|

市場調查報告書

商品編碼

1907279

水凝膠:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Hydrogel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

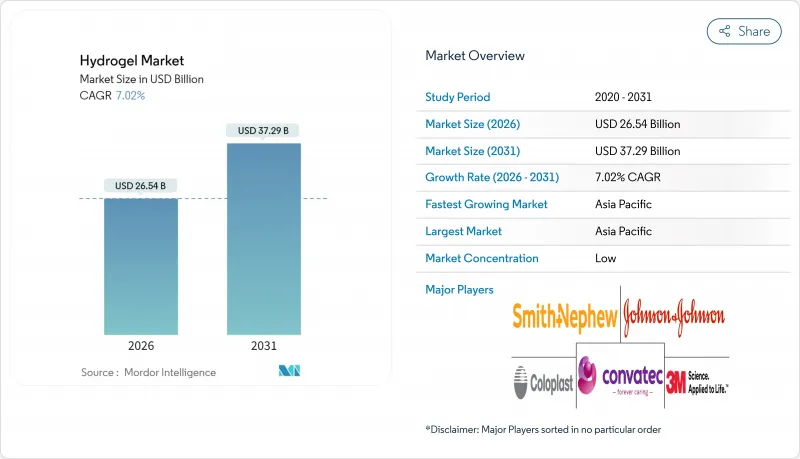

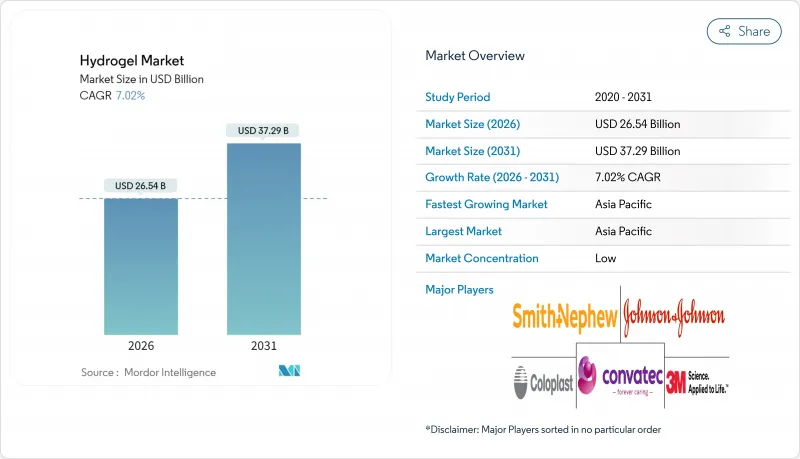

預計到 2026 年,水凝膠市場規模將達到 265.4 億美元,高於 2025 年的 248 億美元。預計到 2031 年,該市場規模將達到 372.9 億美元,2026 年至 2031 年的複合年成長率為 7.02%。

這一成長反映了材料的快速創新、在醫療、農業和個人護理領域日益廣泛的應用,以及生物基化學與日益嚴格的永續永續性要求的契合。長戴型矽水凝膠隱形眼鏡、4D列印植入和用於土壤改良的超吸收性聚合物因其可衡量的臨床效益和更高的資源利用效率,成為推動需求成長的主要動力。亞太地區持續保持強勁的銷售成長,而北美和歐洲則憑藉其監管方面的專業知識和快速的創新週期,繼續保持較高的價格。原料價格的波動以及不可生物分解的超吸收性聚合物的掩埋限制,在抑制利潤的同時,也加速了向可再生單體和可分解網路的轉型。整體而言,水凝膠市場正處於均衡成長階段,成本主導的商品產品支撐著現金流,而高價值的醫療設備和智慧農業則推高了平均售價。

全球水凝膠市場趨勢與洞察

擴大先進創傷護理敷料的應用

臨床證據表明,與紗布和泡沫敷料相比,水凝膠敷料能夠促進上皮化並減少換藥頻率,因此被醫院網路廣泛納入通訊協定。 2025年1月核准FDA批准的膠原蛋白基DermiSphere hDRT,證明了模擬細胞外基質的支架作為再生醫學平台而非被動敷料的有效性。採用一次性支付模式的醫療系統已證明,儘管單位成本較高,但總醫療成本有所降低。 ISO 13485合規性和CE認證有助於簡化跨國擴張流程,並保護創新者免受低品質仿冒品的侵害。隨著支付方將重點放在療效上,能夠證明癒合速度更快、感染率更低的供應商將維持定價權。

拓展在一次性衛生用品中的應用

現代嬰兒尿布和女性用衛生棉中都含有吸水性極強的水凝膠顆粒,其吸水量可達自身重量的500至1000倍,從而創造出防漏且輕薄的產品。中國和日本的大型製造商利用成熟的聚丙烯酸酯生產流程,而新興參與企業則致力於研發植物來源丙烯酸工藝,以符合歐洲和亞洲的微塑膠法規。消費者對舒適度的需求推動了顆粒尺寸和凝膠強度等方面的技術發展,因此需要持續的研發投入。印度、印尼和奈及利亞的都市化推動了水凝膠產品銷售的兩位數成長,確保衛生用品市場仍然是水凝膠市場規模最大的單一需求來源。

丙烯酸和矽酮原料價格波動;

原油價格波動導致丙烯酸價格每年波動幅度高達40%,擠壓了那些未後向整合至丙烯EIA(乙烯異丁烯乙炔縮醛)生產線的生產商的利潤空間。矽酮單體市場反映了中國聚矽氧烷產能的擴張,進一步加劇了成本的不確定性。避險、多元化採購和指數掛鉤的客戶合約可以部分降低風險,但小批量特種化合物生產商在採購方面處於劣勢。生物基生產路線可望帶來價格穩定性,但需要高資本投入和較長的規模化生產週期。

細分市場分析

截至2025年,半結晶質級水凝膠佔了45.35%的市場。其有序的結晶域賦予了水凝膠所需的抗張強度,這對於承重傷口敷料和土壤改良劑至關重要。可預測的溶脹動力學支持藥物控釋基質的應用,而低蠕變變形速率則降低了產品在長期磨損應用中失效的風險。製造商利用其位於東亞的成熟供應鏈來確保規模優勢和價格競爭力。然而,研究實驗室仍在不斷最佳化結晶質相與非晶相的比例,以平衡機械完整性和擴散速率,從而開發用於肌肉骨骼再生的下一代支架材料。

受注射療法和需要快速溶劑交換和細胞浸潤的3D生物列印組織的需求驅動,非晶態水凝膠預計將以7.96%的複合年成長率成長。其無規捲曲網路賦予其剪切稀化特性,使其能夠以微創方式給藥,並適應複雜的解剖部位。生物製藥公司正在整合在體溫下凝膠的熱響應性共聚物,以提高其在體內的保留率,而無需手術固定。雖然快速分解限制了其在承重領域的應用,但透過可控交聯和奈米纖維素複合增強,其應用範圍正在不斷擴大,包括重組手術、眼科和藥物儲存庫等領域。

區域分析

預計到2025年,亞太地區將佔全球水凝膠市場收入的41.00%,到2031年將以7.98%的複合年成長率成長,超過全球平均。中國憑藉其一體化的丙烯酸生產能力以及針對乾旱地區高吸水性土壤改良劑的補貼政策,在該領域佔據主導地位。在日本,HOYA株式會社等公司憑藉其高精度聚合技術和全球分銷網路,引領矽水凝膠隱形眼鏡領域的創新。韓國憑藉其快速的監管響應和電子製造方面的專業知識,使國內企業在軟性生物電子水凝膠組件的供應方面佔據了優勢。

北美已在醫療保健和農業領域建立了高附加價值產業,受益於清晰的FDA法規、創業投資資金和先進的製造基礎設施。美國糖尿病發生率的上升促使人們採用水凝膠敷料傷口護理,而美國西部各州正在引入高吸收性土壤改良劑以應對嚴重的水資源短缺問題。加拿大公共醫療保健系統正在尋求經濟高效的先進敷料,這為採購經過驗證的高價值產品創造了機會。墨西哥作為近岸製造地,既能發揮成本優勢滿足美國市場需求,又能促進當地消費。

歐洲對永續性的重視推動了可生物分解水凝膠的早期應用,並加強了對掩埋處理方式的監管。德國弗勞恩霍夫研究所正在加速研發4D列印植入原型,政府也正在津貼生物基聚合物計劃的研究。英國在脫歐後正在重組相關法規,同時保持與歐盟CE標準的一致性,並為醫療技術領域的成長型企業提供獎勵。北歐國家優先發展循環經濟材料,並推動纖維素基水凝膠的研發。法國和義大利正利用其高階化妝品分銷網路,推廣優質水凝膠面膜和護膚精華液。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 擴大先進創傷護理敷料的應用

- 拓展在一次性衛生用品中的應用

- 促進節水農業材料相關法規的製定

- 矽水凝膠隱形眼鏡的需求不斷成長

- 利用4D列印技術的智慧水凝膠植入

- 市場限制

- 丙烯酸和矽酮原料價格波動;

- 對不可生物分解的樹液製定了嚴格的掩埋規定

- 與泡沫敷料和藻酸鹽敷料的競爭

- 價值鏈分析

- 波特五力模型

- 買方的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按結構

- 半結晶質

- 非晶質

- 結晶質

- 材料

- 聚丙烯酸酯

- 聚丙烯醯胺

- 矽酮

- 其他成分

- 按最終用戶行業分類

- 個人護理和衛生用品

- 藥品和醫療保健

- 食物

- 農業

- 其他終端用戶產業

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 東南亞國協

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 俄羅斯

- 北歐國家

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- 3M

- Alcon

- Ashland

- Axelgaard Manufacturing Co., Ltd.

- Cardinal Health

- Coloplast Ltd

- Convatec

- CooperVision

- DSM

- Essity Health & Medical

- Hannox International Corp.

- HOYA Corporation

- Johnson and Johnson

- Molnlycke Health Care AB

- PAUL HARTMANN AG

- Sekisui Kasei

- Smith+Nephew

第7章 市場機會與未來展望

Hydrogel market size in 2026 is estimated at USD 26.54 billion, growing from 2025 value of USD 24.80 billion with 2031 projections showing USD 37.29 billion, growing at 7.02% CAGR over 2026-2031.

The expansion reflects rapid material innovation, a widening application spectrum across health care, agriculture and personal care, and the alignment of bio-based chemistries with tightening sustainability requirements. Extended-wear silicone-hydrogel contact lenses, 4D-printed implants and soil-conditioning superabsorbent polymers anchor much of the incremental demand by offering measurable clinical or resource-efficiency gains. Asia-Pacific maintains outsized volume growth, yet North America and Europe retain premium price realization through regulatory expertise and fast innovation cycles. Feedstock price volatility and landfill rules on non-biodegradable superabsorbent polymers temper margins but simultaneously accelerate the shift to renewable monomers and degradable networks. Overall, the hydrogel market enjoys balanced momentum as cost-driven commodity volumes underpin cash flow while high-value medical devices and smart agriculture lift average selling prices.

Global Hydrogel Market Trends and Insights

Rising Adoption in Advanced Wound-Care Dressings

Clinical evidence shows that hydrogel dressings accelerate epithelialization and reduce dressing-change frequency versus gauze or foam, prompting broader protocol inclusion by hospital networks. FDA clearance of collagen-based DermiSphere hDRT in January 2025 validated extracellular-matrix-mimicking scaffolds as regenerative platforms rather than passive coverings. Health systems that employ bundled-payment models recognize lower total cost of care despite premium unit pricing. ISO 13485 alignment and CE marking streamline multinational launches and protect innovators against low-spec imitators. As payors focus on outcomes, suppliers that document faster healing and lower infection rates retain pricing power.

Expanding Use in Disposable Hygiene Products

Modern baby diapers and feminine hygiene pads integrate hydrogel particles capable of absorbing 500-1000 times their weight, enabling thinner products without leakage. Large-scale producers in China and Japan capitalize on well-established polyacrylate networks, while new entrants target plant-based acrylic acid routes to meet microplastics regulations in Europe and Asia. Consumer demand for comfort drives engineering around particle size and gel strength, forcing continuous R&D investment. Urbanization in India, Indonesia and Nigeria sustains double-digit unit volumes, ensuring that hygiene remains the single largest outlet for hydrogel market volume.

Volatile Acrylic-Acid and Silicone Feedstock Prices

Crude-oil fluctuations drive acrylic-acid swings of up to 40% annually, eroding margins for producers not backward-integrated into propylene EIA. Silicone monomer markets mirror polysiloxane capacity additions in China, injecting further cost uncertainty. Hedging, multi-sourcing and index-linked customer contracts partially alleviate risk, but specialty formulators with low volumes face purchasing disadvantages. Bio-based routes promise pricing stability but require high capital intensity and scale-up timelines.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Push for Water-Saving Agricultural Inputs

- Growing Demand for Silicone-Hydrogel Contact Lenses

- Strict Landfill Rules on Non-Biodegradable SAPs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Semi-crystalline grades represented 45.35% of hydrogel market share in 2025 because their ordered domains deliver tensile strength essential for load-bearing wound dressings and soil conditioners. Predictable swelling kinetics support controlled drug-release matrices, and the lower creep deformation rate reduces product failure risk in extended-wear applications. Manufacturers capitalize on established supply chains anchored in East Asia, ensuring scale advantages and competitive pricing. Research laboratories nevertheless refine crystalline-amorphous ratios to balance mechanical integrity with diffusion rates, enabling next-generation scaffolds for musculoskeletal regeneration.

Amorphous hydrogels are forecast to post an 7.96% CAGR, propelled by injectable therapeutics and 3D-bioprinted tissues requiring rapid solvent exchange and cellular infiltration. Their random coil networks facilitate shear-thinning behavior, allowing minimally invasive delivery that conforms to complex anatomical sites. Biopharma firms integrate thermo-responsive copolymers that gel at body temperature, improving site retention without surgical fixation. Although susceptibility to rapid degradation can limit load-bearing applications, cross-link modulation and composite reinforcement with nanocellulose broaden use cases across reconstruction, ophthalmology and drug depots.

The Hydrogel Market Report is Segmented by Structure (Semi-Crystalline, Amorphous, and Crystalline), Material (Polyacrylate, Polyacrylamide, and Other Materials), End-User Industry (Personal Care and Hygiene, Pharmaceuticals and Healthcare, and Other End-User Industries), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific contributed 41.00% of global hydrogel market revenue in 2025 and is projected to expand at an 7.98% CAGR through 2031, outpacing the global average. China's dominance rests on integrated acrylic-acid capacity and a policy agenda that subsidizes superabsorbent soil conditioners in drought-prone provinces. Japan leads innovation in silicone-hydrogel contact lenses through firms such as HOYA Corporation, which leverage high-precision polymerization and global distribution networks. South Korea combines regulatory agility with electronics manufacturing know-how, positioning local players to supply hydrogel components for flexible bioelectronics.

North America secures high value density across medical and agricultural applications, benefiting from FDA clarity, venture funding and advanced manufacturing infrastructure. Hospitals in the United States increasingly adopt hydrogel dressings for chronic wounds tied to diabetes prevalence, while western states deploy superabsorbent soil amendments to offset severe water scarcity. Canada's public health system seeks cost-effective advanced dressings, creating procurement opportunities for value-demonstrated products. Mexico serves as a near-shore manufacturing hub, aligning cost advantages with United States demand while spurring regional consumption.

Europe foregrounds sustainability, driving early adoption of biodegradable hydrogels and rigorous scrutiny of landfill disposal practices. Germany's Fraunhofer institutes accelerate 4D-printed implant prototyping, and the government channels research grants toward bio-based polymer projects. The United Kingdom, navigating post-Brexit regulatory realignment, aims to preserve alignment with CE standards while tailoring incentives for med-tech scale-ups. Nordic countries prioritize circular-economy materials, fostering cellulose-based hydrogel R&D. France and Italy exploit luxury cosmetics channels to market premium hydrogel sheet masks and skin-conditioning serums.

- 3M

- Alcon

- Ashland

- Axelgaard Manufacturing Co., Ltd.

- Cardinal Health

- Coloplast Ltd

- Convatec

- CooperVision

- DSM

- Essity Health & Medical

- Hannox International Corp.

- HOYA Corporation

- Johnson and Johnson

- Molnlycke Health Care AB

- PAUL HARTMANN AG

- Sekisui Kasei

- Smith+Nephew

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Adoption in Advanced Wound-Care Dressings

- 4.2.2 Expanding Use in Disposable Hygiene Products

- 4.2.3 Regulatory Push for Water-Saving Agricultural Inputs

- 4.2.4 Growing Demand For Silicone-Hydrogel Contact Lenses

- 4.2.5 4D-Printed Smart Hydrogel Implants

- 4.3 Market Restraints

- 4.3.1 Volatile Acrylic-Acid and Silicone Feedstock Prices

- 4.3.2 Strict Landfill Rules on Non-Biodegradable Saps

- 4.3.3 Competition From Foam and Alginate Dressings

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Buyers

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Structure

- 5.1.1 Semi-crystalline

- 5.1.2 Amorphous

- 5.1.3 Crystalline

- 5.2 By Material

- 5.2.1 Polyacrylate

- 5.2.2 Polyacrylamide

- 5.2.3 Silicone

- 5.2.4 Other Materials

- 5.3 By End-user Industry

- 5.3.1 Personal Care and Hygiene

- 5.3.2 Pharmaceuticals and Healthcare

- 5.3.3 Food

- 5.3.4 Agriculture

- 5.3.5 Other End-user Industries

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 ASEAN Countries

- 5.4.1.6 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Russia

- 5.4.3.6 NORDIC Countries

- 5.4.3.7 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 3M

- 6.4.2 Alcon

- 6.4.3 Ashland

- 6.4.4 Axelgaard Manufacturing Co., Ltd.

- 6.4.5 Cardinal Health

- 6.4.6 Coloplast Ltd

- 6.4.7 Convatec

- 6.4.8 CooperVision

- 6.4.9 DSM

- 6.4.10 Essity Health & Medical

- 6.4.11 Hannox International Corp.

- 6.4.12 HOYA Corporation

- 6.4.13 Johnson and Johnson

- 6.4.14 Molnlycke Health Care AB

- 6.4.15 PAUL HARTMANN AG

- 6.4.16 Sekisui Kasei

- 6.4.17 Smith+Nephew

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment