|

市場調查報告書

商品編碼

1910600

北美合約物流:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)North America Contract Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

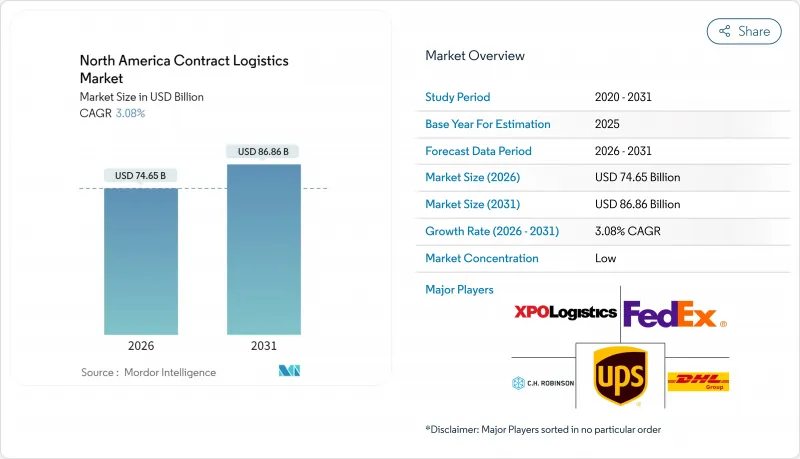

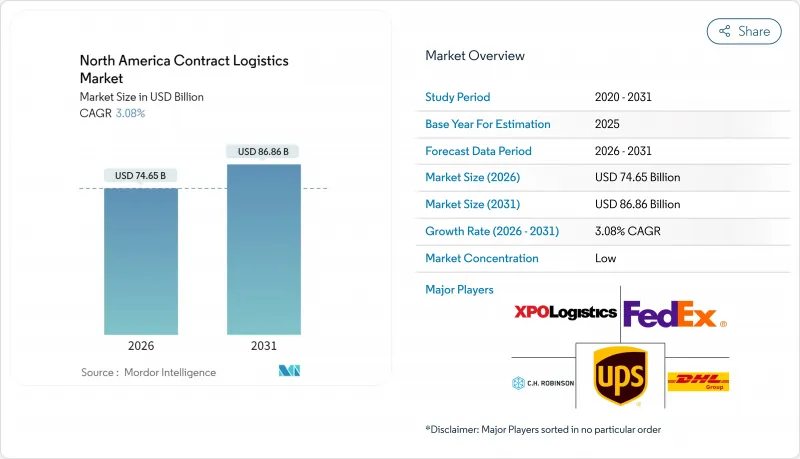

2025年北美合約物流市場價值為724.2億美元,預計到2031年將達到868.6億美元,高於2026年的746.5億美元。

預計在預測期(2026-2031 年)內,複合年成長率將達到 3.08%。

非核心物流職能外包的增加、電子商務交易量的持續成長以及受《美國墨加協定》(USMCA)推動的跨境整合,持續支撐著市場擴張。儘管運輸服務仍佔據支出的大部分,但從組裝到貼標等增值活動正經歷著最快的成長,因為托運人尋求在更靠近終端市場的地方實現更具成本效益的客製化服務。穩定的長期合約為自動化和低溫運輸基礎設施的投資提供了支持,而墨西哥的近岸外包則推動了一波新的物流中心建設浪潮。隨著全球整合商擴大規模,以及本地專業公司開闢技術密集型細分市場,競爭日益激烈。

北美合約物流市場趨勢與洞察

電子商務訂單履約量快速成長

如今,零售商需要機器人倉庫、即時視覺性和全通路整合。聯邦快遞已部署自主移動機器人和高速分類機來處理日益複雜的小包裹,從而縮短了周轉時間並提高了吞吐量。物流供應商正在利用人工智慧預測需求並分配庫存,以提高面向消費者和企業對企業 (B2B) 業務的最後一公里配送準確率。中型第三方物流 (3PL) 公司透過提供分散式節點網路來大幅縮小配送區域,從而增加了合約中標率。曾經無法負擔複雜解決方案的中小型托運人,現在正接入基於雲端的 3PL 入口網站,這些網站以訂閱價格提供倉庫管理系統 (WMS)、運輸管理系統 (TMS) 和費率比較功能。這些變化正在推動外包合作夥伴收入的成長,並進一步提升附加價值服務在北美合約物流市場的重要性。

推動外包邁向成本效益高、資產輕型模式轉型

托運人正透過清算物流資產來重組財務狀況,而第三方物流公司則在收購倉庫、車輛和人才。根據《2024年物流狀況報告》,合約物流收入呈現穩健成長,在市場波動加劇、運力保障變得愈發重要的背景下,其成長速度已超過傳統的整車運輸業務。長期合約使供應商能夠攤銷自動化投資並部署專屬勞動力,從而提升托運人服務關鍵績效指標 (KPI) 並穩定供應商現金流。這一趨勢與北美合約物流市場向混合模式的穩定轉型相一致,該混合模式將專屬資產與經紀業務的柔軟性相結合。

倉庫勞動力短缺和工資上漲

2024年,失業率下降和電子商務勞動力需求激增,促使物流供應商報告揀貨員和堆高機駕駛人的薪資實現了兩位數成長。機器人採用率成長了23%,部分填補了勞動力缺口,同時也推動了資本投資需求。招募獎勵,包括2500美元的簽約獎金,推高了營運成本,而人員配備不足則可能面臨服務處罰。小型托運人往往依賴北美合約物流市場來間接獲得可靠的勞動力。

細分市場分析

2025年,運輸業務將佔總收入的64.35%,這凸顯了貨運在北美合約物流市場中不可取代的地位。卡車運輸仍是核心業務,承擔美國墨西哥貨運量的72.2%和美國加拿大貨運量的60.1%。鐵路運輸支持大宗貨物和長途消費品的運輸,航空運輸支持高價值商品的運輸,海運則支持沿海配送中心的運作。儘管該業務板塊規模保持穩定,但其成長速度與輔助服務相比仍然較為緩慢。

附加價值服務(叢集組裝、套件組裝和貼標)的成長速度將超過其他類別,到2031年將以3.53%的複合年成長率成長。製造商正將最後時刻的客製化工作外包給第三方物流公司,以減少成品庫存並提高市場應對力。 Ryder公司的熱縮包裝和泡殼包裝生產線展示了整合服務如何提高客戶留存率。 Basket 物流的套件組裝方案可以節省工廠空間並提高生產效率。隨著這些解決方案的成熟,供應商正將其與傳統倉儲服務相結合,以提高合約佔有率,這使得北美合約物流市場對希望精簡供應商名單的托運人來說具有重要的戰略價值。

其他福利:

- Excel格式的市場預測(ME)表

- 分析師支持(3個月)

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 電子商務訂單履約量快速成長

- 外包推動成本降低與輕資產模式

- 美墨加協定主導跨境物流流量成長

- 將生產外包到墨西哥推動了新的配送中心建設。

- 中小企業對人工智慧驅動的第三方物流平台的採用現狀

- 與環境、社會和治理(ESG)相關的物流合約正變得越來越受歡迎。

- 市場限制

- 倉庫勞動力短缺和工資上漲

- 各州卡車運輸法規不一致

- 第三方物流供應商的網路保險保費正在上漲

- 電動車卡車充電基礎設施的缺乏阻礙了綠色車隊的普及。

- 價值/供應鏈分析

- 監管環境(包括美墨加協定的影響)

- 科技展望(自動化、人工智慧、物聯網)

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 電子商務洞察(國內和跨境)

- 逆向物流的考量

- 新冠疫情與地緣政治事件的影響

第5章 市場規模與成長預測

- 按服務類型

- 運輸

- 路

- 鐵路

- 航空

- 海上運輸

- 倉庫/配送

- 附加價值服務(組裝、貼標、套件包裝)

- 運輸

- 按合約期限

- 1-3年

- 3年或以上

- 按最終用戶行業分類

- 製造業和汽車業

- 食品/飲料

- 零售與電子商務

- 醫療/製藥

- 化學品

- 其他行業

- 按國家/地區

- 美國

- 加拿大

- 墨西哥

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Deutsche Post DHL Group

- United Parcel Service Inc.

- FedEx Corp.

- CH Robinson Worldwide

- XPO Logistics Inc.

- Kuehne+Nagel International AG

- Ryder System Inc.

- JB Hunt Transport Services Inc.

- DSV

- CEVA Logistics

- Geodis

- Penske Logistics Inc.

- Hellmann Worldwide Logistics

- GXO Logistics

- NFI Industries

- Neovia Logistics Services LLC

- Yusen Logistics

- Werner Enterprises

- PiVAL International

- Metro Supply Chain

第7章 市場機會與未來展望

第8章附錄

- 按活動分類的GDP分佈

- 資金流分析

- 外貿統計

The North America Contract Logistics Market was valued at USD 72.42 billion in 2025 and estimated to grow from USD 74.65 billion in 2026 to reach USD 86.86 billion by 2031, at a CAGR of 3.08% during the forecast period (2026-2031).

Growing outsourcing of non-core logistics functions, persistent e-commerce volume spikes, and cross-border integration enabled by the USMCA continue to anchor expansion. Transportation services still dominate spend, but value-added activities-ranging from assembly to labeling-record the briskest growth as shippers search for cost-effective customization near end markets. Stable long-term contracts underpin investment in automation and cold-chain infrastructure, while near-shoring to Mexico drives a fresh wave of distribution-center construction. Competitive intensity is heightening as global integrators consolidate scale and regional specialists carve out technology-rich niches.

North America Contract Logistics Market Trends and Insights

Surging E-commerce Fulfillment Volumes

Retailers now demand robotics-equipped warehouses, real-time visibility, and omnichannel orchestration. FedEx has deployed autonomous mobile robots and high-speed sorters to cope with package complexity, cutting cycle times and lifting throughput. Logistics providers use AI for demand forecasting and inventory positioning, improving last-mile accuracy for direct-to-consumer and B2B flows. Mid-tier 3PLs increasingly win contracts by offering distributed node networks that slash shipping zones. SME shippers, once priced out of complex solutions, plug into cloud-based 3PL portals that bundle WMS, TMS, and rate shopping features at subscription pricing. These shifts direct more revenue toward outsourced partners and reinforce the importance of value-added services within the North America contract logistics market.

Outsourcing Push for Cost-Efficient Asset-Light Models

Shippers restructure balance sheets by monetizing captive logistics assets while 3PLs pick up warehouses, fleets, and talent. The 2024 State of Logistics report noted a robust uptick in contract logistics revenues, eclipsing traditional trucking segments as volatility made guaranteed capacity critical. Longer contracts enable providers to amortize automation investments and devote dedicated labor, producing higher service KPIs for shippers while stabilizing provider cash flows. The trend harmonizes with the North America contract logistics market's steady shift toward hybrid models that blend dedicated assets with brokerage flexibility.

Warehouse Labor Scarcity & Wage Inflation

Providers reported double-digit pay increases for pickers and forklift drivers in 2024 as unemployment dipped and e-commerce labor demand soared. Robotics deployments rose 23%, partially offsetting shortages while raising capex needs. Recruitment incentives, including USD 2,500 signing bonuses, inflate operating costs, but failing to staff facilities risks service penalties. Shippers lacking scale turn to the North America contract logistics market to secure reliable staffing indirectly.

Other drivers and restraints analyzed in the detailed report include:

- USMCA-Led Cross-Border Flow Growth

- Near-Shoring to Mexico Spurring New DC Builds

- Rising Cyber-Insurance Premiums for 3PLs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Transportation contributed 64.35% of 2025 revenue, illustrating freight's irreplaceable role in the North America contract logistics market. Trucking remains the backbone, carrying 72.2% of U.S.-Mexico and 60.1% of U.S.-Canada flows. Rail supports bulk freight and long-haul consumer goods; air caters to high-value SKUs; ocean feeds coastal DCs. The segment's scale endures, yet its growth pace remains modest compared with ancillary offerings.

The value-added cluster-assembly, kitting, labeling-posts a 3.53% CAGR through 2031, outpacing every other category. Manufacturers delegate late-stage customization to 3PLs to shrink finished-goods inventory and sharpen market responsiveness. Ryder's heat-shrinking and blister-sealing lines illustrate how integrated services deepen customer stickiness. Buske Logistics' kitting programs reclaim plant floor space and elevate throughput. As these solutions mature, providers bundle them with conventional warehousing to lift contractual share of wallet, raising the strategic value of the North America contract logistics market size for shippers looking to rationalize vendor rosters.

The North America Contract Logistics Market Report is Segmented by Service Type (Transportation, Warehousing & Distribution, and Value-Added Services), Contract Duration (1-3 Years and Above 3 Years), End-User Industry (Manufacturing & Automotive, Food & Beverage, Retail & E-Commerce, Healthcare & Pharmaceuticals, and More), Country (United States, Canada, and Mexico). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Deutsche Post DHL Group

- United Parcel Service Inc.

- FedEx Corp.

- C.H. Robinson Worldwide

- XPO Logistics Inc.

- Kuehne + Nagel International AG

- Ryder System Inc.

- J.B. Hunt Transport Services Inc.

- DSV

- CEVA Logistics

- Geodis

- Penske Logistics Inc.

- Hellmann Worldwide Logistics

- GXO Logistics

- NFI Industries

- Neovia Logistics Services LLC

- Yusen Logistics

- Werner Enterprises

- PiVAL International

- Metro Supply Chain

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging e-commerce fulfilment volumes

- 4.2.2 Outsourcing push for cost & asset-light models

- 4.2.3 USMCA-led cross-border flow growth

- 4.2.4 Near-shoring to Mexico spurring new DC builds

- 4.2.5 SME adoption of AI-enabled 3PL platforms

- 4.2.6 ESG-linked logistics contracts gaining traction

- 4.3 Market Restraints

- 4.3.1 Warehouse labour scarcity & wage inflation

- 4.3.2 Patchy state-level trucking regulations

- 4.3.3 Rising cyber-insurance premiums for 3PLs

- 4.3.4 EV-truck charging gaps limiting green fleets

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape (incl. USMCA impact)

- 4.6 Technological Outlook (automation, AI, IoT)

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Insights on E-commerce (domestic & cross-border)

- 4.9 Insights on Reverse Logistics

- 4.10 Impact of COVID-19 and Geo-Political Events

5 Market Size & Growth Forecasts

- 5.1 By Service Type

- 5.1.1 Transportation

- 5.1.1.1 Road

- 5.1.1.2 Rail

- 5.1.1.3 Air

- 5.1.1.4 Sea

- 5.1.2 Warehousing & Distribution

- 5.1.3 Value-added Services (Assembly, Labelling, Kitting)

- 5.1.1 Transportation

- 5.2 By Contract Duration

- 5.2.1 1 - 3 Years

- 5.2.2 Above 3 years

- 5.3 By End-user Industry

- 5.3.1 Manufacturing & Automotive

- 5.3.2 Food & Beverage

- 5.3.3 Retail & E-commerce

- 5.3.4 Healthcare & Pharmaceuticals

- 5.3.5 Chemicals

- 5.3.6 Other Industries

- 5.4 By Country

- 5.4.1 United States

- 5.4.2 Canada

- 5.4.3 Mexico

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Deutsche Post DHL Group

- 6.4.2 United Parcel Service Inc.

- 6.4.3 FedEx Corp.

- 6.4.4 C.H. Robinson Worldwide

- 6.4.5 XPO Logistics Inc.

- 6.4.6 Kuehne + Nagel International AG

- 6.4.7 Ryder System Inc.

- 6.4.8 J.B. Hunt Transport Services Inc.

- 6.4.9 DSV

- 6.4.10 CEVA Logistics

- 6.4.11 Geodis

- 6.4.12 Penske Logistics Inc.

- 6.4.13 Hellmann Worldwide Logistics

- 6.4.14 GXO Logistics

- 6.4.15 NFI Industries

- 6.4.16 Neovia Logistics Services LLC

- 6.4.17 Yusen Logistics

- 6.4.18 Werner Enterprises

- 6.4.19 PiVAL International

- 6.4.20 Metro Supply Chain

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment

8 Appendix

- 8.1 GDP Distribution by Activity

- 8.2 Capital Flows Insights

- 8.3 External Trade Statistics