|

市場調查報告書

商品編碼

1906991

電動車充電站:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Electric Vehicle Charging Station - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

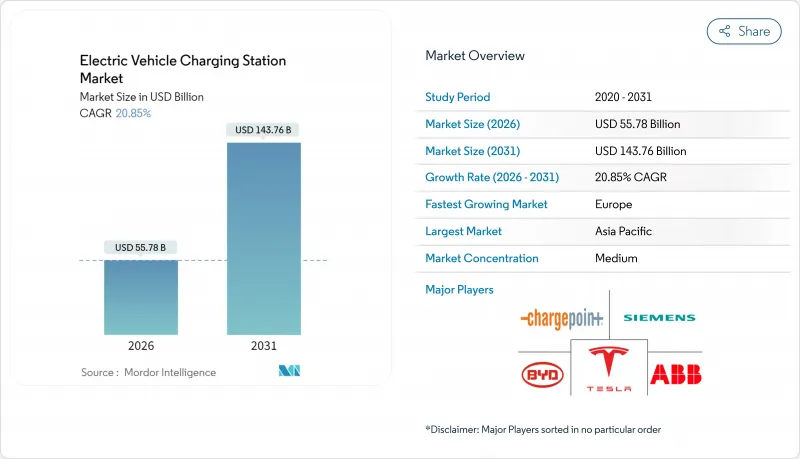

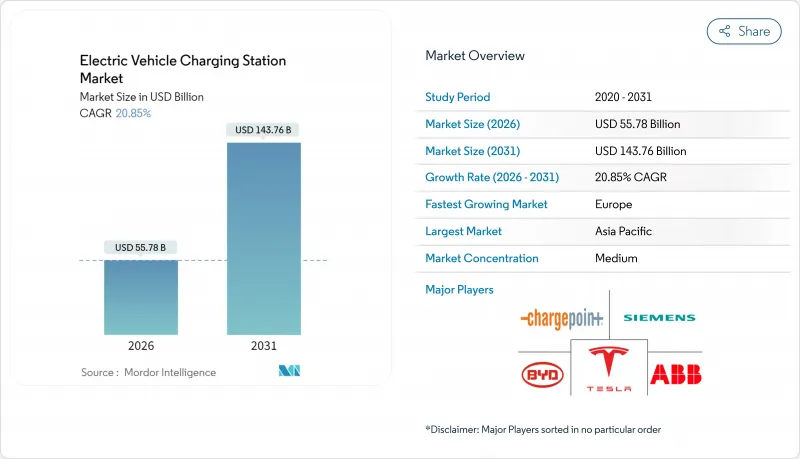

預計到 2026 年,電動車充電站市場規模將達到 557.8 億美元,高於 2025 年的 461.3 億美元。

預計到 2031 年將達到 1,437.6 億美元,2026 年至 2031 年的複合年成長率為 20.85%。

持續的政策壓力促使內燃機汽車逐步淘汰,電池成本的快速下降加速了車輛總擁有成本的盈虧平衡,以及高速公路快速充電走廊的建設旨在緩解里程焦慮,這些都是推動需求激增的關鍵因素。大型車隊營運商正致力於制定多年電氣化目標,確保充電樁的高運轉率,而車網互動(V2G)經營模式則創造了額外的收入來源,並提高了計劃的盈利。儘管亞太地區仍是裝置容量最大的地區,但歐洲目前正經歷最快的成長速度,這主要得益於跨國網路整合。在北美,NEVI Formula計畫以及特斯拉向其他品牌開放其超級充電系統,正在加速充電樁的部署,並提升人們對該技術平台的期望。同時,殼牌等能源巨頭正在關閉加油站,並將資金重新分配到高功率充電樁,這標誌著一種策略轉變,將加劇市場競爭。

全球電動車充電站市場趨勢與洞察

政府主導的零排放強制令及內燃機車輛禁令計劃

隨著各國政府實施具有約束力的零排放車輛強制規定並設定具體的充電容量要求,監管力度正在加速充電基礎設施的部署。歐盟的《替代燃料基礎設施法規》要求成員國根據註冊電動車的數量按比例增加充電容量。同時,加州的《先進清潔車隊法規》要求公共和私營車隊營運商在行業規定的期限內過渡到零排放車輛。 2024年,中國國家發展與改革委員會擴大了高速公路休息區的充電基礎設施,新增了3,000個充電站和5,000個停車位,以支持中國新能源汽車40.9%的市場滲透率。新興市場也面臨監管壓力,沙烏地阿拉伯承諾在2025年安裝5萬個充電站,阿拉伯聯合大公國則設定了2050年實現50%的電動或混合動力汽車保有量的目標。這些強制性規定創造了可預測的需求訊號,並為私人資本投資充電基礎設施提供了合理性。這降低了投資風險,並加速了市場擴張。

透過降低電池單價來平衡總擁有成本 (TCO)。

隨著電動車的整體擁有成本 (TCO) 逐漸與內燃機汽車持平,電池成本的下降正在推動對充電基礎設施的需求。大型採購合約正將鋰離子電池組的價格降至 100 美元/千瓦時以下,這有助於電動車在用電量高的細分市場中與汽油動力汽車展開成本競爭。諸如碳化矽逆變器等組件創新提高了充電效率並減少了能量損耗,使營運商能夠以每千瓦的裝置容量為更多車輛充電。價格合理的電池也使得換電站模式成為可能,該模式可以將資本支出分攤到整個車隊,從而促進電動車充電站產業的服務多元化。電池成本下降和充電效率提高的結合產生了協同效應,透過縮短充電時間和減少基礎設施需求,加速了電動車的普及。商業車隊營運商尤其受益於此趨勢,因為更低的電池成本可以實現更小、更頻繁的充電,從而最佳化營運柔軟性。

150kW以上充電樁需要較高的初始資本投入

高功率充電基礎設施所需的資本支出是其普及推廣的一大障礙,尤其對於獨立營運商和新興市場而言更是如此。 P3集團對歐洲電動卡車充電基礎設施的分析預測,到2030年,歐洲將需要4.5萬個公共充電樁和23.5萬個集中式充電樁。分析指出,高昂的初始資本支出和漫長的電網擴建核准流程是關鍵挑戰。加州能源委員會的一項研究發現,直流快速充電站面臨巨大的資金籌措挑戰,需要每年透過降低需求獲利能力節省4300美元,並透過太陽能併網節省4780至6000美元才能實現盈利。部署能夠為重型車輛提供高達3.75兆瓦充電功率的兆瓦級充電系統,需要對電力基礎設施進行大規模升級,每個安裝項目的成本超過100萬美元。高昂的資本支出尤其限制了農村和低度開發地區的普及,因為這些地區的利用率可能不足以抵消投資成本,造成充電基礎設施可用性的地理差異。

細分市場分析

預計到2025年,乘用車將佔據電動車充電站市場88.45%的佔有率,而商用車市場將以52.20%的複合年成長率(CAGR)實現最快成長,直至2031年,這反映了車隊電氣化強制要求帶來的基礎設施需求。公車是重要的商用車細分市場,隨著都市區空氣品質法規和可預測的線路模式的實施,其電氣化進程正在加速,從而有利於充電基礎設施的最佳化佈局。二輪車在新興市場,尤其是在印度,越來越受歡迎,因為換電模式已被證明具有經濟可行性。卡車由於重量限制和營運需求,需要最先進的充電基礎設施,這推動了高功率充電系統和基於站點的充電解決方案的創新。

商用車的電氣化創造了巨大的基礎需求,從而為充電基礎設施投資提供了充分的理由。這是因為車隊營運商的用車模式可預測,且其用電量高於乘用車。 CharIN 在奧斯陸舉行的 EVS35 大會上正式發布了其兆瓦級充電系統,該系統樹立了高達 3.75 兆瓦的充電容量標桿,使商用車的運營性能能夠與柴油車相媲美。商用車的引進也惠及乘用車基礎設施,因為共用充電走廊降低了單位基礎設施成本,並提高了不同類型車輛的網路利用率。

2025年,直流充電站將佔據電動車充電站市場77.95%的佔有率,預測期內複合年成長率將達到53.10%。這主要得益於營運商旨在縮短充電時間和提高充電效率的策略。橡樹嶺國家實驗室在無線充電技術領域取得了突破性進展,成功實現了透過5英寸(約12.7厘米)的空氣間隙向乘用車傳輸100千瓦的功率,效率高達96%,這有望顛覆傳統的基於連接器的充電方式。 22千瓦以下的交流充電主要用於住宅和職場場所,在這些場所,較長的停車時間允許進行慢速充電,同時在低使用率的安裝環境中保持成本優勢。兆瓦級商用車充電系統的出現,開創了一個獨特的超高功率類別,需要專用的電力基礎設施和冷卻系統。

SAE International 發布了小型電動車無線充電的新標準,其中包括差分感應定位系統 (DIPOS)。該系統可實現不同供應商硬體之間的互通性,充電效率高達 93%。無線充電技術解決了用戶對便利性的擔憂,並透過消除易磨損和人為破壞的實體連接器,降低了基礎設施維護需求。向高功率充電系統的轉變反映了營運商的經濟效益:更快的充電速度可提高充電站利用率和投資回報率,尤其是在交通繁忙、土地成本高昂的地區,更快的充電速度更值得投入。

區域分析

亞太地區將在2025年佔據全球電動車充電站市場60.10%的佔有率,這主要得益於中國1282萬個公共充電樁的規模以及25%的年成長率。目前,中國已在6,000個高速公路服務區部署了國家級充電設施,其覆蓋範圍之廣反映了中國新能源汽車銷售佔全球40.9%的構成比。日本在重型卡車充電系統方面領先,兆瓦級系統特別引人注目;印度的摩托車換電站則展現了提高充電樁密度以滿足低成本出行需求的巨大潛力。在貿易摩擦的背景下,韓國正努力將自身定位為替代電池材料供應商;而澳洲則在偏遠地區建造充電站,以連接遙遠的城市。

歐洲是該地區成長最快的國家,預計到2031年複合年成長率將達到40.50%。 Spark聯盟已在25個國家整合了11,000個高功率連接器,提供透明的價格和100%再生能源。德國計劃在2030年安裝超過100萬個新的充電樁,符合歐盟將基礎設施分配與註冊電動車數量掛鉤的規定。挪威維持著全球人均充電樁數量最高的國家,法國則透過低利率貸款鼓勵私人安裝。英國已從2035年起禁止銷售新的汽油動力汽車,並強制要求公共充電樁實現支付卡互通性,進一步增強了消費者的信任。

在北美,NEVI計畫將加速推進,投資50億美元興建20.4萬個公共充電樁。 IONNA計畫涵蓋七家汽車製造商,將新增3萬個高功率充電介面,並對特斯拉超級充電樁維修,使其能夠兼容其他品牌,預計到2030年將創造60億至120億美元的額外收入。跨產業合作將進一步連接充電和零售設施,效仿歐洲的服務站模式。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 政府主導的零排放強制令及內燃機車輛禁令計劃

- 透過降低電池單價(美元/度)來平衡總擁有成本(TCO)

- 全球高速公路快速充電走廊的建設

- 大型物流公司引進電動車的計畫迅速增加

- 網格業務收益(V2G/V2X)經營模式

- 透過人工智慧最佳化改進充電樁安裝,有助於提高充電運轉率。

- 市場限制

- 150kW以上充電樁的初始資本投資成本較高

- 許可證發放及公用設施接取時間表不統一

- SiC MOSFET原料供不應求

- 連網充電器中的網路安全漏洞

- 監管環境

- 波特五力模型

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模及成長預測(金額)

- 按車輛類型

- 搭乘用車

- 商用車輛

- 公車和長途客車

- 按充電器類型

- 交流充電站

- 直流充電站

- 所有權

- 一般的

- 私人住宅

- 私人 - 車隊/職場

- 按安裝位置

- 家

- 目的地/零售

- 高速公路/公共運輸

- 艦隊倉庫

- 依連接器標準

- CCS

- CHAdeMO

- GB/T

- Tesla NACS

- 無線的

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 南美洲

- 巴西

- 智利

- 南美洲其他地區

- 歐洲

- 德國

- 英國

- 法國

- 挪威

- 義大利

- 西班牙

- 荷蘭

- 波蘭

- 奧地利

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 印尼

- 越南

- 菲律賓

- 澳洲

- 紐西蘭

- 亞太其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 埃及

- 土耳其

- 南非

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- ABB Ltd.

- ChargePoint Inc.

- Tesla Inc.

- Siemens AG

- Schneider Electric Corporation

- Shell Plc.

- ENGIE SA(EVBox)

- BYD Motors Inc.

- Tritium Charging Inc.

- Blink Charging o.

- Delta Electronics Inc.

- Kempower Oyj

- Electrify America, LLC

- IONITY GmbH

- Leviton Manufacturing Co. Inc.

第7章 市場機會與未來展望

Electric vehicle charging station market size in 2026 is estimated at USD 55.78 billion, growing from 2025 value of USD 46.13 billion with 2031 projections showing USD 143.76 billion, growing at 20.85% CAGR over 2026-2031.

Continuous policy pressure to phase out internal-combustion engines, steep battery cost declines that bring total ownership parity forward, and the roll-out of highway fast-charging corridors that neutralize range anxiety are the core forces keeping demand on a steep climb. Large fleet operators are locking in multi-year electrification targets, guaranteeing high charger utilization, while vehicle-to-grid business models create additional revenue layers that lift project returns. Asia-Pacific still accounts for most installations, but Europe now supplies the fastest incremental growth on the back of cross-border network alliances. In North America, the NEVI Formula Program and the opening of Tesla's Supercharger system to other brands accelerate deployment while raising baseline technology expectations. Meanwhile, energy majors like Shell are closing petroleum stations and reallocating capital toward high-power chargers, signaling a strategic shift that tightens competitive intensity.

Global Electric Vehicle Charging Station Market Trends and Insights

Government-backed Zero-emission Mandates and ICE-ban Timelines

Regulatory momentum accelerates charging infrastructure deployment as governments implement binding zero-emission vehicle mandates with specific charging capacity requirements. The EU's Alternative Fuels Infrastructure Regulation mandates that member states increase charging capacity proportionally to EV registrations. At the same time, California's Advanced Clean Fleets Rule requires public and private fleet operators to transition to zero-emission vehicles by sector-specific deadlines. China's National Development and Reform Commission expanded highway service area charging infrastructure by adding 3,000 charging piles and 5,000 parking spaces in 2024, supporting the country's 40.9% new energy vehicle market penetration. Saudi Arabia's commitment to 50,000 charging stations by 2025 and the UAE's target of 50% electric or hybrid vehicles by 2050 extend regulatory pressure to emerging markets. These mandates create predictable demand signals that justify private capital deployment in charging infrastructure, reducing investment risk and accelerating market expansion.

Falling Battery $/kWh Driving TCO Parity

Battery cost reductions approach the critical threshold where electric vehicles achieve total cost of ownership parity with internal combustion engines, catalyzing charging infrastructure demand. Lithium-ion pack prices now edge below USD 100/kWh in leading procurement contracts, helping electric cars reach cost parity with petrol equivalents in usage-heavy segments. Component innovations such as silicon-carbide inverters raise charging efficiency and lower energy losses, allowing operators to serve more vehicles per installed kilowatt. Cheaper batteries also enable swap-station models that spread capex across fleets, broadening service formats within the electric vehicle charging station industry. The convergence of falling battery costs and improved charging efficiency creates a compounding effect where reduced charging times and lower infrastructure utilization requirements accelerate deployment economics. Commercial fleet operators particularly benefit from this dynamic, as reduced battery costs enable smaller, more frequent charging sessions that optimize operational flexibility.

High Upfront CAPEX for More Than 150 kW Chargers

Capital expenditure requirements for high-power charging infrastructure create deployment barriers, particularly for independent operators and emerging markets. The P3 Group analysis of European eTruck charging infrastructure forecasts 45,000 public and 235,000 depot charging points needed by 2030, with high initial capital expenditures and lengthy approval processes for grid expansions identified as primary challenges. The California Energy Commission research demonstrated that DC fast charging stations face significant financing challenges, with potential annual savings of USD 4,300 from demand charge mitigation and USD 4,780 to USD 6,000 from solar integration required to improve viability. The deployment of megawatt charging systems, capable of delivering up to 3.75 MW for heavy-duty vehicles, requires substantial electrical infrastructure upgrades exceeding USD 1 million per installation site. High CAPEX requirements particularly constrain deployment in rural and underserved areas where utilization rates may not justify investment, creating geographic disparities in charging infrastructure availability.

Other drivers and restraints analyzed in the detailed report include:

- Global Build-out of Highway Fast-charging Corridors

- Surging Fleet-Electrification Commitments from Logistics Giants

- Uneven Permitting and Utility Interconnection Timelines

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Passenger cars commanded 88.45% of the electric vehicle charging station market share in 2025, yet commercial vehicles exhibit the fastest growth at 52.20% CAGR through 2031, reflecting the infrastructure requirements for fleet electrification mandates. Buses represent a critical commercial segment where electrification accelerates due to urban air quality mandates and predictable route patterns that enable optimized charging infrastructure deployment. Two-wheelers gain traction in emerging markets where battery swapping models prove economically viable, particularly in India. Trucks require the most sophisticated charging infrastructure due to weight constraints and operational demands, driving innovation in high-power charging systems and depot-based solutions.

Commercial vehicle electrification creates anchor demand that justifies charging infrastructure investment, as fleet operators provide predictable utilization patterns and higher power requirements than passenger vehicles. CharIN officially launched the Megawatt Charging System at EVS35 in Oslo, establishing standards for charging capacities up to 3.75 MW that enable commercial vehicles to achieve operational parity with diesel counterparts. Passenger car infrastructure benefits from commercial vehicle deployment as shared charging corridors reduce per-unit infrastructure costs and improve network utilization rates across vehicle categories.

DC charging station maintained 77.95% of the electric vehicle charging station market share in 2025, while it accelerated at 53.10% CAGR during the forecast period, driven by operator strategies to reduce charging session duration and increase throughput. Oak Ridge National Laboratory achieved a breakthrough in wireless charging technology, demonstrating 100-kW power transfer to passenger vehicles with 96% efficiency across a five-inch air gap, potentially disrupting traditional connector-based charging. AC charging below 22 kW serves primarily residential and workplace applications where longer dwell times accommodate slower charging speeds, while maintaining cost advantages for installations with lower utilization requirements. The emergence of megawatt charging systems for commercial vehicles creates a distinct ultra-high-power category that requires specialized electrical infrastructure and cooling systems.

SAE International published new standards for wireless light-duty EV charging, including the Differential Inductive Positioning System that enables cross-compatibility among different suppliers' hardware with up to 93% efficiency. Wireless charging technology addresses user convenience concerns and reduces infrastructure maintenance requirements by eliminating physical connectors that experience wear and vandalism. The transition toward higher-power charging systems reflects operator economics. Reduced charging times enable higher station utilization and improved return on investment, particularly in high-traffic locations where land costs justify premium charging speeds.

The Electric Vehicle Charging Station Market Report is Segmented by Vehicle Type (Passenger Cars, Commercial Vehicles, and More), Charger Type (AC Charging Station, and DC Charging Station), Ownership Model (Public, and More), Installation Site (Home, and More), Connector Standard (CCS, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific leads the electric vehicle charging station market with a 60.10% share in 2025, supported by China's 12.82 million public connectors and a 25% annual installation increase. National programs now equip 6,000 highway service areas, ensuring long-distance coverage mirrors the country's 40.9% new-energy vehicle sales mix. Japan pioneers megawatt systems for heavy trucks, while India's two-wheeler battery-swapping hubs show how low-cost mobility needs can accelerate charger density. South Korea is positioning itself as an alternative battery-material supplier amid trade tensions, and Australia funds remote-area corridor sites to bridge its vast intercity distances.

Europe shows the fastest regional growth at 40.50% CAGR to 2031. The Spark Alliance integrates 11,000 high-power connectors across 25 countries, offering transparent pricing and 100% renewable electricity. Germany's plan for more than 1 million new charging points by 2030 aligns with EU regulations that tie infrastructure quotas to EV registrations. Norway retains the world's highest per-capita charger count, while France uses low-interest loans to spur private deployments. UK policy bans sales of most new petrol cars from 2035 and now mandates payment-card interoperability at public chargers, further strengthening consumer confidence.

North America accelerates through the NEVI Formula's USD 5 billion funding, enabling 204,000 public ports. The seven-automaker IONNA venture will add 30,000 high-power connectors, and the retrofitting of Tesla Superchargers for multi-brand use could generate USD 6-12 billion in additional revenue by 2030. Cross-industry alliances link charging to retail amenities, mirroring European service-station strategies.

- ABB Ltd.

- ChargePoint Inc.

- Tesla Inc.

- Siemens AG

- Schneider Electric Corporation

- Shell Plc.

- ENGIE SA (EVBox)

- BYD Motors Inc.

- Tritium Charging Inc.

- Blink Charging o.

- Delta Electronics Inc.

- Kempower Oyj

- Electrify America, LLC

- IONITY GmbH

- Leviton Manufacturing Co. Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government-backed zero-emission mandates and ICE-ban timelines

- 4.2.2 Falling battery $/kWh driving TCO parity

- 4.2.3 Global build-out of highway fast-charging corridors

- 4.2.4 Surging fleet-electrification commitments from logistics giants

- 4.2.5 Grid-services monetisation (V2G/V2X) business models

- 4.2.6 AI-optimised charger siting improving utilisation rates

- 4.3 Market Restraints

- 4.3.1 High upfront CAPEX for More Than 150 kW chargers

- 4.3.2 Uneven permitting and utility interconnection timelines

- 4.3.3 Raw-material bottlenecks for SiC MOSFETs

- 4.3.4 Cyber-security vulnerabilities in networked chargers

- 4.4 Regulatory Landscape

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value (USD))

- 5.1 By Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Commercial Vehicles

- 5.1.3 Buses and Coaches

- 5.2 By Charger Type

- 5.2.1 AC Charging Station

- 5.2.2 DC Charging Station

- 5.3 By Ownership Model

- 5.3.1 Public

- 5.3.2 Private - Residential

- 5.3.3 Private - Fleet/Workplace

- 5.4 By Installation Site

- 5.4.1 Home

- 5.4.2 Destination/Retail

- 5.4.3 Highway/Transit

- 5.4.4 Fleet Depot

- 5.5 By Connector Standard

- 5.5.1 CCS

- 5.5.2 CHAdeMO

- 5.5.3 GB/T

- 5.5.4 Tesla NACS

- 5.5.5 Wireless

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Chile

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Norway

- 5.6.3.5 Italy

- 5.6.3.6 Spain

- 5.6.3.7 Netherlands

- 5.6.3.8 Poland

- 5.6.3.9 Austria

- 5.6.3.10 Russia

- 5.6.3.11 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Indonesia

- 5.6.4.6 Vietnam

- 5.6.4.7 Philippines

- 5.6.4.8 Australia

- 5.6.4.9 New Zealand

- 5.6.4.10 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 Egypt

- 5.6.5.4 Turkey

- 5.6.5.5 South Africa

- 5.6.5.7 Rest of Middle East and Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, and Recent Developments)

- 6.4.1 ABB Ltd.

- 6.4.2 ChargePoint Inc.

- 6.4.3 Tesla Inc.

- 6.4.4 Siemens AG

- 6.4.5 Schneider Electric Corporation

- 6.4.6 Shell Plc.

- 6.4.7 ENGIE SA (EVBox)

- 6.4.8 BYD Motors Inc.

- 6.4.9 Tritium Charging Inc.

- 6.4.10 Blink Charging o.

- 6.4.11 Delta Electronics Inc.

- 6.4.12 Kempower Oyj

- 6.4.13 Electrify America, LLC

- 6.4.14 IONITY GmbH

- 6.4.15 Leviton Manufacturing Co. Inc.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment