|

市場調查報告書

商品編碼

1910460

液態防水卷材:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Liquid Applied Membrane - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

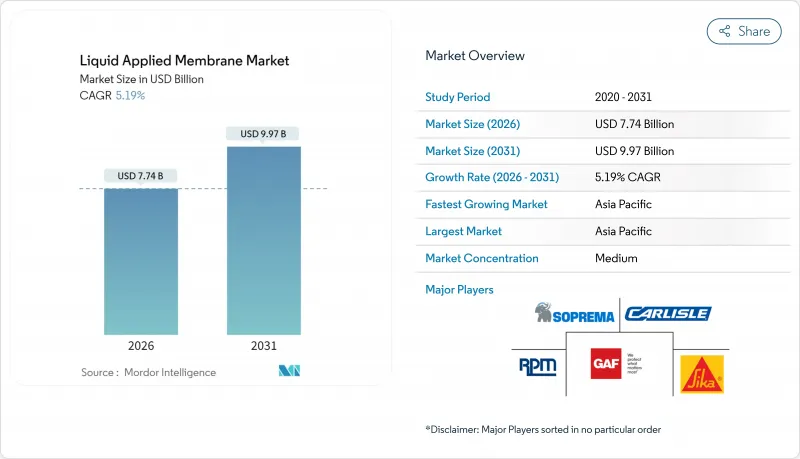

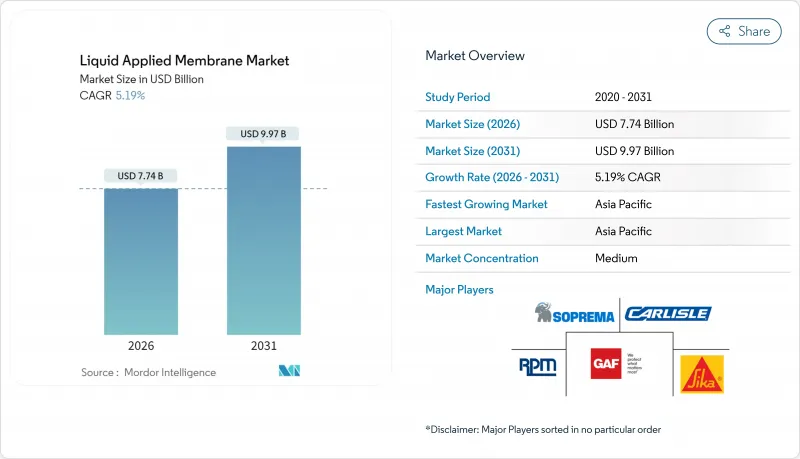

預計到 2025 年,液態防水捲材市場規模將達到 73.6 億美元,到 2026 年將達到 77.4 億美元,到 2031 年將達到 99.7 億美元,預測期(2026-2031 年)複合年成長率為 5.19%。

終端用戶正持續從捲材產品轉向無縫塗料,無縫塗料能夠修復裂縫、抵抗位移並延長使用壽命,從而降低生命週期成本。中國、印度和美國的基建更新項目支撐了市場需求,而加州、加拿大和歐盟更嚴格的低揮發性有機化合物(VOC)法規則推動了水性塗料的普及。鼓勵採用冷屋頂、太陽能組裝和綠色屋頂的建築規範也進一步促進了無縫塗料的應用。為了應對利潤率下降的局面,製造商推出了自修復、太陽能相容和快速固化系統,以減少繁忙施工現場的停工時間。

全球液體防水片材市場趨勢及洞察

擴大防水膜的使用範圍,以延長建築物的使用壽命。

如今,業主們將先進的防水塗層視為可減少非計劃性維修的資本資產。橡樹嶺國家實驗室估計,商業屋頂使用壽命延長五年,每年可為美國減少25億美元的廢棄物成本,並減少掩埋的體積。像MAPEI的Mapelastic AquaDefense這樣的液態防水系統,能夠跨越3.2毫米的裂縫,並在熱循環下保持柔軟性,使其成為地震多發地區的理想選擇。保險公司也開始為指定使用長效防水膜的業主提供保費折扣,這為推廣使用長效防水膜提供了經濟獎勵。

成熟經濟體中老舊屋頂的經濟高效維修

在加拿大,SOPREMA公司對CF Champlain購物中心的屋頂進行了翻新,使其使用壽命延長了25年,同時與完全拆除相比,材料成本降低了45%,施工時間縮短了35%。這種塗層能夠黏附在不規則的基材上,使承包商無需拆除屋頂板,從而避免了對購物中心、醫院和學校等場所的干擾,保證了它們的正常運作。屋頂翻新還減少了廢棄物處理和蘊藏量排放,幫助設施管理團隊在無需大量資本投資的情況下實現ESG目標。

片材和預製篷布供應狀況

熱塑性捲材(例如TPO)在大型物流設施中保持速度優勢,使安裝人員每班可完成超過900平方公尺的鋪設。為了因應塗料市場的成長,製造商推出了自黏片材,降低了使用明火的風險,從而消除了液體防水的一大優勢。然而,在禁止明火的區域,例如複雜的穿透部位、垂直連接處以及生活空間的維修,液體防水仍然是首選。

細分市場分析

瀝青基塗料憑藉數十年的現場經驗和低廉的單位成本,在2025年佔據了液態防水膜市場的30.10%。聚氨酯基塗料憑藉其彈性體特性,能夠抵抗太陽能板、冷屋頂顏料和伸縮縫,推動了價值成長,複合年成長率達到6.24%。

丙烯酸分散體因其可使用滾筒塗刷且易於用水清洗,在維修工程中的應用日益廣泛。聚甲基丙烯酸甲酯 (PMMA) 可在短短 30 分鐘內固化,因此適用於對施工進度要求嚴格的區域,例如人流量大的陽台和體育場大廳。聚氨酯-瀝青混合物和聚脲改性彈性體等混合化學產品滿足了對超快速恢復使用和寒冷氣候施工的特定需求,從而拓展了設計師的設計自由度。

液態防水捲材市場報告按類型(水泥基、瀝青基、聚氨酯、聚脲、丙烯酸等)、應用(屋頂、牆面、地下/隧道、其他應用)、終端用戶行業(住宅、商業、工業、公共設施/基礎設施)和地區(亞太、北美、歐洲等)進行細分。市場預測以美元計價。

區域分析

預計到2025年,亞太地區將佔全球營收的52.70%,並在2031年之前以6.65%的複合年成長率成長。中國的地鐵擴建、印度的智慧城市走廊以及東協的防洪隧道,總需要數億平方公尺的防水材料。當地開發商越來越要求產品符合EN 14891和GB 50108標準,這推動了用於更新測試證書的進口需求。

北美市場雖然成熟,但機會眾多,其中屋頂維修佔據主導地位。美國各市政當局正在擴大冷屋頂」補貼計畫;在加拿大,2025年生效的聯邦VOC法規正在加速水性技術的應用。墨西哥科阿察科阿爾科斯隧道採用了GCP公司的Integritank系統,實現了無縫防腐蝕保護,展現了該地區在複雜計劃中的技術實力。

歐洲的維修熱潮以脫碳為核心,德國的BEG補貼計畫要求提高建築的氣密性,從而推動了流動性氣密材料的廣泛應用。喬治亞採納歐盟的VOC排放上限規定,顯示其監管與東方國家趨於一致。中東和非洲地區展現出巨大的成長潛力,但極端氣候構成了一項挑戰。杜拜世博城公園採用了脂肪族聚脲,使其能夠承受45°C的夏季高溫而不出現粉化(泛白)現象。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 擴大防水膜的使用範圍,以延長建築物的使用壽命。

- 成熟經濟體中老舊屋頂的經濟高效維修

- 亞太地區和非洲基礎建設的快速擴張

- 法規要求使用不含揮發性有機化合物(VOC)的解決方案。

- 太陽能液態屋頂材料的快速普及

- 市場限制

- 片材和預製膜的供應情況

- 石化原料價格波動

- 新興市場建築工程師短缺

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 按類型

- 水泥基

- 瀝青

- 聚氨酯

- 聚脲

- 丙烯酸(分散體)

- PMMA

- 混合型(聚氨酯/聚脲(PU/PUA)、改質聚氨酯/瀝青等)

- 透過使用

- 屋頂材料

- 牆

- 地下和隧道

- 其他用途(地板、陽台、走道、平台、水箱、飲用水箱、種植箱等)

- 按最終用途面積

- 住宅

- 商業的

- 產業

- 公共設施和基礎設施

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- ASEAN

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 俄羅斯

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- Alchimica

- ARDEX Group

- Bostik

- Carlisle Companies Incorporated

- Fosroc Inc.

- GAF Materials LLC

- HB Fuller

- Holcim

- Johns Manville

- MAPEI SpA

- RPM INTERNATIONAL INC.

- Saint-Gobain

- Sika AG

- SOPREMA Group

第7章 市場機會與未來展望

The Liquid Applied Membrane Market was valued at USD 7.36 billion in 2025 and estimated to grow from USD 7.74 billion in 2026 to reach USD 9.97 billion by 2031, at a CAGR of 5.19% during the forecast period (2026-2031).

End-users continue shifting from roll goods to seamless coatings because the latter bridge cracks, tolerate movement, and deliver longer service life, all of which lower lifecycle costs. Infrastructure renewal programs in China, India, and the United States keep demand resilient, while stringent low-VOC rules in California, Canada, and the European Union tilt specifications toward water-borne chemistries. Architectural codes that reward cool roofs, photovoltaic integration, and green-roof assemblies further accelerate uptake. Manufacturers counter margin pressure by launching self-healing, PV-ready, and rapid-cure systems that cut downtime on congested job sites.

Global Liquid Applied Membrane Market Trends and Insights

Growing Usage of Waterproofing Membranes for Building Longevity

Owners now treat advanced coatings as capital assets that curb unplanned repairs. Oak Ridge National Laboratory estimates that extending commercial roof life by just five years could trim United States disposal costs by USD 2.5 billion annually while cutting landfill volume. Liquid systems such as MAPEI's Mapelastic AquaDefense bridge cracks up to 3.2 mm and remain flexible under thermal cycling, making them attractive in seismic zones. Insurance carriers have begun offering premium discounts when owners specify long-life membranes, adding a financial incentive that reinforces adoption.

Cost-Effective Retrofitting for Aging Roofs in Mature Economies

In Canada, SOPREMA resurfaced the CF Champlain shopping center roof, slicing material spend 45% and shortening construction schedules 35% versus full tear-off, all while extending service life another 25 years. Because coatings conform to irregular substrates, contractors avoid disruptive deck removal, allowing malls, hospitals, and schools to stay open. Resurfacing also reduces waste disposal volume and embodied carbon, helping facilities teams achieve ESG goals without large cap-ex budgets.

Availability of Sheet and Prefabricated Membranes

Thermoplastic rolls such as TPO retain a labor-speed edge on wide-open logistics buildings, enabling contractors to install over 900 m2 per shift. Manufacturers responded to coating growth by launching self-adhered sheets that reduce torch risk, eroding one differentiator of liquids. Nonetheless, liquids hold strong in complex penetrations, vertical transitions, and occupied retrofits where flame-free work is mandatory.

Other drivers and restraints analyzed in the detailed report include:

- Infrastructure Boom in Asia-Pacific and Africa

- Regulations Mandating VOC-Free Solutions

- Applicator Skill Shortages in Emerging Markets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Bituminous coatings accounted for 30.10% of the liquid-applied membranes market share in 2025, reflecting decades of field data and low unit cost. Polyurethane led value growth at a 6.24% CAGR, supported by elastomeric performance that tolerates solar modules, cool-roof pigments, and movement joints without embrittlement.

Acrylic dispersions gain traction in refurbishments because crews can apply them with rollers and clean up using water. PMMA fills high-traffic balconies and stadium concourses where rapid 30-minute cure delivers schedule certainty. Hybrid chemistries such as polyurethane-bitumen blends and polyurea-modified elastomers address niche demands for ultra-fast return-to-service or cold-weather application, expanding design flexibility for specifiers.

The Liquid-Applied Membranes Report is Segmented by Type (Cementitious, Bituminous, Polyurethane, Polyurea, Acrylic, and More), Application (Roofing, Walls, Underground and Tunnels, and Other Applications), End-User Sector (Residential, Commercial, Industrial, and Institutional and Infrastructure), and Geography (Asia-Pacific, North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific generated 52.70% of 2025 global revenue and is expected to climb at a 6.65% CAGR through 2031. Chinese metro extensions, Indian smart-city corridors, and ASEAN flood-control tunnels collectively require hundreds of millions of square meters of waterproofing. Local developers increasingly demand EN 14891 and GB 50108 compliance, pushing imports to upgrade testing certificates.

North America represents a mature but opportunity-rich arena dominated by reroofing. U.S. municipalities expand cool-roof rebates, while Canada's federal VOC rule effective 2025 accelerates water-borne technology penetration. Mexico's Coatzacoalcos immersed-tube tunnel specified GCP's Integritank system for seamless corrosion protection, underscoring regional competence in complex projects.

Europe's renovation wave centers on decarbonization, with Germany's BEG subsidy requiring airtightness upgrades that often incorporate fluid air-barriers. Georgia's adoption of EU VOC caps signals regulatory harmonization eastward. Middle East and Africa present high growth but challenging climatic extremes; Dubai's Expo City parks selected aliphatic polyurea to survive 45 °C summers without chalking.

- Alchimica

- ARDEX Group

- Bostik

- Carlisle Companies Incorporated

- Fosroc Inc.

- GAF Materials LLC

- HB Fuller

- Holcim

- Johns Manville

- MAPEI SpA

- RPM INTERNATIONAL INC.

- Saint-Gobain

- Sika AG

- SOPREMA Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Usage of Waterproofing Membranes for Building Longevity

- 4.2.2 Cost-Effective Retrofitting for Aging Roofs in Mature Economies

- 4.2.3 Infrastructure Boom in APAC And Africa

- 4.2.4 Regulations Mandating VOC-Free Solutions

- 4.2.5 Rapid Adoption of PV-Ready Liquid Roof Skins

- 4.3 Market Restraints

- 4.3.1 Availability of Sheet and Prefabricated Membranes

- 4.3.2 Volatile Petrochemical Feedstock Prices

- 4.3.3 Applicator Skill Shortages in Emerging Markets

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Cementitious

- 5.1.2 Bituminous

- 5.1.3 Polyurethane

- 5.1.4 Polyurea

- 5.1.5 Acrylic (Dispersion)

- 5.1.6 PMMA

- 5.1.7 Hybrid (polyurethane/polyurea (PU/PUA), modified polyurethane-bituminous, etc.)

- 5.2 By Application

- 5.2.1 Roofing

- 5.2.2 Walls

- 5.2.3 Underground and Tunnels

- 5.2.4 Other Applications (Floors, Balconies, Walkways, Podiums, Tanks, Potable Water Tanks, Planter Boxes, etc.)

- 5.3 By End-use Sector

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 Industrial

- 5.3.4 Institutional and Infrastructure

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Russia

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Alchimica

- 6.4.2 ARDEX Group

- 6.4.3 Bostik

- 6.4.4 Carlisle Companies Incorporated

- 6.4.5 Fosroc Inc.

- 6.4.6 GAF Materials LLC

- 6.4.7 HB Fuller

- 6.4.8 Holcim

- 6.4.9 Johns Manville

- 6.4.10 MAPEI SpA

- 6.4.11 RPM INTERNATIONAL INC.

- 6.4.12 Saint-Gobain

- 6.4.13 Sika AG

- 6.4.14 SOPREMA Group

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment