|

市場調查報告書

商品編碼

1910447

折疊瓦楞紙包裝:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Folding Carton Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

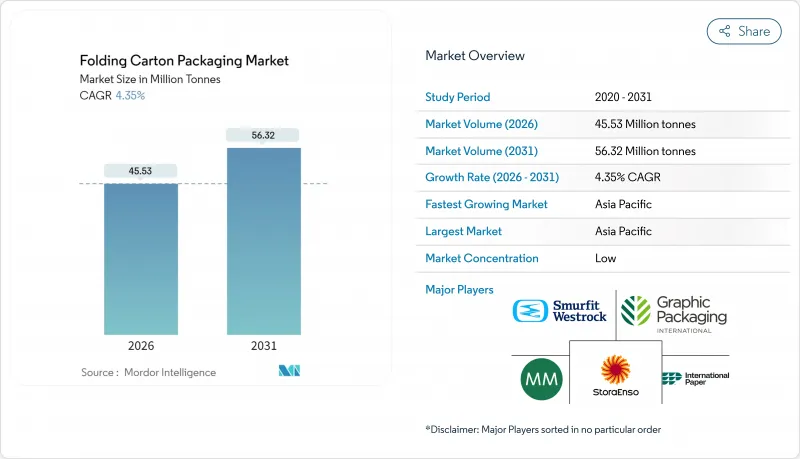

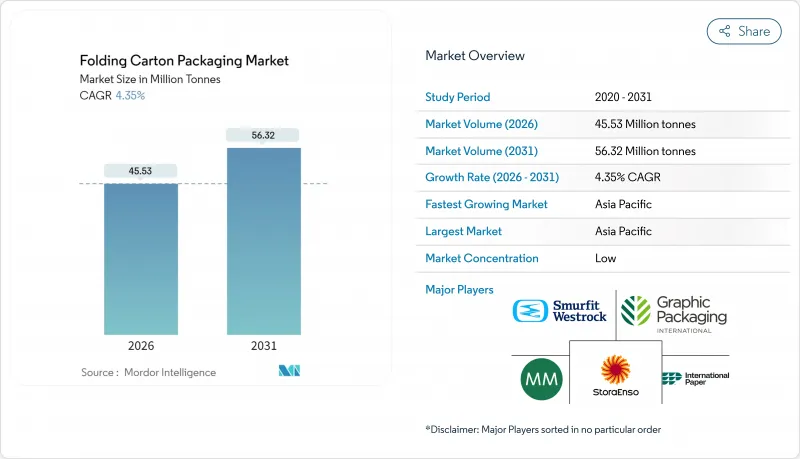

預計折疊紙盒包裝市場將從 2025 年的 4,363 萬噸成長到 2026 年的 4,553 萬噸,到 2031 年將達到 5,632 萬噸,2026 年至 2031 年的複合年成長率為 4.35%。

持續的需求源自於更嚴格的法規促使品牌轉向纖維基替代品,以及電子商務的擴張,後者推動了既能保護產品又能滿足回收要求的包裝形式的發展。消費品(尤其是化妝品和營養補充品)日益高階化,進一步凸顯了折疊瓦楞紙包裝市場中高視覺效果和高附加價值設計的重要性。歐盟和中國的再生材料含量法規提高了低品質生產商的進入門檻,使一體化造紙廠能夠憑藉可追溯的紙板等級獲得市場佔有率。原料價格的波動擠壓了非一體化加工商的利潤空間,同時加速了再生纖維流的採用,因為再生纖維流具有更可預測的成本結構。

全球折疊瓦楞紙包裝市場趨勢與洞察

永續性主導,朝向可再生包裝轉型

為了滿足投資者需求和零售商的回收規定,品牌所有者正從塑膠包裝轉向可再生板包裝。斯道拉恩索承諾在2030年實現100%可再生線,這鞏固了折疊瓦楞紙包裝市場未來多年的需求前景。歐盟的生產者延伸責任制(EPR)成本推高了多材料包裝的處置成本,使得紙盒包裝在成本效益方面更具優勢。飯店和工業領域也正在發生類似的轉變,用模塑纖維隔板取代塑膠內襯。大型零售商也積極響應這些目標,優先選擇帶有再生材料標籤的纖維基包裝。這些趨勢共同作用,使循環經濟成為採購的必要條件,而非只是一種行銷選擇。

電子商務包裝需求快速成長

多通路巨頭正在重新設計小包裹工作流程,以降低破損率和運輸成本,而折疊紙盒則具有體積效率高的優點,並支援全表面圖形印刷。亞馬遜2024年10-K報告指出,包裝最佳化是履約的核心支柱,反映了設計改進如何能降低整個網路的成本。在亞太地區,線上食品和美妝領域的快速成長推動了對能夠承受長途運輸(從第一公里到最後一公里)的防篡改硬質包裝的需求。在逆向物流中,紙盒也具有優勢,因為它們能夠保持完整性,從而降低退貨率。隨著都市區微型倉配中心的興起,支持按需揀貨的小型折疊紙盒在日用品類別中正獲得越來越大的市場佔有率。

原生紙漿價格與供應波動

2024年5月,紙漿現貨價格生產者物價指數(PPI)飆升至219.835,對依賴短期合約的加工商造成了沉重打擊。工廠在維護週期中的停產進一步加劇了供應緊張,迫使加工商在負擔價格飆升或將成本轉嫁給下游之間做出選擇。大型一體化企業透過在箱板紙機和紙板機之間分配纖維來抵消價格波動,而獨立現貨買家則面臨營運資金的消耗。由此產生的成本結構差異正在推動併購,小規模業者也正在尋求改善其資產負債表。避險策略的應用日益增多,但由於零售商減少庫存,需求的不確定性正在削弱其有效性。

細分市場分析

到2025年,醫療保健和製藥業將佔折疊紙盒包裝市場17.34%的佔有率,預計到2031年將以6.71%的複合年成長率成長,主要受人口老齡化和生物製藥上市的推動。雖然防篡改條紋和序列化視窗是符合美國聯邦法規21 CFR Part 211的要求,但這些功能可以輕鬆整合到折疊紙盒中,無需增加多層結構的複雜性。食品和飲料行業將佔折疊紙盒包裝市場33.18%的佔有率,這主要得益於調理食品的普及和飲料多包裝的興起,後者充分利用了冷藏塗層紙板的優勢。與此同時,個人護理行業正在利用優質光澤清漆在競爭激烈的專賣店貨架上脫穎而出。

臨床試驗活動的增加推動了對適用於數位印刷的小批量包裝的需求,從而減少了配方變更期間包裝的過時。擁有A級無塵室設施的紙盒加工商具備優於大宗商品製造商的污染控制和審核準備能力,即使原料成本上漲,也能維持價格溢價。在大眾食品市場,採用輕質塑合板製成的定量包裝穀物和零食托盤滿足了基本需求,並緩解了週期性需求波動。

折疊紙盒包裝市場報告按終端用戶行業(食品飲料、家居用品、個人護理及化妝品、醫療製藥、煙草、電器五金)、基材類型(未漂白紙板等)、印刷技術(膠印、數位印刷等)和地區(北美、歐洲等)進行細分。市場預測以噸為單位。

區域分析

亞太地區將繼續保持其主導地位,預計到2025年將佔據折疊紙盒包裝市場38.42%的佔有率。受中國、印度和印尼全通路零售模式的深入發展所推動,亞太地區預計將持續維持6.82%的複合年成長率。中國加工商正在升級其機械設備,以滿足國內電子產品出口商設定的嚴格抗破強度標準。政府推出的生物分解法規也加速了無PFAS塗層的應用。在日本,便利商店食材自煮包套裝的流行帶動了對冷凍庫冷凍紙板的需求,進而促進了對優質瓦楞紙板的需求。同時,韓國的回收評級系統正在推動纖維包裝材料的標準化,並鼓勵引入高產量脫墨生產線。

在北美,成長將主要由面向消費者的訂閱品牌推動,這些品牌需要印有鮮豔圖案的小批量紙盒。國際紙業以99億美元收購DS Smith,建立了跨境加工網路,縮短了運輸距離,並增強了應對力。加拿大禁止使用難以回收的塑膠,促使冷凍食品和乳製品重新採用紙板套。墨西哥電子產品組裝業務的近岸外包,推高了對防靜電紙盒內襯的需求,進而推動了美國造紙廠原生牛皮紙的進口。

歐洲持續致力於創新,其《包裝及包裝廢棄物法規》規定,到2028年必須全面回收,並於2026年8月前淘汰含氟阻隔材料。德國、法國和英國正率先開發將金屬效果與水性油墨結合的數位裝飾生產線,在追求高階視覺效果的同時,也兼顧了環保法規的要求。儘管東歐加工商已獲得歐盟資金用於升級瓦楞紙板設備,但由於紙板在商店的良好表現,它仍然是糖果甜點出口的首選材料。新的監管政策正在推動對新一代塗佈設備的資本投資,並促使軟包裝薄膜用戶重新考慮使用纖維替代品來生產保存期限更長的產品。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 邁向永續性和可回收包裝

- 電子商務包裝需求快速成長

- 優質化及貨架醒目印刷的需求

- 全球塑膠減量法規

- 數位印刷技術可以實現小批量精準印刷。

- 食材自煮包和即食調理食品訂閱服務的激增

- 市場限制

- 原生紙漿價格與供應波動

- 軟包裝袋替換

- 阻隔性紙盒的回收有限

- 不含 PFAS 塗料的合規成本

- 產業價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 地緣政治影響分析

第5章 市場規模與成長預測

- 按最終用戶行業分類

- 食品/飲料

- 家用

- 個人護理和化妝品

- 醫療和藥品

- 菸草

- 電氣和五金

- 依材料類型

- 固態漂白板(SBB)

- 塗佈未漂白牛皮紙板(CUK)

- 白線塑合板

- 折疊紙盒

- 透過印刷技術

- 膠印

- 數位(噴墨/靜電複印)

- 柔版印刷

- 凹版印刷

- 其他印刷技術

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲和紐西蘭

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 其他中東地區

- 非洲

- 南非

- 埃及

- 其他非洲地區

- 中東

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Smurfit Westrock plc

- Graphic Packaging International LLC

- Mayr-Melnhof Karton AG

- DS Smith plc

- International Paper Company

- Stora Enso Oyj

- Georgia-Pacific LLC

- Mondi plc

- Huhtamaki Oyj

- Seaboard Folding Box Co. Inc.(Vidya Brands)

- American Carton Company

- All Packaging Company

- Edelmann GmbH

- CCL Healthcare(CCL Industries Inc.)

- Rengo Co., Ltd.

- Sonoco Products Company

- Autajon Group

- Southern Champion Tray

第7章 市場機會與未來展望

The folding carton packaging market is expected to grow from 43.63 million tonnes in 2025 to 45.53 million tonnes in 2026 and is forecast to reach 56.32 million tonnes by 2031 at 4.35% CAGR over 2026-2031.

Sustained demand emerges from stricter legislation that steers brands toward fiber-based substitutes and from e-commerce expansion, which rewards protective formats that also meet recycling mandates. Accelerating premiumization in consumer goods, especially cosmetics and nutraceuticals, magnifies the folding carton packaging market's focus on high-graphic, value-added designs. Recycled-content regulations in the European Union and China raise barriers for low-quality producers, enabling integrated mills to capture share with traceable paperboard grades. Raw-material price volatility narrows margins for non-integrated converters, yet it simultaneously accelerates adoption of recycled fiber streams that deliver more predictable cost structures.

Global Folding Carton Packaging Market Trends and Insights

Sustainability-led Shift to Recyclable Packaging

Brand owners are migrating from plastic toward recyclable board to satisfy investor directives and retail take-back rules. Stora Enso's pledge for 100% recyclable lines by 2030 anchors multi-year volume visibility for the folding carton packaging market. Extended Producer Responsibility fees in the EU raise disposal costs on mixed-material packs, tilting the cost-benefit equation in favor of cartons. The hospitality and industrial sectors echo the shift by swapping plastic inserts for molded fiber partitions. Large retailers align with these targets by preferring fiber-based formats that declare recycled-content percentages on-pack. Together, the moves embed circularity as a procurement prerequisite rather than a marketing option.

E-commerce Packaging Demand Boom

Multichannel giants are redesigning parcel workflows to cut damage rates and freight costs, and folding cartons excel at cube efficiency while supporting full-surface graphics. Amazon's 2024 10-K cites packaging optimization as a core fulfillment pillar, reflecting how design tweaks cascade into network savings. Asia Pacific's surging online grocery and beauty segments amplify demand for tamper-evident, rigid solutions that survive long "first-mile-to-last-mile" journeys. Reverse logistics also favors cartons because integrity retention lowers the percentage of unsaleable returns. As micro-fulfillment hubs proliferate in urban centers, small-format folding cartons that accommodate on-demand picking cycles gain share across household staples.

Virgin Pulp Price and Supply Volatility

Pulp spot prices touched a Producer Price Index level of 219.835 in May 2024, exposing converters that rely on short-term contracts. Mill shutdowns during maintenance cycles tighten supply further, forcing converters to either absorb spikes or pass costs downstream. Integrated majors offset swings by diverting fiber between containerboard and cartonboard machines, yet spot-buying independents face working-capital drains. The resulting spread in cost structures accelerates M&A as sub-scale players seek balance-sheet relief. Hedge-instrument adoption rises, but the effectiveness is diluted by demand unpredictability linked to retail destocking.

Other drivers and restraints analyzed in the detailed report include:

- Premiumization and Shelf-Impact Printing Needs

- Global Plastic-Reduction Regulations

- Substitution by Flexible Pouches

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Healthcare and Pharmaceuticals claimed 17.34% of the folding carton packaging market in 2025 and are poised to climb at a 6.71% CAGR to 2031 on the back of aging demographics and biologic drug launches. Compliance with 21 CFR Part 211 demands tamper-evidence striplines and serialization windows, features readily integrated into folding cartons without adding multilayer complexity. The Food and Beverages category, holding 33.18% of the folding carton packaging market share, sustains volumes through ready-meal adoption and beverage multipacks that benefit from refrigerator-grade coated boards. Meanwhile, Personal Care leans on premium gloss varnishes to anchor shelf differentiation in crowded specialty stores.

Growing clinical trial activity triggers short-run packs that suit digital printing, cutting obsolescence when formulations shift. Carton converters with Class A cleanroom sites out-compete commodity players on contamination control and audit readiness, enabling price premiums even as input costs rise. For mass-market foods, portion-controlled cereal and snack trays rely on lightweight chipboard, underpinning baseline volume and cushioning overall demand swings driven by economic cycles.

The Folding Carton Packaging Market Report is Segmented by End-User Industry (Food and Beverages, Household, Personal Care and Cosmetics, Healthcare and Pharmaceuticals, Tobacco, and Electrical and Hardware), Material Type (Solid Bleached Board, and More), Printing Technology (Offset Lithography, Digital, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Volume (Tonnes).

Geography Analysis

Asia Pacific maintains clear leadership with 38.42% of the folding carton packaging market share in 2025 and is advancing at a 6.82% CAGR as omni-channel retail deepens in China, India, and Indonesia. Chinese converters upscale machinery to meet domestic electronics exporters' stringent burst-strength targets, and government mandates on biodegradability accelerate the adoption of PFAS-free coatings. Japanese premium carton demand rises as convenience-store meal kits proliferate and require freezer-grade board. Meanwhile, South Korea's recyclability grading scheme further standardizes fiber packaging inputs and incentivizes high-yield deinking lines.

North America sustains growth through direct-to-consumer subscription brands that need small-batch cartons with vibrant graphics. International Paper's USD 9.9 billion DS Smith acquisition provides coast-to-coast converting nodes, trimming freight miles, and enhancing responsiveness to regional CPG demand surges. Canadian bans on difficult-to-recycle plastics redirect frozen entrees and dairy products back into cartonboard sleeves. Mexico's near-shoring of electronics assembly escalates demand for ESD-safe carton inserts, pulling imports of virgin Kraft liner from United States mills.

Europe remains innovation-centric, with the Packaging and Packaging Waste Regulation forcing full recyclability by 2028 and eliminating fluorinated barriers by August 2026. Germany, France, and the United Kingdom pioneer digital embellishment lines that marry metallic effects with water-based inks, aligning luxury visual targets with environmental mandates. Eastern European converters secure EU funding to update corrugators, yet cartonboard remains the format of choice for confectionery exports due to its higher shelf impact. The new regulatory certainty galvanizes CapEx in next-generation coating kitchens, nudging flexible-film users to reconsider fiber alternatives for long-shelf-life SKUs.

- Smurfit Westrock plc

- Graphic Packaging International LLC

- Mayr-Melnhof Karton AG

- DS Smith plc

- International Paper Company

- Stora Enso Oyj

- Georgia-Pacific LLC

- Mondi plc

- Huhtamaki Oyj

- Seaboard Folding Box Co. Inc. (Vidya Brands)

- American Carton Company

- All Packaging Company

- Edelmann GmbH

- CCL Healthcare (CCL Industries Inc.)

- Rengo Co., Ltd.

- Sonoco Products Company

- Autajon Group

- Southern Champion Tray

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Sustainability-led shift to recyclable packaging

- 4.2.2 E-commerce packaging demand boom

- 4.2.3 Premiumization and shelf-impact printing needs

- 4.2.4 Global plastic-reduction regulations

- 4.2.5 Digital printing enables short-run micro-targeting

- 4.2.6 Meal-kit and ready-meal subscriptions surge

- 4.3 Market Restraints

- 4.3.1 Virgin pulp price and supply volatility

- 4.3.2 Substitution by flexible pouches

- 4.3.3 Limited recycling for barrier cartons

- 4.3.4 PFAS-free coating compliance costs

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Geopolitical Impact Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VOLUME)

- 5.1 By End-user Industry

- 5.1.1 Food and Beverages

- 5.1.2 Household

- 5.1.3 Personal Care and Cosmetics

- 5.1.4 Healthcare and Pharmaceuticals

- 5.1.5 Tobacco

- 5.1.6 Electrical and Hardware

- 5.2 By Material Type

- 5.2.1 Solid Bleached Board (SBB)

- 5.2.2 Coated Unbleached Kraftboard (CUK)

- 5.2.3 White-lined Chipboard

- 5.2.4 Folding Boxboard

- 5.3 By Printing Technology

- 5.3.1 Offset Lithography

- 5.3.2 Digital (Inkjet / Electrophotography)

- 5.3.3 Flexography

- 5.3.4 Gravure

- 5.3.5 Other Printing Technology

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 Rest of Europe

- 5.4.4 Asia Pacific

- 5.4.4.1 China

- 5.4.4.2 Japan

- 5.4.4.3 India

- 5.4.4.4 South Korea

- 5.4.4.5 Australia and New Zealand

- 5.4.4.6 Rest of Asia Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 Middle East

- 5.4.5.1.1 Saudi Arabia

- 5.4.5.1.2 United Arab Emirates

- 5.4.5.1.3 Rest of Middle East

- 5.4.5.2 Africa

- 5.4.5.2.1 South Africa

- 5.4.5.2.2 Egypt

- 5.4.5.2.3 Rest of Africa

- 5.4.5.1 Middle East

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Smurfit Westrock plc

- 6.4.2 Graphic Packaging International LLC

- 6.4.3 Mayr-Melnhof Karton AG

- 6.4.4 DS Smith plc

- 6.4.5 International Paper Company

- 6.4.6 Stora Enso Oyj

- 6.4.7 Georgia-Pacific LLC

- 6.4.8 Mondi plc

- 6.4.9 Huhtamaki Oyj

- 6.4.10 Seaboard Folding Box Co. Inc. (Vidya Brands)

- 6.4.11 American Carton Company

- 6.4.12 All Packaging Company

- 6.4.13 Edelmann GmbH

- 6.4.14 CCL Healthcare (CCL Industries Inc.)

- 6.4.15 Rengo Co., Ltd.

- 6.4.16 Sonoco Products Company

- 6.4.17 Autajon Group

- 6.4.18 Southern Champion Tray

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment