|

市場調查報告書

商品編碼

1907339

潤滑油添加劑:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Lubricant Additives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

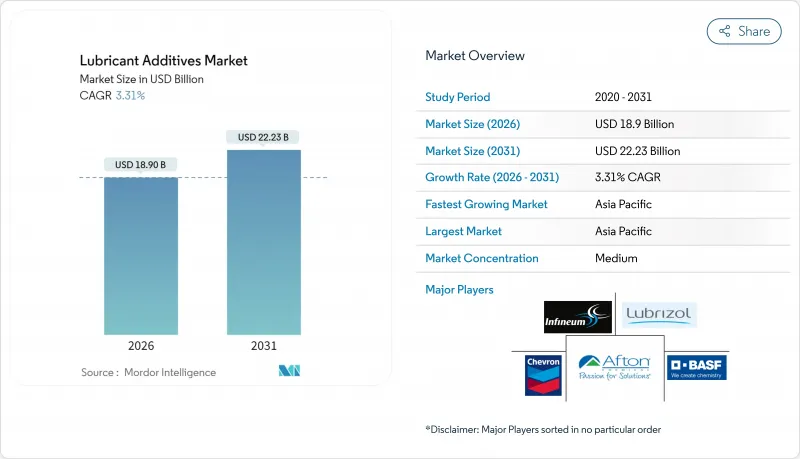

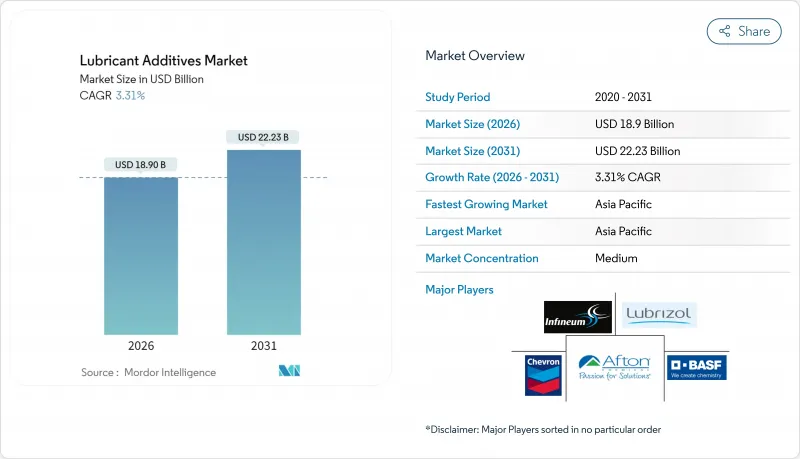

預計到 2026 年,潤滑油添加劑市場規模將達到 189 億美元,高於 2025 年的 182.9 億美元。預計到 2031 年,該市場規模將達到 222.3 億美元,2026 年至 2031 年的複合年成長率為 3.31%。

這一穩步擴張反映了潤滑油產業從銷售主導成長轉變為價值驅動型創新的趨勢,而高階添加劑化學技術抵消了潤滑油需求放緩的影響。以2025年3月推出的ILSAC GF-7為首的不斷完善的監管體系,正在加速採用先進的多功能添加劑,以滿足更嚴格的排放氣體和更低的黏度要求。亞太地區擁有最大的區域市場佔有率和最高的成長勢頭,中國和印度製造業的擴張支撐了汽車和工業潤滑油的強勁消費。競爭格局強調技術差異化而非價格優勢,例如路博潤於2025年2月推出的新一代低SAP機油的Solsperse W60超分散劑。儘管延長換油週期和電氣化限制了添加劑的使用,但奈米級創新和更嚴格的排放氣體法規仍在持續推動高價值解決方案的需求。

全球潤滑油添加劑市場趨勢與洞察

嚴格的排放氣體環境法規

ILSAC GF-7 標準將於 2025 年 3 月生效,該標準要求添加劑供應商在更嚴格的磷和硫含量限制下,保護正時鏈條並抑制低速預燃。針對 SAE 0W-16 機油的全新歐洲 ACEA 2023 C7 等級,正在黏度指數增進劑,這些改進劑和改進劑能夠比基礎油提高至少 0.3% 的燃油經濟性。隨著汽車製造商轉向 0W-8 等級的機油,添加劑配方必須在燃油經濟性、抗磨性能和抗氧化穩定性之間取得平衡。這種平衡提升了高純度清潔劑和先進抗磨增強劑的價值。區域監管趨同加速了性能標準的全球統一,鼓勵跨國供應商投資於通用型添加劑平台,而不是針對特定區域的配方。能夠快速獲得認證的供應商將增強其與調配商和原始設備製造商 (OEM) 的談判地位。

中東和非洲工業基礎設施的擴張

沙烏地阿拉伯的「2030願景」下游多元化計畫正在創建合資企業,旨在更靠近豐富的原料產地生產添加劑。例如,沙烏地阿美與嘉實多的合資工廠以及瑞富集團與法拉比石化公司的合作項目,都體現了該地區邁向自力更生的步伐。一體化綜合設施將降低依賴進口的非洲製造商的物流成本,並縮短紅海走廊沿線客戶的前置作業時間。從長遠來看,這些投資將建立一個出口基地,以滿足亞太地區不斷成長的需求,同時保護當地調配商免受全球運費波動的影響。區域各國政府也正在透過稅收優惠和地租優惠等誘因來促進特種化學品叢集的發展,從而提高新設施的財務可行性。隨著產能的擴大,添加劑供應商將能夠根據中東和非洲市場獨特的極端氣候和燃料特性來調整其配方。

延長車輛和機械的換油週期

在美國,乘用車的換油週期已從5000英里延長至10000英里,風力發電機機齒輪箱的潤滑油壽命目標為36個月。內置於過濾器中的狀態監測感測器可實現數據驅動的維護,將維護推遲到油氧化或顆粒物含量觸發警報。雖然每次加註潤滑油時的添加劑含量增加,但年度添加劑總用量卻在下降。這促使潤滑油調配公司將銷售重心轉向高階長效品牌,給專注於通用化學品的供應商帶來了壓力。獨立維修店的業務收益下降,推動了消費者延長換油週期的做法。為了彌補這一損失,添加劑生產商正在推廣清潔液和過濾器調節片等輔助產品,但這些產品的普及程度有限。

細分市場分析

到2025年,分散劑和乳化劑將佔總收入的29.13%,這反映了它們在保持煙塵和氧化副產物懸浮以及防止清漆形成方面發揮的關鍵作用。隨著原始設備製造商(OEM)轉向顆粒物負荷更高的缸內噴油引擎,預計到2031年,該細分市場將以4.32%的複合年成長率成長,超過潤滑油添加劑市場的整體增速。受分散劑驅動的潤滑油添加劑市場規模預計將穩步擴大,因為對硫酸鹽灰分和磷含量的監管限制日益嚴格,推動了對能夠在低添加劑下發揮作用的高效聚異丁烯琥珀醯亞胺化學品的需求。

由於市場轉向使用低黏度等級(例如 0W-8)的潤滑油,聚合物基黏度指數增進劑佔據了第二大市場佔有率。低黏度等級的潤滑油即使在高溫運作環境下也需要更強的油膜強度。隨著換油週期的延長,保持基礎油黏度變得越來越重要,因此清潔劑和腐蝕抑制劑的需求保持穩定。摩擦改良劑在乘用車和重型機油中的重要性日益凸顯,這些潤滑油正力求提高 1% 的燃油經濟性。同時,極壓添加劑在工業齒輪油和金屬加工液中仍發揮核心作用。供應商正在將這些化學品整合到多功能配方中,並在嚴格的灰分預算內最佳化用量。這一趨勢使得配方師能夠用更少的 SKU 滿足全球引擎測試標準。

潤滑油添加劑報告按功能類型(分散劑/乳化劑、黏度指數增進劑、清潔劑、腐蝕抑制劑等)、潤滑油類型(引擎油、變速箱/液壓油、金屬加工液等)、最終用戶產業(汽車/其他運輸設備、發電、重型機械等)和地區(亞太地區、北美、歐洲等)進行分析。

區域分析

預計到2025年,亞太地區將以45.05%的市佔率引領全球市場,並在2031年之前維持3.98%的複合年成長率。中國垂直整合的石化聯合企業生產價格具競爭力的II類和III類基礎油,供應添加劑調配廠,從而滿足國內和出口需求。印度正利用與生產掛鉤的激勵措施吸引對特種化學品產業的投資,將其打造成為東協組裝的採購中心。日本和韓國提供獨特的聚合物改質劑和高純度分散劑,而泰國和越南則為區域內原始設備製造商(OEM)的售後服務項目提供經濟高效的調配服務。

北美在製定全球性能規範方面仍然發揮著重要作用。總部位於美國的API和ILSAC委員會主導新類別的引進,並推動著配套添加劑測試通訊協定在全球的普及。儘管車輛電氣化和延長換油週期限制了銷售成長,但該地區的車隊所有者仍然要求更高的抗氧化穩定性和燃油經濟性,從而保持添加劑的高單位價值。墨西哥汽車組裝能的擴張進一步支撐了區域需求,因為原始設備製造商(OEM)正在將其供應鏈本地化,以遵守貿易協定中在地採購限制。

歐洲擁有成熟的車輛保有量,並實施全球最高標準的環保法規。 ACEA 2023 標準和提案的歐 VII 標準強制要求潤滑油與顆粒過濾器相容,並採用超低黏度等級,這迫使配方師在灰分限制和渦輪增壓器清潔度之間取得平衡。德國化工巨頭供應先進的抗氧化劑和摩擦改進劑,而英國擁有重要的添加劑研發中心。俄羅斯的地緣政治局勢限制了技術轉讓,但其國內調配商仍在繼續使用傳統的工業潤滑油添加劑。

南美洲正經歷溫和擴張,其中巴西引領成長,農業機械化程度的提高帶動了重型柴油潤滑油消費量的成長。阿根廷的能源改革促進了頁岩氣開發,從而帶動了對齒輪油和鑽井設備液壓油的需求。沙烏地阿拉伯的「2030願景」下游計劃以及阿拉伯聯合大公國致力於成為區域海事服務中心的努力,都刺激了對船用和工業潤滑油的需求。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 嚴格的排放氣體環境法規

- 中東和非洲工業產能擴張

- 亞太地區汽車潤滑油需求激增

- 汽車製造商正擴大轉向高性能機油

- 奈米添加劑封裝技術的出現

- 市場限制

- 延長車輛和機械的更換週期

- 透過電氣化降低引擎機油消耗

- PIB 和其他關鍵化學品的供應不穩定

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 依功能類型

- 分散劑和乳化劑

- 黏度指數增進劑

- 清潔劑

- 腐蝕抑制劑

- 抗氧化劑

- 極壓添加劑

- 摩擦改進劑(FM)

- 其他函數類型

- 按潤滑劑類型

- 機油

- 傳動和液壓油

- 金屬加工油

- 通用工業油

- 齒輪油

- 潤滑脂

- 加工油

- 其他潤滑劑類型

- 按最終用戶行業分類

- 汽車和其他運輸設備

- 發電

- 重型機械

- 冶金與金屬加工

- 食品/飲料

- 其他終端用戶產業

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- ASEAN

- 亞太其他地區

- 北美洲

- 美國

- 墨西哥

- 加拿大

- 歐洲

- 德國

- 英國

- 俄羅斯

- 義大利

- 法國

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介{包括全球概覽、市場概覽、核心業務板塊、現有財務資訊、策略資訊、主要企業市場排名/佔有率、產品和服務以及近期發展動態}

- AFTON CHEMICAL

- BASF

- BRB International BV

- Chevron Corporation

- DOG Deutsche Oelfabrik

- Dorf Ketal Chemicals

- Dover Chemical Corporation

- Evonik Industries AG

- GANESH BENZOPLAST LIMITED.

- INFINEUM INTERNATIONAL LIMITED

- ITALMATCH CHEMICALS SPA

- Kangtai Lubricant Additives Co., Ltd.

- King Industries, Inc.

- Lanxess

- MULTISOL LIMITED

- Nouryon

- RT Vanderbilt Holding Company, Inc.

- Shepherd Chemical

- The Lubrizol Corporation

- Wuxi South Petroleum Additives Co., Ltd.

第7章 市場機會與未來展望

Lubricant Additives Market size in 2026 is estimated at USD 18.9 billion, growing from 2025 value of USD 18.29 billion with 2031 projections showing USD 22.23 billion, growing at 3.31% CAGR over 2026-2031.

This measured expansion reflects the industry's shift from volume-driven growth toward value-focused innovation, where premium additive chemistries offset moderating lubricant demand. Rising regulatory stringency, led by the March 2025 introduction of ILSAC GF-7, has accelerated the uptake of sophisticated multi-functional packages that support tighter emission limits and lower viscosities. Asia-Pacific commands both the largest regional presence and the highest growth momentum because manufacturing expansion in China and India underpins robust automotive and industrial lubricant consumption. Competitive dynamics emphasize technology differentiation rather than price, exemplified by Lubrizol's launch of Solsperse W60 Hyperdispersant in February 2025, a product positioned for next-generation low-SAPs engine oils. Extended drain intervals and electrification temper absolute additive volumes, yet nano-scale innovations and stricter emission standards sustain demand for high-value solutions.

Global Lubricant Additives Market Trends and Insights

Stringent Environmental Regulations on Emissions

ILSAC GF-7 took effect in March 2025 and compels additive suppliers to mitigate low-speed pre-ignition while safeguarding timing chains under tighter phosphorus and sulfur caps. New ACEA 2023 C7 categories in Europe target SAE 0W-16 oils, spurring demand for friction modifiers and viscosity index improvers that deliver at least 0.3% fuel-economy gains versus reference oils. As OEMs push toward 0W-8 grades, additive formulations must reconcile fuel efficiency with wear protection and oxidative stability. This balancing act elevates the value of high-purity detergent chemistries and advanced antiwear boosters. Regulatory convergence across regions accelerates global harmonization of performance standards, incentivizing multinational suppliers to invest in versatile additive platforms rather than region-specific blends. Suppliers that demonstrate rapid certification capabilities secure stronger bargaining power with both blenders and OEMs.

Industrial Capacity Build-up in MEA

Downstream diversification programs under Saudi Arabia's Vision 2030 have triggered joint ventures that localize additive production close to abundant feedstocks. Projects such as the prospective Aramco-Castrol facility and Richful Group's partnership with Farabi Petrochemicals illustrate regional momentum toward self-reliance. Integrated complexes lower logistics costs for import-dependent African manufacturers and shorten lead times for customers across the Red Sea corridor. Over the long term, these investments create an export platform serving Asia-Pacific demand spikes while insulating local blenders from global freight volatility. Regional governments also incentivize specialty chemical clusters through tax holidays and preferential land leases, amplifying the financial viability of greenfield facilities. As installed capacity rises, additive suppliers can tailor formulations to climatic extremes and fuel qualities characteristic of MEA markets.

Extended Drain Intervals in Vehicles and Machinery

Passenger-car oil-change intervals in the United States have doubled from 5,000 miles to 10,000 miles, while wind-turbine gearboxes now target 36-month lubricant life cycles. Condition-monitoring sensors embedded in filters enable data-driven maintenance that defers service until oil oxidation or particle levels trigger alarms. Although each oil fill contains a higher additive loading, the aggregate annual additive volume contracts. Blenders therefore shift marketing toward premium long-life brands, squeezing suppliers focused on commodity chemistries. Independent workshops lose service revenue, reinforcing consumer adoption of extended intervals. To compensate, additive manufacturers promote supplemental products such as flush fluids and filter-conditioner tablets, but uptake remains limited.

Other drivers and restraints analyzed in the detailed report include:

- Surging Automotive Lubricant Demand in Asia-Pacific

- Rising OEM Shift to High-Performance Engine Oils

- Electrification Curbing Engine-Oil Volumes

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Dispersants and emulsifiers accounted for 29.13% of 2025 revenues, reflecting their critical role in keeping soot and oxidation by-products suspended to prevent varnish formation. The segment is forecast to grow at a 4.32% CAGR through 2031, outpacing the lubricant additives market as OEMs migrate to gasoline direct-injection engines with elevated particulate loading. The lubricant additives market size attributed to dispersants is projected to expand steadily because regulatory caps on sulfated ash and phosphorus intensify the need for highly efficient polyisobutylene succinimide chemistries that operate at lower treat rates.

Polymeric viscosity index improvers hold the second-largest share, benefiting from the pivot toward low-viscosity grades such as 0W-8 that require robust film strength at high operating temperatures. Detergents and corrosion inhibitors enjoy stable demand as extended drain intervals magnify the importance of base-number retention. Friction modifiers gain relevance in passenger-car and heavy-duty oils targeting a 1% fuel-economy improvement, while extreme-pressure additives remain core to industrial gear oils and metalworking fluids. Suppliers consolidate these chemistries into multi-functional packages to optimize treat levels within stringent ash budgets, a trend that enables formulators to meet global engine-test matrices with fewer SKUs.

The Lubricant Additives Report is Segmented by Function Type (Dispersants and Emulsifiers, Viscosity Index Improvers, Detergents, Corrosion Inhibitors, and More), Lubricant Type (Engine Oil, Transmission and Hydraulic Fluid, Metalworking Fluid, and More), End-User Industry (Automotive and Other Transportation, Power Generation, Heavy Equipment, and More), and Geography (Asia-Pacific, North America, Europe, and More).

Geography Analysis

Asia-Pacific dominated the global landscape with 45.05% share in 2025 and is anticipated to register a 3.98% CAGR through 2031. China's vertically integrated petrochemical complexes generate competitively priced Group II and Group III base oils that feed additive blend plants, supporting local and export demand. India leverages production-linked incentives to attract investment in specialty chemicals, transforming the country into a sourcing hub for ASEAN assemblers. Japan and South Korea contribute proprietary polymer modifiers and high-purity dispersants, while Thailand and Vietnam offer cost-efficient blending services for regional OEM service-fill programs.

North America retains significant influence through its role in setting global performance specifications. API and ILSAC committees headquartered in the United States drive new category introductions, compelling worldwide adoption of accompanying additive test protocols. While vehicle electrification and extended drain intervals temper volume growth, fleet owners in the region demand superior oxidative stability and fuel-efficiency credentials, sustaining high per-unit additive value. Mexico's expanding automotive assembly capacity further underpins regional demand as OEMs localize supply chains to meet trade-agreement content rules.

Europe combines a mature car parc with some of the world's strictest environmental regulations. ACEA 2023 standards and Euro VII proposals mandate particulate filter compatibility and ultra-low-viscosity grades, forcing formulators to balance ash limits against turbocharger cleanliness. German chemical majors supply advanced antioxidants and friction modifiers, while the United Kingdom maintains notable additive research and development hubs. Russia's geopolitical situation restricts technology transfer, yet domestic blenders continue to consume traditional additive packages for industrial oils.

South America experiences moderate expansion led by Brazil, where agricultural mechanization boosts heavy-duty diesel lubricant consumption. Energy reforms in Argentina encourage shale development, translating into gear-oil and hydraulic-fluid demand for drilling equipment. Saudi Arabia's Vision 2030 downstream projects and United Arab Emirates' push to become a regional maritime services center stimulate demand for marine and industrial lubricants.

- AFTON CHEMICAL

- BASF

- BRB International BV

- Chevron Corporation

- D.O.G Deutsche Oelfabrik

- Dorf Ketal Chemicals

- Dover Chemical Corporation

- Evonik Industries AG

- GANESH BENZOPLAST LIMITED.

- INFINEUM INTERNATIONAL LIMITED

- ITALMATCH CHEMICALS SPA

- Kangtai Lubricant Additives Co., Ltd.

- King Industries, Inc.

- Lanxess

- MULTISOL LIMITED

- Nouryon

- RT Vanderbilt Holding Company, Inc.

- Shepherd Chemical

- The Lubrizol Corporation

- Wuxi South Petroleum Additives Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent environmental regulations on emissions

- 4.2.2 Industrial capacity build-up in MEA

- 4.2.3 Surging automotive lubricant demand in Asia-Pacific

- 4.2.4 Rising OEM shift to high-performance engine oils

- 4.2.5 Emergence of nano-additive packages

- 4.3 Market Restraints

- 4.3.1 Extended drain intervals in vehicles and machinery

- 4.3.2 Electrification curbing engine-oil volumes

- 4.3.3 Volatile supply of PIB and other key chemistries

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Function Type

- 5.1.1 Dispersants and Emulsifiers

- 5.1.2 Viscosity Index Improvers

- 5.1.3 Detergents

- 5.1.4 Corrosion Inhibitors

- 5.1.5 Oxidation Inhibitors

- 5.1.6 Extreme-pressure Additives

- 5.1.7 Friction Modifiers (FM)

- 5.1.8 Other Function Types

- 5.2 By Lubricant Type

- 5.2.1 Engine Oil

- 5.2.2 Transmission and Hydraulic Fluid

- 5.2.3 Metalworking Fluid

- 5.2.4 General Industrial Oil

- 5.2.5 Gear Oil

- 5.2.6 Grease

- 5.2.7 Process Oil

- 5.2.8 Other Lubricant Types

- 5.3 By End-user Industry

- 5.3.1 Automotive and Other Transportation

- 5.3.2 Power Generation

- 5.3.3 Heavy Equipment

- 5.3.4 Metallurgy and Metal Working

- 5.3.5 Food and Beverage

- 5.3.6 Other End-Users Industries

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Mexico

- 5.4.2.3 Canada

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Russia

- 5.4.3.4 Italy

- 5.4.3.5 France

- 5.4.3.6 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles {includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments}

- 6.4.1 AFTON CHEMICAL

- 6.4.2 BASF

- 6.4.3 BRB International BV

- 6.4.4 Chevron Corporation

- 6.4.5 D.O.G Deutsche Oelfabrik

- 6.4.6 Dorf Ketal Chemicals

- 6.4.7 Dover Chemical Corporation

- 6.4.8 Evonik Industries AG

- 6.4.9 GANESH BENZOPLAST LIMITED.

- 6.4.10 INFINEUM INTERNATIONAL LIMITED

- 6.4.11 ITALMATCH CHEMICALS SPA

- 6.4.12 Kangtai Lubricant Additives Co., Ltd.

- 6.4.13 King Industries, Inc.

- 6.4.14 Lanxess

- 6.4.15 MULTISOL LIMITED

- 6.4.16 Nouryon

- 6.4.17 RT Vanderbilt Holding Company, Inc.

- 6.4.18 Shepherd Chemical

- 6.4.19 The Lubrizol Corporation

- 6.4.20 Wuxi South Petroleum Additives Co., Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment