|

市場調查報告書

商品編碼

1907260

菲律賓太陽能市場:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031年)Philippines Solar Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

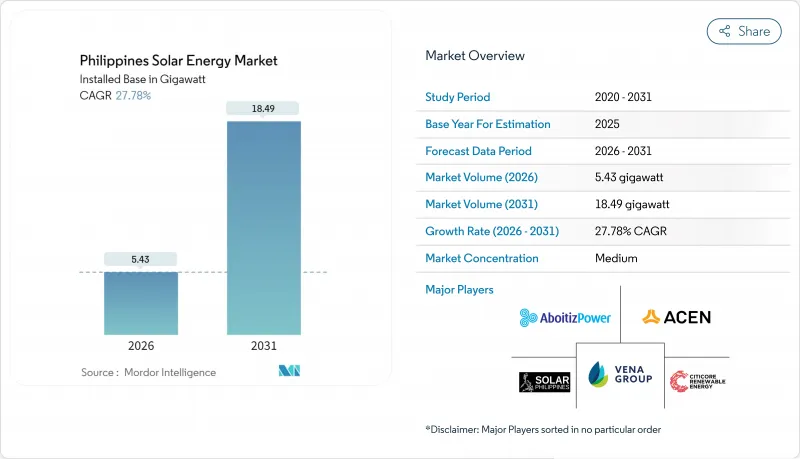

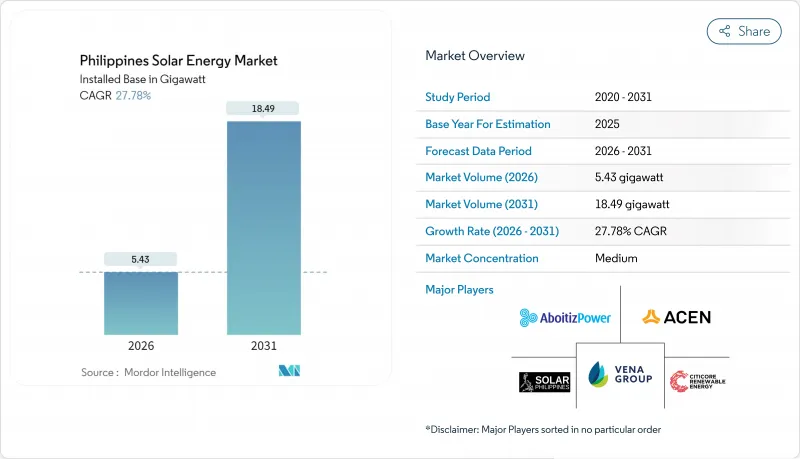

預計菲律賓太陽能市場將從 2025 年的 4.25 吉瓦成長到 2026 年的 5.43 吉瓦,到 2031 年達到 18.49 吉瓦,2026 年至 2031 年的複合年成長率為 27.78%。

組件和系統整體成本的下降已使大型太陽能光電的平準化電力成本低至每千瓦時0.044美元,使新增太陽能發電容量成為滿足基本負載需求的最低成本選擇。超大規模資料中心和業務流程外包公司的強勁需求正在推動混合式太陽能-儲能計劃的應用,以確保全天候清潔電力供應。同時,美國能源部綠色能源競標計畫(GEAP)在第四輪競標中授予了10.2吉瓦的容量,使國內在開發平臺總數超過36吉瓦。在拉古納湖和灌溉水庫上安裝的浮體式太陽能光電系統正成為一種無需佔用土地的替代方案,而將淨計量上限從100千瓦提高到1兆瓦的監管改革預計將鼓勵在商業和工業建築的屋頂上安裝太陽能發電系統。

菲律賓太陽能市場趨勢及展望

光學模組和BOS成本快速下降

預計2023年,全球公用事業規模太陽能光電的平準化電成本(LCOE)將降至0.044美元/度數,較2010年下降90%。這顯著降低了菲律賓所有計劃的資本支出。當地企業現在可以以低於0.19美元/瓦的價格採購一級組件,從而擴大了計劃的利潤空間。為此,Sol-Go計劃建立一條本地組裝線。曾經佔亞洲太陽能預算75%的系統平衡(BOS)支出,如今正成為國內增值發電的新途徑,金屬框架、逆變器和電纜製造商正在重組,以轉向出口。這一成本趨勢使菲律賓太陽能市場與進口液化天然氣和傳統煤炭相比更具競爭力,加速了公用事業公司的採購和公司間的購電協議(PPA)的簽訂。從中長期來看,這將支持一個新興的國內製造基地,該基地到 2030 年每年能夠供應 3-5 吉瓦的組件,從而進一步鞏固供應鏈。

綠色能源競標(GEAP)預計將從 2025 年起創造超過 1 吉瓦的太陽能發電專案儲備。

能源部採用競爭性競標模式,以價格發現機制取代上網電價補貼,首輪競標即選定了1吉瓦的太陽能發電計畫。第四輪競標的目標裝置容量為9,378兆瓦,其中包括光伏和儲能混合系統。開發商的熱情仍然高漲,第三輪能源市場招標(GEA-3)收到的太陽能競標容量達到7,500兆瓦,遠超4,650兆瓦的上限,從而確保了較低的上網電價補貼和20年的穩定電力供應。與競標掛鉤的購電協議(PPA)降低了資金籌措風險,縮小了貸款機構的利差,並允許開發商透過增加運轉率。從第四輪能源市場招標(GEA-4)開始強制要求安裝電池儲能系統,標誌著菲律賓政府在發展有利於電網的可再生能源方面政策日益成熟,這將有助於解決白天棄電問題。總而言之,這些競標正在推動菲律賓太陽能市場走向可預測的建設週期和透明的成本標準。

維薩亞斯-棉蘭老島走廊電網容量薄弱

截至2023年,16個優先輸電計劃中僅有6個完工,耗資披索億披索的棉蘭老島-維薩亞斯主幹輸電線路已延期三年。呂宋島以南地區的太陽能普及受到瓶頸限制,迫使開發商將重點放在已接入電網的地區,導致豐富的太陽輻射資源未能充分利用。儘管《2022-2040年輸電網發展規劃》概述了擴建計劃,但實施進度落後於需求。在高壓輸電線路建設跟上需求之前,計劃規劃可能仍將以呂宋島為中心。

細分市場分析

預計到2025年,太陽能光伏發電將佔菲律賓全部裝置容量,鞏固其在菲律賓太陽能市場100%的佔有率。高效的n型i-TOPCon和雙面組件正在提高發電量並減少土地需求,以27.78%的複合年成長率推動菲律賓太陽能光伏市場規模不斷擴大。另一方面,由於土地短缺和颱風的影響,聚光型太陽光電(CSP)在商業性並不現實,能源部(DOE)總體規劃中也沒有為該技術設定目標。

市場正朝著採用串列型逆變器的光伏+儲能混合架構發展,以提高運轉率並滿足企業購電協議中全天候採購條款的要求。 Terra Solar 的 3.5GW 光伏 + 4.5GWh 儲能專案凸顯了這一混合趨勢,並與超大規模資料中心業者營運商簽訂了長期供貨協議。

菲律賓太陽能市場報告按技術(光伏和聚光型太陽熱能發電)、併網類型(併網和離網)以及最終用戶(大型公用事業公司、商業/工業用戶和住宅)進行細分。市場規模和預測以裝置容量(吉瓦)為單位。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 光學模組和BOS成本快速下降

- 綠色能源競標(GEAP)將從2025年起促成超過1吉瓦的太陽能發電工程。

- 超大規模資料中心業者和業務流程外包 (BPO) 公司的購電協議 (PPA) 要求全天候 (24/7) 提供清潔電力。

- 美國能源部淨計量改革將把100千瓦的上限提高到1兆瓦(2024年)。

- 在灌溉水庫引進浮體式太陽能發電系統(與國家灌溉管理局簽署合作備忘錄)

- 東協內部的碳排放邊境調節機制對出口製造業帶來壓力。

- 市場限制

- 維薩亞斯-棉蘭老島走廊電網容量薄弱

- 與越南和馬來西亞相比,資金籌措成本較高(加權平均資本成本超過9%)

- 根據《綜合農業改革計畫農業用地法》提出的土地徵用糾紛

- 颱風相關的運維中斷會使平準化能源成本增加約4%。

- 供應鏈分析

- 監管環境

- 技術展望

- 波特五力模型

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- PESTEL 分析

第5章 市場規模與成長預測

- 透過技術

- 光伏(PV)

- 聚光型太陽熱能發電(CSP)

- 按網格類型

- 併網

- 離網

- 最終用戶

- 公用事業規模

- 商業和工業(C&I)

- 住宅

- 按成分(定性分析)

- 光學模組/面板

- 逆變器(組串式、集中式、微型)

- 安裝和追蹤系統

- 系統周邊設備和電氣設備

- 儲能和混合整合

第6章 競爭情勢

- 市場集中度

- 策略性舉措(併購、聯盟、購電協議)

- 市場佔有率分析(主要企業的市場排名和佔有率)

- 公司簡介

- Solar Philippines Power Project Holdings

- ACEN Corp.

- Vena Energy

- Citicore Power Inc.

- Aboitiz Power Corp.

- Solenergy Systems Inc.

- SunAsia Energy

- Helios Solar Energy Corp.

- Cleantech Global Renewables

- Trina Solar Ltd.

- Canadian Solar

- JinkoSolar

- First Gen Corp.

- Meralco PowerGen(MGen)

- Shell Pilipinas-Solar

- TotalEnergies-Solar

- NextGen Power

- Enfinity Global

- Rizal Wind-Solar Energy Corp.

- Greenergy Holdings

第7章 市場機會與未來展望

The Philippines Solar Energy Market is expected to grow from 4.25 gigawatt in 2025 to 5.43 gigawatt in 2026 and is forecast to reach 18.49 gigawatt by 2031 at 27.78% CAGR over 2026-2031.

Declining module and balance-of-system costs have driven the levelized cost of utility-scale solar down to USD 0.044 per kWh, making new photovoltaic capacity the least-cost choice for meeting baseload demand. Strong demand from hyperscale data centers and business-process outsourcing firms is accelerating hybrid solar-plus-storage projects that guarantee 24/7 clean power. Meanwhile, the Department of Energy's Green Energy Auction Program (GEAP) has awarded 10.2 GW of capacity in its fourth round, pushing the national development pipeline above 36 GW. Floating solar on Laguna Lake and irrigation reservoirs is emerging as a land-neutral alternative, and reforms that lifted the net-metering ceiling from 100 kW to 1 MW are expected to unlock commercial and industrial rooftops.

Philippines Solar Energy Market Trends and Insights

Rapid Decline in PV Module & BOS Costs

Global utility-scale solar leveledized costs fell to USD 0.044 /kWh in 2023, a 90% drop since 2010, slashing capital outlays for every Philippine project.Local firms now receive price quotes under USD 0.19 /W for Tier-1 modules, widening project margins and spurring Sol-Go to locate assembly lines in the country. Balance-of-system spending, historically 75% of Asian solar budgets, is becoming a new domestic value-add avenue, with metal frame, inverter, and cable manufacturers repositioning for export. This cost trajectory raises the competitive standing of the Philippines' solar energy market against imported LNG and legacy coal, accelerating utility procurement and corporate PPAs. Over the medium term, it also underpins a nascent local manufacturing base that could supply 3-5 GW of modules annually by 2030, further anchoring the supply chain.

Green Energy Auctions (GEAP) Unlocking >=1 GW Solar Pipeline from 2025

The Department of Energy's competitive tender model replaces static feed-in tariffs with price discovery, awarding 1 GW of solar in its inaugural round and setting a 9,378 MW target for the fourth auction that includes solar-storage hybrids. Developer appetite remains robust, GEA-3 drew 7,500 MW of solar bids for a 4,650 MW cap, compressing tariffs and ensuring 20-year off-take certainty. Auction-linked PPAs lower financing risk, enabling lenders to trim spreads and developers to stretch capacity factors with storage add-ons. The integration of mandatory battery systems from GEA-4 onwards signals policy maturation toward grid-friendly renewables that can address midday curtailment. Collectively, auctions move the Philippines' solar energy market toward predictable build-out cycles and transparent cost benchmarks.

Weak Grid Capacity in Visayas-Mindanao Corridor

Only 6 of 16 priority transmission projects were completed by 2023, delaying the PHP 52 billion Mindanao-Visayas backbone by three years.Bottlenecks restrict solar additions south of Luzon, compelling developers to cluster where interconnection is available and leaving ample irradiance unexploited. The Transmission Development Plan 2022-2040 maps expansions, but execution lags grid demand. Until high-voltage lines catch up, project pipelines will stay skewed toward Luzon.

Other drivers and restraints analyzed in the detailed report include:

- Corporate PPAs by Hyperscalers & BPOs Demanding 24/7 Clean Power

- DOE Net-Metering Reform Lifting 100 kW Cap to 1 MW (2024)

- High Financing Costs vs Vietnam & Malaysia (>=9% WACC)

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solar photovoltaic accounted for the entire 2025 installation base, reinforcing a Philippines solar energy market share of 100.00%. High-efficiency n-type i-TOPCon and bifacial modules lift output and cut land needs, helping the Philippines' solar energy market size for PV rise at a 27.78% CAGR. CSP remains commercially non-viable due to land scarcity and typhoons, and the DOE master plan allocates no targets for the technology.

The market's equipment shift toward string inverters and hybrid PV-plus-storage architectures improves uptime and meets 24/7 procurement clauses in corporate PPAs. Terra Solar's 3.5 GW PV and 4.5 GWh storage confirm this hybrid trend, locking in long-duration supply contracts with hyperscalers.

The Philippines Solar Energy Market Report is Segmented by Technology (Solar Photovoltaic and Concentrated Solar Power), Grid Type (On-Grid and Off-Grid), and End-User (Utility-Scale, Commercial and Industrial, and Residential). The Market Sizes and Forecasts are Provided in Terms of Installed Capacity (GW).

List of Companies Covered in this Report:

- Solar Philippines Power Project Holdings

- ACEN Corp.

- Vena Energy

- Citicore Power Inc.

- Aboitiz Power Corp.

- Solenergy Systems Inc.

- SunAsia Energy

- Helios Solar Energy Corp.

- Cleantech Global Renewables

- Trina Solar Ltd.

- Canadian Solar

- JinkoSolar

- First Gen Corp.

- Meralco PowerGen (MGen)

- Shell Pilipinas - Solar

- TotalEnergies - Solar

- NextGen Power

- Enfinity Global

- Rizal Wind-Solar Energy Corp.

- Greenergy Holdings

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid decline in PV module & BOS costs

- 4.2.2 Green energy auctions (GEAP) unlocking >=1 GW solar pipeline from 2025

- 4.2.3 Corporate PPAs by hyperscalers & BPOs demanding 24/7 clean power

- 4.2.4 DOE net-metering reform lifting 100 kW cap to 1 MW (2024)

- 4.2.5 Floating-solar deployment on irrigation reservoirs (National Irrigation Admin MoU)

- 4.2.6 ASEAN-wide carbon border adjustment pressure on export manufacturers

- 4.3 Market Restraints

- 4.3.1 Weak grid capacity in Visayas-Mindanao corridor

- 4.3.2 High financing costs vs. Vietnam & Malaysia (>=9 % WACC)

- 4.3.3 Land-acquisition disputes under CARP agrarian rules

- 4.3.4 Typhoon-related O&M disruptions raising LCOE by ~4 %

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 PESTLE Analysis

5 Market Size & Growth Forecasts

- 5.1 By Technology

- 5.1.1 Solar Photovoltaic (PV)

- 5.1.2 Concentrated Solar Power (CSP)

- 5.2 By Grid Type

- 5.2.1 On-Grid

- 5.2.2 Off-Grid

- 5.3 By End-User

- 5.3.1 Utility-Scale

- 5.3.2 Commercial and Industrial (C&I)

- 5.3.3 Residential

- 5.4 By Component (Qualitative Analysis)

- 5.4.1 Solar Modules/Panels

- 5.4.2 Inverters (String, Central, Micro)

- 5.4.3 Mounting and Tracking Systems

- 5.4.4 Balance-of-System and Electricals

- 5.4.5 Energy Storage and Hybrid Integration

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Solar Philippines Power Project Holdings

- 6.4.2 ACEN Corp.

- 6.4.3 Vena Energy

- 6.4.4 Citicore Power Inc.

- 6.4.5 Aboitiz Power Corp.

- 6.4.6 Solenergy Systems Inc.

- 6.4.7 SunAsia Energy

- 6.4.8 Helios Solar Energy Corp.

- 6.4.9 Cleantech Global Renewables

- 6.4.10 Trina Solar Ltd.

- 6.4.11 Canadian Solar

- 6.4.12 JinkoSolar

- 6.4.13 First Gen Corp.

- 6.4.14 Meralco PowerGen (MGen)

- 6.4.15 Shell Pilipinas - Solar

- 6.4.16 TotalEnergies - Solar

- 6.4.17 NextGen Power

- 6.4.18 Enfinity Global

- 6.4.19 Rizal Wind-Solar Energy Corp.

- 6.4.20 Greenergy Holdings

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment