|

市場調查報告書

商品編碼

1907241

積層製造與材料:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Additive Manufacturing And Materials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

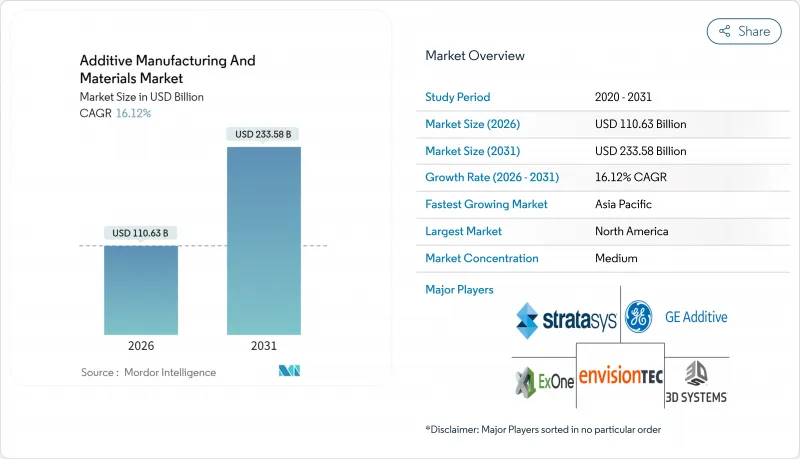

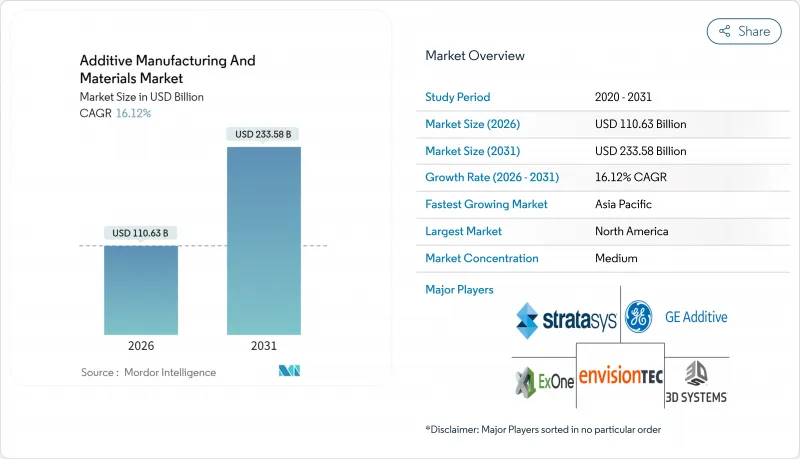

預計積層製造和材料市場將從 2025 年的 952.7 億美元成長到 2026 年的 1,106.3 億美元,預計到 2031 年將達到 2,335.8 億美元,2026 年至 2031 年的複合年成長率為 16.12%。

受材料價格下降、輕量化航太零件需求以及醫療領域快速應用等因素的推動,積層製造和材料市場正從原型製作階段邁向大規模生產階段。美國美國標準與技術研究院 (NIST) 和美國材料與試驗協會 (ASTM) 的標準化項目提供了一套統一的認證流程,降低了認證成本;北美、歐洲和亞太地區的政府激勵措施也加速了工廠層面的採用。隨著供應商將軟體、印表機和認證粉末整合到產品中,提供滿足工業運轉率要求的承包生產線,市場競爭日益激烈。同時,循環經濟政策正促使生產商對回收聚合物和金屬原料進行認證,這在擁有成熟廢棄物處理能力的地區帶來了成本和永續性優勢。航太機構對在軌金屬列印技術的檢驗,開啟了原位微型生產的長期發展前景,從而減少了高成本的發射品質。

全球積層製造及材料市場趨勢及洞察

汽車和航太領域對輕量化零件的需求

航太原始設備製造商 (OEM) 正在將多部件組裝整合為單一列印件,以減輕飛機重量並降低維護成本。通用電氣航空集團的列印燃油噴嘴可取代 20 個零件,為航空公司每架飛機節省 160 萬美元的生命週期營運成本。波音公司將鈦合金格柵支架整合到 787 飛機中,在滿足結構標準的前提下,降低了 200 萬至 300 萬美元的零件成本。汽車製造商正在將類似的整合技術應用於電池外殼和煞車系統,從而延長電動車的續航里程。拓樸最佳化軟體能夠實現機械加工無法實現的有機形狀,使早期採用者獲得性能優勢。 ASTM F2792 標準中的標準化定義統一了術語和測試方法,有助於認證機構加快飛行關鍵零件的核准。

患者客製化醫療植入的快速普及

粉末層熔融技術能夠製造出與個體解剖結構相符的多孔鈦植入,從而改善骨整合並降低失敗率。史賽克公司已生產超過200萬個均質植入物,證明了醫院級積層製造工作流程的擴充性。美國FDA的即時護理指南允許認證醫院在院內列印手術導板,從而縮短前置作業時間並降低庫存成本。分散式生產將價值從集中式工廠轉移到臨床現場,並減少了物流投入。隨著航太領域供應趨緊,不斷成長的高階需求迫使鈷鉻合金和鈦粉供應商擴大霧化產能。

高性能金屬和聚合物高成本

PEEK、PEKK 和航太級鈦粉價格高昂,小規模訂單化工廠難以負擔。霧化器產能有限,等離子噴塗製程能耗龐大,推高了原料成本,而買家又要求批量折扣。供應商夾在要求折扣的客戶和要求研發資金的投資者之間,進退兩難,導致下一代材料的推出被推遲。因此,汽車和消費品產業目前只採購原型產品和高利潤零件,直到成本下降。

細分市場分析

指向性能量沉積技術正以16.98%的複合年成長率快速成長,這主要得益於航太引擎維修領域的需求,該領域所需的公制零件數量超過了粉末床層壓成型技術的需求。該領域採用線材作為原料,其成本比粉末低30-50%,因此可重複利用其他系統中剩餘的材料。同時,熔融沈積成型(FDM)技術在積層製造和材料市場中佔據39.68%的佔有率,這主要得益於其在教育和設計領域的廣泛應用,以及在低應力工業夾具方面的應用。混合式CNC-積層製造平台結合了雷射覆層和五軸加工技術,可在單次裝夾中實現所需的公差和表面光潔度。

粉末層熔融仍然是晶格密集型植入和層厚小於 80µm 的火箭渦輪泵零件的基準技術。黏著劑噴塗成型正在發展,可用於製造鋼製泵殼和砂型鑄造模具,一旦燒結瓶頸得到解決,即可顯著提高生產效率。新興的微波體積製造系統有望實現數量級更快的速度,預示著未來製造時間將不再決定單位經濟效益。

區域分析

到2025年,北美將佔據積層製造和材料市場36.45%的佔有率,主要得益於國防預算、NASA的深空探勘計畫以及成熟的供應商生態系統。聯邦稅收優惠和第174條研發費用會計規定正在推動對新生產線的資本投資。 FDA針對3D列印植入的510(k)指南正在縮短醫療設備OEM廠商的產品上市時間,並促進國內粉末消費。

亞太地區是成長最快的地區,複合年成長率達16.55%,這主要得益於中國為減少對進口引擎零件的依賴而加大對國內印表機製造商的投入。新加坡的國家積層製造叢集正在對航太合金進行認證並培訓工程師,使該國轉型為區域出口中心。印度的生產連結獎勵計畫計畫正在津貼汽車和能源產業購買金屬印表機,而澳洲的一個合作研究中心正在利用當地礦石霧化鈦粉。

歐洲正著力發展永續性。歐盟的「Fit-for-55」計畫鼓勵汽車製造商列印輕量化支架,以減少車輛排放氣體。歐洲太空總署已展示了首批在國際太空站上製造的不銹鋼零件,證實了微重力列印技術在月球基礎設施製造中的有效性。德國汽車製造商正在聯合開發一種鋁矽合金,可實現無縫焊接,且不會產生熱裂紋缺陷,為碰撞相關應用樹立了新的標竿。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 汽車和航太領域對輕量化零件的需求

- 快速推廣患者特異性醫療植入

- 聚合物和金屬粉末價格下跌

- 政府資金和標準的協調統一

- 由於循環經濟的推廣,對再生材料的需求不斷成長。

- 面向太空和遠端任務的現場微型生產

- 市場限制

- 高性能金屬和聚合物高成本

- 對智慧財產權保護的擔憂

- 奈米粉末處理的嚴格環境、健康與安全 (EHS) 法規

- 關鍵合金元素的供應鏈波動

- 產業價值鏈分析

- 監管環境

- 技術展望

- 宏觀經濟因素的影響

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 透過技術

- 基於聚合物的技術

- 熔融沈積成型(FDM)

- 立體光刻技術(SLA)

- 數位光處理(DLP)

- 材料噴射(PolyJet)

- 黏著劑噴塗成型- 聚合物

- 金屬基技術

- 粉末層熔化(SLM,EBM)

- 定向能量沉積

- 陶瓷基技術

- 陶瓷SLA

- 陶瓷黏著劑噴塗成型

- 其他技術

- 基於聚合物的技術

- 依材料類型

- 聚合物

- 熱塑性產品(ABS、PLA)

- 工程塑膠(PA、PEEK)

- 光敏樹脂

- 高性能熱塑性樹脂(Artem、Pec)

- 金屬

- 鈦合金

- 鋁合金

- 不銹鋼

- 鎳基高溫合金

- 貴金屬

- 陶瓷製品

- 氧化鋁

- 氧化鋯

- 碳化矽

- 複合材料和其他新興材料

- 聚合物

- 最終用戶

- 航太/國防

- 車

- 衛生保健

- 醫療設備

- 牙科

- 工業機械

- 消費品

- 建造

- 教育與研究

- 其他最終用戶

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲和紐西蘭

- 東南亞

- 亞太其他地區

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 埃及

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- BASF 3D Printing Solutions GmbH

- Evonik Industries AG

- Arkema SA

- Sandvik AB

- Hoganas AB

- Stratasys Ltd.

- 3D Systems Corporation

- General Electric Company(GE Additive)

- EOS GmbH

- Materialise NV

- Desktop Metal Inc.

- Markforged Holding Corporation

- Carpenter Technology Corporation

- Heraeus Holding GmbH

- GKN Powder Metallurgy Holdings GmbH

- HP Inc.

- Prodways Group SA

- SLM Solutions Group AG

- Henkel AG and Co. KGaA

- DSM-Covestro Additive Manufacturing(Covestro AG)

- ExOne Company(Desktop Metal)

第7章 市場機會與未來展望

The additive manufacturing and materials market is expected to grow from USD 95.27 billion in 2025 to USD 110.63 billion in 2026 and is forecast to reach USD 233.58 billion by 2031 at 16.12% CAGR over 2026-2031.

Falling material prices, aerospace demand for lightweight parts, and rapid healthcare adoption shift the additive manufacturing and materials market away from prototyping and into volume production. Standardization programs at NIST and ASTM provide unified qualification pathways that lower certification costs, while government incentives in North America, Europe, and Asia Pacific accelerate factory-level deployment.Competitive intensity rises as vendors integrate software, printers, and qualified powders to deliver turnkey production lines that meet industrial uptime requirements. Simultaneously, circular-economy policies motivate producers to qualify recycled polymer and metal feedstocks, creating cost and sustainability advantages for regions with established waste-processing capacity. Space agencies validate in-orbit metal printing, opening a long-term frontier for on-site micro-production that removes costly launch mass.

Global Additive Manufacturing And Materials Market Trends and Insights

Demand for lightweight components in automotive and aerospace

Aerospace OEMs condense multi-part assemblies into single printed geometries to trim aircraft weight and maintenance. GE Aviation's printed fuel nozzle replaces twenty components and saves carriers USD 1.6 million in lifetime operating costs per aircraft.Boeing integrates titanium lattice brackets on the 787 that cut part cost by USD 2-3 million while meeting structural standards. Automotive firms replicate this consolidation in battery housings and brake systems to extend electric-vehicle range. Topology-optimization software unlocks organic shapes unattainable with machining, giving early adopters a performance edge. ASTM F2792 definitions standardize terminology and testing, helping certifiers approve flight-critical parts faster.

Rapid adoption of patient-specific healthcare implants

Powder-bed fusion enables porous titanium implants that match individual anatomy, improving osseointegration and cutting failure rates. Stryker has produced over 2 million such devices, proving the scalability of hospital-grade additive workflows.The U.S. FDA's point-of-care guidance lets certified hospitals print surgical guides onsite, reducing lead times and inventory costs. Distributed production shifts value from centralized factories to clinical settings, shrinking logistics footprints. Premium demand pushes cobalt-chrome and titanium powder suppliers to scale atomization capacity despite tight aerospace allocation.

High cost of high-performance metals and polymers

PEEK, PEKK, and aerospace-grade titanium powders trade at premiums that smaller job shops struggle to absorb. Limited atomizer capacity and energy-intensive plasma processes elevate raw-material costs just as buyers push for volume pricing. Suppliers face a squeeze between customers requesting discounts and investors demanding R&D spending, delaying next-generation material rollouts. Automotive and consumer sectors therefore confine purchases to prototypes or high-margin components until cost curves fall.

Other drivers and restraints analyzed in the detailed report include:

- Government funding and standards harmonization

- Supply-chain volatility in critical alloying elements

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Directed Energy Deposition posts a 16.98% CAGR, underpinned by aerospace engine repair where meter-scale parts eclipse powder-bed build volumes. This segment benefits from wire feedstock that costs 30-50% less than powder and recoups material unused in other systems. Fused Deposition Modeling, however, retains 39.68% additive manufacturing and materials market share due to its ubiquity in education, design, and low-stress industrial fixtures. Hybrid CNC-additive platforms merge laser cladding with five-axis milling to meet tolerance and surface roughness targets in a single setup.

Powder Bed Fusion remains the benchmark for lattice-rich implants and rocket turbopump components requiring sub-80 µm layer heights. Binder Jetting evolves for steel pump housings and sand casting molds, offering throughput advantages when sintering bottlenecks are solved. Emerging microwave volumetric systems promise order-of-magnitude speed gains, foreshadowing a future where build time no longer dictates unit economics.

The Additive Manufacturing and Materials Market Report is Segmented by Technology (Polymer-Based, Metal-Based, Ceramic-Based, and More), Material Type (Polymers, Metals, Ceramics, Composite, and More), End User (Aerospace and Defense, Automotive, Healthcare, Industrial Machinery, Consumer Products, Construction, Education and Research, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commands 36.45% additive manufacturing and materials market size in 2025, supported by defense budgets, NASA deep-space initiatives, and a mature supplier ecosystem. Federal tax incentives and Section 174 R&D expensing rules reward capital investment in new production lines. FDA 510(k) guidance for 3D-printed implants accelerates time-to-market for device OEMs, reinforcing domestic powder consumption.

Asia Pacific is the fastest-growing region at a 16.55% CAGR as China funds domestic printer champions to lessen dependence on imported engine parts. Singapore's National Additive Manufacturing cluster certifies aerospace alloys and trains technicians, turning the island into a regional export hub.India's Production-Linked Incentive program subsidizes metal-printer purchases for automotive and energy verticals, while Australia's Cooperative Research Centre advances titanium powder atomization from local ore.

Europe focuses on sustainability; the EU's Fit-for-55 package spurs OEMs to print lightweight brackets that reduce vehicle emissions. The European Space Agency demonstrates the first stainless-steel part fabricated aboard the ISS, validating micro-gravity printing for lunar infrastructure. German carmakers co-develop aluminum-silicon alloys that weld seamlessly without hot-crack defects, setting a benchmark for crash-relevant applications.

- BASF 3D Printing Solutions GmbH

- Evonik Industries AG

- Arkema S.A.

- Sandvik AB

- Hoganas AB

- Stratasys Ltd.

- 3D Systems Corporation

- General Electric Company (GE Additive)

- EOS GmbH

- Materialise NV

- Desktop Metal Inc.

- Markforged Holding Corporation

- Carpenter Technology Corporation

- Heraeus Holding GmbH

- GKN Powder Metallurgy Holdings GmbH

- HP Inc.

- Prodways Group SA

- SLM Solutions Group AG

- Henkel AG and Co. KGaA

- DSM-Covestro Additive Manufacturing (Covestro AG)

- ExOne Company (Desktop Metal)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Demand for lightweight components in automotive and aerospace

- 4.2.2 Rapid adoption of patient-specific healthcare implants

- 4.2.3 Falling polymer and metal powder prices

- 4.2.4 Government funding and standards harmonisation

- 4.2.5 Circular-economy push for recycled feedstocks

- 4.2.6 On-site micro-production for space and remote missions

- 4.3 Market Restraints

- 4.3.1 High cost of high-performance metals and polymers

- 4.3.2 Intellectual-property protection concerns

- 4.3.3 Stringent EHS rules for nano-powder handling

- 4.3.4 Supply-chain volatility in critical alloying elements

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Impact of Macroeconomic Factors

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Threat of New Entrants

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Bargaining Power of Suppliers

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Technology

- 5.1.1 Polymer-based Technologies

- 5.1.1.1 Fused Deposition Modeling (FDM)

- 5.1.1.2 Stereolithography (SLA)

- 5.1.1.3 Digital Light Processing (DLP)

- 5.1.1.4 Material Jetting (PolyJet)

- 5.1.1.5 Binder Jetting - Polymers

- 5.1.2 Metal-based Technologies

- 5.1.2.1 Powder Bed Fusion (SLM, EBM)

- 5.1.2.2 Directed Energy Deposition

- 5.1.3 Ceramic-based Technologies

- 5.1.3.1 Ceramic SLA

- 5.1.3.2 Ceramic Binder Jetting

- 5.1.4 Other Technologies

- 5.1.1 Polymer-based Technologies

- 5.2 By Material Type

- 5.2.1 Polymers

- 5.2.1.1 Commodity Thermoplastics (ABS, PLA)

- 5.2.1.2 Engineering Plastics (PA, PEEK)

- 5.2.1.3 Photopolymer Resins

- 5.2.1.4 High-performance Thermoplastics (ULTEM, PEKK)

- 5.2.2 Metals

- 5.2.2.1 Titanium Alloys

- 5.2.2.2 Aluminum Alloys

- 5.2.2.3 Stainless Steels

- 5.2.2.4 Nickel Super-alloys

- 5.2.2.5 Precious Metals

- 5.2.3 Ceramics

- 5.2.3.1 Alumina

- 5.2.3.2 Zirconia

- 5.2.3.3 Silicon Carbide

- 5.2.4 Composite and Other Emerging Material Feedstocks

- 5.2.1 Polymers

- 5.3 By End User

- 5.3.1 Aerospace and Defense

- 5.3.2 Automotive

- 5.3.3 Healthcare

- 5.3.3.1 Medical Devices

- 5.3.3.2 Dental

- 5.3.4 Industrial Machinery

- 5.3.5 Consumer Products

- 5.3.6 Construction

- 5.3.7 Education and Research

- 5.3.8 Other End Users

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 United Kingdom

- 5.4.3.2 Germany

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Russia

- 5.4.3.7 Rest of Europe

- 5.4.4 Asia Pacific

- 5.4.4.1 China

- 5.4.4.2 Japan

- 5.4.4.3 India

- 5.4.4.4 South Korea

- 5.4.4.5 Australia and New Zealand

- 5.4.4.6 Southeast Asia

- 5.4.4.7 Rest of Asia Pacific

- 5.4.5 Middle East

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Turkey

- 5.4.5.4 Rest of Middle East

- 5.4.6 Africa

- 5.4.6.1 South Africa

- 5.4.6.2 Nigeria

- 5.4.6.3 Egypt

- 5.4.6.4 Rest of Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 BASF 3D Printing Solutions GmbH

- 6.4.2 Evonik Industries AG

- 6.4.3 Arkema S.A.

- 6.4.4 Sandvik AB

- 6.4.5 Hoganas AB

- 6.4.6 Stratasys Ltd.

- 6.4.7 3D Systems Corporation

- 6.4.8 General Electric Company (GE Additive)

- 6.4.9 EOS GmbH

- 6.4.10 Materialise NV

- 6.4.11 Desktop Metal Inc.

- 6.4.12 Markforged Holding Corporation

- 6.4.13 Carpenter Technology Corporation

- 6.4.14 Heraeus Holding GmbH

- 6.4.15 GKN Powder Metallurgy Holdings GmbH

- 6.4.16 HP Inc.

- 6.4.17 Prodways Group SA

- 6.4.18 SLM Solutions Group AG

- 6.4.19 Henkel AG and Co. KGaA

- 6.4.20 DSM-Covestro Additive Manufacturing (Covestro AG)

- 6.4.21 ExOne Company (Desktop Metal)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment