|

市場調查報告書

商品編碼

1910611

醫藥玻璃包裝市場:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Pharmaceutical Glass Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

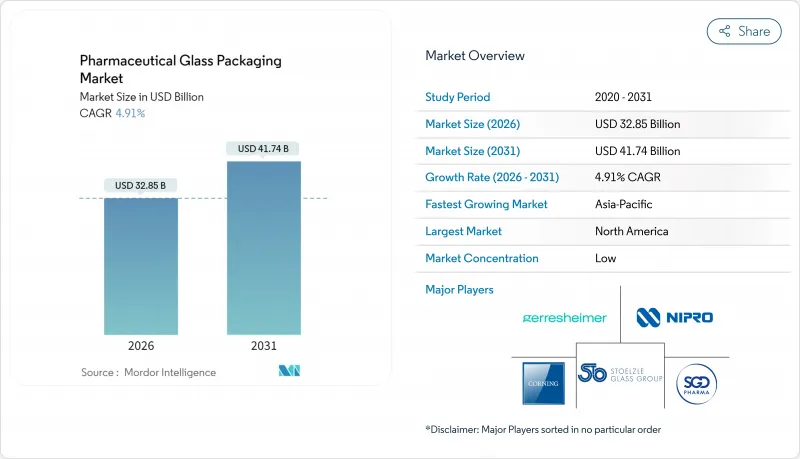

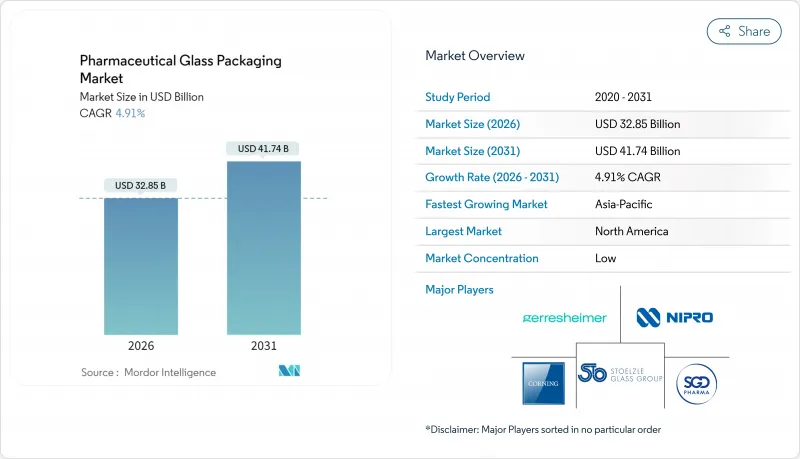

預計醫藥玻璃容器市場將從 2025 年的 313.1 億美元成長到 2026 年的 328.5 億美元,到 2031 年將達到 417.4 億美元,2026 年至 2031 年的複合年成長率為 4.91%。

這一前景反映出市場正穩步轉向更高價值的容器系統,這些系統既能滿足嚴格的無菌性和可萃取物含量限制,又能滿足生物製藥快速規模化生產、分散式疫苗生產和自行注射日益成長的需求。美國食品藥物管理局 (FDA) 和歐洲藥品管理局 (EMA) 日益嚴格的監管持續推動對 I 型硼矽酸玻璃容器的需求。同時,基於人工智慧的檢測技術在提高生產效率的同時,也降低了缺陷風險。此外,熔爐現代化改造和回收材料含量的提高,使製造商能夠在不影響監管合規性的前提下滿足永續性發展要求。因此,儘管面臨原料價格波動和來自先進聚合物日益激烈的競爭等挑戰,醫藥玻璃容器市場仍保持穩定的成長動能。

全球醫藥玻璃包裝市場趨勢及展望

不斷拓展的生物製藥和注射產品線

監管數據顯示,2024年FDA核准的55種新藥中,將有17種是生物製劑,凸顯了生物製劑的持續成長動能。為此,製造商正在加速擴大I型玻璃包裝的生產能力,以確保蛋白質穩定性並降低分層風險。 Stevanato集團的銷售額飆升至11.04億歐元,其中38%來自高附加價值解決方案,顯示高階包裝正在充分利用這一趨勢。在腫瘤和自體免疫療法領域,皮下注射以大容量藥筒的日益普及進一步鞏固了醫藥玻璃包裝市場在支持以病人為中心的給藥方式方面的重要性。基因療法的持續進步將加深對能夠在整個冷凍供應鏈中保持無菌狀態的容器的依賴。這些趨勢共同為生物製藥提供了結構性利好,推動了2030年後的基準需求。

後疫情時代疫苗填充與包裝能力的提升

由於各國政府維持戰略疫苗儲備,全球管瓶消費量仍居高不下。肖特公司生產的超過10億劑新冠疫苗管瓶凸顯了持續的潛在需求。歐洲藥品管理局(EMA)為應對GLP-1促效劑短缺而進行的調整,進一步凸顯了建構韌性供應鏈的努力。在北美,博米奧利製藥公司新增的經FDA核准的儲存能力提振了需求,推動區域銷售額成長47%。印度和東南亞各地的工廠擴建也增加了對當地加工商的供應,從而增強了新興地區的醫藥玻璃包裝市場。這些投資在支持廣泛疫苗接種目標的同時,也緩解了疫情初期訂單量波動的影響。

COP/COC聚合物注射器的快速普及

格雷斯海默公司的ClearJect聚合物注射器具有抗衝擊性和黏合劑的特性,使其適用於自行注射療法。肖特製藥公司的Toppack Freeze產品針對需要極低溫耐久性的mRNA藥物,展現了聚合物的多功能性。由於人們擔心家庭環境中易碎玻璃容器的安全問題,聚合物在高價值細分市場的應用正在加速。雖然玻璃仍是傳統注射劑的主要包裝,但聚合物在黏稠生物製藥和大容量自動注射器領域正不斷擴大市場佔有率。預計這種競爭將在中期內略微抑制醫藥玻璃包裝市場的發展。

細分市場分析

預計到2025年,管瓶將維持34.78%的收入成長,主要得益於其在疫苗、冷凍乾燥生技藥品和臨床批次產品的柔軟性。穩定的需求使得SGD Pharma能夠在五家工廠每天生產超過800萬管瓶,確保全球供應的連續性。隨著庫存調整的結束和腫瘤藥物研發管線補充商業庫存,管瓶的醫藥玻璃包裝市場預計將會擴張。預灌封注射器和藥筒的成長速度最快,複合年成長率達7.15%,這主要得益於皮下注射生技藥品和GLP-1受體拮抗劑等偏好即用型製劑的產品的需求。 BD最新推出的8毫米針頭可適用於高黏度製劑,從而消除了推廣應用的一大障礙。雖然瓶裝產品在口服混懸液和兒童電解質領域保持穩定的需求,但安瓿瓶則滿足了耐熱麻醉劑的特定需求。由於複雜療法的興起,雙腔系統等特殊規格的市場也不斷擴大。人工智慧偵測持續減少所有產品的浪費,從而保護了醫藥玻璃包裝市場的利潤率。

隨著醫療保健模式向以患者為中心的方向轉變,製藥公司正將便利性、依從性和減少就診次數作為首要考慮因素。注射筆可實現多劑量,而自動注射器則可在無需專業人員監督的情況下確保精準給藥。為了保持競爭力,管瓶生產商正在採用模組化填充生產線,提供混合批次填充方案,在透明瓶和琥珀色瓶之間快速切換,以最大限度地減少停機時間。能夠減少顆粒生成並促進矽化的塗層技術正在不斷提升玻璃的性能極限。因此,醫藥玻璃包裝市場的差異化程度日益提高,每個產品類型都在法規應對力、加工性能和總體擁有成本等多個方面展開競爭。

由於其優異的耐化學性和在全球藥典中的廣泛應用,硼矽酸鹽玻璃(I型)預計到2025年將佔市場佔有率的54.71%。隨著高濃度生物製藥和抗體藥物複合體(ADC)對惰性表面的需求日益成長,其市場主導地位將持續維持。新型配方,例如幾乎消除了分層風險的無硼「Valor」玻璃,有望進一步擴大I型玻璃容器的醫藥玻璃包裝市場。同時,經過處理的II型鈉鈣玻璃憑藉其表面塗層技術和在弱酸性注射劑領域的廣泛應用,在低成本方面實現了性能與預算的良好平衡,預計將實現6.59%的複合年成長率。 Gerresheimer最新的II型產品線為中等濃度的治療藥物提供了更多選擇,在這些藥物領域,使用昂貴的硼矽酸玻璃並不划算。

III型玻璃仍廣泛用於口服液、止咳糖漿和滴瓶等產品中,在這些產品中,pH中性比水解應力更為重要。同時,琥珀色玻璃則用於保護光分解藥物和眼科抗病毒藥物的一系列產品。隨著大藥廠設定範圍3排放目標,回收成分的使用量正不斷增加。 SGD Pharma目前已在部分產品線中添加了20%的消費後玻璃屑(玻璃粉),且未違反相關法規。在預測期內,永續性評估將強化採購決策,生命週期分析將成為醫藥玻璃包裝市場中所有類型玻璃的綜合價值提案。

區域分析

2025年,北美地區將占公司總收入的38.42%,主要得益於活躍的研發開發平臺、強勁的創業融資以及嚴格的合規文化。肖特製藥在北卡羅來納州投資3.71億美元,計劃到2030年將美國本土即用型注射器(RTU)的產量提高三倍,這將進一步鞏固其在該地區主導地位。聯邦政府對先進製造業的誘因也正在加速傳統熔爐向電混合動力爐的轉型,從而符合碳減排目標。對GLP-1療法和腫瘤生技藥品的強勁需求,促使主要加工廠實行多班制生產,降低了傳統學名藥生產波動帶來的風險。

在嚴格的法規環境和早期永續性指令的支持下,歐洲保持著均衡成長。新的歐盟包裝和包裝廢棄物法規2025/40豁免了關鍵的醫藥玻璃的部分回收配額,同時品牌所有者也自願承諾整合碎玻璃,以實現其公司的淨零排放目標。對後管瓶和藥筒的生產能力。然而,能源成本仍然是一項競爭挑戰,除非綠色電力價格穩定下來,否則一些製造商將被迫把生產轉移到成本較低的地區。

亞太地區以7.72%的複合年成長率成為成長最快的地區,這主要得益於中國和印度製造業的擴張。預計到2023年,兩國生物製藥市場規模將達到6,506億元人民幣,2029年將增加一倍。政府的獎勵策略推動了高階玻璃製品的進口,同時,國內製造商也正在加速熔爐的重組。跨國合約研發生產企業(CDMO)正在新加坡和韓國建立灌裝包裝工廠,將區域標準提升至美國和歐盟水平,並擴大了醫藥玻璃包裝的潛在市場。東南亞的疫苗研究機構正在利用優惠資金建造灌裝包裝生產線,進一步刺激了管瓶的需求。

儘管南美洲和中東及非洲在絕對數量上落後,但當地的學名藥生產商正透過擴建工廠來減少對進口的依賴,從而獲得發展動力。巴西國家衛生監督局 (ANVISA) 的嚴格監管促使藥品包裝升級,海灣國家也正大力投資醫療保健領域,將其作為經濟多元化計畫的一部分。值得注意的是,區域性的堿灰和液化石油氣 (LPG) 能源供應鏈正在緩解人們對爐用燃料的擔憂,一些成長型市場正在發展成為醫藥玻璃包裝市場出口導向生產的二級樞紐。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 不斷拓展的生物製藥和注射產品線

- 新冠疫情後擴大疫苗填充及包裝產能

- 過渡到即用型(RTU)管瓶和注射器

- 高附加價值硼矽酸玻璃(I型)的需求不斷成長

- 製藥業的永續性要求推動了玻璃的可回收性。

- 利用人工智慧驅動的在線連續品管降低玻璃缺陷率(被低估了)

- 市場限制

- COP/COC聚合物注射器的快速普及

- 堿灰和能源價格波動推高玻璃成本

- 對高活性藥物剝落和破損的擔憂

- 區域容器玻璃熔爐產能短缺(往往被低估)

- 供應鏈分析

- 監理展望

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 依產品

- 瓶子

- 管瓶

- 安瓿

- 藥筒和預填充式注射器

- 其他產品

- 按玻璃類型

- I型硼硼矽酸玻璃

- II 型處理鈉石灰

- 第三型鈉石灰

- 其他玻璃類型

- 按藥物形式

- 注射

- 口服液

- 眼科/鼻科

- 按主題

- 最終用戶

- 製藥創新公司

- 學名藥和合約生產商

- 生技公司

- 配藥藥房

- 動物醫藥

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲和紐西蘭

- 亞太其他地區

- 中東和非洲

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 埃及

- 其他非洲地區

- 中東

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Gerresheimer AG

- Schott AG

- SGD Pharma

- Stevanato Group

- Corning Inc.

- Nipro Corp.

- West Pharmaceutical Services

- Bormioli Pharma

- Owens-Illinois(Ardagh Glass Pharma)

- Stolzle Glass Group

- Beatson Clark

- Shandong Medicinal Glass

- Arab Pharmaceutical Glass

- Piramal Glass

- Sisecam Group

- Baxter BioPharma Solutions

- Kindeva Drug Delivery

- Origin Pharma Packaging

- DWK Life Sciences

- GerroMed(under-reported niche)

第7章 市場機會與未來展望

The pharmaceutical glass packaging market is expected to grow from USD 31.31 billion in 2025 to USD 32.85 billion in 2026 and is forecast to reach USD 41.74 billion by 2031 at 4.91% CAGR over 2026-2031.

This outlook reflects a steady pivot toward high-value container systems that can meet rigorous sterility and leachables limits while supporting rapid biologics scale-up, decentralized vaccine production and growing self-injection preferences. Tightened guidelines from the FDA and the European Medicines Agency continue to elevate demand for Type I borosilicate formats, while AI-enabled inspection unlocks higher throughput with lower defect risk. At the same time, furnace modernization and greater recycled content help producers manage sustainability mandates without compromising regulatory compliance. As a result, the pharmaceutical glass packaging market continues to offer reliable growth opportunities, tempered only by raw-material cost swings and rising competition from advanced polymers.

Global Pharmaceutical Glass Packaging Market Trends and Insights

Expansion of Biologics and Injectable Drugs Pipeline

Regulatory data show 17 biologics approvals among 55 new FDA drugs in 2024, underscoring sustained biologics momentum. Manufacturers therefore accelerate Type I capacity upgrades that ensure protein stability and mitigate delamination risk. A revenue jump to EUR 1,104 million at Stevanato Group, with 38% from high-value solutions, highlights how premium containers capture this wave. Oncology and autoimmune therapies increasingly favor large-volume cartridges that enable subcutaneous dosing, reinforcing the critical role of the pharmaceutical glass packaging market in supporting patient-centric delivery. Continued gene-therapy breakthroughs will deepen reliance on containers that maintain sterility across frozen supply chains. Together these trends give biologics a structural tailwind that raises baseline demand well beyond 2030.

Mounting Vaccine Fill-Finish Capacity Post-COVID

Global vial consumption remains elevated as governments keep strategic vaccine reserves. SCHOTT produced enough vials for more than 1 billion COVID-19 doses, illustrating the sustained baseline. EMA coordination to ease GLP-1 agonist shortages further spotlights the drive for resilient supply chains. North American demand strengthened when Bormioli Pharma lifted regional sales 47% after adding FDA-approved storage capacity. Facility expansions across India and Southeast Asia also push incremental volume to local converters, reinforcing the pharmaceutical glass packaging market across emerging hubs. These investments support broad immunization goals while smoothing order volatility seen during the initial pandemic surge.

Rapid Adoption of COP/COC Polymer Syringes

ClearJect polymer syringes from Gerresheimer deliver break-resistant, glue-free formats that appeal to self-injection therapies. SCHOTT Pharma's TOPPAC Freeze targets mRNA drugs that need deep-cold durability, underscoring polymer versatility. Patient safety concerns for fragile glass in at-home settings accelerate polymer acceptance in high-value niches. While glass maintains dominance for conventional injectables, polymers now capture incremental share in viscous biologics and high-volume autoinjectors. This competitive encroachment creates a modest drag on the pharmaceutical glass packaging market over the medium term.

Other drivers and restraints analyzed in the detailed report include:

- Shift to Ready-to-Use (RTU) Vials and Syringes

- Rising Demand for High-Value Borosilicate Type I Glass

- Volatile Soda-Ash and Energy Prices Inflating Glass Cost

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Vials retained 34.78% revenue in 2025 as their flexibility spans vaccines, lyophilized biologics and clinical batches. Steady demand lets SGD Pharma run more than 8 million vials daily across five plants, safeguarding global supply continuity. The pharmaceutical glass packaging market size for vials is projected to grow as destocking subsides and oncology pipelines refill commercial inventories. Prefillable syringes and cartridges expand fastest at a 7.15% CAGR, propelled by subcutaneous biologics and GLP-1 antagonists that favor ready-to-inject formats. BD's latest eight-millimeter needles address higher viscosity formulations, removing one adoption hurdle. Bottles hold steady in oral suspensions and pediatric electrolytes, whereas ampoules preserve niche demand for heat-stable anesthetics. Specialty formats, including dual-chamber systems, rise alongside complex combination therapies. Across products, AI inspection continues to trim scrap rates, protecting margins within the pharmaceutical glass packaging market.

The shift toward patient-centric care pushes drug developers to prioritize convenience, adherence and reduced clinic visits. Cartridge-based pens accommodate multi-dose regimes, while autoinjectors ensure accurate dose delivery without professional oversight. Vial makers lean on modular filling lines to remain competitive, offering hybrid batches that switch between clear and amber containers with minimal downtime. Coating technologies that reduce particle generation and ease siliconization broaden the performance envelope for glass. Consequently, every product category now competes on a mix of regulatory robustness, machinability and total cost of ownership, heightening differentiation within the pharmaceutical glass packaging market.

Type I borosilicate captured 54.71% revenue in 2025 thanks to sterling chemical resistance and global pharmacopeia acceptance. Its dominance will persist as high-concentration biologics and antibody-drug conjugates demand inert surfaces. The pharmaceutical glass packaging market size for Type I containers benefits further from new compositions like boron-free Valor that virtually eliminate delamination risk. Treated Type II soda-lime glass, however, posts a 6.59% CAGR as surface coatings extend suitability to mildly acidic injectables at lower cost, offering an attractive balance between performance and budget. Gerresheimer's latest Type II lines broaden options for mid-tier therapies that cannot justify premium borosilicate pricing.

Type III glass remains common for oral liquids, cough syrups and dropper bottles where pH neutrality dominates over hydrolytic stress. Meanwhile, colored amber variants shield photolabile drugs and line extensions of ophthalmic antivirals. Recycled content climbs as large pharma institutes Scope 3 emission targets; SGD Pharma now offers 20% post-consumer cullet in selected ranges without compromising regulatory compliance. Over the forecast horizon, sustainability scoring will intensify procurement decisions, making life-cycle analysis an embedded value proposition across all glass types of the pharmaceutical glass packaging market.

The Pharmaceutical Glass Packaging Market Report is Segmented by Product (Bottles, Vials, Ampoules, and More), Glass Type (Type I Borosilicate, Type II Treated Soda-Lime, and More), Drug Formulation (Injectables, Oral Liquids, Ophthalmic/Nasal, Topical), End-User (Pharma Innovator Companies, Generic and CMOs, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 38.42% of 2025 revenue, fueled by intense R&D pipelines, strong venture funding and strict compliance culture. SCHOTT Pharma's USD 371 million investment in North Carolina is slated to triple domestic output of RTU syringes by 2030, further cementing regional leadership. Federal incentives for advanced manufacturing also speed furnace rebuilds into electric hybrids, aligning with carbon-reduction targets. Robust demand for GLP-1 therapeutics and oncology biologics sustains multi-shift operations at major converters, guarding against volume swings in legacy generics.

Europe maintains balanced growth, underpinned by its stringent regulatory environment and early sustainability mandates. The new EU Packaging and Packaging Waste Regulation 2025/40 exempts critical pharma glass from some recycling quotas, yet brand owners voluntarily pledge to integrate cullet to meet corporate net-zero goals. Political support for strategic drug reserves post-COVID fosters local vial and cartridge capacity. However, energy costs remain a competitive thorn, pushing some producers to relocate capacity to lower-cost regions unless green power tariffs stabilize.

Asia-Pacific records the fastest 7.72% CAGR, powered by manufacturing scale-ups in China and India where the 2023 biopharma market stood at 650.6 billion yuan and is forecast to double by 2029. Government stimulus packages encourage high-end glass imports even as domestic players ramp furnace rebuilds. Multinational CDMOs establish fill-finish sites in Singapore and South Korea, raising regional specifications to US and EU levels and enlarging the addressable pharmaceutical glass packaging market. Southeast Asian vaccine institutes leverage concessional funding to build fill-finish lines, further lifting vial demand.

South America and the Middle East & Africa trail in absolute numbers but gain momentum as local generics houses expand facility footprints to cut import reliance. Brazil's stringent ANVISA rules compel packaging upgrades, and Gulf states pursue health-care investment drives as part of economic diversification plans. Importantly, regional arteries for soda ash and LPG energy ease furnace-fuel concerns, positioning select emerging markets as secondary hubs for export-oriented production within the pharmaceutical glass packaging market.

- Gerresheimer AG

- Schott AG

- SGD Pharma

- Stevanato Group

- Corning Inc.

- Nipro Corp.

- West Pharmaceutical Services

- Bormioli Pharma

- Owens-Illinois (Ardagh Glass Pharma)

- Stolzle Glass Group

- Beatson Clark

- Shandong Medicinal Glass

- Arab Pharmaceutical Glass

- Piramal Glass

- Sisecam Group

- Baxter BioPharma Solutions

- Kindeva Drug Delivery

- Origin Pharma Packaging

- DWK Life Sciences

- GerroMed (under-reported niche)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expansion of biologics and injectable drugs pipeline

- 4.2.2 Mounting vaccine fill-finish capacity post-COVID

- 4.2.3 Shift to ready-to-use (RTU) vials and syringes

- 4.2.4 Rising demand for high-value borosilicate Type-I glass

- 4.2.5 Pharma sustainability mandates boosting glass recyclability

- 4.2.6 AI-enabled inline QC reducing glass defect rates (under-reported)

- 4.3 Market Restraints

- 4.3.1 Rapid adoption of COP/COC polymer syringes

- 4.3.2 Volatile soda-ash and energy prices inflating glass cost

- 4.3.3 Delamination and breakage concerns in ultra-potent drugs

- 4.3.4 Regional container-glass furnace capacity shortages (under-reported)

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product

- 5.1.1 Bottles

- 5.1.2 Vials

- 5.1.3 Ampoules

- 5.1.4 Cartridges and Prefillable Syringes

- 5.1.5 Other Product

- 5.2 By Glass Type

- 5.2.1 Type I Borosilicate

- 5.2.2 Type II Treated Soda-Lime

- 5.2.3 Type III Soda-Lime

- 5.2.4 Other Glass Type

- 5.3 By Drug Formulation

- 5.3.1 Injectables

- 5.3.2 Oral Liquids

- 5.3.3 Ophthalmic / Nasal

- 5.3.4 Topical

- 5.4 By End-User

- 5.4.1 Pharma Innovator Companies

- 5.4.2 Generic and CMOs

- 5.4.3 Biotech Firms

- 5.4.4 Compounding Pharmacies

- 5.4.5 Veterinary Pharma

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Australia and New Zealand

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 Middle East

- 5.5.4.1.1 United Arab Emirates

- 5.5.4.1.2 Saudi Arabia

- 5.5.4.1.3 Turkey

- 5.5.4.1.4 Rest of Middle East

- 5.5.4.2 Africa

- 5.5.4.2.1 South Africa

- 5.5.4.2.2 Nigeria

- 5.5.4.2.3 Egypt

- 5.5.4.2.4 Rest of Africa

- 5.5.4.1 Middle East

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global level Overview, Market level overview, and others)

- 6.4.1 Gerresheimer AG

- 6.4.2 Schott AG

- 6.4.3 SGD Pharma

- 6.4.4 Stevanato Group

- 6.4.5 Corning Inc.

- 6.4.6 Nipro Corp.

- 6.4.7 West Pharmaceutical Services

- 6.4.8 Bormioli Pharma

- 6.4.9 Owens-Illinois (Ardagh Glass Pharma)

- 6.4.10 Stolzle Glass Group

- 6.4.11 Beatson Clark

- 6.4.12 Shandong Medicinal Glass

- 6.4.13 Arab Pharmaceutical Glass

- 6.4.14 Piramal Glass

- 6.4.15 Sisecam Group

- 6.4.16 Baxter BioPharma Solutions

- 6.4.17 Kindeva Drug Delivery

- 6.4.18 Origin Pharma Packaging

- 6.4.19 DWK Life Sciences

- 6.4.20 GerroMed (under-reported niche)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment