|

市場調查報告書

商品編碼

1721543

商業節能窗戶市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Commercial Energy Efficient Windows Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

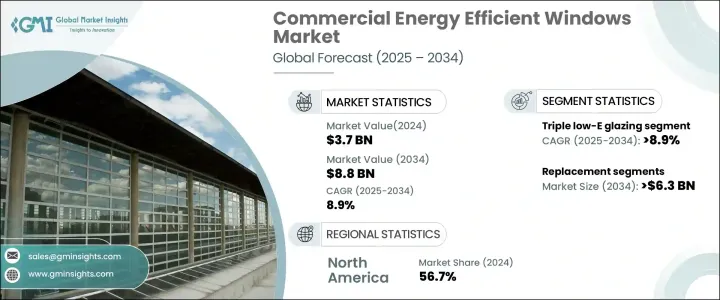

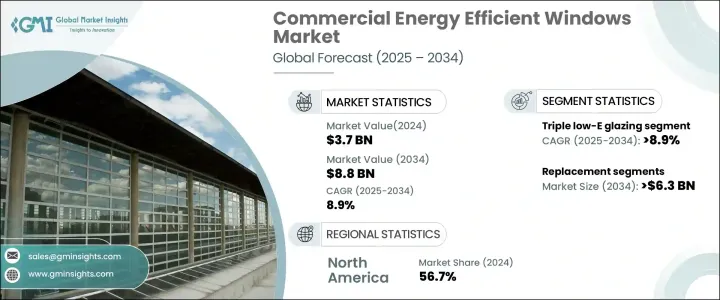

2024 年全球商業節能窗戶市場價值為 37 億美元,預計到 2034 年將以 8.9% 的複合年成長率成長至 88 億美元。這一成長反映了永續建築實踐的快速發展以及商業房地產領域對降低能源消耗的廣泛推動。為了因應不斷上漲的能源成本和環境法規,房地產開發商和建築業主擴大採用高性能、節能的解決方案。由於建築物佔全球能源消耗的很大一部分,因此越來越需要透過創新的開窗解決方案來提高熱性能並減少暖通空調負荷。

商業節能窗戶透過提供高絕緣值、紫外線防護和提高居住者的舒適度,在支持這一轉變中發揮關鍵作用。製造商正在利用電致變色玻璃、真空隔熱玻璃和熱致變色膜等尖端材料不斷突破界限,使節能窗戶不僅更加高效,而且在美學上也適應現代建築趨勢。市場也見證了改造項目的強勁發展,其中過時的基礎設施正在升級以符合現代能源效率要求。減少水電費、提高房產價值以及獲得永續性認證資格等經濟效益進一步加速了商業空間採用節能窗戶。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 37億美元 |

| 預測值 | 88億美元 |

| 複合年成長率 | 8.9% |

2024 年,商業節能窗戶市場價值為 37 億美元。由於許多老化的商業建築缺乏適當的隔熱,對節能窗戶更換的需求持續激增。這些窗戶的設計符合不斷發展的建築能源法規,並降低了與暖氣和冷氣相關的營運成本。業主正在迅速採取行動升級其基礎設施,因為不符合最新的能源標準可能會受到監管處罰。帶有 Low-E(低輻射)塗層的三層玻璃窗等產品正成為首選,尤其是在極端天氣條件的地區。這些先進的窗戶顯著降低了能量損失,幫助建築物營運商保持室內溫度穩定,同時降低能源消耗。隨著永續發展目標成為焦點,商業開發商正在積極選擇節能系統來減少碳足跡並滿足租戶和投資者對環保基礎設施日益成長的需求。

2024 年,北美商業節能窗戶市場佔有 56.7% 的佔有率。僅美國就佔據了 16 億美元的佔有率,並且由於嚴格的能源效率標準和綠色建築實踐的日益普及,繼續引領市場。 LEED 和 BREEAM 等認證的興起,對有助於這些永續發展框架下的積分的高性能窗戶解決方案的需求也隨之增加。全國各地的開發商都優先考慮具有先進熱性能的窗戶,如 Low-E 塗層和三層玻璃,這對於實現能源目標和吸引環保意識的居住者至關重要。新建建築和改造建築領域市場均經歷強勁成長。

全球商業節能窗戶市場的主要參與者包括 Aeroseal Windows、Atrium Corporation、Alpen High-Performance Products、Fenesta、Champion Window、Jeld-Wen、Marvin Windows & Doors、Milgard Manufacturing、Pella Corporation 和 Winco Window 等。這些公司正在透過持續創新和積極的研發投資積極擴大其產品組合,專注於提供卓越絕緣性和耐用性的下一代玻璃技術。與建築公司和商業開發商的合作也使主要製造商能夠滲透尚未開發的區域市場並利用向永續建築的轉變。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- PESTEL分析

第4章:競爭格局

- 介紹

- 戰略儀表板

- 創新與技術格局

第5章:市場規模及預測:依玻璃類型,2021 - 2034

- 主要趨勢

- 雙層玻璃

- 三層低輻射玻璃

第6章:市場規模及預測:依採用情況,2021 - 2034 年

- 主要趨勢

- 替代品

- 絕緣

第7章:市場規模及預測:依窗戶數量,2021 - 2034

- 主要趨勢

- 最多 6 個單位

- >6至10個單位

- >10個單位

第8章:市場規模及預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 亞太地區

- 中國

- 日本

- 澳洲

- 世界其他地區

第9章:公司簡介

- Atrium Corporation

- Aeroseal windows

- Alpen High Performance Products

- Champion Window

- Fenesta

- Jeld-Wen

- Marvin Windows & Doors

- Milgard Manufacturing

- Pella Corporation

- Winco Window

The Global Commercial Energy Efficient Windows Market was valued at USD 3.7 billion in 2024 and is estimated to grow at a CAGR of 8.9% to reach USD 8.8 billion by 2034. This growth reflects the rapid evolution of sustainable construction practices and a widespread push toward minimizing energy consumption in the commercial real estate sector. Property developers and building owners are increasingly embracing high-performance, energy-saving solutions in response to rising energy costs and environmental regulations. As buildings account for a significant share of global energy consumption, there is a growing need to enhance thermal performance and reduce HVAC loads through innovative fenestration solutions.

Commercial energy efficient windows are playing a pivotal role in supporting this transition by offering high insulation value, UV protection, and improved occupant comfort. Manufacturers are pushing boundaries with cutting-edge materials like electrochromic glass, vacuum-insulated glazing, and thermochromic films, making energy-efficient windows not only more effective but also aesthetically adaptable to modern architectural trends. The market is also witnessing strong traction in retrofitting projects, where outdated infrastructure is being upgraded to comply with modern energy efficiency mandates. The economic benefits, such as reduced utility bills, improved property value, and eligibility for sustainability certifications, are further accelerating the adoption of energy-efficient windows in commercial spaces.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.7 Billion |

| Forecast Value | $8.8 Billion |

| CAGR | 8.9% |

In 2024, the commercial energy efficient windows market was valued at USD 3.7 billion. With many aging commercial structures lacking proper insulation, the demand for energy-efficient window replacements continues to surge. These windows are engineered to meet evolving building energy codes and reduce operational costs associated with heating and cooling. Property owners are acting fast to upgrade their infrastructure, as failing to meet the latest energy standards can result in regulatory penalties. Products like triple-glazed windows with Low-E (low emissivity) coatings are becoming the preferred choice, especially in areas experiencing extreme weather conditions. These advanced windows significantly lower energy loss, helping building operators maintain indoor temperature stability while cutting down on energy expenses. As sustainable development goals take center stage, commercial developers are proactively choosing energy-efficient systems to reduce their carbon footprint and meet the rising demand for eco-friendly infrastructure from tenants and investors alike.

North America Commercial Energy Efficient Windows Market held a 56.7% share in 2024. The U.S. alone accounted for USD 1.6 billion and continues to lead the market owing to stringent energy efficiency standards and the growing adoption of green building practices. The rise in certifications such as LEED and BREEAM has created greater demand for high-performance window solutions that contribute to points under these sustainability frameworks. Developers across the country are prioritizing windows with advanced thermal properties like Low-E coatings and triple glazing, which are instrumental in meeting energy targets and attracting environmentally conscious occupants. The market is experiencing robust growth across both new construction and retrofitting sectors.

Major players operating in the global commercial energy-efficient windows market include Aeroseal Windows, Atrium Corporation, Alpen High-Performance Products, Fenesta, Champion Window, Jeld-Wen, Marvin Windows & Doors, Milgard Manufacturing, Pella Corporation, and Winco Window, among others. These companies are actively expanding their portfolios through continuous innovation and aggressive R&D investments focused on next-generation glazing technologies that offer exceptional insulation and durability. Collaborations with construction firms and commercial developers are also enabling key manufacturers to penetrate untapped regional markets and capitalize on the shift toward sustainable construction.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Glazing Type, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 Double glazing

- 5.3 Triple low-E glazing

Chapter 6 Market Size and Forecast, By Adoption, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Replacement

- 6.3 Insulation

Chapter 7 Market Size and Forecast, By Number of Windows, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 Up to 6 units

- 7.3 >6 to 10 units

- 7.4 >10 units

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 Australia

- 8.5 Rest of World

Chapter 9 Company Profiles

- 9.1 Atrium Corporation

- 9.2 Aeroseal windows

- 9.3 Alpen High Performance Products

- 9.4 Champion Window

- 9.5 Fenesta

- 9.6 Jeld-Wen

- 9.7 Marvin Windows & Doors

- 9.8 Milgard Manufacturing

- 9.9 Pella Corporation

- 9.10 Winco Window