|

市場調查報告書

商品編碼

1910474

高純度氧化鋁(HPA):市佔率分析、產業趨勢與統計、成長預測(2026-2031)High-Purity Alumina (HPA) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

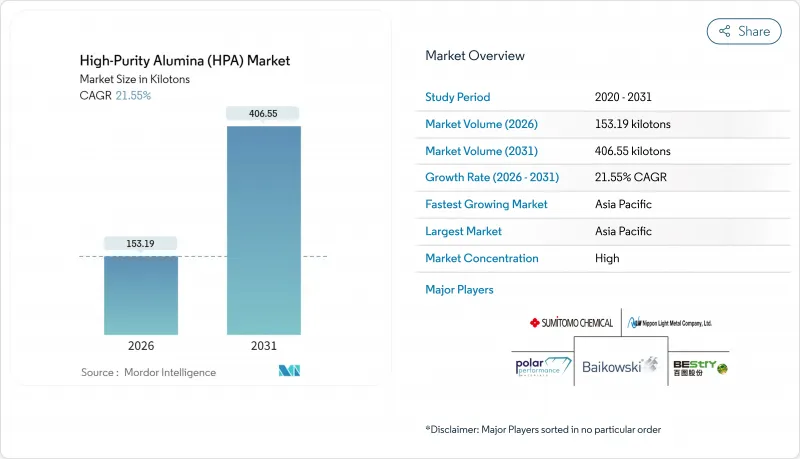

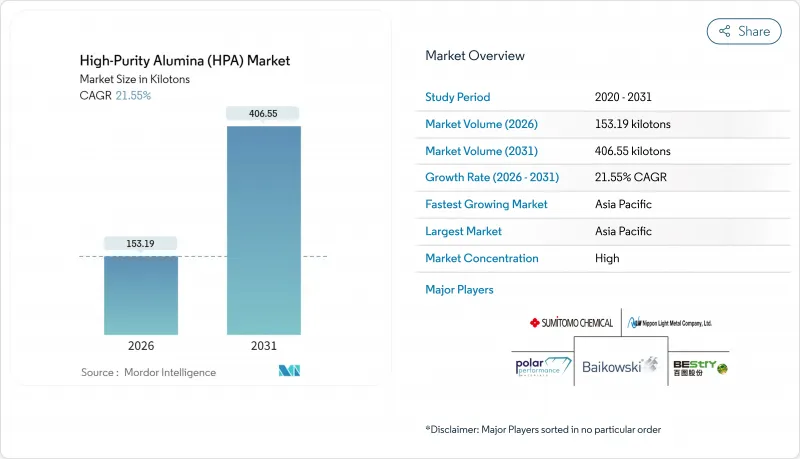

2025 年高純度氧化鋁 (HPA) 市場價值為 126.03 千噸,預計到 2031 年將達到 406.55 千噸,高於 2026 年的 153.19 千噸。

預測期(2026-2031 年)的複合年成長率預計為 21.55%。

這種陡峭的成長軌跡反映了鋰離子電池需求的激增、LED照明的持續發展勢頭以及先進封裝技術加速應用。電動車和儲能計劃數量的成長正推動高純度氧化鋁(HPA)朝向超高純度方向發展,而生產商則競相運作基於鹽酸浸出和溶劑萃取方法等低成本、低碳的生產設施。同時,圖案化藍寶石基板和更大晶圓尺寸的創新正在提高LED晶片的產量比率,從而穩定了對傳統4N級氧化鋁的需求。半導體晶圓廠正在推動6N級氧化鋁在共封裝光學元件和垂直GaN元件中的應用,這為結構性需求增添了新的維度。儘管高昂的生產成本仍然是推廣應用的主要障礙,但快速的規模化生產正在縮小與低純度氧化鋁的成本差距,使電池和電力電子領域的早期採用者能夠承受價格溢價。

全球高純度氧化鋁(HPA)市場趨勢及展望

對LED照明的需求不斷成長

藍寶石基板是高亮度LED的基礎,因為它們能夠承受高熱負荷並保持光學透明度。從2-4吋晶圓到6-8吋晶圓的過渡提高了單次熔煉的晶片產量,從而提高了產量比率並降低了晶圓成本。圖案化藍寶石基板使光提取效率提高了高達40%,直接提高了每瓦流明數。銫摻雜石榴石陶瓷的研究已將發光效率提高到261.98 lm/W,突破了高功率白光發光裝置的性能極限。軟性奈米壓印微影術技術進一步縮短了製程時間,使微結構LED的生產效率提高了六倍。這些進步共同推動了5N級藍寶石在超高亮度元件中的選擇性應用,而LED製造商仍然依賴4N級高功率藍寶石基板。

鋰離子電池市場需求不斷成長

搭乘用電動車 (EV) 和固定式儲能系統中高功率密度電池的快速普及,推動了對採用 5N 和 6N 高純度氧化鋁 (HPA) 的隔膜塗層的需求。這種基於氧化鋁奈米層的塗層能夠改善熱關斷特性並抑制枝晶生長,從而實現快速充電和延長循環壽命。 Altech 公司基於其位於德國的年產 8000 噸 HPA 塗層工廠的矽負極項目,旨在實現比石墨更高的能量保持率。該計劃的淨現值 (NPV) 為 6.84 億歐元(約 7.9355 億美元),內部收益率 (IRR) 為 34%,證實了優質 HPA 的商業性潛力。中國電池 OEM 廠商已開始測試採用陶瓷塗層隔板的 6N HPA,用於新一代快充電池,這標誌著大規模生產合格測試的轉捩點。

高純度氧化鋁成本高昂

煅燒和多次重結晶步驟會導致高能耗,尤其是對於價格較高的5N和6N牌號氧化鋁。 Alpha HPA的溶劑萃取方法聲稱可減少70%的碳排放,並透過省去鋁金屬萃取步驟顯著降低電力消耗量消耗。雖然這縮小了成本差距,但類似裝置的廣泛運作仍需兩到三年時間,這將影響短期採購預算。工業氧化鋁現貨價格的波動進一步加劇了特種用戶長期供應合約談判的複雜性。

細分市場分析

截至2025年,4N級氧化鋁將佔總出貨量的73.12%,主要用於製造通用LED的藍寶石晶圓。同時,受半導體和下一代電池應用對亞ppm級雜質含量要求的推動,6N級氧化鋁的出貨量預計將以22.22%的複合年成長率成長。 Alpha HPA的閉合迴路溶劑萃取先導工廠實現了試劑的完全回收利用,降低了可變生產成本,從而促進了5N級和6N級氧化鋁的廣泛應用。製造商正在採用混合策略,為大規模生產的LED應用提供4N級氧化鋁,同時將增加的產能分配給6N級氧化鋁,以滿足高利潤合約的需求。電池OEM廠商已開始強制要求快充電池採用5N級或更高等級的塗層,提高了傳統上對價格敏感地區的需求穩定性。節能提純技術的研發投入不斷活性化,可望部分消除成本差異,加速高純度氧化鋁市場中高階等級的擴張。

由於成熟的供應鏈和豐富的礬土原料,傳統的鋁醇鹽水解製程預計到2025年將佔全球鋁產量的87.25%。然而,新參與企業更青睞鹽酸浸出工藝,該工藝因其每噸投資成本低、易於去除雜質等優點,正以22.35%的複合年成長率快速成長。一項結合放電等離子緻密化和無壓精整的兩階段燒結技術的研究表明,該技術不僅縮短了爐內加工時間,還能將抗彎強度提高19%。新興的東南亞冶煉廠正在採用模組化鹽酸再生系統,以減少酸的消耗和廢水排放,從而符合日益嚴格的區域環境法規。現有企業則透過在老舊的水解生產線上改造溶劑萃取純化製程來提高純度,從而維持其市場地位。從中長期來看,歐洲和北美提案的碳強度揭露規則可能會成為技術選擇的決定性因素,使潛在投資傾向於隱含排放較低的浸出工廠。

區域分析

在中國完整的氧化鋁價值鏈以及日本和韓國在LED和半導體製造領域的主導地位的支撐下,預計到2025年,亞太地區將佔高純氧化鋁市場規模的75.61%。受電動車的積極普及、晶圓廠的興起以及澳洲新建溶劑萃取精煉廠的運作等因素的推動,該地區市場預計到2031年將以22.85%的年均成長率成長。

在北美,聯邦政府的獎勵措施正推動半導體產業的復甦,而不斷擴大的公共充電基礎設施也提振了對鋰離子電池的需求。加拿大和美國擁有強大的電網,這有助於它們實現低碳生產目標。雖然南美洲、中東和非洲的貢獻相對較小,但隨著礬土豐富的國家向下游產業多元化發展,這些地區蘊藏著長期的成長機會。

巴西正在製定特種氧化鋁的激勵措施,沙烏地阿拉伯正在探索氧化鋁精煉廠,以配合其更廣泛的礦產策略,這些地區為尋求地理多元化的高純度氧化鋁市場參與企業提供了選擇。

其他福利:

- Excel格式的市場預測(ME)表

- 分析師支持(3個月)

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 對LED照明的需求不斷成長

- 鋰離子電池市場需求不斷成長

- 半導體產業對高純度氧化鋁的需求日益成長

- 在電動車電力電子模組中採用基於HPA的熱界面材料

- 電子產業需求增加

- 市場限制

- 高純度氧化鋁高成本

- 低成本替代品的可用性

- 全球原料供應有限

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

第5章 市場規模與成長預測

- 按純度等級(按類型)

- 4N

- 5N

- 6N

- 透過製造技術

- 水解

- 鹽酸浸出

- 透過使用

- LED照明

- 磷光體

- 半導體

- 鋰離子電池

- 技術陶瓷

- 其他(防刮玻璃、光學鏡片等)

- 按最終用戶行業分類

- 電子設備

- 車

- 儲能

- 醫療設備

- 工業製造

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐國家

- 土耳其

- 俄羅斯

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 卡達

- 阿拉伯聯合大公國

- 奈及利亞

- 埃及

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)分析

- 公司簡介

- Advanced Energy Minerals

- Altech Advanced Materials

- Alpha HPA

- Baikowski SA

- Bestry

- Hebei Pengda New Materials Technology Co., Ltd.

- HONGHE CHEMICAL

- Nippon Light Metal Company, Ltd.

- Polar Performance Materials

- RusAL

- Sasol

- Saint-Gobain

- Shandong Keheng Crystal Material Technology Co., Ltd.

- Sumitomo Chemical Co., Ltd.

- Xuancheng Jingrui New Materials Co., Ltd.

第7章 市場機會與未來展望

The High-Purity Alumina Market was valued at 126.03 kilotons in 2025 and estimated to grow from 153.19 kilotons in 2026 to reach 406.55 kilotons by 2031, at a CAGR of 21.55% during the forecast period (2026-2031).

This steep growth curve reflects surging demand from lithium-ion batteries, sustained momentum in LED lighting, and accelerating adoption in advanced semiconductor packaging. An expanding base of electric-vehicle and energy-storage projects is pulling HPA grades toward ultra-high purities, while producers race to commission lower-cost, lower-carbon capacity based on hydrochloric-acid leaching and solvent-extraction routes. At the same time, breakthroughs in patterned sapphire substrates and larger wafer formats are lifting LED chip yields and keeping traditional 4N demand stable. Semiconductor fabs are pushing for 6N grades that support co-packaged optics and vertical GaN devices, adding another layer of structural demand. Although high production cost remains the primary brake on broader uptake, rapid scale-up is narrowing the cost gap versus lower-purity aluminas, and early adopters in batteries and power electronics are absorbing the premium.

Global High-Purity Alumina (HPA) Market Trends and Insights

Increasing Demand for LED-Based Lighting

Sapphire substrates remain the backbone of high-brightness LEDs because they tolerate high thermal loads and sustain optical clarity. Migration from 2-4 to 6-8 in wafers has raised chip throughput per melt, boosted yield, and lowered die cost. Patterned sapphire substrates now lift light-extraction efficiency by up to 40%, directly improving lumens per watt. Research on Ce-doped garnet ceramics has pushed luminous efficiency to 261.98 lm W-1, stretching the performance ceiling for high-power white emitters. Flexible nanoimprint lithography further cuts process time, raising microstructured LED productivity six-fold. Together, these advances keep LED producers firmly anchored to 4N HPA while opening selective pull-through for 5N grades in ultra-high-luminance devices.

Growing Demand from Lithium-Ion Battery Markets

Rapid scale-up of power-dense cells in passenger EVs and stationary storage propels separator-coating demand for 5N and 6N HPA. Coatings based on alumina nanolayers improve thermal shut-down behavior and suppress dendrite growth, enabling faster charging and longer cycle life. Altech's silicon-anode program, underpinned by an 8,000 tons/year HPA coating plant in Germany, targets 30% higher energy retention versus graphite baselines. The project's EUR 684 million (~USD 793.55 million) NPV and 34% IRR confirm commercial traction for premium grades. Battery OEMs in China are already trialing 6N HPA on ceramic-coated separators for next-generation fast-charge cells, marking a pivot point for large-volume qualifying runs.

High Cost of High-Purity Alumina

Calcination and multiple recrystallization stages keep energy use high, especially for 5N and 6N grades, which can trade at price premiums. Alpha HPA's solvent-extraction route, which bypasses the aluminum-metal step, claims 70% lower carbon emissions and a significant cut in power intensity. While this narrows the cost delta, widespread commissioning of similar plants is still two to three years away, exposing near-term procurement budgets. Spot price volatility in industrial alumina further complicates long-term offtake negotiations for specialty users.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Usage in Semiconductors

- Adoption of HPA-Based Thermal Interface Materials in EV Power-Electronics Modules

- Availability of Low-Cost Alternatives

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, the 4N grade commanded 73.12% of total volume, anchored by sapphire wafers for general-purpose LEDs. At the same time, 6N shipments are on a 22.22% CAGR path, lifted by semiconductor and next-generation battery uses that demand sub-ppm impurity levels. Alpha HPA's closed-loop solvent-extraction pilot demonstrated full reagent recycling, lowering variable production cost, and making 5N and 6N more accessible. Manufacturers are adopting hybrid strategies, producing 4N for mass LED use and diverting incremental capacity to 6N to serve high-margin contracts. As battery OEMs begin to mandate more than or equal to 5N coatings for fast-charge cells, demand elasticity improves even in traditionally price-sensitive regions. Heightened research and development around energy-efficient purification is expected to close a portion of the cost gap, accelerating the premium-grade mix within the High-Purity Alumina market.

The legacy aluminum-alkoxide hydrolysis route delivered 87.25% of global output in 2025, owing to mature supply chains and ample bauxite feedstock. However, new entrants are favoring hydrochloric-acid leaching, which is scaling at a 22.35% CAGR, encouraged by lower capex per tonne and easier impurity bleed-off. Two-step sintering studies that combine spark-plasma densification with pressureless finishing showed a 19% flexural-strength gain alongside reduced furnace time. Emerging Southeast Asian refineries use modular HCl regeneration units to cut acid consumption and shrink effluent loads, aligning with stricter regional environmental norms. Incumbents are retrofitting older hydrolysis lines with solvent-extraction polishing stages to raise purity yields, preserving market position. Over the medium term, technology choice may hinge on proposed carbon-intensity disclosure rules in Europe and North America, potentially tipping marginal investment toward leach-based plants that score lower on embedded emissions.

The High Purity Alumina Market Report Segments the Industry by Type (4N, 5N, and 6N), Production Technology (Hydrolysis and Hydrochloric Acid Leaching), Application (LED Lighting, Phosphor, Semiconductor, Lithium-Ion (Li-Ion) Batteries, and More), End-User Industry (Electronics, Automotive, Energy Storage, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa).

Geography Analysis

Asia-Pacific accounted for 75.61% of the High Purity Alumina market volume in 2025, supported by China's integrated alumina value chain and Japan's and South Korea's leadership in LED and semiconductor fabrication. The region's market is projected to add 22.85% annually through 2031, thanks to aggressive EV roll-outs, growing wafer fabs, and new solvent-extraction refineries coming online in Australia.

North America is leveraging federal incentives for semiconductor reshoring and growing public-charging infrastructure that lifts lithium-ion battery demand. Canada and the United States benefit from stable electricity grids, supporting low-carbon production ambitions. South America, the Middle East, and Africa contribute modestly but represent long-run opportunities as bauxite-rich nations seek downstream diversification.

Brazil has outlined incentives for specialty alumina, while Saudi Arabia investigates alumina refining linked to its broader minerals strategy. These regions provide optionality for High-Purity Alumina market participants seeking geographic risk diversification.

- Advanced Energy Minerals

- Altech Advanced Materials

- Alpha HPA

- Baikowski SA

- Bestry

- Hebei Pengda New Materials Technology Co., Ltd.

- HONGHE CHEMICAL

- Nippon Light Metal Company, Ltd.

- Polar Performance Materials

- RusAL

- Sasol

- Saint-Gobain

- Shandong Keheng Crystal Material Technology Co., Ltd.

- Sumitomo Chemical Co., Ltd.

- Xuancheng Jingrui New Materials Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand for Led-based Lighting

- 4.2.2 Growing Demand from Lithium-ion Battery Markets

- 4.2.3 Increasing Usage of High Purity Alumina in Semiconductors

- 4.2.4 Adoption of HPA-Based Thermal Interface Materials in EV Power-Electronics Modules

- 4.2.5 Increasing Demand from the Electronics Industry

- 4.3 Market Restraints

- 4.3.1 High Cost of High-purity Alumina

- 4.3.2 Availabity of Low Cost Alternatives

- 4.3.3 Limited Availability of Raw Material Across the Globe

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products and Services

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Purity Level (Type)

- 5.1.1 4N

- 5.1.2 5N

- 5.1.3 6N

- 5.2 By Production Technology

- 5.2.1 Hydrolysis

- 5.2.2 Hydrochloric Acid Leaching

- 5.3 By Application

- 5.3.1 LED Lighting

- 5.3.2 Phosphor

- 5.3.3 Semiconductor

- 5.3.4 Lithium-ion Batteries

- 5.3.5 Technical Ceramics

- 5.3.6 Others (Scratch-Resistant Glass, Optical Lenses, etc.)

- 5.4 By End-User Industry

- 5.4.1 Electronics

- 5.4.2 Automotive

- 5.4.3 Energy Storage

- 5.4.4 Medical Devices

- 5.4.5 Industrial Manufacturing

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Malaysia

- 5.5.1.6 Thailand

- 5.5.1.7 Indonesia

- 5.5.1.8 Vietnam

- 5.5.1.9 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Nordic Countries

- 5.5.3.7 Turkey

- 5.5.3.8 Russia

- 5.5.3.9 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 Qatar

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 South Africa

- 5.5.5.7 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%) Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Advanced Energy Minerals

- 6.4.2 Altech Advanced Materials

- 6.4.3 Alpha HPA

- 6.4.4 Baikowski SA

- 6.4.5 Bestry

- 6.4.6 Hebei Pengda New Materials Technology Co., Ltd.

- 6.4.7 HONGHE CHEMICAL

- 6.4.8 Nippon Light Metal Company, Ltd.

- 6.4.9 Polar Performance Materials

- 6.4.10 RusAL

- 6.4.11 Sasol

- 6.4.12 Saint-Gobain

- 6.4.13 Shandong Keheng Crystal Material Technology Co., Ltd.

- 6.4.14 Sumitomo Chemical Co., Ltd.

- 6.4.15 Xuancheng Jingrui New Materials Co., Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Application in Scratch-resistant Glasses for Smartphones and Watches

- 7.3 Growing Applications in Manufacturing Optical Lenses