|

市場調查報告書

商品編碼

1910681

節能玻璃:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Energy-efficient Glass - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

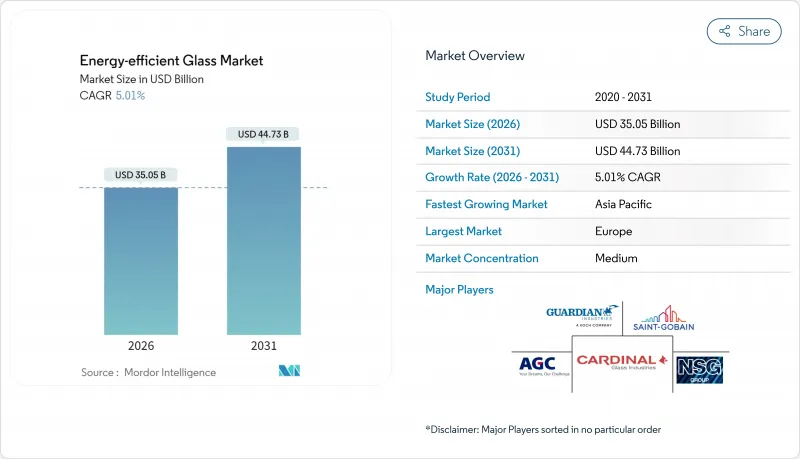

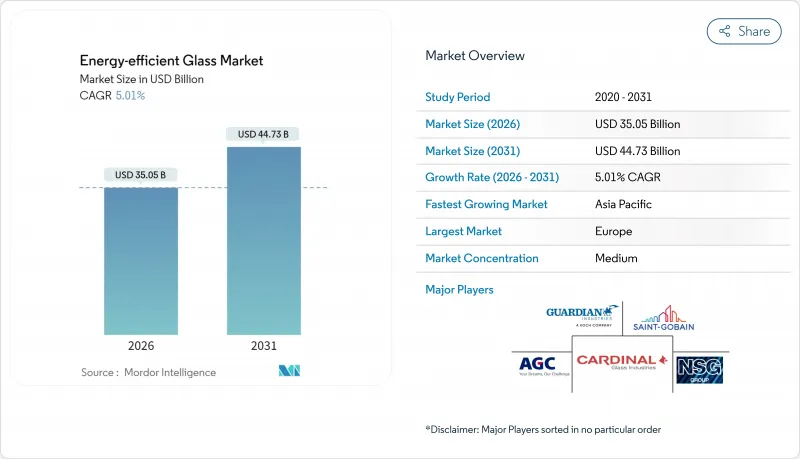

預計到 2026 年,節能玻璃市場價值將達到 350.5 億美元,高於 2025 年的 333.8 億美元。

預計到 2031 年,該產業規模將達到 447.3 億美元,2026 年至 2031 年的複合年成長率為 5.01%。

這一成長主要得益於建築能效標準的不斷提高、綠色建築認證的推廣以及汽車行業向低輻射(Low-E低輻射鍍膜玻璃)玻璃的轉型,後者能夠延長電動車的續航里程。真空絕熱玻璃維修技術的進步、歐盟碳邊境調節機制以及多層前置作業時間塗層技術的運用,使得產品差異化得以維持,並在原料價格波動的情況下保障了利潤率。擁有磁控濺鍍設備的製造商由於設備交付週期長達三年,因此仍保持定價權。同時,玻璃製造商與太陽能技術創新者之間的合作,透過實現符合淨零排放目標的建築一體化太陽能建築幕牆,正在開闢新的收入來源。

全球節能玻璃市場趨勢與洞察

全球建築節能標準日益收緊

最新的《國際節能規範》(IECC) 將窗戶的允許U值降低了高達17%,迫使建築師轉向低輻射(Low-E)三層玻璃和真空玻璃解決方案。加州2025年第24號法規標準將垂直窗戶的U值限制在0.47,因此先進的軟鍍膜玻璃技術對於達到此標準至關重要。加拿大2030年淨零建築目標將固定窗的U值設定為0.27,加速了三層玻璃的需求。這些標準打破了以往公認的性能-成本權衡,使得規格決策可以優先考慮性能而非前期成本。隨著亞太地區各大城市一系列法規的更新,擁有多層銀鍍膜技術的供應商優勢日益凸顯。中期合規期限也為高性能產品提供了穩定的訂單基礎。

擴大綠建築認證(LEED、BREEAM)

此認證架構以透明的方式評估建築圍護結構的能源效率和碳含量。 LEED v4.1認證積分依賴環境產品聲明(EPD),鼓勵製造商量化其碳足跡。美國綠建築委員會(USGBC)估計,到2030年,淨零排放資產需要投入35兆美元,其中大部分將用於降低營運成本的建築幕牆。像倫敦獲得BREEAM認證的水晶大廈這樣的傑出地標建築,其U值接近1.0 W/m²K,這表明先進的玻璃幕牆不僅能獲得認證積分,還能轉化為租金溢價。開發商現在更注重整體擁有成本而非表面材料價格,這推動了對低輻射產品的需求。

與傳統浮法玻璃的初始成本比較

高價值塗層和雙層玻璃的價格比標準浮法玻璃高出 40% 至 80%,這限制了其在對成本敏感的行業的應用。三層玻璃的價格比雙層玻璃高出 15% 至 25%,而隔熱玻璃 (VIG) 的價格則高出 200% 至 300%,主要針對高規格的商業計劃。新興市場優先考慮降低資本成本而非提升性能,減緩了短期銷售成長。然而,不斷上漲的公用事業費率和碳定價機制的實施正在縮短投資回收期,並降低市場接受度。公用事業收費公共和優惠融資進一步降低了成本壁壘,尤其對於面向能源貧困家庭的維修計畫而言更是如此。

細分市場分析

到2025年,軟鍍膜產品將佔節能玻璃市場61.82%的佔有率,並在2031年之前以5.51%的複合年成長率成長。這主要得益於其低於0.04的超低發射率以及與多層玻璃結構的兼容性。隨著建築規範對窗戶U值(熱傳導係數)的要求日益嚴格,與軟鍍膜產品相關的節能玻璃市場規模預計將穩定擴大。先進的多層銀層壓技術可在不犧牲可見光透過率的情況下最佳化太陽熱增益,從而滿足尋求自然採光的辦公大樓和追求室內舒適度的電動車製造商的需求。硬鍍膜熱解玻璃仍然適用於單層店面和對能源效率要求不高的場所,在這些場所,其耐久性和抗刮擦性優於熱性能要求。供應商正在採用封閉式陰極陣列來減少邊緣霧度並降低產量比率損失,並不斷提高大型燈具的濺射均勻性。

汽車需求的激增進一步鞏固了軟塗層技術的優勢。高階電動車品牌如今已將低輻射擋風玻璃列為出廠標配,而ISO 9050等法規結構也已在全球統一了性能指標,縮短了認證週期。然而,濺射生產線的短缺限制了供應,加速了企業併購和簽訂長期供應協議以確保配額。領先的浮法銀製造商正利用垂直整合來控制其銀供應鏈並最大限度地降低成本波動。如果資本投資落後於需求,高選擇性塗層的現貨溢價可能會在整個預測期內持續存在。

這份節能玻璃報告按塗層類型(硬塗層、熱解塗層、軟塗層、磁控濺鍍)、玻璃結構類型(單層、雙層、三層)、終端用戶產業(建築、汽車、太陽能板及其他終端用戶產業)和地區(亞太、北美、歐洲、南美、中東和非洲)進行細分。市場預測以美元計價。

區域分析

到2025年,歐洲在節能玻璃市場仍將佔據34.21%的佔有率,這主要得益於歐盟《建築能源性能指令》(EPBD),該指令要求新建建築達到近零能耗標準。德國和英國透過修訂L部分法規推動了相關規範的製定,而法國的RE2020指令則優先考慮生產過程中的碳排放,從而帶動了對採用電爐生產的低碳浮法玻璃的需求。

亞太地區到2031年將以5.76%的複合年成長率達到最高增速,其中中國新建設量就佔全球近一半。主要城市嚴格的建築規範要求使用三層玻璃,而印度的智慧城市計畫則大力推廣綠建築認證,特別注重建築外圍護結構的能源效率。

北美地區在《美國通貨膨脹控制法案》和加拿大「淨零排放藍圖」的稅額扣抵推動下,實現了穩定成長。加州第24號法規和美國東北部城市的建築性能標準是維修計劃的基礎。南美、中東和非洲雖然規模較小,但戰略地位重要,這些地區能源價格上漲以及極端氣候下的冷卻需求推動了對太陽能控制玻璃的需求。然而,當地的生產能力仍無法滿足需求。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 全球建築節能標準日益收緊

- 綠建築認證(LEED、BREEAM)數量增加

- 電動車原始設備製造商對低輻射(Low-E)玻璃的需求

- 快速維修採用真空絕熱玻璃(VIG)

- 歐盟CBAM為低碳平板玻璃供應鏈提供優惠待遇

- 市場限制

- 與傳統浮法玻璃相比,初始成本較高

- 堿灰和能源價格的波動會影響利潤率。

- 全球磁控濺鍍膜設備產能有限

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 按塗層類型

- 硬塗層(熱解)

- 軟塗層(磁控濺鍍)

- 按玻璃類型

- 單身的

- 雙倍的

- 三倍

- 按最終用戶行業分類

- 建築/施工

- 車

- 太陽能板

- 其他終端用戶產業(工業等)

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 俄羅斯

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- Abrisa Technologies

- AGC Inc.

- CARDINAL GLASS INDUSTRIES, INC

- Central Glass Co., Ltd.

- Corning Incorporated

- Fuyao Group

- Guardian Industries Holdings

- Morley Glass & Glazing Ltd

- Nippon Sheet Glass Co., Ltd

- Saint-Gobain

- SCHOTT

- Sisecam

- TuffX Glass

- Vitro

- Xinyi Glass Holdings Limited

第7章 市場機會與未來展望

Energy-efficient Glass market size in 2026 is estimated at USD 35.05 billion, growing from 2025 value of USD 33.38 billion with 2031 projections showing USD 44.73 billion, growing at 5.01% CAGR over 2026-2031.

Growth flows from stricter building-energy codes, green-building certifications, and the automotive shift to low-E glazing that extends electric-vehicle range. Technological gains in vacuum-insulated glass retrofits, the EU Carbon Border Adjustment Mechanism, and multi-layer silver coatings sustain product differentiation while protecting margins despite raw-material volatility. Producers with magnetron-sputter capacity enjoy pricing power as equipment lead times stretch up to three years. Simultaneously, collaborations between glassmakers and photovoltaic innovators unlock building-integrated solar facades that satisfy net-zero goals and open new revenue pools.

Global Energy-efficient Glass Market Trends and Insights

Stricter Global Building-Energy Codes

The latest International Energy Conservation Code trims allowable window U-factors by up to 17%, pushing architects toward low-E triple panes and vacuum solutions. California's 2025 Title 24 limits vertical fenestration U-factors to 0.47, a level achievable only with advanced soft-coat glazing. Canada's path to net-zero-ready buildings by 2030 sets a 0.27 target for fixed windows, accelerating triple-glazing demand. These codes eliminate loopholes that once permitted trade-offs, so performance now outweighs upfront cost during specification. Suppliers with multi-silver stacks find greater leverage as code updates proliferate across Asia-Pacific capitals. Compliance deadlines over the medium term underpin a dependable order pipeline for high-performance units.

Growth in Green-Building Certifications (LEED, BREEAM)

Certification frameworks reward envelope efficiency and embodied-carbon transparency. LEED v4.1 credits hinge on Environmental Product Declarations, nudging fabricators to quantify carbon footprints. The United States Green Building Council estimates USD 35 trillion must flow into net-zero assets by 2030, much of it earmarked for facades that cut operational loads. BREEAM Outstanding landmarks such as London's Crystal achieve U-values near 1.0 W/m2K, highlighting how advanced glazing delivers certification points that translate into rental premiums. Developers now value total cost of ownership over headline material prices, reinforcing demand for low-emissivity products.

High Upfront Cost Versus Conventional Float Glass

Premium coatings and multiple panes lift prices 40-80% above standard float, constraining adoption where first-cost sensitivity dominates. Triple units carry 15-25% mark-ups over double panes, while VIG commands 200-300% premiums, placing it mostly in high-spec commercial projects. Emerging markets often defer performance gains for capital savings, slowing near-term volume. Yet escalating utility tariffs and nascent carbon pricing are shortening payback horizons, easing resistance. Public-sector subsidies and concessional lending further erode the cost barrier, particularly in retrofits targeting energy-poverty households.

Other drivers and restraints analyzed in the detailed report include:

- OEM Demand for Low-E Glazing in EVs

- EU CBAM Favoring Low-Carbon Flat-Glass Supply Chains

- Limited Global Magnetron-Sputter Coating Capacity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Soft-coat products held 61.82% share of the energy-efficient glass market in 2025 and are growing at a 5.51% CAGR through 2031, reflecting unmatched emissivity below 0.04 and compatibility with multi-pane assemblies. The energy-efficient glass market size attached to soft-coat offerings is forecast to expand steadily as building codes ratchet down window U-factors. Advanced multi-silver stacks optimize solar heat-gain coefficients without sacrificing visible transmittance, appealing to both office towers seeking daylighting and EV makers requiring cabin comfort. Hard-coat pyrolytic glass remains relevant in monolithic storefronts and regions with modest efficiency requirements where durability and scratch resistance outweigh thermal targets. Suppliers continually refine sputter uniformity across jumbo lites, using closed-field cathode arrays that cut edge haze and reduce yield loss.

A surge in automotive demand further cements soft-coat ascendance. Low-E windshields are now factory-specified by premium EV brands, and regulatory frameworks such as ISO 9050 harmonize performance metrics globally, shortening qualification cycles. However, sputter-line scarcity tempers supply, prompting mergers and long-term offtake agreements that lock in allocations. Tier-one float producers leverage vertical integration to control silver supply chains, minimizing cost spikes. Should capital commitments lag demand, spot premiums for high-selectivity coatings may persist well into the forecast horizon.

The Energy-Efficient Glass Report is Segmented by Coating Type (Hard-Coat Pyrolytic and Soft-Coat Magnetron-Sputtered), Glazing Type (Single, Double, and Triple), End-User Industry (Building and Construction, Automotive, Solar Panel, and Other End-User Industries), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe retained 34.21% share of the energy-efficient glass market in 2025 on the back of the EU Energy Performance of Buildings Directive that requires near-zero-energy new builds. Germany and the UK drove specification with updated Part L rules, while France's RE2020 prioritized embodied carbon, steering orders toward low-carbon float made with electric furnaces.

Asia-Pacific posts the briskest 5.76% CAGR through 2031 as China alone accounts for roughly half of global new construction. Stringent Tier-1 city codes now reference triple-pane performance, and India's Smart Cities Mission fosters green-building certifications that spotlight envelope efficiency.

North America records steady gains aided by tax credits under the U.S. Inflation Reduction Act and Canada's net-zero-ready roadmap. Title 24 in California and city-level building-performance standards across the Northeast anchor retrofit pipelines. South America and the Middle East and Africa remain smaller but strategic: rising energy tariffs and extreme-climate cooling needs boost solar-control glazing uptake, though local fabrication capacity still lags demand.

- Abrisa Technologies

- AGC Inc.

- CARDINAL GLASS INDUSTRIES, INC

- Central Glass Co., Ltd.

- Corning Incorporated

- Fuyao Group

- Guardian Industries Holdings

- Morley Glass & Glazing Ltd

- Nippon Sheet Glass Co., Ltd

- Saint-Gobain

- SCHOTT

- ?i?ecam

- TuffX Glass

- Vitro

- Xinyi Glass Holdings Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stricter global building-energy codes

- 4.2.2 Growth in green-building certifications (LEED, BREEAM)

- 4.2.3 OEM demand for low-E glazing in EVs

- 4.2.4 Rapid retrofit uptake of vacuum-insulated glass (VIG)

- 4.2.5 EU CBAM favouring low-carbon flat-glass supply chains

- 4.3 Market Restraints

- 4.3.1 High upfront cost vs. conventional float glass

- 4.3.2 Volatile soda-ash and energy prices impacting margins

- 4.3.3 Limited global magnetron-sputter coating capacity

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Coating Type

- 5.1.1 Hard-coat (pyrolytic)

- 5.1.2 Soft-coat (magnetron-sputtered)

- 5.2 By Glazing Type

- 5.2.1 Single

- 5.2.2 Double

- 5.2.3 Triple

- 5.3 By End-user Industry

- 5.3.1 Building and Construction

- 5.3.2 Automotive

- 5.3.3 Solar Panel

- 5.3.4 Other End-user Industries (Industrial, etc.)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Russia

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Abrisa Technologies

- 6.4.2 AGC Inc.

- 6.4.3 CARDINAL GLASS INDUSTRIES, INC

- 6.4.4 Central Glass Co., Ltd.

- 6.4.5 Corning Incorporated

- 6.4.6 Fuyao Group

- 6.4.7 Guardian Industries Holdings

- 6.4.8 Morley Glass & Glazing Ltd

- 6.4.9 Nippon Sheet Glass Co., Ltd

- 6.4.10 Saint-Gobain

- 6.4.11 SCHOTT

- 6.4.12 ?i?ecam

- 6.4.13 TuffX Glass

- 6.4.14 Vitro

- 6.4.15 Xinyi Glass Holdings Limited

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment