|

市場調查報告書

商品編碼

1910626

功能安全:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Functional Safety - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

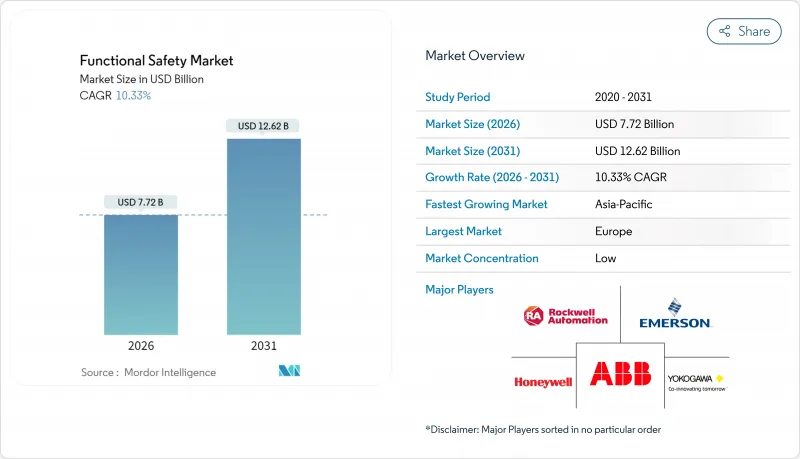

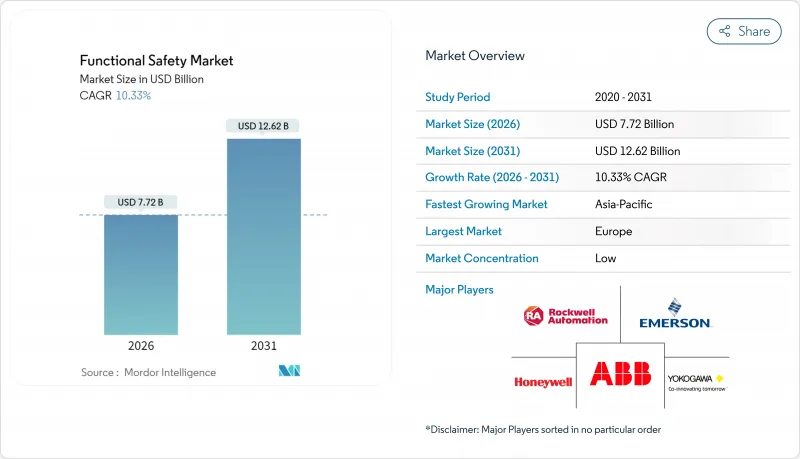

預計到 2026 年,功能安全市場規模將達到 77.2 億美元,高於 2025 年的 70 億美元。預計到 2031 年,該市場規模將達到 126.2 億美元,2026 年至 2031 年的複合年成長率為 10.33%。

強勁的需求源自於日益嚴格的全球標準和工業4.0的普及,迫使製造商從設計階段就將安全功能整合到核心自動化平台中。石油、天然氣和電力設施事故調查後訂定的更嚴格的法規也推動了這一趨勢,而快速的數位化則催生了更多偏愛可程式設計安全邏輯而非硬佈線繼電器的應用場景。此外,整合功能安全和企業網路安全的需求也使供應商受益。 ISA/IEC 62443 指南進一步強化了這一趨勢,該指南將製程安全和網路彈性視為同一領域的兩個面向。因此,能夠在單一解決方案中檢驗SIL 合規性和網路安全設計的供應商將獲得顯著的競爭優勢。

全球功能安全市場趨勢與洞察

更嚴格的全球安全法規和標準

IEC 61508 目前是跨產業產品核可的基礎,而 ISO 26262 的 2024 年修訂版將增加關於人工智慧和機器學習的明確指導,並強制要求在設計階段整合安全功能。因此,希望進入全球市場的製造商將需要通過 SIL 認證的組件和系統級檢驗,這將維持對認可測試實驗室的穩定需求。同時,歐盟機械指令、OSHA 指令以及日本和中國的同等法規正在加強執法力度。這些因素,加上違規行為處罰的增加,促使企業用整合式認證安全控制器取代獨立繼電器,以簡化審核並加快工廠核准速度。

工業4.0的擴展加速了安全系統整合

隨著數位轉型將營運數據推向雲端,安全功能必須與以乙太網路為基礎的網路原生整合,同時保持確定性的回應時間。智慧工廠利用數位雙胞胎技術進行預測性維護,並運用人工智慧分析在感測器漂移威脅到安全完整性等級 (SIL) 目標之前進行偵測。這些應用場景受益於支援多種通訊協定並將診斷功能向上游推送至製造執行系統 (MES) 和企業資源計劃 (ERP) 層的可程式邏輯。這推動了對靈活的安全 PLC 和軟體框架的需求,這些組件和框架能夠在保持認證狀態的同時進行遠端修補。

高昂的實施成本對中小企業的採用構成了挑戰。

獲得 SIL 3 認證需要嚴格的第三方測試和文件編制,這將使計劃總預算增加 15% 至 25%。許多中小企業推遲升級或選擇較低的 SIL 目標,從而減緩了輕工業和離散製造領域的普及。雖然訂閱模式有所幫助,但資本密集度仍然是近期成長的主要限制因素,尤其是在當地法規尚不完善的地區。

細分市場分析

到2025年,安全感測器收入將佔據功能安全市場最大佔有率,達到27.62%,這反映了它們在連接物理危害與控制系統方面發揮的關鍵作用。光學解析度和自診斷能力的不斷提升提高了感測器的可靠性,使製造商能夠延長驗證測試週期並減少停機時間。非接觸式感測技術在無塵室和食品級環境中也得到越來越廣泛的應用,因為它能最大限度地降低污染風險。

預計到2031年,可程式安全系統的需求將以11.05%的複合年成長率成長,成為所有設備類別中成長最快的。隨著工業4.0的興起,使用者傾向於採用軟體可配置邏輯,這種邏輯允許頻繁的產品切換,從而無需在控制面板中重新佈線。OMRON的Sysmac Studio等平台可將程式設計時間縮短90%,有助於緩解認證工程師短缺的瓶頸。最終控制設備(閥門、致動器和驅動器)的需求也在成長,因為流程工業正在用支援狀態監控的SIL認證數位設備取代老舊的機械調速器。整合感測器-控制器軟體包簡化了檢驗流程,預計將推動支出從離散組件轉向捆綁式解決方案,從而在預測期內強化平台提供者的優勢。

到2025年,緊急停車(ESD)系統將佔據功能安全市場佔有率的23.55%,這主要得益於石油、天然氣和化學工廠在製程異常發生時需要快速停機。海上平台和液化天然氣(LNG)工廠的市場密度最高,因為這些場所擁有高價值資產,且標準嚴格,需要多層防護。供應商不斷增強診斷功能和投票架構,以更少的I/O點實現SIL 3等級,並降低生命週期成本。

隨著深水計劃擴大採用高完整性壓力保護系統 (HIPPS) 以避免建造大型火炬塔並減少排放,預計 HIPPS 將以 10.95% 的複合年成長率成長。在北海油田的成功部署已節省了 2,500 萬美元的資本支出 (CAPEX),從而實現了可觀的投資收益率 (ROI)。燃燒器管理和渦輪機械控制在電力和煉油行業中保持穩定的需求。同時,受法規要求採用整合火焰、有毒氣體和熱偵測功能的全覆蓋式系統(整合於單一分析面板中)的推動,火災和氣體偵測系統的需求也隨之成長。

區域分析

到2025年,歐洲將繼續保持在功能安全市場的領先地位,佔有率達28.40%。這主要得益於歐盟機械指令以及德國、義大利和北歐國家對先進自動化技術的廣泛應用。可再生能源和離岸風電的普及速度正在加快,而高價值資產和偏遠地區對具備遠距離診斷功能的SIL 3級安全中斷保護裝置提出了更高的要求。

北美緊隨其後,這得益於美國職業安全與健康管理局 (OSHA)主導的工人安全計劃以及煉油、石化和製藥行業強大的生產能力。該地區在安全與網路安全整合方面處於領先地位,這得益於成熟的 IT-OT 整合技術和龐大的認證工程師團隊。聯邦政府對半導體工廠的獎勵策略正在推動符合 IEC 61508 和 ISA/IEC 62443 標準的可程式安全平台的部署。

預計亞太地區將以11.25%的複合年成長率成長至2031年,成為成長最快的地區。中國製造業的持續進步,以及日本在精密機器人領域的投資,正在推動可程式安全PLC和智慧光柵的大規模採購。東南亞國家正在採用訂閱制的安全服務模式,以滿足日益成長的職場安全需求,而無需大量資本投入。同時,印度新的化學製程安全指南要求新建廠從一開始就按照SIL 2或更高等級的標準進行設計。在中東和非洲地區,沙烏地阿拉伯、卡達和阿拉伯聯合大公國的國家石油公司(NOC)和國際石油公司(IOC)的計劃正在推動新建液化天然氣(LNG)和氫氣設施中高完整性製程控制系統(HIPPS)以及先進的火災和氣體偵測系統的標準化,從而推動了市場成長。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 嚴格的全球安全法規和標準(IEC 61508、ISO 26262)

- 工業4.0和工業自動化的擴展

- 加強石油天然氣和電力產業的事故相關監測

- 功能安全與工業網路安全的融合

- 推出 SIL 認證的 AI/ML 關閉演算法

- 中小企業的「安全即服務」訂閱模式的興起

- 市場限制

- SIL認證組件和系統的初始成本較高

- 現有棕地設施維修的複雜性;

- 註冊功能安全工程師短缺

- 透過OTA進行安全關鍵軟體更新存在不確定性

- 產業價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 對宏觀經濟趨勢的市場評估

第5章 市場規模與成長預測

- 依設備類型

- 安全感應器

- 安全控制設備/模組/繼電器

- 安全開關

- 可程式安全系統

- 緊急停止裝置

- 最終控制設備(閥門、致動器)

- 其他設備類型

- 透過安全系統

- 燃燒器管理系統(BMS)

- 渦輪機械控制(TMC)系統

- 高完整性壓力保護系統(HIPPS)

- 火災和氣體監控控制系統

- 緊急停車系統(ESD)

- 監控與資料採集(SCADA)系統

- 分散式控制系統(DCS)

- 透過服務

- 測試、檢驗和認證

- 設計、工程和維護

- 培訓和諮詢服務

- 按最終用戶行業分類

- 石油和天然氣

- 發電

- 食品/飲料

- 製藥

- 車

- 其他終端用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 新加坡

- 澳洲

- 馬來西亞

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 其他中東地區

- 非洲

- 南非

- 埃及

- 其他非洲地區

- 中東

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Rockwell Automation Inc.

- Emerson Electric Company

- Honeywell International Inc.

- ABB Ltd

- Yokogawa Electric Corporation

- Schneider Electric SE

- Siemens AG

- General Electric Company

- Omron Corporation

- SICK AG

- Panasonic Corporation

- Pepperl+Fuchs SE

- Banner Engineering Corporation

- Pilz GmbH and Co. KG

- HIMA Paul Hildebrandt GmbH

- Mitsubishi Electric Corporation

- Phoenix Contact GmbH and Co. KG

- Turck GmbH and Co. KG

- Balluff GmbH

- IDEC Corporation

第7章 市場機會與未來展望

Functional Safety market size in 2026 is estimated at USD 7.72 billion, growing from 2025 value of USD 7.00 billion with 2031 projections showing USD 12.62 billion, growing at 10.33% CAGR over 2026-2031.

Solid demand arises from the way stricter global standards now intersect with Industry 4.0 roll-outs, forcing manufacturers to embed safety functions into core automation platforms from the concept stage. Heightened regulatory enforcement following incident investigations in oil, gas, and power facilities further boosts adoption, while rapid digitalization creates use cases that favor programmable safety logic over hard-wired relays. Vendors also benefit from the need to merge functional safety with enterprise cybersecurity, a trend reinforced by ISA/IEC 62443 guidelines that treat process safety and cyber resilience as two halves of the same discipline. As a result, solution providers that can validate SIL compliance and cyber-secure design in one offering win a clear competitive edge.

Global Functional Safety Market Trends and Insights

Stringent Global Safety Regulations and Standards

IEC 61508 now anchors product approvals across sectors, and the 2024 ISO 26262 update adds explicit AI and machine-learning guidance, forcing design-stage safety integration. Manufacturers seeking global market entry therefore require SIL-rated components and system-level validation, which sustains predictable demand for accredited testing laboratories. At the same time, the EU Machinery Directive, OSHA directives, and comparable rules in Japan and China have raised enforcement intensity. Coupled with rising penalties for non-compliance, these frameworks motivate enterprises to replace standalone relays with integrated, certificate-backed safety controllers to simplify audits and speed plant approvals.

Industry 4.0 Expansion Accelerates Safety System Integration

Digital transformation places operational data in the cloud, so safety functions must now talk natively to Ethernet-based networks while maintaining deterministic response times. Smart factories use digital twins for predictive shutdowns, and AI analytics spot sensor drift before it threatens SIL targets. Such use cases favor programmable logic that can accept multiple protocols and push diagnostics upstream to MES and ERP layers. Demand therefore tilts toward flexible safety PLCs and software frameworks that can be patched remotely without losing certification status.

High Implementation Costs Challenge SME Adoption

Obtaining SIL 3 certification can add 15-25% to total project budgets because of rigorous third-party testing and documentation. Many SMEs defer upgrades or select lower SIL targets, slowing penetration in light industry and discrete manufacturing. While subscription models help, capital intensity remains the leading brake on near-term growth, especially where local enforcement is still maturing.

Other drivers and restraints analyzed in the detailed report include:

- Incident-Driven Scrutiny in Oil, Gas, and Power

- Integration of Functional Safety with Industrial Cybersecurity

- Brown-Field Retrofitting Presents Complex Integration Challenges

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Revenue from safety sensors accounted for the largest 27.62% share of the functional safety market size in 2025, reflecting their role as the primary link between physical hazards and control systems. Continuous improvements in optical resolution and self-diagnostics increase sensor reliability, letting manufacturers raise proof-test intervals and cut downtime. Adoption also rises in clean-room and food-grade environments where non-contact sensing minimizes contamination risk.

Demand for programmable safety systems is forecast to post an 11.05% CAGR through 2031, the fastest rate among device categories. As Industry 4.0 spreads, users favor software-configurable logic that can adapt to frequent product changeovers without rewiring cabinets. Platforms such as Omron's Sysmac Studio cut programming time by 90%, easing the certified-engineer bottleneck. Final control elements, valves, actuators, and drives, also gain momentum because process industries are replacing aging mechanical governors with SIL-rated digital devices that support condition monitoring. Over the forecast horizon, integrated sensor-controller packages that streamline validation are likely to shift spend away from discrete components toward bundled solutions, reinforcing the trend toward platform providers.

Emergency shutdown (ESD) systems represented 23.55% of the functional safety market share in 2025, anchored in oil, gas, and chemical operations that need rapid isolation during process upsets. Market density is highest on offshore platforms and LNG trains where high-value assets and stricter codes compel multi-layered protection. Vendors continue to enhance diagnostics and voting architectures to meet SIL 3 with fewer I/O points, lowering lifecycle cost.

High-integrity pressure protection systems (HIPPS) are projected to grow at a 10.95% CAGR as deep-water projects adopt them to avoid oversized flare stacks and reduce emissions. Successful deployments on North Sea assets delivered USD 25 million in CAPEX savings, creating a robust ROI case. Burner management and turbomachinery controls maintain steady demand in power and refining, while fire-and-gas systems receive a boost from regulations mandating full coverage models that integrate flame, toxic gas, and heat detection into one analytics dashboard.

The Functional Safety Market Report is Segmented by Device Type (Safety Sensors, Safety Controllers/Modules/Relays, and More), Safety Systems (BMS, TMC, HIPPS, and More), Services (TIC, Design/Engineering/Maintenance, and More), End-User Industry (Oil and Gas, Power Generation, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe retained the lead with 28.40% functional safety market share in 2025, underpinned by the EU Machinery Directive and widespread use of advanced automation in Germany, Italy, and the Nordic states. Adoption intensifies in renewable energy and offshore wind, where high-value assets and remote locations demand SIL 3-compliant shutdown devices capable of remote diagnostics.

North America follows closely, supported by OSHA-driven worker-safety programs and extensive refining, petrochemical, and pharmaceutical capacity. The region also pioneers safety-cybersecurity convergence, helped by mature IT-OT integration skills and a deep bench of certified engineers. Federal stimulus for semiconductor fabs reinforces new installations of programmable safety platforms that meet both IEC 61508 and ISA/IEC 62443 requirements.

Asia-Pacific is poised for the fastest 11.25% CAGR to 2031. China's ongoing manufacturing upgrade, alongside Japan's precision robotics investments, spurs heavy purchases of programmable safety PLCs and smart light curtains. Southeast Asian nations adopt subscription-based safety services to meet rising workplace safety expectations without heavy CAPEX, while India's new chemical-process safety guidelines bring green-field plants straight to SIL 2-plus specification levels. Middle East and Africa contribute incremental gains as NOC and IOC projects in Saudi Arabia, Qatar, and the UAE standardize HIPPS and advanced fire-and-gas detection on green-field LNG and hydrogen facilities.

- Rockwell Automation Inc.

- Emerson Electric Company

- Honeywell International Inc.

- ABB Ltd

- Yokogawa Electric Corporation

- Schneider Electric SE

- Siemens AG

- General Electric Company

- Omron Corporation

- SICK AG

- Panasonic Corporation

- Pepperl+Fuchs SE

- Banner Engineering Corporation

- Pilz GmbH and Co. KG

- HIMA Paul Hildebrandt GmbH

- Mitsubishi Electric Corporation

- Phoenix Contact GmbH and Co. KG

- Turck GmbH and Co. KG

- Balluff GmbH

- IDEC Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent global safety regulations and standards (IEC 61508, ISO 26262)

- 4.2.2 Expansion of Industry 4.0 and industrial automation

- 4.2.3 Heightened incident?related scrutiny in Oil and gas, and power sectors

- 4.2.4 Integration of functional safety with industrial cybersecurity

- 4.2.5 Emergence of SIL-certified AI/ML shutdown algorithms

- 4.2.6 Rise of Safety-as-a-Service subscription models for SMEs

- 4.3 Market Restraints

- 4.3.1 High upfront cost of SIL-certified components and systems

- 4.3.2 Complexity of retrofitting legacy brown-field facilities

- 4.3.3 Shortage of certified functional safety engineers

- 4.3.4 Liability ambiguity for OTA safety-critical software updates

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assessment of Macro-economic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Device Type

- 5.1.1 Safety Sensors

- 5.1.2 Safety Controllers/Modules/Relays

- 5.1.3 Safety Switches

- 5.1.4 Programmable Safety Systems

- 5.1.5 Emergency Stop Devices

- 5.1.6 Final Control Elements (Valves, Actuators)

- 5.1.7 Other Device Types

- 5.2 By Safety Systems

- 5.2.1 Burner Management Systems (BMS)

- 5.2.2 Turbomachinery Control (TMC) Systems

- 5.2.3 High-Integrity Pressure Protection Systems (HIPPS)

- 5.2.4 Fire and Gas Monitoring Control Systems

- 5.2.5 Emergency Shutdown Systems (ESD)

- 5.2.6 Supervisory Control and Data Acquisition (SCADA) Systems

- 5.2.7 Distributed Control Systems (DCS)

- 5.3 By Services

- 5.3.1 Testing, Inspection and Certification

- 5.3.2 Design, Engineering and Maintenance

- 5.3.3 Training and Consulting Services

- 5.4 By End-user Industry

- 5.4.1 Oil and Gas

- 5.4.2 Power Generation

- 5.4.3 Food and Beverage

- 5.4.4 Pharmaceutical

- 5.4.5 Automotive

- 5.4.6 Other End-user Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Singapore

- 5.5.4.6 Australia

- 5.5.4.7 Malaysia

- 5.5.4.8 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Egypt

- 5.5.5.2.3 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Rockwell Automation Inc.

- 6.4.2 Emerson Electric Company

- 6.4.3 Honeywell International Inc.

- 6.4.4 ABB Ltd

- 6.4.5 Yokogawa Electric Corporation

- 6.4.6 Schneider Electric SE

- 6.4.7 Siemens AG

- 6.4.8 General Electric Company

- 6.4.9 Omron Corporation

- 6.4.10 SICK AG

- 6.4.11 Panasonic Corporation

- 6.4.12 Pepperl+Fuchs SE

- 6.4.13 Banner Engineering Corporation

- 6.4.14 Pilz GmbH and Co. KG

- 6.4.15 HIMA Paul Hildebrandt GmbH

- 6.4.16 Mitsubishi Electric Corporation

- 6.4.17 Phoenix Contact GmbH and Co. KG

- 6.4.18 Turck GmbH and Co. KG

- 6.4.19 Balluff GmbH

- 6.4.20 IDEC Corporation

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment