|

市場調查報告書

商品編碼

1907307

銦鎵鋅氧化物(IGZO):市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Indium Gallium Zinc Oxide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

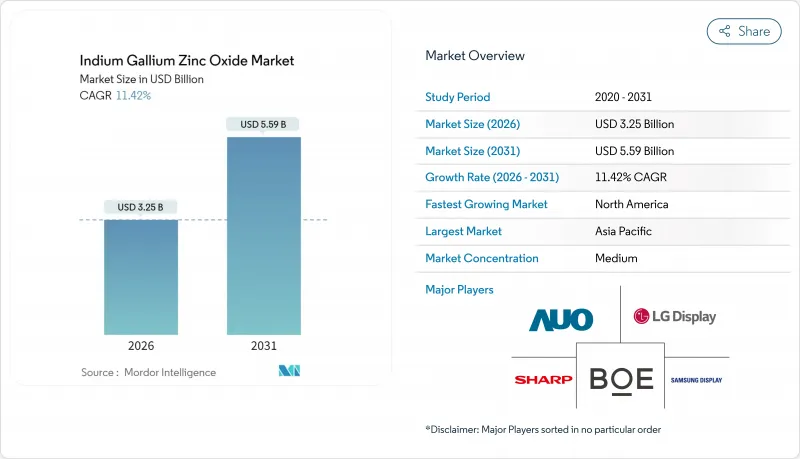

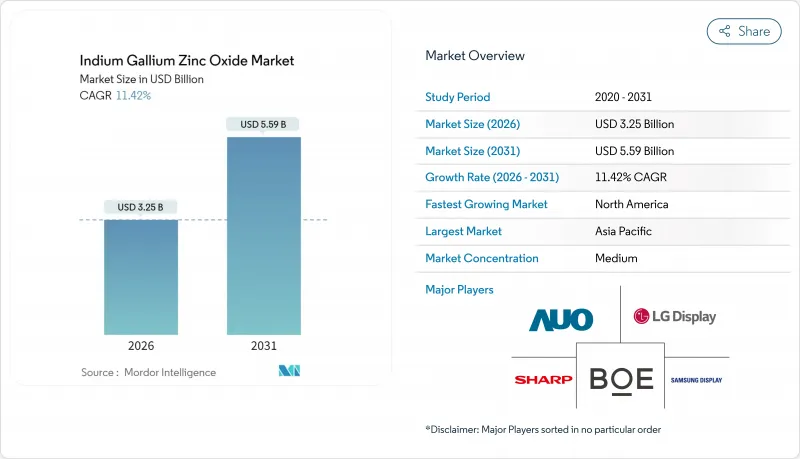

2025 年銦鎵鋅氧化物 (IGZO) 市值為 29.2 億美元,預計到 2031 年將達到 55.9 億美元,高於 2026 年的 32.5 億美元。

預計在預測期(2026-2031 年)內,複合年成長率將達到 11.42%。

這一成長動能主要得益於顯示器製造商向氧化物薄膜電晶體(TFT)的轉型,與傳統的矽背板相比,TFT能夠實現更高的解析度和更低的功耗。消費者對節能型智慧型手機、筆記型電腦和大尺寸電視的偏好日益成長,恰逢亞洲氧化物TFT產能的提升。此外,市場也正在加速採用銦鎵鋅氧化物(IGZO)技術,應用於折疊式顯示器和汽車顯示器,因為這些應用對機械柔軟性和寬溫域穩定性要求極高。同時,主要面板供應商的垂直整合正在縮短開發週期,使IGZO在成本上能夠與成熟的矽技術相媲美。

全球銦鎵鋅氧化物(IGZO)市場趨勢及展望

高解析度OLED和8K電視的需求激增

向 8K 電視面板的過渡需要非晶質無法匹敵的高速開關性能。 IGZO 的高電子遷移率能夠實現高密度電晶體陣列,這對於超高清內容至關重要,同時還能保持面板效率。 LG Display 於 2024 年開始量產 13 吋疊層 OLED 筆記型電腦面板,採用氧化物 TFT 背板技術,與層級構造相比,功耗降低了 40%。三星也在其透明電視原型機中使用了 IGZO,利用較小的電晶體在不犧牲驅動電流的情況下傳輸更多光線。隨著廣播公司和串流媒體公司大力推廣 8K 內容,面板製造商正將氧化物 TFT 定位為在不超出功耗預算的情況下保持亮度裕度的唯一可擴展方案。

對節能型攜帶式設備的需求

智慧型手機和筆記型電腦製造商正努力在不犧牲更新率的前提下延長電池續航時間。 IGZO 背板在顯示靜態影像時可承受微安培等級漏電流,進而將面板功耗降低高達 50%。 Imec 展示了基於 IGZO 的動態隨機存取記憶體 (DRAM) 單元,其能源效率優於傳統 SRAM,這標誌著氧化物技術在低功耗運算模組中已廣泛應用。蘋果公司已將其第二代 LTPO 堆疊中的所有驅動 TFT 都升級為 IGZO,並報告智慧型手錶的能源效率提高了 5% 至 15%。隨著遠端辦公設備需求的不斷成長,顯示器電力消耗仍然是關注的焦點,這為銦鎵鋅氧化物 (IGZO) 提供了長期的市場成長前景。

與 LTPS/LTPO 矽背板的競爭

面板製造商已在低溫多晶矽生產線上投入巨資,這些生產線已達到旗艦智慧型手機的性能目標。低溫多晶矽(LTPS)具有更高的電洞遷移率,並透過實現複雜的面板電路來減少驅動單元的數量。蘋果公司繼續在iPhone顯示器中使用低溫多晶矽,並選擇性地添加銦鎵鋅氧化物(IGZO),這表明他們採取的是混合策略,而非完全轉向。製程的成熟和成熟的晶圓廠產量比率曲線使得矽在成本敏感領域具有吸引力。這種現有的資本基礎限制了銦鎵鋅氧化物(IGZO)市場在某些高階細分市場的近期成長潛力。

細分市場分析

到2025年,智慧型手機領域將佔據銦鎵鋅氧化物(IGZO)市場43.95%的佔有率,這主要得益於氧化物薄膜電晶體(TFT)的廣泛應用。氧化物TFT在提高像素密度的同時,也能降低電池消耗。可折疊和軟性顯示器將超越其他應用領域,到2031年將以12.63%的複合年成長率成長,這得益於IGZO優異的機械穩定性,即使經過數千次彎曲也能保持其柔韌性。平板電腦和二合一電腦利用氧化物背板在大螢幕上保持均勻亮度,這對於創新專業人士來說至關重要。穿戴式裝置將利用IGZO的超低關斷電流特性,在緊湊的機殼中顯著延長電池續航力。電視和大型面板將利用氧化物的柔韌性,實現8K解析度和透明模式,從而重新定義觀看體驗。

二線應用也在不斷擴展。隨著駕駛座數位化,汽車顯示器正逐步過渡到IGZO技術,以避免矽材料因高溫和振動而導致的劣化。工業和監護儀也正在整合氧化物TFT,以提高手術和製程控制中的影像精度。這些多樣化的應用場景正在推動銦鎵鋅氧化物(IGZO)應用市場規模的擴大,並支撐著均衡的需求結構,從而緩解單一最終產品週期性波動的影響。

截至2025年,家用電子電器將佔銦鎵鋅氧化物(IGZO)市場59.55%的佔有率,這反映了該技術起源於行動裝置和電視製造。汽車和交通運輸行業將以12.44%的複合年成長率(CAGR)實現最快成長,因為原始設備製造商(OEM)正在用全景數位儀表板取代類比儀表。醫療機構正在利用IGZO的影像保真度來製造診斷監視器,而工業應用則在工廠車間部署堅固耐用的氧化物面板。航太和國防領域正在採用氧化物薄膜電晶體(TFT)來製造航空電子設備,因為這些應用對抗輻射性和熱穩定性要求很高。

跨產業的成長動能正吸引新的資本流入氧化物供應鏈。京東方投資45吋9K氧化物面板用於汽車應用,顯示市場對高效節能背板能夠滿足嚴格的汽車安全和亮度標準越來越有信心。這種多元化發展增強了市場韌性,降低了對消費者升級的依賴,並拓寬了銦鎵鋅氧化物(IGZO)市場的收入基礎。

銦鎵鋅氧化物 (IGZO) 市場報告按應用領域(智慧型手機、功能手機等)、終端用戶產業(家用電子電器等)、顯示技術(LCD、OLED 等)、沉積技術(射頻磁控濺鍍等)、導電相(非晶質IGZO 等)和地區(北美、南美等)進行細分。市場預測以美元 (USD) 為以金額為準。

區域分析

2025年,亞太地區將佔據銦鎵鋅氧化物(IGZO)市場65.20%的營收佔有率,京東方(BOE)、LG Display和三星顯示器(Samsung Display)等廠商將擴大其氧化物TFT生產線,以滿足全球對OLED智慧型手機和電視的需求。中國計劃在2025年佔全球76%的OLED產能,其中IGZO背板訂單量大規模。日本憑藉單晶氧化物薄膜技術的研發,持續保持在該領域的主導;而韓國則利用混合LTPO-IGZO堆疊技術,確保其旗艦產品始終處於技術前沿。

北美地區成長最快,複合年成長率達12.18%,這主要得益於蘋果公司對氧化物技術的日益普及以及該地區對AR/ VR頭戴裝置,而這些設備需要高解析度、低延遲的顯示器。應用材料公司累計,2024年第三季顯示器相關業務收入將達到15.8億美元,到年底先進製程節點業務收入將達到25億美元,凸顯了為支援區域產能擴張而不斷成長的設備需求。

歐洲專注於汽車和工業領域的應用,在這些領域,能源效率與永續性的需求不謀而合。當地研究機構正主導鎵和鍺回收的研究,以緩解氧化物薄膜電晶體(TFT)生產中的原料壓力。在中東、非洲和拉丁美洲,家用電子電器的日益普及帶來了不斷成長的需求,為銦鎵鋅氧化物(IGZO)市場創造了長期成長潛力。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 高解析度OLED和8K電視的需求激增

- 對節能型行動裝置的需求

- 折疊式和軟性顯示器的快速普及

- 採用低洩漏IGZO背板的穿戴式裝置普及

- 整合到空間計算頭戴式設備(AR/VR/MR)

- 用於神經形態記憶體內運算的IGZO陣列

- 市場限制

- 與 LTPS/LTPO 矽背板的競爭

- 銦供應鏈波動及定價

- 廢棄IGZO濺鍍靶材的回收率低

- 潮濕環境中因亞能隙缺陷所引起的電流漂移

- 價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 宏觀經濟因素如何影響市場

第5章 市場規模與成長預測

- 透過使用

- 智慧型手機和功能手機

- 平板電腦和二合一電腦

- 穿戴式裝置

- 電視機和大顯示螢幕

- 汽車顯示器

- 工業和醫療顯示器

- 按最終用途行業分類

- 家用電子電器

- 汽車和運輸設備

- 衛生保健

- 工業和製造業

- 航太/國防

- 其他

- 透過顯示技術

- 液晶顯示器

- 有機發光二極體

- 微型LED和迷你LED

- 電子紙和其他新興技術

- 透過成膜技術

- 射頻磁控濺射

- 脈衝直流磁控濺射

- 原子層沉積法

- 解決方案/噴墨列印

- 其他技術

- 透過傳導階段

- 非晶質IGZO

- 多晶IGZO

- 單晶IGZO

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 亞太其他地區

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 其他中東地區

- 非洲

- 南非

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Sharp Corporation

- LG Display Co., Ltd.

- Samsung Display Co., Ltd.

- AU Optronics Corp.

- BOE Technology Group Co., Ltd.

- Japan Display Inc.

- Tianma Microelectronics Co., Ltd.

- Apple Inc.

- Sony Group Corporation

- ASUS(ASUSTeK Computer Inc.)

- Panasonic Holdings Corporation

- Innolux Corporation

- Visionox Technology, Inc.

- Everdisplay Optronics(Shanghai)Co., Ltd.

- TCL China Star Optoelectronics Technology Co., Ltd.

- Kunshan GVO Optoelectronics Co., Ltd.

- Fujitsu Limited

- Rohm Semiconductor

- ULVAC, Inc.

- Applied Materials, Inc.

第7章 市場機會與未來展望

The Indium gallium zinc oxide market was valued at USD 2.92 billion in 2025 and estimated to grow from USD 3.25 billion in 2026 to reach USD 5.59 billion by 2031, at a CAGR of 11.42% during the forecast period (2026-2031).

This momentum comes from display makers migrating to oxide-based thin-film transistors that enable sharper resolution and lower power draw than legacy silicon backplanes. Growing consumer preference for energy-efficient smartphones, laptops, and large-format TVs aligns with the rising supply of oxide TFT capacity across Asia. Indium gallium zinc oxide market adoption also accelerates in foldable and automotive displays, where mechanical flexibility and wide-temperature stability are critical. At the same time, vertical integration by major panel vendors shortens development cycles and brings cost parity with mature silicon technologies.

Global Indium Gallium Zinc Oxide Market Trends and Insights

Surge in High-Resolution OLED and 8K TV Demand

Migration to 8K television panels raises switching-speed requirements that amorphous silicon struggles to meet. IGZO's higher electron mobility enables dense transistor arrays essential for ultra-high-definition content while preserving panel efficiency. LG Display began mass production of 13-inch tandem OLED laptop panels in 2024 that cut power use 40% relative to single-layer stacks, a milestone made possible by oxide TFT backplanes. Samsung is also applying IGZO to transparent TV prototypes, leveraging smaller transistors that transmit more light without sacrificing drive current. As broadcasters and streaming firms promote 8K content, panel makers view oxide TFTs as the only scalable route to maintain brightness headroom without overshooting power budgets.

Requirement for Energy-Efficient Portable Devices

Smartphone and laptop brands seek longer battery life without sacrificing refresh rates. IGZO backplanes allow displays to retain static images at micro-ampere leakage levels, reducing panel power by up to 50%. Imec demonstrated IGZO-based dynamic RAM cells that outperform conventional SRAM in energy efficiency, hinting at wider oxide adoption in low-power computing blocks. Apple moved all drive TFTs in its second-generation LTPO stacks to IGZO, reporting 5-15% efficiency gains in smartwatches. Rising demand for remote work devices keeps display power under scrutiny, securing a long runway for Indium gallium zinc oxide market growth.

Competition from LTPS/LTPO Silicon Backplanes

Panel makers have invested heavily in low-temperature polysilicon lines that already meet flagship smartphone performance targets. LTPS offers higher hole mobility, facilitating complex on-panel circuitry that can reduce driver count. Apple continues to employ LTPO silicon on iPhone displays and adds IGZO selectively, showing a hybrid path rather than a full switch. Process maturity and fabs' established yield curves make silicon variants attractive where cost sensitivity is high. This entrenched capital base tempers near-term upside for the Indium gallium zinc oxide market in certain premium segments.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Adoption in Foldable and Flexible Displays

- Proliferation of Wearables Using Low-Leakage IGZO Backplanes

- Supply-Chain Volatility and Pricing of Indium

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The smartphone segment captured 43.95% of the Indium gallium zinc oxide market in 2025 owing to oxide TFT adoption that boosts pixel density without draining batteries. Foldable and flexible displays post a 12.63% CAGR to 2031, outpacing all other uses as IGZO's mechanical stability keeps mobility intact across thousands of bends. Tablets and 2-in-1 PCs leverage oxide backplanes to maintain uniform luminance on larger screens, a key spec for creative professionals. Wearables exploit IGZO's ultra-low off-current to multiply battery life in compact housings. TVs and large-format panels apply oxide mobility to unlock 8K and transparent modes that redefine viewing experiences.

Second-tier applications are also scaling. Automotive displays migrate to IGZO for cockpit digitization, where heat and vibration would otherwise degrade silicon. Industrial and medical monitors integrate oxide TFTs for image criticality in surgery and process control. These diverse use cases collectively lift the Indium gallium zinc oxide market size for applications, supporting a balanced demand profile that cushions cyclical shifts in any single end product.

Consumer electronics owned 59.55% of the Indium gallium zinc oxide market size in 2025, reflecting the technology's roots in mobile and TV manufacturing. Automotive and transportation exhibit the fastest climb at 12.44% CAGR as OEMs replace analog gauges with panoramic digital dashboards. Healthcare facilities favor IGZO's image fidelity for diagnostic monitors, while industrial players deploy rugged oxide panels on factory floors. Aerospace and defense adopt oxide TFTs for avionics, where radiation tolerance and thermal stability are mandatory.

Cross-industry momentum brings fresh capital into oxide supply chains. BOE's investment in 45-inch 9K oxide panels for vehicles signals growing confidence that power-efficient backplanes can meet stringent in-car safety and brightness standards. Such diversification strengthens market resilience, reducing reliance on consumer upgrades alone and widening the revenue canvas for the Indium gallium zinc oxide market.

The Indium Gallium Zinc Oxide Report is Segmented by Application (Smartphones and Feature Phones, and More), End-Use Industry (Consumer Electronics, and More), Display Technology (LCD, OLED, and More), Deposition Technology (RF Magnetron Sputtering, and More), Conductivity Phase (Amorphous IGZO, and More), and Geography (North America, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific commanded 65.20% of the Indium gallium zinc oxide market revenue in 2025 as BOE, LG Display, and Samsung Display ramped oxide TFT lines to feed the global appetite for OLED phones and TVs. China alone plans to control 76% of world OLED capacity by 2025, funnelling large orders for IGZO backplanes. Japan maintains research leadership through advances in single-crystal oxide films, while South Korea leverages hybrid LTPO-IGZO stacks to keep flagship devices on the cutting edge.

North America is the fastest-growing region at 12.18% CAGR, thanks to Apple's broadening oxide adoption and the region's push into AR/VR headsets that demand high-resolution, low-latency displays. Applied Materials booked USD 1.58 billion in Q3 2024 display-related revenue and projects USD 2.5 billion from advanced nodes by year-end, underscoring equipment momentum behind regional capacity expansion.

Europe follows with a focus on automotive and industrial deployments where energy efficiency aligns with sustainability mandates. Research institutes there lead gallium and germanium recycling studies aimed at easing raw-material pressure on oxide TFT production. Middle East and Africa plus Latin America show emerging uptake as consumer electronics penetration deepens, creating long-term whitespace for the Indium gallium zinc oxide market.

- Sharp Corporation

- LG Display Co., Ltd.

- Samsung Display Co., Ltd.

- AU Optronics Corp.

- BOE Technology Group Co., Ltd.

- Japan Display Inc.

- Tianma Microelectronics Co., Ltd.

- Apple Inc.

- Sony Group Corporation

- ASUS (ASUSTeK Computer Inc.)

- Panasonic Holdings Corporation

- Innolux Corporation

- Visionox Technology, Inc.

- Everdisplay Optronics (Shanghai) Co., Ltd.

- TCL China Star Optoelectronics Technology Co., Ltd.

- Kunshan GVO Optoelectronics Co., Ltd.

- Fujitsu Limited

- Rohm Semiconductor

- ULVAC, Inc.

- Applied Materials, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in high-resolution OLED and 8K TV demand

- 4.2.2 Requirement for energy-efficient portable devices

- 4.2.3 Rapid adoption in foldable and flexible displays

- 4.2.4 Proliferation of wearables using low-leakage IGZO backplanes

- 4.2.5 Integration in spatial-computing headsets (AR/VR/MR)

- 4.2.6 IGZO arrays enabling neuromorphic in-memory computing

- 4.3 Market Restraints

- 4.3.1 Competition from LTPS/LTPO silicon backplanes

- 4.3.2 Supply-chain volatility and pricing of indium

- 4.3.3 Low recycling rates of spent IGZO sputter targets

- 4.3.4 Current drift from sub-gap defects in humid environments

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Application

- 5.1.1 Smartphones and Feature Phones

- 5.1.2 Tablets and 2-in-1 PCs

- 5.1.3 Wearable Devices

- 5.1.4 Televisions and Large-format Displays

- 5.1.5 Automotive Displays

- 5.1.6 Industrial and Medical Displays

- 5.2 By End-use Industry

- 5.2.1 Consumer Electronics

- 5.2.2 Automotive and Transportation

- 5.2.3 Healthcare

- 5.2.4 Industrial and Manufacturing

- 5.2.5 Aerospace and Defense

- 5.2.6 Others

- 5.3 By Display Technology

- 5.3.1 LCD

- 5.3.2 OLED

- 5.3.3 MicroLED and MiniLED

- 5.3.4 E-Paper and Other Emerging

- 5.4 By Deposition Technology

- 5.4.1 RF Magnetron Sputtering

- 5.4.2 Pulsed-DC Magnetron Sputtering

- 5.4.3 Atomic Layer Deposition

- 5.4.4 Solution / Ink-jet Printing

- 5.4.5 Other Techniques

- 5.5 By Conductivity Phase

- 5.5.1 Amorphous IGZO

- 5.5.2 Polycrystalline IGZO

- 5.5.3 Single-crystal IGZO

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 South Korea

- 5.6.4.4 India

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)}

- 6.4.1 Sharp Corporation

- 6.4.2 LG Display Co., Ltd.

- 6.4.3 Samsung Display Co., Ltd.

- 6.4.4 AU Optronics Corp.

- 6.4.5 BOE Technology Group Co., Ltd.

- 6.4.6 Japan Display Inc.

- 6.4.7 Tianma Microelectronics Co., Ltd.

- 6.4.8 Apple Inc.

- 6.4.9 Sony Group Corporation

- 6.4.10 ASUS (ASUSTeK Computer Inc.)

- 6.4.11 Panasonic Holdings Corporation

- 6.4.12 Innolux Corporation

- 6.4.13 Visionox Technology, Inc.

- 6.4.14 Everdisplay Optronics (Shanghai) Co., Ltd.

- 6.4.15 TCL China Star Optoelectronics Technology Co., Ltd.

- 6.4.16 Kunshan GVO Optoelectronics Co., Ltd.

- 6.4.17 Fujitsu Limited

- 6.4.18 Rohm Semiconductor

- 6.4.19 ULVAC, Inc.

- 6.4.20 Applied Materials, Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment