|

市場調查報告書

商品編碼

1910466

高效能添加劑:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031 年)Performance Additives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

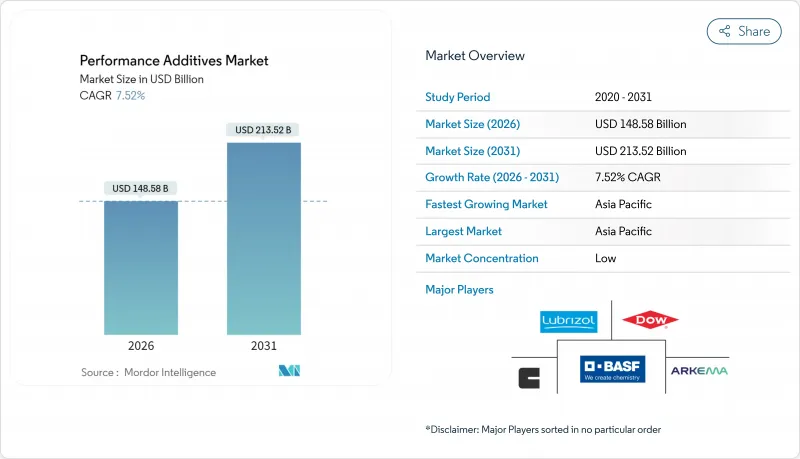

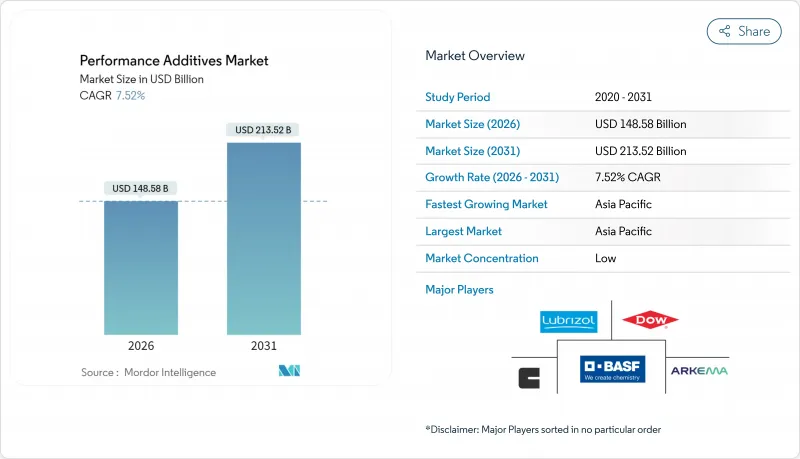

預計高性能添加劑市場將從 2025 年的 1,381.9 億美元成長到 2026 年的 1,485.8 億美元,到 2031 年將達到 2,135.2 億美元,2026 年至 2031 年的複合年成長率為 7.52%。

對能夠提升塑膠、潤滑劑和塗料耐久性、永續性和加工效率的特種化學品的強勁需求,正推動高性能添加劑市場擴張。成長的利多因素包括汽車電氣化進程的加速、全球向水性低VOC塗料的轉型,以及促進基於添加劑的化學回收解決方案的循環經濟政策的加強。生產商也正在利用亞太地區的基礎設施發展計劃,該地區快速的工業化進程支撐著產量和價值的雙重成長,儘管原油原料價格波動帶來了短期成本壓力。對阻燃性、紫外線穩定性和增強阻隔性的需求不斷成長,進一步鞏固了高性能添加劑作為現代材料解決方案關鍵組成部分的地位。

全球高性能添加劑市場趨勢與洞察

在終端用途領域以塑膠取代傳統材料

在汽車、建築和消費品製造領域,對輕質、耐腐蝕且易於成型的塑膠的需求日益成長,這些塑膠正在取代金屬、木材和玻璃。為了在極端工況下保持性能,這些替代材料需要添加熱穩定劑、紫外線吸收劑和阻燃劑。BASF的阻燃聚鄰苯二甲醯胺 Ultramid 用於高壓電動車零件,證明先進的添加劑能夠使塑膠承受 -40°C 至 150°C 的溫度波動,同時滿足嚴格的介電性能閾值。隨著塑膠廣泛應用於引擎室部件、外飾板和模組化建築構件,對多功能添加劑的需求也在同步成長,這為高性能添加劑市場的長期成長奠定了基礎。

新興經濟體對塑膠的需求快速成長

都市化、可支配收入的成長以及大規模的基礎設施建設規劃正在加速亞太和非洲部分地區的塑膠消費。大規模公路、鐵路和住宅計劃需要地工合成、管線和隔熱材料,而這些材料又需要抗氧化劑、加工助劑和衝擊改質劑。在印度,隨著國內水泥產量以每年6-8%的速度成長,特種化學品製造商正在擴大產能以滿足建築添加劑需求的激增。東南亞消費品包裝產業也出現了類似的趨勢,推動了高性能分散劑和潤滑劑的進口。這些趨勢預示著,到2030年,新興地區將成為高性能添加劑市場的主要需求驅動力。

對一次性塑膠和有害物質實施嚴格監管

食品接觸和包裝應用中某些添加劑的監管禁令迫使配方師進行高成本的配方調整和環境標籤認證。加州計畫於2027年禁止在食品包裝中使用四種傳統塑膠添加劑,這將為其他地區樹立榜樣。歐盟將於2025年更新食品接觸法規,進一步收緊遷移限制,並要求產品系列進行全面審查。科萊恩等公司已於2023年12月前完成從其穩定劑產品組合中淘汰全氟烷基和多氟烷基物質(PFAS)的工作。雖然這些措施加強了環境合規性,但也導致短期成本上升和認證延遲,減緩了高效能添加劑市場的成長速度。

細分市場分析

到2025年,塑膠添加劑將佔高性能添加劑市場42.62%的佔有率,貢獻市場總收入的大部分。到2031年,該市場將以9.18%的複合年成長率成長,主要受兩大因素驅動:電子產業日益嚴格的阻燃劑法規以及電動車對耐紫外線、輕量化零件的需求。先進的分散劑、抗氧化劑和無鹵阻燃劑因其在不犧牲強度的前提下追求輕量化零件而備受加工商青睞,價格也相對較高。

橡膠添加劑在輪胎和輸送機製造領域的需求將保持穩定,但隨著出行方式向電動車平台轉型,輕質聚合物複合材料的應用日益普及,其在塑膠產業的成長速度將落後於電動車領域。塗料添加劑的需求則因水性解決方案的普及而不斷成長,這主要得益於殺菌劑和流變控制劑等產品的推動。

這份「性能添加劑報告」按類別(塑膠添加劑、橡膠添加劑、油漆和塗料添加劑、燃料添加劑等)、形式(固體/粉末、液體、母粒/顆粒、微膠囊化)、終端用戶行業(包裝、汽車和運輸、建築等)和地區(亞太地區、北美、歐洲、南美、中東和非洲)分析添加劑。

區域分析

截至 2025 年,亞太地區佔據了高性能添加劑市場 46.55% 的主導佔有率,預計到 2031 年,其收入將以 8.31% 的複合年成長率成長。鐵路、公路和數位基礎設施的公共支出不斷增加,推動了對建築分散劑、高效減水劑和防護塗料的需求。

北美市場呈現緩慢但持續的成長態勢,這主要得益於日益嚴格的燃油經濟性標準以及對本地採購特種化學品的偏好不斷增強。汽車製造商和航太巨頭正與添加劑供應商緊密合作,以實現生命週期碳排放目標,並維持先進分散劑和潤滑性改進劑的高附加價值利潤。

歐洲正面臨一系列經濟狀況。能源成本壓力導致2024年化學品產量下降,但應對氣候變遷和循環經濟的政策引領正在刺激對新型添加劑的需求。各公司正競相開發不含PFAS的阻燃劑和低遷移穩定劑,以符合歐盟《化學品永續性戰略》。

中東和非洲在高性能添加劑市場規模中所佔比例仍然較小,但其基礎設施塗料、管道樹脂和潤滑油基礎油添加劑的需求成長高於平均水準。充足的碳氫化合物原料供應使波灣合作理事會(GCC)國家得以擴展其後向整合的添加劑生產線,而撒哈拉以南非洲的都市化則推動了對耐候塗料和包裝材料的需求。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 在終端用途領域以塑膠取代傳統材料

- 新興經濟體對塑膠的需求快速成長

- 全球日益嚴格的燃油經濟性和排放氣體標準推動了對高性能潤滑油和燃油添加劑的需求。

- 向水性及低VOC塗料的轉變將推動對特種添加劑需求的成長。

- 基於添加劑的化學回收和循環聚合物計劃正蓬勃發展

- 市場限制

- 對一次性塑膠和有害物質實施嚴格監管

- 原油衍生原料價格波動

- 一項旨在監管包裝功能性添加劑中微塑膠的法案目前正在審議中。

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 按添加劑類別

- 塑膠添加劑

- 潤滑油

- 加工助劑(氟樹脂基)

- 流動改善劑

- 滑爽添加劑

- 抗靜電添加劑

- 顏料潤濕劑

- 填料分散劑

- 防霧添加劑

- 塑化劑

- 穩定器

- 阻燃劑

- 衝擊修正器

- 橡膠添加劑

- 加速器

- 劣化

- 發泡和黏合劑

- 油漆和塗料添加劑

- 消毒劑

- 分散劑和潤濕劑

- 消泡劑和脫氣劑

- 流變改性劑

- 表面改質劑

- 穩定器

- 流動性和平滑性添加劑

- 其他油漆和塗料添加劑

- 燃油添加劑

- 泥沙控制

- 十六烷改良劑

- 潤滑性促進劑

- 抗氧化劑

- 防腐蝕

- 燃料染料

- 低溫流動改善劑

- 抗爆劑

- 其他燃料添加劑

- 油墨添加劑

- 流變改性劑

- 防滑劑

- 消泡劑

- 分散劑

- 抗氧化劑

- 螯合劑

- 其他油墨添加劑

- 皮革添加物

- 整理加工劑

- 肥酒

- Syntans

- 其他皮革添加劑

- 潤滑油添加劑

- 分散劑和乳化劑

- 黏度指數增進劑

- 清潔劑

- 腐蝕抑制劑

- 抗氧化劑

- 極壓添加劑

- 摩擦改進劑

- 其他潤滑油添加劑

- 黏合劑和密封劑添加劑

- 抗氧化劑

- 光線穩定器

- 增稠劑

- 其他添加物

- 塑膠添加劑

- 按形式

- 固體/粉末

- 液體

- 母粒/顆粒

- 微膠囊化

- 按最終用戶行業分類

- 包裝

- 汽車/運輸設備

- 建築/施工

- 電氣和電子設備

- 工業機械

- 消費品

- 能源和電力(包括石油和天然氣)

- 其他終端用戶產業

- 按地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 東南亞國協

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐國家

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- Afton Chemical

- Akzo Nobel NV

- Albemarle Corporation

- Arkema

- Ashland

- Baerlocher GmbH

- BASF

- Chevron Oronite Company LLC

- Clariant

- Dow

- Eastman Chemical Company

- Evonik Industries AG

- Exxon Mobil Corporation

- Honeywell International Inc.

- Huntsman International LLC

- Lanxess

- Mitsui & Co.(Asia Pacific)Pte. Ltd.

- Performance Additives

- Songwon

- The Lubrizol Corporation

- Univar Solutions LLC

- WR Grace & Co

第7章 市場機會與未來展望

The Performance Additives market is expected to grow from USD 138.19 billion in 2025 to USD 148.58 billion in 2026 and is forecast to reach USD 213.52 billion by 2031 at 7.52% CAGR over 2026-2031.

Strong demand for specialty chemicals that boost durability, sustainability, and processing efficiency across plastics, lubricants, and coatings keeps the performance additives market on an expansion track. Growth tailwinds include accelerating automotive electrification, the global pivot toward waterborne low-VOC coatings, and intensified circular-economy policies that elevate additive-enabled chemical recycling solutions. Producers are also capitalizing on infrastructure programs in Asia-Pacific, where rapid industrialization supports both volume and value growth despite short-term cost pressure from volatile crude-derived feedstocks. Heightened requirements for flammability resistance, UV stability, and enhanced barrier properties further anchor the performance additives market as an essential enabler of modern materials solutions.

Global Performance Additives Market Trends and Insights

Replacement of Conventional Materials by Plastics Across End-Use Sectors

Demand for light, corrosion-resistant, and easily formable plastics displaces metals, wood, and glass across automotive, construction, and consumer-goods manufacturing. Each substitution requires thermal stabilizers, UV absorbers, and flame retardants that preserve performance under harsher operating envelopes. BASF's flame-retardant Ultramid polyphthalamide for high-voltage electric-vehicle components illustrates how advanced additives permit plastics to withstand temperature swings from -40 °C to 150 °C while meeting stringent dielectric thresholds. As plastics penetrate under-the-hood parts, exterior body panels, and modular building components, volume requirements for multi-functional additive packages climb in tandem, anchoring a long-run growth vector for the performance additives market.

Rapid Plastics Demand Growth in Emerging Economies

Urbanization, rising disposable incomes, and pervasive infrastructure programs are accelerating plastics consumption in Asia-Pacific and parts of Africa. Large-scale highway, rail, and housing projects demand geosynthetics, pipes, and insulation that rely on antioxidants, processing aids, and impact modifiers. In India, specialty-chemical producers are adding capacity to meet surging demand for construction additives that align with national cement output growing 6 to 8% annually. Similar momentum in Southeast Asia's consumer-packaging sector is stimulating imports of high-performance dispersants and slip agents. These dynamics solidify emerging regions as the principal volume engine of the performance additives market through 2030.

Stringent Restrictions on Single-Use Plastics and Hazardous Substances

Regulatory bans on selected additives in food contact and packaging push formulators toward costlier reformulations and eco-labels. California's 2027 prohibition on four legacy plastic additives in food packaging establishes a template for other jurisdictions. The European Union's 2025 update to food-contact regulations imposes tighter migration limits that force comprehensive portfolio audits. Companies like Clariant completed a phased elimination of PFAS from stabilizer ranges by December 2023. While these moves enhance environmental compliance, they introduce short-term cost spikes and qualification delays that shave growth points from the performance additives market.

Other drivers and restraints analyzed in the detailed report include:

- Tightening Global Fuel-Economy and Emissions Norms

- Shift Toward Water-Borne and Low-VOC Coatings

- Volatile Crude-Derived Feedstock Prices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plastic additives commanded 42.62% of the performance additives market share in 2025, contributing the lion's share of revenue to the overall performance additives market. Their 9.18% CAGR through 2031 is propelled by dual imperatives: tighter flammability rules in electronics and the need for UV-stable lightweight parts in electric vehicles. Cutting-edge dispersants, antioxidants, and halogen-free flame retardants capture premium pricing as processors target weight savings without compromising strength.

Rubber additives uphold steady volumes in tire and conveyor-belt manufacturing, but growth lags plastics as mobility shifts to EV platforms that favor lightweight polymer composites. Paints and coatings additives enjoy a lift from waterborne migration, especially for biocide and rheology-control packages.

The Performance Additives Report is Segmented by Additive Category (Plastic Additives, Rubber Additives, Paints and Coatings Additives, Fuel Additives, and More), Form (Solid/Powder, Liquid, Masterbatch/Pellet, and Micro-Encapsulated), End-User Industry (Packaging, Automotive and Transportation, Building and Construction, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa).

Geography Analysis

Asia-Pacific retained a commanding 46.55% share of the performance additives market in 2025 and is forecast to lift revenues at an 8.31% CAGR to 2031. High public spending on rail, highways, and digital infrastructure multiplies demand for construction-grade dispersants, superplasticizers, and protective coatings.

North America exhibits moderate yet durable expansion underpinned by stringent fuel-economy standards and a growing preference for locally sourced specialty chemicals. Auto OEMs and aerospace primes leverage close collaboration with additive suppliers to meet lifecycle-carbon targets, sustaining premium margins for advanced dispersants and lubricity modifiers.

Europe navigates mixed macro conditions: energy-cost pressures curtailed chemical output in 2024, but policy leadership on climate and circularity nurtures new additive demand. Companies fast-track PFAS-free flame retardants and low-migration stabilizers to comply with the EU Chemicals Strategy for Sustainability.

Middle East and Africa, while still representing a smaller slice of the performance additives market size, register above-average growth in additives for infrastructure coatings, pipe resins, and lubricant basestocks. Hydrocarbon feedstock availability positions Gulf Cooperation Council members to expand backward-integrated additive lines, while sub-Saharan Africa's urbanization lifts demand for weather-resistant paints and packaging.

- Afton Chemical

- Akzo Nobel N.V.

- Albemarle Corporation

- Arkema

- Ashland

- Baerlocher GmbH

- BASF

- Chevron Oronite Company LLC

- Clariant

- Dow

- Eastman Chemical Company

- Evonik Industries AG

- Exxon Mobil Corporation

- Honeywell International Inc.

- Huntsman International LLC

- Lanxess

- Mitsui & Co. (Asia Pacific) Pte. Ltd.

- Performance Additives

- Songwon

- The Lubrizol Corporation

- Univar Solutions LLC

- W. R. Grace & Co

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Replacement of Conventional Materials by Plastics Across End-Use Sectors

- 4.2.2 Rapid Plastics Demand Growth in Emerging Economies

- 4.2.3 Tightening Global Fuel-Economy and Emissions Norms Driving High-Performance Lubricant and Fuel Additives

- 4.2.4 Shift Toward Water-Borne and Low-VOC Coatings Boosts Specialty Additive Uptake

- 4.2.5 Additive-Enabled Chemical-Recycling and Circular-Polymer Initiatives Gain Traction

- 4.3 Market Restraints

- 4.3.1 Stringent Restrictions on Single-Use Plastics and Hazardous Substances

- 4.3.2 Volatile Crude-Derived Feedstock Prices

- 4.3.3 Pending Micro-Plastics Legislation Targeting Functional Additives in Packaging

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Additive Category

- 5.1.1 Plastic Additives

- 5.1.1.1 Lubricants

- 5.1.1.2 Processing Aids (Fluoropolymer-based)

- 5.1.1.3 Flow Improvers

- 5.1.1.4 Slip Additives

- 5.1.1.5 Antistatic Additives

- 5.1.1.6 Pigment Wetting Agents

- 5.1.1.7 Filler Dispersants

- 5.1.1.8 Antifog Additives

- 5.1.1.9 Plasticizers

- 5.1.1.10 Stabilizers

- 5.1.1.11 Flame Retardants

- 5.1.1.12 Impact Modifiers

- 5.1.2 Rubber Additives

- 5.1.2.1 Accelerators

- 5.1.2.2 Antidegradants

- 5.1.2.3 Blowing and Adhesive Agents

- 5.1.3 Paints and Coatings Additives

- 5.1.3.1 Biocides

- 5.1.3.2 Dispersants and Wetting Agents

- 5.1.3.3 Defoamers and De-aerators

- 5.1.3.4 Rheology Modifiers

- 5.1.3.5 Surface Modifiers

- 5.1.3.6 Stabilizers

- 5.1.3.7 Flow and Leveling Additives

- 5.1.3.8 Other Paint and Coating Additives

- 5.1.4 Fuel Additives

- 5.1.4.1 Deposit Control

- 5.1.4.2 Cetane Improvers

- 5.1.4.3 Lubricity Improvers

- 5.1.4.4 Antioxidants

- 5.1.4.5 Anticorrosion

- 5.1.4.6 Fuel Dyes

- 5.1.4.7 Cold-Flow Improvers

- 5.1.4.8 Antiknock Agents

- 5.1.4.9 Other Fuel Additives

- 5.1.5 Ink Additives

- 5.1.5.1 Rheology Modifiers

- 5.1.5.2 Slip / Rub Agents

- 5.1.5.3 Defoamers

- 5.1.5.4 Dispersants

- 5.1.5.5 Antioxidants

- 5.1.5.6 Chelating Agents

- 5.1.5.7 Other Ink Additives

- 5.1.6 Leather Additives

- 5.1.6.1 Finishing Agents

- 5.1.6.2 Fat Liquors

- 5.1.6.3 Syntans

- 5.1.6.4 Other Leather Additives

- 5.1.7 Lubricant Additives

- 5.1.7.1 Dispersants and Emulsifiers

- 5.1.7.2 Viscosity-Index Improvers

- 5.1.7.3 Detergents

- 5.1.7.4 Corrosion Inhibitors

- 5.1.7.5 Oxidation Inhibitors

- 5.1.7.6 Extreme-Pressure Additives

- 5.1.7.7 Friction Modifiers

- 5.1.7.8 Other Lubricant Additives

- 5.1.8 Adhesives and Sealants Additives

- 5.1.8.1 Antioxidants

- 5.1.8.2 Light Stabilizers

- 5.1.8.3 Tackifiers

- 5.1.8.4 Other Additives

- 5.1.1 Plastic Additives

- 5.2 By Form

- 5.2.1 Solid / Powder

- 5.2.2 Liquid

- 5.2.3 Masterbatch / Pellet

- 5.2.4 Micro-encapsulated

- 5.3 By End-user Industry

- 5.3.1 Packaging

- 5.3.2 Automotive and Transportation

- 5.3.3 Building and Construction

- 5.3.4 Electrical and Electronics

- 5.3.5 Industrial Machinery

- 5.3.6 Consumer Goods

- 5.3.7 Energy and Power (incl. Oil and Gas)

- 5.3.8 Other End-user Industries

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 Japan

- 5.4.1.3 India

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 NORDIC Countries

- 5.4.3.8 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Afton Chemical

- 6.4.2 Akzo Nobel N.V.

- 6.4.3 Albemarle Corporation

- 6.4.4 Arkema

- 6.4.5 Ashland

- 6.4.6 Baerlocher GmbH

- 6.4.7 BASF

- 6.4.8 Chevron Oronite Company LLC

- 6.4.9 Clariant

- 6.4.10 Dow

- 6.4.11 Eastman Chemical Company

- 6.4.12 Evonik Industries AG

- 6.4.13 Exxon Mobil Corporation

- 6.4.14 Honeywell International Inc.

- 6.4.15 Huntsman International LLC

- 6.4.16 Lanxess

- 6.4.17 Mitsui & Co. (Asia Pacific) Pte. Ltd.

- 6.4.18 Performance Additives

- 6.4.19 Songwon

- 6.4.20 The Lubrizol Corporation

- 6.4.21 Univar Solutions LLC

- 6.4.22 W. R. Grace & Co

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment