|

市場調查報告書

商品編碼

1876591

液冷式電動車充電線纜市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Liquid-Cooled EV Charging Cable Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

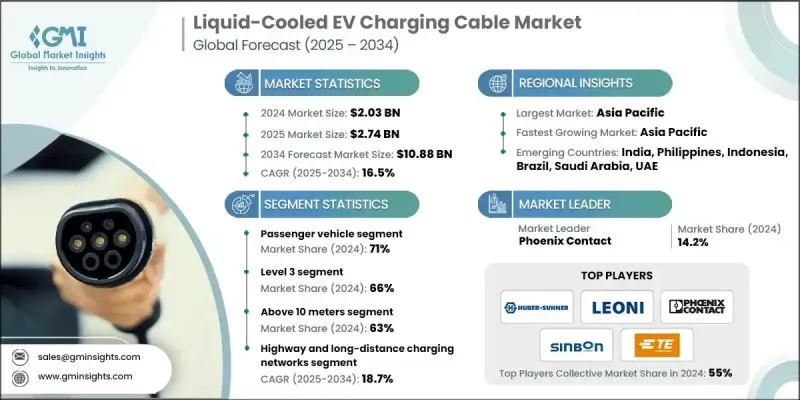

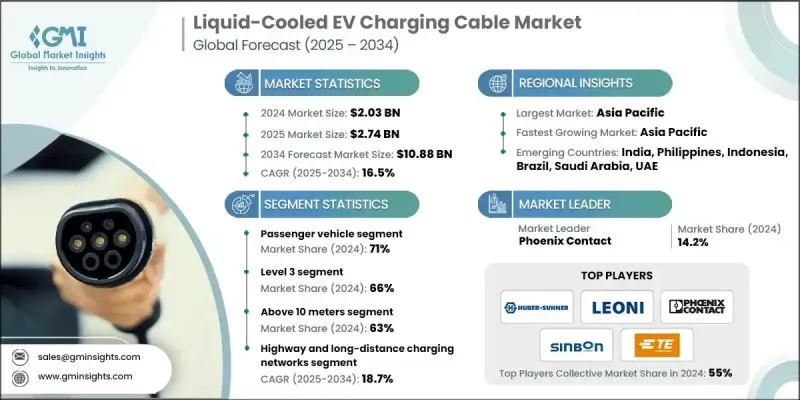

2024 年全球液冷電動車充電電纜市場價值為 20.3 億美元,預計到 2034 年將以 16.5% 的複合年成長率成長至 108.8 億美元。

超快速直流充電基礎設施的加速部署正在改變電動車充電格局。液冷充電電纜支援從 150 千瓦到超過 1.5 兆瓦的高電流容量,在保持緊湊設計的同時,實現了更快、更安全的充電。這些電纜使營運商和網路供應商能夠在不增加電纜重量或發熱風險的情況下顯著縮短充電時間。該技術還最佳化了場地利用率,簡化了高功率充電器的運作和維護,並支援大規模車隊電氣化和高速公路走廊建設。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 20.3億美元 |

| 預測值 | 108.8億美元 |

| 複合年成長率 | 16.5% |

隨著製造商和原始設備製造商 (OEM) 擴大營運規模以滿足日益成長的兆瓦級需求,市場正經歷投資和生產擴張的加速。眾多生產商和充電基礎設施整合商已升級了製造設施,啟動了液冷組件的試點生產,並與連接器和冷卻系統供應商合作,以加速部署功率範圍從 350 千瓦到超過 1000 千瓦的充電系統。包括卡車、巴士和送貨車隊在內的商用運輸向電動化的轉型日益成長,這極大地推動了液冷充電解決方案的發展。高負載充電應用需要穩定的散熱性能,因此,對於那些希望在嚴苛的運行條件下延長設備壽命並實現高效散熱的營運商而言,液冷電纜是理想之選。

2024年,乘用車市場佔據71%的市場佔有率,預計到2034年將以16.2%的複合年成長率成長。該細分市場的強勁表現與全球電動車的快速普及以及對超快速充電方案日益成長的需求密切相關。隨著汽車製造商不斷整合更高電壓的系統,快速充電過程中的高效散熱變得至關重要。液冷電纜能夠實現安全緊湊的電力傳輸,在確保系統安全性和效能可靠性的同時,提高能量傳輸效率並縮短充電時間。

3級充電市場佔據66%的市場佔有率,預計在2025年至2034年間將以17.5%的複合年成長率成長。該細分市場的領先地位源於其提供超快速直流充電的能力,可顯著減少車輛停機時間。隨著電動車普及率的激增,對超過350千瓦的高功率充電的需求也急劇上升,尤其是在公共和高速公路充電應用領域。液冷電纜在這一領域發揮著至關重要的作用,它能夠在高電流下高效散熱,確保可靠、安全的運行,即使在連續高負荷循環下也能延長電纜的使用壽命。

美國液冷式電動車充電電纜市場佔85%的市場佔有率,預計2024年市場規模將達到5.544億美元。美國市場的擴張主要得益於聯邦和州政府大力支持的高速充電網路在全國範圍內的部署。公共和車隊充電網路兆瓦級基礎設施的快速發展,刺激了對能夠承受高電壓和高電流的先進液冷式電纜系統的需求。這些解決方案能夠提升安全性、效能和耐用性,這對於大規模的公共和商業充電環境至關重要。

全球液冷式電動車充電線市場的主要參與者包括住友電工、ABB、Huber+Suhner、菲尼克斯電氣、TE Connectivity、KemPower、Besen International、Brugg eConnect、Leoni 和 Sinbon Electronics。這些公司透過技術創新和策略擴張不斷增強其競爭優勢。液冷式電動車充電線市場的關鍵參與者正在採取一系列策略措施來提升其市場地位。許多公司正在投資研發,以設計能夠支援超高功率位準,同時保持靈活性和安全性的下一代線。與充電系統製造商和熱管理專家的策略合作正在加速技術的商業化進程。各公司也正在擴大產能並建立在地化製造中心,以滿足區域需求並縮短供應鏈週期。

目錄

第1章:方法論

- 市場範圍和定義

- 研究設計

- 研究方法

- 資料收集方法

- 資料探勘來源

- 全球的

- 地區/國家

- 基準估算和計算

- 基準年計算

- 市場估算的關鍵趨勢

- 初步研究和驗證

- 原始資料

- 預測模型

- 研究假設和局限性

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率分析

- 成本結構

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 高功率直流快速充電的需求不斷成長

- 乘用車和商用車領域電動車普及率不斷提高

- 增加對充電基礎設施擴建的投資

- 電纜耐久性和散熱管理方面的進步

- 支持性的政府政策與減排目標

- 產業陷阱與挑戰

- 複雜的安裝和冷卻系統整合

- 熟練維修人員數量有限

- 市場機遇

- 在兆瓦級充電通道中整合液冷電纜

- 擴大電動車基礎設施領域的公私合作

- 輕量軟性電纜設計方面的技術創新

- 車隊電氣化和充電站充電需求不斷成長

- 新進業者進入市場,提供成本效益高的冷卻解決方案

- 成長促進因素

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 波特的分析

- PESTEL 分析

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 專利分析

- 價格趨勢

- 按地區

- 搭車

- 成本細分分析

- 商業案例及投資報酬率分析

- 總擁有成本框架

- 投資報酬率計算方法

- 實施時間表和里程碑

- 風險評估與緩解策略

- 永續性和環境影響分析

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

- 未來展望與機遇

- 新興應用機遇

- 投資需求及資金來源

- 風險評估與緩解策略

- 針對市場參與者的策略建議

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估價與預測:依車輛類型分類,2021-2034年

- 主要趨勢

- 乘客

- 掀背車

- 轎車

- SUV

- 商業的

- 輕型商用車(LCV)

- 中型商用車(MCV)

- 重型商用車(HCV)

第6章:市場估算與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 公共充電站

- 商用車隊充電

- 住宅/私人充電

- 高速公路和長途充電網路

第7章:市場估算與預測:依收費水準分類,2021-2034年

- 主要趨勢

- 一級

- 二級

- 3級

第8章:市場估算與預測:依電纜長度分類,2021-2034年

- 主要趨勢

- 低於5米

- 6-10米

- 10公尺以上

第9章:市場估算與預測:依電力產業分類,2021-2034年

- 主要趨勢

- 交流充電

- 直流充電

第10章:市場估計與預測:依導體材料分類,2021-2034年

- 主要趨勢

- 銅

- 鋁

第11章:市場估價與預測:依連接器分類,2021-2034年

- 主要趨勢

- 1型

- 類型 2

- CCS1

- CCS2

- CHAdeMO

- 其他

第12章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 菲律賓

- 印尼

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第13章:公司簡介

- 全球參與者

- ABB

- Aptiv

- Huawei

- Huber+Suhner

- Johnson Electric

- Leoni AG

- Phoenix Contact

- Siemens

- Sinbon Electronics

- TE Connectivity

- Volex

- 區域玩家

- Blink Charging

- Boyd

- BTC Power

- CPC Worldwide

- FreeWire Technologies

- Kempower

- OMG

- Tritium

- Wallbox

- 新興參與者

- AG Electrical

- Cargill

- Engineered Fluids

- E-valucon / Sam Woo Electronics

- i-charging

- Linke Cable Technology

- Senku

- TST Cables

The Global Liquid-Cooled EV Charging Cable Market was valued at USD 2.03 billion in 2024 and is estimated to grow at a CAGR of 16.5% to reach USD 10.88 billion by 2034.

The accelerated deployment of ultra-fast DC charging infrastructure is transforming the EV charging landscape. Liquid-cooled charging cables support high current capacities ranging from 150 kW to more than 1.5 MW, enabling faster and safer charging while maintaining a compact design. These cables allow operators and network providers to reduce charging time significantly without increasing cable weight or heat risks. This technology also optimizes site area usage, simplifies operation and maintenance of high-power chargers, and supports large-scale fleet electrification and highway corridor development.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.03 Billion |

| Forecast Value | $10.88 Billion |

| CAGR | 16.5% |

The market is seeing intensified investments and production expansion as manufacturers and OEMs scale operations to meet rising megawatt-level demand. Numerous producers and charging infrastructure integrators have upgraded manufacturing facilities, initiated pilot-scale production of liquid-cooling components, and partnered with connector and cooling system suppliers to accelerate deployment of charging systems ranging from 350 kW to over 1,000 kW. The growing transition to electric commercial transport, including trucks, buses, and delivery fleets, is a major catalyst for liquid-cooled charging solutions. Heavy-duty charging applications demand consistent thermal performance, making liquid-cooled cables ideal for operators seeking longer equipment lifespan and efficient thermal regulation under demanding operational conditions.

In 2024, the passenger vehicle segment held a 71% share and is anticipated to grow at a CAGR of 16.2% through 2034. The strong dominance of this segment is linked to the rapid global increase in electric car adoption and the rising need for ultra-fast charging options. As automakers continue integrating higher voltage systems, efficient heat management during fast charging becomes critical. Liquid-cooled cables enable safe and compact power delivery, allowing higher energy throughput and shorter charging durations while maintaining system safety and performance reliability.

The level 3 segment held a 66% share and is expected to grow at a CAGR of 17.5% between 2025 and 2034. This segment's leadership stems from its capability to deliver ultra-fast DC charging that significantly minimizes vehicle downtime. With the surge in electric vehicle adoption, demand for high-power charging exceeding 350 kW has risen sharply, especially in public and highway charging applications. Liquid-cooled cables play a vital role in this space by managing heat efficiently during high current flow, ensuring reliable, safe operation, and longer cable service life even under continuous heavy-duty cycles.

United States Liquid-Cooled EV Charging Cable Market held an 85% share, generating USD 554.4 million in 2024. Market expansion in the U.S. is being driven by the nationwide implementation of high-speed charging networks supported by federal and state initiatives. Rapid development of megawatt-scale infrastructure across both public and fleet networks is stimulating demand for advanced liquid-cooled cable systems that can handle high voltage and current levels. These solutions enhance safety, performance, and durability, which are critical in large-scale public and commercial charging environments.

Leading players in the Global Liquid-Cooled EV Charging Cable Market include Sumitomo Electric, ABB, Huber+Suhner, Phoenix Contact, TE Connectivity, KemPower, Besen International, Brugg eConnect, Leoni, and Sinbon Electronics. These companies continue to strengthen their competitive advantage through technological innovation and strategic expansion. Key participants in the Liquid-Cooled EV Charging Cable Market are adopting a range of strategic initiatives to enhance their market position. Many are investing in research and development to design next-generation cables capable of supporting ultra-high power levels while maintaining flexibility and safety. Strategic collaborations with charging system manufacturers and thermal management specialists are helping accelerate technology commercialization. Companies are also expanding production capacities and establishing localized manufacturing hubs to meet regional demand and reduce supply chain lead times.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Vehicle

- 2.2.3 Charging Level

- 2.2.4 Cable Length

- 2.2.5 Power

- 2.2.6 Application

- 2.2.7 Conductor Material

- 2.2.8 Connector

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for high-power dc fast charging

- 3.2.1.2 Increasing EV adoption across passenger and commercial segments

- 3.2.1.3 Growing investments in charging infrastructure expansion

- 3.2.1.4 Advancements in cable durability and thermal management

- 3.2.1.5 Supportive government policies and emission reduction targets

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Complex installation and cooling system integration

- 3.2.2.2 Limited availability of skilled maintenance personnel

- 3.2.3 Market opportunities

- 3.2.3.1 Integration of liquid-cooled cables in megawatt charging corridors

- 3.2.3.2 Expansion of public-private partnerships in EV infrastructure

- 3.2.3.3 Technological innovation in lightweight and flexible cable design

- 3.2.3.4 Rising demand for fleet electrification and depot charging

- 3.2.3.5 Entry of new players offering cost-optimized cooling solutions

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 LAMEA

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Patent analysis

- 3.9 Price trends

- 3.9.1 By region

- 3.9.2 By vehicle

- 3.10 Cost breakdown analysis

- 3.11 Business Case & ROI Analysis

- 3.11.1 Total cost of ownership framework

- 3.11.2 ROI calculation methodologies

- 3.11.3 Implementation timeline & milestones

- 3.11.4 Risk assessment & mitigation strategies

- 3.12 Sustainability and environmental impact analysis

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Future outlook & opportunities

- 3.13.1 Emerging Application Opportunities

- 3.13.2 Investment Requirements & Funding Sources

- 3.13.3 Risk Assessment & Mitigation Strategies

- 3.13.4 Strategic Recommendations for Market Participants

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LAMEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Passenger

- 5.2.1 Hatchbacks

- 5.2.2 Sedans

- 5.2.3 SUV

- 5.3 Commercial

- 5.3.1 Light commercial vehicles (LCV)

- 5.3.2 Medium commercial vehicles (MCV)

- 5.3.3 Heavy commercial vehicles (HCV)

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Public Charging Stations

- 6.3 Commercial Fleet Charging

- 6.4 Residential / Private Charging

- 6.5 Highway and Long-Distance Charging Networks

Chapter 7 Market Estimates & Forecast, By Charging Level, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Level 1

- 7.3 Level 2

- 7.4 Level 3

Chapter 8 Market Estimates & Forecast, By Cable Length, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Below 5 meters

- 8.3 6-10 meters

- 8.4 Above 10 meters

Chapter 9 Market Estimates & Forecast, By Power, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 AC charging

- 9.3 DC charging

Chapter 10 Market Estimates & Forecast, By Conductor Material, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 Copper

- 10.3 Aluminum

Chapter 11 Market Estimates & Forecast, By Connector, 2021 - 2034 ($Bn, Units)

- 11.1 Key trends

- 11.2 Type 1

- 11.3 Type 2

- 11.4 CCS1

- 11.5 CCS2

- 11.6 CHAdeMO

- 11.7 Others

Chapter 12 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 US

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.3.6 Russia

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.4.6 Philippines

- 12.4.7 Indonesia

- 12.5 LAMEA

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.5.4 South Africa

- 12.5.5 Saudi Arabia

- 12.5.6 UAE

Chapter 13 Company Profiles

- 13.1 Global Players

- 13.1.1 ABB

- 13.1.2 Aptiv

- 13.1.3 Huawei

- 13.1.4 Huber+Suhner

- 13.1.5 Johnson Electric

- 13.1.6 Leoni AG

- 13.1.7 Phoenix Contact

- 13.1.8 Siemens

- 13.1.9 Sinbon Electronics

- 13.1.10 TE Connectivity

- 13.1.11 Volex

- 13.2 Regional Players

- 13.2.1 Blink Charging

- 13.2.2 Boyd

- 13.2.3 BTC Power

- 13.2.4 CPC Worldwide

- 13.2.5 FreeWire Technologies

- 13.2.6 Kempower

- 13.2.7 OMG

- 13.2.8 Tritium

- 13.2.9 Wallbox

- 13.3 Emerging Players

- 13.3.1 AG Electrical

- 13.3.2 Cargill

- 13.3.3 Engineered Fluids

- 13.3.4 E-valucon / Sam Woo Electronics

- 13.3.5 i-charging

- 13.3.6 Linke Cable Technology

- 13.3.7 Senku

- 13.3.8 TST Cables