓷粉,推動了葉蠟石市場的發展。生產商指出,與高嶺土基配方相比,葉蠟石強度提升高達24%,因此能夠生產更輕的產品,並降低物流成本。更短的燒製週期進一步降低了能耗,減少了碳排放,符合區域脫碳政策的要求。隨著政府獎勵策略推動經濟適用住宅需求的成長,瓷磚製造商正在簽訂遠期契約,以可預測的條款購買葉蠟石,從而降低高嶺土價格波動的風險。此外,葉蠟石能夠可靠地熱轉化為莫來石,最大限度地減少釉藥缺陷,從而支持生產高利潤的高階瓷磚產品。這些結構優勢使葉蠟石市場成為亞太陶瓷產業競爭力的重要組成部分。

電弧煉鋼中耐火材料需求不斷成長。

隨著電爐煉鋼粗鋼比例的增加,鋼包和中間包需要能夠承受快速熱循環的耐火材料。日本鋼鐵廠數十年來一直使用葉蠟石(日本國內俗稱「矽藻土」),並已證實其在1600度C運作下具有形成莫來石的特性。印度和東南亞新建的電爐也採用了類似的材料規格,這促進了區域採購協議的達成。跨國耐火材料製造商正透過垂直整合來規避供應風險,例如2024年收購RHI Magnesia的美國資產。隨著鋼鐵廠提高廢鋼熔煉量以減少範圍1排放,葉蠟石市場從中受益,進一步鞏固了其在耐火材料領域的領先地位。

職業粉塵危害法規

2024年,美國礦山安全與健康管理局(MSHA)將可吸入結晶質二氧化矽的允許濃度降低至50 μg/m³,並要求在濃度達到25 μg/m³時實施相應的應對措施。這帶來了新的技術措施和健康監測要求。歐盟指令也隨之調整,使得合規成為全球性挑戰。升級通風系統、安裝袋式除塵器以及實施符合ISO標準的監測都需要資本支出,這將影響利潤率,尤其對於中型礦業公司而言。然而,大型礦業公司可以利用這些法規,透過第三方認證的「低粉塵」供應項目來脫穎而出,從而有可能擴大其在葉蠟石市場的佔有率。

細分市場分析

到2025年,天然級葉蠟石將佔葉蠟石市場的86.64%,因為簡單的破碎和分選流程使得交付成本經濟實惠。位於拉賈斯坦邦和北卡羅來納州的礦場是全球貿易的支柱,它們直接向耐火材料和陶瓷廠供應葉蠟石,分選工序極少。這些供應支撐著與宏觀產業產量相符的基準成長。

加工後的「其他」等級礦石雖然總量較小,但預計到2031年,其複合年成長率將達到2.68%,超過天然等級礦石。生產商採用磁選、浮選和去離子水洗滌等工藝,將鐵含量降低至0.4%以下(重量比),從而開拓了諸如半透明火星塞絕緣體和固體電解質框架等高階應用領域。微波焙燒結合濕式高強度磁選,可達到96%的除鐵率,因此被電子製造商廣泛採用。礦業公司正採用雙產品策略,既要實現葉蠟石市場大宗商品部分的獲利,又要獲取特種礦石的利潤,最終最佳化其收入結構。

葉蠟石市場報告按類型(天然葉蠟石、其他類型)、應用(陶瓷、耐火材料、填充材、玻璃纖維、橡膠和屋頂材料、肥料、裝飾石材、其他應用)和地區(亞太地區、北美地區、歐洲地區、南美地區、中東和非洲地區)進行細分。市場預測以噸為單位。

區域分析

到2025年,亞太地區將佔全球消費量的75.50%,這主要得益於中國、印度和日本完善的從礦山到窯爐的一體化供應鏈。光是印度一國就將生產約15萬噸陶瓷,佔全球總產量的24%至25%,為該地區的陶瓷產業叢集提供穩定的原料供應。中國瓷磚製造商佔全球瓷磚出貨量的一半,他們提前簽訂年度採購協議以確保運費優勢。同時,日本正利用高純度紅木在連續鑄造製程的特定耐火材料,凸顯了該地區陶瓷應用的廣泛性。

中東和非洲將成為成長最快的地區,到2031年年均複合成長率將達到2.74% 。波灣合作理事會的基礎設施建設正在推動瓷磚需求,而北非的小型鋼廠則指定使用當地耐火材料以減少對進口的依賴。南非和摩洛哥的礦產開發商正在探勘鋁質片岩帶,尋找新的礦床,旨在開發國內原料資源,從而重塑貿易流向,使其轉向葉蠟石市場。

在北美,嚴格的聯邦二氧化矽法規推高了合規成本,但也促使企業採用最佳可行控制技術,從而維持了適度成長。阿巴拉契亞地區的礦商受益接近性中西部鋼鐵客戶的地理優勢,而西海岸港口則為向亞洲出口高品質粉末提供了便利。歐洲專注於高價值工業陶瓷和特殊塗料,當地礦床純度不足時,則從印度進口更高價值等級的產品。南美洲的潛力得益於巴西4,515.3萬噸的滑石-葉蠟石蘊藏量,隨著下游需求的成長,這可為未來建立國內礦物加工中心奠定基礎。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 亞洲陶瓷產能擴張

- 電弧煉鋼中耐火材料需求不斷成長。

- 用於厚壁工業塗料的輕質礦物填料

- 石棉訴訟後,化妝品中滑石粉向葉蠟石的過渡

- 固態電池用陶瓷需要高純度的鋁和矽原料。

- 市場限制

- 職業粉塵危害法規

- 富含替代礦物(滑石、高嶺土、長石)

- 低鐵高鋁礦體短缺

- 價值鏈分析

- 波特五力模型

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 按類型

- 天然葉蠟石

- 其他類型

- 透過使用

- 陶瓷

- 耐火材料

- 填充材(紙張、油漆、殺蟲劑)

- 玻璃纖維

- 橡膠和屋頂材料

- 肥料(土壤改良劑)

- 裝飾石材

- 其他用途

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐國家

- 土耳其

- 俄羅斯

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 埃及

- 奈及利亞

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- Anand Talc

- Avani Group

- Hankook Mineral Powder Co. Ltd.

- Hebei Yayang Spodumene Co., Ltd.

- Idwala Industrial Holdings

- Jinhae Pyrophyllite

- Liaoyuan Pharmaceutical Co., Ltd.

- NINGBO INNO PHARMCHEM CO., LTD.

- PT Gunung Bale

- RT Vanderbilt Holding Company, Inc.

- RHI Magnesita

- SAMIROCK Company

- SEPRA

- SKKU Minerals

- Wonderstone

第7章 市場機會與未來展望

The Pyrophyllite Market was valued at 770.11 kilotons in 2025 and estimated to grow from 786.13 kilotons in 2026 to reach 871.36 kilotons by 2031, at a CAGR of 2.08% during the forecast period (2026-2031).

This steady expansion reflects the mineral's dependable physical attributes-thermal stability, chemical inertness, and low-shrinkage behavior-that help industrial users maintain reproducible product quality. Demand growth is anchored in Asia-Pacific, where ceramics capacity build-outs and electric-arc steelmaking together keep throughput volumes high. Solid-state battery ceramics and high-build protective coatings create incremental demand points that offset slower growth in legacy filler uses. Intensifying regulatory oversight of respirable crystalline silica raises mining costs, yet also elevates quality-control standards that favor well-capitalized suppliers with robust dust-mitigation technology. Competitive consolidation-illustrated by RHI Magnesita's 2024 purchase of Resco Products-reinforces supply security for large refractory buyers, underlining the pyrophyllite market's role as a strategic materials platform.

Global Pyrophyllite Market Trends and Insights

Ceramics Capacity Build-out in Asia-Pacific

Robust expansions in tile and sanitary-ware lines throughout China and India underpin the pyrophyllite market by absorbing large volumes into triaxial porcelain mixes. Producers cite up to 24% strength gains over kaolin-based recipes, enabling lighter-weight products that cut logistics costs. Shorter firing cycles further lower energy consumption and trim carbon footprints in line with regional decarbonization policies. As government stimulus pushes affordable housing, tile makers secure forward contracts that lock in pyrophyllite at predictable terms, shielding them from kaolin price swings. The mineral's predictable thermal conversion to mullite also minimizes glaze defects, supporting premium tile SKUs that command higher margins. These structural gains make the pyrophyllite market integral to Asia-Pacific's ceramic competitiveness.

Rising Refractory Demand in Electric-Arc Steelmaking

Electric-arc furnaces now account for a growing share of crude steel output, and each unit requires ladle and tundish refractories that resist rapid thermal cycling. Japanese steelmakers have relied on pyrophyllite (locally called roseki) for decades, validating its mullite-forming behavior under 1,600 °C service loads. New EAF rollouts across India and Southeast Asia replicate those material specifications, driving regional procurement contracts. Multinational refractory houses hedge supply risk through vertical integration, as seen in RHI Magnesita's 2024 U.S. asset acquisition. As steel mills intensify scrap melting to curtail Scope 1 emissions, the pyrophyllite market enjoys tailwinds that reinforce its refractory franchise.

Occupational Dust-Hazard Regulations

The U.S. Mine Safety and Health Administration in 2024 cut allowable respirable crystalline silica levels to 50 μg/m3 and mandated action at 25 μg/m3, triggering new engineering controls and medical surveillance obligations. European directives align closely, making compliance a global imperative. Upgrading ventilation, installing baghouse filters, and conducting ISO-compliant monitoring impose capital outlays that weigh on margins, especially for mid-tier miners. However, larger operators leverage these mandates to differentiate via third-party certified "low-dust" supply programs, potentially consolidating share within the pyrophyllite market.

Other drivers and restraints analyzed in the detailed report include:

- Lightweight Mineral Fillers for High-Build Industrial Coatings

- Shift from Talc to Pyrophyllite in Cosmetics After Asbestos Litigation

- Abundant Substitute Minerals

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Natural grades constituted 86.64% of the pyrophyllite market in 2025 on the strength of straightforward crushing-and-screening flowsheets that keep delivered-cost economics favorable. Rajasthan and North Carolina mines anchor global trade, supplying refractory and ceramic plants directly with minimal upgrading. These volumes underpin baseline growth that aligns with macro industrial output.

Processed "other" grades occupy a smaller base yet outpace natural grades at a 2.68% CAGR to 2031. Producers deploy magnetic separation, flotation, and de-ionized water washing to slash iron to below 0.4 wt%, unlocking advanced uses such as translucent spark-plug insulators and solid-state electrolyte frameworks. Microwave roasting coupled with wet-high-intensity magnetic separation achieves 96% iron removal, widening acceptance among electronics manufacturers. Dual-product strategies let miners monetize the pyrophyllite market's commodity tier while capturing specialty margins, ultimately strengthening their revenue mix.

The Pyrophyllite Market Report is Segmented by Type (Natural Pyrophyllite, Other Types), Application (Ceramics, Refractory, Filler Materials, Fiberglass, Rubber and Roofing, Fertilizers, Ornamental Stones, Other Applications), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Asia-Pacific commanded 75.50% of 2025 consumption, underpinned by integrated mine-to-kiln supply chains in China, India, and Japan. India alone produced roughly 150,000 tons, equal to 24-25% of global output, conferring raw-material security to regional ceramics clusters. Chinese tile producers, accounting for half of world ceramic-tile shipments, front-load annual purchase contracts to lock in freight advantage. Concurrently, Japan leverages high-purity roseki for niche refractories in continuous-casting operations, underscoring the region's sophisticated application spectrum.

The Middle East and Africa is the fastest-growing geography at 2.74% CAGR through 2031. Gulf Cooperation Council infrastructure visions push tile demand, while North African steel mini-mills specify local refractory supply to cut import reliance. Mineral developers in South Africa and Morocco survey aluminous schist belts for new deposits, aiming to foster indigenous feedstock streams that could recalibrate trade flows into the pyrophyllite market.

North America sustains modest growth amid stringent federal silica rules that lift compliance costs but incentivize best-available-control-technology adoption. Appalachian operators bank on proximity to midwestern steel customers, whereas West-Coast ports facilitate Asian exports of upgraded powders. Europe focuses on high-margin technical ceramics and specialty coatings, importing value-added grades from India when local deposits lack required purity. South America's latent potential rests on Brazil's 45.153 million-ton talc-and-pyrophyllite reserve base, which underpins future domestic beneficiation hubs once downstream demand scales.

- Anand Talc

- Avani Group

- Hankook Mineral Powder Co. Ltd.

- Hebei Yayang Spodumene Co., Ltd.

- Idwala Industrial Holdings

- Jinhae Pyrophyllite

- Liaoyuan Pharmaceutical Co., Ltd.

- NINGBO INNO PHARMCHEM CO., LTD.

- PT Gunung Bale

- R.T. Vanderbilt Holding Company, Inc.

- RHI Magnesita

- SAMIROCK Company

- SEPRA

- SKKU Minerals

- Wonderstone

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Ceramics capacity build-out in Asia

- 4.2.2 Rising refractory demand in electric-arc steelmaking

- 4.2.3 Lightweight mineral fillers for high-build industrial coatings

- 4.2.4 Shift from talc to pyrophyllite in cosmetics after asbestos litigation

- 4.2.5 Solid-state battery ceramics requiring high-purity Al-Si feedstocks

- 4.3 Market Restraints

- 4.3.1 Occupational dust-hazard regulations

- 4.3.2 Abundant substitute minerals (talc, kaolin, feldspar)

- 4.3.3 Scarcity of low-iron, high-Al2O3 ore bodies

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Type

- 5.1.1 Natural Pyrophyllite

- 5.1.2 Other Types

- 5.2 By Application

- 5.2.1 Ceramics

- 5.2.2 Refractory

- 5.2.3 Filler Materials (Paper, Paints, Insecticides)

- 5.2.4 Fiberglass

- 5.2.5 Rubber and Roofing

- 5.2.6 Fertilizers (Soil Conditioners)

- 5.2.7 Ornamental Stones

- 5.2.8 Other Applications

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Nordic Countries

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Qatar

- 5.3.5.4 Egypt

- 5.3.5.5 Nigeria

- 5.3.5.6 South Africa

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Anand Talc

- 6.4.2 Avani Group

- 6.4.3 Hankook Mineral Powder Co. Ltd.

- 6.4.4 Hebei Yayang Spodumene Co., Ltd.

- 6.4.5 Idwala Industrial Holdings

- 6.4.6 Jinhae Pyrophyllite

- 6.4.7 Liaoyuan Pharmaceutical Co., Ltd.

- 6.4.8 NINGBO INNO PHARMCHEM CO., LTD.

- 6.4.9 PT Gunung Bale

- 6.4.10 R.T. Vanderbilt Holding Company, Inc.

- 6.4.11 RHI Magnesita

- 6.4.12 SAMIROCK Company

- 6.4.13 SEPRA

- 6.4.14 SKKU Minerals

- 6.4.15 Wonderstone

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment