|

市場調查報告書

商品編碼

1910604

邊緣人工智慧硬體:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Edge AI Hardware - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

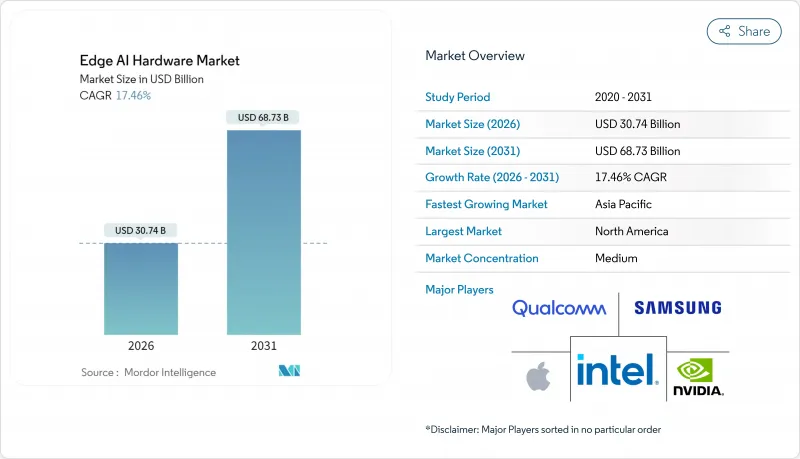

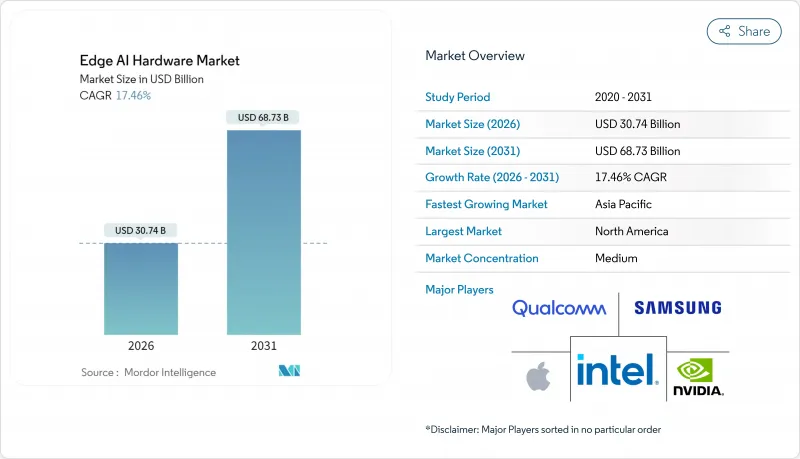

預計到 2025 年,邊緣 AI 硬體市場規模將達到 261.7 億美元,到 2026 年將成長至 307.4 億美元,到 2031 年將成長至 687.3 億美元,在預測期(2026-2031 年)內,複合年成長率為 17.46%。

這一成長動能主要得益於對設備端推理需求的不斷成長,這種推理方式能夠降低延遲、保護資料主權並減少能耗。高階智慧型手機、人工智慧個人電腦以及關鍵的汽車安全系統正在支撐近期成長。諸如《晶片與科學法案》等政府激勵措施正在推動國內製造業產能的提升,而支援5G的多接取邊緣運算(MEC)則正在拓展可處理的工作負載範圍。市場競爭較為溫和,各半導體巨頭都在努力捍衛市場佔有率,而應用專用晶片供應商則致力於最佳化每瓦性能。先進晶圓代工廠的供應鏈集中度以及不斷擴大的出口限制加劇了區域市場的複雜性,同時也促進了本土替代技術的研發。

全球邊緣人工智慧硬體市場趨勢與洞察

人工智慧賦能的個人電腦的興起將改變處理器架構。

最新筆記型電腦晶片中的專用神經處理單元 (NPU) 可提供 40-50 TOPS 的本地 AI 吞吐量,使大型語言模型和生成式工作負載能夠離線運行並實現即時響應。微軟 Copilot+PC 的新設計標準正在推動所有 OEM 廠商採用類似的加速整合方案,引導藍圖從通用核心轉向異構運算。到 2030 年的半導體藍圖優先考慮推理最佳化型晶片,從而持續推動對邊緣運算節點的需求。

智慧型手機人工智慧功能驅動的高階市場更新週期

旗艦移動處理器將提供 45-50 TOPS 的推理性能,並透過將 AI 任務卸載到專用引擎來延長電池續航時間。設備內翻譯、生成式影像處理和個人助理功能將為高階產品帶來明顯的升級動力,從而縮短更換週期。中階產品將保留上一年旗艦級的功能,並擴大專用 AI 晶片的出貨量。

先進節點製造成本限制了市場進入

開發3奈米裝置需要超過1億美元的掩模費用,每片晶圓的成本超過2萬美元,這限制了新進者的市場。隨著小規模的公司尋求擴大規模並在細分領域脫穎而出,行業整合正在加速。節點最佳化設計和晶片分割在一定程度上抵消了成本,但也進一步鞏固了擁有現有供應協議的現有企業的優勢。

細分市場分析

到2025年,GPU設備將佔據邊緣AI硬體市場50.12%的佔有率,這主要得益於成熟的軟體堆疊和高並行吞吐量。隨著設計人員優先考慮每瓦性能,ASIC和NPU預計在預測期內將以18.74%的複合年成長率成長。隨著汽車和工業領域的買家優先考慮確定性延遲和功能安全性,ASIC的邊緣AI硬體市場規模預計將呈指數級成長。 CPU在需要通用資源的混合工作負載中仍將保持價值,而FPGA將在通訊和國防領域的可重構應用中繼續蓬勃發展。

晶片封裝將CPU、GPU和NPU模組整合到通用基板上,每個晶粒針對不同任務進行最佳化,共用記憶體介面。供應商在矽層整合安全區域和功能安全監控器,以滿足醫療和汽車行業的監管要求。多代晶圓代工廠策略降低了地緣政治風險,而對先進製程節點的依賴則維持了與大型晶圓廠的議價能力。

到2025年,智慧型手機將佔據邊緣AI硬體市場39.25%的佔有率,這主要得益於其年度更新周期和大規模生產。然而,機器人和無人機領域,尤其是那些需要低延遲推理的自主導航和視覺分析領域,將以19.32%的複合年成長率成長。專用邊緣闆卡整合了視覺處理器和深度感測器,可在毫秒級時間內實現避障。

攝影機整合邊緣人工智慧技術,可在機櫃內進行即時偵測,從而降低零售分析和智慧城市專案的影像回程傳輸成本。穿戴式裝置採用超低功耗神經網路引擎,即使在電池電量有限的情況下也能持續擷取健康數據。智慧音箱將語音採集、波束成形和自然語言處理推理功能整合到單一晶片上,減少了組件數量,並透過本地音訊傳輸增強了隱私性。

區域分析

北美地區佔總收入的38.92%,這主要得益於2025年高達520億美元的CHIPS獎勵計劃,以及汽車、零售和醫療保健行業企業試點項目的領先部署。Start-Ups正利用創業投資推動特定產業加速器的商業化。出口管制政策限制了國際銷售,而國內國防和航太需求仍然強勁。

亞太地區成長速度超過其他地區,複合年成長率達19.27%。中國正扶持國內GPU和NPU企業以規避進口限制;韓國正斥資70億美元打造國家級人工智慧晶片生產線;日本的「社會5.0」計畫正在推動智慧工廠轉型,而這需要確定性邊緣運算。

歐洲透過耗資430億歐元的「晶片法案」在主權目標和預算現實之間尋求平衡。德國和法國的汽車產業中心優先發展邊緣推理技術,並確保功能安全,而GDPR合規性則推動了本地分析的發展。以色列充滿活力的Start-Ups生態系統瞄準國防和醫療成像應用領域,並向歐洲、中東和非洲地區出口電路板。

拉丁美洲在農業無人機和智慧城市監控系統方面已率先採用。中東正在加速投資建設主權資料中心,並結合邊緣閘道器,以承載用於物流和能源基礎設施的人工智慧。非洲雖然仍在發展中,但其技術平台正在超越傳統模式,採用行動優先部署並結合衛星回程傳輸。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 人工智慧驅動的個人電腦(AI PC)的興起

- 人工智慧智慧型手機升級週期

- MEC引入對5G和6G延遲的降低效果

- 對汽車L2-L4 ADAS邊緣推理的需求

- 節能型模擬與PIM加速器

- 類似《CHIPS法案》的政府獎勵

- 市場限制

- 先進節點初始開發成本(NRE)不斷上升

- 工具鏈分散化和軟體鎖定

- 邊緣運算與矽谷人才短缺

- 供應鏈中的地緣政治出口管制

- 產業價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 宏觀經濟因素的影響

第5章 市場規模與成長預測

- 按處理器

- CPU

- GPU

- FPGA

- 專用積體電路與神經網路處理器

- 透過裝置

- 智慧型手機

- 攝影機和智慧視覺感測器

- 機器人和無人機

- 穿戴式裝置

- 智慧音箱與家庭中樞

- 其他邊緣設備

- 按最終用戶行業分類

- 家用電子電器

- 汽車/運輸設備

- 製造和工業IoT

- 衛生保健

- 政府和公共

- 其他終端用戶產業

- 按安裝位置

- 設備邊緣

- 近邊緣伺服器

- 遠邊緣/MEC

- 雲端輔助混合

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 新加坡

- 澳洲

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 埃及

- 其他非洲地區

- 中東

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- NVIDIA Corporation

- Intel Corporation

- Qualcomm Incorporated

- Samsung Electronics Co., Ltd.

- Apple Inc.

- Advanced Micro Devices, Inc.

- Huawei Technologies Co., Ltd.

- Alphabet Inc.(Google LLC)

- Amazon.com, Inc.

- Alibaba Group Holding Limited

- Baidu, Inc.

- Continental AG

- DENSO Corporation

- Robert Bosch GmbH

- Kalray SA

- MediaTek Inc.

- Imagination Technologies Limited

- Hailo Technologies Ltd.

- SiMa.ai, Inc.

- BrainChip Holdings Ltd.

- Syntiant Corp.

- Mythic, Inc.

- Gyrfalcon Technology Inc.

第7章 市場機會與未來展望

The Edge AI hardware market was valued at USD 26.17 billion in 2025 and estimated to grow from USD 30.74 billion in 2026 to reach USD 68.73 billion by 2031, at a CAGR of 17.46% during the forecast period (2026-2031).

Momentum stems from rising demand for on-device inference that cuts latency, safeguards data sovereignty, and lowers energy consumption. Premium-tier smartphones, AI-enabled personal computers, and mandatory automotive safety systems anchor near-term growth. Government incentives such as the CHIPS and Science Act encourage domestic production capacity, while 5G-powered multi-access edge computing (MEC) broadens the addressable workload. Competitive intensity is moderate as diversified semiconductor leaders defend share against application-specific chip suppliers that optimize performance per watt. Supply-chain concentration at advanced foundries and widening export controls add regional complexity but also stimulate indigenous alternatives.

Global Edge AI Hardware Market Trends and Insights

Rise of AI-Enabled Personal Computing Transforms Processor Architecture

Dedicated neural processing units (NPUs) in the latest laptop chips achieve 40-50 TOPS of local AI throughput, allowing large language models and genera-tive workloads to run offline with instant response times. New design baselines from Microsoft Copilot+ PCs compel every OEM to integrate similar acceleration, steering roadmaps toward heterogeneous compute rather than general-purpose cores. Semiconductor roadmaps through 2030 now prioritize inference-optimized tiles, driving sustained demand for edge-centric nodes.

Smartphone AI Capabilities Drive Premium Segment Refresh Cycles

Flagship mobile processors deliver 45-50 TOPS inference and extend battery life by scheduling AI tasks to dedicated engines. On-device translation, generative imaging, and personal-assistant features create clear upgrade motives across premium tiers, shortening replacement intervals. Mid-range designs will inherit last year's flagship capabilities, expanding volume shipments of specialized AI silicon.

Advanced Node Manufacturing Costs Limit Market Entry

Developing a 3 nm device demands over USD 100 million in masks and USD 20,000 per wafer, constraining access for new entrants. Consolidation accelerates as smaller firms seek scale or niche differentiation. Design-for-node co-optimization and chiplet partitioning partially offset cost but reinforce the advantage for incumbents with existing supply contracts.

Other drivers and restraints analyzed in the detailed report include:

- 5G Infrastructure Enables Distributed Edge Computing Architectures

- Automotive Safety Regulations Mandate Advanced Driver Assistance Systems

- Export Control Restrictions Fragment Global Supply Chains

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

GPU devices captured 50.12% Edge AI hardware market share in 2025 owing to mature software stacks and high parallel throughput. Over the forecast horizon, ASICs and NPUs are projected to post a 18.74% CAGR as designers emphasize performance per watt. The Edge AI hardware market size for ASICs is expected to rise sharply as automotive and industrial buyers prioritize deterministic latency and functional safety. CPUs retain value where mixed workloads require general-purpose resources, and FPGAs grow in reconfigurable roles across telecom and defense.

Chiplet packaging combines CPU, GPU, and NPU tiles on common substrates, optimizing each die for distinct tasks while sharing memory interfaces. Vendors integrate security enclaves and functional-safety monitors at the silicon layer, satisfying regulatory mandates in healthcare and automotive deployments. Multi-foundry strategies mitigate geopolitical risk, yet advanced-node dependence keeps negotiating leverage with leading fabs.

Smartphones accounted for 39.25% of the Edge AI hardware market size in 2025, leveraging annual refresh cycles and large unit volumes. Robots and drones, however, represent the fastest trajectory, climbing at 19.32% CAGR as autonomous navigation and vision analytics demand low-latency inference. Specialized edge boards pair vision processors with depth sensors, enabling millisecond obstacle avoidance.

Cameras integrate edge AI to execute real-time detection within enclosures, reducing video backhaul costs for retail analytics and smart cities. Wearables adopt ultra-low-power neural engines that extract health insights continuously under limited battery budgets. Smart speakers consolidate voice capture, beamforming, and NLP inference on single chips, shrinking the bill of materials and enhancing privacy by keeping audio local.

The Edge AI Hardware Market Report is Segmented by Processor (CPU, GPU, and More), Device (Smartphones, Cameras and Smart Vision Sensors, and More), End-User Industry (Consumer Electronics, Automotive and Transportation, and More), Deployment Location (Device Edge, Near Edge Servers, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America controlled 38.92% revenue in 2025 on the back of USD 52 billion CHIPS incentives and early enterprise pilots in automotive, retail, and healthcare. Start-ups leverage venture capital density to commercialize domain-specific accelerators. Export-control policy constrains outbound sales, yet secures domestic defense and aerospace demand.

Asia-Pacific is advancing at a 19.27% CAGR, outpacing all other regions. China funds native GPU and NPU ventures to circumvent import restrictions, while South Korea allocates USD 7 billion for national AI chip lines. Japan's Society 5.0 agenda stimulates smart-factory retrofits that require deterministic edge compute.

Europe balances sovereignty aims with budget realities under its EUR 43 billion Chips Act. Automotive hubs in Germany and France prioritize functional-safe edge inference, while GDPR compliance encourages on-premise analytics. Israel's vibrant start-up ecosystem targets defense and medical imaging use cases, exporting boards across EMEA.

Latin America sees early adoption in agriculture drones and smart-city surveillance. The Middle East accelerates investment in sovereign data centers coupled with edge gateways to host AI for logistics and energy infrastructure. Africa remains nascent but leapfrogs legacy stacks through mobile-first deployments allied with satellite backhaul.

- NVIDIA Corporation

- Intel Corporation

- Qualcomm Incorporated

- Samsung Electronics Co., Ltd.

- Apple Inc.

- Advanced Micro Devices, Inc.

- Huawei Technologies Co., Ltd.

- Alphabet Inc. (Google LLC)

- Amazon.com, Inc.

- Alibaba Group Holding Limited

- Baidu, Inc.

- Continental AG

- DENSO Corporation

- Robert Bosch GmbH

- Kalray S.A.

- MediaTek Inc.

- Imagination Technologies Limited

- Hailo Technologies Ltd.

- SiMa.ai, Inc.

- BrainChip Holdings Ltd.

- Syntiant Corp.

- Mythic, Inc.

- Gyrfalcon Technology Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise of AI-enabled Personal Computing (AI PCs)

- 4.2.2 Smartphone upgrade cycle toward on-device AI

- 4.2.3 5G and 6G-driven MEC deployments lower latency

- 4.2.4 Automotive L2-L4 ADAS edge inference demand

- 4.2.5 Energy-efficient Analog and PIM accelerators

- 4.2.6 Government CHIPS ACT-style incentives

- 4.3 Market Restraints

- 4.3.1 High upfront NRE costs for advanced nodes

- 4.3.2 Fragmented toolchains and software lock-in

- 4.3.3 Talent shortage in edge-oriented ML and silicon

- 4.3.4 Supply-chain geopolitical export controls

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Processor

- 5.1.1 CPU

- 5.1.2 GPU

- 5.1.3 FPGA

- 5.1.4 ASIC and NPU

- 5.2 By Device

- 5.2.1 Smartphones

- 5.2.2 Cameras and Smart Vision Sensors

- 5.2.3 Robots and Drones

- 5.2.4 Wearables

- 5.2.5 Smart Speakers and Home Hubs

- 5.2.6 Other Edge Devices

- 5.3 By End-User Industry

- 5.3.1 Consumer Electronics

- 5.3.2 Automotive and Transportation

- 5.3.3 Manufacturing and Industrial IoT

- 5.3.4 Healthcare

- 5.3.5 Government and Public Safety

- 5.3.6 Other End-User Industries

- 5.4 By Deployment Location

- 5.4.1 Device Edge

- 5.4.2 Near Edge Servers

- 5.4.3 Far Edge / MEC

- 5.4.4 Cloud-Assisted Hybrid

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Singapore

- 5.5.4.6 Australia

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 NVIDIA Corporation

- 6.4.2 Intel Corporation

- 6.4.3 Qualcomm Incorporated

- 6.4.4 Samsung Electronics Co., Ltd.

- 6.4.5 Apple Inc.

- 6.4.6 Advanced Micro Devices, Inc.

- 6.4.7 Huawei Technologies Co., Ltd.

- 6.4.8 Alphabet Inc. (Google LLC)

- 6.4.9 Amazon.com, Inc.

- 6.4.10 Alibaba Group Holding Limited

- 6.4.11 Baidu, Inc.

- 6.4.12 Continental AG

- 6.4.13 DENSO Corporation

- 6.4.14 Robert Bosch GmbH

- 6.4.15 Kalray S.A.

- 6.4.16 MediaTek Inc.

- 6.4.17 Imagination Technologies Limited

- 6.4.18 Hailo Technologies Ltd.

- 6.4.19 SiMa.ai, Inc.

- 6.4.20 BrainChip Holdings Ltd.

- 6.4.21 Syntiant Corp.

- 6.4.22 Mythic, Inc.

- 6.4.23 Gyrfalcon Technology Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment