|

市場調查報告書

商品編碼

1910548

智慧虛擬助理(IVA)-市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Intelligent Virtual Assistant (IVA) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

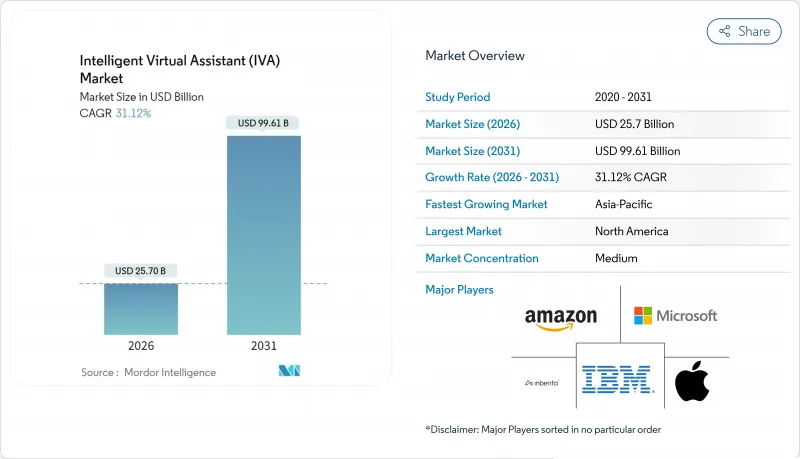

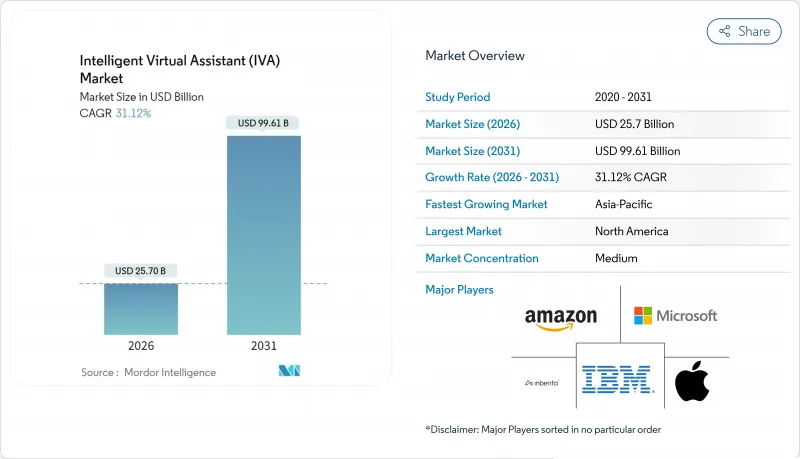

智慧虛擬助理市場預計將從 2025 年的 196 億美元成長到 2026 年的 257 億美元,到 2031 年將達到 996.1 億美元,2026 年至 2031 年的複合年成長率為 31.12%。

這種快速擴張主要得益於支援多種語言的大規模語言模型、由專用人工智慧晶片驅動的設備端推理(每台設備售價約4萬美元)以及企業為控制不斷上漲的雲端成本而施加的壓力。由於生成式人工智慧展現出明顯的成本節約優勢,企業仍持續投資於此。例如,一家大型旅行社在實施主導智慧虛擬助理(IVA)的自助服務管道後,每年節省了1000萬美元的成本。儘管雲端仍然佔據主導地位,但避免向超大規模服務供應商持續付費的邊緣和本地部署方案正日益受到重視。這種趨勢在消費硬體領域同樣明顯,智慧音箱和車載助手的普及正在重塑人們對始終在線對話服務的期望。

全球智慧虛擬助理(IVA)市場趨勢與洞察

全通路客戶服務聊天機器人的普及率不斷提高

預計到2025年,全球銀行將在聊天機器人技術方面投資94億美元,顯示控制成本的需求與全天候服務的期望高度契合。自助解決問題的比例正日益接近80-90%,早期採用者已記錄高達40%的生產力提升。零售商透過將文字、語音和視訊管道整合到單一流程中,並在適當時無縫轉接至人工客服,實現了客戶參與提升40%。基於記憶的個人化功能可跨裝置保存對話歷史記錄,讓客戶無需重複操作即可繼續互動。最終,客戶滿意度分數提升,客服中心的工作量也顯著降低。

智慧音箱和物聯網語音設備的普及

汽車製造商正利用 Cerence、微軟和 NVIDIA 的語音平台,將 ChatGPT 式服務直接整合到車載資訊娛樂系統中。大眾汽車的歐洲車型已經配備了五種語言的雲端語音助理。在汽車領域之外,消費性電子產品製造商和穿戴式裝置品牌也在採用本地語音辨識,以保護用戶隱私並降低延遲。駕駛調查顯示,77% 的駕駛表示,如果車載語音控制功能更強大,他們會選擇使用。隨著供應商將相同的核心模型移植到嵌入式晶片上,智慧虛擬助理市場正在家庭、汽車和工業等日常環境中拓展新的應用領域。

持續存在的隱私和資料安全問題

歐盟人工智慧法律中的隱私權條款要求供應商從設計初就證明其資料最小化和加密措施的有效性。在醫療保健領域,美國醫療資訊科技協調辦公室 (ONC) 的法規要求預測演算法的決策日誌必須透明。金融機構正在實施可追溯的管道和差分隱私技術,但這些投資推高了計劃成本並延長了引進週期。因此,許多高階主管傾向於採用本地部署架構,將所有客戶話語保留在內部,據報道,與同等雲端費用相比,這種方式可節省高達 80% 的成本,同時滿足主權法規的要求。

細分市場分析

到2025年,智慧音箱將佔總收入的45.68%,大規模的用戶群將透過與音樂和影片服務捆綁銷售而持續成長。儘管成熟市場的成長速度有所放緩,但供應商提升銷售配備高保真麥克風和本地語言模型推理功能的升級版套餐來減少雲端呼叫。同時,車載助理到2031年的複合年成長率將達到32.58%,在所有硬體類別中位居榜首。大眾和雷諾等汽車製造商使用Cerence的白牌產品,為使用者提供行動互動式導航、空調控制和電子商務服務。

用於擴增實境(AR)頭戴裝置和工業掃描器的穿戴式/嵌入式智慧虛擬助理(IVA)模組開闢了新的切入點,使工人在物流和現場維護任務中能夠透過語音指令解放雙手。這些設備將語音與注視、手勢和觸覺回饋結合,從而提升使用者的人體工學體驗。智慧虛擬助理市場如今涵蓋了從固定揚聲器到完全行動裝置的各種產品,其神經網路架構也針對每種外形規格的運算能力限制進行了最佳化。

由於雲端部署易於擴展、模型更新以及與企業軟體整合,因此仍佔支出的 67.35%。然而,成本可預測性和資料在地化方法正推動著向本地部署和邊緣部署的顯著轉變,這些部署方式正以每年 33.72% 的速度成長。在本地部署生成式 AI 晶片的公司發現,其推理成本已降至同等雲端使用成本的五分之一。隨著受監管行業將敏感語音日誌轉移到防火牆後,本地智慧虛擬助理市場預計將迅速擴張。

邊緣原生智慧語音助理 (IVA) 支援汽車、航太和醫療設備等產業中對延遲低於 100 毫秒的要求極高的即時工作負載。目前,供應商正在交付記憶體小於 8GB 的神經處理單元 (NPU) 內核,這些內核搭載了量化邏輯層級模型 (LLM)。這種專用設計能夠在降低能耗的同時保留對話上下文,這對於在駕駛或手術輔助等場景下實現不間斷運行至關重要。

區域分析

北美佔36.55%的市場佔有率,主要得益於早期企業投資、充裕的創業投資以及成熟的供應商生態系統。猶他州、科羅拉多和加州的州法律強調透明度,而聯邦政府的NIST框架則提供了一套通用的風險管理術語。醫療智慧語音助理(IVA)必須記錄可解釋性證據以符合ONC標準,這鼓勵醫療服務提供者選擇能夠發布完整決策軌跡的平台。加拿大的無障礙標準EN 301 549:2024進一步鞏固了對能夠滿足殘障使用者需求的包容性語音技術的需求。該地區強大的研發能力以及健全的合規文化,使其在商業部署方面保持優勢。

亞太地區是成長最快的地區,複合年成長率高達34.05%。各國政府的人工智慧策略,例如中國的《國家藍圖》和新加坡10億新元的預算撥款,都在支持人才培育和試驗計畫。印度銀行業對互動式人工智慧的應用表明,多語言智慧虛擬助理能夠以低成本實現分店的擴張。日本汽車製造商正在將車載助手作為品牌差異化優勢進行推廣,並透過整合邊緣人工智慧晶片來克服行動電話網路不穩定的問題。儘管語言多樣性仍然是一個障礙,但多語言語言學習模型(LLM)的最新突破正在縮短開發週期,並向中型企業開放智慧虛擬助理市場。

歐洲在平衡創新與嚴格管治發揮關鍵作用。歐盟人工智慧法制定了涵蓋分類、文件和人工監督的統一規則,鼓勵供應商採用透明的模型架構。汽車製造商正與人工智慧專家合作,以符合功能安全標準和新的可解釋性條款。 EN 301 549 無障礙指南確保了包容性設計,醫療機構只有在經過嚴格的偏見審核後才會採用 IVA 工具。擁有隱私和公平性認證的供應商在公共部門競標中享有優先權,從而塑造了整個歐洲的競爭格局。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 全通路客戶服務聊天機器人的普及率不斷提高

- 智慧音箱和物聯網語音設備的普及

- 多語言大規模語言模式自然語言處理突破

- 客服中心成本壓力

- 在老年護理和數位療法中採用情緒感知型智慧語音助手

- 公共部門數位服務的可訪問性要求

- 市場限制

- 持續存在的隱私和資料安全問題

- 客戶在處理複雜諮詢時更傾向於選擇人工客服

- 對人工智慧可解釋性和暗黑模式的監管審查

- 幻覺導致的品牌聲譽風險

- 價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 依產品

- 聊天機器人

- 智慧音箱

- 車載智慧虛擬助手

- 穿戴式/嵌入式設備

- 透過部署模式

- 雲

- 本地部署/邊緣部署

- 透過使用者介面技術

- 基於文本(文本到文本)

- 基於語音(ASR+TTS)

- 多模態(音訊+視訊)

- 最終用戶

- 零售與電子商務

- BFSI

- 衛生保健

- 通訊/IT

- 旅遊與飯店

- 其他行業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 荷蘭

- 其他歐洲

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 亞太其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Amazon.com Inc.

- Google LLC(Alphabet)

- Apple Inc.

- Microsoft Corp.

- IBM Corp.

- Meta Platforms Inc.

- Alibaba Group

- Baidu Inc.

- Samsung Electronics Co. Ltd.

- Xiaomi Inc.

- OpenAI

- Anthropic

- Harman International

- Nuance Communications Inc.

- Avaamo Inc.

- EdgeVerve Systems Ltd.

- Ipsoft Inc.(Amelia)

- Kore.ai Inc.

- Inbenta Technologies Inc.

- Creative Virtual Ltd.

- Serviceaide Inc.

- Rasa Technologies GmbH

- SoundHound AI Inc.

- Tencent Holdings Ltd.

第7章 市場機會與未來展望

The intelligent virtual assistant market is expected to grow from USD 19.60 billion in 2025 to USD 25.7 billion in 2026 and is forecast to reach USD 99.61 billion by 2031 at 31.12% CAGR over 2026-2031.

Multilingual large-language models, on-device inference enabled by specialized AI chips that retail for about USD 40,000 per unit, and corporate pressure to curb expanding cloud costs are the primary forces behind this rapid expansion. Enterprises continue to invest because generative AI deployments are demonstrating clear savings; a major travel company, for example, reports USD 10 million in annual cost reductions after introducing an IVA-led self-service channel. Edge and on-premise options that avoid recurring hyperscale fees are moving up the priority list, even though cloud remains dominant. The momentum is equally visible in consumer hardware, as the popularity of smart speakers and in-car assistants reshapes expectations for always-on conversational services.

Global Intelligent Virtual Assistant (IVA) Market Trends and Insights

Rising Adoption of Omnichannel Customer-Service Chatbots

Global banks expect to invest USD 9.4 billion in chatbot technology by 2025, a sign of how strongly cost-containment needs align with 24/7 service expectations. Autonomous resolution rates of 80-90% are increasingly common, and productivity gains reaching 40% have been logged by early banking adopters. Retailers cite engagement lifts of 40% when text, voice, and visual channels are fused into a single flow, creating smooth hand-offs to human agents when context demands. Memory-based personalization now preserves conversation history across devices, allowing customers to resume interactions without repetition. The result is higher customer-satisfaction scores alongside measurable savings in contact-center workloads.

Proliferation of Smart Speakers and IoT Voice End-Points

Automotive OEMs tap voice platforms from Cerence, Microsoft, and NVIDIA to add ChatGPT-style services directly to infotainment stacks.Volkswagen's European models already ship with a cloud-updated assistant that supports five languages. Beyond cars, appliance makers and wearable brands embed local speech recognition to protect privacy and cut latency. Driver surveys find that 77% would choose in-vehicle voice control when advanced features are available. As vendors port the same core models to embedded silicon, the intelligent virtual assistant market gains new daily-use entry points inside homes, cars, and industrial settings.

Persistent Privacy and Data-Security Concerns

The EU AI Act's privacy-preserving clauses force suppliers to demonstrate data-minimization and encryption by design. In healthcare, U.S. ONC rules demand transparent decision logs for predictive algorithms. Financial institutions add traceable pipelines and differential-privacy techniques, but those investments raise project costs and lengthen deployment cycles. Many chiefs therefore favor on-premise stacks that keep all customer utterances in situ, reporting cost reductions of up to 80% versus equivalent cloud bills while satisfying sovereignty rules.

Other drivers and restraints analyzed in the detailed report include:

- Breakthroughs in Multilingual Large-Language-Model NLP

- Contact-Center Cost-Containment Pressure

- Regulatory Scrutiny on AI Explainability and Dark-Patterns

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Smart speakers generated 45.68% of 2025 revenue, underscoring the sizeable installed base that continues to expand through bundling with music or video services. Although growth moderates in mature markets, vendors are upselling premium tiers that feature high-fidelity microphones and local language-model inference to reduce cloud calls. At the same time, in-car assistants are on track to post 32.58% CAGR through 2031, the fastest among hardware categories. Automakers such as Volkswagen and Renault use white-label offerings from Cerence to deliver conversational navigation, climate control, and e-commerce services on the road.

Wearable and embedded IVA modules for AR headsets and industrial scanners supply a fresh entry path, enabling voice commands that free workers' hands in logistics and field maintenance. These devices often combine voice with gaze, gesture, or haptic feedback, elevating user ergonomics. The intelligent virtual assistant market now spans a continuum from stationary speakers to fully mobile endpoints, and suppliers are tailoring neural-network footprints to the computational limits of each form factor.

Cloud deployment still accounts for 67.35% of current spend because of easy scaling, model updates, and integration with enterprise software. Yet, cost predictability and data-localization laws are driving a decisive turn to on-prem and edge deployments that are growing 33.72% annually. Enterprises deploying generative AI chips on site report overall inference expenses as low as one-fifth of comparable cloud bills. The intelligent virtual assistant market size for on-prem projects is forecast to expand sharply as regulated verticals move sensitive voice logs inside the firewall.

Edge-native IVAs support real-time workloads in automotive, aerospace, and healthcare devices where sub-100-millisecond latency is mandatory. Suppliers are now shipping neural-processing-unit cores that host quantized LLMs with less than 8 GB of memory. This specialization lowers energy draw while keeping conversational context intact, a key requirement for uninterrupted driving or surgical assistance scenarios.

The AI Virtual Assistant Market Report is Segmented by Product (Chatbot, Smart Speaker, and More), Deployment Mode (Cloud and On-Premise), User Interface Technology (Text-Based (Text-To-Text), Voice-Based (ASR + TTS), and More), End-User (BFSI, Healthcare, Telecom and IT, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America holds 36.55% share on the strength of early enterprise investment, a deep venture capital pool, and a maturing vendor ecosystem. State-level laws in Utah, Colorado, and California emphasize transparency, while the federal NIST framework offers a common risk-management vocabulary. Healthcare IVAs must log explainability evidence to meet ONC standards, prompting providers to choose platforms that expose full decision traces. Canada's accessibility mandate EN 301 549:2024 further cements demand for inclusive voice technologies that work for users with disabilities. The region's R&D capability combined with a robust compliance culture maintains a lead in commercial deployments.

Asia Pacific is the fastest-expanding region at 34.05% CAGR. Government AI strategies, such as China's national roadmap and Singapore's SGD 1 billion allocation, underwrite talent development and pilot programs. Conversational AI adoption in India's banking arena demonstrates how multilingual IVAs extend branch reach at lower cost. Japanese automakers push in-car assistants as brand differentiators, integrating edge AI chips to overcome patchy cellular coverage. Linguistic diversity remains a hurdle, but recent multilingual LLM breakthroughs shrink development timelines and open the intelligent virtual assistant market to mid-tier enterprises.

Europe occupies a pivotal role, balancing innovation with stringent governance. The EU AI Act imposes harmonized rules that cover classification, documentation, and human oversight, nudging suppliers toward transparent model architectures. Automotive firms collaborate with AI specialists to comply with both functional safety norms and new explainability clauses. Accessibility guidance in EN 301 549 ensures inclusive design, while healthcare institutions adopt IVA tools only after rigorous bias audits. Vendors that can certify privacy and fairness gain preferred status in public-sector tenders, shaping competitive dynamics across the continent.

- Amazon.com Inc.

- Google LLC (Alphabet)

- Apple Inc.

- Microsoft Corp.

- IBM Corp.

- Meta Platforms Inc.

- Alibaba Group

- Baidu Inc.

- Samsung Electronics Co. Ltd.

- Xiaomi Inc.

- OpenAI

- Anthropic

- Harman International

- Nuance Communications Inc.

- Avaamo Inc.

- EdgeVerve Systems Ltd.

- Ipsoft Inc. (Amelia)

- Kore.ai Inc.

- Inbenta Technologies Inc.

- Creative Virtual Ltd.

- Serviceaide Inc.

- Rasa Technologies GmbH

- SoundHound AI Inc.

- Tencent Holdings Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising adoption of omnichannel customer-service chatbots

- 4.2.2 Proliferation of smart speakers and IoT voice end-points

- 4.2.3 Breakthroughs in multilingual large-language-model NLP

- 4.2.4 Contact-center cost-containment pressure

- 4.2.5 Emotion-aware IVA uptake in elder-care and digital therapeutics

- 4.2.6 Accessibility mandates for public-sector digital services

- 4.3 Market Restraints

- 4.3.1 Persistent privacy and data-security concerns

- 4.3.2 Customer preference for human agents in complex queries

- 4.3.3 Regulatory scrutiny on AI explainability and dark-patterns

- 4.3.4 Hallucination-driven brand-reputation risk

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product (Value)

- 5.1.1 Chatbots

- 5.1.2 Smart Speakers

- 5.1.3 In-Car IVAs

- 5.1.4 Wearable / Embedded Devices

- 5.2 By Deployment Mode (Value)

- 5.2.1 Cloud

- 5.2.2 On-premise / Edge

- 5.3 By User Interface Technology (Value)

- 5.3.1 Text-based (Text-to-Text)

- 5.3.2 Voice-based (ASR + TTS)

- 5.3.3 Multimodal (Voice + Visual)

- 5.4 By End-User

- 5.4.1 Retail and eCommerce

- 5.4.2 BFSI

- 5.4.3 Healthcare

- 5.4.4 Telecom and IT

- 5.4.5 Travel and Hospitality

- 5.4.6 Other Industries

- 5.5 By Geography (Value)

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Spain

- 5.5.3.5 Netherlands

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amazon.com Inc.

- 6.4.2 Google LLC (Alphabet)

- 6.4.3 Apple Inc.

- 6.4.4 Microsoft Corp.

- 6.4.5 IBM Corp.

- 6.4.6 Meta Platforms Inc.

- 6.4.7 Alibaba Group

- 6.4.8 Baidu Inc.

- 6.4.9 Samsung Electronics Co. Ltd.

- 6.4.10 Xiaomi Inc.

- 6.4.11 OpenAI

- 6.4.12 Anthropic

- 6.4.13 Harman International

- 6.4.14 Nuance Communications Inc.

- 6.4.15 Avaamo Inc.

- 6.4.16 EdgeVerve Systems Ltd.

- 6.4.17 Ipsoft Inc. (Amelia)

- 6.4.18 Kore.ai Inc.

- 6.4.19 Inbenta Technologies Inc.

- 6.4.20 Creative Virtual Ltd.

- 6.4.21 Serviceaide Inc.

- 6.4.22 Rasa Technologies GmbH

- 6.4.23 SoundHound AI Inc.

- 6.4.24 Tencent Holdings Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment