|

市場調查報告書

商品編碼

1910717

身份驗證(ID):市場佔有率分析、行業趨勢和統計數據、成長預測(2026-2031)Identity (ID) Verification - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

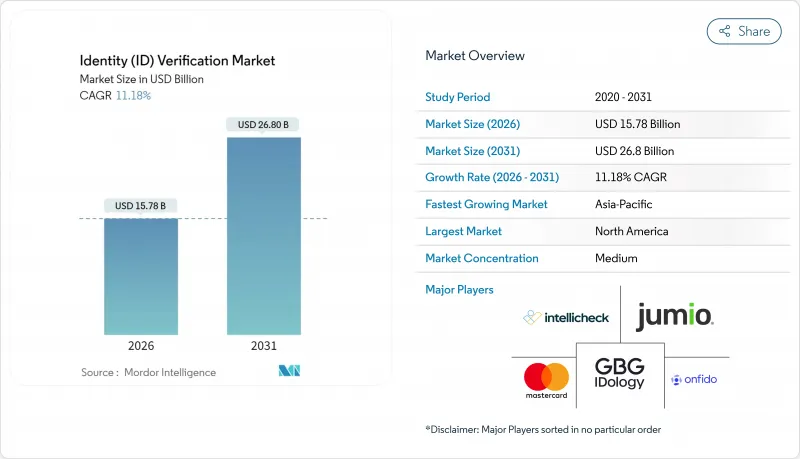

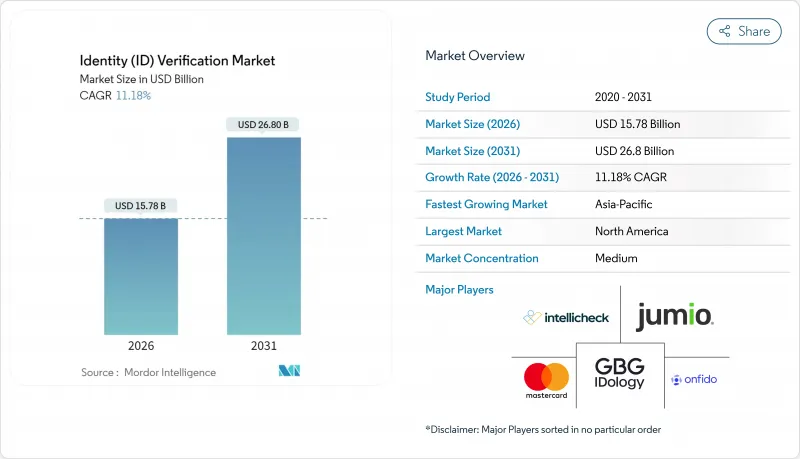

身分驗證市場預計將從 2025 年的 141.9 億美元成長到 2026 年的 157.8 億美元,預計到 2031 年將達到 268 億美元,2026 年至 2031 年的複合年成長率為 11.18%。

這項擴張反映出企業正從簡單的合規性檢查轉向策略性安全投資,因為企業面臨著人工智慧產生的詐騙、深度造假攻擊以及日益成長的監管罰款。僅深度造假一項就激增了3000%,迫使供應商將被動生物識別和行為分析直接整合到用戶註冊流程中。雲端原生部署現在已成為大多數新部署的預設選擇,它允許將模型更新即時推送至全球所有租戶,從而加速創新。同時,對可攜式、隱私保護憑證的需求不斷成長,推動了將政府頒發的行動駕駛執照、檢驗憑證和Web3錢包整合到單一用戶流程中的試點計畫。隨著全端安全公司擴大收購細分領域的專業公司以獲取人工智慧文件鑒識科技,市場整合正在活性化。然而,沒有一家供應商的收入超過15%,這為那些專注於解決邊緣風險和特定產業法規的專業新參與企業留下了充足的成長空間。

全球身分檢驗市場趨勢與洞察

網路詐騙和監管罰款都在增加

預計2024年,詐欺性開戶將佔金融交易總量的2.1%,較兩年前的1.27%大幅增加。據估計,約42.5%的已偵測詐騙事件利用了生成式人工智慧技術,迫使銀行部署多層防禦系統,以即時偵測合成身分資訊、深度造假語音等。監理機關也採取了同樣強硬的立場,2023年全球金融機構因違反KYC(了解你的客戶)規定而被罰款66億美元。風險上升和罰款增加的雙重壓力正促使買家轉向企業級編配平台,這些平台透過單一API整合文件取證、生物識別驗證和持續行為監控功能。

遠端入職和電子KYC要求的激增

亞太地區78%的消費者認為,在使用新的金融應用程式之前,進行數位身分驗證至關重要。監管機構正在將這一趨勢納入法律法規。歐盟強制要求成員國在24個月內發行數位身分錢包,從而有效地將電子身分驗證(e-KYC)制度化。一家美國排名前十的銀行在實施語音認證後發現,採用自動化檢驗的機構可以將服務台處理時間縮短多達45秒。當檢驗的憑證可以在不同服務提供者之間傳輸時,就會產生網路效應,從而將重新註冊的門檻降低一半,並增強平台規模優勢。

碎片化世界中的監管標準

KYC(了解你的客戶)法規不僅因國家而異,即使在同一地區,不同監管機構的監管規定也存在差異,這迫使平台運行並行的身份驗證流程和資料居住架構。美國強調可移植性,而歐盟的GDPR則提倡在地化,這使得統一的雲端部署變得更加複雜。在亞洲,日本要求獲得金融服務廳的許可,而韓國則強制要求加密貨幣交易所與銀行合作。合規團隊在應對這些複雜的法規時,擴張週期被延長,營運成本也隨之上升。

細分市場分析

到2025年,雲端部署將佔身分驗證市場65.12%的佔有率,年複合成長率(CAGR)為12.72%,因為企業更傾向於彈性使用而非資本密集伺服器。預計到2031年,與雲端部署相關的身份驗證市場規模將達到187億美元,這反映了數位銀行和零工經濟平台對API的快速採用。持續的模型更新、集中式威脅情報共用和零停機修補更新已使雲端成為標準架構。本地部署僅在法規要求本地資料處理的情況下才強制執行,但一旦提供者建立經認證的區域中心,雲端部署在這些司法管轄區通常也是允許的。

韌性也是一項促進因素。萬事達卡每年分析 1,430 億筆交易,以更新其異常檢測評分程序,從而為所有租戶帶來即時的收益。 Cloud 雲端集線器還簡化了與檢驗憑證和行動駕駛執照的整合,將計劃週期從數月縮短至數週。隨著邊緣資料中心的普及,延遲問題逐漸消失,即使是需要亞秒往返時間的生物識別視訊串流,也能在雲端部署。

預計到2025年,生物識別引擎將佔據身份驗證市場35.84%的佔有率,並在2031年之前保持12.86%的複合年成長率,超越僅依賴文件的認證方式。到2031年,與生物識別相關的身份驗證市場規模預計將超過101億美元,這主要得益於被動式活體檢測技術的發展,該技術可在背景影片幀中隱蔽運行。供應商正在融合臉部、語音和行為訊號,以實現持續認證,從而減少帳戶被盜用的風險。

文件驗證仍將持續,但會逐漸退居次要地位。 Aware 等供應商正在發布即時合成媒體偵測技術,該技術能夠偵測肉眼無法辨識的 GPU 渲染痕跡。金融機構已實施多模態生物識別,準確率提高了 250%,人工審核成本降低,客戶轉換率也得到提升。基於知識的問題和靜態資料庫匹配往往僅限於特定應用場景,例如低風險的年齡限制。

身份驗證市場按部署模式(本地部署、雲端部署)、解決方案類型(文件/身份驗證、生物識別等)、最終用戶行業垂直領域(金融服務(BFSI)、零售/電子商務等)、組織規模(大型企業、中小企業(SME))和地區進行細分。市場預測以美元(USD)為單位。

區域分析

北美地區在2025年維持了32.43%的識別市場佔有率,這得益於積極的詐欺防範措施和生物識別的早期應用。美國計劃從2025年5月起在全國範圍內的TSA查核點接受行動駕駛執照,這反映了運輸安全局對數位身分的信心。加拿大的開放銀行藍圖將進一步加速跨平台身分可攜性的發展。

亞太地區預計將以11.52%的複合年成長率實現顯著成長,這主要得益於新加坡的金融科技沙盒、印度的Aadhaar整合付款基礎以及日本金融廳的加密貨幣監管政策。 Trulioo在新加坡設立辦事處後,企業認證率達到了90%,顯示該地區對其KYC API的需求強勁。智慧型手機普及率的不斷提高以及即時支付方案的興起,預計將使亞太地區在預測期內成為Trulioo最大的增量收入來源。

其他福利:

- Excel格式的市場預測(ME)表

- 分析師支持(3個月)

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 網路詐騙和監管罰款增加

- 遠端入職和電子KYC要求的激增

- 人工智慧驅動的文檔檢驗準確性提升

- 跨境數位身分互通性試點項目

- 新興市場金融科技普惠計劃

- 檢驗憑證和 Web3 身分錢包的興起

- 市場限制

- 碎片化世界中的監管標準

- 深度造假和生成式人工智慧欺騙威脅

- 傳統核心系統的高昂整合成本

- 數據主權障礙限制了雲端技術的普及

- 供應鏈分析

- 監管環境

- 技術展望

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 評估市場中的宏觀經濟因素

第5章 市場規模與成長預測

- 透過部署

- 本地部署

- 雲

- 按解決方案類型

- 文件/身分核實

- 生物識別

- 身份驗證和活體檢測

- 其他

- 按最終用戶行業分類

- 金融服務(BFSI)

- 零售與電子商務

- 政府/公共部門

- 衛生保健

- 通訊/IT

- 其他

- 按組織規模

- 主要企業

- 中小企業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 東南亞

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 埃及

- 其他非洲地區

- 中東

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Mastercard

- Onfido

- GBG(Idology)

- Intellicheck

- Jumio

- Trulioo

- Mitek Systems

- Veriff

- IBM

- AuthenticID

- Experian

- TransUnion

- LexisNexis Risk Solutions

- Pindrop

- ComplyCube

- Nuance Communications

- Thales Group

- IDEMIA

- Okta

- Ping Identity

- Equifax

- NEC Corporation

- Acuant

- Persona

第7章 市場機會與未來展望

The identity verification market is expected to grow from USD 14.19 billion in 2025 to USD 15.78 billion in 2026 and is forecast to reach USD 26.8 billion by 2031 at 11.18% CAGR over 2026-2031.

The expansion reflects a decisive shift from checkbox compliance toward strategic security investment as enterprises confront AI-generated fraud, deepfake attacks, and rising regulatory fines. Deepfakes alone jumped 3,000%, compelling vendors to embed passive liveness and behavioral analytics directly into onboarding workflows. Cloud-native deployment, now the default choice for most new rollouts, accelerates innovation because model updates can be pushed instantly across global tenants. Meanwhile, demand for portable, privacy-preserving credentials is spurring pilots that link government-issued mobile driver's licenses, verifiable credentials, and Web3 wallets into a single user journey. Consolidation is intensifying as full-stack security firms buy niche specialists to acquire AI document-forensics talent, yet no provider controls more than 15% revenue, leaving ample headroom for focused entrants that solve edge-case risks or industry-specific regulations.

Global Identity (ID) Verification Market Trends and Insights

Increasing Cyber-Fraud and Regulatory Fines

Fraudulent account openings spiked to 2.1% of financial transactions in 2024, a sharp rise from 1.27% two years earlier.An estimated 42.5% of detected fraud events now leverage generative AI, which forces banks to deploy multi-layer defences that spot synthetic IDs and deepfake voices in real time. Regulators are equally assertive: global institutions paid USD 6.6 billion in KYC-related penalties during 2023. The combined pressure of higher risk and higher fines is pushing buyers toward enterprise-grade orchestration platforms that integrate document forensics, biometric liveness, and continuous behavioural monitoring in a single API.

Surge in Remote Onboarding and e-KYC Mandates

Seventy-eight percent of APAC consumers deem digital identity checks essential before using new financial apps. Regulators are codifying that preference: the EU requires every member state to issue a Digital Identity Wallet within 24 months, effectively institutionalising electronic KYC. Organisations that automate verification cut service-desk handle times by up to 45 seconds, as a top-10 US bank confirmed after rolling out voice authentication. Network effects then arise when verified credentials become transferable across providers, halving repeat onboarding friction and reinforcing platform scale advantages.

Fragmented Global Regulatory Standards

KYC rules vary not only by country but sometimes by banking supervisor inside the same region, forcing platforms to run parallel verification flows and data-residency architectures. The United States stresses portability, whereas EU GDPR pushes localisation, complicating unified cloud deployments. In Asia, Japan insists on FSA licences while South Korea demands bank partnerships for cryptocurrency exchanges. As compliance teams juggle this patchwork, expansion timetables lengthen and operating costs rise.

Other drivers and restraints analyzed in the detailed report include:

- AI-Driven Accuracy Improvements in Document Forensics

- Cross-Border Digital ID Interoperability Pilots

- Deepfake and Generative-AI Spoofing Threats

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cloud deployment captured 65.12% identity verification market share in 2025 and is expanding at a 12.72% CAGR as firms prefer elastic consumption to capital-heavy servers. The identity verification market size associated with cloud deployments is projected to reach USD 18.7 billion by 2031, reflecting rapid API adoption among digital banks and gig-economy platforms. Continuous model updates, centralised threat-intel sharing, and zero-downtime patching position cloud as the reference architecture. On-premise remains mandatory only where statutes mandate local data processing, yet even those jurisdictions accept cloud when providers open certified regional centres.

Resilience is another driver. Mastercard analyses 143 billion annual transactions to update anomaly-scoring routines that instantly benefit every tenant. Cloud hubs also simplify integration with verifiable credentials and mobile driver's licenses, cutting project timelines from months to weeks. As edge data centres proliferate, latency concerns fade, allowing cloud adoption even for biometric video streams that demand sub-second round-trip times.

Biometric engines held 35.84% of identity verification market share in 2025 and post a 12.86% CAGR through 2031, outpacing document-only approaches. The identity verification market size tied to biometric modalities is forecast to surpass USD 10.1 billion by 2031, driven by passive liveness that operates invisibly in background video frames. Vendors blend facial, voice, and behavioural signals to deliver continuous authentication, narrowing the attack surface for account takeover.

Document checks will persist yet increasingly act as a secondary step. Providers like Aware release real-time synthetic-media detection that flags GPU-rendered artefacts invisible to the naked eye Aware. Financial institutions deploying multi-modal biometrics report 250% accuracy gains, which lowers manual review cost and boosts customer conversion. Knowledge-based questions and static database lookups now serve niche use cases such as low-risk age gating.

Identity Verification Market is Segmented by Deployment (On-Premises, Cloud), Solution Type (Document / ID Verification, Biometric Verification, and More), End User Industry (Financial Services (BFSI), Retail and E-Commerce, and More), Organization Size (Large Enterprises, Small and Medium Enterprises (SMEs)), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 32.43% identity verification market share in 2025, buoyed by aggressive fraud enforcement and early biometric rollouts. The United States plans nationwide mobile driver's license acceptance at TSA checkpoints from May 2025, signalling federal confidence in digital credentials. Canada's open-banking roadmap further accelerates cross-platform identity portability.

Asia-Pacific stands out with 11.52% CAGR, propelled by Singapore's fintech sandbox, India's Aadhaar-linked payment rails, and Japan's FSA crypto rules. Trulioo reached a 90% business-verification rate after opening its Singapore hub, illustrating demand for regional KYC APIs. Rising smartphone penetration and real-time payment schemes make APAC the largest incremental revenue pool over the forecast horizon.

- Mastercard

- Onfido

- GBG (Idology)

- Intellicheck

- Jumio

- Trulioo

- Mitek Systems

- Veriff

- IBM

- AuthenticID

- Experian

- TransUnion

- LexisNexis Risk Solutions

- Pindrop

- ComplyCube

- Nuance Communications

- Thales Group

- IDEMIA

- Okta

- Ping Identity

- Equifax

- NEC Corporation

- Acuant

- Persona

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing cyber-fraud and regulatory fines

- 4.2.2 Surge in remote onboarding and e-KYC mandates

- 4.2.3 AI-driven accuracy improvements in document forensics

- 4.2.4 Cross-border digital ID interoperability pilots

- 4.2.5 Fintech inclusion programmes in emerging markets

- 4.2.6 Rise of verifiable credentials and Web3 identity wallets

- 4.3 Market Restraints

- 4.3.1 Fragmented global regulatory standards

- 4.3.2 Deepfake and generative-AI spoofing threats

- 4.3.3 High integration cost for legacy core systems

- 4.3.4 Data-sovereignty barriers limiting cloud roll-outs

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Degree of Competition

- 4.8 Assesment of Macroeconomic Factors on the market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment

- 5.1.1 On-premise

- 5.1.2 Cloud

- 5.2 By Solution Type

- 5.2.1 Document / ID Verification

- 5.2.2 Biometric Verification

- 5.2.3 Authentication and Liveness

- 5.2.4 Others

- 5.3 By End-user Industry

- 5.3.1 Financial Services (BFSI)

- 5.3.2 Retail and E-commerce

- 5.3.3 Government and Public Sector

- 5.3.4 Healthcare

- 5.3.5 Telecom and IT

- 5.3.6 Others

- 5.4 By Organization Size

- 5.4.1 Large Enterprises

- 5.4.2 Small and Medium Enterprises (SMEs)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Southeast Asia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Mastercard

- 6.4.2 Onfido

- 6.4.3 GBG (Idology)

- 6.4.4 Intellicheck

- 6.4.5 Jumio

- 6.4.6 Trulioo

- 6.4.7 Mitek Systems

- 6.4.8 Veriff

- 6.4.9 IBM

- 6.4.10 AuthenticID

- 6.4.11 Experian

- 6.4.12 TransUnion

- 6.4.13 LexisNexis Risk Solutions

- 6.4.14 Pindrop

- 6.4.15 ComplyCube

- 6.4.16 Nuance Communications

- 6.4.17 Thales Group

- 6.4.18 IDEMIA

- 6.4.19 Okta

- 6.4.20 Ping Identity

- 6.4.21 Equifax

- 6.4.22 NEC Corporation

- 6.4.23 Acuant

- 6.4.24 Persona

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment