|

市場調查報告書

商品編碼

1913396

高純度氧化鋁市場:市場機會、成長促進因素、產業趨勢分析及預測(2026-2035)High Purity Alumina Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035 |

||||||

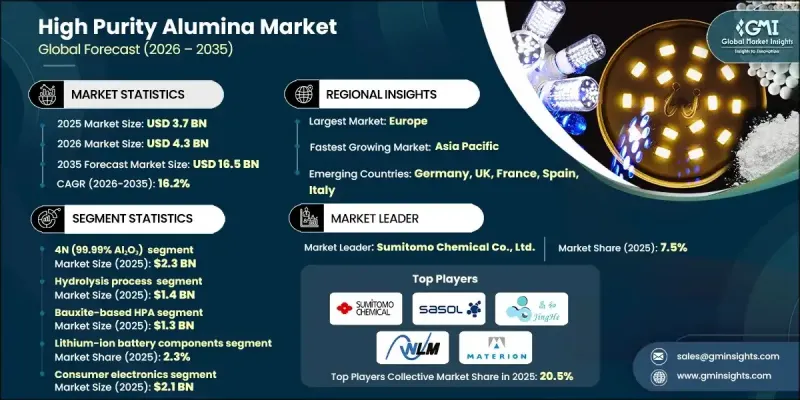

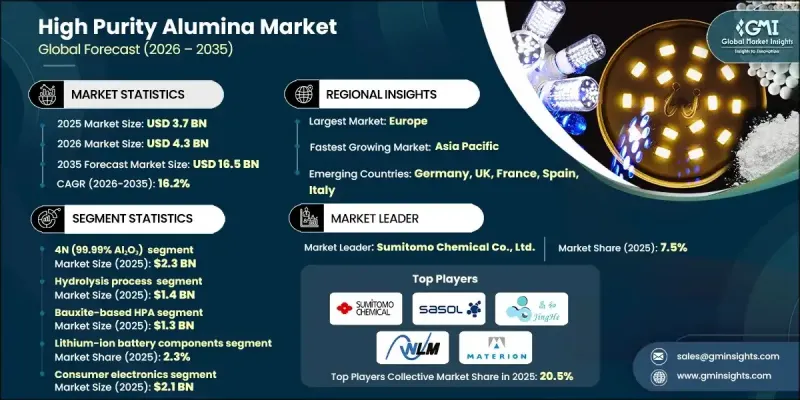

全球高純度氧化鋁市場預計到 2025 年將價值 37 億美元,到 2035 年達到 165 億美元,年複合成長率為 16.2%。

市場成長的驅動力在於對滿足高階工業應用嚴苛的品質、可靠性和性能要求的先進材料的需求不斷成長。高純度氧化鋁由雜質含量極低的氧化鋁製成,具有優異的熱穩定性、高耐化學性和卓越的電絕緣性能。這些特性使其成為對精度和耐久性要求極高的應用領域的關鍵材料。各製造領域對高性能材料的持續依賴支撐著市場的穩定擴張。生產技術的顯著進步也推動了市場的發展勢頭,現代化的精煉和提純方法確保了材料品質的穩定性。製造商越來越能夠根據特定應用的需求對材料性能進行微調,同時提高能源效率並減少排放。這種發展反映了整個工業界向永續製造實踐和最佳化生產流程轉變的趨勢,使高純度氧化鋁成為下一代技術的關鍵材料。

| 市場覆蓋範圍 | |

|---|---|

| 開始年份 | 2025 |

| 預測期 | 2026-2035 |

| 初始市場規模 | 37億美元 |

| 市場規模預測 | 165億美元 |

| 複合年成長率 | 16.2% |

預計到2025年,水解製程市場規模將達到14億美元。與鹽酸浸出法一樣,水解製程正逐漸成為一種經濟高效且擴充性生產的方法,能夠提供穩定的純度水準。它兼具大規模生產和嚴格品管的優勢,使其非常適合滿足日益成長的工業需求。

預計到2025年,鋰離子電池組件市佔率將達到2.3%。對高純度氧化鋁的需求持續向對材料一致性和可靠性要求極高的應用領域轉移。在製造公差日益嚴格的背景下,尤其是在高溫和精密加工環境下,對高熱穩定性、光學透明度和低污染要求的應用領域仍將保持強勁需求。

預計到2025年,北美高純度氧化鋁市場規模將達5.253億美元。該地區的成長主要得益於先進電子、航太、國防和儲能產業的強勁需求。持續加大研發投入、創新以及提高生產標準,進一步推動了全部區域高純度氧化鋁的應用和消費。

目錄

第1章:分析方法和範圍

第2章執行摘要

第3章業界考察

- 產業生態系分析

- 供應商情況

- 利潤率

- 每個階段的附加價值

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 促進要素

- 對先進電子設備的需求不斷成長

- 電動車生態系統的快速成長

- LED和照明技術拓展

- 產業潛在風險與挑戰

- 生產成本高且能源需求旺盛

- 來自低成本區域生產商的競爭壓力

- 市場機遇

- 擴大下一代電池的應用

- 5G及未來6G基礎設施的擴展

- 在航太和國防領域的應用日益廣泛

- 促進要素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特五力分析

- PESTEL 分析

- 科技與創新趨勢

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按純度等級

- 未來市場趨勢

- 科技與創新趨勢

- 當前技術趨勢

- 新興技術

- 專利狀態

- 貿易統計資料(HS編碼)(註:貿易統計僅涵蓋主要國家)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續努力

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 考慮到碳足跡

第4章 競爭情勢

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 按地區

- 企業矩陣分析

- 主要企業的競爭分析

- 競爭定位矩陣

- 主要趨勢

- 企業合併(M&A)

- 商業夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章 依純度等級分類的市場估算與預測(2022-2035 年)

- 3N(99.9% AL2O3)

- 4N(99.99% AL2O3)

- 5N(99.999% AL2O3)

- 6N(99.9999% AL2O3)

- UHPA - 超高純度氧化鋁(純度超過 99.9999%)

第6章 依製造技術分類的市場估算與預測(2022-2035 年)

- 水解法

- 鹽酸(HCl)浸出法

- 醇鹽法

- 熱解

- 三層電解精煉

- 分餾結晶

- 真空蒸餾

- 其他

第7章 市場估算與預測:依原料分類(2022-2035 年)

- 礬土基高純度空氣

- 高嶺土基HPA

- 鋁金屬基高純度鋁

- 高鋁黏土基HPA

第8章 按應用領域分類的市場估算與預測(2022-2035 年)

- LED基板和照明

- 藍寶石基板生產

- 半導體製造

- 鋰離子電池零件

- 5G和電信基礎設施

- 醫療和生物醫學應用

- 量子運算組件

- 航太與國防陶瓷

- 電力電子和高頻裝置

- 技術陶瓷和先進陶瓷

- 電子顯示器、光電子學

- 其他

第9章 依最終用途產業分類的市場估算與預測(2022-2035 年)

- 家用電子電器

- 車

- 航太與國防

- 醫療和醫療設備

- 電訊

- 能源與電力

- 工業/製造業

- 其他

第10章 各地區市場估計與預測(2022-2035 年)

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 其他歐洲

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 其他拉丁美洲

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 其他中東和非洲地區

第11章 公司簡介

- Alcoa Corporation

- Altech Chemicals Limited

- Baikowski

- Caplinq Corporation

- Emerging sustainable HPA producers

- Hebei Pengda Advanced Materials Technology

- Materion Corporation

- Nippon Light Metal Holdings Co., Ltd.

- Norsk Hydro ASA

- Orbite Technologies Inc.

- PSB Industries SA

- Sumitomo Chemical Co., Ltd.

- Sasol Limited

- Xuancheng Jingrui New Materials Co., Ltd.

The Global High Purity Alumina Market was valued at USD 3.7 billion in 2025 and is estimated to grow at a CAGR of 16.2% to reach USD 16.5 billion by 2035.

Market growth is driven by rising demand for advanced materials that meet strict quality, reliability, and performance requirements across high-end industrial applications. High purity alumina, derived from aluminum oxide with minimal impurity content, offers excellent thermal stability, strong chemical resistance, and superior electrical insulation properties. These characteristics make it a critical material for applications where precision and durability are essential. Continued reliance on high-performance materials across manufacturing sectors has supported consistent market expansion. Significant improvements in production technologies have also contributed to market momentum, as modernized refining and purification methods now deliver more uniform material quality. Manufacturers are increasingly able to fine-tune material characteristics to meet application-specific requirements while improving energy efficiency and lowering emissions. This evolution reflects the broader industrial shift toward sustainable manufacturing practices and optimized production processes, positioning high purity alumina as a key material in next-generation technologies.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $3.7 Billion |

| Forecast Value | $16.5 Billion |

| CAGR | 16.2% |

The hydrolysis process segment reached USD 1.4 billion in 2025. Alongside HCl leaching, hydrolysis has gained prominence as a cost-effective and scalable production method capable of delivering consistent purity levels. Its ability to balance large-scale output with strict quality control has made it well-suited to meet growing industrial demand.

The lithium-ion battery components segment held 2.3% share in 2025. Demand for high purity alumina continues to shift toward applications that require exceptional material consistency and reliability. Usage remains strong across sectors that depend on high thermal stability, optical clarity, and minimal contamination, particularly as manufacturing tolerances become increasingly stringent in high-temperature and precision-driven environments.

North America High Purity Alumina Market generated USD 525.3 million in 2025. Growth in this region is supported by strong demand from advanced electronics, aerospace, defense, and energy storage industries. Continued investment in research, innovation, and high manufacturing standards is further accelerating adoption and consumption across the region.

Key companies operating in the Global High Purity Alumina Market include Alcoa Corporation, Baikowski, Norsk Hydro ASA, Materion Corporation, Nippon Light Metal Holdings Co., Ltd., Sumitomo Chemical Co., Ltd., Sasol Limited, Altech Chemicals Limited, Orbite Technologies Inc., PSB Industries SA, Caplinq Corporation, Hebei Pengda Advanced Materials Technology, Xuancheng Jingrui New Materials Co., Ltd., and emerging sustainable HPA producers. Companies in the Global High Purity Alumina Market are strengthening their market position through technology advancement, capacity expansion, and product specialization. Many players are investing in process innovation to achieve higher purity levels while reducing production costs and environmental impact. Strategic focus on application-specific grades allows suppliers to meet evolving customer requirements in electronics, energy storage, and advanced manufacturing. Geographic expansion and localized production are being used to improve supply reliability and reduce logistics risks.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Purity Grade

- 2.2.2 Production Technology

- 2.2.3 Raw Material

- 2.2.4 Application

- 2.2.5 End Use Industry

- 2.2.6 Regional

- 2.3 TAM Analysis, 2025-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for advanced electronics

- 3.2.1.2 Rapid growth in electric vehicle ecosystems

- 3.2.1.3 Expansion of LED and lighting technologies

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High production costs and energy requirements

- 3.2.2.2 Competitive pressure from low-cost regional producers

- 3.2.3 Market opportunities

- 3.2.3.1 Growing adoption in next-generation batteries

- 3.2.3.2 Expansion of 5G and future 6G infrastructure

- 3.2.3.3 Increasing use in aerospace and defence applications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By purity grade

- 3.9 Future market trends

- 3.10 Technology and innovation landscape

- 3.10.1 Current technological trends

- 3.10.2 Emerging technologies

- 3.11 Patent landscape

- 3.12 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.12.1 Major importing countries

- 3.12.2 Major exporting countries

- 3.13 Sustainability and environmental aspects

- 3.13.1 Sustainable practices

- 3.13.2 Waste reduction strategies

- 3.13.3 Energy efficiency in production

- 3.13.4 Eco-friendly initiatives

- 3.14 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Purity Grade, 2022-2035 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 3N (99.9% AL2O3)

- 5.3 4N (99.99% AL2O3)

- 5.4 5N(99.999% AL2O3)

- 5.5 6N (99.9999% AL2O3)

- 5.6 UHPA - ultra high purity alumina (>99.9999%)

Chapter 6 Market Estimates and Forecast, By Production Technology, 2022-2035 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Hydrolysis process

- 6.3 HCL (hydrochloric acid) leaching

- 6.4 Alkoxide process

- 6.5 Thermal decomposition

- 6.6 Three-layer electrolytic refining

- 6.7 Fractional crystallization

- 6.8 Vacuum distillation

- 6.9 Others

Chapter 7 Market Estimates and Forecast, By Raw Material, 2022-2035 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Bauxite-based HPA

- 7.3 Kaolin-based HPA

- 7.4 Aluminum metal-based HPA

- 7.5 High-alumina clay-based HPA

Chapter 8 Market Estimates and Forecast, By Application, 2022-2035 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Led substrates and lighting

- 8.3 Sapphire substrate production

- 8.4 Semiconductor manufacturing

- 8.5 Lithium-ion battery components

- 8.6 5g and telecommunications infrastructure

- 8.7 Medical and biomedical applications

- 8.8 Quantum computing components

- 8.9 Aerospace and defense ceramics

- 8.10 Power electronics and RF devices

- 8.11 Technical ceramics and advanced ceramics

- 8.12 Electronic displays and optoelectronics

- 8.13 Others

Chapter 9 Market Estimates and Forecast, By End Use Industry, 2022-2035 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 Consumer electronics

- 9.3 Automotive

- 9.4 Aerospace and defense

- 9.5 Healthcare and medical devices

- 9.6 Telecommunications

- 9.7 Energy and power

- 9.8 Industrial manufacturing

- 9.9 Others

Chapter 10 Market Estimates and Forecast, By Region, 2022-2035 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.2.3 Mexico

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Rest of Latin America

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

- 10.6.4 Rest of Middle East and Africa

Chapter 11 Company Profiles

- 11.1 Alcoa Corporation

- 11.2 Altech Chemicals Limited

- 11.3 Baikowski

- 11.4 Caplinq Corporation

- 11.5 Emerging sustainable HPA producers

- 11.6 Hebei Pengda Advanced Materials Technology

- 11.7 Materion Corporation

- 11.8 Nippon Light Metal Holdings Co., Ltd.

- 11.9 Norsk Hydro ASA

- 11.10 Orbite Technologies Inc.

- 11.11 PSB Industries SA

- 11.12 Sumitomo Chemical Co., Ltd.

- 11.13 Sasol Limited

- 11.14 Xuancheng Jingrui New Materials Co., Ltd.