|

市場調查報告書

商品編碼

1906983

玻璃纖維增強聚合物:市場佔有率分析、產業趨勢與統計、成長預測(2026-2031)Glass Fiber Reinforced Polymer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

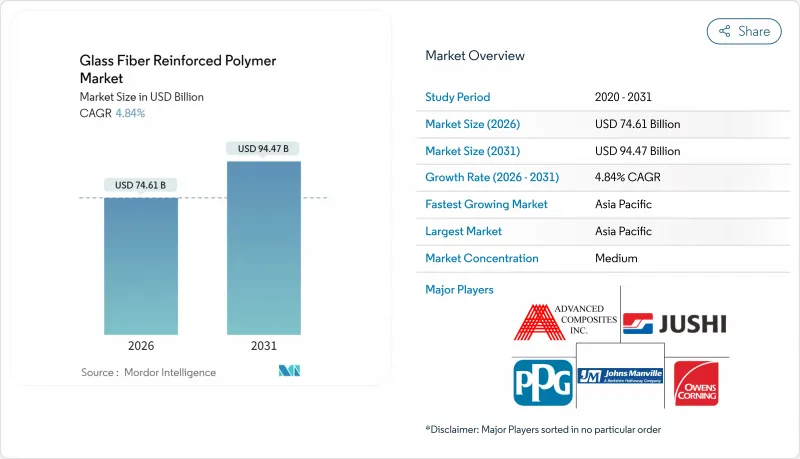

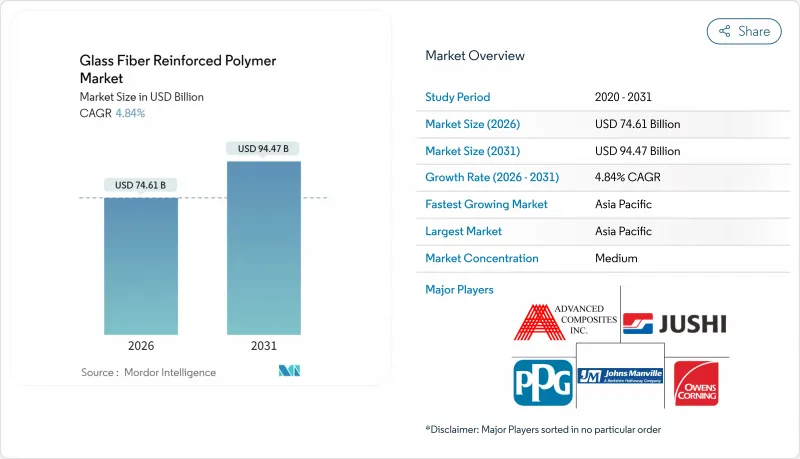

預計玻璃纖維增強聚合物市場將從 2025 年的 711.7 億美元成長到 2026 年的 746.1 億美元,到 2031 年將達到 944.7 億美元,2026 年至 2031 年的複合年成長率為 4.84%。

需求成長主要由交通運輸、可再生能源、航太和建築業的原始設備製造商 (OEM) 推動,他們採用無腐蝕複合材料取代現有材料,以減輕重量、提高耐久性並滿足更嚴格的永續性目標。快速的都市化,尤其是在亞太地區,正在推動基礎設施投資,這些投資指定使用玻璃纖維增強聚合物解決方案來製造鋼筋、橋面和管道內襯。材料創新正在拓展性能範圍。生物基環氧樹脂正進入大規模生產階段,四縫加固和碳-玻璃纖維複合材料複合材料正在催生新的結構應用。競爭異常激烈,但多元化程度正在提高。跨國公司正在精簡低利潤產品線並與回收商合作,而區域製造商則在更靠近客戶的地方擴大產能,以避免物流和匯率風險。儘管報廢處理仍面臨挑戰,熱解和碳化矽增值回收的技術創新正在推動循環經濟計劃,並緩解歐洲和北美的監管壓力。

全球玻璃纖維增強聚合物市場趨勢及洞察

汽車產業需求不斷成長

電動車專案正在加速複合材料的應用,因為每減輕一公斤重量,就能增加續航里程並縮小電池尺寸。玻璃纖維增強熱塑性塑膠正在取代電池機殼中的沖壓鋼,在提高耐火性和絕緣性的同時,也能減輕40%的重量。汽車製造商正在採用碳-玻璃混合變速箱殼體,這種殼體在保持剛性以實現精確齒輪定位的同時,還能減輕30%的重量。玻璃纖維增強聚合物市場的參與企業正在利用降低的模具成本,在本地生產諸如張緊鋼板彈簧之類的專用零件,這些零件可以為商用車減輕高達50公斤的重量,從而提高有效負載容量。

擴大玻璃纖維增強聚合物在風力發電機中的應用

風電產業是成長最快的終端用戶,因為高聳的塔架和長長的葉片需要輕質而堅固的材料。渦輪機原始設備製造商 (OEM) 正在整合碳-玻璃複合材料混合翼樑和根部嵌件,以實現可接受的葉尖撓度,從而打造 15 兆瓦級平台。立陶宛研究人員展示了熱解工藝,與掩埋處理相比,可將廢棄物處理的影響減少高達 51%。諸如此類的進展有助於改善生命週期認證,而這在國內競標中正變得越來越重要。

高昂的製造成本

特殊的纖維上漿製程、嚴格的製程控制以及高能耗的熔煉過程,使得它們比普通金屬價格更高。 2024年的價格下跌擠壓了利潤空間,導致歐文斯科寧複合材料部門2024年第一季的銷售額下降11%至5.23億美元,並促使該公司對其玻璃纖維增強材料部門進行戰略評估。資本密集的熔煉爐以及新興地區有限的規模經濟效益,使得單位成本居高不下,減緩了成本敏感型細分市場對玻璃纖維增強材料的採用。

細分市場分析

聚酯樹脂價格低廉,且與壓縮成型和噴塗成型製程相容性強,預計到2025年將佔據玻璃纖維增強聚合物市場61.47%的佔有率。環氧樹脂雖然市佔率較小,但憑藉其優異的黏合性、抗疲勞性和低空隙率的加工性能,預計到2031年將以4.99%的複合年成長率高速成長,滿足航太、風能和汽車業的嚴格規範要求。乙烯基酯樹脂的耐化學性優於聚酯樹脂,成本低於環氧樹脂,因此在對性能要求中等的細分市場(如船舶和化學品儲存計劃)中需求旺盛。一種新開發的生物基環氧樹脂含有23%的可再生乙二醇,在不影響機械強度的前提下,可減少21%的生產排放,有助於滿足ESG評分卡和採購指南的要求。奈米填料改質環氧樹脂也可用作固體聚合物電解質,在結構電池和超級電容具有開創性的應用前景。在玻璃纖維增強聚合物市場,隨著下游客戶尋求低碳替代品,傳統聚酯樹脂的成本壓力預計將持續存在。

為了適應高速樹脂傳輸線,乙烯基酯樹脂生產商正在提高固化速度。同時,聚氨酯樹脂擴大應用於衝擊吸收板,在這些應用中,韌性比剛性更為重要。諸如PEEK之類的特殊熱塑性樹脂仍然是油氣井下工具的關鍵材料,這些工具需要耐高溫達240°C。由於中國的大型聚酯工廠擁有獨立的爐窯網路,能夠根據需求波動快速調整產量,因此供應過剩的擔憂有限。環氧樹脂供應商透過雙酚A和環氧氯丙烷的遠期合約來對沖原料價格波動風險,從而穩定航太主要製造商的價格。連續加工技術的創新,例如60秒脫模的快速固化環氧樹脂,正在縮短生產週期,並支持玻璃纖維增強聚合物市場大規模生產的擴張。

由於其在中等批量生產中具有高重複性和經濟性,壓縮成型(包括片狀成型塑膠和玻璃纖維氈熱塑性塑膠)預計在2025年將佔總收入的30.56%。射出成型預計到2031年將維持4.89%的複合年成長率,這主要得益於高流動性、長纖維熱塑性塑膠的出現,這些塑膠無需二次加工即可生產薄壁複雜零件。真空輔助樹脂傳遞模塑技術正在不斷發展,該技術利用固化過程中的壓力,將纖維含量提高到62%,拉伸強度提高到760兆帕,同時將厚度減少4%。對於建築板材和遊艇船體而言,手工鋪層仍然是主流工藝,因為在這些領域,設計自由度遠大於生產週期。

連續拉擠成型生產線整合了在線連續拋光和底漆工藝,降低了窗框和電網橫擔等下游產品的人事費用。可在熱固性和熱塑性基體之間切換的混合生產單元提高了資產利用率,並實現了玻璃纖維增強聚合物市場的複合材料模組化。機器人操作減少了廢棄物,閉合迴路數位雙胞胎技術能夠即時偵測樹脂過載區域,防止分層熱點出現。對於大批量生產的汽車門檻梁,低於 55 秒的生產週期在成本上可與鋁擠型相媲美,這也是主要一級供應商設定的 2027 年目標。在新興經濟體,支援技術轉移的優惠融資計畫正使本地生產的壓縮機能夠滿足當地需求。

區域分析

預計到2025年,亞太地區將佔全球銷售額的48.35%,並在2031年之前以4.93%的複合年成長率成長。中國正加速產能擴張,例如BASF投資108億美元的湛江綜合體項目,運作再生能源,並為汽車和電子應用領域提供複合材料。印度的鐵路和公路現代化計畫正在刺激國內需求,BASF宣布增加聚醯胺和PBT的產量,以滿足下游加工商的需求。東南亞國協的供應鏈多元化正在推動近岸外包,玻璃纖維增強聚合物市場的參與企業選擇更靠近終端用戶的位置進行生產。

在北美,美國在渦輪葉片、航太和基礎設施的需求成長方面處於主導。巨石集團正在美國完成一座新熔爐的建設,這將確保區域供應安全並避免進口關稅。聯邦政府的「購買美國貨」條款越來越傾向國內採購,這既有利於現有生產商,也有利於新參與企業。加拿大正專注於輕型公車和電池機殼,以滿足零排放車輛法規的要求。在歐洲,循環經濟立法正在推動對再生樹脂和葉片間玻璃纖維回收技術的投資。 Carbon Rivers公司的多級熱解技術可回收用於隔熱材料和片狀成型塑膠的纖維,並因此獲得了津貼和品牌所有者的合作。德國正在支持需要耐腐蝕襯裡的氫氣管道維修,而北海離岸風力發電的擴張也持續推動高模量粗紗的需求。雖然南美洲和中東及非洲仍然是小眾市場,但隨著巴西對其港口進行現代化改造,沙烏地阿拉伯向交通運輸和可再生能源領域的重大計劃投入資金,這些市場正在獲得發展動力,為玻璃纖維增強聚合物市場開闢了新的競爭領域。

其他福利:

- Excel格式的市場預測(ME)表

- 分析師支持(3個月)

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 汽車產業需求不斷成長

- 風力發電機中玻璃纖維增強聚合物的使用日益增多

- 航太工業中玻璃纖維增強聚合物的應用日益增多

- 建築和基礎設施行業的擴張

- 建設產業越來越重視能源效率和輕量材料

- 市場限制

- 高昂的製造成本

- 回收能力有限

- 替代材料的可用性

- 價值鏈分析

- 波特五力模型

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 依樹脂類型

- 聚酯纖維

- 乙烯基酯樹脂

- 環氧樹脂

- 聚氨酯

- 其他樹脂類型(PEEK樹脂、酚醛樹脂等)

- 透過流程

- 人工流程

- 壓縮成型

- 片狀成型塑膠(SMC)工藝

- 玻璃纖維氈熱塑性樹脂工藝

- 連續製程

- 射出成型

- 依纖維類型

- 粗紗

- 切割纖維墊

- 連續纖維絲氈

- 粗紗/織物

- 按最終用戶行業分類

- 能源

- 車

- 船

- 建築和基礎設施

- 電氣和電子設備

- 航太/國防

- 其他終端使用者產業(醫療保健、消費品)

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- Advanced Composites Inc.

- BASF SE

- BGF Industries

- Binani Industries Ltd.

- Celanese Corporation

- China Beihai Fiberglass Co. Ltd

- China Jushi Co. Ltd

- Chongqing Polycomp International Corp.(CPIC)

- Gurit Services AG, Zurich

- Jiuding New Material Co., Ltd

- Johns Manville

- Nippon Electric Glass Co.,Ltd.

- Owens Corning

- PPG Industries Inc.

- Reliance Industries Limited

- SAERTEX GmbH & Co. KG

- Scott Bader Company Ltd.

- The Composite Group

第7章 市場機會與未來展望

The Glass Fiber Reinforced Polymer market is expected to grow from USD 71.17 billion in 2025 to USD 74.61 billion in 2026 and is forecast to reach USD 94.47 billion by 2031 at 4.84% CAGR over 2026-2031.

Demand is rising as OEMs in transportation, renewable energy, aerospace, and construction replace heavier metals with corrosion-free composites to lower weight, boost durability, and meet stricter sustainability targets. Rapid urbanization, especially in Asia-Pacific, is stimulating infrastructure investments that specify glass fiber reinforced polymer solutions for rebar, bridge decks, and pipeline liners. Material innovation is widening the performance envelope: bio-based epoxy chemistries are entering series production, while quadaxial stitched reinforcements and hybrid carbon-glass fabrics are enabling new structural applications. Competition is intense but fragmented; multinationals are pruning low-margin lines and partnering with recyclers, whereas regional producers expand capacity close to customers to hedge logistics risk and currency volatility. End-of-life hurdles remain; nevertheless, breakthroughs in pyrolysis and silicon-carbide up-cycling are improving the circularity narrative and easing regulatory pressure in Europe and North America.

Global Glass Fiber Reinforced Polymer Market Trends and Insights

Growing Demand from the Automotive Sector

Electric-mobility programs are accelerating composite uptake because every kilogram saved extends driving range and shrinks battery size. Glass fiber reinforced thermoplastics now replace stamped steel in battery enclosures, trimming mass by 40% while improving fire resistance and thermal insulation. OEMs deploy hybrid carbon-glass transmission housings that cut 30% weight yet keep stiffness for precise gear alignment. Glass fiber reinforced polymer market participants also exploit lower tooling costs to localize niche parts such as tension leaf springs that remove up to 50 kg from commercial vehicles, thereby permitting higher payloads.

Increasing Usage of Glass Fiber Reinforced Polymers in Wind Turbines

The wind sector is the fastest-growing end-user because taller towers and longer blades mandate lighter yet stronger materials. Turbine OEMs integrate carbon-glass hybrid spars and root inserts to keep tip deflection within limits, thereby enabling 15-MW platforms. Lithuanian researchers have validated pyrolysis routes that reclaim fibers and toxic styrene from end-of-life blades, reducing disposal impacts by up to 51% versus landfill. These advances improve the life-cycle credentials that national tenders increasingly require.

High Manufacturing Cost

Specialized fiber sizing, tight process controls, and energy-intensive melting raise costs versus commodity metals. Price declines during 2024 squeezed margins; Owens Corning's Composites sales fell 11% to USD 523 million in Q1 2024, prompting a strategic review of its glass reinforcements unit. Capital-intensive furnaces and limited economies of scale in emerging regions keep unit costs elevated, delaying adoption in cost-driven segments.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Adoption of Glass Fiber Reinforced Polymers in the Aerospace Industry

- Expansion of Construction and Infrastructure Sector

- Limited Recycling Capabilities

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Polyester resins dominated 2025 demand with a 61.47% share of the glass fiber reinforced polymer market size, thanks to low price and broad compatibility with compression and spray-up processes. Epoxy, though smaller, will register the highest 4.99% CAGR to 2031 because its superior adhesion, fatigue resistance, and low-void processing meet stringent aerospace, wind, and automotive specifications. Vinyl ester fills the mid-performance niche, combining better chemical resistance than polyester with lower cost than epoxy, and thus appeals to marine and chemical containment projects. Recent bio-based epoxies containing 23% renewable glycol cut manufacturing emissions by 21% without sacrificing mechanical strength, supporting ESG scorecards and procurement guidelines. Nanofiller-modified epoxies that double as solid polymer electrolytes open structural battery and supercapacitor use cases. The glass fiber reinforced polymer market expects continued cost pressure on conventional polyester as downstream customers seek lower embedded carbon alternatives.

Vinyl ester producers are enhancing cure kinetics to suit high-speed resin transfer lines, while polyurethane chemistries gain adoption in impact-absorption panels where toughness outweighs stiffness. Niche thermoplastics such as PEEK remain essential in oil-and-gas downhole tools requiring 240 °C service temperatures. Oversupply concerns are limited because large polyester plants in China run captive furnace networks, allowing quick output throttling during demand swings. Epoxy suppliers hedge raw-material volatility through forward contracts on bisphenol-A and epichlorohydrin, stabilizing pricing to aerospace primes. Innovations in continuous processing, such as snap-cure epoxies that reach demold in 60 seconds, will compress cycle time and support volume ramp-ups in the glass fiber reinforced polymer market.

Compression molding, including Sheet Molding Compound and Glass Mat Thermoplastic, accounted for 30.56% of 2025 revenue due to high repeatability and favorable economics at medium volumes. Injection molding will post a 4.89% CAGR through 2031 as high-flow, long-fiber thermoplastic compounds allow thin-wall complex parts without secondary finishing. Vacuum-assisted resin transfer molding has evolved; adding pressure during cure boosts fiber volume to 62% and lifts tensile strength to 760 MPa while trimming thickness by 4%. Manual lay-up persists for architectural panels and yacht hulls where design freedom overrules takt time.

Continuous pultrusion lines now integrate inline sanding and priming, reducing downstream labor for window frames and power-grid crossarms. Hybrid production cells that switch between thermoset and thermoplastic matrices extend asset utilization and enable multimaterial modules in the glass fiber reinforced polymer market. Robotic handling lowers scrap, and closed-loop digital twins detect resin-rich zones in real time, preventing delamination hot spots. Cost parity with aluminum extrusion is within reach for high-volume automotive sill beams once cycle times fall below 55 seconds, a benchmark that major Tier-1 suppliers target by 2027. In emerging economies, localized compression presses fill regional demand, aided by concessional financing that supports technology transfer.

The Glass Fiber Reinforced Polymer Market Report Segments the Industry by Resin Type (Polyester, Vinyl Ester, Epoxy, and More), Process (Manual Process, Compression Molding, and More), Fiber Form (Rovings, Chopped Strands Mats, and More), End-User Industry (Energy, Automotive, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa).

Geography Analysis

Asia-Pacific dominated with 48.35% revenue in 2025 and is projected to grow at a 4.93% CAGR through 2031. China accelerates capacity with mega-plants such as BASF's USD 10.8 billion Zhanjiang Verbund, which will operate on 100% renewable electricity and supply automotive and electronics composites. India's rail and road modernization campaigns stimulate local demand; BASF has announced additional polyamide and PBT expansions to serve downstream converters. ASEAN countries leverage near-shoring as supply-chain diversification pushes glass fiber reinforced polymer market participants to locate closer to end users.

In North America, the United States leads turbine blade, aerospace, and infrastructure uptake. Jushi Group is finalizing a greenfield furnace in the country, promising regional supply security and import duty avoidance. Federal Buy-America clauses increasingly favor domestic sourcing, benefitting incumbent producers and new entrants. Canada focuses on lightweight buses and battery enclosures to meet zero-emission vehicle mandates. Europe enforces circular-economy legislation that spurs investment in recyclable resins and blade-to-blade glass reclamation. Carbon Rivers' multi-stage pyrolysis recovers fiber for reuse in insulation and sheet molding compounds, attracting grants and brand-owner partnerships. Germany supports hydrogen pipeline retrofits that require corrosion-resistant liners, while offshore wind build-out in the North Sea sustains high-modulus roving demand. South America and Middle East & Africa remain niche but are gaining momentum as Brazil upgrades ports and Saudi Arabia funds mega-projects in transport and renewable energy, opening new arenas for the glass fiber reinforced polymer market.

- Advanced Composites Inc.

- BASF SE

- BGF Industries

- Binani Industries Ltd.

- Celanese Corporation

- China Beihai Fiberglass Co. Ltd

- China Jushi Co. Ltd

- Chongqing Polycomp International Corp. (CPIC)

- Gurit Services AG, Zurich

- Jiuding New Material Co., Ltd

- Johns Manville

- Nippon Electric Glass Co.,Ltd.

- Owens Corning

- PPG Industries Inc.

- Reliance Industries Limited

- SAERTEX GmbH & Co. KG

- Scott Bader Company Ltd.

- The Composite Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Demand from the Automotive Sector

- 4.2.2 Increasing Usage of Glass Fiber Reinforced Polymers in Wind Turbines

- 4.2.3 Increasing Adoption of Glass Fiber Reinforced Polymers in the Aerospace Industry

- 4.2.4 Expandion of Construction and Infrastructure Sector

- 4.2.5 Growing Emphasis on Energy Efficent and Low-Weight Materials in Construction Industry

- 4.3 Market Restraints

- 4.3.1 High Manufacturing Cost

- 4.3.2 Limited Recycling Capabilities

- 4.3.3 Availability of Alternative Materials

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Resin Type

- 5.1.1 Polyester

- 5.1.2 Vinyl Ester

- 5.1.3 Epoxy

- 5.1.4 Polyurethane

- 5.1.5 Other Resin Types (PEEK Resin, Phenolic Resin, etc.)

- 5.2 By Process

- 5.2.1 Manual Process

- 5.2.2 Compression Molding

- 5.2.2.1 Sheet Molding Compound Process

- 5.2.2.2 Glass Mat Thermoplastic Process

- 5.2.3 Continuous Process

- 5.2.4 Injection Molding

- 5.3 By Fiber Form

- 5.3.1 Rovings

- 5.3.2 Chopped Strands Mats

- 5.3.3 Continuous Filament Mats

- 5.3.4 Woven Rovings/Fabrics

- 5.4 By End User Industry

- 5.4.1 Energy

- 5.4.2 Automotive

- 5.4.3 Marine

- 5.4.4 Construction and Infrastructure

- 5.4.5 Electrical and Electronics

- 5.4.6 Aerospace and Defence

- 5.4.7 Other End User Industries (Healthcare, Consumer Goods)

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Advanced Composites Inc.

- 6.4.2 BASF SE

- 6.4.3 BGF Industries

- 6.4.4 Binani Industries Ltd.

- 6.4.5 Celanese Corporation

- 6.4.6 China Beihai Fiberglass Co. Ltd

- 6.4.7 China Jushi Co. Ltd

- 6.4.8 Chongqing Polycomp International Corp. (CPIC)

- 6.4.9 Gurit Services AG, Zurich

- 6.4.10 Jiuding New Material Co., Ltd

- 6.4.11 Johns Manville

- 6.4.12 Nippon Electric Glass Co.,Ltd.

- 6.4.13 Owens Corning

- 6.4.14 PPG Industries Inc.

- 6.4.15 Reliance Industries Limited

- 6.4.16 SAERTEX GmbH & Co. KG

- 6.4.17 Scott Bader Company Ltd.

- 6.4.18 The Composite Group

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Increasing Applications in Marine Industry